Polyolefin Pipes Market by Type (PE, PP, Plastomer), Application (Irrigation, Potable & Plumbing, Wastewater Drainage, Power & Communication, Industrial), End-use Industry (Building & Construction, Agriculture), and Region - Global Forecast to 2026

Updated on : April 03, 2024

Polyolefin Pipes Market

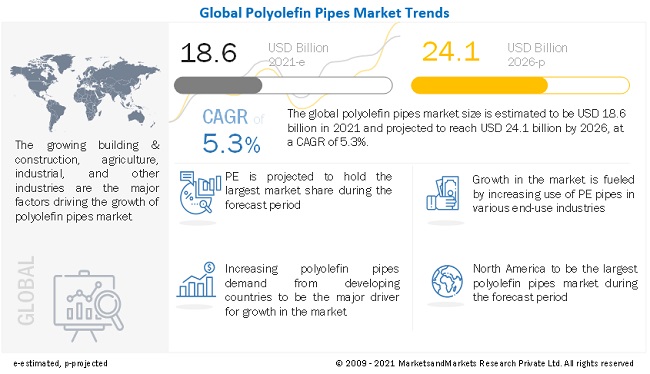

The global polyolefin pipes market was valued at USD 18.6 billion in 2021 and is projected to reach USD 24.1 billion by 2026, growing at 5.3% cagr from 2021 to 2026. The polyolefin pipes market growth is majorly driven by the growing building & construction, agriculture, and other industries, in the emerging economies of APAC and South America. Also, the increasing PE applications globally will drive market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Polyolefin Pipes Market

Production of different types of polyolefin pipes, such as PE, PP, plastomer, and other was normal till mid-march but after the COVID-19 pandemic the situation deteriorates at a huge scale due to the following reasons:

- Lack of demand for polyolefin pipes in construction

- Reduced workforce availability

- Government regulations to close the production facility

- Reduced operating capacity of the production facility

- Disruption in foam supply chain from raw material sourcing to end products

- Closing of international borders for shipment

COVID-19 has created disruption in all end-use industries, such as building & construction, agriculture, and industrial among others. Due to disruption, the demand for polyolefin pipes type has reduced drastically. Manufacturing facilities are either forced to close due to government regulations or voluntarily due to lack of demand.

Export activities have reduced drastically or completely shut down to prevent the spread of COVID-19 across the world, subsequently, transportation through air, water, and land were suspended for almost 3 months across the world. All these factors have lowered the demand for foam products across industries, which has caused a shrink in market size, growth rate, and potential investment in the polyolefin pipes industry. Consumer spending has also reduced and limits to necessary daily products due to uncertain future situations.

Polyolefin Pipes Market Dynamics

Driver: Sprinkler and drip irrigation provide good growth potential

Sprinkler irrigation is an advanced method of irrigation by which water is sprayed through nozzles connected to a network of pipes with water supplied under pressure. This method of irrigation has higher application and distribution efficiency and affects considerable savings of water. The development of sprinkler irrigation got a boost after the Second World War, and there has been a tremendous development of it, particularly in Europe and in the US. It serves nearly 45% of the irrigated area. Sprinkler irrigation in other countries of the world is under varying degrees of development. A large quantity of water can be conveyed through large diameter pipes with practically no transmission losses. Therefore, the market for PO pipes is expected to grow in the years to come.

By introducing the PO pipe conveyance system, clubbed with sprinkler and drip irrigation for the crop, it is possible to expand irrigation facilities to a larger area from the same quantity of water. The conveyance of water through pipes, coupled with the use of pressurized irrigation methods, is practiced in many countries. For instance, development in this direction has already started in the water-scarce states in India, such as Gujarat and Maharashtra. Maharashtra Government sanctions lift irrigation schemes only if the water is conveyed through pipes and use drip or sprinkler method of irrigation.

Restraint: Rising concerns pertaining to plastic disposal

Plastics are inexpensive, lightweight, and durable materials, which can readily be molded into a variety of products for a wide range of applications. Consequently, the production of plastics has increased significantly in the past 60 years. However, the current level of their usage and disposal generates several environmental problems. Nearly 4% of the global oil & gas production is used as feedstock for plastics, while 3%–4% is expended to provide energy for their manufacturing. A major portion of plastics produced each year is used to make disposable items that are discarded within a year. These factors suggest that the current use of plastics is not sustainable. Moreover, as these polymers are not easily degradable, the large amount of discarded end-of-life plastics is accumulating as debris in landfills and in natural habitats worldwide. Stringent regulations and directives against plastics usage owing to their hazardous impact on the environment during production and disposal are anticipated to retard the global market. Agencies such as FDA, REACH, and ASTM have issued several directives concerning PO pipes usage and manufacturing. This decreases PO pipes consumption in certain end-use applications, thus restraining the growth of the PO pipes market.

The manufacturing companies are tackling this restraint of plastic disposal concern. It shows that opinions among consumers and businesses provide ample opportunity for governments to take tangible, effective actions, such as promoting waste segregation at the household level, improving waste collection, and recycling capacity, and ensuring better product labeling, all of which will increase recycling rates.

Opportunity: Growing need of PO pipes for communication and cooking gas supplies

Home office and online commerce are pushing digitization. This upheaval in the economy seems to have very little to do with pipes at first glance. However, large sums are currently being invested in the expansion of fibre optic networks all across the globe. PO cable protection pipes are required to shield the expensive cables from harmful environmental influences.

In addition, utility companies have been using PO pipe buried in the ground to distribute natural gas from transmission lines and terminals to its customers. This material is more durable than steel or copper because it does not corrode and needs no anticorrosion protection

Challenges: Climatic challenges to maintain pipes

During pipes and fittings installation it is important to consider the connection between temperature variations and the problems that may arise from them. The extreme climatic conditions influence both the laying process and the lifespan of the products but also their proper performance, thus causing problems for the entire system. In aqueducts and public networks, managing authorities choose materials based on different criteria ranging from ease of installation to corrosion resistance, also taking into consideration the cost-effectiveness and the life of the products.

Despite their high resistance, extreme climatic conditions are not to be underestimated since they have influence on the physical status of the water that flows inside the pipes and those could slow down and influence the laying operations. The very cold-weather, as well as the extremely hot one, influences the installation of the piping system. The pipes, to counteract the frost and the consequent interruption of the water flow, require to be buried. The width of the excavation should be at least 20 cm around the diameter of the pipe and at least 1m above the pipe. Hence, temperature variations cause an additional slowdown in all on site operations, forcing installers to take expensive precautions in many ways.

PE segment is estimated to dominate the overall polyolefin pipes market.

PE has a high demand from polyolefin pipe manufacturers for applications in various end-use industries. PE is a thermoplastic pipe made from material that can be melted and reformed. It is rugged, flexible, and durable. It has outstanding chemical and environmental stress crack resistance and these performance benefits of PE pipe drive the growth of the segment.

Industrial application segment is estimated to dominate the overall polyolefin pipes market.

The polyolefin pipe is corrosion-resistant and has a long history of use as an abrasion-resistant material in industrial applications. It is lightweight, easy to install, and reduces the number of fittings needed in a system because of its flexibility. Because of the hazardous nature of some chemicals which are required to be transported, it is imperative that the piping system does not leak. The heat fusing polyolefin pipe provides a leak-free joint which is as strong if not stronger than the pipe itself in tension and pressure applications. These joints are self-restrained. They do not need thrust blocks or restraint harnesses except where the pipe attaches to a non-polyethylene system.

Agriculture is the fastest-growing market for polyolefin pipes by end-use industry.

The agriculture end-use industry is projected to lead the global polyolefin pipes market during the forecast period. Due to their inherent features, polyolefin pipes are best suited for agriculture and irrigation applications. The toughness and resistance to strong chemicals and corrosion are some of its major features. These, along with factors such as low weight, cost-effectiveness, and durability are leading to their rising demand.

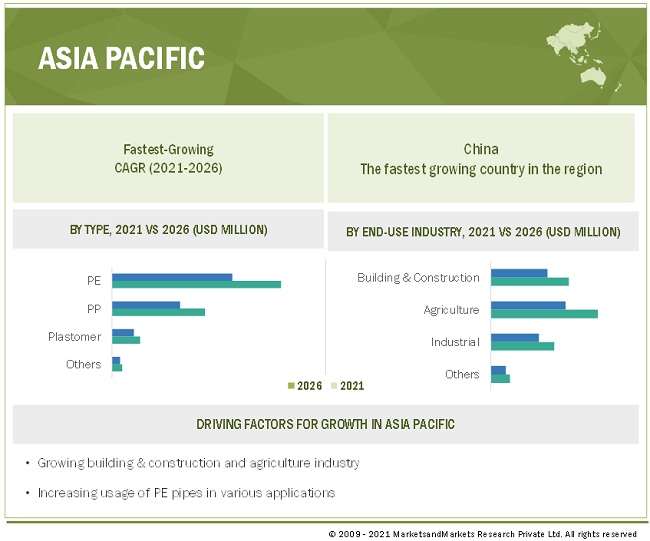

APAC is projected to be the fastest-growing polyolefin pipes market.

APAC is estimated to be the fastest-growing polyolefin pipes market during the forecast period. Among China, Japan, South Korea, India, and Rest of APAC, China was the largest consumer of polyolefin pipe in the region as of 2020 in terms of value as well as volume. Low cost of raw materials as well as their ease of availability, along with the low cost of establishing production facilities are some of the major factors driving the polyolefin pipes market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Polyolefin Pipes Market Players

AGRU (Austria), GF Piping Systems (Switzerland), Advanced Drainage Systems (US), Chevron Phillips Chemical Company (US), JM Eagle (US), Aliaxis (Belgium), Radius Systems (UK), Prinsco (US), Polyplastic Group (Russia), Nan Ya Plastics Corporation (Taiwan), Thai-Asia P.E. (Thailand), United Poly Systems (US), Future Pipe Industries (UAE), WL Plastics (US), Aquatherm (US), Blue Diamond Industries (US), Armtec (Canada), Pipeline Plastics (US), TeraPlast Group (Romania), Charter Plastics (US), Infra Pipe Solutions Pvt Ltd. (Canada), Pars Ethylene Kish (Iran), Vesbo Piping Systems (Turkey) are the key players operating in the polyolefin pipes market. These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for polyolefin pipes from emerging economies.

Polyolefin Pipes Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Million Meter) |

|

Segments |

Type, Application, End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

AGRU (Austria), GF Piping Systems (Switzerland), Advanced Drainage Systems (US), Chevron Phillips Chemical Company (US), JM Eagle (US), Aliaxis (Belgium), Radius Systems (UK), Prinsco (US), Polyplastic Group (Russia), Nan Ya Plastics Corporation (Taiwan), Thai-Asia P.E. (Thailand), United Poly Systems (US), Future Pipe Industries (UAE), WL Plastics (US), Aquatherm (US), Blue Diamond Industries (US), Armtec (Canada), Pipeline Plastics (US), TeraPlast Group (Romania), Charter Plastics (US), Infra Pipe Solutions Pvt Ltd. (Canada), Pars Ethylene Kish (Iran), Vesbo Piping Systems (Turkey) |

This research report categorizes the polyolefin pipes market based on type, application, end-use industry, and region.

Based on the type:

- PE

- PP

- Plastomer

- Others

Based on the application:

- Irrigation

- Potable & Plumbing

- Wastewater Drainage

- Power & Communication

- Industrial Application

- Chemical Transportation

- Others

Based on the end-use industry:

- Building & Construction

- Agriculture

- Industrial

- Others

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2021, GF Piping Systems acquired FGS Brazil Industries which serves the local water and gas distribution market and other industrial segments. The acquisition provides GF Piping Systems with a unique platform for further growth in Brazil and South America.

- In March 2021, Prinsco, Inc partnered with Momentum Environmental (US), an engineering company. The partnership has added the brand, Preserver to Prinsco’s product portfolio as an innovative and cost-effective gravity separator option for the treatment of stormwater. Preserver is an affordable alternative to hydrodynamic separators, swirl separators, and vortex concentrators.

- In March 2020, GF Piping Systems entered into a partnership agreement with Oxford Flow Ltd., Oxford (UK), and acquired a stake in the company. Its innovative pressure-regulating valve enables utility companies to reduce water loss, a major problem around the globe.

- In July 2019, Advanced Drainage Systems acquired Infiltrator, a leading national provider of plastic leach field chambers and systems, septic tanks, and accessories, primarily for use in residential applications. This acquisition aims at strengthening its product portfolio and enhancing its customer base.

- In December 2020, Aliaxis completed divestment of Harrington Industrial Plastics due to the impact of the COVID-19 pandemic on the company.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the polyolefin pipes market?

Sprinkler and drip irrigation provide good growth potential, hot water bathroom application where PO pipes are replacing PVC pipes, increasing usage of engineered PO in manufacturing pipes, improved characteristics of plastomers over conventional plastics and elastomers, increasing adoption of bio-based polymer such as PLA and BioPE, and growing emphasis by local government on rainwater harvesting are the major factor influencing the growth of the polyolefin pipes market.

What are the major types of polyolefin pipes market?

The major types of polyolefin pipes market include PE, PP, Plastomer, and among others.

Who are the major manufacturers operating in the market?

AGRU (Austria), GF Piping Systems (Switzerland), Advanced Drainage Systems (US), Chevron Phillips Chemical Company (US), JM Eagle (US), Aliaxis (Belgium), Radius Systems (UK), Prinsco (US), Polyplastic Group (Russia), Nan Ya Plastics Corporation (Taiwan), Thai-Asia P.E. (Thailand), United Poly Systems (US), Future Pipe Industries (UAE), WL Plastics (US), Aquatherm (US), Blue Diamond Industries (US), Armtec (Canada), Pipeline Plastics (US), TeraPlast Group (Romania), Charter Plastics (US), Infra Pipe Solutions Pvt Ltd. (Canada), Pars Ethylene Kish (Iran), Vesbo Piping Systems (Turkey) among many others, are some of the major manufacturers.

What is the most significant restraint for the polyolefin pipes market?

Higher capacity-to-demand ratio, rising concerns pertaining to plastic disposal, economic slowdown, and the impact of COVID-19 on the manufacturing sector are the factors restraining the market.

What is the projected growth rate for polyolefin pipes market?

The polyolefin pipes market is projected to grow at a CAGR of 5.3% from 2021 till 2026. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 POLYOLEFIN PIPES MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 POLYOLEFIN PIPES MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 POLYOLEFIN PIPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 PRIMARIES

2.1.3.1 Polyolefin pipes

2.2 MARKET SIZE ESTIMATION

FIGURE 2 POLYOLEFIN PIPES MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for arriving at market size using top-down analysis

FIGURE 3 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY SIDE)

2.3 DATA TRIANGULATION

FIGURE 7 POLYOLEFIN PIPES MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISKS

TABLE 2 RISKS ASSOCIATED

2.7 GROWTH FORECAST ASSUMPTIONS

2.7.1 GROWTH RATE ASSUMPTIONS /GROWTH FORECAST

2.7.2 POLYOLEFIN PIPES MARKET

2.7.2.1 Supply side

FIGURE 8 MARKET CAGR PROJECTIONS FROM THE SUPPLY SIDE

2.7.2.2 Demand side

FIGURE 9 APPROACH FOR MARKET SIZING FROM THE DEMAND SIDE

2.7.2.3 Insights from primary experts

FIGURE 10 MARKET VALIDATION FROM PRIMARY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 11 PE SEGMENT TO DOMINATE THE MARKET BY 2026

FIGURE 12 INDUSTRIAL APPLICATION SEGMENT TO LEAD THE MARKET BY 2026

FIGURE 13 AGRICULTURE TO BE LARGEST END-USE INDUSTRY OF POLYOLEFIN PIPES DURING FORECAST PERIOD

FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2021 AND 2026

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 EMERGING ECONOMIES TO WITNESS RELATIVELY HIGHER DEMAND FOR POLYOLEFIN PIPES

FIGURE 15 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN POLYOLEFIN PIPES MARKET DURING FORECAST PERIOD

4.2 POLYOLEFIN PIPES MARKET, BY TYPE

FIGURE 16 PE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 POLYOLEFIN PIPES MARKET, BY APPLICATION

FIGURE 17 INDUSTRIAL APPLICATION PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 POLYOLEFIN PIPES MARKET, BY END-USE INDUSTRY

FIGURE 18 BUILDING & CONSTRUCTION SEGMENT PROJECTED TO LEAD MARKET BY 2026

4.5 POLYOLEFIN PIPES MARKET, BY COUNTRY

FIGURE 19 MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET SEGMENTATION

5.2.1 POLYOLEFIN PIPES MARKET, BY TYPE

5.2.2 POLYOLEFIN PIPES MARKET, BY APPLICATION

5.2.3 POLYOLEFIN PIPES MARKET, BY END-USE INDUSTRY

5.3 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYOLEFIN PIPES MARKET

5.3.1 DRIVERS

5.3.1.1 Sprinkler and drip irrigation provide good growth potential

5.3.1.2 Hot water bathroom application where PO pipes are replacing PVC pipes

5.3.1.3 Increasing usage of engineered PO in manufacturing pipes

TABLE 3 PROPERTIES OF KEY POLYOLEFIN TYPES

5.3.1.4 Improved characteristics of plastomers over conventional plastics and elastomers

5.3.2 RESTRAINTS

5.3.2.1 Higher capacity-to-demand ratio

5.3.2.2 Rising concerns pertaining to plastic disposal

5.3.2.3 Economic slowdown and impact of COVID-19 on the manufacturing sector

FIGURE 21 EUROPE: MANUFACTURING INDUSTRY OUTPUT INDEX

5.3.3 OPPORTUNITIES

5.3.3.1 Increasing demand for cross-linked HDPE

5.3.3.2 Increasing demand for metallocene-based PO

5.3.3.3 Increasing demand for metallocene-based LLDPE

5.3.3.4 Growing deep- and ultra-deep-water oil & gas exploration and production activities

5.3.4 CHALLENGES

5.3.4.1 Replacement of PEX by PP pipes

5.3.4.2 Fluctuation in raw material prices

5.3.4.3 Absence of global design and qualification standards

5.3.4.4 Difficulties in large-scale manufacturing of PO pipes

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS: POLYOLEFIN PIPES MARKET

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 4 POLYOLEFIN PIPES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 PATENT ANALYSIS

5.5.1 INTRODUCTION

5.5.2 METHODOLOGY

5.5.3 DOCUMENT TYPE

TABLE 5 TOTAL NUMBER OF PATENTS

FIGURE 23 TOTAL NUMBER OF PATENTS

5.5.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 24 NUMBER OF PATENTS YEAR-WISE DURING LAST TEN YEARS

5.5.5 INSIGHT

5.5.6 LEGAL STATUS OF PATENTS

FIGURE 25 LEGAL STATUS OF PATENTS

5.5.7 JURISDICTION ANALYSIS

FIGURE 26 TOP JURISDICTION-BY DOCUMENT

5.5.8 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 6 PATENTS BY BOREALIS AG

TABLE 7 PATENTS BY MCELROY MANUFACTURING INC

TABLE 8 PATENTS BY DU PONT

5.5.9 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

TABLE 9 TOP TEN PATENT OWNERS

TABLE 10 LIST OF PATENTS BY DU PONT

5.5.10 BY TYPE

5.5.10.1 Methodology

TABLE 11 PATENTS, BY TYPE

5.6 IMPACT OF COVID-19 ON POLYOLEFIN PIPES MARKET

5.6.1 REPORTED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 28 UNPRECEDENTED PACE OF GLOBAL PROPAGATION OF COVID-19

5.6.2 IMPACT ON END-USE INDUSTRIES

5.6.3 IMPACT ON END-USE INDUSTRY

5.6.3.1 Building & construction

5.6.3.2 Agriculture

5.6.3.3 Industrial

5.6.4 IMPACT OF COVID-19 ON SUPPLY CHAIN

TABLE 12 IMPACT OF COVID-19 ON SUPPLY CHAIN

5.7 AVERAGE SELLING PRICE ANALYSIS

5.8 TRENDS AND DISRUPTIONS IMPACTING MARKET

6 POLYOLEFIN PIPES MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 29 POLYOLEFIN PIPES MARKET, BY TYPE

TABLE 13 POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 14 POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2 BY MATERIAL

6.2.1 POLYETHYLENE (PE)

6.2.1.1 Commodity

6.2.1.1.1 High-density polyethylene (HDPE)

6.2.1.1.2 PE32

6.2.1.1.3 PE63

6.2.1.1.4 PE80

6.2.1.1.5 PE100

6.2.1.1.6 Medium density polyethylene (MDPE)

6.2.1.1.7 Linear low-density polyethylene (LLDPE) and metallocene linear low-density polyethylene (mLLDPE)

6.2.1.1.8 Others

6.2.1.2 Specialty

6.2.1.2.1 Cross-linked polyethylene (PEX)

6.2.1.2.2 Polyethylene of raised temperature (PE-RT)

6.2.2 POLYPROPYLENE (PP)

6.2.3 PLASTOMERS

6.2.4 OTHERS

7 POLYOLEFIN PIPES MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 30 INDUSTRIAL APPLICATION TO BE FASTEST-GROWING IN POLYOLEFIN PIPES MARKET

TABLE 15 POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 16 POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 IRRIGATION

7.3 POTABLE & PLUMBING

7.3.1 DOMESTIC

7.3.2 MUNICIPAL

7.4 WASTEWATER DRAINAGE

7.5 POWER & COMMUNICATION

7.6 INDUSTRIAL APPLICATIONS

7.7 CHEMICAL TRANSPORTATION

7.8 OTHERS

8 POLYOLEFIN PIPES MARKET, BY END-USE INDUSTRY (Page No. - 84)

8.1 INTRODUCTION

FIGURE 31 AGRICULTURE EXPECTED TO BE LARGEST END-USE INDUSTRY OF POLYOLEFIN PIPES

TABLE 17 POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 18 POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

8.2 BUILDING & CONSTRUCTION

8.2.1 RESIDENTIAL

8.2.2 COMMERCIAL

8.3 AGRICULTURE

8.3.1 DRIP IRRIGATION

8.3.2 SPRINKLER IRRIGATION

8.3.3 LATERAL IRRIGATION

8.3.4 SUB-IRRIGATION

8.3.5 OTHERS

8.4 INDUSTRIAL

8.4.1 OIL & GAS

8.4.2 CHEMICAL

8.4.3 AUTOMOTIVE (RADIATOR PIPES)

8.4.4 MINING & METALS

8.4.5 UTILITIES & RENEWABLES

8.4.6 OTHERS

8.5 OTHERS

9 POLYOLEFIN PIPES MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 32 REGION SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 19 POLYOLEFIN PIPES MARKET SIZE, BY REGION, 2019–2026 (MILLION METER)

TABLE 20 POLYOLEFIN PIPES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 21 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 22 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 24 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 25 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 26 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 27 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 28 ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Healthy growth of manufacturing industry to drive market

TABLE 29 CHINA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 30 CHINA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 31 CHINA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 32 CHINA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.2 INDIA

9.2.2.1 FDI initiatives to support market growth

TABLE 33 INDIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 34 INDIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 INDIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 36 INDIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Increasing urban population to drive demand in residential applications

TABLE 37 JAPAN: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 38 JAPAN: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 JAPAN: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 40 JAPAN: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 High economic interest of government in residential, commercial, and infrastructure projects

TABLE 41 SOUTH KOREA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 42 SOUTH KOREA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 SOUTH KOREA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 44 SOUTH KOREA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

TABLE 45 REST OF ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 46 REST OF ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 REST OF ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 48 REST OF ASIA PACIFIC: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: POLYOLEFIN PIPES MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 50 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 52 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 54 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 56 NORTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Increasing applications in construction and agriculture industries to drive market

TABLE 57 US: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 58 US: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 US: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 60 US: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Improved standard of living and spending capacity of people to boost market growth

TABLE 61 CANADA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 62 CANADA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 CANADA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 64 CANADA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Liberalization in trade policy to drive growth

TABLE 65 MEXICO: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 66 MEXICO: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 MEXICO: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 68 MEXICO: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 35 EUROPE: POLYOLEFIN PIPES MARKET SNAPSHOT

TABLE 69 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 70 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 72 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 74 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 75 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 76 EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Sprinkler and drip are two major forms of irrigation in the country

TABLE 77 GERMANY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 78 GERMANY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 GERMANY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 80 GERMANY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.2 UK

9.4.2.1 Government plans to invest in residential projects

TABLE 81 UK: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 82 UK: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 UK: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 84 UK: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Rise in construction of buildings to offer growth opportunities for the market

TABLE 85 FRANCE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 86 FRANCE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 FRANCE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 88 FRANCE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Strong construction sector to boost market growth

TABLE 89 ITALY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 90 ITALY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 ITALY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 92 ITALY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Increasing exports and rising consumer spending to boost market growth

TABLE 93 SPAIN: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 94 SPAIN: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 SPAIN: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 96 SPAIN: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.6 RUSSIA

9.4.6.1 Increasing investments in infrastructure to support market growth

TABLE 97 RUSSIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 98 RUSSIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 RUSSIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 100 RUSSIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.7 TURKEY

9.4.7.1 Demand for polyolefin pipes in residential sector to drive market

TABLE 101 TURKEY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 102 TURKEY: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 TURKEY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 104 TURKEY: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.4.8 REST OF EUROPE

TABLE 105 REST OF EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 106 REST OF EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 REST OF EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 108 REST OF EUROPE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 109 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 110 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 112 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 114 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 116 MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Investments in building & construction sector

TABLE 117 SAUDI ARABIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 118 SAUDI ARABIA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 SAUDI ARABIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 120 SAUDI ARABIA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.2 SOUTH AFRICA

9.5.2.1 Steady recovery of various end-use industries from impact of COVID-19 to support market growth

TABLE 121 SOUTH AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 122 SOUTH AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 SOUTH AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 124 SOUTH AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.3 UAE

9.5.3.1 Technological advancements and new reformed policies to drive market

TABLE 125 UAE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 126 UAE: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 UAE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 128 UAE: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 129 REST OF MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 130 REST OF MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 132 REST OF MIDDLE EAST & AFRICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 133 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION METER)

TABLE 134 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 135 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 136 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION METER)

TABLE 138 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 139 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 140 SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Construction of new manufacturing plants driving market growth

TABLE 141 BRAZIL: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 142 BRAZIL: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 BRAZIL: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 144 BRAZIL: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Economic uncertainty to affect consumption of polyolefin pipes

TABLE 145 ARGENTINA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 146 ARGENTINA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 ARGENTINA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 148 ARGENTINA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 149 REST OF SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 150 REST OF SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 REST OF SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION METER)

TABLE 152 REST OF SOUTH AMERICA: POLYOLEFIN PIPES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 143)

10.1 INTRODUCTION

10.1.1 PO PIPES MARKET, KEY DEVELOPMENTS

TABLE 153 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

10.2 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE OF TOP COMPANIES IN PO PIPES MARKET

10.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

10.4 COMPANY EVALUATION MATRIX

10.5 COMPETITIVE EVALUATION QUADRANT

10.5.1 TERMINOLOGY/NOMENCLATURE

10.5.1.1 Star

10.5.1.2 Pervasive

10.5.1.3 Emerging leader

10.5.1.4 Participant

FIGURE 37 PO PIPES MARKET (GLOBAL) COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2020

10.6 REVENUE ANALYSIS OF TOP MARKET PLAYERS

10.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PO PIPES MARKET

10.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE PO PIPES MARKET

10.7 COMPETITIVE EVALUATION QUADRANT (OTHER KEY PLAYERS)

10.7.1 TERMINOLOGY/NOMENCLATURE

10.7.1.1 Progressive companies

10.7.1.2 Responsive companies

10.7.1.3 Dynamic companies

FIGURE 40 PO PIPES MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR OTHER KEY PLAYERS, 2020

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 DEALS

TABLE 157 PO PIPES MARKET: DEALS

10.8.2 OTHERS

TABLE 158 PO PIPES MARKET: OTHERS

11 COMPANY PROFILES (Page No. - 155)

11.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 AGRU

TABLE 159 AGRU: COMPANY OVERVIEW

11.1.2 GF PIPING SYSTEMS

FIGURE 41 GF PIPING SYSTEMS: COMPANY SNAPSHOT

TABLE 161 GF PIPING SYSTEMS: DEALS

11.1.3 ADVANCED DRAINAGE SYSTEMS

TABLE 162 ADVANCED DRAINAGE SYSTEMS: COMPANY OVERVIEW

FIGURE 42 ADVANCED DRAINAGE SYSTEMS: COMPANY SNAPSHOT

TABLE 163 ADVANCE DRAINAGE SYSTEMS: DEALS

TABLE 164 ADVANCE DRAINAGE SYSTEMS: OTHERS

11.1.4 CHEVRON PHILLIPS CHEMICAL COMPANY

TABLE 165 CHEVRON PHILLIPS CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 43 CHEVRON PHILLIPS CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 166 CHEVRON PHILLIPS CHEMICAL COMPANY: DEALS

11.1.5 JM EAGLE

TABLE 167 JM EAGLE: COMPANY OVERVIEW

11.1.6 RADIUS SYSTEMS

TABLE 168 RADIUS SYSTEMS: COMPANY OVERVIEW

11.1.7 ALIAXIS

TABLE 169 ALIAXIS: COMPANY OVERVIEW

FIGURE 44 ALIAXIS: COMPANY SNAPSHOT

TABLE 170 ALIAXIS: DEALS

11.1.8 PRINSCO

TABLE 171 PRINSCO: COMPANY OVERVIEW

TABLE 172 PRINSCO, INC.: DEALS

11.1.9 THAI-ASIA P.E. PIPE CO., LTD.

TABLE 173 THAI-ASIA P.E. PIPE CO., LTD.: COMPANY OVERVIEW

11.1.10 UNITED POLY SYSTEMS

TABLE 174 UNITED POLY SYSTEMS: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 FUTURE PIPE INDUSTRIES

11.2.2 WL PLASTICS

11.2.3 AQUATHERM

11.2.4 BLUE DIAMOND INDUSTRIES

11.2.5 ARMTEC

11.2.6 PIPELINE PLASTIC LLC

11.2.7 TERAPLAST GROUP

11.2.8 CHARTER PLASTICS

11.2.9 INFRA PIPE SOLUTIONS PVT LTD

11.2.10 PARS ETHYLENE KISH

11.2.11 VESBO PIPING SYSTEM

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 183)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

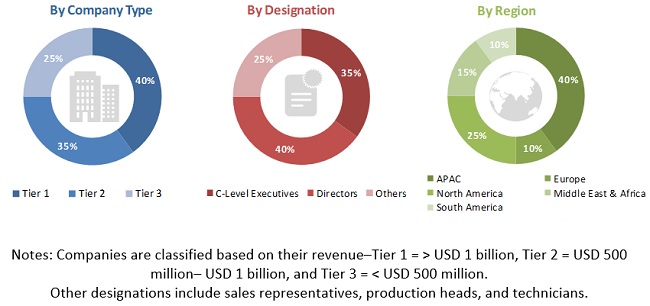

The study involved four major activities in estimating the current size of the polyolefin pipes market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the polyolefin pipes market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The polyolefin pipes market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as building & construction, agriculture, industrial, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polyolefin pipes market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the polyolefin pipes market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the polyolefin pipes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the polyolefin pipes market

- To analyze and forecast the size of the market based on type, application, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the polyolefin pipes market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the polyolefin pipes market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the polyolefin pipes market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyolefin Pipes Market