Certificate Authority Market by Offering (Certificate Types, Services), SSL Certificate Validation Type ( Domain Validation, Organization Validation, Extended Validation), Organization Size, Vertical, and Region - Global Forecast to 2028

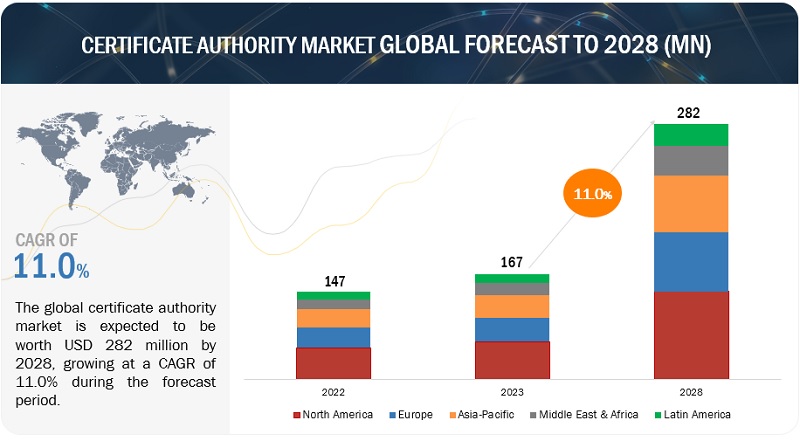

The global certificate authority market size was estimated at USD 167 million in 2023 and is projected to reach USD 282 million by 2028 at a CAGR of 11.0% during the forecast period. The expansion of the certificate authority market can be attributed to a rise in instances of HTTPS phishing attacks and stringent regulatory standards and data privacy compliances.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Certificate Authority Market Dynamics

Driver: Rise in instances of HTTPS phishing attacks

The increase in HTTP phishing assaults emphasizes the importance of providing safe and reliable communication channels by employing reputable certificate authorities and legitimate SSL/TLS certificates. Certificate authorities are essential in phishing attack risk prevention and mitigation, safeguarding users and organizations from potential data breaches and monetary losses. The SSL/TLS certificates that enable safe and encrypted communication between websites and users are provided by certificate authorities, which are essential to this process. Phishing attacks frequently make use of bogus websites that seem like authentic websites. Legitimate websites may prove their legitimacy and encrypt the communication channel by getting SSL/TLS certificates from trustworthy certificate authorities, making it more difficult for hackers to intercept or tamper sensitive data.

Opportunity: Exponential increase in the adoption of IoT trends across industry verticals

The importance of certificate authority in supplying secure identity management, authentication, and encryption for IoT devices and applications increases as the IoT ecosystem develops and diversifies. Certificate authority has proven itself as a highly secure and flexible solution for protecting and managing the entire connected devices life cycle in an IoT environment. IoT systems and solutions can seamlessly manage and integrate certificates with the help of certificate authority services. In addition to guaranteeing safe and scalable certificate administration, this enables organizations to take advantage of their current IoT infrastructure.

Restraint: Running private certificate authorities or using self-signed certificates

Many organizations set up private certification authorities or use self-signed certificates to authenticate and secure internal servers, applications, and IP addresses that do not require public trust yet need the security provided by SSL encryption. Using self-signed certificates might be helpful to increase network security on an organization’s internal network. But it’s crucial to understand the dangers of utilizing self-signed certificates and take precautions against them. Web browsers, operating systems, and other systems that depend on public trust anchors do not automatically trust self-signed certificates. Users that use self-signed certificates could run across problems or warnings that say the certificate cannot be trusted. Users may get confused and concerned about their security as a result, which may make them reluctant to connect with systems that employ self-signed certificates.

Challenge:Lack of awareness among organizations about the importance of SSL certificates

Organizations across industry verticals do not use digital certificates for their websites due to their lack of awareness about the importance of secured websites. Lack of insight into the certificate system is also a prime concern. The lack of a systematic process causes certificates to be lost on the network because several departments from different locations request and enroll certificates onto endpoints. For instance, it could be quite challenging for administrators to hunt down and renew one certificate after it has expired. A lack of understanding of certificate authority and a shortage of skilled PKI management personnel are other challenges many organizations face.

Certificate Authority Market Ecosystem

By vertical, retail, and eCommerce segment is to grow at the highest CAGR during the forecast period.

The retail and eCommerce industry is a frequent target of phishing attacks and fraudulent activities. Certificate authorities provide SSL/TLS certificates that help prevent these malicious activities by displaying visual cues, such as the padlock icon or the organization's verified name, which distinguish legitimate websites from fraudulent ones. By implementing SSL/TLS certificates, retail and eCommerce businesses can protect their customers from phishing scams, build trust, and maintain the integrity of their brands.

The retail and eCommerce industry heavily relies on online transactions, including purchases, payments, and customer data exchanges. Certificate authorities play a critical role in providing SSL/TLS certificates that secure these transactions by encrypting sensitive data, such as credit card information, ensuring secure communication channels, and protecting customer privacy. Implementing SSL/TLS certificates instills confidence in customers, reduces the risk of data breaches, and promotes a secure shopping experience.

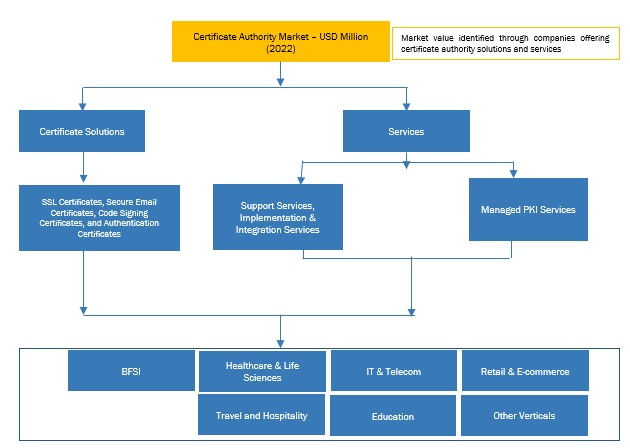

By offerings, the services segment is expected to grow at higher CAGR during the forecast period

Certificate authority services are the support offered by vendors to assist their customers with the efficient use and operation of certificates. These services include support, implementation, integration, and managed PKI services. Moreover, these services offer guidelines on the use of certificates and help embed best practices in organizations. The complex nature of digital security requires collaboration between various stakeholders, including certificate authorities, software vendors, cybersecurity firms, and industry consortiums. Market drivers for certificate authority services include the need for collaboration and partnerships to develop and implement standardized security practices and frameworks.

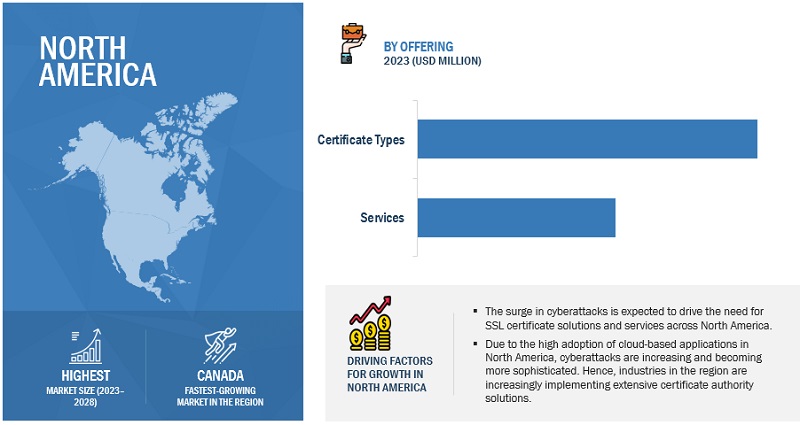

By region, North America accounts for the highest market size during the forecast period.

North America consists of developed countries that are technologically advanced with well-developed infrastructure. Being the strongest economies, the US and Canada are the top contributing countries in North America in the certificate authority market. The digital revolution of several industries, including banking, healthcare, e-commerce, and government services, is leading the way in North America. The need for certificate authority and digital certificates has risen due to the development of cloud computing, Internet of Things (IoT) devices, and mobile apps, raising the requirement for secure communication and data security. Moreover, the cyberattack surge is expected to drive the need for SSL certificate solutions and services across North America. North America is a major target for cyberattacks, and certificate authority plays an important role in protecting businesses and individuals from these attacks.

Key Market Players

Sectigo (US), Digicert (US), GlobalSign (Belgium), GoDaddy (US), IdenTrust (US), Entrust (US), Certum (Poland), Actalis (Italy), Lets Encrypt (US), SSL.Com (US), E-Tugra (Turkey), WISekey (Switzerland), Trustwave (US), SwissSign (Switzerland), TWCA (China), Buypass (Norway), Camerfirma (Spain), Harica Greece), Certigna (France), NETLOCK (Hungary), TURKTRUST (Turkey), certSIGN (Romania), Disig (Slovakia), Network Solutions (US), OneSpan (US) are the key players and other players in the certificate authority market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

offering, SSL certification validation type, organization size, verticals, and regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global certificate authority market include Sectigo (US), Digicert (US), GlobalSign (Belgium), GoDaddy (US), IdenTrust (US), Entrust (US), Certum (Poland), Actalis (Italy), Lets Encrypt (US), SSL.Com (US), E-Tugra (Turkey), WISekey (Switzerland), Trustwave (US), SwissSign (Switzerland), TWCA (China), Buypass (Norway), Camerfirma (Spain), Harica Greece), Certigna (France), NETLOCK (Hungary), TURKTRUST (Turkey), certSIGN (Romania), Disig (Slovakia), Network Solutions (US), OneSpan (US) |

The study categorizes the certificate authority market by offering, SSL certification validation type, organization size, verticals, and regions.

By Offerings:

- Certificate Type

- Services

By SSL Certification Validation Type:

- Domain Validation

- Organization Validation

- Extended Validation

By organization size:

- Large Organization

- SMEs

By Verticals:

- BFSI

- Retail and eCommerce

- Government and Defence

- Healthcare and Life Sciences

- IT and Telecom

- Travel and Hospitality

- Education

- Other Verticals

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In January 2023, DigiCert launched Trust Lifecycle Manager. The solution unifies CA-agnostic certificate management, private PKI services, and public trust issuance for seamless digital trust infrastructure.

- In March 2023, GlobalSign announced the successful establishment of a technology partnership with essendi it. The partnership will integrate essendi xc with GlobalSign’s certificate platform, Atlas.

- In May 2022, IdenTrust issued new Subordinate CA (SubCA), "IGC Device CA 2" to remain compliant with all Federal Public Key Infrastructure Policy Authority (FPKIPA) requirements. It will replace the current "IGC Device CA 1" SubCA.

- In February 2022, Sectigo announced accessibility updates to its flagship product Sectigo Certificate Manager (SCM) that meet global compliance guidelines. SCM's new artificial intelligence automatic accessibility solution through Equal Web improves the user experience.

- In November 2021, Sectigo partnered with Infinite Rangers. Infinite Ranges is one of the leading experts in public key infrastructure (PKI), encryption, and identity and access management. It offers DevSecOps consulting services. Infinite Ranges provided Sectigo professional services in the United States through this collaboration.

Frequently Asked Questions (FAQ):

What are the opportunities in the global certificate authority market?

The increase in the need for cloud-based security solutions among SMEs, the exponential increase in the adoption of IoT trends across industry verticals, proliferation of cloud-based and virtualization technologies are a few factors contributing to the growth and creating new opportunities for the certificate authority market.

What is the definition of the certificate authority market?

A certificate authority is a trusted entity that issues digital certificates that are verifiable small data files that contain identity credentials to help websites, people, and devices represent their authentic online identity. Certificate authorities are a critical part of the Internet's Public Key Infrastructure (PKI), and they play a major role in Internet operations by issuing Secure Sockets Layer (SSL) certificates. The certificate authority market includes players offering various types of certificates, such as SSL certificates, secure email certificates, code signing certificates, and authentication certificates. Additionally, it includes government entities and non-profit organizations.

Which region is expected to show the highest market share in the certificate authority market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include Sectigo (US), Digicert (US), GlobalSign (Belgium), GoDaddy (US), IdenTrust (US), Entrust (US), Certum (Poland), Actalis (Italy), Lets Encrypt (US), SSL.Com (US), E-Tugra (Turkey), WISekey (Switzerland), Trustwave (US), SwissSign (Switzerland), TWCA (China), Buypass (Norway), Camerfirma (Spain), Harica Greece), Certigna (France), NETLOCK (Hungary), TURKTRUST (Turkey), certSIGN (Romania), Disig (Slovakia), Network Solutions (US), OneSpan (US).

What is the current size of the global certificate authority market?

The global certificate authority market size is projected to grow from USD 167 million in 2023 to USD 282 million by 2028 at a Compound Annual Growth Rate (CAGR) of 11% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in instances of HTTPS phishing attacks- Stringent regulatory standards and need for data privacy compliance- Rising concerns regarding loss of critical dataRESTRAINTS- Use of self-signed certificates by private certification authoritiesOPPORTUNITIES- Rising popularity of cloud-based security solutions among SMEs- Exponential increase in adoption of IoT solutions across industry verticals- Proliferation of cloud-based and virtualization technologiesCHALLENGES- Lack of awareness among organizations regarding importance of SSL certificates

-

5.3 USE CASESSECTIGO HELPED SSLTRUST REMAIN COMPETITIVE AND BUILD STRONG CUSTOMER BASE IN SSL MARKETFINANCE IN MOTION USES GLOBALSIGN’S MANAGED PKI SOLUTION AND KEYTALK APPLICATION TO SAFEGUARD EMAIL COMMUNICATIONS BETWEEN EMPLOYEES AND CLIENTSE-MUDHRA HELPED MAURITIUS GOVERNMENT IMPLEMENT NATIONAL PKI INFRASTRUCTURE

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.7 INDICATIVE PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISCERTIFICATE AUTHORITY MARKET AND INTERNET OF THINGS

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.11 TECHNOLOGY ROADMAP

- 5.12 BUSINESS MODEL

- 5.13 EVOLUTION OF CERTIFICATE AUTHENTICATION

-

5.14 REGULATORY LANDSCAPEGENERAL DATA PROTECTION REGULATIONHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTFEDERAL INFORMATION SECURITY MANAGEMENT ACTSARBANES–OXLEY ACTGRAMM–LEACH–BLILEY ACTPAYMENT CARD INDUSTRY DATA SECURITY STANDARDFEDERAL INFORMATION PROCESSING STANDARDS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 KEY CONFERENCES & EVENTS, 2023

- 6.1 INTRODUCTION

-

6.2 CERTIFICATE TYPESGROWING USE OF CERTIFICATE AUTHORITY MECHANISMS TO ENHANCE SECURITY TO DRIVE MARKETCERTIFICATE TYPES: CERTIFICATE AUTHORITY MARKET DRIVERSSSL CERTIFICATESSECURE EMAIL CERTIFICATESCODE SIGNING CERTIFICATESAUTHENTICATION CERTIFICATES

-

6.3 SERVICESRISING FOCUS ON ASSISTING CUSTOMERS WITH EFFICIENT USE AND OPERATION OF CERTIFICATES TO DRIVE GROWTHSERVICES: MARKET DRIVERSSUPPORT SERVICESIMPLEMENTATION & INTEGRATION SERVICESMANAGED PKI SERVICES

- 7.1 INTRODUCTION

-

7.2 DOMAIN VALIDATIONNEED TO SAFEGUARD USER CREDENTIALS AT AFFORDABLE COST TO BOOST GROWTHDOMAIN VALIDATION: CERTIFICATE AUTHORITY MARKET DRIVERS

-

7.3 ORGANIZATION VALIDATIONFOCUS ON EMPHASIZING IMPORTANCE OF CUSTOMER DATA TO ENCOURAGE GROWTHORGANIZATION VALIDATION: MARKET DRIVERS

-

7.4 EXTENDED VALIDATIONNEED FOR ROBUST IDENTITY ASSURANCE AND ADDED TRUST TO ENCOURAGE USE OF CERTIFICATE AUTHORITY SOLUTIONSEXTENDED VALIDATION: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 LARGE ENTERPRISESWIDESPREAD ADOPTION OF CLOUD SERVICES TO BOOST USE OF DIGITAL CERTIFICATESLARGE ENTERPRISES: CERTIFICATE AUTHORITY MARKET DRIVERS

-

8.3 SMALL & MEDIUM-SIZED ENTERPRISES (SMES)FOCUS ON PRIORITIZING TRUSTED RELATIONSHIPS WITH CUSTOMERS TO DRIVE DEMANDSMES: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)DEMAND TO ENCRYPT TRANSACTION GATEWAY TO SAFEGUARD CRITICAL INFORMATION TO BOOST GROWTHBFSI: CERTIFICATE AUTHORITY MARKET DRIVERS

-

9.3 RETAIL & ECOMMERCENEED TO SAFEGUARD CUSTOMERS’ CREDENTIALS AND ENHANCE THEIR EXPERIENCE TO PROPEL MARKETRETAIL & ECOMMERCE: MARKET DRIVERS

-

9.4 GOVERNMENT & DEFENSEFOCUS ON IMPROVING WORK PATTERNS IN PUBLIC SECTOR DEPARTMENTS TO ENCOURAGE USE OF CERTIFICATE AUTHORITY SERVICESGOVERNMENT & DEFENSE: MARKET DRIVERS

-

9.5 HEALTHCARE & LIFE SCIENCESDEPLOYMENT OF CUTTING-EDGE TECHNOLOGIES TO IMPROVE CUSTOMER EXPERIENCE TO ENCOURAGE GROWTHHEALTHCARE & LIFE SCIENCES: CERTIFICATE AUTHORITY MARKET DRIVERS

-

9.6 IT & TELECOMRISE OF INNOVATIVE TECHNOLOGIES TO SAFEGUARD SENSITIVE INFORMATION TO AUGMENT DEMANDIT & TELECOM: CERTIFICATE AUTHORITY MARKET DRIVERS

-

9.7 TRAVEL & HOSPITALITYRISING CASES OF IDENTITY THREATS TO DRIVE DEPLOYMENT OF SECURITY CERTIFICATESTRAVEL & HOSPITALITY: MARKET DRIVERS

-

9.8 EDUCATIONNEED TO PROTECT CONFIDENTIAL DATA RELATED TO APPLICATIONS AND PATENTS TO DRIVE USE OF CERTIFICATE AUTHORITY CERTIFICATESEDUCATION: MARKET DRIVERS

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: CERTIFICATE AUTHORITY MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Stringent regulations to drive adoption of certificate authority solutionsCANADA- Increase in fraud and malicious attacks due to digitalization to propel growth

-

10.3 EUROPEEUROPE: CERTIFICATE AUTHORITY MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Increasing cyberattacks to boost adoption of certificate authority solutionsGERMANY- Growing use of innovative IT systems in German enterprises to boost adoption of certificate authority servicesFRANCE- Growing use of SSL certificates by French government to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: CERTIFICATE AUTHORITY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Increasing investments in advanced technologies to drive growthJAPAN- Strong base of technologically advanced industries to boost adoption of certificate authority solutionsINDIA- Rise in online shopping trends to propel need for certificate authorityREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CERTIFICATE AUTHORITY MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Significant growth in online financial services to drive demand for SSL certificatesAFRICA- Need to improve security of national identity programs to encourage adoption of SSL certificates

-

10.6 LATIN AMERICALATIN AMERICA: CERTIFICATE AUTHORITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Data loss through theft to leverage adoption of certificate authority solutionsMEXICO- Rapid cloud adoption to boost popularity of certificate authority solutionsREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS FOR KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 11.5 RANKING OF KEY PLAYERS

-

11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023COMPANY EVALUATION MATRIX FOR KEY PLAYERS: DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING OF KEY PLAYERS

-

11.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.9 COMPETITIVE SCENARIOPRODUCT/SOLUTION LAUNCHESDEALS

-

12.1 KEY PLAYERSSECTIGO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDIGICERT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLOBALSIGN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGODADDY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIDENTRUST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENTRUST- Business overview- Products/Solutions/Services offered- Recent developmentsCERTUM- Business overview- Products/Solutions/Services offered- Recent developmentsACTALIS- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSLET’S ENCRYPTSSL.COME-TUGRAWISEKEYTRUSTWAVESWISSSIGNTWCABUYPASSCAMERFIRMAHARICACERTIGNANETLOCKTURKTRUSTCERTSIGNDISIGNETWORK SOLUTIONSONESPAN

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PUBLIC KEY INFRASTRUCTURE MARKET

- 13.4 DIGITAL SIGNATURE MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 CERTIFICATE AUTHORITY MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 PORTER’S FIVE FORCES MODEL: IMPACT ANALYSIS

- TABLE 6 IDENTRUST: CERTIFICATE PRICING MODEL

- TABLE 7 ENTRUST: CERTIFICATE PRICING MODEL

- TABLE 8 DIGICERT: CERTIFICATE PRICING MODEL

- TABLE 9 LIST OF PATENTS GRANTED, 2022

- TABLE 10 TECHNOLOGY ROADMAP

- TABLE 11 BUSINESS MODEL

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 LIST OF CONFERENCES & EVENTS, 2023

- TABLE 15 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 16 CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 19 CERTIFICATE TYPES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 CERTIFICATE TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SSL CERTIFICATES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 SSL CERTIFICATES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SECURE EMAIL CERTIFICATES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 SECURE EMAIL CERTIFICATES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 CODE SIGNING CERTIFICATES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 CODE SIGNING CERTIFICATES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 AUTHENTICATION CERTIFICATES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 AUTHENTICATION CERTIFICATES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 CERTIFICATE AUTHORITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 30 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 31 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SUPPORT SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 SUPPORT SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 IMPLEMENTATION & INTEGRATION SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 IMPLEMENTATION & INTEGRATION SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MANAGED PKI SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 MANAGED PKI SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 40 MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 41 DOMAIN VALIDATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 DOMAIN VALIDATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 ORGANIZATION VALIDATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 ORGANIZATION VALIDATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 EXTENDED VALIDATION: CERTIFICATE AUTHORITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 EXTENDED VALIDATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 48 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 49 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SMES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 SMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 54 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 55 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 RETAIL & ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 IT & TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 IT & TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 EDUCATION: CERTIFICATE AUTHORITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 US: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 88 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 US: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 90 US: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 91 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 92 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 93 US: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 94 US: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 95 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 96 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 97 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 98 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 100 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 102 CANADA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 103 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 104 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 CANADA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 106 CANADA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 107 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 109 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 110 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 124 EUROPE: CERTIFICATE AUTHORITY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 UK: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 UK: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 128 UK: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 129 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 130 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 131 UK: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 132 UK: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 133 UK: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 134 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 136 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 137 GERMANY: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 140 GERMANY: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 141 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 142 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 GERMANY: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 144 GERMANY: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 145 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 147 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 FRANCE: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 150 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 151 FRANCE: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 152 FRANCE: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 153 FRANCE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 154 FRANCE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 155 FRANCE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 156 FRANCE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 157 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 158 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 159 FRANCE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 160 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 161 REST OF EUROPE: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 162 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 164 REST OF EUROPE: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 166 REST OF EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 168 REST OF EUROPE: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 170 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 171 REST OF EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 172 REST OF EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 CHINA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 188 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 CHINA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 190 CHINA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 191 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 192 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 194 CHINA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 195 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 197 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 198 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 199 JAPAN: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 200 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 201 JAPAN: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 202 JAPAN: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 203 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 204 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 205 JAPAN: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 206 JAPAN: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 207 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 208 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 209 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 210 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 211 INDIA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 212 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 213 INDIA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 214 INDIA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 215 INDIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 216 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 217 INDIA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 218 INDIA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 219 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 220 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 221 INDIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 222 INDIA: CERTIFICATE AUTHORITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: CERTIFICATE AUTHORITY MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 232 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 249 MIDDLE EAST: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 250 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 251 MIDDLE EAST: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 252 MIDDLE EAST: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 253 MIDDLE EAST: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 254 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 255 MIDDLE EAST: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 256 MIDDLE EAST: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 257 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 258 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 259 MIDDLE EAST: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 260 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 261 AFRICA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 262 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 263 AFRICA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 264 AFRICA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 265 AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 266 AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 267 AFRICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 268 AFRICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 269 AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 270 AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 271 AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 272 AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 273 LATIN AMERICA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 276 LATIN AMERICA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 278 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 279 LATIN AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 280 LATIN AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 282 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 283 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 284 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 286 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 287 BRAZIL: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 288 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 289 BRAZIL: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 290 BRAZIL: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 291 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 292 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 293 BRAZIL: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 294 BRAZIL: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 295 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 296 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 297 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 298 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 299 MEXICO: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 300 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 301 MEXICO: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 302 MEXICO: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 303 MEXICO: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 304 MEXICO: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 305 MEXICO: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 306 MEXICO: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 307 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 308 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 309 MEXICO: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 310 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 311 REST OF LATIN AMERICA: CERTIFICATE AUTHORITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 312 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: MARKET, BY CERTIFICATE TYPE, 2017–2022 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: MARKET, BY CERTIFICATE TYPE, 2023–2028 (USD MILLION)

- TABLE 315 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 316 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 317 REST OF LATIN AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2017–2022 (USD MILLION)

- TABLE 318 REST OF LATIN AMERICA: MARKET, BY SSL CERTIFICATION VALIDATION TYPE, 2023–2028 (USD MILLION)

- TABLE 319 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 320 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 321 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 322 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 323 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 324 EVALUATION CRITERIA FOR KEY PLAYERS

- TABLE 325 GLOBAL COMPANY FOOTPRINT

- TABLE 326 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 327 COMPANY FOOTPRINT, BY REGION

- TABLE 328 CERTIFICATE AUTHORITY MARKET: PRODUCT/SOLUTION LAUNCHES, 2020–2023

- TABLE 329 MARKET: DEALS, 2020–2023

- TABLE 330 SECTIGO: BUSINESS OVERVIEW

- TABLE 331 SECTIGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 SECTIGO: PRODUCT LAUNCHES

- TABLE 333 SECTIGO: DEALS

- TABLE 334 DIGICERT: BUSINESS OVERVIEW

- TABLE 335 DIGICERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 DIGICERT: PRODUCT LAUNCHES

- TABLE 337 DIGICERT: DEALS

- TABLE 338 GLOBALSIGN: BUSINESS OVERVIEW

- TABLE 339 GLOBALSIGN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 GLOBALSIGN: PRODUCT LAUNCHES

- TABLE 341 GLOBALSIGN: DEALS

- TABLE 342 GODADDY: BUSINESS OVERVIEW

- TABLE 343 GODADDY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 GODADDY: PRODUCT LAUNCHES

- TABLE 345 GODADDY: DEALS

- TABLE 346 IDENTRUST: BUSINESS OVERVIEW

- TABLE 347 IDENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 IDENTRUST: PRODUCT LAUNCHES

- TABLE 349 IDENTRUST: DEALS

- TABLE 350 ENTRUST: BUSINESS OVERVIEW

- TABLE 351 ENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 ENTRUST: PRODUCT LAUNCHES

- TABLE 353 ENTRUST: DEALS

- TABLE 354 CERTUM: BUSINESS OVERVIEW

- TABLE 355 CERTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 356 CERTUM: PRODUCT LAUNCHES

- TABLE 357 CERTUM: DEALS

- TABLE 358 ACTALIS: BUSINESS OVERVIEW

- TABLE 359 ACTALIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 PUBLIC KEY INFRASTRUCTURE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 361 PUBLIC KEY INFRASTRUCTURE MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 362 PUBLIC KEY INFRASTRUCTURE MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 363 PUBLIC KEY INFRASTRUCTURE MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

- TABLE 364 DIGITAL SIGNATURE MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 365 DIGITAL SIGNATURE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 366 DIGITAL SIGNATURE MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 367 DIGITAL SIGNATURE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OFFERED BY CERTIFICATE AUTHORITY VENDORS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OFFERED BY CERTIFICATE AUTHORITY VENDORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 3 (TOP-DOWN): DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 6 CERTIFICATE AUTHORITY MARKET: REGIONAL SNAPSHOT

- FIGURE 7 RAPID USE OF ONLINE SERVICES BY ORGANIZATIONS TO DRIVE GROWTH OF CERTIFICATE AUTHORITY MARKET

- FIGURE 8 SERVICES SEGMENT TO GROW AT HIGHER CAGR IN 2023

- FIGURE 9 SSL CERTIFICATE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 DOMAIN VALIDATION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 MANAGED SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 SMES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 13 BFSI SEGMENT AND NORTH AMERICA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 14 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 15 CERTIFICATE AUTHENTICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ECOSYSTEM MAP

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 LIST OF MAJOR PATENTS GRANTED, 2013–2023

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 DOMAIN VALIDATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 RETAIL & ECOMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 30 REVENUE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 31 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 32 RANKING OF KEY PLAYERS, 2022

- FIGURE 33 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 34 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 35 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 36 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 37 GODADDY: COMPANY SNAPSHOT

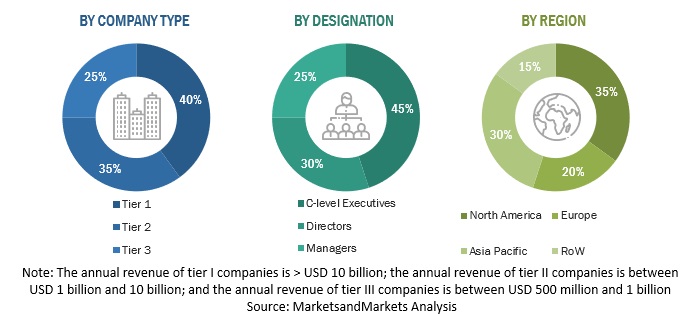

The study involved major activities in estimating the current market size for the certificate authority market. Exhaustive secondary research was done to collect information on the certificate authority industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the certificate authority market.

Secondary Research

The market share and revenue of the companies offering certificate authority solutions and services for various verticals were identified through the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, and journals, as well as research papers and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspective–all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), chief information security officers (CISOs), chief technology officers (CTOs), chief operating officers (COOs), vice presidents (VPs), managing directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the certificate authority market.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global certificate authority market and estimate the size of various other dependent sub-segments in the overall certificate authority market.

Bottom-Up approach:

To know about the assumptions considered for the study, Request for Free Sample Report

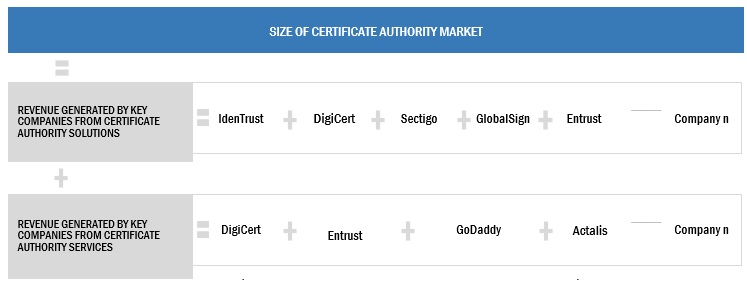

In this market size estimation approach, we have identified the key companies providing certificate authority solutions. Some of these are IdenTrust, DigiCert, Sectigo, GoDaddy, GlobalSign, Certum, Entrust, etc. These companies contribute to more than 90% of the global certificate authority market. After confirming the market share of these companies with industry experts through primary interviews, we have estimated their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenues of the business units (BUs) of these companies that offer certificate authority solutions were identified through similar sources. We then estimated the revenue generated through the sale of specific certificate authority solutions via primary research. The collective revenue of vendors offering certificate authority solutions and services comprised 90-95% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed to by smaller players that are a part of the unorganized market, the market size of organized players (90-95%) and unorganized players (5-10%) collectively was assumed to be the size of the certificate authority market for the financial year (FY) 2022

Top-Down approach:

In the top-down approach, the overall market was segmented into solutions and services. The market share of certificate authority solutions, including SSL certificates, secure email certificates, code signing certificates, and authentication certificates, was considered to estimate the market size for solutions. The market share of certificate authority services included the revenue generated from subscriptions of support services, implementation & integration services, and managed PKI services. The certificate authority market size was derived from certificate authority solutions and service offerings by different verticals. The total size of the certificate authority market comprises solutions and services.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A certificate authority is a trusted entity that issues digital certificates that are verifiable small data files that contain identity credentials to help websites, people, and devices represent their authentic online identity. Certificate authorities are a critical part of the internet's Public Key Infrastructure (PKI), and they play a major role in internet operations by issuing Secure Sockets Layer (SSL) certificates. These certificates are used by web browsers to authenticate content sent from web servers. The certificate authority market includes players offering various types of certificates, such as SSL certificates, secure email certificates, code signing certificates, and authentication certificates. Additionally, it includes government entities and non-profit organizations.

Key Stakeholders

- Government bodies and public safety agencies

- Project managers

- Developers

- Cybersecurity vendors

- Value-Added Resellers (VARs)

- Business analysts

- Quality assurance (QA)/test engineers

- Providers of certificate authority solutions and services

- Consulting firms

- Third-party vendors

- Investors and venture capitalists

- Technology providers

Report Objectives

- To define, describe, and forecast the certificate authority market, by offering (certificate types and services), SSL certificate validation types, organization size, industry vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market’s growth.

- To analyze opportunities in the market and provide the competitive landscape of the market.

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as mergers & acquisitions, product enhancements, and research and development (R&D) activities, in the market.

- To analyze the impact of recession on the growth of the market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Certificate Authority Market

good job

Interested in market on PKI technology