Fetal Monitoring Market by Product (Ultrasound, Fetal Monitors, Telemetry Devices, Fetal Electrodes), Portability (Portable, Non-portable), Method (Invasive, Non-invasive), Application (Antepartum, Intrapartum), End User & Region - Global Forecast to 2027

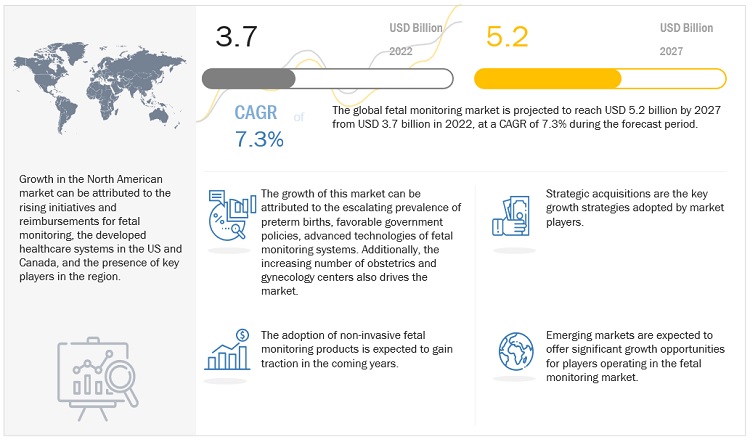

The global fetal monitoring market in terms of revenue was estimated to be worth $3.7 billion in 2022 and is poised to reach $5.2 billion by 2027, growing at a CAGR of 7.3% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The advancements in technologies for fetal monitoring systems, and the growing number of obstetrics and gynecology centers are the major factors driving the market’s growth.

Attractive Opportunities in the Fetal monitoring Market

e- estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Fetal Monitoring Market Dynamics

Driver: Rising number of preterm births and increasing adoption of infertility treatment

Many research types have shown that the incidence of preterm births is growing due to hypertension, prolonged pre-labor rupture of membranes, antepartum hemorrhage, multiple gestations, assisted reproductive technology, short cervixes, Urinary Tract Infections (UTIs), and placenta previa, among others. There has been an adoption of advanced medical technologies in fetal monitoring systems due to The rising number of preterm births, according to the WHO, an estimated 15 million preterm births occur every year and approximately 1 million babies die each year right after birth, and the numerous neurological or physical disabilities that follow preterm births are a grave concern.

Opportunity: Development of non-invasive, portable, and advanced fetal monitors

The key manufacturers in the market are expanding their product lines to include portable and wireless monitoring systems that are accurate, safe, and affordable. For instance, in November 2021, the Shantou Institute of Ultrasonic Instruments Co., Ltd. (China) launched the Apogee 6 series of color Doppler ultrasound imaging solutions. This series included the Apogee 6200, Apogee 6300, and Apogee 6500 color Doppler ultrasound systems, that provides a solution for cardiac, abdominal, vascular, musculoskeletal, urology, and OB/GYN clinical applications.

Restraint: Availability of refurbished products

The major restraint for the growth of this market is the availability of refurbished fetal monitoring products. The companies that offer refurbished fetal monitoring products are CeviMed, SOMA TECH, Jaken Medical, and Absolute Medical Services. For cost-effectiveness various small and medium-sized hospitals opt for refurbished systems, particularly in developing countries which are price-sensitive markets. Due to these factors, there is surge in the demand for refurbished fetal monitoring and it is expected to rise in the coming years, as all these refurbished equipments offer the same functionalities as new equipment but at lower costs. This factor will hamper the revenue of companies that are offering branded fetal monitoring products in the market.

Challenge: Lack of skilled healthcare professionals

Recently, there is a shortage of professionals to deliver obstetrics, gynecology, and other preventive and reproductive healthcare services, predominantly specializing in women's health. According to The American College of Obstetricians and Gynecologists (ACOG), the demand for obstetrics and gynecology professionals is expected to increase from 50,850 to 52,660 (4%) by 2030. This means that obstetrics and gynecology efforts could increasingly focus on high-risk pregnancies, the management of complex gynecological conditions, and surgical procedures.

The market is moderately consolidated. The top players— GE Healthcare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), FUJIFILM SonoSite, Inc. (US), and Cardinal Health, Inc. (US)-in the market accounted for a combined majority market share in 2021. There is a high degree of competition among the market players. Only major companies can afford high-capital investments as well as the high cost of R&D and manufacturing. This will prevent new entrants from entering this market.

Ultrasound devices segment accounted for the largest share of the fetal monitoring industry, by products

The fetal monitoring market is segmented into ultrasound devices, electronic maternal/fetal monitors, fetal electrodes, fetal doppler devices, uterine contraction monitors, telemetry devices, accessories & consumables, and other products. Ultrasound accounts for the major share in this market due to the increasing demand for minimally invasive gynecological treatments, and large use of ultrasound in obstetrics.

Non-portable systems segment accounted for the largest share in the fetal monitoring industry, by portability

The fetal monitoring market has been segmented into non-portable systems and portable systems. The non-portable systems segment accounted for the largest share of the market. Factor such as the large use of non-portable systems in hospitals and clinics which are the major end users is driving the growth of the market.

Non-invasive segment accounted for the largest share in the fetal monitoring industry, by method

The fetal monitoring market has been segmented into invasive and non-invasive. The non-invasive segment accounted for the largest share of the market. The increasing incidence of high-risk pregnancies, coupled with ongoing research activities and the launch of innovative products are the factors driving the market growth.

Antepartum segment accounted for the largest share in the fetal monitoring industry, by application

The fetal monitoring market has been segmented into antepartum and intrapartum. The antepartum segment accounted for the largest share of the market. Antepartum is the longest time period of gestation period for fetal monitoring to diagnose any fetal abnormalities, thus, driving the market growth.

Hospitals segment accounted for the largest share in the fetal monitoring industry, by end user

The fetal monitoring market has been segmented into hospitals, obstetrics & gynecology clinics, and home care settings. The hospitals segment accounted for the largest share of the market. The rising government healthcare expenditure, and availability of high end facilities are the factors driving the market growth.

North America is the largest region for fetal monitoring industry.

The global fetal monitoring market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. North America was the largest regional market for fetal monitoring. The availability of experts and availability of Neonatal Intensive Care Units (NICUs) are the major factors that supports the growth of the market in North America. However, the Asia Pacific region offers high-growth opportunities for players in the market. This regional segment is projected to register the highest CAGR during the forecast period. Factors such as low-weight births, and rising number of marital age individuals due to which there will be more number of pregnancies are factors driving the market growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

Some key players in the fetal monitoring market are:

- GE Healthcare (US)

- Siemens Healthineers (Germany)

- Koninklijke Philips N.V. (Netherlands)

- FUJIFILM SonoSite, Inc. (US)

- Cardinal Health, Inc. (US)

Scope of the Fetal Monitoring Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$3.7 billion |

|

Projected Revenue by 2027 |

$5.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.3% |

|

Market Driver |

Rising number of preterm births and increasing adoption of infertility treatment |

|

Market Opportunity |

Development of non-invasive, portable, and advanced fetal monitors |

This report categorizes the fetal monitoring market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Ultrasound Devices

- Electronic Maternal/Fetal Monitors

-

Uterine Contraction Monitor

- 2D Ultrasound

- 3D/4D Ultrasound

- Doppler Imaging

- Fetal Electrodes

- Fetal Doppler Devices

- Telemetry Devices

- Accessories and Consumables

- Other Products

By Portability

- Portable systems

- Non-portable systems

By Method

- Invasive

- Non-Invasive

By Application

- Antepartum

- Intrapartum

By End User

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Afric

Recent Developments of Fetal Monitoring Industry

- In May 2022, GE Healthcare (US) and Pulsenmore (Israel) signed an agreement to accelerate the adoption of Pulsenmore's home care ultrasound solutions and support their goal to pursue US FDA clearance and commercial expansion.

- In April 2022, ArchiMed Group (France) acquired Natus Medical Incorporated (US) to expand the reach and breadth of Natus' market-leading products, reinforcing the focus on research & development and pursuing acquisitions of complementary businesses.

- In March 2021, CONTEC Medical Systems Co., Ltd. (China) launched CMS1700B Color Doppler Ultrasonic Diagnostic System, which is mainly suitable for the diagnosis of problems in the abdomen, heart, peripheral vessels, breast, obstetrics and gynecology, small organs, urology, muscle, incretion, pediatrics, etc.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global fetal monitoring market?

The global fetal monitoring market boasts a total revenue value of $5.2 billion by 2027.

What is the estimated growth rate (CAGR) of the global fetal monitoring market?

The global fetal monitoring market has an estimated compound annual growth rate (CAGR) of 7.3% and a revenue size in the region of $3.7 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising number of preterm births and increasing adoption of infertility treatment- Advanced and innovative fetal monitoring technologies- Government initiatives and increasing collaborations for research by health agencies- Reimbursement and insurance policies for fetal monitoring services- Active product launches by key manufacturers- Increasing number of obstetrics and gynecology centers for fetal monitoringRESTRAINTS- High costs of fetal monitoring equipment- Availability of refurbished productsOPPORTUNITIES- Development of non-invasive, portable, and advanced fetal monitors- Emerging markets and strengthening infrastructureCHALLENGES- Product recalls- Lack of skilled healthcare professionals

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

-

5.6 REGULATORY LANDSCAPEEU REGULATIONSUS REGULATIONS

-

5.7 PORTER'S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTES

-

5.8 PATENT ANALYSIS OF FETAL MONITORING PRODUCTS

-

5.9 TRADE ANALYSIS FOR ULTRASOUNDIMPORT DATA FOR ULTRASOUND, BY COUNTRY, 2017–2021 (USD MILLION)EXPORT DATA FOR ULTRASOUND, BY COUNTRY, 2017–2021 (USD MILLION)

- 5.10 TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 ULTRASOUND DEVICES2D ULTRASOUND- Increasing commercialization of innovative 2D technologies3D & 4D ULTRASOUND- Technological advantages of 3D & 4D ultrasound over 2D ultrasoundDOPPLER IMAGING- Doppler imaging vital to analyze hemodynamics in fetal surveillance

-

6.3 ELECTRONIC MATERNAL/FETAL MONITORSRISING NUMBER OF HIGH-RISK PREGNANCIES

-

6.4 FETAL ELECTRODESNEED FOR INTRAPARTUM FETAL SURVEILLANCE

-

6.5 FETAL DOPPLER DEVICESINCREASING USE OF FETAL DOPPLERS IN-HOME CARE SETTINGS

-

6.6 UTERINE CONTRACTION MONITORSINTERNAL UTERINE CONTRACTION MONITORS- Accurate measurements obtained by internal UCMsEXTERNAL UTERINE CONTRACTION MONITORS- Developments underway to overcome drawbacks of external UCMs

-

6.7 TELEMETRY DEVICESREMOTE MONITORING INCORPORATED INTO TELEMETRY DEVICES

-

6.8 ACCESSORIES & CONSUMABLESADVANCEMENTS IN FETAL MONITORING TO LEAD TO INCREASING UTILIZATION OF ACCESSORIES & CONSUMABLES

- 6.9 OTHER PRODUCTS

- 7.1 INTRODUCTION

-

7.2 NON-PORTABLE SYSTEMSTECHNOLOGICAL ADVANCEMENTS IN NON-PORTABLE SYSTEMS TO SUPPORT MARKET GROWTH

-

7.3 PORTABLE SYSTEMSREMOTE ACCURACY OFFERED BY PORTABLE SYSTEMS TO DRIVE MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 NON-INVASIVE METHODNON-INVASIVE METHODS WIDELY ADOPTED IN HIGH-RISK PREGNANCIES

-

8.3 INVASIVE METHODCONSISTENT TRANSMISSION OF FETAL HEART RATE POSSIBLE VIA INVASIVE METHODS

- 9.1 INTRODUCTION

-

9.2 ANTEPARTUMINCREASING INCIDENCES OF PREGNANCY-RELATED COMPLICATIONS TO SUPPORT GROWTH

-

9.3 INTRAPARTUMFAVORABLE GUIDELINES BY HEALTHCARE AUTHORITIES TO PROPEL GROWTH

- 10.1 INTRODUCTION

-

10.2 HOSPITALSAVAILABILITY OF WELL-ESTABLISHED HEALTHCARE INFRASTRUCTURE TO DRIVE SEGMENT GROWTH

-

10.3 OBSTETRICS & GYNECOLOGY CLINICSRISING EMPHASIS ON PERINATAL CARE TO BOLSTER GROWTH OF SEGMENT

-

10.4 HOME CARE SETTINGSREMOTE CARE BY PORTABLE FETAL MONITORING SYSTEMS TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACTUS- US held largest share of North American market in 2021CANADA- Growing government initiatives for fetal and maternal care to drive market growth in Canada

-

11.3 EUROPERECESSION IMPACTGERMANY- Increasing healthcare expenditure to support market growth in GermanyUK- Rising emphasis on better maternity services to drive market growth in UKFRANCE- Increasing focus on healthcare policies to accelerate market growth in FranceITALY- Increasing healthcare expenditure to propel growth of market in ItalySPAIN- Declining birth rate to restrain growth of market in SpainREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACTJAPAN- Increasing focus on launch of innovative products to propel market growth in JapanCHINA- Developing healthcare infrastructure in China to support market growthINDIA- Growing number of preterm births to drive market growth in IndiaSOUTH KOREA- Increasing implementation of ultrasound technology to drive market in South KoreaAUSTRALIA- Rising emphasis on maternal care to bolster market growth in AustraliaREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLDRECESSION IMPACTLATIN AMERICA- Favorable government policies to support growth of marketMIDDLE EAST & AFRICA- High number of pre-term births recorded to boost market

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANT (2021)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSGE HEALTHCARE- Business overview- Recent developments- MnM viewSIEMENS HEALTHINEERS- Business overview- Recent developments- MnM viewCARDINAL HEALTH, INC.- Business overview- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Recent developments- MnM viewFUJIFILM SONOSITE, INC.- Business overview- Recent developments- MnM viewHUNTLEIGH HEALTHCARE LIMITED- Business overviewNATUS MEDICAL INCORPORATED- Business overview- Recent developmentsTHE COOPER COMPANIES, INC.- Business overview- Products offered- Recent developmentsCONTEC MEDICAL SYSTEMS CO., LTD.- Business overview- Products offered- Recent developmentsEDAN INSTRUMENTS, INC.- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSNEOVENTA MEDICAL ABBIONET CO., LTD.PROGETTI SRLTRISMED CO., LTD.SHENZHEN LUCKCOME TECHNOLOGY INC., LTD.MEDGYN PRODUCTS, INC.DIXIONPROMED TECHNOLOGY CO., LTD.ADVANCED INSTRUMENTATIONSBRAEL-MEDICAL EQUIPMENTGPC MEDICAL LTD.SHENZHEN VCOMIN TECHNOLOGY LIMITEDBISTOS CO., LTD.MEDIANA CO., LTD.LIFE PLUS HEALTHCARE (P) LTD.CHOICEMMEDTRIVITRON HEALTHCAREDOTT MEDICAL CO. LTD.SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.NEMO HEALTHCAREMINDCHILD MEDICAL, INC.MELODY INTERNATIONAL LTD.JANITRI INNOVATIONS PVT. LTD.LAERDAL GLOBAL HEALTH

- 14.1 INDUSTRY INSIGHTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 CPT CODES FOR VAGINAL DELIVERIES

- TABLE 4 PRODUCT RECALLS IN FETAL MONITORING MARKET

- TABLE 5 REGULATORY AUTHORITIES

- TABLE 6 AVERAGE SELLING PRICE OF FETAL MONITORING PRODUCTS

- TABLE 7 FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 8 ULTRASOUND DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 9 ULTRASOUND DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 10 2D ULTRASOUND: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 11 3D & 4D ULTRASOUND: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 12 DOPPLER IMAGING: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 13 ELECTRONIC MATERNAL/FETAL MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 FETAL ELECTRODES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 15 FETAL DOPPLER DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 16 UTERINE CONTRACTION MONITORS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 UTERINE CONTRACTION MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 INTERNAL UTERINE CONTRACTION MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 EXTERNAL UTERINE CONTRACTION MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 TELEMETRY DEVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 21 ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 OTHER PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 23 FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 24 NON-PORTABLE SYSTEMS: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 PORTABLE SYSTEMS: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 26 FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 27 NON-INVASIVE FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 INVASIVE FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 30 ANTEPARTUM FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 INTRAPARTUM FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 32 FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 33 HOSPITALS: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 34 OBSTETRICS & GYNECOLOGY CLINICS: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 35 HOME CARE SETTINGS: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 36 FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: FETAL MONITORING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 45 ULTRASOUND CPT CODES

- TABLE 46 US: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 47 US: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 48 US: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 US: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 50 US: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 51 US: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 52 US: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 53 CANADA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 54 CANADA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 55 CANADA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 56 CANADA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 57 CANADA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 58 CANADA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 59 CANADA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 60 EUROPE: FETAL MONITORING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 61 EUROPE: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 62 EUROPE: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 63 EUROPE: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 EUROPE: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 65 EUROPE: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 67 EUROPE: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 68 GERMANY: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 69 GERMANY: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 70 GERMANY: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 71 GERMANY: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 72 GERMANY: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 73 GERMANY: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 74 GERMANY: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 75 UK: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 76 UK: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 77 UK: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 78 UK: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 79 UK: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 80 UK: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 81 UK: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 82 FRANCE: HEALTHCARE SPENDING, 2011–2019

- TABLE 83 FRANCE: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 84 FRANCE: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 85 FRANCE: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 86 FRANCE: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 87 FRANCE: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 88 FRANCE: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 89 FRANCE: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 90 ITALY: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 91 ITALY: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 92 ITALY: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 ITALY: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 94 ITALY: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 95 ITALY: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 96 ITALY: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 97 SPAIN: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 98 SPAIN: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 99 SPAIN: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 SPAIN: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 101 SPAIN: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 102 SPAIN: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 103 SPAIN: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 104 REST OF EUROPE: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 REST OF EUROPE: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 107 REST OF EUROPE: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 108 REST OF EUROPE: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 109 REST OF EUROPE: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 110 REST OF EUROPE: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FETAL MONITORING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 112 ASIA PACIFIC: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 119 JAPAN: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 120 JAPAN: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 121 JAPAN: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 122 JAPAN: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 123 JAPAN: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 124 JAPAN: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 125 JAPAN: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 126 CHINA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 127 CHINA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 128 CHINA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 129 CHINA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 130 CHINA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 131 CHINA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 132 CHINA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 133 INDIA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 134 INDIA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 135 INDIA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 136 INDIA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 137 INDIA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 138 INDIA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 139 INDIA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 140 SOUTH KOREA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 141 SOUTH KOREA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 142 SOUTH KOREA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 143 SOUTH KOREA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 144 SOUTH KOREA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 145 SOUTH KOREA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 146 SOUTH KOREA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 147 AUSTRALIA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 148 AUSTRALIA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 149 AUSTRALIA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 150 AUSTRALIA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 151 AUSTRALIA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 152 AUSTRALIA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 153 AUSTRALIA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 161 REST OF THE WORLD: FETAL MONITORING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 162 REST OF THE WORLD: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 163 REST OF THE WORLD: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 164 REST OF THE WORLD: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 165 REST OF THE WORLD: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 166 REST OF THE WORLD: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 167 REST OF THE WORLD: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 168 REST OF THE WORLD: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 170 LATIN AMERICA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 171 LATIN AMERICA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 172 LATIN AMERICA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 173 LATIN AMERICA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 174 LATIN AMERICA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 175 LATIN AMERICA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET FOR ULTRASOUND DEVICES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET FOR UTERINE CONTRACTION MONITORS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET, BY PORTABILITY, 2020–2027 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: FETAL MONITORING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 183 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 184 FETAL MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 185 PRODUCT FOOTPRINT OF KEY PLAYERS

- TABLE 186 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 187 PRODUCT LAUNCHES, 2019–NOVEMBER 2022

- TABLE 188 DEALS, 2019–NOVEMBER 2022

- TABLE 189 OTHER DEVELOPMENTS, 2019–NOVEMBER 2022

- TABLE 190 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 191 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 192 GE HEALTHCARE: DEALS

- TABLE 193 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- TABLE 194 SIEMENS HEALTHINEERS: PRODUCTS OFFERED

- TABLE 195 SIEMENS HEALTHINEERS: DEALS

- TABLE 196 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

- TABLE 197 CARDINAL HEALTH, INC.: PRODUCTS OFFERED

- TABLE 198 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 199 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 200 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES

- TABLE 201 FUJIFILM SONOSITE, INC.: BUSINESS OVERVIEW

- TABLE 202 FUJIFILM SONOSITE, INC.: PRODUCTS OFFERED

- TABLE 203 FUJIFILM SONOSITE, INC.: PRODUCT LAUNCHES

- TABLE 204 FUJIFILM SONOSITE, INC.: DEALS

- TABLE 205 HUNTLEIGH HEALTHCARE LIMITED: BUSINESS OVERVIEW

- TABLE 206 HUNTLEIGH HEALTHCARE LIMITED: PRODUCTS OFFERED

- TABLE 207 NATUS MEDICAL INCORPORATED: BUSINESS OVERVIEW

- TABLE 208 NATUS MEDICAL INCORPORATED: PRODUCTS OFFERED

- TABLE 209 NATUS MEDICAL INCORPORATED: DEALS

- TABLE 210 THE COOPER COMPANIES, INC.: BUSINESS OVERVIEW

- TABLE 211 THE COOPER COMPANIES, INC.: PRODUCTS OFFERED

- TABLE 212 THE COOPER COMPANIES, INC.: DEALS

- TABLE 213 CONTEC MEDICAL SYSTEMS CO., LTD.: BUSINESS OVERVIEW

- TABLE 214 CONTEC MEDICAL SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 215 CONTEC MEDICAL SYSTEMS CO., LTD.: PRODUCT LAUNCHES

- TABLE 216 CONTEC MEDICAL SYSTEMS CO., LTD.: DEALS

- TABLE 217 EDAN INSTRUMENTS, INC.: BUSINESS OVERVIEW

- TABLE 218 EDAN INSTRUMENTS, INC.: PRODUCTS OFFERED

- TABLE 219 EDAN INSTRUMENTS, INC.: DEALS

- TABLE 220 EDAN INSTRUMENTS, INC.: OTHER DEVELOPMENTS

- FIGURE 1 FETAL MONITORING MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 APPROACH 3: PARENT MARKET ANALYSIS (ULTRASOUND MARKET)

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 FETAL MONITORING MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

- FIGURE 10 FETAL MONITORING MARKET, BY PORTABILITY, 2022 VS. 2027 (USD BILLION)

- FIGURE 11 FETAL MONITORING MARKET, BY METHOD, 2022 VS. 2027 (USD BILLION)

- FIGURE 12 FETAL MONITORING MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

- FIGURE 13 FETAL MONITORING MARKET, BY END USER, 2022 VS. 2027 (USD BILLION)

- FIGURE 14 REGIONAL SNAPSHOT OF FETAL MONITORING MARKET

- FIGURE 15 RISING PRETERM BIRTHS TO DRIVE FETAL MONITORING MARKET

- FIGURE 16 NON-INVASIVE METHODS ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 DEVELOPING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 FETAL MONITORING MARKET DYNAMICS

- FIGURE 21 DIRECT DISTRIBUTION – PREFERRED STRATEGY OF PROMINENT COMPANIES

- FIGURE 22 FETAL MONITORING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 FETAL MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 KEY PLAYERS IN FETAL MONITORING MARKET ECOSYSTEM

- FIGURE 25 PATENT ANALYSIS: UTERINE CONTRACTION MONITORS (2013–NOVEMBER 2022)

- FIGURE 26 PATENT ANALYSIS: FETAL DOPPLERS (2013–NOVEMBER 2022)

- FIGURE 27 PATENT ANALYSIS: FETAL ELECTRODES (2013–NOVEMBER 2022)

- FIGURE 28 NORTH AMERICA: FETAL MONITORING MARKET SNAPSHOT

- FIGURE 29 US: PRETERM BIRTH RATE, BY RACE/ETHNICITY, 2018–2020 (AVERAGE)

- FIGURE 30 CANADA: NUMBER OF BIRTHS, 2011 TO 2021

- FIGURE 31 ASIA PACIFIC: FETAL MONITORING MARKET SNAPSHOT

- FIGURE 32 REVENUE SHARE ANALYSIS OF TOP PLAYERS

- FIGURE 33 FETAL MONITORING MARKET SHARE ANALYSIS, BY KEY PLAYER (2021)

- FIGURE 34 FETAL MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 35 FETAL MONITORING MARKET: START-UP/SME EVALUATION QUADRANT, 2021

- FIGURE 36 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 37 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT

- FIGURE 38 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

- FIGURE 39 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 40 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 ARJO: COMPANY SNAPSHOT

- FIGURE 42 NATUS MEDICAL INCORPORATED: COMPANY SNAPSHOT

- FIGURE 43 THE COOPER COMPANIES, INC.: COMPANY SNAPSHOT

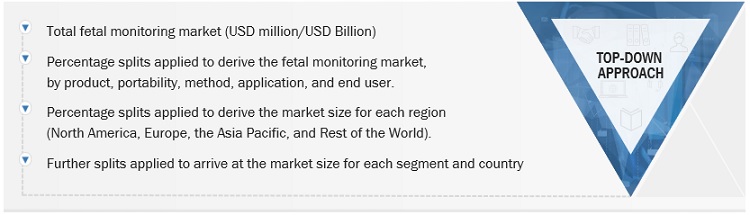

This study involved four major activities in estimating the current size of the fetal monitoring market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

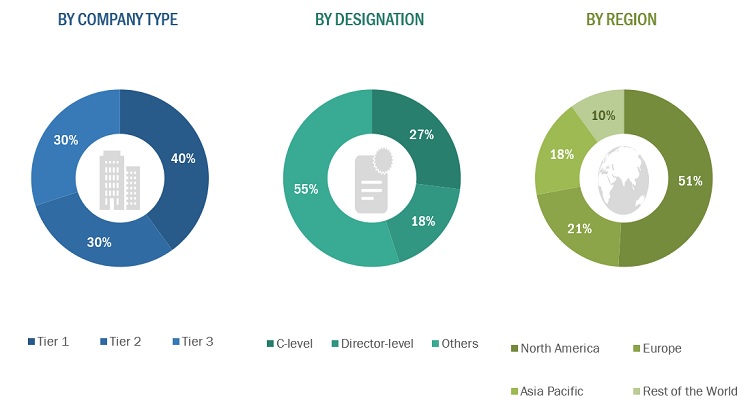

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the fetal monitoring market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the fetal monitoring market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Fetal monitoring Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global fetal monitoring market by product, portability, method, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall fetal monitoring market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, agreements, partnerships, and acquisitions in the fetal monitoring market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Fetal monitoring market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, and Rest of the World.

Company profiles

- Additional five company profiles of players operating in the fetal monitoring market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fetal Monitoring Market

What is the scope of the growth of the global Fetal Monitoring Market across different geographies?

I want more detailed market size costings for the global market as well as segmentation wise for the global Fetal Monitoring Market

Can you share more elaborated report on the global leading companies of the Fetal Monitoring Market?