Feed Acidifiers Market by Type (Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Sorbic Acid, Malic Acid), Form (Dry, Liquid), Compound (Blended, Single), Livestock (Poultry, Swine, Ruminants, Aquaculture), and Region - Global Forecast to 2023

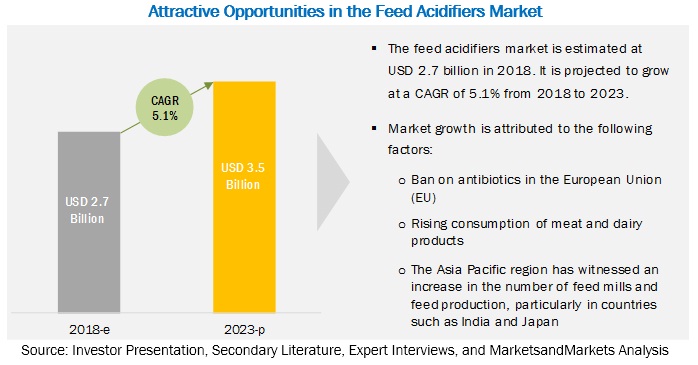

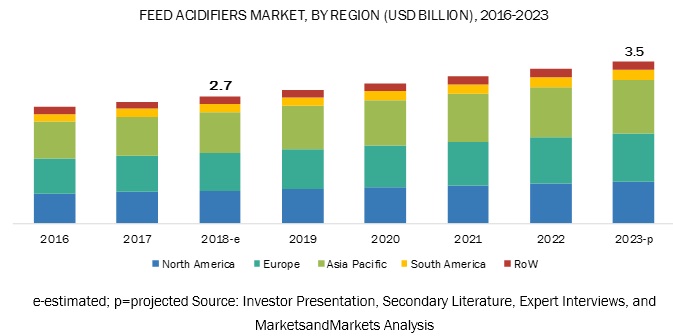

[204 Pages] The feed acidifiers market was estimated to grow from USD 2.7 billion in 2018 to USD 3.5 billion by 2023, at a CAGR of 5.1% during the forecast period. The major factors driving the global feed acidifiers market include the rising consumption of livestock by-products, high threat of diseases in livestock, growing government aids or funds promoting the wellness of the feed industry, and ban of antibiotics in the European Union (EU). This market is experiencing strong growth due to initiatives being taken for improving animal health globally.

By livestock, the poultry segment is projected to dominate the feed acidifiers market during the forecast period.

By livestock, the global market is sub-segmented into poultry, swine, ruminants, aquaculture, and others. The poultry segment is projected to dominate this market during the forecast period. Poultry currently accounts for the largest meat production segment in the global meat industry. Broilers, layers, and breeders that are domesticated to produce eggs and meat for commercial consumption are considered as “poultry.”

By type, the propionic acid segment is projected to dominate the market during the forecast period.

Propionic acid stands as the most widely used feed acidifier in the market. Being an organically sourced acidifier, its usage as a feed additive remains a favorable one, as it is safe for consumers, animals, and the environment alike. Even when used as a chemical preservative, the acid is a generally recognized safe (GRAS) substance by the USFDA, when used in accordance with the Feed Additive regulation, and as a good manufacturing or feeding practice.

As a feed additive, propionic acid is majorly used as a dietary supplement and as a source of nutrition. Propionic acid is also used in the ensiling process for poultry feed, as it improves silage production and provides aerobic stability in silages. It also helps curb bacterial growth in molds, and hence, can also be used as a preservative in animal feed. The preservative effect of propionic acid thereby aids the prevention of feed nutrient losses and mycotoxin formation. Additionally, propionic acid also helps prevent fertility disorders, digestive problems, and immune deficiency in livestock. Such factors have helped propionic acid to maintain dominance in the feed acidifiers market.

By form, the dry segment is projected to dominate the global market during the forecast period.

Feed acidifiers are most widely used in their dry form. Most companies in this market offer their products in the dry form, due to its ease of usage, storage, and transportability. These products are widely used in feed formulations due to their free-flowing structure and their ability to provide consistency. Such factors are expected to drive the market for the dry form of feed acidifiers during the forecast period.

The increased demand for animal products in countries such as China and India is expected to drive the market for feed acidifiers in Asia Pacific.

With rapid economic growth in the region, the demand for meat is rising, especially in countries such as China, India, Japan, and Thailand, for both domestic consumption as well as exports. This increased demand for meat has triggered meat production in the region, due to which the uptake of feed additives such as acidifiers has increased and is expected to witness a healthy growth rate

Market Dynamics

Driver: High threat of diseases in livestock

The outbreak of diseases such as avian flu, BSE (bovine spongiform encephalopathy), and SARS (severe acute respiratory syndrome) not only affect livestock breeding and the economy, but also pose a threat to human health. The emergence of swine diarrhea in the US caused significant losses to swine farmers. Moreover, countries such as China, India, and Indonesia are constantly facing outbreaks of avian flu and swine flu, due to the hot and humid climatic conditions. Meat vendors, meat processors, wholesalers, retailers, and ultimately, livestock growers suffer financial losses due to the culling of disease-affected animals, which further leads to a drop-in animal productivity. The foot and mouth disease (FMD) outbreak in the UK in 2007 led to losses of USD 3.7 billion to the livestock sector. The avian flu outbreak of 2013 resulted in economic losses worth USD 6.1 billion in China. Nearly, 130 people were infected in mainland China during this outbreak, according to the UN. Feed safety has increasingly become a matter of concern for many governments around the world, especially those in North America and Europe. Also, consumers around the world are now more aware and informed and are giving importance to the extrinsic attributes of the meat they consume. Certain pathogenic and parasitic contaminations in meat products—Salmonella, Listeria, and E. coli—could thereby cause various disease outbreaks in livestock animals.

Many countries, including South Korea and Slovakia, have banned pork imports from Germany due to the health risks involved. The use of natural feed additives, such as acidifiers, provide balanced nutrition to animals and protects them against such harmful environmental entities. They also play an important role in overcoming issues related to animal feeding assurance, environment-friendly meat production, and animal welfare. Acidifiers provide various nutritional elements, which help improve the productivity of livestock, besides maintaining good-quality feed.

The usage of feed acidifiers in such cases proved to be an effective medium to reduce disease outbreaks by improving animal health, by improving feed efficiency, by inhibiting pathogenic bacteria growth, and reducing risks of sub-clinical infections. The addition of feed acidifiers to feed also helps in maintaining an optimum pH in the stomach of the livestock, stimulates feed consumption, and improves protein and energy digestibility by reducing microbial competition with host nutrients and endogenous nitrogen losses. Most feed ingredients from plant sources prove to be inadequate in meeting such requirements, and carrying out these functionalities. Therefore, the inclusion of feed acidifiers is important for the maintenance of animal health in such cases. This is one of the major factors driving the demand for feed acidifiers.

Restraint: Rising prices of feed acidifiers

The trend of price increase has been observed for feed acidifiers, owing to which the market for these products has been hindered. Manufacturers of feed acidifiers are faced with rising product prices and diminishing supply, inducing market pressures that have led to the increase in price structures. For example, formic acid and propionic acid, which boast of a wide range of applications, including animal nutrition, have been experiencing a rise in consumption, thereby leading to a rise in their prices. Apart from being used as a feed preservative and acidifier, formic acid is also used in leather processing for the efficient fixing of dyes and acts as a re-tanning agent. Potassium formate, which is a salt of formic acid, is used as an environmentally acceptable de-icing agent, which is used on roads and airport runways. Additionally, both formic acid and potassium formate are used in the oilfield industry as a part of the drilling process and in shale gas exploration. Formic acid is also used as a descaling agent.

Propionic acid, on the other hand, finds usage in the production of pharmaceuticals as a crop protection agent, solvent, and as a food preservative, apart from being used as a feed acidifier and preservative. Such a wide range of applications has led to rising demands, resulting in manufacturers increasing their prices for feed acidifier products. For example, BASF is expected to increase its prices of formic and propionic acid in 2018. This increase in prices is expected to follow after a recent increase in similar product prices, in 2017, when BASF increased its formic acid prices by USD 0.03 per pound, for its formic acid 85%, 90%, 95%, and 99% grades. Similarly, citric acid prices have been rising, owing to high production costs and a tightening supply. The supply of citric acid is highly concentrated in China, which makes it a highly concentrated market. This has led to a very constricted global supply of citric acid from Europe and the Americas, resulting in rising prices. Additionally, citric acid finds its major application in food & beverage products, making it a limited commodity to be used in feed. About 70% of the supply of citric acid is used for food & beverage products, which has resulted in a rise in its prices. These factors are expected to highly restrict the market growth for feed acidifiers during the forecast period.

Opportunity: Encapsulation techniques being used for feed acidifiers

Feed acidifiers have positive effects on livestock health but are often difficult to properly process in feed. Acidifiers tend to lose their efficacy and efficiency, owing to their vulnerability to high temperatures, dusty environment, significant odors, and other volatile properties. As a result, manufacturers are now coming up with newer technologies that help improve feed efficiency by successfully locking in feed acidifiers along with their relevant efficacies and properties. Encapsulation acts as a novel technology for feed products, especially for acidifiers that allow them to improve their release and enteric action and have a longer shelf-life by protecting them against environmental changes, by keeping the liquid, gaseous, or solid acidifier substance packed in a tiny millimetric capsule. These acidifiers are encapsulated in such a manner that the digestive tract obtains small quantities of various acids in a progressive manner. As a result, the amount of acidifiers released into the stomach remains low while the amount reaching the intestinal tract is higher, thereby improving operating efficiency. Along with this protection against extreme environmental factors, encapsulation also maintains the key properties of acidifiers, such as the enhancement of palatability, stability in ration, improved digestion, and better livestock performance.

Challenge: Efficacy maintenance of feed acidifiers

The corrosive property of feed acidifiers results in significant damage while handling them, and also to the equipment where the product is processed or stored. Furthermore, manufacturers and distributors of feed acidifiers are looking at formulating efficient supply chain models for acidifiers, as these products may tend to lose their efficacy during transport. Although the regional network to reach customers is established through distributors, the feed acidifiers market has been shifting toward service-based requirements to gain market presence. The distribution of acidifiers without losing the natural nutrient quality requires effective packaging systems and a strong supply chain. In order to maintain this stability and effectiveness of acidifiers, manufacturers prefer delivering this product directly to the customer’s location.

This approach could also help increase customer satisfaction, and help improve the market presence of companies. Therefore, an efficient supply chain planning and management system is required to maintain the inventory and improve the storage of different acidifier ingredients. In such cases, manufacturers are required to maintain strong sales and analysis teams to identify and provide customer solutions, and to cater to such customer requirements. However, salts of organic acids remain colorless and mostly less corrosive in nature, than their acidic forms, and are easier to handle during the feed manufacturing process, making these the more preferred product. These factors make it difficult for manufacturers to maintain proper acidifier efficacy levels, thereby inhibiting market growth.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD), Volume (Tons) |

|

Segments covered |

Type, Form, Compound, Livestock, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

|

Companies covered |

BASF SE, Yara International ASA, Kemin Industries, Inc., Biomin Holding GmbH, Kemira Oyj, Perstorp Holding AB, Novus International, Inc., Corbion NV, Impextraco NV, Addcon Group GmbH, Anpario PLC, Peterlabs Holdings Berhad, Jefo Nutrition, Inc., Pancosma SA, and Nutrex NV. |

The research report categorizes the feed acidifiers to forecast the revenues and analyze the trends in each of the following sub-segments:

On the basis of type, the feed acidifiers market has been segmented as follows:

- Propionic acid

- Formic acid

- Lactic acid

- Citric acid

- Malic acid

- Sorbic acid

- Others (fumaric acid, tartaric acid, butyric acid, acetic acid, and benzoic acid)

On the basis of form, the market has been segmented as follows:

- Dry

- Liquid

On the basis of compound, the market has been segmented as follows:

- Blended

- Single

On the basis of livestock, the market has been segmented as follows:

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

- Others (Equine and pets)

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

*Rest of the World (RoW) includes the Middle East and Africa.

Key Market Players

BASF SE, Yara International ASA, Kemin Industries, Inc., Biomin Holding GmbH, Kemira Oyj, Perstorp Holding AB, Novus International, Inc., Corbion NV, Impextraco NV, Addcon Group GmbH, Anpario PLC, Peterlabs Holdings Berhad, Jefo Nutrition, Inc., Pancosma SA, and Nutrex NV.

BASF SE is a manufacturer of feed acidifiers. It has a large customer base in Europe and North America. The company continues to focus on maintaining its market position in the global animal nutrition market through geographic expansion in high-growth markets. The company focuses on the production of performance products along with an R&D program to develop new solutions for the feed acidifiers market for different types of acids such as propionic acid, formic acid, and fumaric acid. It focuses on expanding its product portfolio through expansions and collaborations that will help fulfill the demand from feed industries in the coming years.

Owing to the attractive opportunities in the animal nutrition industry, the company has expanded its facilities to cater to the growing demand for feed acidifiers, thereby enhancing its sales and profitability.

Recent Developments

- In June 2016, BASF SE (Germany) and Balchem Corporation (U.S.) introduced Amasil formic acid, approved for use by swine producers, at the World Pork Expo in Des Moines, Iowa, US

- In January 2018, Kemin acquired Agri-Marketing Corp. This provided exclusive distribution and manufacturing services for Kemin’s products in Canada. The new Kemin location will focus on serving the animal nutrition and health market, as well as the pet food and rendering industries. It will look to grow its business through offering an expanded portfolio.

- In Novemnber 2017, Novus International, Inc. opened a new manufacturing facility in Calhoun County, Texas, US.

- In January 2016, Pancosma acquired Btech (Brazil), a feed additives company. This acquisition strengthened the position of the company in the Brazilian feed additives market.

- In March 2015, Biomin opened a new production facility in Panama. It helped the company to provide fast delivery to all Biomin customers as well as distributors in the American market.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the feed acidifiers market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Research Limitations

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in this Market

4.2 Market For Feed Acidifiers, By Key Country

4.3 Asia Pacific: Market For Feed Acidifiers, By Type & Key Country

4.4 Feed Acidifiers Market, By Form & Region

4.5 Market For Feed Acidifiers, By Livestock & Region

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Consumption of Meat and Dairy Products

5.2.1.2 High Threat of Diseases in Livestock

5.2.1.3 Growing Government Aids Or Funds Promoting the Wellness of the Feed Industry

5.2.1.4 Ban of Antibiotics in the European Union (EU)

5.2.2 Restraints

5.2.2.1 Rising Prices of Feed Acidifiers

5.2.3 Opportunities

5.2.3.1 Encapsulation Techniques Being Used for Feed Acidifiers

5.2.4 Challenges

5.2.4.1 Efficacy Maintenance of Feed Acidifiers

5.3 Value Chain Analysis

5.4 Regulatory Framework

5.4.1 US

5.4.2 European Union

5.4.3 China

5.4.4 Japan

5.4.5 India

6 Feed Acidifiers Market, By Type (Page No. - 53)

6.1 Introduction

6.2 Propionic Acid

6.2.1 Propionic Acid is the Most Widely Used Feed Acidifier

6.3 Formic Acid

6.3.1 Being A Colourless Fuming Liquid and Remains Soluble in Water Enabling Proper Mixing in Animal Feed

6.4 Citric Acid

6.4.1 Citric Acid is Palatable in Nature and Meets the Daily Nutrition Requirement of Livestock

6.5 Lactic Acid

6.5.1 Lactic Acid is A More Cost Effective Feed Acidifier Owing to Its Strong Efficacy

6.6 Sorbic Acid

6.6.1 Sorbic Acid and Its Salts are Used as Feed Acidifiers Specifically Aimed at Acting as Antimicrobial Agents

6.7 Malic Acid

6.7.1 Malic Acid is Gaining Popularity as A Preservative and Acidity Regulator in Pet Food

6.8 Others

7 Feed Acidifiers Market, By Form (Page No. - 63)

7.1 Introduction

7.2 Dry

7.2.1 Widely Preferred Due to Its Ease of Usage, Storage and Transportability

7.3 Liquid

7.3.1 Offers Several Benefits to Livestock Feed Such as Ease of Mixing, Uniformity in Form, and Lesser Dust Formation

8 Feed Acidifiers Market, By Compound (Page No. - 68)

8.1 Introduction

8.2 Blended Compound

8.2.1 Gaining Popularity Due to Their Synergistic Action to Improve Animal Health and Performance

8.3 Single Compound

8.3.1 Help in Improving Performance. Increasing Nutritent Digestibility, and Controling Growth of Harmful Gut Bacteria

9 Feed Acidifiers Market, By Livestock (Page No. - 74)

9.1 Introduction

9.2 Poultry

9.2.1 Broilers

9.2.2 Layers

9.2.3 Breeders

9.3 Swine

9.3.1 Sow

9.3.2 Grower

9.3.3 Starter

9.4 Ruminants

9.4.1 Dairy Cattle

9.4.2 Beef Cattle

9.4.3 Others

9.5 Aquaculture

9.6 Others

9.6.1 Equine

9.6.2 Pets

10 Feed Acidifiers Market, By Region (Page No. - 87)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Increasing Demand From Animal Rearers for Supplement and Mineral Rich Feed Products

10.2.2 Mexico

10.2.2.1 Mexico is A High Growth Market for Meat and Meat Products Expecting A Further Rise in Consumption and Export of Beef Products

10.2.3 Canada

10.2.3.1 Growting Concerns Among Animal Producers Regarding the Safety of Animal Health are Leading to Rise in Demand for Feed Acidifiers

10.3 Europe

10.3.1 Spain

10.3.1.1 Increasing Livestock Rearing and the Growing Feed Industry in the Country are Propelling the Market for Feed Acidifiers

10.3.2 France

10.3.2.1 Domestic Demand for Meat Products Plays an Important Role in the Rising Demand for Feed Acidifiers in Livestock Feed

10.3.3 Germany

10.3.3.1 Modernization of the Livestock Industry has Resulted in the Use of Scientific Methods for the Production of Livestock

10.3.4 UK

10.3.4.1 Adoption of Mega-Farms and Intensive Factory Farming for Cattle, Poultry, and Swine to Drive Market Growth

10.3.5 Italy

10.3.5.1 Increasing Demand for Naturally Sourced Feed Acidifiers to Propell the Market Growth

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Advancements in the Feed Industry of the Country are Expected to Create Demand for Superior-Quality Feed Incorporating Feed Acidifiers

10.4.2 India

10.4.2.1 Ease of Availability of Raw Materials and A Major Export Destination for Feed Acidifiers

10.4.3 Japan

10.4.3.1 Stabilization in Feed Prices to Drive the Adoption of Feed Acidifiers

10.4.4 Thailand

10.4.4.1 Growing Demand for Feed Acidifiers From the Poultry Industry

10.4.5 Vietnam

10.4.5.1 Increasing Feed Production to Have A Proportional Impact on the Consumption of Feed Acidifiers

10.4.6 Rest of Asia Pacific

10.5 South America

10.5.1 Brazil

10.5.1.1 Increase in the Modernization of the Meat Processing and Dairy Industries

10.5.2 Argentina

10.5.2.1 Rise in Awareness Regarding the Importance of Livestock Nutrition for Good Quality Meat and Other Animal-Based By-Products

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Africa

10.6.1.1 Support From Government Programs and the Expanding Livestock Production to Drive Consumption of Feed Acidifiers

10.6.2 Middle East

10.6.2.1 Increase in Meat Consumption and Production and Rise in Livestock Disease Outbreaks

11 Competitive Landscape (Page No. - 159)

11.1 Overview

11.2 Competitive Scenario

11.3 Market Ranking Analysis

11.4 Expansions

11.5 Acquisitions

11.6 Product Launches

11.7 Collaborations & Divestments

12 Company Profiles (Page No. - 166)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Introduction

12.2 BASF SE

12.3 Yara International ASA

12.4 Kemin Industries, Inc.

12.5 Biomin Holding GmbH

12.6 Kemira OYJ

12.7 Perstorp Holding Ab

12.8 Novus International, Inc.

12.9 Corbion Nv

12.10 Impextraco Nv

12.11 Addcon Group GmbH

12.12 Anpario PLC

12.13 Peterlabs Holdings Berhad

12.14 Jefo Nutrition, Inc.

12.15 Pancosma SA

12.16 Nutrex Nv

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 197)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (184 Tables)

Table 1 US Dollar Exchange Rate Considered for the Study, 2013–2017

Table 2 Market Snapshot, 2018 vs. 2023

Table 3 Feed Acidifier Market Size, By Type, 2016–2023 (Kt)

Table 4 Feed Acidifiers Market Size, By Type, 2016–2023 (USD Million)

Table 5 Propionic Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 6 Propionic Acid: Feed Acidifier Market Size, By Region, 2016–2023 (USD Million)

Table 7 Formic Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 8 Formic Acid: Market Size, By Region, 2016–2023 (USD Million)

Table 9 Citric Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 10 Citric Acid: Market Size, By Region, 2016–2023 (USD Million)

Table 11 Lactic Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 12 Lactic Acid: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Sorbic Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 14 Sorbic Acid: Market Size, By Region, 2016–2023 (USD Million)

Table 15 Malic Acid: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 16 Malic Acid: Market Size, By Region, 2016–2023 (USD Million)

Table 17 Others: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 18 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Feed Acidifier Market Size, By Form, 2016–2023 (Kt)

Table 20 Feed Acidifiers Market Size, By Form, 2016–2023 (USD Million)

Table 21 Dry Feed Acidifier Market Size, By Region, 2016–2023 (Kt)

Table 22 Dry Feed Acidifiers Market Size, By Region, 2016–2023 (USD Million)

Table 23 Liquid Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 24 Liquid Feed Acidifier Market Size, By Region, 2016–2023 (USD Million)

Table 25 Feed Acidifier Market Size, By Compound, 2016–2023 (Kt)

Table 26 Market Size, By Compound, 2016–2023 (USD Million)

Table 27 Blended Compound: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 28 Blended Compound: Feed Acidifier Market Size, By Region, 2016–2023 (USD Million)

Table 29 Single Compound: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 30 Single Compound: Feed Acidifier Market Size, By Region, 2016–2023 (USD Million)

Table 31 Feed Acidifier Market Size, By Livestock, 2016–2023 (Kt)

Table 32 Feed Acidifier Market Size, By Livestock, 2016–2023 (USD Million)

Table 33 Poultry: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 34 Poultry: Market Size, By Region, 2016–2023 (USD Million)

Table 35 Poultry: Market Size, By Type, 2016–2023 (Kt)

Table 36 Poultry: Market Size, By Type, 2016–2023 (USD Million)

Table 37 Swine: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 38 Swine: Market Size, By Region, 2016–2023 (USD Million)

Table 39 Swine: Market Size, By Type, 2016–2023 (Kt)

Table 40 Swine: Market Size, By Type, 2016–2023 (USD Million)

Table 41 Ruminants: Feed Acidifiers Market Size, By Region, 2016–2024 (Kt)

Table 42 Ruminants: Market Size, By Region, 2016–2023 (USD Million)

Table 43 Ruminants: Market Size, By Type, 2016–2023 (Kt)

Table 44 Ruminants: Market Size, By Type, 2016–2023 (USD Million)

Table 45 Aquaculture: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 46 Aquaculture: Market Size, By Region, 2016–2023 (USD Million)

Table 47 Other Livestock: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 48 Other Livestock: Market Size, By Region, 2016–2023 (USD Million)

Table 49 Feed Acidifier Market Size, By Region, 2016–2023 (Kt)

Table 50 Feed Acidifier Market Size, By Region, 2016–2023 (USD Million)

Table 51 North America: Feed Acidifiers Market Size, By Country, 2016–2023 (Kt)

Table 52 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 53 North America: Market Size, By Type, 2016–2023 (Kt)

Table 54 North America: Market Size, By Type, 2016–2023 (USD Million)

Table 55 North America: Market Size, By Compound, 2016–2023 (Kt)

Table 56 North America: Market Size, By Compound, 2016–2023 (USD Million)

Table 57 North America: Market Size, By Form, 2016–2023 (Kt)

Table 58 North America: Market Size, By Form, 2016–2023 (USD Million)

Table 59 North America: Market Size, By Livestock, 2016–2023 (Kt)

Table 60 North America: Market Size, By Livestock, 2016–2023 (USD Million)

Table 61 US: Market Size, By Type, 2016–2023 (Kt)

Table 62 US: Market Size, By Type, 2016–2023 (USD Million)

Table 63 US: Market Size, By Compound, 2016–2023 (Kt)

Table 64 US: Market Size, By Compound, 2016–2023 (USD Million)

Table 65 Mexico: Market Size, By Type, 2016–2023 (Kt)

Table 66 Mexico: Market Size, By Type, 2016–2023 (USD Million)

Table 67 Mexico: Market Size, By Compound, 2016–2023 (Kt)

Table 68 Mexico: Market Size, By Compound, 2016–2023 (USD Million)

Table 69 Canada: Market Size, By Type, 2016–2023 (Kt)

Table 70 Canada: Market Size, By Type, 2016–2023 (USD Million)

Table 71 Canada: Market Size, By Compound, 2016–2023 (Kt)

Table 72 Canada: Market Size, By Compound, 2016–2023 (USD Million)

Table 73 Europe: Feed Acidifiers Market Size, By Country, 2016–2023 (Kt)

Table 74 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 75 Europe: Market Size, By Type, 2016–2023 (Kt)

Table 76 Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 77 Europe: Market Size, By Compound, 2016–2023 (Kt)

Table 78 Europe: Market Size, By Compound, 2016–2023 (USD Million)

Table 79 Europe: Market Size, By Form, 2016–2023 (Kt)

Table 80 Europe: Market Size, By Form, 2016–2023 (USD Million)

Table 81 Europe: Market Size, By Livestock, 2016–2023 (Kt)

Table 82 Europe: Market Size, By Livestock, 2016–2023 (USD Million)

Table 83 Spain: Market Size, By Type, 2016–2023 (Kt)

Table 84 Spain: Market Size, By Type, 2016–2023 (USD Million)

Table 85 Spain: Market Size, By Compound, 2016–2023 (Kt)

Table 86 Spain: Market Size, By Compound, 2016–2023 (USD Million)

Table 87 France: Market Size, By Type, 2016–2023 (Kt)

Table 88 France: Market Size, By Type, 2016–2023 (USD Million)

Table 89 France: Market Size, By Compound, 2016–2023 (Kt)

Table 90 France: Market Size, By Compound, 2016–2023 (USD Million)

Table 91 Germany: Market Size, By Type, 2016–2023 (Kt)

Table 92 Germany: Market Size, By Type, 2016–2023 (USD Million)

Table 93 Germany: Market Size, By Compound, 2016–2023 (Kt)

Table 94 Germany: Market Size, By Compound, 2016–2023 (USD Million)

Table 95 UK: Feed Acidifiers Market Size, By Type, 2016–2023 (Kt)

Table 96 UK: Market Size, By Type, 2016–2023 (USD Million)

Table 97 UK: Market Size, By Compound, 2016–2023 (Kt)

Table 98 UK: Market Size, By Compound, 2016–2023 (USD Million)

Table 99 Italy: Feed Acidifier Market Size, By Type, 2016–2023 (Kt)

Table 100 Italy: Market Size, By Type, 2016–2023 (USD Million)

Table 101 Italy: Market Size, By Compound, 2016–2023 (Kt)

Table 102 Italy: Market Size, By Compound, 2016–2023 (USD Million)

Table 103 Rest of Europe: Market Size, By Type, 2016–2023 (Kt)

Table 104 Rest of Europe: Market Size, By Type, 2016–2023 (USD Million)

Table 105 Rest of Europe: Market Size, By Compound, 2016–2023 (Kt)

Table 106 Rest of Europe: Market Size, By Compound, 2016–2023 (USD Million)

Table 107 Asia Pacific: Feed Acidifier Market Size, By Country, 2016–2023 (Kt)

Table 108 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 109 Asia Pacific: Market Size, By Type, 2016–2023 (Kt)

Table 110 Asia Pacific: Market Size, By Type, 2016–2023 (USD Million)

Table 111 Asia Pacific: Market Size, By Compound, 2016–2023 (Kt)

Table 112 Asia Pacific: Market Size, By Compound, 2016–2023 (USD Million)

Table 113 Asia Pacific: Market Size, By Form, 2016–2023 (Kt)

Table 114 Asia Pacific: Market Size, By Form, 2016–2023 (USD Million)

Table 115 Asia Pacific: Market Size, By Livestock, 2016–2023 (Kt)

Table 116 Asia Pacific: Market Size, By Livestock, 2016–2023 (USD Million)

Table 117 China: Market Size, By Type, 2016–2023 (Kt)

Table 118 China: Market Size, By Type, 2016–2023 (USD Million)

Table 119 China: Market Size, By Compound, 2016–2023 (Kt)

Table 120 China: Market Size, By Compound, 2016–2023 (USD Million)

Table 121 India: Feed Acidifiers Market Size, By Type, 2016–2023 (Kt)

Table 122 India: Market Size, By Type, 2016–2023 (USD Million)

Table 123 India: Market Size, By Compound, 2016–2023 (Kt)

Table 124 India: Market Size, By Compound, 2016–2023 (USD Million)

Table 125 Japan: Feed Acidifier Market Size, By Type, 2016–2023 (Kt)

Table 126 Japan: Market Size, By Type, 2016–2023 (USD Million)

Table 127 Japan: Market Size, By Compound, 2016–2023 (Kt)

Table 128 Japan: Market Size, By Compound, 2016–2023 (USD Million)

Table 129 Thailand: Market Size, By Type, 2016–2023 (Kt)

Table 130 Thailand: Market Size, By Type, 2016–2023 (USD Million)

Table 131 Thailand: Market Size, By Compound, 2016–2023 (Kt)

Table 132 Thailand: Market Size, By Compound, 2016–2023 (USD Million)

Table 133 Vietnam: Feed Acidifiers Market Size, By Type, 2016–2023 (Kt)

Table 134 Vietnam: Market Size, By Type, 2016–2023 (USD Million)

Table 135 Vietnam: Market Size, By Compound, 2016–2023 (Kt)

Table 136 Vietnam: Market Size, By Compound, 2016–2023 (USD Million)

Table 137 Rest of Asia Pacific: Market Size, By Type, 2016–2023 (Kt)

Table 138 Rest of Asia Pacific: Market Size, By Type, 2016–2023 (USD Million)

Table 139 Rest of Asia Pacific: Market Size, By Compound, 2016–2023 (Kt)

Table 140 Rest of Asia Pacific: Market Size, By Compound, 2016–2023 (USD Million)

Table 141 South America: Feed Acidifiers Market Size, By Country, 2016–2023 (Kt)

Table 142 South America: Market Size, By Country, 2016–2023 (USD Million)

Table 143 South America: Market Size, By Type, 2016–2023 (Kt)

Table 144 South America: Market Size, By Type, 2016–2023 (USD Million)

Table 145 South America: Market Size, By Compound, 2016–2023 (Kt)

Table 146 South America: Market Size, By Compound, 2016–2023 (USD Million)

Table 147 South America: Market Size, By Form, 2016–2023 (Kt)

Table 148 South America: Market Size, By Form, 2016–2023 (USD Million)

Table 149 South America: Market Size, By Livestock, 2016–2023 (Kt)

Table 150 South America: Market Size, By Livestock, 2016–2023 (USD Million)

Table 151 Brazil: Market Size, By Type, 2016–2023 (Kt)

Table 152 Brazil: Market Size, By Type, 2016–2023 (USD Million)

Table 153 Brazil: Market Size, By Compound, 2016–2023 (Kt)

Table 154 Brazil: Market Size, By Compound, 2016–2023 (USD Million)

Table 155 Argentina: Market Size, By Type, 2016–2023 (Kt)

Table 156 Argentina: Market Size, By Type, 2016–2023 (USD Million)

Table 157 Argentina: Market Size, By Compound, 2016–2023 (Kt)

Table 158 Argentina: Market Size, By Compound, 2016–2023 (USD Million)

Table 159 Rest of South America: Feed Acidifiers Market Size, By Type, 2016–2023 (Kt)

Table 160 Rest of South America: Market Size, By Type, 2016–2023 (USD Million)

Table 161 Rest of South America: Market Size, By Compound, 2016–2023 (Kt)

Table 162 Rest of South America: Market Size, By Compound, 2016–2023 (USD Million)

Table 163 RoW: Feed Acidifiers Market Size, By Region, 2016–2023 (Kt)

Table 164 RoW: Market Size, By Region, 2016–2023 (USD Million)

Table 165 RoW: Market Size, By Type, 2016–2023 (Kt)

Table 166 RoW: Market Size, By Type, 2016–2023 (USD Million)

Table 167 RoW: Market Size, By Compound, 2016–2023 (Kt)

Table 168 RoW: Market Size, By Compound, 2016–2023 (USD Million)

Table 169 RoW: Market Size, By Form, 2016–2023 (Kt)

Table 170 RoW: Market Size, By Form, 2016–2023 (USD Million)

Table 171 RoW: Market Size, By Livestock, 2016–2023 (Kt)

Table 172 RoW: Market Size, By Livestock, 2016–2023 (USD Million)

Table 173 Africa: Feed Acidifier Market Size, By Type, 2016–2023 (Kt)

Table 174 Africa: Market Size, By Type, 2016–2023 (USD Million)

Table 175 Africa: Market Size, By Compound, 2016–2023 (Kt)

Table 176 Africa: Market Size, By Compound, 2016–2023 (USD Million)

Table 177 Middle East: Feed Acidifiers Market Size, By Type, 2016–2023 (Kt)

Table 178 Middle East: Market Size, By Type, 2016–2023 (USD Million)

Table 179 Middle East: Market Size, By Compound, 2016–2023 (Kt)

Table 180 Middle East: Market Size, By Compound, 2016–2023 (USD Million)

Table 181 Expansions & Investments, 2013–2018

Table 182 Acquisitions, 2013–2018

Table 183 Product Launches, 2013–2018

Table 184 Collaborations & Divestments, 2013–2018

List of Figures (41 Figures)

Figure 1 Market Snapshot

Figure 2 Feed Acidifiers Market, By Region

Figure 3 Feed Acidifier Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Feed Acidifiers Market Size, By Type, 2018 vs. 2023 (USD Million)

Figure 8 Market Size, By Compound, 2018 vs. 2023 (USD Million)

Figure 9Market Size, By Livestock, 2018 vs. 2023 (USD Million)

Figure 10 Feed Acidifier Market Share (Value), By Region, 2017

Figure 11 Rising Consumption of Meat and Dairy Products to Drive the Demand for Feed Acidifiers

Figure 12 Brazil and China are Projected to Be the Fastest-Growing Markets for Feed Acidifiers Between 2018 and 2023

Figure 13 Formic Acid Accounted for the Largest Share of the Asia Pacific Feed Acidifier Market

Figure 14 Asia Pacific to Dominate the Feed Acidifier Market Across All Forms Through 2023, in Terms of Value

Figure 15 Poultry to Be the Fastest-Growing Segment During the Forecast Period

Figure 16 Market Dynamics: Feed Acidifier Market

Figure 17 Global Meat Consumption Estimates, 2015–2024 (Kt Cwe)

Figure 18 Global Milk Production, 2013–2015 (Mt)

Figure 19 Value Chain Analysis: Feed Acidifiers

Figure 20 Feed Acidifiers Market Share (Value), By Type, 2018 vs. 2023

Figure 21 Feed Acidifier Market Share (Value), By Form, 2018 vs. 2023

Figure 22 Feed Acidifier Market Share (Value), By Compound, 2018 vs. 2023

Figure 23 Feed Acidifier Market Share (Value), By Livestock, 2018 vs. 2023

Figure 24 Geographic Snapshot: Rapidly Growing Markets are Emerging as New Hotspots (2016–2023)

Figure 25 Asia Pacific Feed Acidifier Market Snapshot

Figure 26 South America Feed Acidifier Market Projected to Grow at Highest Growth

Figure 27 Key Strategies Adopted By Leading Players in the Feed Acidifier Market, 2013–2018

Figure 28 Number of Developments Between 2013 and 2017

Figure 29 Ranking of Key Players in the Feed Acidifier Market

Figure 30 BASF SE: Company Snapshot

Figure 31 BASF SE: SWOT Analysis

Figure 32 Yara International ASA: Company Snapshot

Figure 33 Yara International ASA: SWOT Analysis

Figure 34 Kemin Industries, Inc.: SWOT Analysis

Figure 35 Kemira OYJ: Company Snapshot

Figure 36 Kemira OYJ: SWOT Analysis

Figure 37 Perstorp Holding Ab: Company Snapshot

Figure 38 Perstorp Holding Ab: SWOT Analysis

Figure 39 Corbion Nv: Company Snapshot

Figure 40 Anpario PLC: Company Snapshot

Figure 41 Peterlabs Holdings Berhad: Company Snapshot

Growth opportunities and latent adjacency in Feed Acidifiers Market

Does this report provide market numbers for Saudi Arabian Feed Acidifiers market ?