Newborn Screening Market by Product (Instrument, Consumables), Test Type (Dried Blood Spot, Hearing Screening, CCHD), Technology (Tandem Mass Spectrometry, Immunoassay, Enzyme Assay, Molecular, Pulse Oximetry), End User (Hospitals) & Region - Global Forecast to 2026

Market Growth Outlook Summary

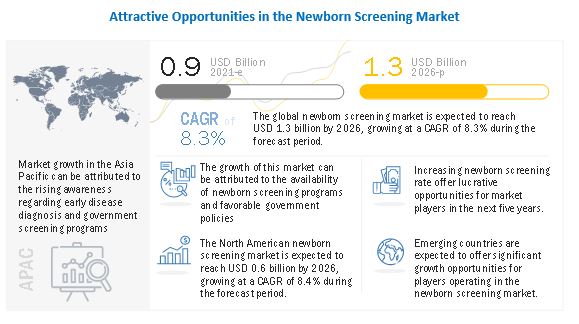

The global newborn screening market growth forecasted to transform from $0.9 billion in 2021 to $1.3 billion by 2026, driven by a CAGR of 8.3%. In this new version, we have added country-level segmentation in each region. Also, we have further segmented the newborn disorder screening instruments into fully automated instruments and other instruments (semi-automated instruments, incubators, shakers, etc.). In addition, in the new version, we have included the end-user segment. Growth in this market is primarily driven by the increasing prevalence of newborn disorders and favourable reimbursement policies. However, the availability of refurbished products is expected to restrain the growth of this market to a certain extent during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Newborn Screening Market Dynamics

Driver: Growing prevalence of newborn disorders

The prevalence of newborn diseases has risen in recent years, prompting providers to raise awareness and support the demand for advanced screening instruments. Hearing, metabolic, and hormonal disorders and critical congenital heart disease are the major newborn disorders; most are treatable if diagnosed early.

- According to the US CDC, during 2015–2017, the prevalence of newborn disorders was 34 per 10,000 live births in the US. Approximately 12,900 infants are expected to be identified each year with a disorder. Moreover, according to the same source, the most prevalent disorders are hearing loss (16.5 per 10,000), congenital hypothyroidism (6.0 per 10,000), sickle-cell disease (4.9 per 10,000), and cystic fibrosis (1.8 per 10,000).

- According to the Indian Pediatric Academy, the prevalence of congenital heart disease in children is 9 per 1,000 births. Each year, more than 200,000 children are born with congenital heart disease.

- According to BabysFirstTest.org, an organization supported by the US Health Resources and Services Administration (HRSA), critical congenital heart disease is estimated to affect two out of every 1,000 babies born each year in the US.

Opportunity: Emerging Markets

India, China, and Brazil provide significant opportunities to players in this market due to their high birth rates and increasing disposable income. According to the UN Children’s Fund, India records 25 million births every year, or nearly one-fifth of the global annual childbirths. The high birth rate and the availability of newborn screening in public hospitals indicates a strong demand for market products and consumables.

On the other hand, China has achieved great progress in newborn screening during the past 35 years. Moreover, by 2017, the overall uptake rate for CH and PKU screening crossed 96%. Also, each year, nearly 17 million infants undergo screening for CH and PKU. Currently, CH/PKU and hearing loss are included as national screening programs, mandatory for all newborns in China. By 2017, more than 150 NBS labs in China offered screening programs for CAH and G6PD. There are also ~100 NBS labs screening for IMDs by using tandem mass spectrometry technology. The strong newborn screening infrastructure in China indicates the potential for market growth.

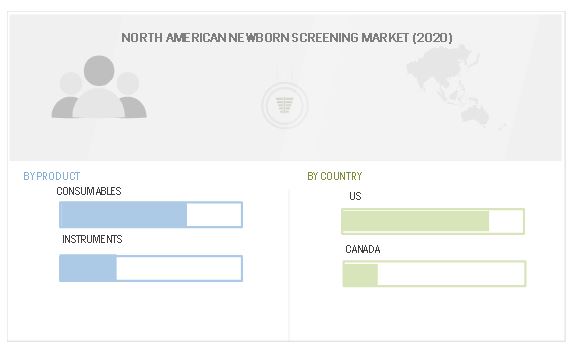

Consumables segment accounted for the largest share of the newborn screening industry by product

Based on the product, the newborn screening market is segmented into consumables and instruments. Consumables accounted for the largest share of the newborn screening industry. The large share of this market segment is mainly due to the constant requirement for consumables in newborn screening. The increasing newborn disease prevalence, and increasing newborn screening rate across the globe are the major driving factors that supports the growth of consumables.

Immunoassays & enzymatic assays accounted for the largest share of the newborn screening industry by technology

Based on technology, the newborn screening market is segmented into immunoassays & enzymatic assays, tandem mass spectrometry, molecular assays, hearing screening technologies, pulse oximetry, and other technologies. In 2019, the immunoassays & enzymatic assays segment dominated this market. This is mainly due to the wide usage of these assays to screen for disorders in newborns.

North America accounted for the largest share of the newborn screening industry

The market, by region, has been segmented into North America, Europe, the Asia Pacific, and the Rest of the world (RoW). North America is the largest market for newborn screening, followed by Europe. Growth in the North American market can be attributed to the availability of newborn screening programs, favorable reimbursement policies, and a strong market player presence.

The Asia Pacific is expected to register the highest CAGR during the forecast period. Growth in this region is driven by the large newborn pool, increasing screening rate, and rising awareness regarding early diagnosis.

Prominent players in the newborn screening market are PerkinElmer (US), Natus Medical (US), Bio-Rad Laboratories (US), Danaher Corporation (US), and Medtronic (Ireland). Others include Chromsystems Instruments & Chemicals GmbH (Germany), Trivitron Healthcare (India), Baebies (US), Parseq Lab (Russia), Recipe Chemicals+Instruments (Germany), and Demant A/S (Denmark).

Scope of the Newborn Screening Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$0.9 billion |

|

Projected Revenue Size by 2026 |

$1.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.3% |

|

Market Driver |

Growing prevalence of newborn disorders |

|

Market Opportunity |

Emerging markets |

This research report categorizes the global newborn screening market to forecast revenue and analyze trends in each of the following submarkets :

By Product

-

Consumables

- Assay kits & reagents

- Other consumables ( columns and screening cards)

-

instruments

-

Disorder screening instruments

- Fully-automated instruments

- Other instruments (sei-automated instruments, shakers, incubator and etc.)

-

Disorder screening instruments

-

Hearing screening instruments

- Accessories

- Devices

- Pulse oximeters

By Test

- Dry blood spot tests

- Hearing screening tests

- CCHD screening tests

By technology

- Immune assays & enzymatic assays

- Tandem mass spectrometry

- Molecular assays

- Hearing screening technologies

- Pulse oximetry

- Other Technologies (Fluorescence, gel electrophoresis and etc.)

By End User

- Clinical Laboratories

- Hospitals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Newborn Screening Industry:

- In September 2020, PerkinElmer (US) received CE-IVD approval for the EONIS screening assay used to screen for SMA (spinal muscular atrophy), SCID (severe combined immunodeficiency), and XLA (X-linked agammaglobulinemia) in newborns.

- In December 2019, PerkinElmer (US) received US FDA approval for the GSP Neonatal Creatine Kinase MM (CK-MM) kit for screening newborns affected by Duchenne muscular dystrophy (DMD).

- In October 2019, Demant A/S (Denmark) launched its easyScreen BERAphone, a hearing screening device, at the 64th International Congress of Hearing Aid Acousticians in Nuremberg, Germany.

- In January 2018, Demant A/S (Denmark) launched GSI Novus, a handheld newborn hearing screener.

Frequently Asked Questions (FAQs):

What is the projected market value of the global newborn screening market?

The global newborn screening market boasts a total revenue value of $0.9 billion in 2021 and is projected to register a revenue value of $1.3 billion by 2026.

What is the estimated growth rate (CAGR) of the global newborn screening market for the next five years?

The global newborn screening market in terms of revenue is poised to grow at a CAGR of 8.3%.

What does the current study of the newborn screening market consist of?

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.9 LIMITATIONS OF THE CURRENT EDITION

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: PATIENT-BASED METHODOLOGY

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 7 NEWBORN SCREENING MARKET, BY PRODUCT, 2021 VS. 2026

FIGURE 8 NEWBORN SCREENING INSTRUMENTS MARKET, BY TYPE, 2021 VS. 2026

FIGURE 9 MARKET, BY TECHNOLOGY, 2021 VS. 2026

FIGURE 10 MARKET, BY TEST, 2021 VS. 2026

FIGURE 11 MARKET, BY END USER, 2021 VS. 2026

FIGURE 12 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 NEWBORN SCREENING MARKET OVERVIEW

FIGURE 13 FAVORABLE GOVERNMENT POLICIES AND AVAILABILITY OF NEWBORN SCREENING PROGRAMS TO SUPPORT THE MARKET

4.2 MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 14 CONSUMABLES ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.3 NORTH AMERICAN MARKET, BY PRODUCT AND COUNTRY

FIGURE 15 US DOMINATES THE GLOBAL MARKET

4.4 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 NEWBORN SCREENING MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of newborn disorders

5.2.1.2 Newborn screening programs and legislation

5.2.1.3 Favorable reimbursement policies

5.2.2 OPPORTUNITIES

5.2.2.1 Growth potential of emerging economies

5.2.3 CHALLENGES

5.2.3.1 Availability of refurbished products

5.3 COVID-19 IMPACT ON NEWBORN SCREENING

5.4 PRICING ANALYSIS

5.5 PATENT ANALYSIS

5.6 TRADE ANALYSIS

5.6.1 TRADE ANALYSIS FOR SPECTROMETERS

TABLE 1 EXPORT DATA FOR SPECTROMETERS, SPECTROPHOTOMETERS AND SPECTROGRAPHS USING OPTICAL RADIATIONS, SUCH AS UV, VISIBLE, IR, BY COUNTRY, 2016—2020 (USD MILLION)

TABLE 2 IMPORT DATA FOR SPECTROMETERS, SPECTROPHOTOMETERS AND SPECTROGRAPHS USING OPTICAL RADIATIONS, SUCH AS UV, VISIBLE, IR, BY COUNTRY, 2016—2020 (USD MILLION)

5.7 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 19 DIRECT DISTRIBUTION—THE PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.9 ECOSYSTEM ANALYSIS

5.1 TECHNOLOGY ANALYSIS

5.11 PESTLE ANALYSIS

5.12 REGULATORY LANDSCAPE

FIGURE 20 510(K) APPROVAL PROCESS

5.13 PORTER’S FIVE ANALYSIS

FIGURE 21 GLOBAL MARKET, PORTER’S FIVE ANALYSIS

6 NEWBORN SCREENING MARKET, BY PRODUCT (Page No. - 53)

6.1 INTRODUCTION

TABLE 3 MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 CONSUMABLES

TABLE 4 NEWBORN SCREENING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2.1 ASSAY KITS & REAGENTS

6.2.1.1 Assay kits & reagents hold the largest share of the consumables market

TABLE 5 ASSAY KITS & REAGENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.2.2 OTHER CONSUMABLES

TABLE 6 OTHER NEWBORN SCREENING CONSUMABLES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 7 NEWBORN SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.3.1 NEWBORN DISORDER SCREENING INSTRUMENTS

TABLE 8 NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1.1 Fully automated instruments

6.3.1.1.1 Fully automated instruments dominate the disorder screening instruments market

TABLE 10 FULLY AUTOMATED INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.1.2 Other instruments

TABLE 11 OTHER NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2 NEWBORN HEARING SCREENING INSTRUMENTS

TABLE 12 NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 13 NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2.1 Accessories

6.3.2.1.1 The accessories segment dominates the hearing screening instruments market

TABLE 14 ACCESSORIES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.2.2 Devices

6.3.2.2.1 Government recommendations ensure sustained demand for hearing screening devices

TABLE 15 DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3.3 PULSE OXIMETERS

6.3.3.1 The high prevalence of CCHD and recommendations for pulse oximetry testing drive the market growth

TABLE 16 PULSE OXIMETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 NEWBORN SCREENING MARKET, BY TEST (Page No. - 62)

7.1 INTRODUCTION

TABLE 17 GLOBAL MARKET, BY TEST, 2018–2026 (USD MILLION)

7.2 DRY BLOOD SPOT TESTS

7.2.1 DRY BLOOD SPOT TESTS DOMINATE THE MARKET

TABLE 18 NEWBORN DRY BLOOD SPOT TESTS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 HEARING SCREENING TESTS

7.3.1 RECOMMENDATIONS FROM GOVERNMENT ORGANIZATIONS TO SUPPORT THE MARKET GROWTH

TABLE 19 NEWBORN HEARING SCREENING TESTS MARKET, BY REGION, 2018–2026 (USD MILLION)

7.4 CRITICAL CONGENITAL HEART DEFECT SCREENING TESTS

7.4.1 APAC TO SHOW RISING DEMAND FOR CCHD SCREENING TESTS

TABLE 20 NEWBORN CCHD SCREENING TESTS MARKET, BY REGION, 2019–2026 (USD MILLION)

8 NEWBORN SCREENING MARKET, BY TECHNOLOGY (Page No. - 66)

8.1 INTRODUCTION

TABLE 21 MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

8.2 IMMUNOASSAYS & ENZYMATIC ASSAYS

8.2.1 ENZYMATIC AND IMMUNOASSAYS DOMINATE THE MARKET, BY TECHNOLOGY

TABLE 22 MARKET FOR IMMUNOASSAYS & ENZYMATIC ASSAYS, BY REGION, 2019–2026 (USD MILLION)

8.3 TANDEM MASS SPECTROMETRY

8.3.1 NORTH AMERICA HOLDS THE LARGEST SHARE OF THE TANDEM MASS SPECTROMETRY MARKET

TABLE 23 MARKET FOR TANDEM MASS SPECTROMETRY, BY REGION, 2018–2026 (USD MILLION)

8.4 MOLECULAR ASSAYS

8.4.1 RISING NUMBER OF SEVERE COMBINED IMMUNODEFICIENCY CASES IN NEWBORNS TO SUPPORT THE MARKET GROWTH

TABLE 24 MARKET FOR MOLECULAR ASSAYS, BY REGION, 2018–2026 (USD MILLION)

8.5 HEARING SCREENING TECHNOLOGIES

8.5.1 APAC EXPECTED TO REGISTER HIGHEST GROWTH RATE IN THIS MARKET

TABLE 25 MARKET FOR HEARING SCREENING TECHNOLOGIES, BY REGION, 2018–2026 (USD MILLION)

8.6 PULSE OXIMETRY

8.6.1 INCREASING PREVALENCE OF CCHD TO SUPPORT THE MARKET GROWTH

TABLE 26 MARKET FOR PULSE OXIMETRY, BY REGION, 2018–2026 (USD MILLION)

8.7 OTHER TECHNOLOGIES

TABLE 27 OTHER NEWBORN SCREENING TECHNOLOGIES MARKET, BY REGION,2018–2026 (USD MILLION)

9 NEWBORN SCREENING MARKET, BY END USER (Page No. - 72)

9.1 INTRODUCTION

TABLE 28 MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 CLINICAL LABORATORIES

9.2.1 PRESENCE OF SKILLED PROFESSIONAL AND ROBUST INFRASTRUCTURE TO SUPPORT THE MARKET GROWTH

TABLE 29 MARKET FOR CLINICAL LABORATORIES, BY REGION, 2018–2026 (USD MILLION)

9.3 HOSPITALS

9.3.1 NORTH AMERICA DOMINATES THE HOSPITALS SEGMENT

TABLE 30 MARKET FOR HOSPITALS, BY REGION, 2018–2026 (USD MILLION)

10 NEWBORN SCREENING MARKET, BY REGION (Page No. - 75)

10.1 INTRODUCTION

TABLE 31 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

TABLE 32 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Availability of reimbursement in the country is expected to support the market growth

TABLE 41 US: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 42 US: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 US: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 US: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 US: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 46 US: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 47 US: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 48 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Investments for newborn screening in Canada to support market growth

TABLE 49 CANADA: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 50 CANADA: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 51 CANADA: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 CANADA: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 CANADA: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 CANADA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 55 CANADA: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 56 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 57 EUROPE: NEWBORN SCREENING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany holds the largest share of the European newborn screening market

TABLE 66 GERMANY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 67 GERMANY: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 GERMANY: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 GERMANY: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 GERMANY: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 France accounted for the second-largest market share in Europe

TABLE 74 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 75 FRANCE: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 FRANCE: NEWBORN SCREENING MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 FRANCE: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 FRANCE: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 80 FRANCE: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 81 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Favorable initiatives and reimbursement scenario indicate strong prospects for market growth

TABLE 82 UK: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 83 UK: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 UK: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 UK: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 UK: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 UK: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 88 UK: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 89 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Availability of health insurance to support the market growth in the country

TABLE 90 SPAIN: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 91 SPAIN: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 SPAIN: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 SPAIN: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 SPAIN: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 SPAIN: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 96 SPAIN: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 97 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Amendments by the Italian government support newborn screening in the country

TABLE 98 ITALY: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 ITALY: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ITALY: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 ITALY: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 ITALY: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 ITALY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 104 ITALY: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 105 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 106 ROE: HEALTH EXPENDITURE (% OF GDP), 2010–2017

TABLE 107 ROE: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 108 ROE: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 ROE: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 ROE: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 ROE: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 ROE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 113 ROE: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 114 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 115 ASIA PACIFIC: NEWBORN SCREENING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China dominates the newborn screening market in the APAC

TABLE 124 CHINA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 125 CHINA: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 CHINA: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 CHINA: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 CHINA: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 CHINA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 130 CHINA: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 131 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Rising testing volumes and growing healthcare expenditure drive the market

TABLE 132 JAPAN: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 133 JAPAN: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 JAPAN: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 JAPAN: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 JAPAN: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 JAPAN: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 138 JAPAN: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 AUSTRALIA

10.4.3.1 Favorable government policies in the country drive thegrowth of the market

TABLE 140 AUSTRALIA: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 141 AUSTRALIA: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 AUSTRALIA: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 AUSTRALIA: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 AUSTRALIA: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 AUSTRALIA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 146 AUSTRALIA: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 147 AUSTRALIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 148 ROAPAC: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 149 ROAPAC: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 ROAPAC: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 ROAPAC: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 ROAPAC: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 ROAPAC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 154 ROAPAC: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 155 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 156 ROW: NEWBORN SCREENING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 157 ROW: MARKET FOR CONSUMABLES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 ROW: MARKET FOR INSTRUMENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 ROW: NEWBORN DISORDER SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 ROW: NEWBORN HEARING SCREENING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 ROW: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 162 ROW: MARKET, BY TEST, 2019–2026 (USD MILLION)

TABLE 163 ROW: MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE NEWBORN SCREENING MARKET, JANUARY 2017–NOVEMBER 2020

FIGURE 24 MARKET EVOLUTION FRAMEWORK: JANUARY 2017 TO JANUARY 2021

11.2 MARKET SHARE ANALYSIS

FIGURE 25 GLOBAL MARKET SHARE ANALYSIS, 2019

11.3 COMPANY EVALUATION MATRIX

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 26 VENDOR DIVE: GLOBAL MARKET

11.4 COMPETITIVE LEADERSHIP MAPPING (START-UPS)

11.4.1 PROGRESSIVE COMPANIES

11.4.2 STARTING BLOCKS

11.4.3 RESPONSIVE COMPANIES

11.4.4 DYNAMIC COMPANIES

FIGURE 27 VENDOR DIVE MATRIX FOR START-UPS: GLOBAL MARKET

11.5 COMPETITIVE SCENARIO

11.5.1 PRODUCT LAUNCHES & APPROVALS

TABLE 164 GLOBAL MARKET: PRODUCT LAUNCHES & APPROVALS, 2017–2021

11.5.2 DEALS

TABLE 165 GLOBAL MARKET: DEALS 2017–2021

11.5.3 OTHER DEVELOPMENTS

TABLE 166 NEWBORN SCREENING MARKET: OTHER DEVELOPMENTS, 2017–2021

FIGURE 28 PRODUCT BENCHMARKING

FIGURE 29 GEOGRAPHIC ASSESSMENT

12 COMPANY PROFILES (Page No. - 136)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1.1 PERKINELMER

FIGURE 30 PERKINELMER: COMPANY SNAPSHOT (2019)

12.1.2 DEMANT

FIGURE 31 DEMANT A/S: COMPANY SNAPSHOT (2019)

12.1.3 NATUS MEDICAL

FIGURE 32 NATUS MEDICAL: COMPANY SNAPSHOT (2019)

12.1.4 MASIMO

FIGURE 33 MASIMO: COMPANY SNAPSHOT (2019)

12.1.5 AB SCIEX

FIGURE 34 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

12.1.6 MEDTRONIC

FIGURE 35 MEDTRONIC: COMPANY SNAPSHOT (2019)

12.1.7 BAEBIES

12.1.8 INTELLIGENT HEARING SYSTEMS CORP.

12.1.9 WELCH ALLYN

FIGURE 36 HILL-ROM HOLDINGS: COMPANY SNAPSHOT (2019)

12.1.10 WATERS CORPORATION

12.1.11 THERMO FISHER SCIENTIFIC

12.1.12 TRIVITRON HEALTHCARE

12.2 START-UPS/SME PLAYERS

12.2.1 BIO-RAD LABORATORIES

FIGURE 37 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2019)

12.2.2 CHROMSYSTEMS INSTRUMENTS & CHEMICALS

12.2.3 PARSEQ LAB

12.2.4 RECIPE CHEMICALS + INSTRUMENTS GMBH

12.2.5 ZIVAK TECHNOLOGIES

12.2.6 CAMAG

12.2.7 OTODYNAMICS

12.2.8 ZENTECH

12.2.9 VIVOSONIC

12.2.10 MP BIOMEDICALS

12.2.11 CENTOGENE

12.2.12 DRG INTERNATIONAL

12.2.13 REGIS TECHNOLOGIES

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 168)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

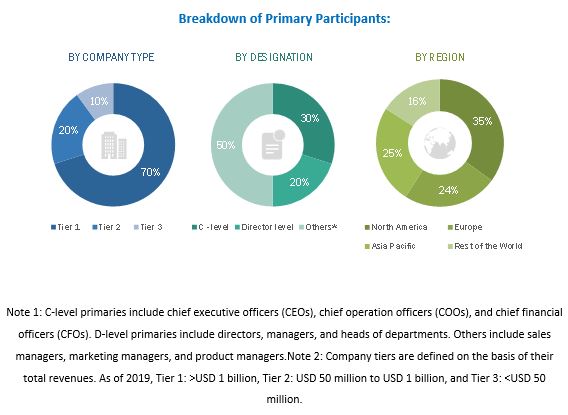

The study involved four major activities in estimating the current size of the newborn screening market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Several stakeholders, such as newborn screening product manufacturers, vendors, and distributors; researchers; and doctors from hospitals and research laboraotories, were consulted for this report. The demand side of this market is characterized by significant use of newborn screening products due to the increasing prevalence of newborn disease, and the growing newborn screening rate across the globe. The supply side is characterized by advancements in technology and a shift towards advanced devices. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the newborn screening market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the newborn screening industry.

Report Objectives

- To define, describe, and forecast the newborn screening market by product, test, technology, end user and region

- To forecast the revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, industry-specific challenges, opportunities, and challenges affecting the growth of the market

- To analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, product launches, and research and development activities in the newborn screening market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Newborn Screening Market

How emerging markets offering revenue expansion opportunities in Newborn Screening Market?

What are the major tailwinds and headwinds for the Newborn Screening Market?

Are there any changing variables which would affect the business landscape of Newborn Screening Market?