Feed Additives Market

Feed Additives Market by Livestock, Type (Amino Acids, Probiotics, Vitamins, Acidifiers, Enzymes, Flavors & Sweeteners, Mycotoxin Detoxifiers, Minerals, and Antioxidants), Livestock, Form, Source, Function, and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

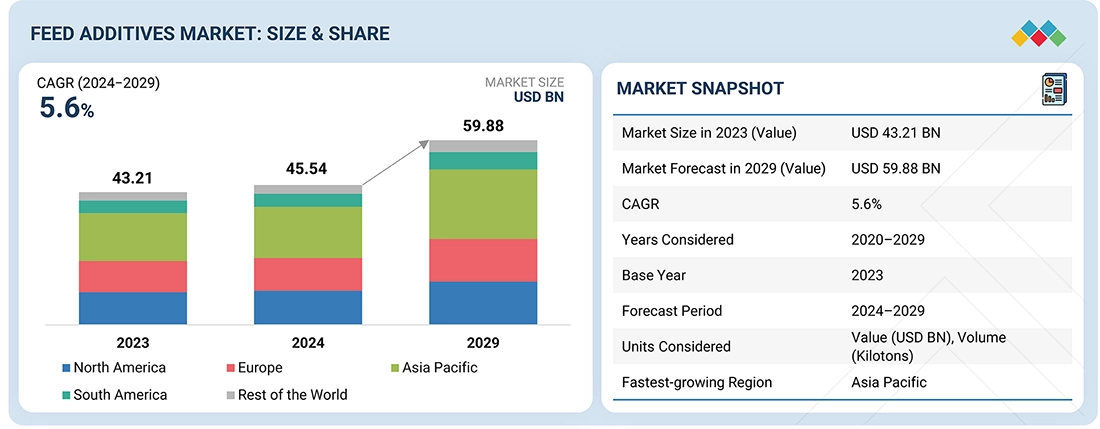

The feed additives market is projected to reach USD 59.88 billion by 2029 from USD 45.54 billion in 2024, at a CAGR of 5.6% from 2024 to 2029. Increasing livestock production and emphasis on animal health and performance have promoted the growth of this market

KEY TAKEAWAYS

-

By RegionThe Asia Pacific feed additives market dominated, with a share of 36.1% in 2023.

-

By TypeBy type, the preservative segment is expected to register the highest CAGR of 9.9%.

-

By LivestockBy livestock, the poultry segment is projected to grow at the fastest rate from 2024 to 2029.

-

By FormBy form, the dry segment is expected to dominate the market.

-

By SourceBy source, the natural segment will grow the fastest during the forecast period.

-

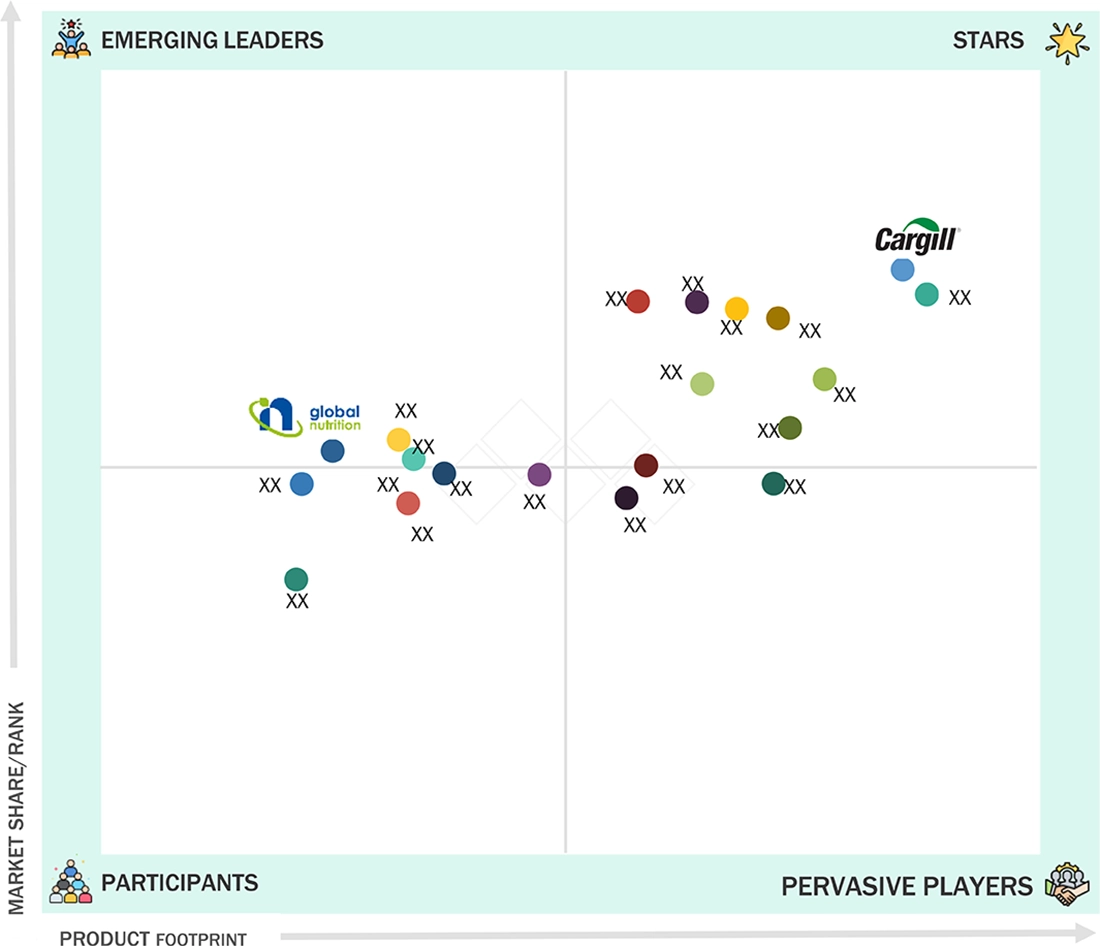

Competitive LandscapeCargill, Incorporated (US), ADM (US), and International Flavors & Fragrances Inc. (US) were identified as some of the star players in the feed additives market (global), given their strong market share and product footprint.

Feed additives are essential for animal nutrition as they improve the quality of feed, enhance the efficiency of the growth of livestock, prevent diseases, and improve feed utilization, thereby improving animals’ performance and health. They also improve the yield and quality of food from animal origin. The growth in consumption of animal-based products, growth in feed production, standardization of meat products due to disease outbreaks, and implementation of innovative animal husbandry practices to improve meat quality have led to the increased consumption of feed additives.

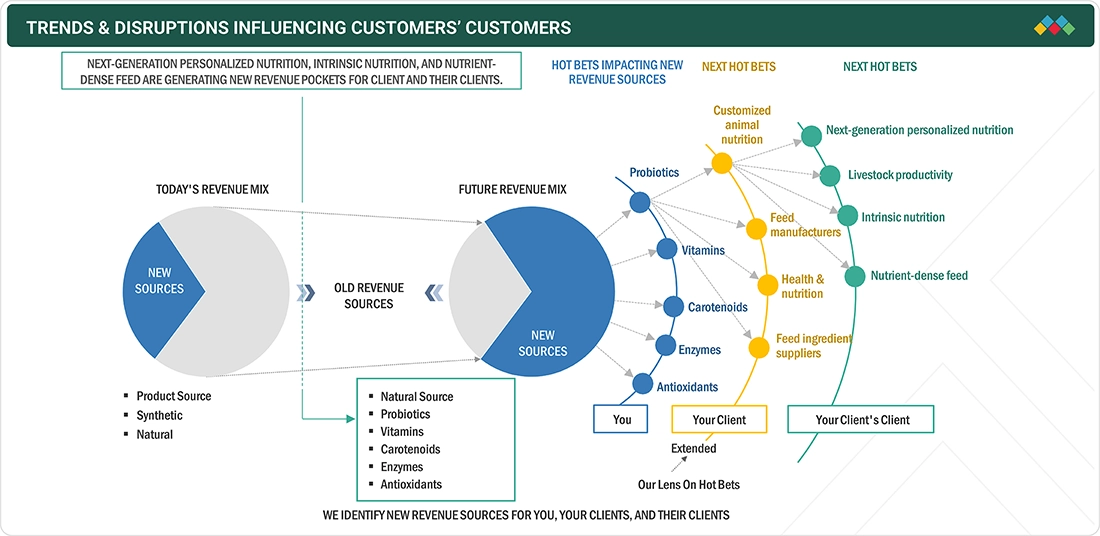

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are new emerging types of feed additives, and the target end users are clients of feed additive manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users, thus affecting the revenue of hotbets and further the revenues of feed additive manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in demand and consumption of livestock-based products

-

Rise in awareness about feed quality

Level

-

Ban on antibiotics in different nations

-

Volatile raw material prices for feed additives

Level

-

Shift toward natural growth promoters

-

Increase in demand for nutritional supplements for monogastric animals

Level

-

Sustainability of feed and livestock chain

-

Quality control of genetic feed additive products manufactured by Asian companies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in demand and consumption of livestock-based products

The increase in demand for livestock-based products, such as meat, dairy, and eggs, is expected to fuel the adoption of feed additives to improve animal growth and productivity. Poultry meat, in particular, is a key driver of global meat production due to its high demand, low production cost, and affordability across developed and developing regions. Feed additives are increasingly preferred for enhancing feed quality and nutritional value due to the rising demand for these products.

Restraint: Ban on antibiotics in different nations

The regulatory restriction on the use of antibiotics in animal feed is a significant restraint for the feed additives market. Antibiotics were used abundantly to promote growth and prevent diseases in livestock. However, due to growing concerns about antibiotic resistance and the risk of residues in human food, stringent regulations have been put in place across the world. Namibia was the first African country to do so in 1991, banning routine antibiotic use in its beef industry. The European Union also imposed a ban, effective January 2022, with the ban on the use of Ethoxyquin (EQ) antibiotics in diets fed to farm animals for growth promotion or as compensation for poor welfare conditions

Opportunity: Shift toward natural growth promoters

Antimicrobial compounds are commonly included in poultry diets for promoting growth and controlling diseases. The EU banned feed-grade antibiotic growth promoters owing to cross-resistance and due to the risk posed to the EU’s food safety and public health. Due to this, feed manufacturers are adopting new forms of natural feed additives apart from antibiotics with the help of modern science. This new generation of growth enhancers includes botanical additives such as appropriate herbs or plant extract blends. Herbs and plant extracts used as feed additives include different bioactive ingredients such as alkaloids, bitters, flavonoids, glycosides, mucilage, saponins, and tannins. Therefore, various effects are expected from herbs and plant extracts—they act on the appetite and intestinal microflora, stimulating pancreatic secretions to increase endogenous enzyme activity and the immune system. Many plant products and their constituents have broad antimicrobial activity and antioxidant & sedative properties.

Challenge: Sustainability of feed and livestock chain

The global feed industry is concerned with improving feed efficiency through enhanced feed conversion rates for livestock and aquaculture. Sustainability in the feed and livestock industries can be achieved by adopting a harmonized environmental footprint methodology based on life cycle analysis along the entire chain. Standardized metrics can support the assessment of resource efficiency indicators, while efficient usage of feed ingredients reduces the environmental footprint of livestock farming. Besides, utilizing co-products from other industries reduces the dependency on land-grown crops and, hence, supports resource-efficient feed production.

feed additives market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lallemand Animal Nutrition and INRAE have renewed their 30-year partnership through a new Associated Partnership Laboratory (APL) agreement. | This collaboration enables advance research on microbial solutions for ruminant nutrition and health, leveraging shared resources and innovative technologies |

|

NOVUS has recently enhanced its feed additives portfolio with the acquisition of BioResource International, Inc. (BRI)., integrating BRI’s fermentation expertise with NOVUS’ CIBENZA Enzyme Feed Additive. | This expansion supports improved feed formulations, enhancing animal nutrition and performance while addressing sustainability challenges in the global feed additives market. |

|

Evonik invested USD 26.5 million in developing and expanding its methylmercapto-propionaldehyde (MMP) production plant in Wesseling, Germany | The expansion helps the company to strengthen its world-scale global methionine production network. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of feed additives. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), dsm-firmenich (Switzerland), and Ajinomoto Co. Inc. (Japan), among others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Feed Additives Market, By Type

Based on type, the amino acid segment is projected to lead the feed additives market in 2024. Amino acids support livestock growth, production, activity, and overall health. They provide the energy required for the growth of bones and muscles and improve muscle movement, digestion, and blood circulation.

Feed Additives Market, By Livestock

Among livestock, the market is estimated to be led by the poultry segment in 2024. Poultry birds are mainly consumed for meat and eggs; in addition, rising consumer preference for colored yolk across the globe is one of the driving factors for the usage of feed additives in the poultry segment. Feed additives in poultry are also used to prevent the sudden outbreak of diseases that drive the demand for feed additives.

Feed Additives Market, By Form

The dry form of feed additives is dominant due to convenience and high demand from livestock producers. They are easier to store and handle and have better transportability compared to the liquid form, which is more prone to degradation and spoilage

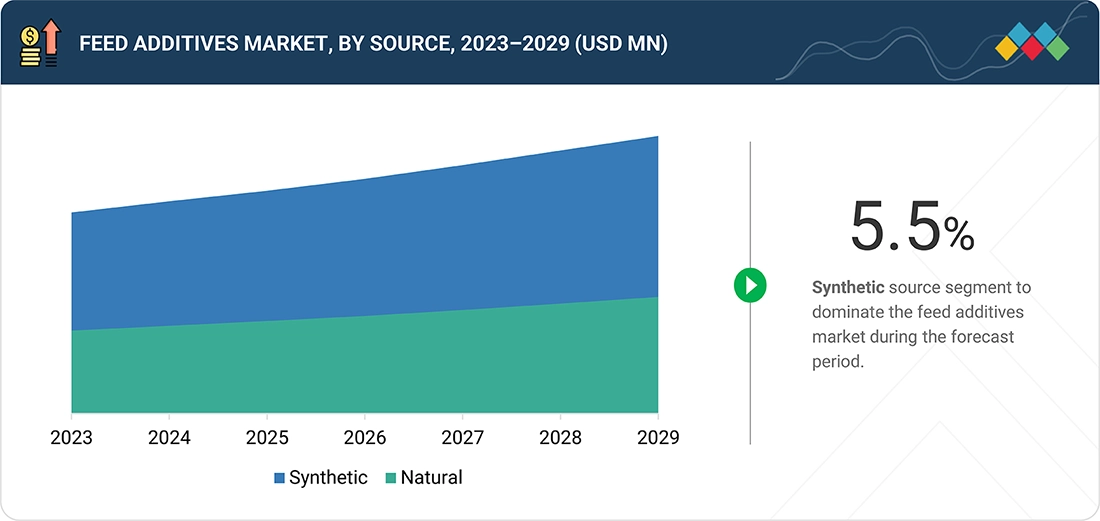

Feed Additives Market, By Source

The synthetic segment dominated the market in 2024, owing to the lower cost of production of synthetic additives as compared to that of natural additives, coupled with the constrained supply of raw materials for the extraction of natural additives.

REGION

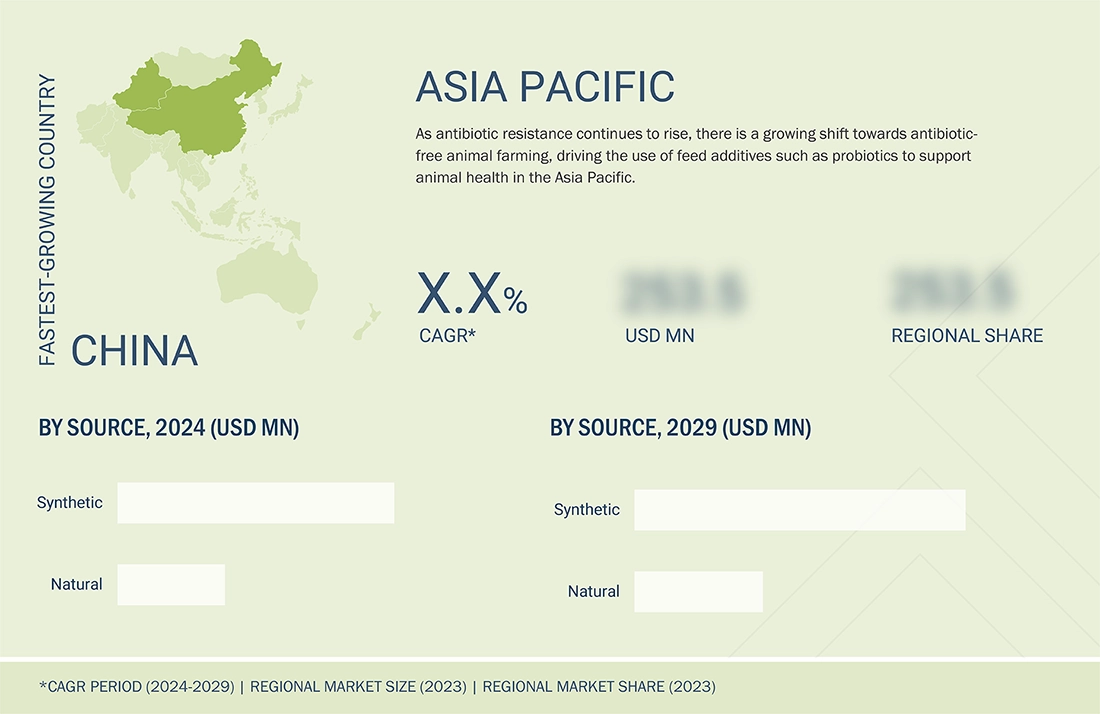

Asia Pacific to be fastest-growing region in global feed additives market during forecast period

The Asia Pacific market is estimated to account for the largest share in 2024. This dominance is attributed to the presence of the large livestock population and their growth. Furthermore, increasing consumption of quality livestock-based products has subsequently led to the increasing demand for feed and increased awareness about the importance of quality feed among livestock producers and feed buyers. The booming population and protein demand in this region have also expedited market growth. Specialty meat markets are largely concentrated in this region, especially in China and Asian countries, which will further support the growth in this region.

feed additives market: COMPANY EVALUATION MATRIX

In the feed additives market matrix, Cargill, Incorporated (US) and ADM (US) (Star) lead with a strong market share and extensive product footprint for key livestock segments, driven by their strong geographical presence, significant formulation and distribution capabilities, and strong ties with livestock farms and livestock growers. Neospark Drugs and Chemicals Private Limited (India) and Global Nutrition International (France) (Emerging Leader) are gaining traction with their product innovations in the feed additives market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 42.21 Billion |

| Market Forecast in 2029 (Value) | USD 59.88 Billion |

| Growth Rate | CAGR of 5.6% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Rest of the World |

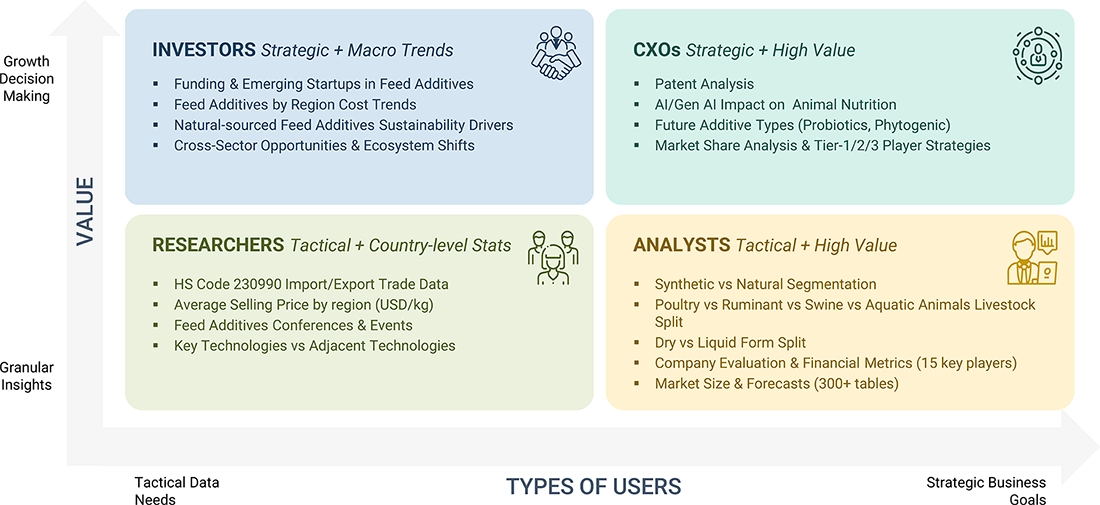

WHAT IS IN IT FOR YOU: feed additives market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand analysis of feed additives across poultry and ruminant segment | Species-specific additive mapping (e.g., phytogenics in poultry feed, preservatives in ruminant feed) | Detailed feed additive demand forecast by livestock at regional level |

| Market trend analysis of natural, synthetic, additive sources | Source-wise demand forecast and cost-benefit analysis and clean-label positioning strategies for phytogenic and probiotic-based products | Informed sourcing decisions aligned with sustainability goals and a competitive edge through natural additive integration and labeling advantages |

| Market share of powder, liquid, additive forms | Regional breakdown of form-wise adoption rates and performance insights on stability, solubility, and feed mixing compatibility | Form-specific go-to-market strategy for product differentiation and improved additive efficacy and user convenience in feed production |

RECENT DEVELOPMENTS

- September 2024 : Cargill, Incorporated (US) expanded its feed additives market presence by acquiring two US feed mills from Compana Pet Brands, located in Denver, Colorado, and Kansas City, Kansas. This strategic acquisition, part of Cargill's broader effort to enhance its animal nutrition capabilities, reflects its commitment to bolstering production and distribution amid rising US pet care sales. Financial details were not disclosed

- August 2024 : Volac International Ltd. (England) launched a new website dedicated to its feed additives division. The platform emphasizes the company's expertise in microbiology, biochemistry, enzymology, and immunology, showcasing its range of evidence-based products for mycotoxin risk management and phytogenic solutions. The initiative aims to enhance livestock health, resilience, and sustainability in global feed production systems

- June 2024 : International Flavors & Fragrances Inc. (US) launched two innovative poultry feed additives in the European market: Axtra XAP, a multi-enzyme blend that enhances efficiency and reduces costs, and Syncra AVI, an enzyme-probiotic complex that improves gut health and performance. These solutions, already available in North America, South Africa, and Asia Pacific, are now set to advance poultry production across Europe

- February 2024 : dsm-firmenich (Switzerland) partnered with Donau Soja to highlight the environmental impact of animal feed ingredients using Sustell, the leading LCA software platform providing the food value chain, an advanced life cycle assessment (LCA) platform. This collaboration aims to measure and improve sustainability across the feed and animal protein sectors.

Table of Contents

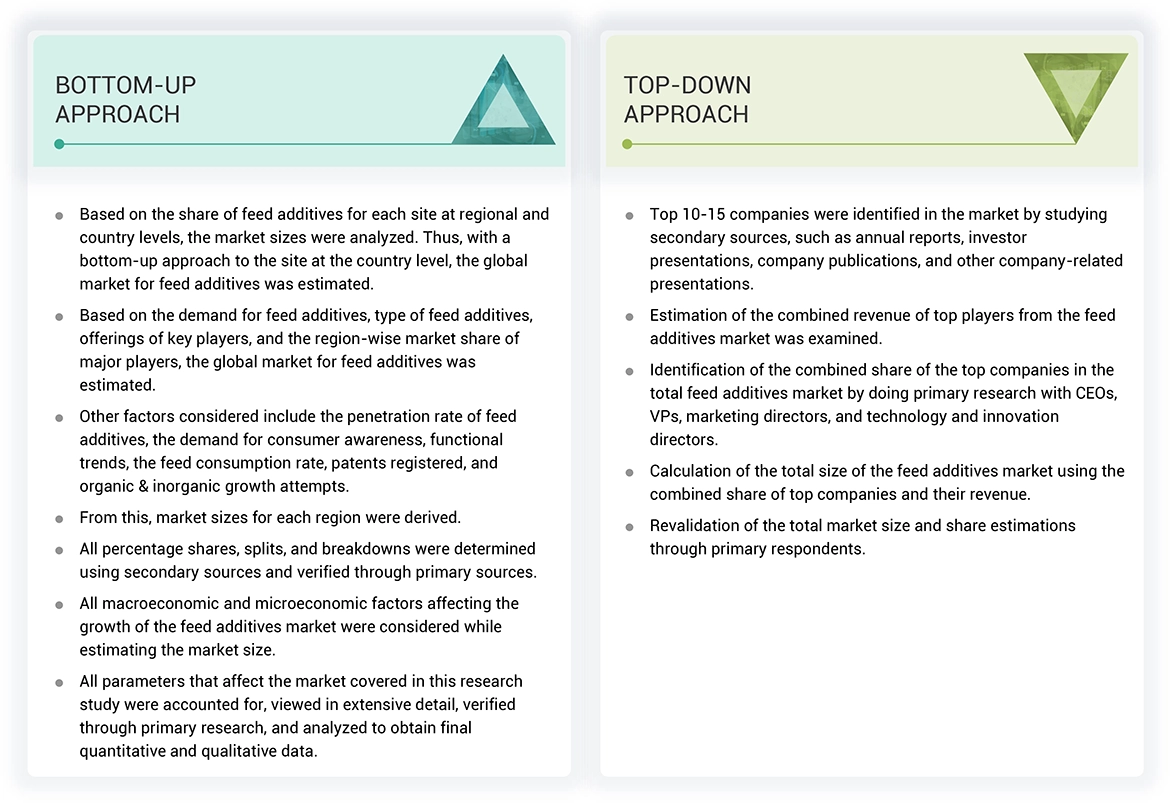

Methodology

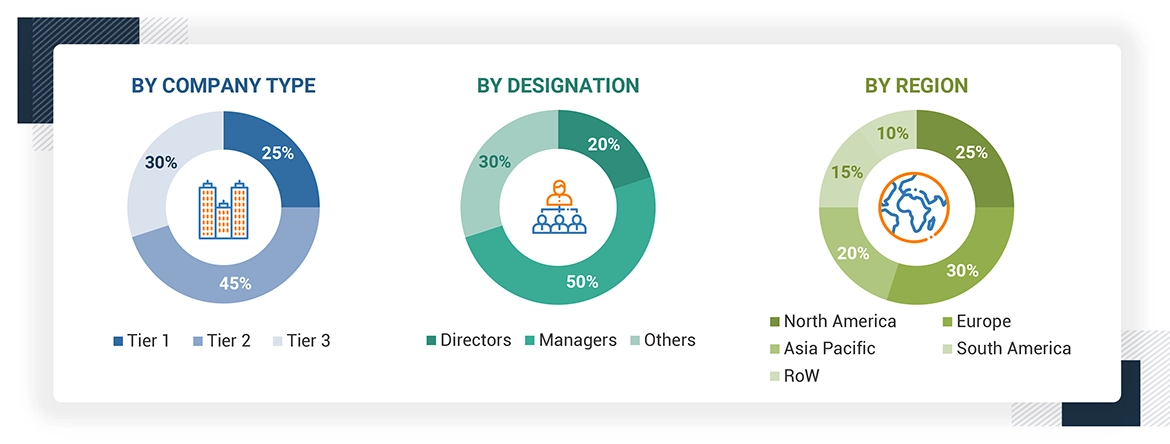

The study involved two major approaches in estimating the current size of the feed additives market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the feed additives market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to feed additives by livestock, type, form, source, functions, and regions. Stakeholders from the demand side, such as livestock growers who are using feed additives, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of feed additives and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Cargill, Incorporated (US) |

General Manager |

|

ADM (US) |

Sales Manager |

|

dsm-firmenich (Switzerland) |

Manager |

|

International Flavors & Fragrances Inc (US) |

Head of processing department |

|

BASF SE (Germany) |

Marketing Manager |

|

Ajinomoto Co. Inc (Japan) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed additives market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Feed Additives Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall feed additives market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the European Food Safety Authority, “Feed additives are products used in animal nutrition to achieve an effect on the feed itself, on the animals, on food products obtained from the animals consuming the feed additive, or on the environment. For instance, feed additives are used to enhance flavor of feed, to meet the need for certain nutrients, or to increase the performance of animals in good health. They are used in feed for food-producing animals and in pet food.”

According to the European Commission, “Feed additives are defined as products used in animal nutrition for the purpose of improving the quality of feed and the quality of food from animal origin, or to improve the animals’ performance and health, e.g., providing enhanced digestibility of the feed materials. Feed additives may not be put on the market unless authorization has been given, following a scientific evaluation demonstrating that the additive has no harmful effects on human and animal health and the environment.”

Stakeholders

- Feed manufacturers

- Dairy, poultry farms, and livestock farms

- Feed importers and exporters

- Intermediary suppliers such as traders and distributors of feed additives such as amino acids, phosphates, enzymes, vitamins, acidifiers, carotenoids, mycotoxin detoxifiers, flavors & sweeteners, antibiotics, minerals, antioxidants, nonprotein nitrogen, phytogenics, preservatives, and probiotics

- Government and research organizations

-

Associations and industry bodies:

- Food and Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- European Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

- International Feed Industry Federation (IFIF)

- Organization for Economic Co-operation and Development (OECD)

- Animal Feed Manufacturers Association (AFMA)

- The Irish Grain and Feed Association (IGFA)

- National Grain and Feed Association (NGFA)

- The Compound Feed Manufacturers Association (CLFMA)

- Brazilian Poultry Association and the Brazilian Chicken Producers and Exporters Association (UBABEF)

- Japan Feed Manufacturers Association (JAFMA)

- Animal Nutrition Association of Canada (ANAC)

Report Objectives

- To determine and project the size of the feed additives market with respect to the livestock, type, source, form, functions (qualitative), and regions in terms of value over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the feed additives market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

This research report categorizes the feed additives market based on livestock, type, form, source, functions (qualitative) and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe feed additives market into key countries.

- Further breakdown of the Rest of Asia Pacific feed additives market into key countries.

- Further breakdown of the Rest of South America feed additives market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Feed Additives Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Feed Additives Market