3D Machine Vision Market by Offering (Hardware and Software), Product (PC-based and Smart Camera-based), Application, Vertical (Industrial and Non-Industrial) & Geography - Global Forecast till 2025

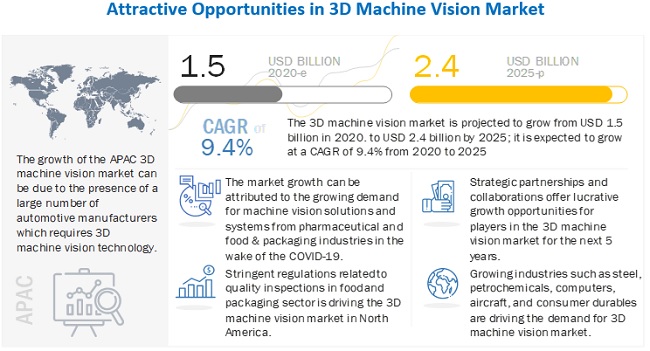

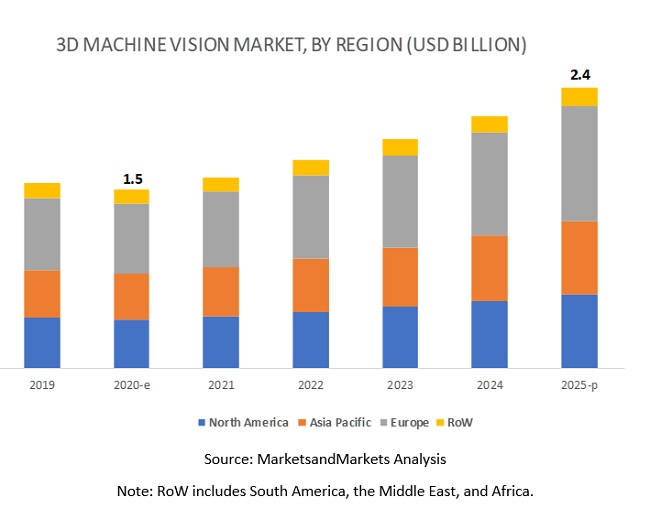

The 3D machine vision market was valued at USD 1.5 billion in 2020 and is projected to reach USD 2.4 billion by 2025; growing at a CAGR of 9.4% from 2020 to 2025.

The 3D Machine Vision Market is experiencing significant growth due to increasing demand for automation and quality control in industries like manufacturing, automotive, and electronics. Key trends driving the market include advancements in imaging technology, AI-driven data analysis, and the integration of 3D machine vision systems in robotics for enhanced precision and efficiency. As industries move towards smart manufacturing and Industry 4.0, the adoption of 3D machine vision is accelerating, providing opportunities for further technological innovation and market expansion in the coming years.

The rising awareness of consumers about product quality has led to an increased demand for quality inspection and automation of end products. A growing number of companies are focusing on automation systems to reduce their production costs post-COVID-19 But due to the lockdown across countries, companies are facing severe cash flow issues and are deferring new projects related to the implementation of 3D machine vision in their factories. The ongoing COVID-19 pandemic has caused disruptions in economies and supply chains, thereby causing companies operating in different industries to adopt a global supply chain model. A number of manufacturing companies have halted their production, which has collaterally damaged the supply chain and negatively impacted the 3D machine vision market.

3D Machine Vision Market Dynamics

Drivers: Increasing need for quality inspection and automation

Manufacturing companies across the globe are planning to invest more on automation post COVID-19. Also, the need for automated quality assurance has increased as industries have realized its importance in manufacturing processes. This need is however further elevated due to the COVID-19 outbreak due to less intervention by human involved in the process. This has resulted in the widespread acceptance of machine vision as an integral part of long-term automation development processes.

Growing demand for vision-guided robotics systems

Recently, vision-guided robotics systems have led to significant changes in the machine vision market. There has been a rapid growth in the use of industrial robots for automation in the automotive and consumer electronics sectors. This is leading to an increasing need for the integration of machine vision systems with vision-guided robot controllers. Machine vision systems enhance the efficiency of robots by allowing them to see and respond to their environments.

Restraints: Varying end-user requirements

The importance of 3D machine vision is likely to increase in the manufacturing sector, as the industry undergoes a gradual transition from product standardization to product customization. It is difficult to develop a standard machine vision system, as there are several manufacturing industries to cover, and specifications differ based on individual customer requirements.

Cameras expected to lead hardware segment for 3D machine vision market

The 3D machine vision market for hardware is expected to hold the largest share during the forecast period. The cameras segment in hardware is projected to grow at the highest CAGR from 2020 to 2025. Cameras in machine vision systems play an important role in capturing 3D images. The high demand for high-quality images and quick image processing is fueling the growth of the cameras segment of the market. The smart camera-based machine vision system is expected to grow at a faster rate during the forecast period as smart camera-based machine vision systems are cost-effective, compact, and flexible since it is easier to implement changes in these systems based on revised regulations and standards. In addition, with the advancements in smart camera technology and IoT, which can be easily be integrated with smart cameras, and the penetration of the smart camera-based machine vision systems is likely to increase in the next few years.

Positioning & Guidance to hold the highest share among Smart Camera-based applications in the 3D machine vision market during the forecast period

The smart camera-based systems segment of the 3D machine vision market for positioning & guidance is expected to grow at the highest CAGR as well as will hold the largest share from 2020 to 2025. This is because the smart camera-based 3D machine vision systems are mostly preferred by manufacturers for flexible robotic vision inspections for processor development and the round-the-clock operations. The automotive industry increasingly depends on robotic vision inspection technology.

Food & beverages in industrial vertical to grow at the fastest rate in the 3D machine vision market during the forecast period

The 3D machine vision market for food & beverages is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the use of 3D machine vision in the food industry as several companies use 3D machine vision systems for application-specific solutions in the areas of grading, sorting, portioning, processing, quality checking during processing, and packaging. The market is also expected to witness stable growth during the COVID-19 crisis owing to the increasing global demand for food and beverages. Also, the growing food production capacity and the increasing automation in the food industry in APAC are fueling the growth of the market for food & beverages in APAC.

Postal & Logistics to hold the largest market in the non-industrial vertical for 3D machine vision market during the forecast period

The 3D machine vision market for postal and logistics will hold the largest market share in the non-industrial vertical during the forecast period. 3D machine vision-based autonomous navigation (self-localization, obstacle detection, docking) helps in providing the required flexibility and free-navigation capability in crowded environments, for inter-cell transportation logistics services. However the outbreak and spread of COVID-19 have impacted the postal and logistics activities as most of these services remained shut across the world.

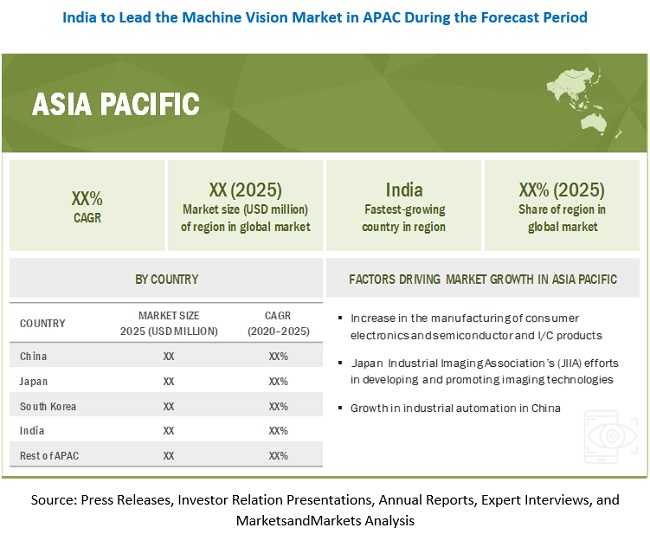

APAC held the largest market share in the 3D machine vision market between 2020 and 2025

The 3D machine vision market in APAC is expected to hold a major market share during the forecast period as countries in APAC such as China, Japan, India, and South Korea have some of the largest manufacturing facilities wherein automation of manufacturing processes has been taken as the highest priority. Also, strong competition among consumer electronics companies in APAC is likely to boost the adoption of machine vision systems in the region. The growing awareness about and demand for high-quality and zero-defect products has fueled the need for 3D machine vision in inspection-related applications in the manufacturing fields.

However, the outbreak of COVID-19 has significantly affected the manufacturing sector of APAC. As the neighboring countries are linked to one another through trade relations and supply chain the entire region is affected with the outbreak of COVID-19 which will have a significant impact on the said market in this region for the forecast period.

Key Market Players

The key players in the ecosystem of the 3D machine vision market profiled in this report are OMRON Corporation (Japan), Keyence Corporation (Japan), Cognex Corporation (US), Basler AG (Germany), National Instruments (US), ISRA Vision AG (Germany), TKH group (Netherlands), Stemmer Imaging (Germany), MVTec Software GmbH (Germany), and Tordivel AS (Norway).

Scope of the Report:

|

Report Metric |

Details |

|

Estimated Market size |

USD 1.5 Billion |

|

Projected Market size |

USD 2.4 Billion |

|

Growth Rate |

9.4% |

|

Market size available for years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

Value, USD |

|

Segments covered |

Offering, Product, Application and Vertical |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Omron Corporation (Japan), Cognex Corporation (US), Basler AG (Germany), Keyence (Japan), National Instruments(US), TKH Group (Netherlands), Sony Corporation (Japan), ISRA Vision (Germany), Stemmer Imaging (Germany) and Intel Corporation (US). |

3D Machine Vision Market Segmentation

3D Machine Vision Market, By Offering

- Hardware

- Software

3D Machine Vision Market, By Vertical:

-

Industrial

- Automotive

- Electronics and Semiconductor

- Consumer Electronics

- Glass

- Metals

- Wood and Paper

- Pharmaceuticals

- Food & Packaging

- Rubber & Plastics

- Printing

- Machinery/Equipment

- Solar Panel Manufacturing

- Textile

-

Non–industrial

- Healthcare

- Security and Surveillance

- Postal & Logistics

- Intelligent Transportation Systems

- Military & Defense

3D Machine Vision Market, By Product:

- PC-based

- Smart-camera based

3D Machine Vision Market, By Application:

- Quality assurance and inspection

- Positioning and guidance

- Measurement

- Identification

3D Machine Vision Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East

- Africa

OMRON (Japan)

OMRON is a dominant player in the 3D machine vision market. It has a strong employee base and a robust focus on R&D. It concentrates on developing innovative and diverse products. The company’s vision sensors and machine vision systems are capable of analyzing images for appearance inspection, character inspection, positioning, and defect inspection. In this product category, the company offers vision sensors, PC vision systems, smart cameras, lightning systems, and lenses. OMRON depends on the market in Asia, especially Japan and China, for its revenue. The company has a high concentration of production units in Asia. It could open production units in other geographic regions to increase its worldwide presence and emerge as a strong market player globally.

Recent Developments

- In November 2019, OMRON Corporation developed the industry's fastest 3D vision sensing technology for compact vision sensors to three-dimensionally recognize the position and orientation of the target objects. Incorporating this technology in robots is expected to enable fast and accurate assembly of bulk parts by automating the conventional human-intensive process

- In September 2019, OMRON Corporation launched the E3AS series of reflective-type photoelectric sensors, which provide the smallest body and the longest sensing distance capability for a distance of 1,500 mm. These sensors offer stable detection without getting being influenced by the sensing distances or features of objects (colors, materials, surfaces, etc.). This makes the selection, adjustment, and maintenance of sensors easy and improves their system commissioning and operation rates.

Frequently Asked Questions (FAQ):

Which are the major applications of the 3D machine vision market? How big is the opportunity for their growth in the developing economies in the next five years?

The major applications of 3D machine vision includes automotive, pharmacy, electronics and semicondctor, consumer electronics, food and beverage among others. It is expected to boost the demand for 3D machine vision in this industries leading to USD 2.4billion opportunity till 2025.

Which are the major companies in the 3D machine vision market? What are their major strategies to strengthen their market presence?

The major companies in machine vision includes Omron Corporation (Japan), Cognex Corporation (US), Basler AG (Germany), Keyence (Japan), National Instruments (US), TKH (Netherlands). Cognex is the dominant player in the 3D machine vision market. Cognex offers 3D machine vision systems, software, sensors, surface inspection systems, and industrial ID readers for automation processes. The major strategies adopted by these players are product launches and acquisition strategy.

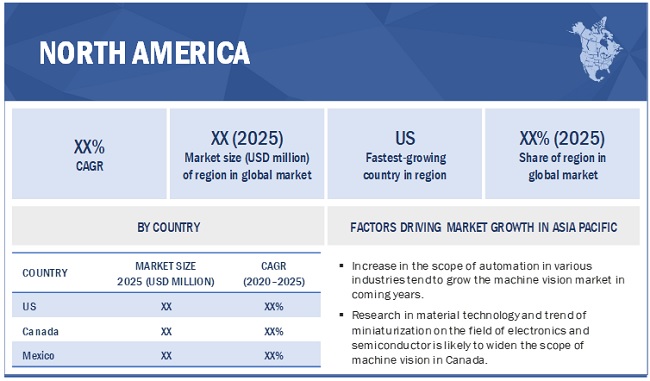

Which are the leading countries in the 3D machine vision market? What would be the share of North America and APAC in this market for the next five years?

3D Machine vision market is expected to grow at the highest CAGR in APAC region during the forecast period. The countries in APAC such as China, Japan, India, and South Korea have some of the largest manufacturing facilities wherein automation of manufacturing processes has been taken as the highest priority.

Which type of product is expected to witness significant demand for 3D machine vision in the coming years?

Smart camera-based machine vision systems are cost-effective, compact, and flexible since it is easier to implement changes in these systems based on revised regulations and standards. In addition, with the advancements in smart camera technology and IoT, which can be easily be integrated with smart cameras, and the penetration of the smart camera-based machine vision systems is likely to increase in the next few years.Hence, smart cameras is expected to grow at a significant rate in coming years.

What are the recent advancement in 3D machine vision expected to boost the market?

Recent advancements in imaging technology such as deep learning software, liquid lens, vision processing unit, 360-degree camera, hyperspectral imaging, and hybrid image sensor have increased the scope for 3D machine vision systems to be used in a wide range of applications in various industrial sectors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 3D MACHINE VISION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 7 QUALITY ASSURANCE & INSPECTION SEGMENT TO HOLD THE LARGEST SIZE OF THE 3D MACHINE VISION MARKET FROM 2020 TO 2025

FIGURE 8 HARDWARE SEGMENT TO HOLD LARGE SIZE OF THE MARKET FROM 2020 2025

FIGURE 9 SMART CAMERA-BASED SYSTEMS SEGMENT TO HOLD LARGE SIZE OF THE MACHINE VISION MARKET FROM 2020 TO 2025

FIGURE 10 NON-INDUSTRIAL SEGMENT TO GROW WITH THE HIGHEST CAGR IN MARKET FROM 2020 TO 2025

FIGURE 11 MARKET, BY REGION, 2019

FIGURE 12 APAC TO LEAD THE MACHINE VISION MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 3D MACHINE VISION MARKET, 2020–2025 (USD MILLION)

FIGURE 13 INDUSTRIAL SEGMENT HELD LARGE SHARE OF THE MARKET IN 2019

4.2 MARKET, BY APPLICATION, 2020 & 2025

FIGURE 14 QUALITY ASSURANCE & INSPECTION SEGMENT TO HOLD THE LARGEST SIZE OF THE MARKET BY 2025

4.3 MARKET, BY REGION, 2020–2025

FIGURE 15 MACHINE VISION MARKET IN APAC TO GROW AT THE HIGHEST RATE FROM 2020 TO 2025

4.4 MARKET, BY OFFERING, 2020 & 2025

FIGURE 16 HARDWARE SEGMENT TO HOLD LARGE SIZE OF THE MARKET FROM 2020 TO 2025

4.5 MARKET, BY PRODUCT, 2020 & 2025

FIGURE 17 SMART CAMERA-BASED SYSTEMS SEGMENT TO HOLD LARGE SIZE OF THE MARKET FROM 2020 TO 2025

4.6 MARKET, BY VERTICAL, 2020 & 2025

FIGURE 18 NON-INDUSTRIAL SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

5 COVID-19 IMPACT ON 3D MACHINE VISION MARKET (Page No. - 56)

FIGURE 19 PRE-COVID-19 AND POST-COVID-19 SCENARIOS FOR MACHINE VISION MARKET

5.1 PRE-COVID-19 SCENARIO

5.2 POST-COVID-19 SCENARIO

5.3 INDUSTRIAL IMPACT

5.4 REGIONAL IMPACT

6 MARKET OVERVIEW (Page No. - 59)

6.1 INTRODUCTION

6.2 MARKET DYNAMICS

FIGURE 20 INCREASING DEMAND FOR 3D OBJECT ANALYSES IN MANUFACTURING APPLICATIONS DRIVING THE GROWTH OF THE MARKET

6.2.1 DRIVERS

FIGURE 21 MACHINE VISION MARKET: DRIVERS AND THEIR IMPACT

6.2.1.1 Increasing need for quality inspection and automation

6.2.1.2 Growing demand for vision-guided robotics systems

6.2.1.3 Rising need for ASICs

6.2.1.4 Growing need for inspection in food and packaging industries

6.2.2 RESTRAINTS

FIGURE 22 MACHINE VISION MARKET RESTRAINTS AND THEIR IMPACT

6.2.2.1 Varying end-user requirements

6.2.2.2 Lack of skilled professionals in manufacturing factories

FIGURE 23 UNDERQUALIFIED WORKERS IN VARIOUS COUNTRIES IN 2019

6.2.3 OPPORTUNITIES

FIGURE 24 MACHINE VISION MARKET OPPORTUNITIES AND THEIR IMPACT

6.2.3.1 Increasing manufacturing of hybrid and electric cars

FIGURE 25 INCREASING DEMAND FOR HYBRID AND ELECTRIC VEHICLES BETWEEN 2020 AND 2040

6.2.3.2 Government initiatives to support industrial automation

6.2.3.3 Increasing demand for artificial intelligence (AI) in machine vision

6.2.3.4 Growing adoption of Industry 4.0

6.2.3.5 Increasing wages leading to opportunities in vision-guided industrial robots and other automation technologies in China

FIGURE 26 AVERAGE YEARLY WAGES IN THE MANUFACTURING SECTOR IN CHINA

6.2.4 CHALLENGES

FIGURE 27 3D MACHINE VISION MARKET CHALLENGES AND THEIR IMPACT

6.2.4.1 Complexity in integrating 3D machine vision systems

6.2.4.2 Lack of user awareness about rapidly changing 3D machine vision technology

6.3 VALUE CHAIN ANALYSIS: MACHINE VISION MARKET

FIGURE 28 VALUE CHAIN ANALYSIS: MACHINE VISION

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 MANUFACTURING

6.3.3 SYSTEM INTEGRATORS AND SERVICE PROVIDERS

6.3.4 MATERIAL AND EQUIPMENT SUPPLIERS

6.3.5 END USERS

6.4 ECOSYSTEM

FIGURE 29 MACHINE VISION MARKET ECOSYSTEM

TABLE 1 COMPANIES ROLE IN ECOSYSTEM/ VALUE CHAIN

7 3D MACHINE VISION MARKET, BY OFFERING (Page No. - 73)

7.1 INTRODUCTION

FIGURE 30 HARDWARE SEGMENT TO HOLD LARGE SIZE OF THE MARKET FROM 2020 TO 2025

TABLE 2 PRE-COVID-19: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

TABLE 3 POST-COVID-19: MARKET, BY OFFERING, 2017–2025 (USD MILLION)

7.2 HARDWARE

TABLE 4 MARKET FOR HARDWARE, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 5 MARKET FOR HARDWARE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 6 MARKET FOR HARDWARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 7 MARKET FOR HARDWARE, BY REGION, 2020–2025 (USD MILLION)

7.2.1 CAMERAS

7.2.1.1 Camera type

7.2.1.1.1 Line scan cameras

7.2.1.1.2 Area scan cameras

TABLE 8 MACHINE VISION MARKET FOR CAMERAS, BY CAMERA TYPE, 2017–2019 (USD MILLION)

TABLE 9 MARKET FOR CAMERAS, BY CAMERA TYPE, 2020–2025 (USD MILLION)

7.2.1.2 Image detection technique

7.2.1.2.1 Stereoscopic vision systems

FIGURE 31 WORKING OF STEREOSCOPIC VISION CAMERAS

7.2.1.2.2 Structured light systems

7.2.1.2.3 Time-of-flight (TOF) technique

FIGURE 32 WORKING OF TIME-OF-FLIGHT SENSORS

TABLE 10 3D MACHINE VISION MARKET FOR CAMERAS, BY IMAGE DETECTION TECHNIQUE, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR CAMERAS, BY IMAGE DETECTION TECHNIQUE, 2020–2025 (USD MILLION)

7.2.1.2.4 Comparison between 3D machine vision technologies

TABLE 12 COMPARATIVE STUDY OF 3D MACHINE VISION TECHNOLOGIES

7.2.2 FRAME GRABBERS

7.2.3 OPTICS

7.2.4 LIGHTING

7.2.5 OTHERS

7.3 SOFTWARE

TABLE 13 MARKET FOR SOFTWARE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 14 MARKET FOR SOFTWARE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 15 MARKET FOR SOFTWARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 16 MARKET FOR SOFTWARE, BY REGION, 2020–2025 (USD MILLION)

7.3.1 TRADITIONAL

7.3.2 DEEP LEARNING

8 3D MACHINE VISION MARKET, BY PRODUCT (Page No. - 85)

8.1 INTRODUCTION

FIGURE 33 SMART CAMERA-BASED SYSTEMS SEGMENT TO HOLD LARGE SIZE OF THE MARKET FROM 2020 TO 2025

TABLE 17 PRE-COVID-19: MARKET, BY PRODUCT, 2017–2022 (USD MILLION)

TABLE 18 POST-COVID-19: MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

8.2 SMART CAMERA-BASED SYSTEMS

TABLE 19 MARKET FOR SMART CAMERA-BASED SYSTEMS, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 20 MARKET FOR SMART CAMERA-BASED SYSTEMS, BY APPLICATION, 2020–2025 (USD MILLION)

8.3 PC-BASED SYSTEMS

TABLE 21 MARKET FOR PC-BASED SYSTEMS, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 22 MARKET FOR PC-BASED SYSTEMS, BY APPLICATION, 2020–2025 (USD MILLION)

9 3D MACHINE VISION MARKET, BY APPLICATION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 34 QUALITY ASSURANCE & INSPECTION SEGMENT TO HOLD THE LARGEST SIZE OF THE MARKET FROM 2020 TO 2025

TABLE 23 PRE-COVID-19: MACHINE VISION MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

TABLE 24 POST-COVID-19: MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

9.2 QUALITY ASSURANCE & INSPECTION

TABLE 25 MARKET FOR QUALITY ASSURANCE & INSPECTION, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 26 MARKET FOR QUALITY ASSURANCE & INSPECTION, BY PRODUCT, 2020–2025 (USD MILLION)

9.3 POSITIONING & GUIDANCE

TABLE 27 MARKET FOR POSITIONING & GUIDANCE, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 28 MARKET FOR POSITIONING & GUIDANCE, BY PRODUCT, 2020–2025 (USD MILLION)

9.4 MEASUREMENT

TABLE 29 MARKET FOR MEASUREMENT, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 30 MARKET FOR MEASUREMENT, BY PRODUCT, 2020–2025 (USD MILLION)

9.5 IDENTIFICATION

TABLE 31 MARKET FOR IDENTIFICATION APPLICATION, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 32 MARKET FOR IDENTIFICATION APPLICATION, BY PRODUCT, 2020–2025 (USD MILLION)

10 3D MACHINE VISION MARKET, BY VERTICAL (Page No. - 96)

10.1 INTRODUCTION

FIGURE 35 MARKET, BY VERTICAL

FIGURE 36 INDUSTRIAL SEGMENT TO HOLD LARGE SIZE OF THE MACHINE VISION MARKET FROM 2020 TO 2025

TABLE 33 PRE-COVID-19: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

TABLE 34 POST-COVID-19: MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

10.2 INDUSTRIAL

TABLE 35 MARKET, BY INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 36 MARKET, BY INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 37 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2020–2025 (USD MILLION)

10.2.1 AUTOMOTIVE

10.2.1.1 Impact of COVID-19

TABLE 39 MARKET FOR AUTOMOTIVE, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 MARKET FOR AUTOMOTIVE, BY REGION, 2020–2025 (USD MILLION)

10.2.2 SEMICONDUCTOR, IC, AND PCB

10.2.2.1 Impact of COVID-19

TABLE 41 MACHINE VISION MARKET FOR SEMICONDUCTOR, IC, AND PCB, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 MARKET FOR SEMICONDUCTOR, IC, AND PCB,BY REGION, 2020–2025 (USD MILLION)

10.2.3 CONSUMER ELECTRONICS

10.2.3.1 Impact of COVID-19

TABLE 43 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 44 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2025 (USD MILLION)

10.2.4 GLASS

10.2.4.1 Impact of COVID-19

TABLE 45 MARKET FOR GLASS, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 MARKET FOR GLASS, BY REGION, 2020–2025 (USD MILLION)

10.2.5 METALS

10.2.5.1 Impact of COVID-19

TABLE 47 3D MACHINE VISION MARKET FOR METALS, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 MARKET FOR METALS, BY REGION, 2020–2025 (USD MILLION)

10.2.6 WOOD & PAPER

10.2.6.1 Impact of COVID-19

TABLE 49 MARKET FOR WOOD & PAPER, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 MARKET FOR WOOD & PAPER, BY REGION, 2020–2025 (USD MILLION)

10.2.7 PHARMACEUTICAL & MEDICAL DEVICES

10.2.7.1 Impact of COVID-19

TABLE 51 MARKET FOR PHARMACEUTICAL AND MEDICAL DEVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 MARKET FOR PHARMACEUTICAL AND MEDICAL DEVICES, BY REGION, 2020–2025 (USD MILLION)

10.2.8 RUBBER & PLASTICS

10.2.8.1 Impact of COVID-19

TABLE 53 MARKET FOR RUBBER & PLASTICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 54 MARKET FOR RUBBER & PLASTICS, BY REGION, 2020–2025 (USD MILLION)

10.2.9 FOOD & BEVERAGES

10.2.9.1 Impact of COVID-19

TABLE 55 MARKET FOR FOOD & BEVERAGES, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 MARKET FOR FOOD & BEVERAGES, BY REGION, 2020–2025 (USD MILLION)

10.2.10 PRINTING AND PUBLISHING

TABLE 57 MACHINE VISION MARKET FOR PRINTING AND PUBLISHING, BY REGION, 2017–2019 (USD MILLION)

TABLE 58 MARKET FOR PRINTING AND PUBLISHING, BY REGION, 2020–2025 (USD MILLION)

10.2.11 SOLAR PANEL MANUFACTURING

TABLE 59 3D MACHINE VISION MARKET FOR SOLAR PANEL MANUFACTURING, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 MARKET FOR SOLAR PANEL MANUFACTURING, BY REGION, 2020–2025 (USD MILLION)

10.2.12 MACHINERY TOOLS

TABLE 61 MARKET FOR MACHINERY TOOLS, BY REGION, 2017–2019 (USD MILLION)

TABLE 62 MARKET FOR MACHINERY TOOLS, BY REGION,2020–2025 (USD MILLION)

10.3 NON-INDUSTRIAL

TABLE 63 MARKET, BY NON-INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 64 MARKET, BY NON-INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 65 MARKET FOR NON-INDUSTRIAL VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 MARKET FOR NON-INDUSTRIAL VERTICAL, BY REGION, 2020–2025 (USD MILLION)

10.3.1 HEALTHCARE

10.3.1.1 Impact of COVID-19

TABLE 67 MARKET FOR HEALTHCARE, BY REGION, 2017–2019 (USD MILLION)

TABLE 68 MARKET FOR HEALTHCARE, BY REGION, 2020–2025 (USD MILLION)

10.3.2 SECURITY AND SURVEILLANCE

10.3.2.1 Impact of COVID-19

TABLE 69 MARKET FOR SECURITY AND SURVEILLANCE, BY REGION, 2017–2019 (USD MILLION)

TABLE 70 MARKET FOR SECURITY AND SURVEILLANCE, BY REGION, 2020–2025 (USD MILLION)

10.3.3 POSTAL AND LOGISTICS

10.3.3.1 Impact of COVID-19

TABLE 71 3D MACHINE VISION MARKET FOR POSTAL AND LOGISTICS, BY REGION, 2017–2019 (USD MILLION)

TABLE 72 MARKET FOR POSTAL AND LOGISTICS, BY REGION, 2020–2025 (USD MILLION)

10.3.4 INTELLIGENT TRANSPORTATION SYSTEMS

10.3.4.1 Impact of COVID-19

TABLE 73 MARKET FOR INTELLIGENT TRANSPORTATION SYSTEMS, BY REGION, 2017–2019 (USD MILLION)

TABLE 74 MARKET FOR INTELLIGENT TRANSPORTATION SYSTEMS, BY REGION, 2020–2025 (USD MILLION)

10.3.5 MILITARY & DEFENSE

10.3.5.1 Impact of COVID-19

TABLE 75 MARKET FOR MILITARY & DEFENSE, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 MARKET FOR MILITARY & DEFENSE, BY REGION, 2020–2025 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 122)

11.1 INTRODUCTION

11.1.1 IMPACT OF COVID-19

FIGURE 37 GEOGRAPHIC SNAPSHOT OF THE MACHINE VISION MARKET CAGR (2020–2025)

FIGURE 38 APAC TO LEAD THE MARKET FROM 2020 TO 2025

TABLE 77 PRE-COVID-19: MARKET, BY REGION, 2017–2022 (USD MILLION)

TABLE 78 POST-COVID-19: MARKET, BY REGION, 2017–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 IMPACT OF COVID-19

FIGURE 39 SNAPSHOT OF THE 3D MACHINE VISION MARKET IN NORTH AMERICA

TABLE 79 MARKET IN NORTH AMERICA, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 83 MARKET IN NORTH AMERICA, BY NON-INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY NON-INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 87 MARKET FOR HARDWARE IN NORTH AMERICA, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 88 MARKET FOR HARDWARE IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 89 MARKET FOR SOFTWARE IN NORTH AMERICA, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 90 MARKET FOR SOFTWARE IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

11.2.2 US

11.2.2.1 Impact of COVID-19

11.2.3 CANADA

11.2.3.1 Impact of COVID-19

11.2.4 MEXICO

TABLE 91 3D MACHINE VISION MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 92 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

11.3 EUROPE

11.3.1 IMPACT OF COVID-19

FIGURE 40 SNAPSHOT OF THE MACHINE VISION MARKET IN EUROPE

TABLE 93 MARKET IN EUROPE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 94 MARKET IN EUROPE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY NON-INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY NON-INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 99 MARKET IN EUROPE, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 101 MARKET FOR HARDWARE IN EUROPE, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 102 MARKET FOR HARDWARE IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 103 MARKET FOR SOFTWARE IN EUROPE, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 104 MARKET FOR SOFTWARE IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

11.3.2 UK

11.3.2.1 Impact of COVID-19

11.3.3 GERMANY

11.3.3.1 Impact of COVID-19

11.3.4 FRANCE

11.3.4.1 Impact of COVID-19

11.3.5 ITALY

11.3.5.1 Impact of COVID-19

11.3.6 SPAIN

11.3.7 REST OF EUROPE

TABLE 105 3D MACHINE VISION MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 106 MACHINE VISION MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

11.4 APAC

11.4.1 IMPACT OF COVID-19

FIGURE 41 SNAPSHOT OF THE MARKET IN APAC

TABLE 107 MARKET IN APAC, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 108 MARKET IN APAC, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 109 MARKET IN APAC, BY INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 110 MARKET IN APAC, BY INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 111 MARKET IN APAC, BY NON-INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 112 MARKET IN APAC, BY NON-INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 113 MARKET IN APAC, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 114 MARKET IN APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 115 MARKET FOR HARDWARE IN APAC, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 116 MARKET FOR HARDWARE IN APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 117 MARKET FOR SOFTWARE IN APAC, BY OFFERING, 2017–2019 (USD MILLION

TABLE 118 MARKET FOR SOFTWARE IN APAC, BY OFFERING, 2020–2025 (USD MILLION

11.4.2 CHINA

11.4.2.1 Impact of COVID-19

11.4.3 JAPAN

11.4.3.1 Impact of COVID-19

11.4.4 SOUTH KOREA

11.4.4.1 Impact of COVID-19

11.4.5 INDIA

11.4.5.1 Impact of COVID-19

11.4.6 REST OF APAC

TABLE 119 3D MACHINE VISION MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 120 MACHINE VISION MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

11.5 ROW

11.5.1 IMPACT OF COVID-19

TABLE 121 MARKET IN ROW, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 122 MARKET IN ROW, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 123 MARKET IN ROW, BY INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 124 MARKET IN ROW, BY INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 125 MARKET IN ROW, BY NON-INDUSTRIAL VERTICAL, 2017–2019 (USD MILLION)

TABLE 126 MARKET IN ROW, BY NON-INDUSTRIAL VERTICAL, 2020–2025 (USD MILLION)

TABLE 127 MARKET IN ROW, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 128 MARKET IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 129 MARKET FOR HARDWARE IN ROW, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 130 MARKET FOR HARDWARE IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 131 MARKET FOR SOFTWARE IN ROW, BY OFFERING, 2017–2019 (USD MILLION)

TABLE 132 MARKET FOR SOFTWARE IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

11.5.2 MIDDLE EAST

11.5.3 AFRICA

11.5.4 SOUTH AMERICA

TABLE 133 3D MACHINE VISION MARKET IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 134 MACHINE VISION MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 OVERVIEW

FIGURE 42 ORGANIC AND INORGANIC STRATEGIES ADOPTED BY COMPANIES OPERATING IN MARKET FROM JANUARY 2017 TO MAY 2020

12.2 MARKET RANK ANALYSIS

FIGURE 43 MAJOR 3D MACHINE VISION PROVIDERS

12.3 COMPETITIVE SITUATION AND TRENDS

12.3.1 PRODUCT LAUNCHES

TABLE 135 PRODUCT LAUNCHES (JANUARY 2019–MAY 2020)

12.3.2 MERGERS & ACQUISITIONS

TABLE 136 MERGERS & ACQUISITIONS (JANUARY 2017–MAY 2020)

12.3.3 OTHERS

TABLE 137 AGREEMENTS (FEBRUARY 2018– MAY 2020)

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 VISIONARY LEADERS

12.4.2 DYNAMIC DIFFERENTIATORS

12.4.3 INNOVATORS

12.4.4 EMERGING COMPANIES

FIGURE 44 3D MACHINE VISION MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

13 COMPANY PROFILES (Page No. - 165)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 KEY PLAYERS

13.1.1 COGNEX CORPORATION

FIGURE 45 COGNEX CORPORATION: COMPANY SNAPSHOT

13.1.2 KEYENCE CORPORATION

FIGURE 46 KEYENCE: COMPANY SNAPSHOT

13.1.3 BASLER AG

FIGURE 47 BASLER AG: COMPANY SNAPSHOT

13.1.4 OMRON CORPORATION

FIGURE 48 OMRON CORPORATION: COMPANY SNAPSHOT

13.1.5 NATIONAL INSTRUMENTS

FIGURE 49 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

13.1.6 SONY CORPORATION

FIGURE 50 SONY CORPORATION: COMPANY SNAPSHOT

13.1.7 ISRA VISION AG

FIGURE 51 ISRA VISION AG: COMPANY SNAPSHOT

13.1.8 TKH GROUP

FIGURE 52 TKH GROUP: COMPANY SNAPSHOT

13.1.9 INTEL CORPORATION

FIGURE 53 INTEL CORPORATION: COMPANY SNAPSHOT

13.1.10 STEMMER IMAGING

13.2 RIGHT-TO-WIN

13.3 OTHER PLAYERS

13.3.1 AMETEK INC.

13.3.2 QUALITAS TECHNOLOGIES

13.3.3 BAUMER OPTRONIC

13.3.4 ALGOLUX

13.3.5 TORDIVEL AS

13.3.6 INUITIVE

13.3.7 MVTEC SOFTWARE GMBH

13.3.8 JAI A/S

13.3.9 INDUSTRIAL VISION SYSTEMS LTD.

13.3.10 HERMARY OPTO ELECTRONICS INC.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 207)

14.1 INTRODUCTION

TABLE 138 ADJACENT MARKET ANALYSIS

14.2 MACHINE VISION MARKET

TABLE 139 POST-COVID-19: 3D MACHINE VISION MARKET, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 140 POST-COVID-19: MACHINE VISION MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

TABLE 141 POST-COVID-19: MACHINE VISION MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

TABLE 142 POST-COVID-19: MACHINE VISION MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 143 POST-COVID-19: MACHINE VISION MARKET, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

14.3 INDUSTRIAL CONTROL FACTORY AUTOMATION MARKET

TABLE 144 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY COMPONENT, 2017–2025 (USD BILLION)

TABLE 145 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR COMPONENT, BY PROCESS INDUSTRY, 2017–2025 (USD BILLION)

TABLE 146 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR COMPONENT, BY DISCRETE INDUSTRY, 2017–2025 (USD BILLION)

TABLE 147 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 148 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 149 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2017–2025 (USD BILLION)

TABLE 150 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 151 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY DISCRETE INDUSTRY, 2017–2025 (USD MILLION)

TABLE 152 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR MACHINE VISION, BY REGION, 2017–2025 (USD MILLION)

TABLE 153 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR CONTROL VALVES, BY PROCESS INDUSTRY, 2017–2025 (USD MILLION)

TABLE 154 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET FOR CONTROL VALVES, BY REGION, 2017–2025 (USD MILLION)

TABLE 155 INDUSTRIAL CONTROL AND FACTORY AUTOMATION MARKET, BY REGION, 2017–2025 (USD BILLION)

14.4 SMART MANUFACTURING

FIGURE 54 SMART MANUFACTURING MARKET ECOSYSTEM

TABLE 156 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY ENABLING TECHNOLOGY, 2017–2025 (USD BILLION)

FIGURE 55 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR COLLABORATIVE ROBOTS

TABLE 157 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY COLLABORATIVE ROBOT, 2017–2025 (USD BILLION)

FIGURE 56 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR DIGITAL TWIN

TABLE 158 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY DIGITAL TWIN, 2017–2025 (USD BILLION)

FIGURE 57 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR INDUSTRIAL 3D PRINTING

TABLE 159 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY INDUSTRIAL 3D PRINTING, 2017–2025 (USD BILLION)

FIGURE 58 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR MACHINE CONDITION MONITORING

TABLE 160 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY MACHINE CONDITION MONITORING, 2017–2025 (USD BILLION)

FIGURE 59 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR OTHER ENABLING TECHNOLOGIES

TABLE 161 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY OTHER ENABLING TECHNOLOGY, 2017–2025 (USD BILLION)

FIGURE 60 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR INFORMATION TECHNOLOGIES

TABLE 162 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET, BY INFORMATION TECHNOLOGY, 2017–2025 (USD BILLION)

FIGURE 61 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR MANUFACTURING EXECUTION SYSTEM

TABLE 163 PRE- AND POST-COVID-19 ANALYSIS OF SMART MANUFACTURING MARKET, BY MANUFACTURING EXECUTION SYSTEM, 2017–2025 (USD BILLION)

FIGURE 62 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET FOR PLANT ASSET MANAGEMENT

TABLE 164 PRE- AND POST-COVID-19 ANALYSIS OF SMART MANUFACTURING MARKET, BY PLANT ASSET MANAGEMENT, 2017–2025 (USD BILLION)

TABLE 165 SMART MANUFACTURING MARKET, BY REGION, 2017–2025 (USD BILLION)

FIGURE 63 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN NORTH AMERICA

TABLE 166 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET IN NORTH AMERICA, 2017–2025 (USD BILLION)

FIGURE 64 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN EUROPE

TABLE 167 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET IN EUROPE, 2017–2025 (USD BILLION)

FIGURE 65 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN APAC

TABLE 168 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET IN APAC, 2017–2025 (USD BILLION)

FIGURE 66 IMPACT OF COVID-19 ON SMART MANUFACTURING MARKET IN ROW

TABLE 169 PRE- AND POST-COVID-19 ANALYSIS FOR SMART MANUFACTURING MARKET IN ROW, 2017–2025 (USD BILLION)

14.5 INDUSTRIAL ROBOTICS MARKET

FIGURE 67 TRADITIONAL INDUSTRIAL ROBOTS MARKET TO DECLINE CONSIDERABLY DURING 2019–2020 OWING TO COVID-19 PANDEMIC

FIGURE 68 ROBOTICS ECOSYSTEM

TABLE 170 ARTICULATED ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 69 PRE- AND POST-COVID-19 ESTIMATES FOR ARTICULATED ROBOTS MARKET

TABLE 171 SCARA ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 70 PRE- AND POST-COVID-19 ESTIMATES FOR SCARA ROBOTS MARKET

TABLE 172 PARALLEL ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 71 PRE- AND POST-COVID-19 ESTIMATES FOR PARALLEL ROBOTS MARKET

TABLE 173 CARTESIAN ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 72 PRE- AND POST-COVID-19 ESTIMATES FOR CARTESIAN ROBOTS MARKET

FIGURE 73 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR AUTOMOTIVE INDUSTRY

FIGURE 74 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR ELECTRICAL AND ELECTRONICS INDUSTRY

FIGURE 75 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR CHEMICALS, RUBBER, AND PLASTICS INDUSTRY

FIGURE 76 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY

FIGURE 77 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PRECISION ENGINEERING AND OPTICS INDUSTRY

FIGURE 78 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET FOR PHARMACEUTICALS AND COSMETICS INDUSTRY

TABLE 174 GLOBAL TRADITIONAL INDUSTRIAL ROBOTS MARKET, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 79 IMPACT OF COVID-19 ON GLOBAL TRADITIONAL INDUSTRIAL ROBOTS MARKET

TABLE 175 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 80 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN NORTH AMERICA

TABLE 176 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 81 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN EUROPE

TABLE 177 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN APAC, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD BILLION)

FIGURE 82 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN APAC

TABLE 178 TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2025 (USD MILLION)

FIGURE 83 IMPACT OF COVID-19 ON TRADITIONAL INDUSTRIAL ROBOTS MARKET IN ROW

14.6 3D SENSOR MARKET

TABLE 179 3D SENSORS MARKET, BY TYPE, 2017—2025 (USD MILLION)

FIGURE 84 CONSUMER ELECTRONICS EXPECTED TO BE THE LARGEST MARKET FOR 3D IMAGE SENSORS DURING THE FORECAST PERIOD

TABLE 180 3D SENSORS MARKET, BY TECHNOLOGY, 2017—2025 (USD MILLION)

FIGURE 85 TIME-OF-FLIGHT TECHNOLOGY EXPECTED TO LEAD THE 3D SENSORS MARKET DURING THE FORECAST PERIOD

TABLE 181 3D SENSORS MARKET FOR CONSUMER ELECTRONICS, BY APPLICATION, 2017—2025 (USD MILLION)

TABLE 182 3D SENSORS MARKET, BY REGION, 2017—2025 (USD MILLION)

FIGURE 86 3D SENSORS MARKET IN APAC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

15 APPENDIX (Page No. - 238)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORT

15.6 AUTHOR DETAILS

The study involved the estimation of the current size of the 3D Machine Vision Market. Exhaustive secondary research was conducted to collect information about the market, the peer market, and the parent market, the impact of COVID-19 outbreak in the said market. This was followed by the validation of these findings, assumptions, and sizing with industry experts identified across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. It was followed by market breakdown and data triangulation procedures which were used to estimate the market size of segments and sub-segments.

Secondary Research

The research methodology used to estimate and forecast the machine vision market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the machine vision market. Each industrial and non-industrial wise COVID-19 impact was estimated from various secondary sources. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the machine vision market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, service providers, and related executives from various key companies and organizations operating in the ecosystem of the 3D machine vision market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the 3D machine vision market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in significant applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the 3D machine vision market based on offering, product, application, vertical, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders, by identifying the high growth segments of the 3D machine vision market

- To strategically analyze the micro-markets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the market size, in terms of value, for various segments, with regard to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with detailing the competitive landscape for market leaders

- To track and analyze the competitive developments such as joint ventures, mergers and acquisitions, new product developments, and research and development (R&D) carried out in the 3D machine vision market

- To analyze the penetration of the 3D machine vision market through secondary and primary research for both pre- and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in 3D Machine Vision Market