Smart Camera Market for Security & Surveillance by Application (Public Spaces, Commercial Facilities, Residential Infrastructure), Sensor Technology, Scanning Technology, and Region (Americas, Europe, APAC) - Global Forecast to 2020

The global smart camera for security & surveillance market is estimated to grow from USD 1.93 Billion in 2015 to USD 3.06 Billion by 2020, at a CAGR of 9.7% from 2015 to 2020.

The global smart camera for security & surveillance market is estimated to grow from USD 1.93 Billion in 2015 to USD 3.06 Billion by 2020, at a CAGR of 9.7% from 2015 to 2020. The major driver for the global smart camera market for security & surveillance is the increasing usage of smart cameras for security & surveillance purposes in various applications, such as public spaces, military & defense, transit facilities, commercial facilities, enterprise & government infrastructure, and residential infrastructure.

Smart cameras for security & surveillance have specific applications across various industry verticals. The fastest-growing application segments of the global smart camera for security & surveillance market are commercial facilities, public spaces, and residential infrastructure. There is an increase in the demand for smart cameras for various security & surveillance applications, such as protection from terrorist attacks, in household security market, in smart buildings, and outdoor security market. Continuous technical advancements are being carried out for the development of better quality smart cameras. The growing concern for national security among countries of the world is one of the factors driving the demand for smart cameras, which in turn, is fueling the growth of the global smart camera for security & surveillance market.

The global smart camera market for security & surveillance has been segmented into two types, namely, sensor technology and scanning technology. These segments individually cater to the total market. The CMOS subsegment of the sensor technology segment is expected to lead the global smart camera market for security & surveillance between 2015 and 2020. Smaller size, low power consumption, ease of integration, faster frame rate, and lower manufacturing cost of CMOS sensors are the factors leading to the growth of this subsegment.

The area scan subsegment of the scanning technology segment is expected to lead the global smart camera market for security & surveillance during the forecast period. This subsegment is projected to grow at the highest CAGR between 2015 and 2020. Area scan cameras can capture images of preset resolution in both directions, that is, in terms of length and width of an object. Area scan cameras can be used in almost all the applications where the object whose image is to be captured is not stationary.

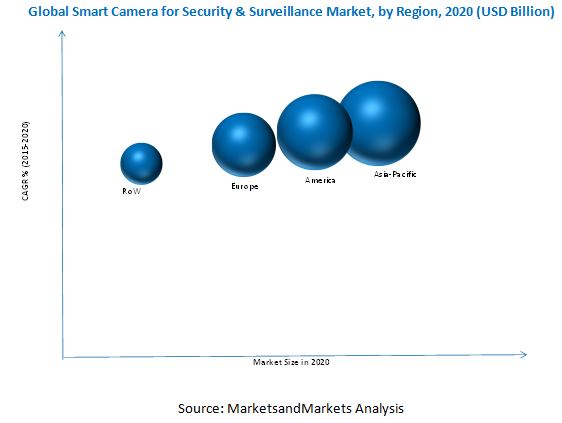

Geographically, the global smart camera for security & surveillance market has been segmented into the Americas, Europe, Asia-Pacific, and rest of the world (RoW). The Asia-Pacific region is projected to lead the global smart camera for security & surveillance between 2015 and 2020. The Asia-Pacific smart camera market for security & surveillance is projected to grow at the highest CAGR during forecast period. The growth of the Asia-Pacific smart camera for security & surveillance market can be attributed to the technological developments taking place in the Asia-Pacific region. Besides, the region is also emerging as a manufacturing hub for smart cameras. The public spaces, military & defense, and transit facilities are the application segments of the Asia-Pacific smart camera for security & surveillance market that are expected to witness increased growth during the forecast period. Various countries, such as China, Japan, and South Korea are driving the market for smart camera for security & surveillance market in the Asia-Pacific region.

Interface of smart cameras, such as GigE vision relies on a CPU to process each incoming packet, with associated multiple interrupts per received image. These images are later forwarded to the receiver, thereby increasing the CPU load. A high CPU load inevitably results in processing delays in the host PC and reduces image processing capability. This is one of the major factors that may restrain the growth of the global smart camera market for security & surveillance.

Some of the key companies operating in the global smart camera for security & surveillance market include FLIR Systems, Inc., Canon Inc., Samsung Techwin Co., Ltd., Sony Corporation, Panasonic Corporation, Bosch Security Systems, Inc., Raptor Photonics Ltd., and Watec Co., Ltd. FLIR Systems, Inc. adopted strategies of new product launches and acquisitions to gain substantial share in the global smart camera market for security & surveillance. For instance, in 2015, FLIR Systems, Inc. announced acquisition of DVTEL, Inc. (U.S.). This acquisition is expected to help the company to develop software and hardware technologies for advanced video surveillance. Furthermore, the company is also known for its large-scale sales channels and distribution networks, which help it to increase its market share, globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Segmentation and Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Integrated Ecosystem of the Global Smart Camera for Security & Surveillance Market

2.2 Arriving at the Global Smart Camera market for Security & Surveillance Size

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand Side Approach

2.2.4 Macro Indicator-Based Approach

2.3 Assumptions

3 Executive Summary (Page No. - 19)

4 Market Overview (Page No. - 21)

4.1 Introduction

4.2 Smart Camera for Security & Surveillance Market: Comparison With Smart Camera Market (Parent Market)

4.3 Market Drivers and Restraints

4.4 Key Market Dynamics

4.5 Demand Side Analysis

5 Smart Camera for Security & Surveillance Market, By Sensor Technology (Page No. - 28)

5.1 Introduction

5.2 Cmos

5.3 Ccd

5.4 Comparison With Parent Market

6 Smart Camera for Security & Surveillance Market, By Scanning Technology (Page No. - 32)

6.1 Introduction

6.2 Line Scan

6.3 Area Scan

6.4 Comparison With Parent Market

7 Smart Camera for Security & Surveillance Market, By Application (Page No. - 36)

7.1 Introduction

7.2 Public Spaces

7.3 Military & Defense

7.4 Transit Facilities

7.5 Commercial Facilities

7.6 Enterprise & Government Infrastructure

7.7 Residential Infrastructure

8 Smart Camera for Security & Surveillance Market, By Region (Page No. - 45)

8.1 Introduction

8.1.1 Americas

8.1.2 Europe

8.1.3 Asia-Pacific

8.1.4 Rest of the World

9 Competitive Landscape (Page No. - 55)

9.1 Introduction

9.1.1 Market Assessment for the Top Players

9.2 New Product Developments

9.3 Acquisitions and Other Expansions

10 Company Profiles (Page No. - 60)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

10.1 Bosch Security Systems, Inc.

10.2 Canon Inc.

10.3 Flir Systems, Inc.

10.4 Panasonic Corporation

10.5 Raptor Photonics Ltd.

10.6 Samsung Techwin Co., Ltd.

10.7 Sony Corporation

10.8 Watec Co., Ltd.

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 79)

11.1 Customization Options

11.1.1 Product Portfolio Analysis

11.1.2 Country-Level Data Analysis

11.1.3 Product Comparison of Various Competitors

11.1.4 Trade Analysis

11.2 Introducing RT: Real Time Market Intelligence

11.2.1 RT Snapshots

11.3 Related Reports

List of Tables (43 Tables)

Table 1 R&D Expenditure, 2012-2013 (USD Billion)

Table 2 Smart Camera for Security & Surveillance Market: Comparison With Parent Market, 2013-2020 (USD Billion)

Table 3 Smart Camera Market for Security & Surveillance: Drivers and Restraints

Table 4 Smart Camera for Security & Surveillance Market , By Region, 2013-2020 (USD Million)

Table 5 Smart Camera Market for Security & Surveillance, By Application, 2013-2020 (USD Million)

Table 6 Smart Camera for Security & Surveillance Market , By Scanning Technology, 2014-2020 (USD Million)

Table 7 Smart Camera Market for Security & Surveillance, By Sensing Technology, 2013-2020 (USD Million)

Table 8 Smart Camera for Security & Surveillance Market : Comparison With Application Market, 2013-2020 (USD Billion)

Table 9 Smart Camera Market for Security & Surveillance, By Sensor Technology, 2013-2020 (USD Million)

Table 10 Smart Camera for Security & Surveillance Market , By Sensor Technology: Comparison With Parent Market, 2013-2020 (USD Million)

Table 11 Smart Camera for Security & Surveillance Market, By Scanning Technology, 2013-2020 (USD Million)

Table 12 Smart Camera for Security & Surveillance Market By Scanning Technology: Comparison With Parent Market, 2013-2020 (USD Million)

Table 13 Smart Camera for Security & Surveillance Market, By Application, 2013–2020 (USD Million)

Table 14 Smart Camera for Security & Surveillance Market in Public Spaces, By Region, 2013–2020 (USD Million)

Table 15 Smart Cameras for Security & Surveillance Market in Military & Defense, By Region, 2013–2020 (USD Million)

Table 16 Smart Camera for Security & Surveillance Market in Transit Facilities, By Region, 2013–2020 (USD Million)

Table 17 Smart Camera Market for Security & Surveillance in Commercial Facilities, By Region, 2013–2020 (USD Million)

Table 18 Smart Camera for Security & Surveillance Market in Enterprise & Government Infrastructure, By Region, 2013–2020 (USD Million)

Table 19 Smart Camera for Security & Surveillance Market in Residential Infrastructure, By Region, 2013–2020 (USD Million)

Table 20 Smart Camera for Security & Surveillance Market, By Region, 2013-2020 (USD Million)

Table 21 Americas Smart Camera Market for Security & Surveillance, By Country, 2014-2020 (USD Million)

Table 22 Americas Smart Camera for Security & Surveillance Market, By Application, 2013-2020 (USD Million)

Table 23 Europe Smart Camera for Security & Surveillance Market , By Country, 2013-2020 (USD Million)

Table 24 Europe Smart Camera for Security & Surveillance Market, By Application, 2013-2020 (USD Million)

Table 25 Asia-Pacific Smart Camera for Security & Surveillance Market, By Country, 2013-2020 (USD Million)

Table 26 Asia-Pacific Smart Camera Market for Security & Surveillance, By Application, 2013-2020 (USD Million)

Table 27 RoW Smart Camera for Security & Surveillance Market, By Region, 2013-2020 (USD Million)

Table 28 RoW Smart Camera for Security & Surveillance Market, By Application, 2013-2020 (USD Million)

Table 29 Smart Camera Market for Security & Surveillance: New Product Developments

Table 30 Smart Camera for Security & Surveillance Market: Acquisitions and Other Expansions

Table 31 Canon Inc.: Revenue, By Business Segment, 2011–2014 (USD Billion)

Table 32 Canon Inc.: Revenue, By Geographic Segment, 2011–2014 (USD Billion)

Table 33 Flir Systems, Inc: Revenue, By Business Segment, 2011–2014 (USD Million)

Table 34 Flir Systems, Inc: Revenue, By Geographic Segment, 2011–2014 (USD Million)

Table 35 Panasonic Corporation: Revenue, By Business Segment, 2011–2015 (USD Billion)

Table 36 Panasonic Corporation: Revenue, By Geographic Segment, 2011–2015 (USD Billion)

Table 37 Samsung Techwin Co., Ltd. : Revenue, By Business Segment, 2011–2014 (USD Million)

Table 38 Samsung Techwin Co., Ltd: Revenue, By Geographic Segment, 2011–2014 (USD Million)

Table 39 Samsung Techwin Co., Ltd.: Revenue, By Business Segment, 2011–2014 (USD Million)

Table 40 Samsung Techwin Co., Ltd.: Revenue, By Geographic Segment, 2011–2014 (USD Million)

Table 41 Sony Corporation: Sales and Operating Revenue, By Business Segments, 2011–2015 (USD Billion)

Table 42 Sony Corporation: Sales and Operating Revenue, By Business Subsegment, 2011–2015 (USD Billion)

Table 43 Sony Corporation: Sales & Operating Revenue, By Geographic Segment, 2011–2015 (USD Billion)

List of Figures (35 Figures)

Figure 1 Global Intelligence Camera for Security & Surveillance Market: Segmentation & Coverage

Figure 2 Integrated Ecosystem of the Smart Camera for Security & Surveillance Market

Figure 3 Arriving at Global Smart Camera for Security & Surveillance Market Size: Top-Down Approach

Figure 4 Arriving at Global Smart Camera Market for Security & Surveillance Size: Bottom-Up Approach

Figure 5 Global Application Market, 2014 (USD Billion)

Figure 6 R&D Expenditure, 2012 & 2013 (USD Billion)

Figure 7 Smart Camera Market for Security & Surveillance: Snapshot

Figure 8 Smart Camera for Security & Surveillance Market: Growth Aspects

Figure 9 Smart Camera Market for Security & Surveillance: Comparison With Parent Market, 2013-2020 (USD Billion)

Figure 10 Smart Camera for Security & Surveillance Market, By Geography, 2015 & 2020 (USD Million)

Figure 11 Smart Camera for Security & Surveillance Market, By Application, 2015 & 2020 (USD Million)

Figure 12 Smart Camera for Security & Surveillance Market, By Scanning Technology, 2015 & 2020 (USD Million)

Figure 13 Smart Camera Market for Security & Surveillance, By Sensor Technology, 2015 & 2020 (USD Million)

Figure 14 Demand Side Analysis, 2013-2020 (USD Billion)

Figure 15 Smart Camera for Security & Surveillance Market, By Sensor Technology, 2015 & 2020 (USD Million)

Figure 16 Smart Camera Market for Security & Surveillance, By Sensor Technology: Comparison With Parent Market, 2013-2020 (USD Million)

Figure 17 Smart Camera for Security & Surveillance Market, By Scanning Technology, 2015 & 2020 (USD Million)

Figure 18 Smart Camera Market for Security & Surveillance, By Scanning Technology: Comparison With Parent Market, 2013-2020 (USD Million)

Figure 19 Smart Camera for Security & Surveillance Market, By Application, 2015 & 2020 (USD Million)

Figure 20 Smart Camera for Security & Surveillance Market in Public Spaces, By Region, 2013-2020 (USD Million)

Figure 21 Smart Camera Market for Security & Surveillance in Military & Defense, By Region, 2013-2020 (USD Million)

Figure 22 Smart Camera for Security & Surveillance Market in Transit Facilities, By Region, 2013-2020 (USD Million)

Figure 23 Smart Camera Market for Security & Surveillance in Commercial Facilities, By Region, 2013-2020 (USD Million)

Figure 24 Smart Camera for Security & Surveillance Market in Enterprise & Government Infrastructure, By Region, 2013-2020 (USD Million)

Figure 25 Smart Camera Market for Security & Surveillance in Residential Infrastructure, By Region, 2013-2020 (USD Million)

Figure 26 Smart Camera for Security & Surveillance Market, By Region, 2014-2020 (USD Million)

Figure 27 Americas Smart Camera for Security & Surveillance Market, By Country, 2015 & 2020 (USD Million)

Figure 28 Americas Smart Camera Market for Security & Surveillance, By Application, 2015 & 2020 (USD Million)

Figure 29 Europe Smart Camera for Security & Surveillance Market, By Country, 2015 & 2020 (USD Million)

Figure 30 Europe Smart Camera Market for Security & Surveillance, By Application, 2015 & 2020 (USD Million)

Figure 31 Asia-Pacific Smart Camera for Security & Surveillance Market, By Country, 2015 & 2020 (USD Million)

Figure 32 Asia-Pacific Smart Camera Market for Security & Surveillance, By Application, 2015 & 2020 (USD Million)

Figure 33 RoW Smart Camera for Security & Surveillance Market, By Country, 2015 & 2020 (USD Million)

Figure 34 RoW Smart Camera for Security & Surveillance Market, By Application, 2015 & 2020 (USD Million)

Figure 35 Smart for Security & Surveillance Camera Market: Market Assessment for the Top Players, 2014

The global smart camera market for security & surveillance has been segmented into sensor technology and scanning technology. Both these segments individually cater to the global market. The sensor technology segment of the global smart camera for security & surveillance market has been further classified into CMOS and CCD. The scanning technology segment of the global smart camera for security & surveillance market has been segmented into line scan and area scan. Geographically, the global smart camera market for security & surveillance has been segmented into the Americas, Europe, Asia-Pacific, and rest of the world (RoW).

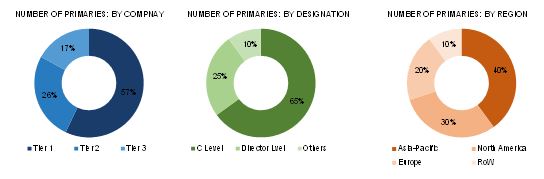

The key players operating in the global smart camera market for security & surveillance were identified across different regions, along with their offerings, distribution channels, and geographical presence. Moreover, the average revenue generated by these companies, which have been segmented on the basis of region, was used to arrive at the overall market size. This overall size of the global smart camera for security & surveillance market was used in the top-down approach to estimate the sizes of various subsegments via percentage splits from secondary and primary research. The entire procedure included study of annual and financial reports of the top market players and interviews of the industry experts, such as CEOs, vice presidents, directors, and marketing executives to obtain key insights regarding the global smart camera market for security & surveillance.

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding ecosystem of the global smart camera market for security & surveillance comprising product manufacturers and suppliers, original equipment manufacturers (OEMs), system integrators, middleware and firmware providers, suppliers and distributors, technology providers, service providers, and manufacturers of electronic devices. This study answers several questions of the stakeholders, primarily, by providing insights on the market segments that need to be focused during the next two to five years for prioritizing efforts and investments.

Target Audience

- Original Equipment Manufacturers (OEMs)

- ODM and OEM Technology Solution Providers

- Suppliers and Distributors

- Research Organizations and Institutes

- Market Research and Consulting Firms

- Technology Standards Organizations, Forums, Alliances, and Associations

- Technology Investors

- Analysts and Strategic Business Planners

- End Users

- Government and Other Regulatory Bodies

Scope of the global smart camera for security & surveillance market:

Global Smart Camera for Security & Surveillance Market, By Application:

- Public Spaces

- Military & Defense

- Transit Facilities

- Commercial Facilities

- Enterprise & Government Infrastructure

- Residential Infrastructure

Global Smart Camera for Security & Surveillance Market, By Sensor Technology

- CMOS

- CCD

Global Smart Camera for Security & Surveillance Market, By Scanning Technology

- Area Scan

- Line Scan

Global Smart Camera for Security & Surveillance Market, By Region

- Americas

- Europe

- Asia-Pacific

- RoW

Available Customizations:

Along with the market data, MarketsandMarkets also offers customizations to meet specific needs of the clients. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Growth opportunities and latent adjacency in Smart Camera Market