Livestock Flooring Market

Livestock Flooring Market by Product Type (Slat Floors, Interlocking Floors, Grating and Panel Series), Material Type (Concrete, Rubber, Plastic, Steel and Hybrid), Livestock, Farm Type and Region - Global Forecast 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The livestock flooring market is estimated to be USD 1.76 billion in 2025 and is projected to grow at a rate of 4.2% between 2025 and 2030. The livestock flooring market is a dynamic sector of the wider agriculture industry, which has undergone innovations aimed at catering to the specialized needs of various livestock through tailored flooring solutions. It encompasses the use of materials, including concrete, rubber, plastic, steel, and hybrid, designed for the optimization of animal comfort, safety, and productivity while at the same time addressing issues of durability and ease of maintenance caused by the varying conditions in farms. With livestock farming spreading worldwide, innovations in floor systems for livestock tailored to particular livestock needs will play a major role in meeting sustainability and productivity objectives in new-age agricultural systems.

KEY TAKEAWAYS

- The Asia Pacific livestock flooring market is expected to dominate, with a share of 37.8% in 2025.

- By product type, the inter-locking floors segment is expected to register the highest CAGR of 5.3%.

- By material type, the hybrid material segment is projected to grow at the fastest rate from 2025 to 2030.

- By livestock, the powder segment is expected to dominate the market.

- The cattle flooring segment will grow at the fastest rate during the forecast period.

- Key players in the livestock flooring market include Tetra Laval Group, Anders Concrete, and Wolfenden Concrete. Their products aim to improve animal welfare, reduce injuries, and enhance sanitation on farms.

- Key startups in the livestock flooring market include MIK International GmbH & Co. KG, Nooyen Group, Agri-Plastics, and J&D Manufacturing. These companies focus on developing innovative, cost-effective, and animal-friendly flooring solutions made from plastic, rubber, and engineered materials.

The global livestock flooring market is experiencing robust expansion, fundamentally driven by the escalating focus on animal welfare, biosecurity, and operational efficiency across commercial farming landscapes. This essential sector provides specialized flooring solutions, segmented by product design (e.g., Slat Floors, Interlocking Floors), material composition (including Concrete, Plastic, and high-comfort Rubber), and specific livestock application (Cattle, Swine, Poultry). Key drivers include the global intensification of livestock production and stringent regulatory standards promoting animal health, which necessitate durable, hygienic, and anti-slip surfaces to minimize injuries and disease transmission. The market is witnessing a shift towards technologically advanced and sustainable materials, with plastic and hybrid options gaining traction over traditional concrete due to superior drainage, ease of cleaning, and reduced long-term maintenance costs, positioning this infrastructure as a critical investment for enhancing productivity in modern agriculture.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The global Livestock Flooring market is currently experiencing a profound paradigm shift, transitioning its core value proposition from mere structural resilience to advanced animal welfare and integrated data solutions. Fueled by escalating global consumer advocacy for ethical sourcing and the convergence of stringent regulatory standards, the industry's revenue landscape is rapidly migrating from traditional, CapEx-focused materials (e.g., concrete) towards innovative, high-performance hybrid systems. This market disruption mandates that manufacturers prioritize the development of sensor-embedded flooring, sustainable composite materials, and modular designs that directly optimize animal well-being, improve biosecurity, and drive operational efficiency, thereby offering farm operators demonstrable returns on investment and future-proofing their business against evolving market and compliance demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased beef production globally

-

Stricter Animal Welfare Regulations

Level

-

Labor-intensive process of rubber recycling

-

High Initial Investment Cost

Level

-

Rise of cattle production in emerging economies

-

Shift to Sustainable & Hybrid Materials

Level

-

Presence of large number of small-scale cattle farmers

-

Low Awareness Among Small Farmers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drivers: Increased beef production globally

The global production of beef is increasing as the world population and its need for food grows, facilitated by increasing urbanization and high income in newly developing economies. It, therefore, calls for sustainability to not only meet ethics but also the standards of industries. According to the American Farm Bureau Federation’s September 2022 data, beef production in the US in August 2022 hit a record 2.51 billion pounds, up 6% year-on-year. Cattle slaughter totaled 3.08 million head, reflecting a 7% increase. Annual cattle slaughter reached 22.49 million head, 1.8% above 2021 levels, with heifer slaughter rising 9.3% and cow slaughter up 6%. According to the USDA’s 2023 data, the US leads global beef production with 12.29 million metric tons (20% of global output) in 2023/2024. Brazil comes next with 10.95 million metric tons (18%), followed by China with 7.53 million metric tons (13%). Together, these countries underscore a strong supply chain supported by rising global demand. As beef production increases, the demand for livestock flooring systems in cattle operations will also rise. These systems help reduce stress, injuries, and diseases, leading to increased productivity.

Restraints: Labor-intensive process of rubber recycling

Rubber is one of the most widely used materials in livestock flooring systems, and recycled rubber is the most preferred because it is cheaper and readily available. However, recycling rubber is a complex process that requires a lot of resources, thus posing notable challenges in its application. According to an article by Martin's Rubber Co. Ltd. (UK) in March 2021, vulcanization that gives rubber strength and elasticity permanently "sets" its chemical bonds, and recycling is tough. Unlike thermoplastics that can be remelted and recycled, the vulcanized rubber's structure cannot easily be undone. Recycling involves cleaning the rubber, reducing it to smaller pieces, and processing it into crumb rubber through granulation. Despite all the efforts put into recycling rubber, it is compromised in terms of quality, strength, and durability. Thus, these challenges influence and significantly constrain the market for livestock flooring. The heavy reliance on recycled rubber for flooring limits product lifespan and durability, especially in high-traffic farming environments. Other constraints include the high cost of recycled materials due to the labor-intensive nature of recycling, resulting in the low availability of livestock flooring products. This calls for innovation in rubber recycling technologies to achieve better quality and sustainability of the materials introduced into livestock flooring systems.

Opportunities: Rise of cattle production in emerging economies

The rise of cattle production in emerging economies is expected to offer growth opportunities for the livestock flooring market. As reported by the FAO in 2023, the share of the developing world in global dairy production has increased due to an increase in the number of producing animals rather than increasing productivity per head. This increase is caused by increased disposable incomes and high demand for meat and dairy products in the Indian subcontinent, parts of Africa, and South and Central America. As the countries continue to focus on cattle farming to fill the demand, the requirement for sustainable and humane practices is receiving attention. Livestock flooring systems, in the context of enhancing cattle comfort, health, and productivity, can be highly instrumental in contributing to this growth. India is one of the world's largest contributors to global dairy production. According to the Ministry of Fisheries, Animal Husbandry & Dairying, India (March 2021), the average annual productivity of cattle was 1,777 kg per animal in 2019-20, which is 27.95% higher than in 2013-14. Yet, it is still lower than the global average of 2,699 kg per animal. Livestock flooring systems can bridge the gap toward improvement in cattle health and, ultimately, output. Any developing country, in its quest to modernize farm infrastructure, currently takes a step toward sustainable growth and higher productivity through such flooring systems.

Challenges: Presence of large number of small-scale cattle farmers

Small family farms occupy 86% of all US farms, with gross cash farm income less than USD 350,000. According to the US Department of Agriculture’s December 2024 data, such small farms mainly generate their household incomes from off-farm sources. This massive population of small-scale cattle farmers is a challenge to the livestock flooring market because most of these small farmers will not be able to afford the initial investment in livestock flooring systems. Because they have fewer finances and a lower profit margin, such farmers are likely to choose the traditional, less costly flooring systems rather than the expensive livestock options, which most people view as too expensive. In addition, livestock flooring requires retraining and an understanding of the long-term benefits of animal health and productivity. Most small-scale farmers are not highly aware of overall efficiency, the reduction of veterinary costs, and the improvement of animal well-being. Since many small cattle operations are focused on short-term financial sustainability, they may view the upfront costs of installing livestock flooring as an unnecessary expense. This creates a barrier to the market's growth, as small farmers form a substantial portion of the cattle farming industry.

Livestock Flooring Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers rubber mats, slatted flooring systems, walking alley mats, and roll/mattress systems (e.g. KEW Plus LongLine TarsaCare, KURA, LOSPA SB, espaFLEX) that improve foot health, reduce slip risk, reduce ammonia & emissions, and promote animal comfort. | Strengthens leadership in welfare-oriented flooring; can command premium pricing; enhances brand reputation; wide geographical reach; innovation differentiator. |

|

Specializes in durable concrete slatted floors and concrete pen designs for swine, cattle etc., often in large-scale barns. They partner with other firms to optimise installation and adapt concrete flooring to livestock welfare and emissions norms. | Benefit from high durability, low maintenance concrete flooring demand; strong position in sectors where concrete is favored; scale advantages; ability to meet regulatory concrete/emission standards. |

|

Provides slatted or pen-floor concrete flooring solutions, especially for large operations where structural strength, ease of cleaning, and long life are valued. | Gains from contracts with large farms; less frequent replacement → cost leverage; deep market trust in concrete flooring; opportunity to standardize and mass-produce designs. |

|

Offers livestock flooring with anti-slip floors, comfort mats, mattresses, feeding steps etc; often uses recycled rubber/environmentally conscious materials and focuses on welfare design. | Taps into sustainability trends; appeals to farms with welfare, environmental or organic standards; builds reputation for being green; possibly gets policy/incentives support. |

|

Manufactures flooring systems (often slats/panels) for livestock housing — combining concrete and perhaps hybrid materials — aimed at hygiene, drainage, emission reduction etc. | Diversification of product offerings; regional & global reach; ability to serve retrofit & new build markets; strong relationships with livestock farms requiring reliable, durable solutions. |

|

Through its agricultural-subsidiaries (e.g. DeLaval etc.) integrates livestock flooring as part of animal housing / welfare systems; using durable floor designs (concrete/rubber hybrids) that suit large dairies, continuous operations etc. | Benefit from bundling (flooring + other dairy infrastructure/housing systems); reputation and trust in large commercial operations; ability to push premium integrated solutions; geographic reach. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The livestock flooring market is a complex system, integrating manufacturers, suppliers, distributors, and end users, which include livestock farms and animal housing facilities. The market serves all kinds of livestock: cattle, swine, poultry, equine, and small animals such as sheep and goats. The stakeholders include flooring material providers, who are experts in concrete, rubber, plastic, steel, and hybrid solutions. Livestock flooring systems are designed to increase animal welfare, maximize productivity, and meet hygiene and waste management standards. More changes in agricultural technology, standardization of rules and regulations, and the international call for environment-friendly and resource-use-efficient livestock farming also affect this ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By product type, the slat floors segment is estimated to lead the market share during the forecast period.

The slat floors segment is estimated to lead the livestock flooring market during the forecast period due to the wide adoption of this flooring type for animal welfare, productivity, and hygiene. Research indicates that it works effectively across different livestock systems. In an October 2021 study presented by the Indian National Agricultural System, lambs reared on elevated plastic slatted floors demonstrated better growth rate, cleanliness, body condition scores under the criteria of a scoring system, and reduced mortality rates. Although the initial outlay may be greater, this type of flooring offers advantages that include better hygiene, less stress, and lower worm load, which makes it suited to zero-grazing systems. A study conducted by the Indian Journal of Animal Sciences in September 2021 reported that plastic-slatted floors made goat shelters more convenient and productive in semi-arid conditions. The findings showed that growth rates, cleanness, and physiological parameters improved, with Barbari goats showing significantly higher albumin levels (p<0.05) when in plastic-flooring units. This slatted floor, made from materials such as plastic, rubber, and concrete, has an advantage since it applies to different livestock systems. These advantages include reduced stress, better hygiene, and improved growth rates, which sustain its acceptance in the commercial farming sector for several soil types.

By livestock, the cattle flooring segment is estimated to lead the market during the forecast period.

Cattle flooring is expected to have the largest market share due to the increasing focus on raising the welfare, productivity, and efficiency of cattle farms. As per the USDA (September 2024), EU beef production is projected to grow by 2.2% in 2024, boosted by strong carcass prices and higher slaughter levels in Poland, Italy, and Spain. However, it is estimated that there will be a decline of 1.5% in beef production in 2025. Cow slaughter increased by 4.93% during the first half of 2024, and calf slaughter dropped by 1.59%. According to the World Health Organization (December 2023), a considerable amount of milk is produced globally. The top four milk-producing countries in 2022 were India at 213.8 million tons, the US, Pakistan, China, and Brazil. Such levels of dairy production call for high-performance flooring solutions to keep cattle healthy and maximize production. Durable, hygienic cattle flooring systems, such as non-slip rubber mats and drainage-enhanced slats, are becoming increasingly indispensable in reducing injuries, managing waste more effectively, and bringing about better welfare in high-production regions. This rapidly increasing dependence on innovative flooring systems is likely to propel their use in the world's livestock industries.

REGION

Asia Pacific dominated the livestock flooring market.

In the Asian context, the history of cattle farming in recent decades has grown phenomenally for several reasons: the rise of the population in these economies, increased economic prosperity, and enhanced meat and dairy demand. Owing to continuous economic expansion and the concomitant growth of income in such economies, higher levels of animal product consumption can be witnessed. As such, in the region, milk production - being the highest in the world - continues upwardly. A report released by the Food and Agriculture Organization of the United Nations in December 2022 projected that Asia's milk output will be close to 419 million tons in 2022, with an increase of 2.1% from the previous year. Milk production is also expected to surge in India, Pakistan, China, and Japan. As cattle farming grows, the necessity for efficient livestock flooring becomes vital. Livestock flooring has a significant role in ensuring that animals are healthy, comfortable, and productive. Properly designed flooring can minimize injuries, infections, and diseases caused by a dirty and unsafe environment for livestock. It also facilitates waste management and ensures that the flooring is easy to maintain, which contributes to the overall efficiency of cattle farming operations.

Livestock Flooring Market: COMPANY EVALUATION MATRIX

The competitive landscape of the livestock flooring market is characterized by a mix of global manufacturers and specialized regional players, each focusing on material innovation, animal welfare, and sustainability. Leading companies are increasingly investing in the development of advanced flooring systems that enhance durability, comfort, and hygiene while minimizing emissions and maintenance costs. Rubber-based solutions are gaining prominence for their animal-friendly and eco-efficient properties, while concrete flooring continues to dominate large-scale commercial farms for its strength and cost-effectiveness. Players are differentiating themselves through innovation in design—such as anti-slip surfaces, drainage optimization, and shock absorption—and through strategic collaborations, product diversification, and region-specific adaptations. Overall, the market is evolving from conventional flooring materials toward smarter, welfare-driven, and environmentally compliant flooring systems, reflecting a shift toward sustainable livestock management practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- The Tetra Laval Group (Switzerland)

- Anders Concrete (Belgium)

- Wolfenden Concrete Limited (UK)

- Agri & Industrial Rubber Ltd. (Ireland)

- Gummiwerk KRAIBURG Elastik GmbH & Co. KG (Germany)

- Bioret Group (France)

- Animat Inc. (Canada)

- Agriprom (Netherlands)

- Legend Rubber Inc. (Canada)

- Kapoor Mats and Steel (India)

- Vikas Rubbers (India)

- MIK INTERNATIONAL GmbH & Co. KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 1.76 Billion |

| Revenue Forecast in 2030 | USD 2.16 Billion |

| Growth Rate | CAGR of 4.2% from 2025-2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Billion), Volume (Hectares) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product Type: Slat Floors, Interlocking Floors, Grating, Panel Series. By Material Type: Concrete, Plastic, Rubber, Steel, Hybrid. By Livestock: Cattle Flooring, Poultry Flooring, Swine Flooring, Equine Flooring, Other Livestock Flooring. By Farm Type: Commercial Farms, Small Farms, Other Farm Types (Breeding Facilities, Veterinary Clinics, Among Others). |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: Livestock Flooring Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Livestock Flooring Manufacturers & Equipment Suppliers | 1. Material performance benchmarking (rubber, plastic, concrete, composite) under different livestock types and housing systems 2. Regional regulatory and animal welfare compliance mapping 3. Cost-benefit and lifecycle analysis for flooring technologies | 1. Improved product design and material innovation 2. Faster compliance with animal welfare and safety standards 3. Enhanced durability and market competitiveness |

| Farmers & Livestock Producers | 1. Flooring selection matrix by animal type (dairy, swine, poultry, equine) and barn conditions 2. ROI assessment of flooring upgrades on productivity, hygiene, and animal comfort 3. Data-backed insights on flooring maintenance and waste management efficiency | 1. Improved herd health and performance 2. Reduced operational and maintenance costs 3. Enhanced animal comfort and welfare outcomes |

| Regulatory Bodies & Animal Welfare Organizations | 1. Comparative evaluation of flooring standards across regions (EU, North America, APAC) 2. Data on injury rates, hygiene levels, and sustainability metrics 3. Framework for compliance monitoring and welfare certification | 1. Stronger enforcement of welfare and sustainability guidelines 2. Streamlined regulatory oversight 3. Improved animal well-being and environmental accountability |

| Distributors & Farm Infrastructure Integrators | 1. Market demand mapping by livestock type and region 2. Supplier capability and certification benchmarking 3. Integration analysis for flooring with other barn automation systems | 1. Optimized inventory and distribution strategies 2. Enhanced supplier selection and procurement efficiency 3. Competitive differentiation through bundled infrastructure solutions |

RECENT DEVELOPMENTS

- October 2024 : Gummiwerk KRAIBURG Elastik GmbH & Co. KG launched the KEW Plus LongLine TarsaCare continuous roll system, offering innovative jointless mats with superior comfort, hock protection, and bedding retention. This solution aligns with increasing animal welfare demands and addresses modern dairy farm needs, thus strengthening the company’s market leadership.

- September 2023 : Anders Concrete formed a strategic partnership with AvT Montage and van Osch. This partnership strengthened its position in the livestock flooring market by combining expertise in concrete pen designs for pig houses in the Netherlands. This collaboration enhances innovation, streamlines project execution, and reinforces Anders Concrete’s market presence through tailored solutions that meet modern farming needs.

- August 2022 : Gummiwerk KRAIBURG Elastik GmbH & Co. KG (Germany) launched the KEW Plus JarsaCare 3-layer comfort zone mattress system. It features an innovative design that prioritizes animal comfort and joint health, meeting the industry's demand for sustainable welfare solutions, thus enhancing the company's market presence and reputation.

- March 2022 : EASYFIX installed Dream Cubicles and Jupiter Cow Mattresses at Funks Midway Dairy in Minnesota. These flexible and durable designs enhanced cow comfort by reducing injuries and stress. This customer-focused approach strengthened EASYFIX's reputation for innovative livestock solutions, solidifying its position in the premium flooring and livestock comfort market.

- January 2021 : Wolfenden Concrete Limited (UK) introduced the SUPA GREEN series, which integrates DB Group's groundbreaking Cemfree technology for ultra-low carbon diagonal slats and slurry channels. This development complies with environmental requirements, reducing carbon emissions by 62% with higher durability. The launch consolidated Wolfenden's leadership in the livestock flooring market as it answered the needs of farmers for cost-effective and sustainable solutions that improve productivity and herd health.

Table of Contents

Methodology

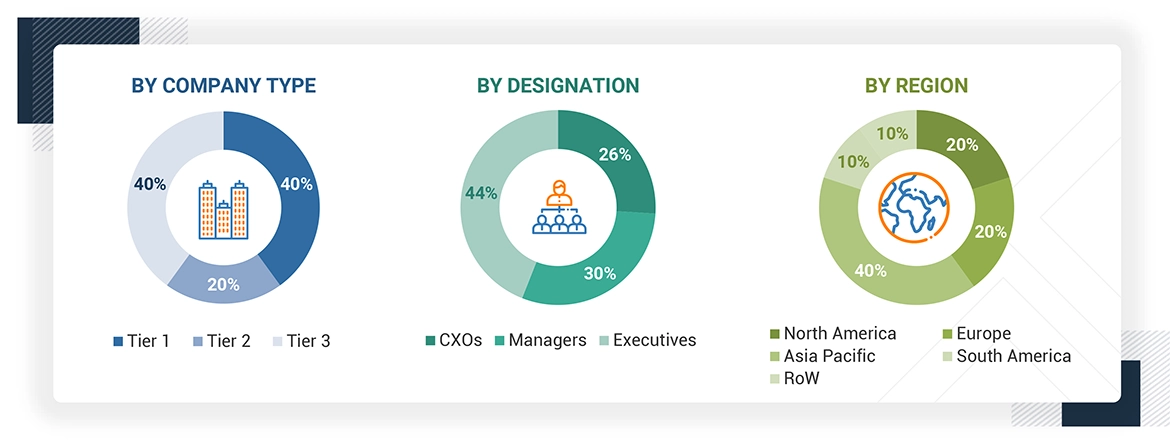

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the livestock flooring market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, a variety of sources were referred to in order to collect information for this study, such as the International Dairy Federation (IDF), World Organisation for Animal Health (OIE), Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), and European Food Safety Authority (EFSA). These sources were used to gather relevant data and insights into the livestock flooring market. Secondary sources also included industry journals, scientific studies, white papers, company annual reports, investor presentations, certified publications, articles by recognized experts and regulatory bodies, and trade directories. Paid databases were additionally utilized to enhance the comprehensiveness of this research.

Secondary research was conducted to obtain crucial information on the supply chain of the livestock flooring industry, the total pool of market players, as well as the classification and segmentation of the market based on industry trends at both global and regional levels. This research also provided insights into key developments shaping the market from a strategic perspective.

Primary Research

The livestock flooring market comprises several stakeholders in the supply chain, including raw material suppliers, flooring system manufacturers, suppliers, and maintenance service providers. Various primary sources from both the supply and demand sides of the market were interviewed to gather qualitative and quantitative insights. The primary interviewees from the supply-side include livestock flooring manufacturers and material suppliers. On the demand-side, the primary sources include livestock farmers, distributors, importers, exporters, and end-users such as animal farm operators.

*RoW includes the South America Middle East and Africa.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

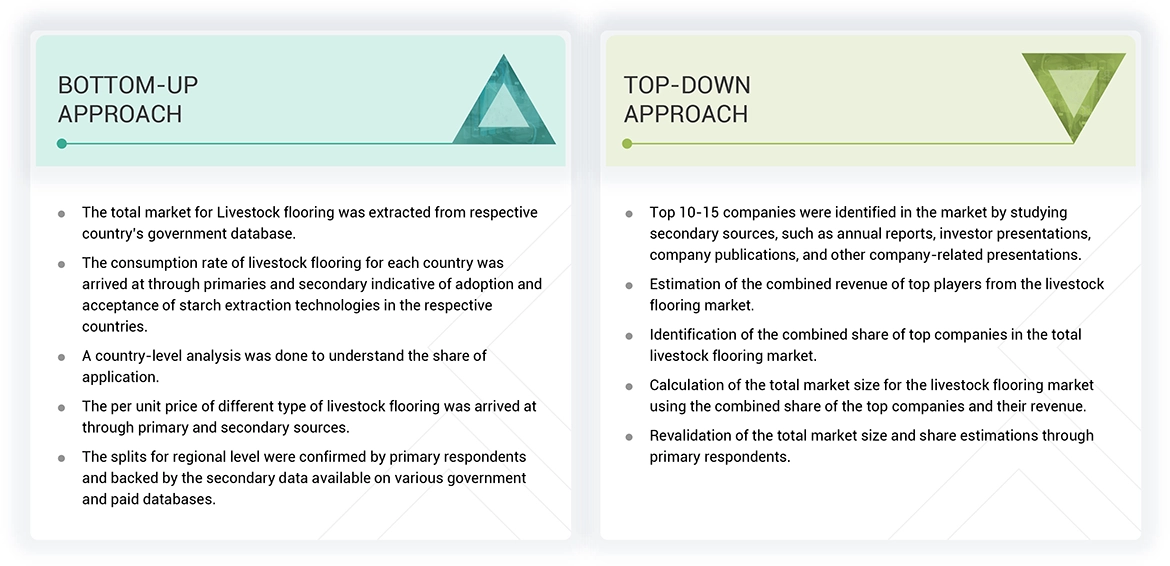

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the livestock flooring market. These approaches were extensively to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Livestock Flooring Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall livestock flooring market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The livestock flooring market encompasses the production and supply of flooring solutions systems specifically designed for use in livestock farming. These flooring systems are critical to enhancing animal welfare, ensuring hygiene, and optimizing operational efficiency in agricultural operations. The market is segmented by product type, material type, farm type and livestock application. Product types include slat floors, interlocking floors, grating, and panel series, each designed to meet the specific needs of different farming environments. Material types range from concrete and rubber to plastic, steel, and hybrid solutions, with each material offering distinct advantages in terms of durability, comfort, and cost-effectiveness. The market also caters to various livestock sectors, including cattle, swine, poultry, and equine, with each requiring tailored flooring solutions for comfort, waste management, and long-term sustainability. As demand for higher standards in animal husbandry continues to rise, the livestock flooring market is evolving to meet the needs of modern farming practices, driven by the increasing focus on hygiene, animal welfare, and farm sustainability.

Stakeholders

- Livestock flooring raw material suppliers and manufacturers

- Livestock flooring material importers and exporters

- Livestock flooring traders and distributors

- Government and research organizations

-

Associations and industrial bodies

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- World Organization for Animal Health

- Australian Department of Agriculture, Fisheries and Forestry

- European Food Safety Authority (EFSA)

- Humane Society of the United States (HSUS)

- Farm Animal Welfare Committee (FAWC)

- National Farm Animal Care Council (NFACC)

Report Objectives

MARKET INTELLIGENCE

- To define, segment, and estimate the size of the livestock flooring market with respect to its material type, product type, livestock, farm type, and region ranging from 2025 to 2030

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the complete value chain and the influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the total market

COMPETITIVE INTELLIGENCE

- To identify and profile the key players in the livestock flooring market

- To provide a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

- To analyze the value chain and products across the key regions and their impact on the prominent market players

- To provide insights on key product innovations and investments in the livestock flooring market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for livestock flooring into the Czech Republic, The Netherlands, Belgium, Hungary, Romania, and Ireland

- Further breakdown of the Rest of South America market for livestock flooring into Chile, Colombia, Paraguay, and Peru

- Further breakdown of other countries in the RoW market for livestock flooring into the Middle East & Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Livestock Flooring Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Livestock Flooring Market