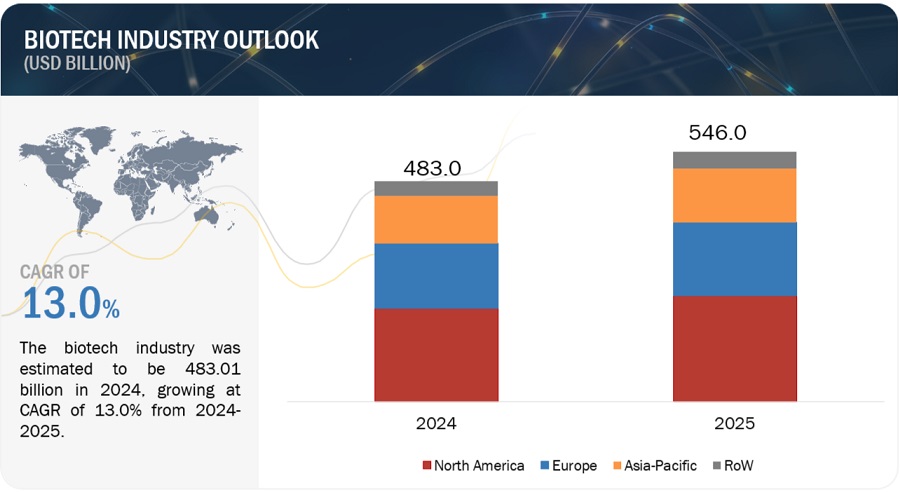

Global Biotech Industry Outlook 2025

The global biotech industry market size is estimated to grow from USD 483.0 billion in 2024 to USD 546.0 billion by 2025, at a growth rate of ~13.0%.

The global biotechnology industry is set to experience rapid growth and innovation, driven by advances in personalized medicine, AI integration, and the increasing demand for biologics. The industry will see expanded use of biologic drugs, such as monoclonal antibodies and gene therapies, especially for complex diseases like cancer, genetic disorders, and autoimmune conditions. Personalized medicine will take center stage, with treatments tailored to individual genetic profiles, improving efficacy and reducing side effects. Additionally, the use of AI and machine learning will significantly accelerate drug discovery, clinical trial designs, and biomanufacturing processes, helping companies bring therapies to market faster and more cost-effectively. The biotechnology sector will also focus on sustainability, with a shift toward greener biomanufacturing practices. Innovations like single-use bioprocessing, continuous biomanufacturing, and eco-friendly production methods will reduce costs, improve product yield, and minimize the environmental footprint of biologics production.

To know about the assumptions considered for the study, Request for Free Sample Report

The Global Biotech Industry Outlook for 2025 is an invaluable summary of key trends that influenced the performance of the sector in 2024, provides a comparative analysis of sectoral growth rates and valuation in 2025 of key segments across Biotechnology industry, analyzes key trends to watch out for in 2025 and is interspersed with examples of industry best practices and success stories. As providers prepare for a tough 2025 with ongoing workforce challenges, transitioning and/or adopting digital solutions for automation and generative AI, continued M&A / consolidation / partnerships, the Biotechnology industry must anticipate and be prepared for the ensuing trends that will determine business success in 2025. A summary of key recommendations and growth opportunities for 2025 is provided.

The Biotech Industry Outlook 2025 is structured to provide:

- Analysis of factors, that influenced the performance and characteristics of the Biotech sector in 2025 as compared to 2024,

- Revenue estimations and growth rate projections for key sectors across Biotech between 2024 and 2025,

- Highlights of the key trends to watch out for in 2025,

- Recommendations and prioritized list of growth opportunities for 2025,

- Best practices and success stories that exemplify how market participants overcame challenges to build and deploy solutions using innovative business models.

- Act as the knowledge base for an interactive session with the industry experts at MarketsandMarkets.

The Biotech Industry Outlook 2025 report is an insightful toolkit for incumbent market participants, tech players, SME’s, the investment community as well as the long list of players who form part of the upstream supply chain in this sector.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Global Biotech Indus