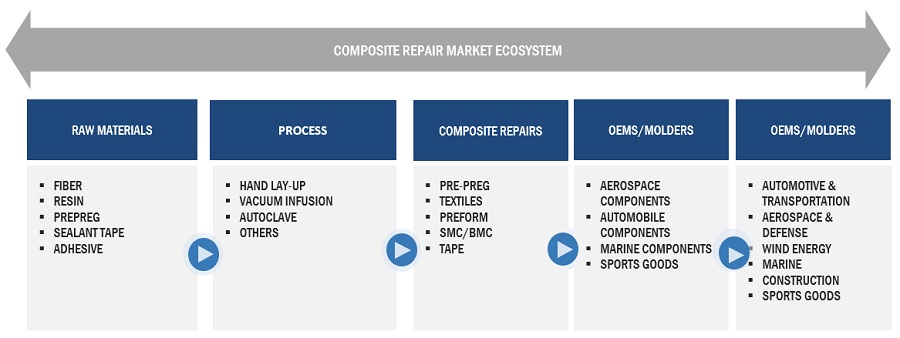

Composite Repair Market by Type (Structural, Semi-Structural, Cosmetic), Process (Hand Lay-Up, Vacuum Infusion, Autoclave), End-Use Industry (Aerospace & Defense, Wind Energy, Automotive & Transportation, Marine), and Region - Global Forecast to 2028

Composite Repair Market

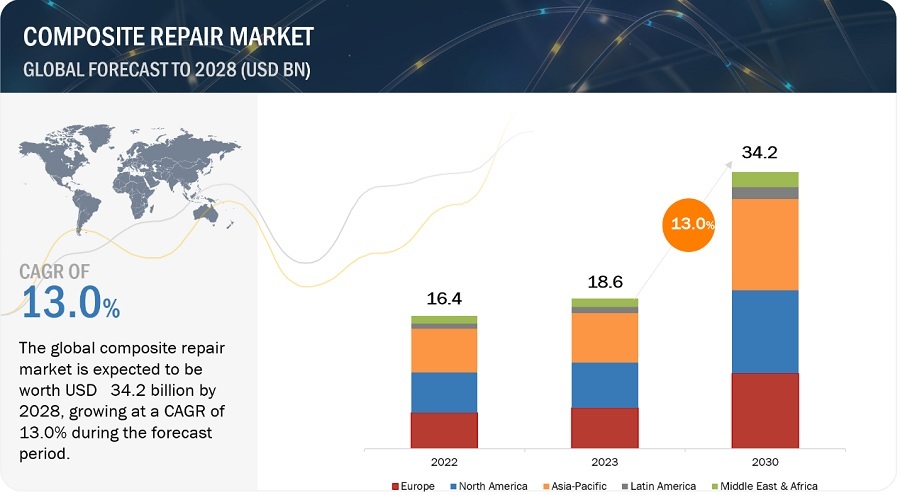

Composite Repair Market is estimated to be USD 18.6 billion in 2023 and is projected to reach USD 34.2 billion by 2028, at a cagr 13.0%. Over the world, the market is expanding significantly, and during the forecast period, a similar trend is anticipated. The demand for composite repair has been driven by several factors, including the increasing investment in rehabilitating old structures, and cost saving associated with composite structure repair. The major applications of composite repair include aerospace & defense, wind energy, automotive & transportation, marine, construction, pipes & tanks, and others.

In the aerospace industry, with a significant increase in the application of fiber-reinforced composites across the aircraft parts over the past decade, the repairs market is expected to grow significantly. The composite repair requirement will be driven by the new-generation commercial passenger aircraft, including 787 Dreamliner and A350; these aircraft account for 50% and 53% composites by weight, respectively. Although, these aircraft save 20%–30% of the maintenance cost, the damage due to lightning, collision with bird or any other object will need composite repair.

In the wind energy industry, composite wind turbine blades have an expected service life of 15–20 years. Most of the rotor blades carry 1–2 years of post-installation warranty. So, still, there are 17–18 years outside the warranty period, which require proper maintenance and repair. Without proper repair and maintenance, the efficiency diminishes with every defect on the surface and this results in a reduction in power production. The European wind energy market is more mature than the U.S. and the inspection is much regular in Europe. However, the operators in the U.S. are paying importance to regular blade maintenance.

Attractive Opportunities in Composite Repair Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Composite Repair Market Dynamics

Driver: cost saving associated with composite structure repair

Composite parts replacement is very costly. Thus, repair is preferred until the damage is non-repairable or a potential risk is associated with it. Composite repair can save up to 60% of the cost than replacement depending upon the end-use industry, type of repair, and damage.

For example, composite repair saved one-sixth of the cost as compared to the replacement in Carter Country Bridge over the Little Sandy River, which was first decided to be replaced and could cost USD 600,000. But, through repair it was completed only in USD 105,000. So, in the coming years with the ageing aircraft, bridges, and wind turbines composite repair will be adopted significantly.

Restraint: low penetration of composites in end-use industries in the least developed countries

In least developed countries of South America and Africa, the use of conventional material such as steel, aluminum, and wood are comparatively more than the composites. The resistance to change from conventional to advanced material is restricting the growing use of composites. The switching cost from conventional materials to composites is also higher. As a result of these challenges, the penetration of composites in the least developed countries of Africa and South America is still very low. This is acting as the restraint for the composite repairs market.

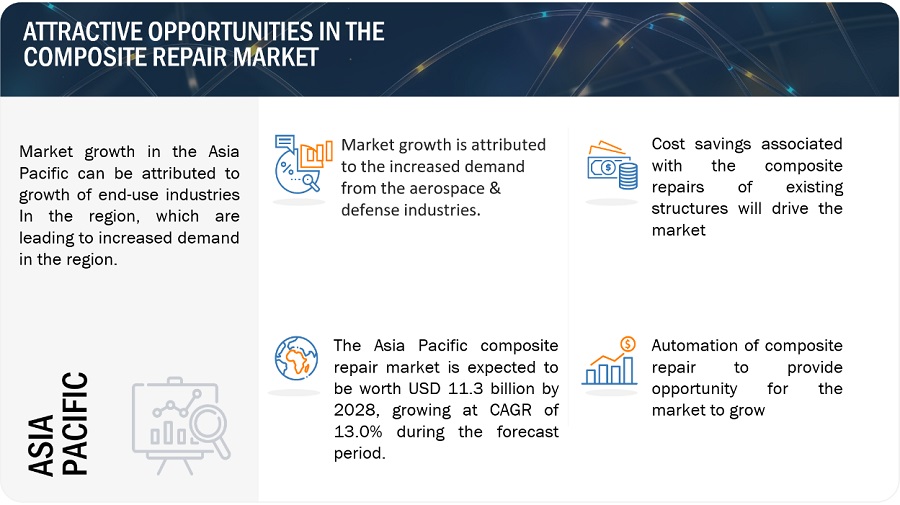

Opportunity: Automation of composite repair

Manual composite repair is time-consuming and incur higher cost. Automated repair saves 60% of the time than manual composite repair. This also saves cost as well as the risk of human error. With the increasing usage of composites in components from flaps, engine nacelles, fairings, vertical tail, to the entire forward wing structure and fuselage, the repair will be more difficult in the future. The airline and MRO companies have to gear up to meet the increasing composite repair demands. Currently, several automated repair technologies are under development including a fairly small mobile system by Airbus Group Innovations (Germany), the Inspection and Repair Preparation Cell (IRPC) (U.S.), and a system using resin infusion by the German Aerospace Center (Germany). Airbus Group Innovations (Germany) uses robotic arm to perform digital scanning, ultrasonic testing, milling to remove damage and automated tape laying to create patch repair, and then automate patch application. GKN Aerospace was involved in developing automated laser technology to improved, cost-effective composite structure repair, while consuming one-third time and saving 60% cost.

BCT GmbH (Germany) is also introduced automatic scarfing in 2013 to reduce machining time and to improve the quality of the repair preparations. A prototype mobile robot was also built and tested on actual aircraft. This demonstrated the ability to complete bonded composite repairs. on carbon fiber-reinforced plastic (CFRP) structure such as 787 and A350 XWB fuselages and wings.

Challenge: Skilled labor shortage

The lack of skilled composite repair technicians is one of the major challenges for the composite repairs market. In several countries, absence of proper and recognized training standards is also posing challenges for the market. As the use of composites in end-use industries will be aging, there will be significant demand for composite repair personnel. It is crucial to complete scheduled and effective repair of damages to avoid any project downtime and financial loss.

At the current situation, the availability or supply of trained personnel is disproportional to the growing demands. This may cause a long-term skill shortage and consequently can impact the quality and availability of inspection and repair.

It requires training, practice, and experience to become proficient in composite repair. The market lacks in the internationally recognized standards for composite repair. To avoid this, end-users are developing and offering training specific to their types of repair.

Composite Repair Market Ecosystem

Cosmetic type of composite repair products to be the fastest growing market by 2028, in terms of value.

The cosmetic repair segment is expected to witness the highest CAGR in the next five to ten years with the significant increase in the usage of composites in automobiles in order to increase the fuel efficiency. If during inspection it is found that the damage is minor and it has not affected the structural integrity of the component, then a cosmetic repair is carried out to decorate and protect the surface. In cosmetic repair, reinforcing material is not used, rather non-structural filler is used to protect the surface until a more permanent repair is being carried out. Through cosmetic repair the structure does not regain any strength, therefore, it is used only where strength is least important. High shrinkage may cause the cosmetic repairs to start cracking after a short period of time in operation. In general, the repairs done to motors, cars, and other vehicles constructed from composite materials are cosmetic rather than structural as if the body panels are damaged they cannot be repaired through cosmetic repair process, the damaged part has to be replaced.

Autoclave to be the fastest growing segment in the composite repair market, in terms of value.

Autoclave is a pressure vessel, which provides curing condition to the composite where the application of vacuum, pressure, heat, and cure temperature are controlled. The high pressure helps to mold the thicker sections of complex structures. This process takes long cure cycle as large autoclave mass takes long time to heat and cool down. An autoclave applies both heat and pressure to the workload placed inside of it.

Most of the aircraft parts are repaired by autoclave process. Autoclaves used for composite bonding in the aerospace, military, and other high-performance industries must be built with extra care with attention to detail. Autoclave is a costlier process as compared to hand lay-up and vacuum infusion processes. It offers high quality of repair. Thus, it is only affordable in repair of components where high performance is crucial, such as aerospace parts.

Automotive & Transportation end-use industry segment to be the fastest growing the composite repair market, in terms of value.

The use of composites in the global automotive industry is still small. Carbon fiber-reinforced plastics are limited to racing cars, supercars, and high-end luxury vehicles. However, in order to meet the recent fuel economy and emission standards, the demand for carbon fiber composites is expected to grow at a significant rate. Further, the economies of scale will make it more affordable. Currently, in high-end cars, carbon fiber-reinforced plastics are used in body panels, hoods, deck, roofs, fenders, and door panels. In case of damage, they are either replaced or removed as it associates a little incentive to repair despite their high cost. But, as the penetration of composites increases in structural components of chassis, new repair strategies are expected to emerge in the coming years.

The automotive industry is expected to adopt the repair techniques used in aerospace.

In automotive composite repairs, use of two-part epoxy adhesive is most common. For smaller repairs, single-unit adhesive applicator with two chambers loaded with adhesive resin and curing agent is used. For severe damage, the entire body panel or subpanels are removed, and a replacement piece is attached with the help of adhesive. Other than adhesive repair, fusion technique is also used whereby heating the damaged area minor damages are repaired by resin flowing back together.

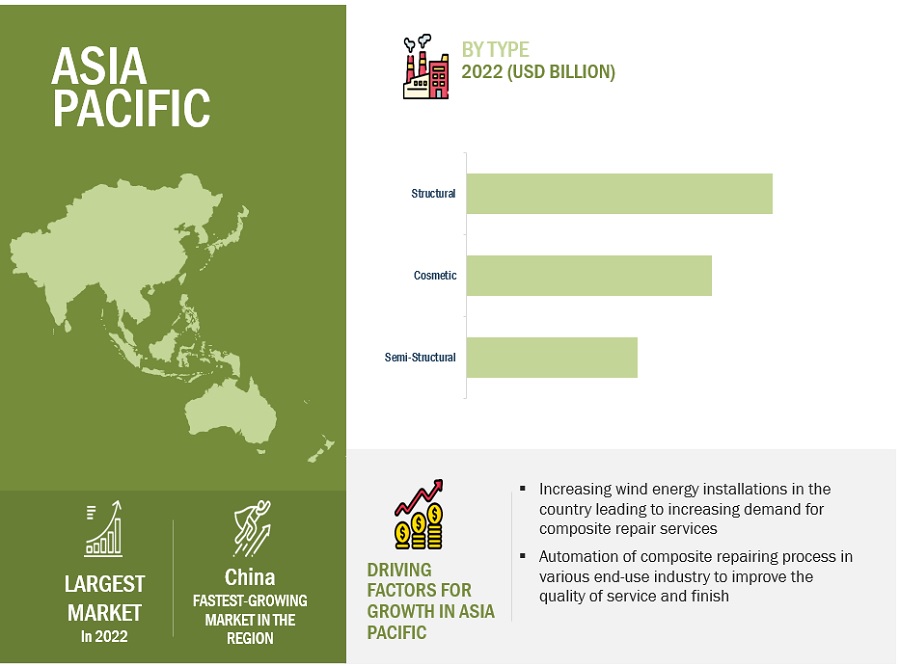

Asia Pacific held the largest market share in the composite repair market.

Asia-Pacific accounted for the largest market share of 32.9% in the global composite repairs market and is projected to lead during the forecast period owing to the largest existing wind energy capacity installations in China, Japan, India, and Australia. The aerospace composite repairs market also has significant opportunities as plenty of aircraft orders are being placed by airlines in the region. In Asia-Pacific, China, Japan, India Australia & New Zealand, South Korea, and Thailand are the key countries in the composite repairs market. Asia-Pacific is the fastest growing composite repairs market, which is projected to register a CAGR of 13.1% between 2023 and 2028. The remarkable growth of the wind energy industry in the Asia-Pacific has driven the composites and thereby the composite repairs market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Composite Repair Market Players

The composite repair market is dominated by a few globally established players such as Lufthansa Technik AG (Germany), Air France KLM E&M (France), and HAECO (U.S.), UpWind Solution (U.S.), Total Wind Group A/S (Denmark), and Technical Wind Services (Scotland), Citadel Technologies (U.S.), Milliken Infrastructure (U.S.), and T.D. Williamson (U.S.), West Systems (U.S.) and WR composites (U.K.), Fibrwraps (U.S.) and Concrete Repairs Ltd. (U.K.), among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the composite repair market. The research includes a detailed competitive analysis of these key players in the composite repair market, including company profiles, recent developments, and key market strategies.

Read More: Composite Repair Companies

Composite Repair Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 18.6 billion |

|

Revenue Forecast in 2028 |

USD 34.2 billion |

|

CAGR |

13.0% |

|

Market size available for years |

2020 - 2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023 – 2028 |

|

Units considered |

Value (USD billion/million) |

|

Segments Covered |

By Type, By Process, By End-Use Industries, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

Lufthansa Technik AG (Germany), Air France KLM E&M (France), and HAECO (U.S.), UpWind Solution (U.S.), Total Wind Group A/S (Denmark), and Technical Wind Services (Scotland), . Citadel Technologies (U.S.), Milliken Infrastructure (U.S.), and T.D. Williamson (U.S.), West Systems (U.S.) and WR composites (U.K.), Fibrwraps (U.S.) and Concrete Repairs Ltd. (U.K.). |

The study categorizes the composite repair market based on Glass type, Product type, Application, and Region.

By Type:

- Structural

- Semi-Structural

- Cosmetic

By Process:

- Hand Lay-Up

- Vacuum Infusion

- Autoclave

- Others

By End-User:

- Aerospace & Defense

- Wind Energy

- Automtoive & Transportation

- Marine

- Construction

- Pipes & Tanks

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In March 2023, AFKLM E&M and Spirit AeroSystems entered an agreement for the repair and overhaul of composite components for Spirit's commercial aircraft. The agreement includes a long-term commitment from Spirit, and it will allow Air France-KLM E&M to expand its capacity for composite repair and overhaul.

- In November 2022, TWS signed a new deal with Innogy Renewables to provide operations and maintenance services for the East Anglia One offshore wind farm. The deal is worth USD 50.26 million.

- In June 2022, UpWind Solutions partnered with GE Renewable Energy to provide asset management services for GE Renewable Energy's wind turbines.

- In March 2022, Total Wind Group signed a deal with Iberdrola to provide operations and maintenance services for the Wikinger offshore wind farm in the Baltic Sea. The deal is for a period of 15 years and is worth an estimated USD 1 billion.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the composite repair market?

Automation of composite repair.

Which is the largest country-level market for composite repair market?

China is the largest composite repair market due to high demand from well-established end-use industries.

What are the challenges in the composite repair market?

Lack of standardization on materials and testing in the composite repair market.

Which type of composite repair type holds the largest market share?

structural type hold the largest share in terms of value, in the composite repair market.

How is the composite repair market aligned?

The market is growing at a faster pace. It is a potential market and many service providers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Lufthansa Technik AG (Germany), Air France KLM E&M (France), and HAECO (U.S.), UpWind Solution (U.S.), Total Wind Group A/S (Denmark), and Technical Wind Services (Scotland), . Citadel Technologies (U.S.), Milliken Infrastructure (U.S.), and T.D. Williamson (U.S.), West Systems (U.S.) and WR composites (U.K.), Fibrwraps (U.S.) and Concrete Repairs Ltd. (U.K.).

What is the biggest restraint in the composite repair market?

Introduction of self-healing composites is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased investments in rehabilitation of old structures- Cost savings associated with composite structure repairRESTRAINTS- Low penetration of composites in underdeveloped economies- Introduction of self-healing compositesOPPORTUNITIES- Growing use of composites in end use industries- Introduction of new and advanced technologies- Automation of composite repairCHALLENGES- Skilled labor shortage- Lack of standardization of material and testing- Financial losses incurred during composite repair

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 TECHNOLOGY ANALYSIS

-

5.5 ECOSYSTEM MAPPING

-

5.6 VALUE CHAIN ANALYSISRAW MATERIAL AND LABORREPAIR SERVICE PROVIDERSEND USE INDUSTRIES

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 COMPOSITE REPAIR MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOSOPTIMISTIC SCENARIOPESSIMISTIC SCENARIOREALISTIC SCENARIO

-

5.9 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP PATENT APPLICANTSPATENTS BY BOEING CO.PATENTS BY UNIVERSITY OF SICHUANTOP TEN PATENT OWNERS (US) IN LAST 10 YEARS

- 5.10 CASE STUDY ANALYSIS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.1 INTRODUCTIONSTRUCTURAL- Improving aerospace industry to drive marketSEMI-STRUCTURAL- Demand from wind energy to increase usageCOSMETIC- Higher purchasing power to increase demand

-

7.1 INTRODUCTIONHAND LAY-UP- Convenience of usage in wide variety of applications to drive marketVACUUM INFUSION- Complex and airtight structure repairs in aerospace & defense industry to drive demandAUTOCLAVE- Increased usage of composites in high-performance industries to drive marketOTHER PROCESSES- Usage of composites in newer applications to drive segment- Composite wrap- Out-of-autoclave- Prepreg molding

-

8.1 INTRODUCTIONAEROSPACE & DEFENSE- Aircraft fuel efficiency to drive segment- Commercial aircraft- Business and general aviation aircraft- Civil helicopter- Military aircraftWIND ENERGY- Need for clean energy generation and increased installation of wind turbines to boost segment- Wind turbine bladeAUTOMOTIVE & TRANSPORTATION- Increasing competition and consumer demand for cosmetic changes to drive market- Automobile- RailMARINE- Need for easily repairable parts to withstand marine environment to accelerate demand- Powerboat- Sailboat- Cruise shipCONSTRUCTION- Increased usage for cost-saving efficient construction products to improve demand- Civil construction- Residential and commercial buildingPIPES AND TANKS- Demand from various end use industries to drive market- Oil & gas- Sewage- Chemical- IrrigationOTHER END USE INDUSTRIES- Increasing consumption of composites in various applications to drive market- Sporting goods- Medical- Electrical and electronics

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: COMPOSITE REPAIR MARKET, BY TYPENORTH AMERICA: COMPOSITE REPAIR MARKET, BY PROCESSNORTH AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRYNORTH AMERICA: COMPOSITE REPAIR MARKET, BY COUNTRY- US- Canada

-

9.3 EUROPEEUROPE: COMPOSITE REPAIR MARKET, BY TYPEEUROPE: COMPOSITE REPAIR MARKET, BY PROCESSEUROPE: COMPOSITE REPAIR MARKET, BY END USE INDUSTRYEUROPE: COMPOSITE REPAIR MARKET, BY COUNTRY- Germany- France- UK- Spain- Rest of Europe

-

9.4 ASIA PACIFICASIA PACIFIC: COMPOSITE REPAIR MARKET, BY TYPEASIA PACIFIC: COMPOSITE REPAIR MARKET, BY PROCESSASIA PACIFIC: COMPOSITE REPAIR MARKET, BY END USE INDUSTRYASIA PACIFIC: COMPOSITE REPAIR MARKET, BY COUNTRY- China- India- Australia and New Zealand- Japan- South Korea- Taiwan- Thailand- Rest of Asia Pacific

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY TYPEMIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY PROCESSMIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRYMIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY COUNTRY- UAE- Saudi Arabia- South Africa- Rest of Middle East & Africa

-

9.6 LATIN AMERICALATIN AMERICA: COMPOSITE REPAIR MARKET, BY TYPELATIN AMERICA: COMPOSITE REPAIR MARKET, BY PROCESSLATIN AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRYLATIN AMERICA: COMPOSITE REPAIR MARKET, BY COUNTRY- Brazil- Mexico- Rest of Latin America

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS, 2022

- 10.3 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP THREE MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 MARKET EVALUATION FRAMEWORK

-

11.1 KEY COMPANIESLUFTHANSA TECHNIK AG- Business overview- Products offered- MnM viewAIR FRANCE-KLM E&M- Business overview- Products offered- Recent developments- MnM viewHAECO- Business overview- Products offered- MnM viewUPWIND SOLUTIONS, INC.- Business overview- Products offered- Recent developments- MnM viewTOTAL WIND GROUP- Business overview- Products offered- Recent developments- MnM viewTECHNICAL WIND SERVICES- Business overview- Products offered- Recent developments- MnM viewCITADEL TECHNOLOGIES- Business overview- Products offered- MnM viewMILLIKEN INFRASTRUCTURE- Business overview- Products offered- MnM viewT.D. WILLIAMSON- Business overview- Products offered- MnM viewWEST SYSTEM- Business overview- Products offered- MnM viewWR COMPOSITE- Business overview- Products offered- MnM viewCONCRETE REPAIRS LTD.- Business overview- Products offered- MnM viewWALKER TECHNICAL RESOURCES LTD.- Business overview- Products offered- MnM view

-

11.2 OTHER PLAYERSFURMANITE CORPORATIONCOMPOSITE TECHNOLOGIES LTD.FGS COMPOSITESHAMBLE YACHT SERVICESCRAWFORD COMPOSITES LLCDELFT INFRA COMPOSITES

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 COMPOSITE REPAIR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 COMPOSITE REPAIR MARKET: SUPPLY CHAIN

- TABLE 3 COMPOSITE REPAIR MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 4 COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 5 COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 6 STRUCTURAL COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 7 STRUCTURAL COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 8 SEMI-STRUCTURAL COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 9 SEMI-STRUCTURAL COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 10 COSMETIC COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 11 COSMETIC COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 12 COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 13 COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 14 HAND LAY-UP COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 15 HAND LAY-UP COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 VACUUM INFUSION COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 17 VACUUM INFUSION COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 AUTOCLAVE COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 19 AUTOCLAVE COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 OTHER PROCESSES COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 21 OTHER PROCESSES COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 23 COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 24 COMPOSITE REPAIR MARKET IN AEROSPACE & DEFENSE, BY REGION, 2020–2022 (USD MILLION)

- TABLE 25 COMPOSITE REPAIR MARKET IN AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 COMPOSITE REPAIR MARKET IN WIND ENERGY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 27 COMPOSITE REPAIR MARKET IN WIND ENERGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 COMPOSITE REPAIR MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 29 COMPOSITE REPAIR MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 COMPOSITE REPAIR MARKET IN MARINE, BY REGION, 2020–2022 (USD MILLION)

- TABLE 31 COMPOSITE REPAIR MARKET IN MARINE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 COMPOSITE REPAIR MARKET IN CONSTRUCTION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 33 COMPOSITE REPAIR MARKET IN CONSTRUCTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 COMPOSITE REPAIR MARKET IN PIPES AND TANKS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 35 COMPOSITE REPAIR MARKET IN PIPES AND TANKS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 COMPOSITE REPAIR MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 37 COMPOSITE REPAIR MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 COMPOSITE REPAIR MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 39 COMPOSITE REPAIR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: COMPOSITE REPAIR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 US: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 49 US: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 50 CANADA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 51 CANADA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 53 EUROPE: COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 54 EUROPE: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 55 EUROPE: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 57 EUROPE: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: COMPOSITE REPAIR MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 59 EUROPE: COMPOSITE REPAIR MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 GERMANY: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 61 GERMANY: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 62 FRANCE: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 63 FRANCE: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 64 UK: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 65 UK: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 66 SPAIN: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 67 SPAIN: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 69 REST OF EUROPE: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: COMPOSITE REPAIRS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 CHINA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 79 CHINA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 80 INDIA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 81 INDIA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 82 AUSTRALIA AND NEW ZEALAND: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 83 AUSTRALIA AND NEW ZEALAND: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 84 JAPAN: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 85 JAPAN: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 86 SOUTH KOREA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 87 SOUTH KOREA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 88 TAIWAN: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 89 TAIWAN: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 90 THAILAND: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 91 THAILAND: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: COMPOSITE REPAIRS MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: COMPOSITE REPAIRS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 UAE: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 103 UAE: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 104 SAUDI ARABIA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 105 SAUDI ARABIA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 106 SOUTH AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 107 SOUTH AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 108 REST OF MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 109 REST OF MIDDLE EAST & AFRICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 110 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 111 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 113 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 115 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY END USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: COMPOSITE REPAIR MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 117 LATIN AMERICA: COMPOSITE REPAIRS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 BRAZIL: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 119 BRAZIL: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 120 MEXICO: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 121 MEXICO: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 122 REST OF LATIN AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 123 REST OF LATIN AMERICA: COMPOSITE REPAIR MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 124 COMPOSITE REPAIR MARKET: PRODUCT FOOTPRINT, 2022

- TABLE 125 COMPOSITE REPAIR MARKET: END USE INDUSTRY FOOTPRINT, 2022

- TABLE 126 COMPOSITE REPAIR MARKET: REGIONAL FOOTPRINT, 2022

- TABLE 127 COMPOSITE REPAIR MARKET: DEALS, 2018–2023

- TABLE 128 COMPOSITE REPAIR MARKET: PRODUCT DEVELOPMENT, 2018–2022

- TABLE 129 LUFTHANSA TECHNIK AG: COMPANY OVERVIEW

- TABLE 130 AIR FRANCE-KLM E&M: COMPANY OVERVIEW

- TABLE 131 AIR FRANCE-KLM E&M: DEALS

- TABLE 132 HAECO: COMPANY OVERVIEW

- TABLE 133 UPWIND SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 134 UPWIND SOLUTIONS, INC.: DEALS

- TABLE 135 TOTAL WIND GROUP: COMPANY OVERVIEW

- TABLE 136 TOTAL WIND GROUP: PRODUCT LAUNCHES

- TABLE 137 TOTAL WIND GROUP: DEALS

- TABLE 138 TECHNICAL WIND SERVICES: COMPANY OVERVIEW

- TABLE 139 TECHNICAL WIND SERVICES: DEALS

- TABLE 140 CITADEL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 141 MILLIKEN INFRASTRUCTURE: COMPANY OVERVIEW

- TABLE 142 T.D. WILLIAMSON: COMPANY OVERVIEW

- TABLE 143 WEST SYSTEM: COMPANY OVERVIEW

- TABLE 144 WR COMPOSITE: COMPANY OVERVIEW

- TABLE 145 CONCRETE REPAIRS LTD.: COMPANY OVERVIEW

- TABLE 146 WALKER TECHNICAL RESOURCES LTD.: COMPANY OVERVIEW

- TABLE 147 FURMANITE CORPORATION: COMPANY OVERVIEW

- TABLE 148 COMPOSITE TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 149 FGS COMPOSITES: COMPANY OVERVIEW

- TABLE 150 HAMBLE YACHT SERVICES: COMPANY OVERVIEW

- TABLE 151 CRAWFORD COMPOSITES LLC: COMPANY OVERVIEW

- TABLE 152 DELFT INFRA COMPOSITES: COMPANY OVERVIEW

- FIGURE 1 COMPOSITE REPAIR MARKET SEGMENTATION

- FIGURE 2 COMPOSITE REPAIR MARKET: RESEARCH DESIGN

- FIGURE 3 SUPPLY SIDE

- FIGURE 4 DEMAND SIDE

- FIGURE 5 COMPOSITE REPAIR MARKET: BOTTOM-UP APPROACH

- FIGURE 6 COMPOSITE REPAIR MARKET: TOP-DOWN APPROACH

- FIGURE 7 COMPOSITE REPAIR MARKET: DATA TRIANGULATION

- FIGURE 8 STRUCTURAL TYPE SEGMENT DOMINATED COMPOSITE REPAIR MARKET IN 2022

- FIGURE 9 HAND LAY-UP ACCOUNTED FOR LARGEST SHARE OF COMPOSITE REPAIR MARKET IN 2022

- FIGURE 10 AEROSPACE & DEFENSE GREW AT HIGHEST RATE IN 2022

- FIGURE 11 ASIA PACIFIC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN COMPOSITE REPAIR MARKET DURING FORECAST PERIOD

- FIGURE 13 HIGH DEMAND FROM END USE INDUSTRIES TO DRIVE COMPOSITE REPAIR MARKET

- FIGURE 14 STRUCTURAL TYPE COMPOSITE REPAIR TO DOMINATE OVERALL MARKET

- FIGURE 15 HAND LAY-UP PROCESS TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 16 AEROSPACE & DEFENSE END USE INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 COMPOSITE REPAIR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 COMPOSITE REPAIR MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 COMPOSITE REPAIR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE, 2011–2021

- FIGURE 22 PUBLICATION TRENDS, 2012–2022

- FIGURE 23 LEGAL STATUS

- FIGURE 24 PATENT JURISDICTION ANALYSIS, 2020

- FIGURE 25 TOP PATENT APPLICANTS

- FIGURE 26 STRUCTURAL SEGMENT ACCOUNTED FOR MAJOR SHARE OF COMPOSITE REPAIR MARKET IN 2022 (USD MILLION)

- FIGURE 27 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN STRUCTURAL COMPOSITE REPAIR MARKET

- FIGURE 28 ASIA PACIFIC TO LEAD SEMI-STRUCTURAL COMPOSITE REPAIR MARKET BY 2028

- FIGURE 29 ASIA PACIFIC TO BE LARGEST MARKET IN COSMETIC COMPOSITE REPAIR MARKET

- FIGURE 30 HAND LAY-UP PROCESS SEGMENT DOMINATED COMPOSITE REPAIR MARKET IN 2022 (USD MILLION)

- FIGURE 31 ASIA PACIFIC TO HAVE LARGEST MARKET SHARE IN HAND LAY-UP PROCESS SEGMENT DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO LEAD VACUUM INFUSION PROCESS SEGMENT IN COMPOSITE REPAIR MARKET BY 2028

- FIGURE 33 ASIA PACIFIC TO ACCOUNT FOR HIGHEST MARKET SHARE IN AUTOCLAVE PROCESS SEGMENT BETWEEN 2023 AND 2028

- FIGURE 34 ASIA PACIFIC TO LEAD OTHER PROCESSES SEGMENT OF COMPOSITE REPAIR MARKET BETWEEN 2023 AND 2028

- FIGURE 35 AEROSPACE & DEFENSE SEGMENT ACCOUNTED FOR LARGEST END USE SEGMENT IN GLOBAL COMPOSITE REPAIR MARKET IN 2022

- FIGURE 36 ASIA PACIFIC TO GROW FASTER IN AEROSPACE & DEFENSE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 37 ASIA PACIFIC TO REMAIN LARGEST MARKET FOR COMPOSITE REPAIRS IN WIND ENERGY INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 38 NORTH AMERICA TO LEAD COMPOSITE REPAIR MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO POSSESS HIGHEST MARKET SHARE IN MARINE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 40 NORTH AMERICA TO REMAIN LARGEST MARKET FOR COMPOSITE REPAIR IN CONSTRUCTION INDUSTRY

- FIGURE 41 ASIA PACIFIC TO HAVE HIGHEST CAGR OF COMPOSITE REPAIR MARKET IN PIPES AND TANKS INDUSTRY DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE FOR OTHER END USE INDUSTRES DURING FORECAST PERIOD

- FIGURE 43 CHINA TO DRIVE COMPOSITE REPAIR MARKET WITH HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 44 NORTH AMERICA: COMPOSITE REPAIR MARKET SNAPSHOT

- FIGURE 45 EUROPE: COMPOSITE REPAIR MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: COMPOSITE REPAIR MARKET SNAPSHOT

- FIGURE 47 MARKET SHARE OF TOP COMPANIES IN COMPOSITE REPAIR MARKET

- FIGURE 48 COMPOSITE REPAIR MARKET: COMPANY RANKING, 2022

- FIGURE 49 COMPOSITE REPAIR MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS, 2020–2022

- FIGURE 50 COMPOSITE REPAIR MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 51 COMPOSITE REPAIR MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 52 LUFTHANSA TECHNIK AG: COMPANY SNAPSHOT

- FIGURE 53 AIR FRANCE-KLM E&M: COMPANY SNAPSHOT

- FIGURE 54 HAECO: COMPANY SNAPSHOT

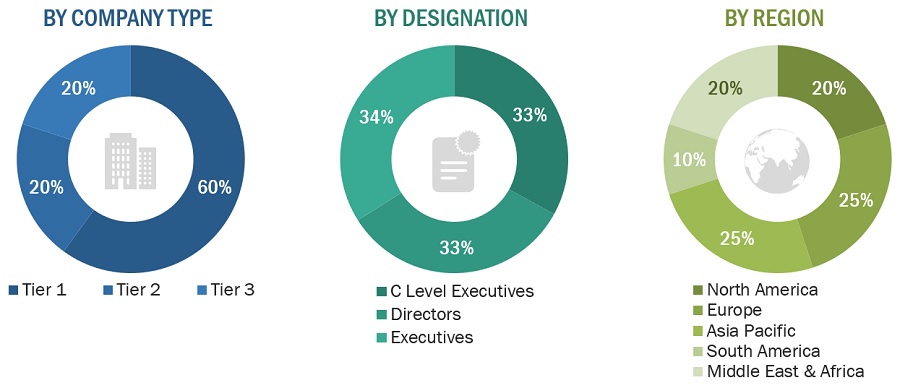

The study involves two major activities in estimating the current size of the composite repair market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information has been sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; and databases. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. These have also been utilized to obtain information about the key developments from a market-oriented perspective. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The stakeholders in the value chain of the composite repair market include raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries in the composite repair market. Primary sources from the supply side include experts from companies involved in the composite repair.

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

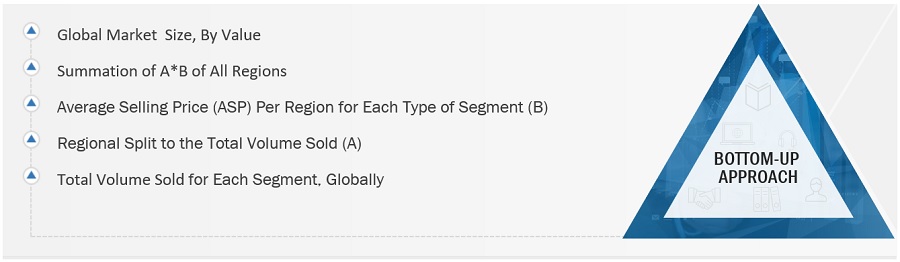

The research methodology used to estimate the size of the composite repair market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in composite repair in different applications of the composite repair industry at a regional level. Such procurements provide information on the demand aspects of the composite repair industry for each application. For each application, all possible segments of the composite repair market were integrated and mapped.

Composite repair Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Composite repair Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Fiber-reinforced composites are used in end-use industries including aerospace & defense, wind energy, automotive & transportation, marine, construction, pipe & tank, electrical & electronics, and sporting goods. However, due to several reasons such as lightning, collision, bird strike, erosion, corrosion, or manufacturing defects, the composite structure gets damaged. As composite parts replacement is costlier, composite repair is performed on disbands or delamination, holes or punctures, cracks, and other damages to bring back the part to its previous working condition.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To analyze and forecast the global composite repair market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type, process, and end-use industry.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the composite repair market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Composite Repair Market