Aerospace Composites Market

Aerospace Composites Market by Fiber Type (Glass Fiber, Carbon Fiber, Ceramic Fiber), Matrix Type (Polymer Matrix Composite, Metal Matrix Composite, Ceramic Matrix Composite), Manufacturing Process, Aircraft Type, Applications & Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

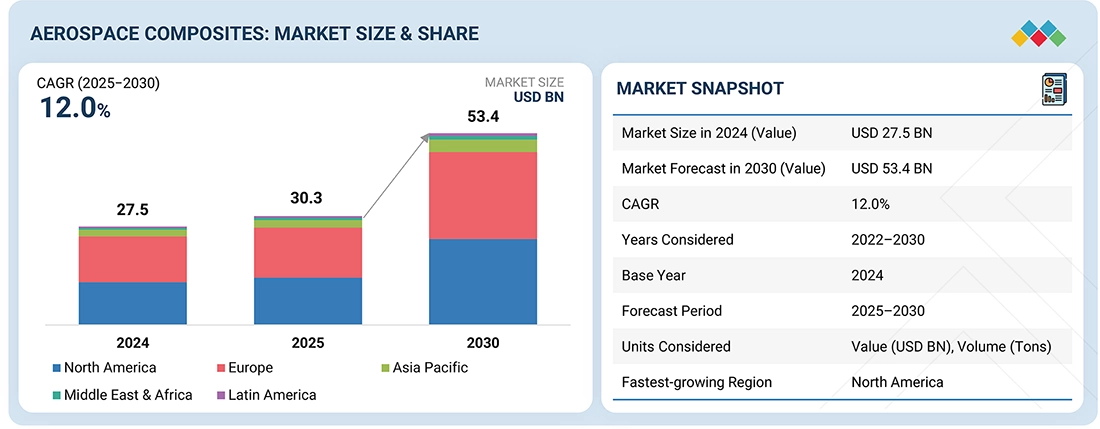

The aerospace composites market is expected to reach USD 53.4 billion by 2030, up from USD 30.3 billion in 2025, at a CAGR of 12.0% from 2025 to 2030. The growth of the aerospace composites market is driven by the increasing demand for advanced composite materials that provide superior performance, efficiency, and sustainability in modern aircraft.

KEY TAKEAWAYS

-

BY FIBER TYPEThe aerospace composites market includes glass fiber, carbon fiber, ceramic fiber, and other fibers. Driven by the imperative for lighter, more fuel-efficient aircraft and the enforcement of stricter emissions standards, composites are increasingly utilized in primary structures, interiors, and propulsion systems. Developments in resin chemistries, such as toughened epoxies and PEEK, along with advancements in manufacturing techniques—including automated fiber placement and out-of-autoclave processing—are improving performance while simultaneously reducing costs and cycle times.

-

BY MATRIX TYPEKey matrix types include polymer matrix composites (PMCs), metal matrix composites (MMCs), and ceramic matrix composites (CMCs). PMCs dominate airframe and interior applications due to their low weight, excellent fatigue resistance, and cost-effective processing, while MMCs and CMCs are used in high-temperature, wear-intensive components (e.g., engine hot sections) because of their superior stiffness, thermal stability, and oxidation resistance.

-

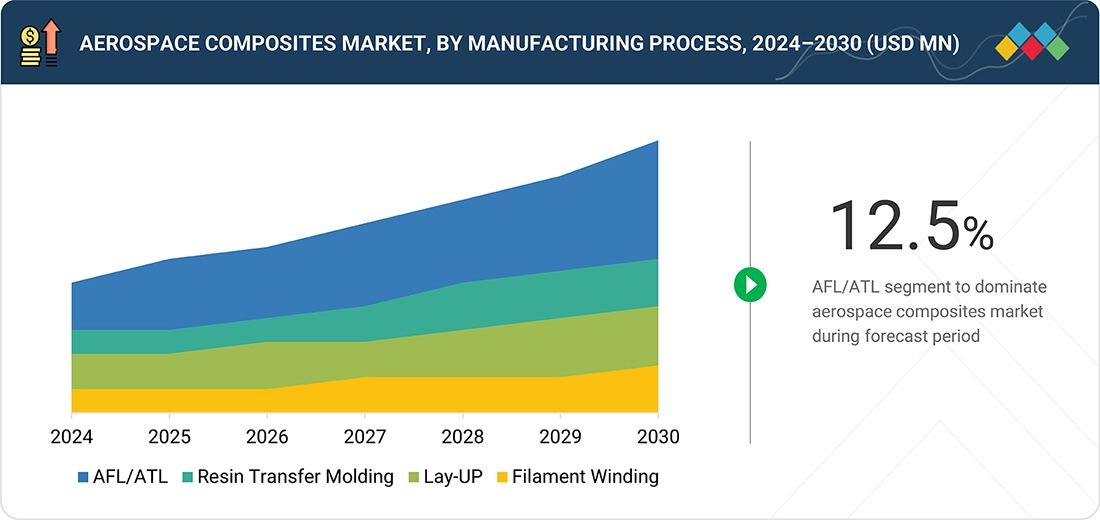

BY MANUFACTURING PROCESSThe main manufacturing processes include AFP/ATL, lay-up, resin transfer molding, filament winding, and other methods. AFP/ATL allows for high-speed, precise fiber placement for large primary structures, while lay-up (manual or automated) is preferred for complex shapes and lower-volume production. Resin transfer molding and filament winding produce near-net, repeatable components such as nacelles, blades, and pressure vessels, with increasing use of out-of-autoclave curing to reduce cycle times and costs.

-

BY AIRCRAFT TYPEThe aircraft types include commercial aircraft, business and general aviation, civil helicopters, military aircraft, and other aircraft. Commercial programs account for the largest share of demand and composite use, especially in wings, fuselage panels, nacelles, and interiors. Military and rotorcraft focus on performance and survivability, using composites for weight reduction, vibration damping, and radar signature control, while business and general aviation emphasize range, operating economics, and cabin comfort.

-

BY REGIONThe aerospace composites market includes Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa. Europe is the largest market for aerospace composites, hosting several major aerospace companies and seeing new aircraft projects, all of which drive the growing use of aerospace composite materials and products.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Syensqo (Belgium), Toray Industries, Inc. (Japan), and Mitsubishi Chemical Group Corporation have entered into numerous agreements and partnerships to meet the increasing demand for aerospace composites across innovative applications.

The aerospace composites market is experiencing consistent growth, propelled by the increasing demand for lightweight, high-performance composite materials such as carbon fiber and glass fiber, which are used in advanced composites to improve fuel efficiency, lower emissions, and comply with rigorous safety standards. Recent agreements and developments—including strategic partnerships between original equipment manufacturers (OEMs) and material suppliers, investments in recycling technologies, and innovations in high-strength and sustainable composites—are transforming the industry landscape.

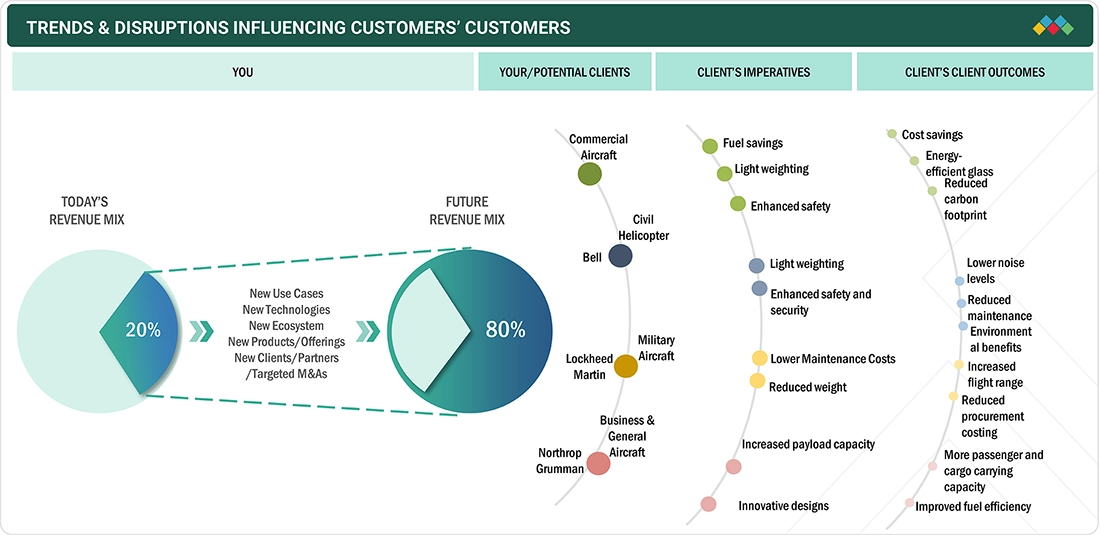

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the aerospace composites market, evolving trends and disruptive forces influence customer businesses. Aircraft manufacturers such as Boeing, Airbus, Lockheed Martin, and others are the core customers for aerospace composite suppliers. These manufacturers, in turn, serve specific aircraft platforms including commercial aircraft, military aircraft, civil helicopters, and business or general aviation. Changes in market dynamics, like the need for lightweighting, fuel efficiency, improved safety, and increased payload, are key priorities for end users. These priorities are driven by customer expectations for lower operating costs, reduced carbon footprints, decreased maintenance, and greater efficiency. As these trends gain momentum, they directly impact the revenue streams of OEMs and aircraft platforms, ultimately reshaping demand patterns for aerospace composites. Consequently, composite material suppliers must adjust their offerings—fiber types, matrix systems, and manufacturing processes—to meet new use cases, technologies, and customer needs. This shift is expected to significantly change revenue dependency from current solutions (~80%) to emerging applications (~80%) over the next 4–5 years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for lightweight and fuel-efficient aircraft

-

Rising adoption of composite materials for enhanced performance and durability

Level

-

High cost of advanced aerospace composites

-

Stringent regulations and certification requirements for material approval

Level

-

Expanding aircraft fleet to meet rising passenger traffic

-

Growing investments in next-generation aircraft and space exploration programs

Level

-

Volatility in raw material prices

-

Supply Chain disruptions affecting material availability and costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for lightweight and fuel-efficient aircraft

The aerospace industry constantly faces pressure to cut emissions and operating costs. Light materials, like advanced composites, provide substantial weight savings, which boost fuel efficiency and reduce maintenance expenses. Airlines and OEMs are increasingly focusing on these materials in both commercial and military aircraft to comply with strict environmental standards and enhance performance.

Restraint: High cost of advanced aerospace materials

Despite their advantages, aerospace-grade composites and ceramic matrix composites entail significant production and processing expenses. These costs are further exacerbated by intricate manufacturing demands, a limited number of suppliers, and protracted certification procedures. Consequently, their widespread adoption remains constrained, especially among regional aircraft manufacturers and low-cost airlines, thereby hindering their penetration into the mass market.

Opportunity: Expanding aircraft fleet to meet rising air passenger traffic

Global air passenger traffic continues to rise, especially in emerging economies like India, China, and Southeast Asia, leading to record aircraft orders from Boeing, Airbus, and other OEMs. This growth drives demand for advanced aerospace composites that support next-generation aircraft design, enhance durability, and lower lifecycle costs. Additionally, increased investments in space exploration, UAVs, and sustainable aviation create new opportunities for aerospace composite applications.

Challenge: Volatility in raw material prices and supply chain disruptions

The aerospace industry is significantly susceptible to fluctuations in raw material prices, notably titanium and carbon fibers. International trade tensions and geopolitical risks have revealed vulnerabilities within supply chains, resulting in delays and cost overruns. Ensuring a reliable supply of high-quality composites while effectively managing cost pressures continues to be a paramount challenge for original equipment manufacturers (OEMs) and suppliers alike.

Aerospace Composites Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of advanced carbon fiber composites in 787 Dreamliner fuselage and wings | 20% weight reduction compared to traditional aluminum, improved fuel efficiency, and reduced maintenance cost |

|

Carbon fiber composites in A350 aircraft structures and exterior body | High strength-to-weight ratio, superior corrosion resistance, extended service life |

|

Ceramic matrix composites (CMCs) in jet engine components | Withstands higher operating temperatures, improves engine efficiency by 10–15%, reduces fuel burn |

|

Advanced composites in military aircraft structures | Enhanced durability, lower structural weight, and improved payload capacity |

|

Composite materials in unmanned aerial vehicles (UAVs) | Lightweight design, higher endurance, improved stealth capabilities |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aerospace composites market ecosystem includes raw material suppliers (e.g., SABIC, Jushi), composite manufacturers (e.g., Toray, Syensqo), part producers (e.g., 3M, Lee Aerospace), and end users (e.g., Boeing, Airbus). Raw materials like composites are processed into lightweight, high-performance components for aircraft. End users drive demand for fuel efficiency and sustainability, while manufacturers produce precision-engineered parts. Collaboration across the value chain is essential for innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aerospace Composites Market, By Fiber Type

As of 2024, carbon fiber held the largest share of the aerospace composites market, in terms of value and volume, and this trend is expected to continue into 2025. Widely used in manufacturing primary aircraft structures such as fuselages, wings, and tail sections, carbon fiber composites provide an exceptional strength-to-weight ratio, which is vital for improving fuel efficiency. Aircraft like the Boeing 787 Dreamliner extensively use carbon fiber in both structural and interior parts, including seats, overhead bins, and cabin panels. Their lightweight nature reduces the overall aircraft weight and enhances fuel economy. Ongoing research and development efforts aim to lower carbon fiber production costs, making it more competitive with traditional metals and encouraging broader adoption. In 2025, notable developments include Toray Industries signing a long-term supply agreement with Boeing to deliver advanced carbon fiber materials for upcoming aircraft programs, and Hexcel Corporation expanding its carbon fiber prepreg manufacturing facility in Utah to meet increasing demand from aerospace OEMs. These advances highlight continued momentum and investment in carbon fiber composites across the global aerospace sector.

Aerospace Composites Market, By Matrix Type

The aerospace composites market is segmented by matrix type into polymer matrix, metal matrix, and ceramic matrix composites, with the polymer matrix segment expected to hold the largest share during the forecast period. This dominance is driven by the widespread use of polymer matrix composites (PMCs) in structural and interior components because of their lightweight nature, high strength, corrosion resistance, and design flexibility. As the aerospace industry continues to prioritize fuel efficiency, durability, and sustainability, the demand for PMCs is forecasted to grow steadily. Ongoing R&D efforts are focused on improving the performance, thermal stability, and cost-effectiveness of these materials, ensuring their ongoing relevance in both commercial and military aircraft programs.

Aerospace Composites Market, By Manufacturing Process

The aerospace composites market is divided by manufacturing process into automated fiber placement (AFP), automated tape laying (ATL), lay-up, resin transfer molding, filament winding, and others. AFP and ATL technologies are experiencing significant growth. These automated techniques provide high precision, speed, and the ability to create complex, load-bearing composite structures, making them essential for modern aircraft manufacturing. Their adoption reduces material waste and labor costs while increasing product consistency. As the demand for fuel-efficient and lightweight aircraft rises, ongoing advancements in Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), including the integration of digital twin technology and robotics, are set to improve production efficiency and open new avenues for next-generation aerospace composite applications.

Aerospace Composites Market, By Aircraft Type

Based on aircraft type, the aerospace composites market has been divided into commercial aircraft, business & general, civil helicopters, military aircraft, and others. In 2024, the commercial aircraft segment is expected to hold the largest share of the aerospace composites market, driven by the growing demand for lightweight, fuel-efficient, and environmentally friendly aircraft. Composites are widely used in fuselages, wings, empennages, and interiors of next-generation jets like the Airbus A350 XWB, where their strength-to-weight advantage improves performance and reduces emissions. Advances in composite materials and automated manufacturing processes are further boosting design flexibility and production efficiency. In 2025, Boeing signed a multi-year agreement with Hexcel Corporation to expand the supply of carbon fiber prepregs for its 737 MAX and future electric aircraft programs, reinforcing the importance of composites in driving innovation and achieving sustainability goals in the commercial aviation sector.

Aerospace Composites Market, By Application

In the aerospace composites market, exterior applications dominate the segment. Large amounts of material are used in wings, fuselage skins, empennage, nacelles, fairings, and radomes, where reducing weight directly results in lower fuel consumption and emissions. Advances in AFP/ATL and out-of-autoclave processing, along with requirements for corrosion resistance, lightning-strike, and erosion protection, are speeding up adoption in these exterior structures across high-rate single-aisle and composite-intensive widebody programs.

REGION

North America to be fastest-growing region in global aerospace composites market during forecast period

The North America aerospace composites market is projected to have the highest CAGR during the forecast period, driven by strong demand for next-generation commercial aircraft, defense modernization initiatives, and growing investments in space exploration. Leading OEMs and suppliers in the US and Canada are adopting advanced composites to improve fuel efficiency, reduce emissions, and enhance aircraft performance. Increasing air passenger traffic, along with significant R&D efforts in sustainable aviation and electric aircraft, is further boosting the adoption of aerospace composites in the region.

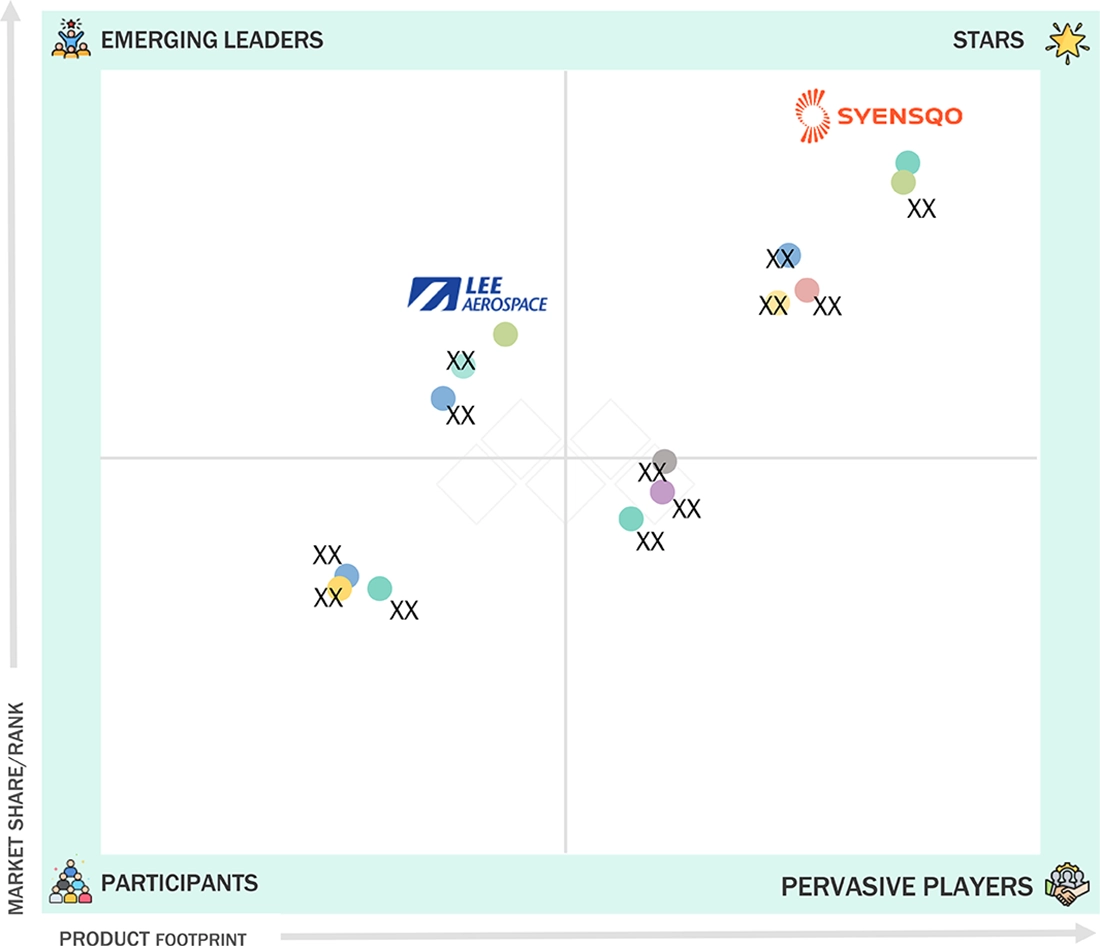

Aerospace Composites Market: COMPANY EVALUATION MATRIX

Within the aerospace composites market matrix, Syensqo (Star) maintains a dominant position, characterized by a substantial market share and an extensive range of products, propelled by its advanced composites and high-performance materials that are extensively utilized in commercial and defense aviation sectors. Lee Aerospace (Emerging Leader) is increasingly gaining recognition for its specialized composite components tailored for aerospace applications, fortifying its market position through innovation and niche product offerings. Although Syensqo remains the market leader due to its scale and diversified portfolio, Lee Aerospace demonstrates considerable potential to ascend to the leading quadrant as the demand for high-strength composites continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 27.5 Billion |

| Revenue Forecast in 2030 | USD 53.4 Billion |

| Growth Rate | CAGR of 12.0% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

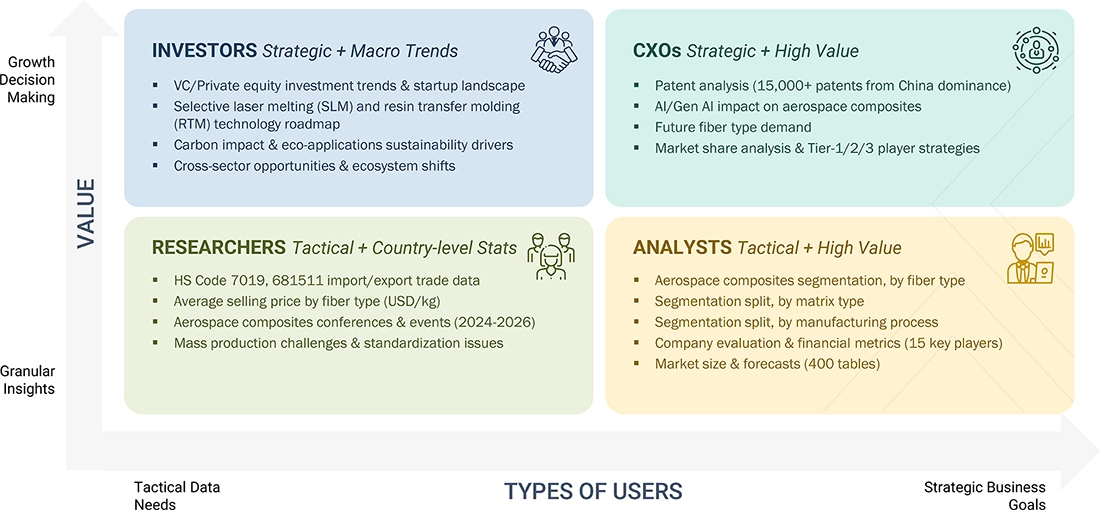

WHAT IS IN IT FOR YOU: Aerospace Composites Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Aircraft OEM |

|

|

| Composite Material Manufacturer |

|

|

| Engine Manufacturer |

|

|

| Raw Material Supplier |

|

|

| Defense Contractor |

|

|

RECENT DEVELOPMENTS

- May 2025 : Syensqo demonstrated CYCOM 5250-4HT prepreg as a titanium substitute in Boeing’s MQ-25 Stingray UAV exhaust nozzle, showcasing high-temperature composite innovation.

- March 2024 : Hexcel Corporation and Arkema entered into a strategic partnership to develop high-performance thermoplastic composite structures. These structures were designed and manufactured using HexPly thermoplastic tapes. This innovative demonstrator was successfully created as part of the collaborative project HAICoPAS (Highly Automatized Integrated Composites for Performing Adaptable Structures), led by Hexcel and Arkema.

- January 2024 : Materion Beryllium & Composites (subsidiary of Materion Corporation) partnered with Liquidmetal Technologies Inc., in partnership with Liquidmetal and other Certified Liquidmetal Partners, will use their alloy production technologies to provide high-quality products and support services to their customers.

Table of Contents

Methodology

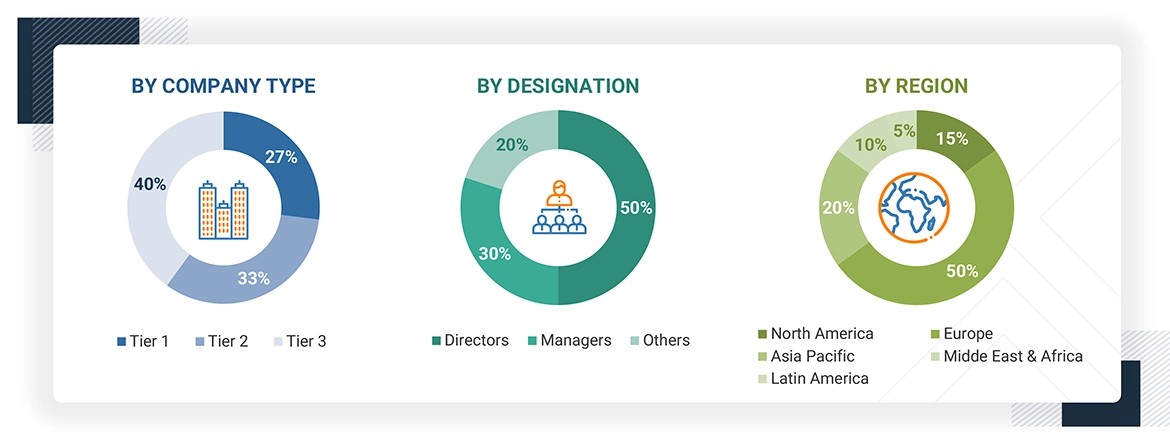

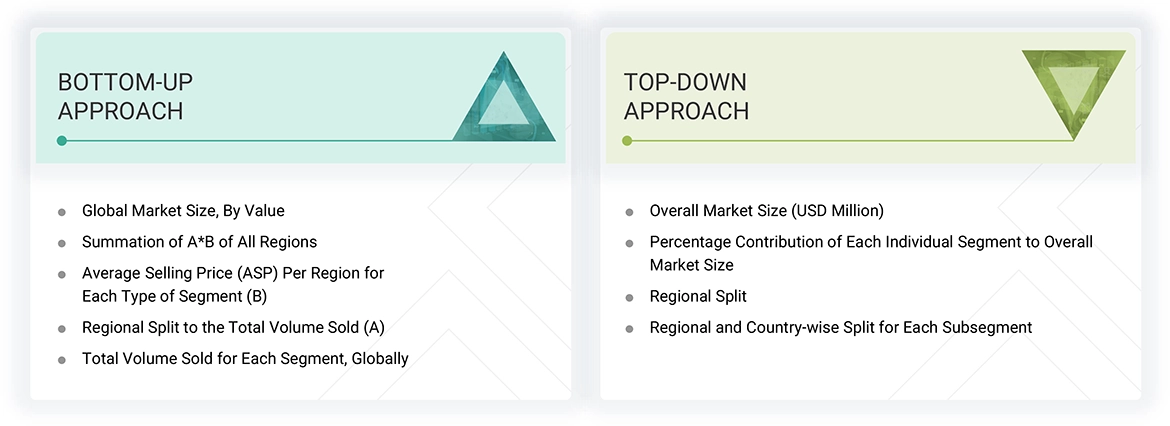

The study to estimate the current size of the aerospace composites market involved two key steps. First, comprehensive secondary research was conducted to gather data on the market itself, as well as related and parent markets. This was followed by primary research, where insights, assumptions, and market estimates were validated through interviews with industry experts across the value chain. Both top-down and bottom-up methodologies were applied to determine the overall market size. Finally, the market was segmented, and data triangulation techniques were used to refine and validate the estimates for each segment and subsegment.

Secondary Research

Secondary sources consulted for this research included financial reports of aerospace composite manufacturers, along with data from trade organizations, business publications, and professional associations. This secondary research provided essential insights into the industry's value chain, identified key players, and helped classify and segment the market based on prevailing industry trends down to the regional and sub-regional levels. The information gathered was thoroughly analyzed to estimate the overall size of the aerospace composites market, which was then validated through primary research with industry experts.

Primary Research

Extensive primary research was carried out following the collection of market insights through secondary research to validate the aerospace composites market scenario. Numerous interviews were conducted with industry experts from both the demand and supply sides across key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was gathered through structured questionnaires, emails, and telephonic interviews. On the supply side, respondents included industry professionals such as CXOs, Vice Presidents, Directors of business development, marketing, product innovation teams, system integrators, component suppliers, distributors, and key opinion leaders in the aerospace composites space. These interviews provided valuable insights into market statistics, revenue data, segmentation, size estimations, forecasts, and enabled data triangulation. On the demand side, stakeholders such as CIOs, CTOs, CSOs, and installation teams from end-user organizations were consulted to gain a better understanding of customer perspectives, current usage patterns, supplier evaluations, and the future outlook for aerospace composites, all of which influence the overall market dynamics.

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the aerospace composites market primarily focused on a demand-side approach. Market sizing was conducted by analyzing procurement activities and modernization efforts involving aerospace composite products across various applications at the regional level. These procurement trends offered valuable insights into the demand patterns within the aerospace composites industry for each application segment. All relevant segments were thoroughly mapped and integrated to provide a comprehensive view of the market structure and size across different end-use applications.

Data Triangulation

After estimating the overall market size through the process described above, the total market was further segmented into various segments and subsegments. To ensure accuracy, data triangulation and market breakdown techniques were applied wherever relevant, forming a key part of the overall market engineering process. This involved analyzing multiple factors and trends from both the demand and supply sides. Additionally, the final market size and segment-level figures were validated using a combination of top-down and bottom-up approaches to ensure precision and reliability of the statistical estimates.

Market Definition

Aerospace composites are advanced materials used in the construction of aircraft and spacecraft, consisting of two or more distinct components, typically high-strength fibers and a matrix material. The fibers, such as carbon or glass, provide structural strength and rigidity, while the matrix binds the fibers together and transfers loads between them. The key benefit of using composites in aerospace applications is their exceptional strength-to-weight ratio, which significantly reduces the overall weight of the aircraft or spacecraft, enhancing fuel efficiency and performance. Common types include carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), which are widely applied in critical areas such as fuselage structures, wings, interiors, and propulsion systems.

Stakeholders

- Aerospace composites manufacturers

- Aircraft manufacturers

- Universities, governments, and research organizations

- Aerospace composites and composite associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the aerospace composites market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global aerospace composites market by fiber type, matrix type, manufacturing process, aircraft type, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the aerospace composites market? What are the key strategies market players adopt to strengthen their market presence?

Key players include Syensqo (Belgium), Toray Industries (Japan), Mitsubishi Chemical Group (Japan), Hexcel Corporation (US), Teijin Limited (Japan), SGL Carbon (Germany), Spirit AeroSystems (US), Materion Corporation (US), Lee Aerospace (US), General Dynamics (US), 3M (US), FDC Composites Inc. (Canada), Avior Produits Intégrés Inc. (Canada), Collins Aerospace (US), and Aernnova Aerospace S.A. (Spain). Partnerships and deals are the primary strategies adopted to strengthen market presence.

What are the drivers and opportunities for the aerospace composites market?

Rising air traffic, demand for fuel-efficient aircraft, and technological advancements are key drivers. Opportunities lie in the growing reliance on composite materials for high-performance, lightweight, and sustainable aircraft design.

Which region is expected to hold the highest market share?

Europe is expected to hold the largest market share due to the presence of major aerospace manufacturers and ongoing aircraft development projects.

What is the projected CAGR of the aerospace composites market during 2025–2030?

The market is projected to grow at a CAGR of 12.0% from 2025 to 2030.

How is the aerospace composites market structured and positioned in terms of key technologies, applications, and industry trends?

The market is evolving rapidly with increased adoption of carbon and glass fiber composites. It is driven by trends in lightweight design, fuel efficiency, and advanced technologies such as automated fiber placement (AFP), automated tape laying (ATL), digital twin, and robotics.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aerospace Composites Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aerospace Composites Market