Global BioTech Industry Clairvoyance in 2024

The Global BioTech Industry witnessed new approvals such as the first CRISPR gene therapy, when Casgevy created history. Innovations in healthcare technology kept the morales of the stakeholders high amid market volatility. As we step in 2024, industry is expecting launch of up to 21 cell therapies and 31 gene therapies. Personalized mRNA vaccines in cancer (such as melanoma, pancreas, and others) as an emerging therapy will add new revenue streams. So where must you invest this year? What are the available options?

Cell and Gene Therapy: Opportunity with Limitations

It’s a tricky segment where stakeholders must wait and watch. One on hand the approvals in cell and gene therapy is expected to trigger high growth in this area, on the other hand, numerous reports highlight a critical "capacity crunch" in the cell and gene therapy sector of the biopharmaceutical industry, as suggested by Markets and Markets BioTech Industry Outlook 2024 report.

BioPlan, a prominent provider of independent strategic information for the life sciences industry, suggests that there is currently a fivefold shortage in cell and gene therapy manufacturing capacity. The commitment of companies launching novel cell and gene therapies to revolutionize patient lives can be realized through effective preparation of the market, their products, and internal go-to-market strategies. Personalized mRNA vaccines in cancer (such as melanoma, pancreas, and others) will be an emerging therapy this year.

While capacity crunch may be faced by many key players. Companies such as the FUJIFILM Corporation has already invested USD 200 million in two subsidiaries, marking a substantial expansion of its global cell therapy contract development and manufacturing (CDMO) capabilities. The construction is set to commence in 2024. Similar investments are expected to counter the capacity crunch issue in the CGT manufacturing segment.

For more details, get in touch with us here

Demand for Artificial Intelligence and ML tools grows in biopharmaceuticals and Biotech Industry

By 2025, over 30% of novel drugs and materials are expected to undergo systematic discovery through generative AI techniques, a significant rise from the current absence of such methods. Investment in AI-powered discovery tools exceeded USD 60 billion in 2023, effectively doubling the combined amount invested in 2021 and 2022. A comparable trend is anticipated in 2024, signifying significant growth in the field of AI. Some of the key start-ups leading this segment are Araceli Biosciences, Pathos, April19Discovery, CardiaTec Biosciences and Skymount Medical. AI-driven drug discovery startups focus ar not limited to offering diverse solutions, spanning convolutional graph networks, molecular modeling, protein-drug interactions, but overall agile drug development. It is forecasted that implementing generative AI could increase up to 3-5% sales productivity (from current numbers).

Smaller companies and start-ups are investing more in tech enablement in collaboration with the big pharmaceutical giants. Recently, three companies were observed to implement this plan.

- Exscientia became the first company to use AI to fully develop a drug and advance its clinical trials. It has pipelines in clinical trials to enter the clinic in 2024.

- Insilico can discover a drug compound in just 46 days, significantly reducing the time frame for new drug development. Insilico expects to receive results for pipeline trial before the end of 2024.

- XtalPi has partnered with Pfizer and Goldman Sachs and is using AI and quantum computers to create “digital twins” of potential drugs to predict and assess their effectiveness.

Artificial Intelligence (AI) has taken a lead in technological advancements within the pharmaceutical sector. Forecasts indicate that AI is poised to revolutionize pre-clinical drug discovery, potentially lowering costs by up to 40%.

Tough road awaits as more US based drug manufacturers and suppliers sit on the fence

Phase wise capping of drugs have been planned from 2024 and this will limit the growth of many players in the US market. Under the Rescue Plan Act, US drug companies must rebate the Medicaid program if the price increases on prescription medicines outpace inflation. This year, we expect rebates that could even be larger than the actual net cost of the drug. What will the manufacturers do?

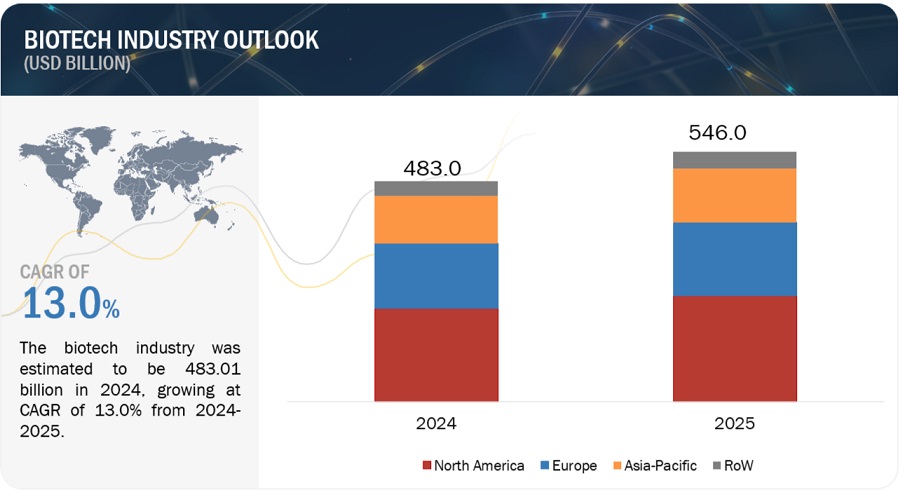

Source: MnM’s Global BioTech Industry Outlook Report 2024

Markets and Markets anticipates that the average monthly Social Security check will increase from USD 1,848 to USD 1,907, and the maximum benefit will rise to USD 3,822 monthly in 2024, up from USD 3,627 in 2023. Though marginal, this increase will lead to prescription switches and impact drug adherence as many patients may find it hard to continue the same medicines with increased cost. Although Part D Medicare will offer relief to patients on long-term medication and high-priced drugs, the prescribers may want to switch them to different medications to keep the pharma world growing. 2024-2029 will be a crucial phase for the US pharma industry

More drug price hikes are anticipated based on upcoming judgments from US lawmakers. Drugmakers, including Merck, Johnson & Johnson and Bristol Myers Squibb, have already filed cases against the price talks. Many of them might follow Pfizer’s road-map.

The process of drug price negotiations by Medicare has started from Feb 1, 2024. Based on US Government report, the U.S. Department of Health and Human Services (HHS), through the Centers for Medicare & Medicaid Services (CMS), has sent initial offers to the participating drug companies of the first 10 prescription drugs selected for negotiation in the first cycle of the Medicare Drug Price Negotiation Program. Some of the immediate benefits that has been highlight are “From capping insulin at $35 per month, to making drug companies pay a rebate for raising their prices faster than inflation, to capping out of pocket costs in Part D”

The CMS is expected to make final price offers to the manufacturers by August 2024, and those drug manufacturers get two weeks to accept or reject them. Upon failure, they may be forced to pay an excise tax of up to 95% of a medication’s US sales or pull all their drug products from the Medicare and Medicaid markets.

US drug makers are sitting on the fence this year. Not only will their products be impacted due to pricing, but switches will also follow (brand switching) and prescriber sentiments shall vary, and all of it will impact their drug sales.

For more details, get in touch with us here

Biosimilars continues to attract investors and manufacturers in anticipation of high returns in near term.

Biologics License Application (BLA) adjustments in the US expected in 2024. Impact is unclear as of now. The FDA has long predicted it will approve between 10–20 cell and gene therapies (CGTs) a year by 2025. But it may not hit the mark and that may impact the drug companies planning to file for FDA approvals. CVS (USA) added more than 30 products to the Performance Drug List-Standard Control for January 2024. Biosimilars are the newest additions (Lucentis biosimilars Byooviz and Cimerli).

Catalent, Lonza, Samsung Biologics, WuXi Biologics, Boehringer Ingelheim BioXcellence , Patheon (Thermo Fisher), Fujifilm Diosynth Biotechnologies, AGC Biologics, and KBI Biopharma were the top biologics CDMOs in 2023. Considering the impact of IRA in the US, these players may have an opportunity to strike deals with US-based drug manufacturers planning to move to biologics.

Marketwise, Japan, the UK, India, China, the US, and Sweden have developed complex biomanufacturing facilities to meet this rising demand and are focusing on the US drug manufacturers in 2024.

CDMOs are also increasing innovative ways to generate business. Whereas they would previously directly approach drug manufacturers, they are now collaborating with VCs to secure access to drug companies funded by these venture capitals. For example, Samsung Biologics has signed a deal with Kurma Partners, gaining access to portfolio companies working on gene to Investigational New Drug (IND) process.

Ready to embrace the future of BioTech and unlock growth opportunities for your business? Reach out to lead.outlookstudies@marketsandmarkets.com to learn more and stay ahead of the competition!

80% of the Forbes Global 2000 B2B companies rely on MarketsandMarkets to identify growth opportunities in emerging technologies and use cases that will have a positive revenue impact.

- Food Packaging Market Size Set for Strong Growth Through 2030 Amid Rising Demand for Convenience Foods

- Fertilizers Industry Set to Grow at 4.1% CAGR Through 2030

- Leading Automated Guided Vehicle Companies 2024: An In-depth Analysis

- CHARGED UP: SHIFT TO E-MOBILITY AND THE EVOLUTION OF TRANSPORTATION

- Global Automotive Market: Predictions For 2024

And..Finally

An increase in interest rates, higher-than-expected inflation, regulatory pressures, and a post-COVID slump created a tough environment for US-based biotech companies in 2023. With interest rates ranging from 0% to over 5%, the added cost of debt has impacted the profitability of mid-small companies, adding more financial strain in 2023. By November 2023, 87% of the biotech firms in S&P 500 had disclosed their Q3 earnings; most reported a modest positive surprise of ~1%, indicating challenging times in 2024

Looking back at the biotech sectors faced a significant transformation, witnessing layoffs (115 biopharma companies announcing layoffs, exceeding figures from the previous year.) and workforce reductions, particularly impacting smaller enterprises. Infinity, NexImmune, and Sana were highlighted as part of this agility in navigating biotech transformations. With high hopes on 2024, the industry is hoping Biotech Industry to bounce back and create opportunities.

In the US, states are supporting small biotech companies by monetizing earned R&D and remaining considerate towards net operating loss tax credits, sales tax exemptions for the purchase of R&D equipment and allowing investment tax credits to drive angel capital investment in the US biosciences industry. Moody's cut China's credit outlook to negative in December 2023 and expected annual GDP growth at 4% in 2024. This will indirectly impact the growth of the biotech industry as well. How do you safeguard your supplies and close your inventory in China? Talk to us for a detailed one on one customized session.