Industry 4.0 Market Size, Share & Industry Growth Analysis Report by Technology (Industrial Robots, Blockchain, Industrial Sensors, Industrial 3D Printing, Machine Vision, HMI, AI in Manufacturing, Digital Twin, AGV's, Machine Condition Monitoring) and Geography - Global Growth Driver and Industry Forecast to 2028

Updated on : Oct 23, 2024

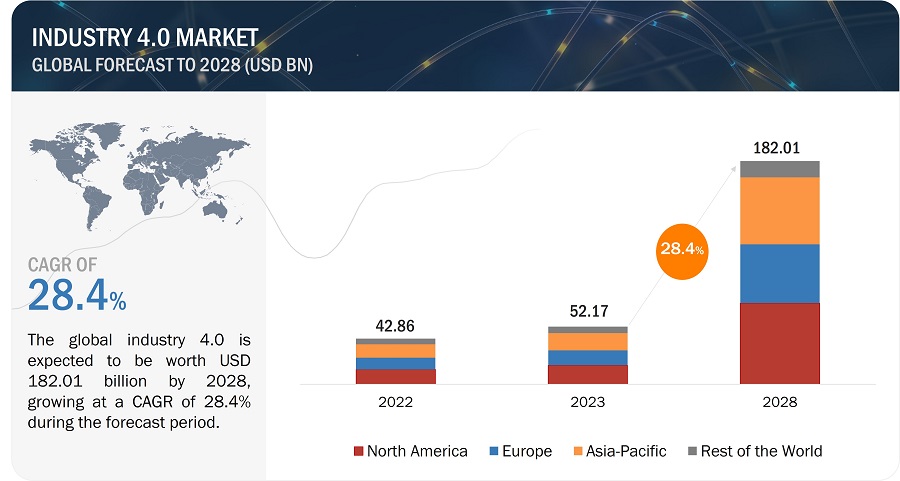

The global Industry 4.0 market size was valued at USD 52.17 billion in 2023 and is estimated to reach USD 182.01 billion by 2028, registering a CAGR of 28.4% during the forecast period.

The Industry 4.0 market is rapidly expanding, driven by technological advancements in AI, IoT, robotics, and 3D printing that enable manufacturers to automate processes, personalize products, and increase efficiency. Customer demands for more customized, sustainable, and rapidly updated products necessitate flexible and adaptable manufacturing models. Finally, the growing need for resilience in the face of disruptions and sustainability concerns has led Industry 4.0 to prioritize resource optimization, adaptability, and worker well-being, creating an impactful market landscape.

Industry 4.0 Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Escalated focus on implementing green technologies for sustainable manufacturing

Green technologies encompass progressive methodologies, materials, and techniques related to clean energy and waste recycling, among other aspects, aiming to mitigate climate change. Embracing these technologies, such as renewable energy and storage, waste-to-energy solutions, implementing AI for carbon emission tracking, and green infrastructure development, empowers the manufacturing sector to promote lean production, minimize emissions, and actively participate in climate action. This results in minimized waste and substantially reduced overall environmental footprint associated with manufacturing processes. Manufacturers requiring substantial energy for continuous operations can embrace sustainability by incorporating renewable sources like solar, wind, and biomass energy. A case in point is Greenam Energy, part of the AM International group, and SPIC, a leader in the fertilizer industry. Greenham Energy's floating solar power plant within SPIC's premises generates green power for captive use, allowing SPIC to power its operations and sell excess energy to the state grid, promoting the adoption of renewable power.

Restraint: Lack of proficient workforce acquainted with advanced manufacturing equipment

The lack of a proficient workforce poses a significant roadblock to Industry 4.0 adoption. From knowledge and skills gaps in complex technologies to cultural resistance to change, this barrier creates challenges in integration, implementation, and talent acquisition. Also, despite the increasing popularity of digitalization, many organizations are unaware of the capabilities of different technologies due to their complex structure and lack of process understanding. For example, creating a digital twin of an asset/processor to deploy IIoT demands various technologies, skillsets, and trained workers to handle the latest equipment and software systems. The digital change will lead to a change in the specifications of skills required for employees at different stages of the value chain, starting from development to sales and marketing. For this, existing workers must be trained to operate new systems. The consequences include slowed progress, competitive disadvantage, and potential unemployment, highlighting the need for collaborative solutions. This ultimately costs the company to provide accessible training, prioritize reskilling to bring continuous learning to bridge this gap, and ensure a smooth transition to Industry 4.0’s transformative potential.

Opportunity: Proliferation of 3D printing technology in the manufacturing of medical equipment and customized drugs.

The widespread adoption of 3D printing technology in manufacturing medical equipment and customized drugs within Industry 4.0 has fostered a promising environment full of opportunities. This upsurge is reshaping the landscape by offering increased flexibility, accuracy, and personalization in the production processes of medical devices and pharmaceuticals. Stratasys, a key player in 3D printing solutions, offers BioMimics, enabling the development of highly realistic, patient-specific anatomical models. These models have various applications, including surgical planning, medical training, and the creation of tailored medical devices. Aprecia Pharmaceuticals introduces 3D-printed pharmaceuticals like SPRITAM, featuring precise dosage control and rapid disintegration to enhance patient adherence. Additionally, Organovo's expertise in bioprinting focuses on creating 3D-printed human tissues, revolutionizing medical research and drug testing with personalized and functional tissue constructs. This technological advancement showcases how 3D printing in Industry 4.0 enhances the efficiency of medical equipment and pioneers personalized medicine, marking a transformative shift in healthcare innovation.

Challenge: Necessity for continuous technological advancements

The adoption of Industry 4.0 encounters a significant hurdle due to the constant need for technological advancements. As technology evolves swiftly, businesses aiming to embrace Industry 4.0 principles find it challenging to keep up with the latest developments. This necessitates continual investments in equipment, software, and employee training. For instance, incorporating automated manufacturing systems, which integrate robotics and IoT devices, requires regular updates to ensure compatibility with evolving software and connectivity standards. Edge computing, crucial for real-time data processing in Industry 4.0, depends on advanced AI algorithms, compelling companies to frequently update their algorithms to maintain competitiveness. Likewise, sensor technologies, essential for data capture in Industry 4.0 applications, undergo rapid evolution, requiring regular upgrades to include the latest features. This ongoing need for technological updates can strain financial resources and impede the seamless integration of Industry 4.0 principles. Siemens, a global technology company, is a notable example, emphasizing the necessity of continuous investments to keep its digital twin solutions synchronized with evolving physical counterparts, illustrating the broader challenges faced by industries managing extensive sensor networks, automated manufacturing systems, and AI algorithms.

Industry 4.0 Market Ecosystem

The Industry 4.0 market is competitive, with major companies such as ABB, Honeywell International Inc, 3D Systems, Rockwell Automation, Siemens, and Emerson Electric Co, among others, being significant manufacturers of Industry 4.0 solutions and numerous small- and medium-sized vital enterprises. Many players offer Industry 4.0 solutions and their components, while many players and details offer integration services. These integration services are widely required in process as well as discrete industries.

Based on the technology, the digital twin segment is expected to account for the largest market share during the forecast period.

Digital twin technology is anticipated to undergo rapid expansion in the foreseeable future, primarily due to the advent of Industry 4.0 principles. Industry 4.0 signifies a transformative shift towards seamlessly integrating digital technologies with human-centric processes, wherein digital twins play a pivotal role by offering virtual representations of physical assets, processes, and systems, facilitating real-time monitoring, analysis, and optimization. This collaborative environment, characteristic of Industry 4.0, encourages synergistic interactions between humans and machines, leveraging digital twins to enhance decision-making, boost efficiency, and foster innovation across diverse manufacturing, healthcare, and transportation sectors. Moreover, Industry 4.0's focus on personalization and customization aligns well with digital twins' capabilities, enabling organizations to create tailored simulations and models to address specific needs and preferences, ultimately leading to more precise insights and superior outcomes. Overall, the convergence of digital twin technology with Industry 4.0 principles drives its expansion by unlocking new avenues for collaboration, innovation, and efficiency within an increasingly interconnected and human-centric industrial landscape.

Based on industry, the automotive segment is projected to contribute significant market share during the forecast period.

The automotive segment is poised for rapid growth in the coming years, largely due to the influence of Industry 4.0 principles. Industry 4.0 represents a significant evolution in manufacturing processes, emphasizing the seamless integration of digital technologies, automation, and human expertise. In the automotive sector, advancements such as automated manufacturing facilities, connected vehicles, and enhanced customer experiences drive the market. Industry 4.0 facilitates the development of intelligent manufacturing systems capable of real-time data analysis, predictive maintenance, and adaptive production processes, leading to increased efficiency, reduced downtime, and enhanced product quality. Additionally, Industry 4.0 promotes greater customization and personalization, allowing automotive manufacturers to tailor products and services to individual customer preferences, thereby improving customer satisfaction and brand loyalty.

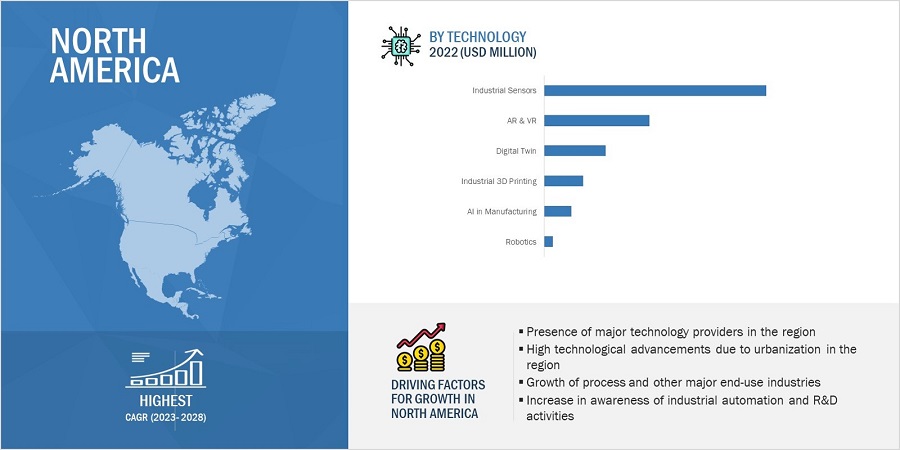

Based on region, North America is projected to grow fastest for the Industry 4.0 market

The scope of the Industry 4.0 market in North America includes the US, Canada and Mexico. The Industry 4.0 market in North America is expected to record the highest CAGR during the forecast period. Industry 4.0 represents a transformative shift in manufacturing and industry, emphasizing the integration of advanced digital technologies with traditional processes, thereby enhancing efficiency, productivity, and competitiveness. In North America, this transition is facilitated by several factors, including a strong ecosystem of technology companies, research institutions, and innovative startups, as well as robust infrastructure and a skilled workforce. Moreover, North America boasts a vibrant entrepreneurial culture and a supportive regulatory environment, which fosters innovation and encourages investment in emerging technologies.

Industry 4.0 Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Industry 4.0 market is dominated by a few globally established players such as ABB (Switzerland), Honeywell International Inc (US), 3D Systems (US), Rockwell Automation (US), Siemens (Germany ), and Emerson Electric Co (US), among others, etc.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Sustainability, Technology, End-Use and Region. |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

ABB (Switzerland), Honeywell International Inc (US), 3D Systems (US), Rockwell Automation (US), Siemens (Germany ), and Emerson Electric Co (US among others |

Industry 4.0 Market Highlights

This research report categorizes the Industry 4.0 market based on sustainability technology, end-use industry, and region

|

Segment |

Subsegment |

|

Based on Technology: |

|

|

Based on Industry |

|

|

Based on Region: |

|

Recent Developments

- In October 2023, Amphenol Corporation subsidiary Piher Sensing Systems announced the introduction of its new hcso-1w open loop current sensor. The hcso-1w is a high-accuracy sensor that is ideal for measuring AC and DC currents in battery management systems, industrial battery chargers and motor control applications.

- In June 2023, Honeywell unveiled its latest Honeywell Digital Prime solution, a cloud-based digital twin designed to streamline the monitoring, management, and testing process control changes and system modifications. This cost-effective tool empowers users to conduct frequent testing, leading to heightened precision in results and a notable reduction in the need for reactive maintenance.

- In April 2023, Stratasys introduced GrabCAD Print Pro software, including Riven’s integrated quality assurance features. This advanced software manages the print preparation process for Stratasys 3D printers, catering to manufacturers seeking efficient production of end-use parts at scale. It focuses on enhancing printed-part accuracy, minimizing waste, and reducing time to production.

Frequently Asked Questions (FAQs):

Which are the major companies in the Industry 4.0 market? What are their significant strategies to strengthen their market presence?

The major companies in the Industry 4.0 market are – ABB, Honeywell International Inc, 3D Systems, Rockwell Automation, Siemens, Emerson Electric Co, and so on. The significant strategies these players adopt are product launches and developments, contracts, collaborations, acquisitions, and expansions.

What is the potential market for Industry 4.0 in the region?

The North American region is expected to dominate the Industry 4.0 market

What are the opportunities for new market entrants?

Opportunities in the Industry 4.0 market arise from the growth of the automotive, power & energy, chemicals and medical industries.

What are the drivers and opportunities for the Industry 4.0 market?

Factors such as increasing demand for sustainable manufacturing and rising focus on technological advancements fuel the need to grow the Industry 4.0 market.

Who are the major end users of the industry expected to drive the market’s growth in the next 5 years?

The significant consumers for Industry 4.0 are automotive, electronics, energy, oil & gas, medical, and chemicals, which all show effective growth rates.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INDUSTRY 4.0 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRY 4.0: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

TABLE 1 LIST OF SECONDARY SOURCES

2.1.2.1 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Primary interviews with experts

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 SIZE ESTIMATION METHODOLOGY FOR MACHINE CONDITION MONITORING MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENTS

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 3 INDUSTRY 4.0 MARKET, 2017–2020 (USD BILLION)

TABLE 4 MARKET, 2021–2026 (USD BILLION)

FIGURE 5 EFFECT OF COVID-19 ON ARKET

3.1 POST-COVID-19 SCENARIO

TABLE 5 POST-COVID-19 SCENARIO: ARKET, 2021–2026 (USD BILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 6 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD BILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 7 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2026 (USD BILLION)

FIGURE 6 INDUSTRIAL SENSORS SEGMENT TO LEAD MARKET FROM 2021 TO 2026

FIGURE 7 APAC TO HOLD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INDUSTRY 4.0 MARKET

FIGURE 8 RAPID ADOPTION OF AI, IOT, AND BLOCKCHAIN TECHNOLOGIES IN MANUFACTURING SECTOR TO FUEL MARKET FROM 2021 TO 2026

4.2 MARKET, BY TECHNOLOGY

FIGURE 9 INDUSTRIAL SENSORS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2021 TO 2026

4.3 MARKET, BY TECHNOLOGY AND REGION

FIGURE 10 APAC TO HOLD LARGEST SIZE OF MARKET IN 2026

4.4 MARKET, BY COUNTRY

FIGURE 11 INDUSTRY 4.0 MARKET IN US TO RECORD HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 MARKET DYNAMICS: INDUSTRY 4.0 MARKET, 2020

5.2.1 DRIVERS

5.2.1.1 Rapid adoption of Artificial Intelligence (AI) and Internet of Things (IoT) in manufacturing sector

5.2.1.2 Increasing demand for industrial robots in pharmaceutical and medical device manufacturing sector

5.2.1.3 Rising government investments in 3D printing and additive manufacturing

TABLE 8 GOVERNMENT INVESTMENTS IN 3D PRINTING PROJECTS

5.2.1.4 Growing adoption of blockchain technology in manufacturing industry

FIGURE 13 MARKET: IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled workforce conversant with new developments in AI and IoT technologies

5.2.2.2 Restricted use of industrial robots in startups due to high implementation costs

5.2.2.3 High cost of 3D printing materials prevents small companies from competing with big players

5.2.2.4 Negative health effects of excessive use of AR & VR

FIGURE 14 INDUSTRY 4.0 MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing application of AI and IoT in medical wearables

5.2.3.2 Rising popularity of 5G in cloud robotics sector

5.2.3.3 Surge in use of 3D printing technology for medical equipment and customized drugs during COVID-19 pandemic

5.2.4 CHALLENGES

5.2.4.1 Susceptibility of IoT and AI technologies to cyber attacks

5.2.4.2 Interoperability and integration issues of industrial robots

5.2.4.3 High cost associated with deployment of VR technology

FIGURE 15 COST ANALYSIS: VR EQUIPMENT

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 INDUSTRY 4.0 MARKET: VALUE CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 ECOSYSTEM ANALYSIS

FIGURE 17 INDUSTRY 4.0 ECOSYSTEM

TABLE 10 ECOSYSTEM: INDUSTRY 4.0

5.6 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INDUSTRY 4.0 MARKET

FIGURE 18 INDUSTRY 4.0 (YC-YCC SHIFT)

5.7 CASE STUDY ANALYSIS

TABLE 11 IMPLEMENTATION OF INDUSTRY 4.0 SOLUTION AT HOMBURG PLANT - BOSCH REXROTH

TABLE 12 IMPLEMENTATION OF FULLY AUTOMATED PRODUCTION LINE AT FORD

5.8 TECHNOLOGY ANALYSIS

5.8.1 CLOUD COMPUTING

5.8.2 5G

5.8.3 MACHINE LEARNING IN COMPUTER VISION

5.9 PRICING ANALYSIS

TABLE 13 AVERAGE SELLING PRICE (ASP) TREND OF TOP COMPANIES FOR AGV

TABLE 14 AVERAGE SELLING PRICE (ASP) TREND OF TOP COMPANIES FOR COLLABORATIVE ROBOTS

TABLE 15 AVERAGE SELLING PRICE (ASP) TREND OF TOP COMPANIES FOR MACHINE CONDITION MONITORING SENSORS

TABLE 16 AVERAGE SELLING PRICE (ASP) TREND OF TOP COMPANIES FOR VIBRATION MONITORING SYSTEMS

5.10 TRADE ANALYSIS

5.10.1 IMPORT & EXPORT SCENARIO

FIGURE 19 IMPORT, BY COUNTRY, 2016−2020 (USD THOUSAND)

TABLE 17 IMPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 842710)

FIGURE 20 EXPORT, BY COUNTRY, 2016−2020 (USD THOUSAND)

TABLE 18 EXPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 842710)

FIGURE 21 IMPORT, BY COUNTRY, 2016−2020 (USD THOUSAND)

TABLE 19 IMPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 847950)

FIGURE 22 EXPORT, BY COUNTRY, 2016−2020 (USD THOUSAND)

TABLE 20 EXPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 847950)

FIGURE 23 IMPORT, BY COUNTRY 2016−2020 (USD MILLION)

TABLE 21 IMPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 903190)

FIGURE 24 EXPORT, BY COUNTRY, 2016−2020 (USD MILLION)

TABLE 22 EXPORT, BY COUNTRY, 2016−2020 (USD THOUSAND) (HS CODE 903190)

5.11 PATENT ANALYSIS

FIGURE 25 TOP 10 INDUSTRY 4.0 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 23 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 26 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

5.12 MARKET STANDARDS

TABLE 24 STANDARDS RELATED TO IOT IN MANUFACTURING

5.12.1 STANDARDS RELATED TO INDUSTRIAL ROBOTS

TABLE 25 STANDARDS RELATED TO 3D PRINTING AND ADDITIVE MANUFACTURING

5.12.2 STANDARDS RELATED TO MACHINE CONDITION MONITORING

6 INDUSTRY 4.0 MARKET, BY TECHNOLOGY (Page No. - 85)

FIGURE 27 MARKET, BY TECHNOLOGY

6.1MARKET FOR INDUSTRIAL ROBOTS

6.1.1 TRADITIONAL INDUSTRIAL ROBOTS

TABLE 26 MARKET FOR TRADITIONAL ROBOTS, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR TRADITIONAL ROBOTS, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 28 MARKET FOR TRADITIONAL ROBOTS, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR TRADITIONAL ROBOTS, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.1.1.1 Articulated robots

6.1.1.2 Cartesian Robots

6.1.1.3 Selective Compliance Assembly Robot Arm (SCARA)

6.1.1.4 Cylindrical Robots

6.1.1.5 Other robots

6.1.2 COLLABORATIVE ROBOTS

6.1.2.1 Emerging trend in robotics industry

TABLE 30 INDUSTRY 4.0 MARKET FOR COLLABORATIVE ROBOTS, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR COLLABORATIVE ROBOTS, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 32 MARKET FOR COLLABORATIVE ROBOTS, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR COLLABORATIVE ROBOTS, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.2 MARKET FOR BLOCKCHAIN IN MANUFACTURING

6.2.1 DEFINITION

6.2.2 BLOCKCHAIN IN MANUFACTURING

FIGURE 28 TYPICAL APPLICATIONS OF BLOCKACHAIN IN MANUFACTURING SECTOR

6.2.2.1 Drivers contributing to growth of industry 4.0 market for blockchain in manufacturing

6.2.2.1.1 Increasing demand for real-time data analyses, enhanced visibility, and proactive maintenance in manufacturing industry

6.2.2.2 Challenges to growth of market for blockchain in manufacturing

6.2.2.2.1 Concerns regarding security, privacy, and control

TABLE 34 STARTUP COMPANIES INVOLVED IN MARKET FOR BLOCKCHAIN IN MANUFACTURING

TABLE 35 FUNDING ANALYSIS FOR STARTUPS INVOLVED IN MARKET FOR BLOCKCHAIN IN MANUFACTURING

6.3 INDUSTRY 4.0 MARKET FOR INDUSTRIAL SENSORS

TABLE 36 MARKET FOR INDUSTRIAL SENSORS, BY SENSOR TYPE, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR INDUSTRIAL SENSORS, BY SENSOR TYPE, 2021–2026 (USD MILLION)

TABLE 38 MARKET FOR INDUSTRIAL SENSORS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 39 MARKET FOR INDUSTRIAL SENSORS, BY TYPE, 2021–2026 (USD MILLION)

6.3.1 LEVEL SENSORS

6.3.1.1 Used for level sensing and measurement in factories

6.3.2 TEMPERATURE SENSORS

6.3.2.1 Growing use in process and non-process applications

6.3.3 FLOW SENSORS

6.3.3.1 Increasing demand in oil & energy industries

6.3.4 POSITION SENSORS

6.3.4.1 Increasing application areas due to technological advancements

6.3.5 PRESSURE SENSORS

6.3.5.1 Used in semiconductor processing, robotics, and test & measurement applications

6.3.6 FORCE SENSORS

6.3.6.1 Increasing use of force sensors in automated robots

6.3.7 HUMIDITY & MOISTURE SENSORS

6.3.7.1 High demand in chemicals, pharmaceuticals, oil & gas, and food & beverages industries

6.3.8 GAS SENSORS

6.3.8.1 Used in industries to measure concentration of gases in air

TABLE 40 INDUSTRY 4.0 MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 42 MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.4 MARKET FOR INDUSTRIAL 3D PRINTING

6.4.1 EVOLUTION OF INDUSTRIAL 3D PRINTING TO DRIVE INDUSTRY 4.0 MARKET

TABLE 44 MARKET FOR INDUSTRIAL 3D PRINTING, BY OFFERINGS, 2017–2020 (USD MILLION)

TABLE 45 INDUSTRY 4.0 FOR INDUSTRIAL 3D PRINTING, BY OFFERINGS, 2021–2026 (USD MILLION)

TABLE 46 MARKET FOR INDUSTRIAL 3D PRINTING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR INDUSTRIAL 3D PRINTING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 48 MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS, 2017–2020 (USD MILLION)

TABLE 49 INDUSTRY 4.0 MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS, 2021–2026 (USD MILLION)

TABLE 50 MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 MARKET FOR INDUSTRIAL 3D PRINTING, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 52 MARKET FOR INDUSTRIAL 3D PRINTING, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 53 MARKET FOR INDUSTRIAL 3D PRINTING, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.5 INDUSTRY 4.0 MARKET FOR MACHINE VISION

TABLE 54 MARKET FOR MACHINE VISION, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 55 MARKET FOR MACHINE VISION, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 56 MARKET FOR MACHINE VISION, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 57 MARKET FOR MACHINE VISION, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 58 MARKET FOR MACHINE VISION, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR MACHINE VISION, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 60 MARKET FOR MACHINE VISION, BY PROCESS INDUSTRY, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR MACHINE VISION, BY PROCESS INDUSTRY, 2021–2026 (USD MILLION)

TABLE 62 MARKET FOR MACHINE VISION, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 63 MARKET FOR MACHINE VISION, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.5.1 CAMERA

6.5.1.1 Digital Camera

6.5.1.2 Smart Camera

6.5.2 FRAME GRABBERS, OPTICS, AND LED LIGHTING

6.5.2.1 Increasing demand for LED and laser lighting

6.5.3 PROCESSOR AND SOFTWARE

6.5.3.1 Important part of machine vision systems

6.6 INDUSTRY 4.0 MARKET FOR HMI

6.6.1 MARKET FOR HMI, BY OFFERING

FIGURE 29 HMI MARKET, BY OFFERING

TABLE 64 MARKET FOR HMI, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 65 MARKET FOR HMI, BY OFFERING, 2021–2026 (USD MILLION)

6.6.1.1 Hardware

FIGURE 30 MARKET FOR HMI, BY HARDWARE

TABLE 66 MARKET FOR HMI, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 67 MARKET FOR HMI, BY HARDWARE, 2021–2026 (USD MILLION)

6.6.1.1.1 Basic HMI

6.6.1.1.1.1 High demand for simple and price-sensitive applications

6.6.1.1.2 Advanced Panel-based HMI

6.6.1.1.2.1 Ability to implement high-performance visualization

6.6.1.1.3 Advanced PC-based HMI

6.6.1.1.3.1 Offers IoT and cloud connectivity for big data analytics

6.6.1.1.4 Others

6.6.1.2 Software

FIGURE 31 HMI MARKET, BY SOFTWARE

6.6.1.2.1 On-premises HMI

6.6.1.2.1.1 Increased adoption due to need for data security and customization

6.6.1.2.2 Cloud-based HMI

6.6.1.2.2.1 Low installation cost encourages adoption by small enterprises

TABLE 68 MARKET FOR HMI, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR HMI, BY SOFTWARE, 2021–2026 (USD MILLION)

6.6.1.3 Services

6.6.2 INDUSTRY 4.0 MARKET FOR HMI, BY CONFIGURATION

FIGURE 32 MARKET FOR HMI, BY CONFIGURATION

TABLE 70 MARKET FOR HMI, BY CONFIGURATION, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR HMI, BY CONFIGURATION, 2021–2026 (USD MILLION)

6.6.2.1 Embedded HMI

6.6.2.1.1 Offers enormous benefits to end users

6.6.2.2 Standalone HMI

6.6.2.2.1 Requirement for smaller HMI solutions drives demand

6.6.3 INDUSTRY 4.0 MARKET FOR HMI, BY TECHNOLOGY

6.6.3.1 Motion HMI

6.6.3.2 Bionic HMI

6.6.3.3 Tactile HMI

6.6.3.4 Acoustic HMI

6.6.4 MARKET FOR HMI, BY END-USER INDUSTRY

FIGURE 33 MARKET FOR HMI, BY END-USER INDUSTRY

TABLE 72 MARKET FOR HMI, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR HMI, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

6.6.4.1 Process industries

FIGURE 34 MARKET FOR HMI, BY PROCESS INDUSTRIES

TABLE 74 MARKET FOR HMI, BY PROCESS INDUSTRIES, 2017–2020 (USD MILLION)

TABLE 75 MARKET FOR HMI, BY PROCESS INDUSTRIES, 2021–2026 (USD MILLION)

6.6.4.1.1 Oil & Gas

6.6.4.1.1.1 Increasing demand for HMI solutions for remote monitoring

6.6.4.1.2 Food & beverages

6.6.4.1.2.1 Stringent quality requirements encourage adoption of HMI solutions

6.6.4.1.3 Pharmaceuticals

6.6.4.1.3.1 Surging adoption of HMI solutions due to complex manufacturing processes

6.6.4.1.4 Chemicals

6.6.4.1.4.1 Demand for HMI solutions to increase operational efficiency

6.6.4.1.5 Energy & power

6.6.4.1.5.1 Surging demand for advanced monitoring solutions

6.6.4.1.6 Metals & mining

6.6.4.1.6.1 High-risk operations require adoption of HMI solutions

6.6.4.1.7 Water & wastewater

6.6.4.1.7.1 Technological advancements in water treatment operations raise need for HMI solutions

6.6.4.1.8 Others

6.6.4.2 Discrete industry

FIGURE 35 INDUSTRY 4.0 MARKET FOR HMI, BY DISCRETE INDUSTRIES

TABLE 76 MARKET FOR HMI, BY DISCRETE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 77 MARKET FOR HMI, BY DISCRETE INDUSTRY, 2021–2026 (USD MILLION)

6.6.4.2.1 Automotive

6.6.4.2.1.1 Technological innovations to boost demand for HMI solutions

6.6.4.2.2 Aerospace & defense

6.6.4.2.2.1 Adoption of HMI solutions to ensure reliability of equipment

6.6.4.2.3 Packaging

6.6.4.2.3.1 Increasing emphasis on quality packaging boosts demand for HMI solutions

6.6.4.2.4 Medical devices

6.6.4.2.4.1 Growing need to monitor medical device manufacturing processes

6.6.4.2.5 Semiconductor & electronics

6.6.4.2.5.1 High competition increases demand for HMI solutions

6.6.4.2.6 Other discrete industries

6.7 INDUSTRY 4.0 MARKET FOR ARTIFICIAL INTELLIGENCE IN MANUFACTURING

TABLE 78 MARKET FOR AI IN MANUFACTURING, 2017–2026 (USD MILLION)

6.7.1 ARTIFICIAL INTELLIGENCE IN MANUFACTURING, BY OFFERING

TABLE 79 MARKET FOR AI IN MANUFACTURING, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR AI IN MANUFACTURING, BY OFFERING, 2021–2026 (USD MILLION)

6.7.1.1 Hardware

TABLE 81 MARKET FOR AI IN MANUFACTURING, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR AI IN MANUFACTURING, BY HARDWARE, 2021–2026 (USD MILLION)

6.7.1.1.1 Processor

FIGURE 36 GPU MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 83 MARKET FOR AI IN MANUFACTURING, BY PROCESSOR, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR AI IN MANUFACTURING, BY PROCESSOR, 2021–2026 (USD MILLION)

6.7.1.1.1.1 MPU

6.7.1.1.1.2 GPU

6.7.1.1.1.3 FPGA

6.7.1.1.1.4 ASIC

6.7.1.1.2 Memory

6.7.1.1.2.1 Development and deployment of high-bandwidth memory for AI applications

6.7.1.1.3 Network

6.7.1.1.3.1 Increasing demand for next generation networks in smart factories

6.7.1.2 Software

TABLE 85 INDUSTRY 4.0 MARKET FOR AI IN MANUFACTURING, FOR OFFERING, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR AI IN MANUFACTURING, FOR OFFERING, BY SOFTWARE, 2021–2026 (USD MILLION)

6.7.1.2.1 AI solutions

6.7.1.2.1.1 On-premises

6.7.1.2.1.1.1 Preferred by data-sensitive enterprises

6.7.1.2.1.2 Cloud

6.7.1.2.1.2.1 AI solution providers focusing on development of robust cloud-based solutions

6.7.1.2.2 AI platform

6.7.1.2.2.1 Machine learning framework

6.7.1.2.2.1.1 Helps speed up smart factory operations

6.7.1.2.2.2 Application program interface

6.7.1.2.2.2.1 Provides building blocks for software applications

6.7.1.3 Services

TABLE 87 MARKET FOR AI IN MANUFACTURING, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR AI IN MANUFACTURING, BY SERVICES, 2021–2026 (USD MILLION)

6.7.1.3.1 Deployment & integration

6.7.1.3.1.1 Key service for configuring AI systems in manufacturing

6.7.1.3.2 Support & maintenance

6.7.1.3.2.1 Required to keep systems at an acceptable standard

6.7.1.4 Impact of COVID-19 on various AI technology offerings for manufacturing

6.7.2 INDUSTRY 4.0 MARKET FOR ARTIFICIAL INTELLIGENCE IN MANUFACTURING, BY TECHNOLOGY

TABLE 89 MARKET FOR AI IN MANUFACTURING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR AI IN MANUFACTURING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

FIGURE 37 MACHINE LEARNING TO HOLD LARGEST SHARE OF MARKET FOR AI IN MANUFACTURING IN 2020 AND 2026

6.7.2.1 Machine learning

TABLE 91 MARKET FOR AI IN MANUFACTURING, FOR MACHINE LEARNING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR AI IN MANUFACTURING, FOR MACHINE LEARNING, BY TYPE, 2021–2026 (USD MILLION)

6.7.2.1.1 Deep learning

6.7.2.1.1.1 In demand for predictive maintenance and quality control purposes

6.7.2.1.2 Supervised learning

6.7.2.1.2.1 Used for facial recognition and other applications

6.7.2.1.3 Reinforcement learning

6.7.2.1.3.1 Allows systems and software to determine ideal behavior to maximize performance

6.7.2.1.4 Unsupervised learning

6.7.2.1.4.1 Uses clustering methods on unlabeled training data

6.7.2.1.5 Others

6.7.2.2 Natural language processing

6.7.2.2.1 Serves wide range of speech recognition applications

6.7.2.3 Context-aware computing

6.7.2.3.1 Accelerated growth due to development of sophisticated hard and soft sensors

TABLE 93 INDUSTRY 4.0 MARKET FOR AI IN MANUFACTURING, FOR CONTEXT-AWARE COMPUTING, BY TYPE, 2017–2020 (USD MILLION)

TABLE 94 MARKET FOR AI IN MANUFACTURING, FOR CONTEXT-AWARE COMPUTING, BY TYPE, 2021–2026 (USD MILLION)

6.7.2.4 Computer vision

6.7.2.4.1 Used for predictive maintenance and machinery inspection purposes

6.7.3 ARTIFICIAL INTELLIGENCE IN MANUFACTURING, BY APPLICATION

TABLE 95 MARKET FOR AI IN MANUFACTURING, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 MARKET FOR AI IN MANUFACTURING, BY APPLICATION, 2021–2026 (USD MILLION)

FIGURE 38 QUALITY CONTROL TO WITNESS HIGHEST GROWTH THROUGH FORECAST PERIOD

6.7.3.1 Predictive maintenance and machinery inspection

6.7.3.1.1 Provides framework for all planned maintenance activities

6.7.3.2 Material movement

6.7.3.2.1 AI-based technology streamlines in-plant logistics

6.7.3.3 Production planning

6.7.3.3.1 Helps standardize product and process sequence

6.7.3.4 Field services

6.7.3.4.1 Extensively used in heavy metals & machine manufacturing, oil & gas, and energy & power industries

6.7.3.5 Quality control

6.7.3.5.1 Wide use of AI-based quality control systems in pharmaceuticals, food & beverages, and semiconductor industries

6.7.3.6 Cybersecurity

6.7.3.6.1 Growing need for cybersecurity systems due to automation in manufacturing

6.7.3.7 Industrial robots

6.7.3.7.1 Help increase productivity and efficiency

6.7.3.8 Reclamation

6.7.3.8.1 AI-based systems used to detect important components in waste or slag

6.7.4 ARTIFICIAL INTELLIGENCE IN MANUFACTURING, BY INDUSTRY

TABLE 97 INDUSTRY 4.0 MARKET FOR AI IN MANUFACTURING, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET FOR AI IN MANUFACTURING, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 39 AUTOMOBILE HELD LARGEST SIZE OF AI IN MANUFACTURING MARKET IN 2020

6.7.4.1 Automobile

6.7.4.1.1 Wide use of machine learning and computer vision in automobile industry

6.7.4.1.2 Impact of COVID-19 on AI in manufacturing market for automobile industry

6.7.4.2 Energy & power

6.7.4.2.1 AI-based solutions enhance production output and reduce downtime

6.7.4.2.2 Impact of COVID-19 on AI in manufacturing market for energy & power industry

6.7.4.3 Pharmaceuticals

6.7.4.3.1 Growing demand for AI solutions from Chinese pharmaceuticals industry

6.7.4.3.2 Impact of COVID-19 on AI in manufacturing market for pharmaceuticals industry

6.7.4.4 Heavy metals & machine manufacturing

6.7.4.4.1 Heavy demand for AI solutions expected from APAC

6.7.4.4.2 Impact of COVID-19 on AI in manufacturing market for heavy metals & machine manufacturing industry

6.7.4.5 Semiconductors & electronics

6.7.4.5.1 AI likely to optimize production cost, technology implementation, and integration of components

6.7.4.5.2 Impact of COVID-19 on AI in manufacturing market for semiconductor & electronics industry

6.7.4.6 Food & beverages

6.7.4.6.1 AI-based solutions enhance quality of food production

6.7.4.6.2 Impact of COVID-19 on AI in manufacturing market for food & beverages industry

6.7.4.7 Others

6.8 INDUSTRY 4.0 MARKET FOR DIGITAL TWIN

6.8.1 MARKET FOR DIGITAL TWIN, BY TECHNOLOGY

FIGURE 40 MARKET FOR DIGITAL TWIN, BY TECHNOLOGY

6.8.1.1 Internet of Things (IOT)

6.8.1.2 Blockchain

6.8.1.3 Artificial intelligence & machine learning

6.8.1.4 Augmented reality, virtual reality & mixed reality

6.8.1.5 Big data analytics

6.8.1.6 5G

6.8.2 INDUSTRY 4.0 MARKET FOR DIGITAL TWIN, BY USAGE TYPE

FIGURE 41 MARKET FOR DIGITAL TWIN, BY USAGE TYPE

TABLE 99 MARKET FOR DIGITAL TWIN, BY USAGE TYPE, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR DIGITAL TWIN, BY USAGE TYPE, 2021–2026 (USD MILLION)

6.8.2.1 Product digital twin

6.8.2.1.1 Expected to witness significant growth during forecast period

6.8.2.2 Process digital twin

6.8.2.2.1 Plays major role in digital twin market

6.8.2.3 System digital twin

6.8.2.3.1 Expected to dominate market during forecast period

6.8.3 INDUSTRY 4.0 MARKET FOR DIGITAL TWIN, BY APPLICATION

FIGURE 42 MARKET FOR DIGITAL TWIN, BY APPLICATION

FIGURE 43 MARKET FOR DIGITAL TWIN, BY APPLICATION (2021–2026)

TABLE 101 MARKET FOR DIGITAL TWIN, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 102 MARKET FOR DIGITAL TWIN, BY APPLICATION, 2021–2026 (USD MILLION)

6.8.3.1 Product design & development

6.8.3.1.1 Expected to register steady market growth

6.8.3.2 Performance monitoring

6.8.3.2.1 Likely to see rising demand in future

6.8.3.3 Predictive maintenance

6.8.3.3.1 Reduces maintenance costs and operational downtime

6.8.3.4 Inventory management

6.8.3.4.1 High demand in transportation & logistics industry

6.8.3.5 Business optimization

6.8.3.5.1 Expected to dominate market during forecast period

6.8.3.6 Others

6.8.4 INDUSTRY 4.0 MARKET FOR DIGITAL TWIN, BY INDUSTRY

FIGURE 44 MARKET FOR DIGITAL TWIN, BY INDUSTRY

TABLE 103 MARKET FOR DIGITAL TWIN, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR DIGITAL TWIN, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 45 AUTOMOTIVE & TRANSPORTATION TO DOMINATE MARKET FOR DIGITAL TWIN DURING FORECAST PERIOD

6.8.4.1 Aerospace & defense

6.8.4.1.1 Expected to witness significant market growth

6.8.4.2 Automotive

6.8.4.2.1 Likely to dominate Industry 4.0 market during forecast period

6.8.4.3 Home & commercial

6.8.4.3.1 Stable growth expected in post-COVID-19 period

6.8.4.4 Healthcare

6.8.4.4.1 Least affected segment during COVID-19 crisis

6.8.4.5 Energy & utilities

6.8.4.5.1 Increasing digitalization to boost market

6.8.4.6 Oil & gas

6.8.4.6.1 High demand for system digital twins

6.8.4.7 Agriculture

6.8.4.7.1 Expected to witness significant growth during forecast period

6.8.4.8 Telecommunication

6.8.4.8.1 Expected to boost market growth post 5G commercialization

6.8.4.9 Retail

6.8.4.9.1 Inventory management segment to account for largest share of market

6.8.4.10 Others

6.8.4.10.1 Increasing demand for digital twin in semiconductor manufacturing industry

6.9 INDUSTRY 4.0 MARKET FOR AUTOMATED GUIDED VEHICLES (AGV)

6.9.1 MARKET FOR AGV, BY TYPE

FIGURE 46 MARKET FOR AGV, BY TYPE

FIGURE 47 TOW VEHICLES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SIZE OF AGV MARKET IN 2021

TABLE 105 MARKET FOR AGV, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 MARKET FOR AGV, BY TYPE, 2021–2026 (USD MILLION)

6.9.1.1 Tow vehicles

6.9.1.1.1 Expected to hold largest size of market in 2020

TABLE 107 MARKET FOR AGV, FOR TOW VEHICLES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 108 MARKET FOR AGV, FOR TOW VEHICLES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.1.2 Unit load carriers

6.9.1.2.1 Major demand from automotive industry

TABLE 109 INDUSTRY 4.0 MARKET FOR AGV, FOR UNIT LOAD CARRIERS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 110 MARKET FOR AGV, FOR UNIT LOAD CARRIERS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.1.3 Pallet trucks

6.9.1.3.1 Vision-guided pallet trucks to register highest growth during forecast period

TABLE 111 MARKET FOR PALLET TRUCKS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 112 MARKET FOR PALLET TRUCKS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.1.4 Assembly line vehicles

6.9.1.4.1 Wide use for transportation of subassemblies

TABLE 113 MARKET FOR AGV, FOR ASSEMBLY LINE VEHICLES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 114 MARKET FOR AGV, FOR ASSEMBLY LINE VEHICLES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.1.5 Forklift trucks

6.9.1.5.1 Increasing demand for forklift trucks in applications involving heavy materials

TABLE 115 INDUSTRY 4.0 MARKET FOR AGV, FOR FORKLIFT TRUCKS, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 116 MARKET FOR AGV, FOR FORKLIFT TRUCKS, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.1.6 Others

TABLE 117 MARKET FOR AGV, FOR OTHER TYPES, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 118 MARKET FOR AGV, FOR OTHER TYPES, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.2 MARKET FOR AGV, BY NAVIGATION TECHNOLOGY

FIGURE 48 AGV MARKET, BY NAVIGATION TECHNOLOGY

TABLE 119 MARKET FOR AGV, BY NAVIGATION TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 120 MARKET FOR AGV, BY NAVIGATION TECHNOLOGY, 2021–2026 (USD MILLION)

6.9.2.1 Laser guidance

6.9.2.1.1 Expected to hold largest size of market during forecast period

6.9.2.2 Magnetic guidance

6.9.2.2.1 Chiefly used in food & beverages and automotive industries

6.9.2.3 Inductive guidance

6.9.2.3.1 Wide use due to lack of intereference from external noise

6.9.2.4 Optical tape guidance

6.9.2.4.1 Increasing demand in end use industries requiring clean environments

6.9.2.5 Vision guidance

6.9.2.5.1 Expected to register highest CAGR during forecast period

6.9.2.6 Others

6.9.3 INDUSTRY 4.0 MARKET FOR AGV, BY INDUSTRY

FIGURE 49 AGV MARKET, BY INDUSTRY

FIGURE 50 AUTOMOTIVE SEGMENT TO HOLD LARGEST SIZE OF MARKET FOR AGV FROM 2021 TO 2026

TABLE 121 MARKET FOR AGV, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 122 MARKET FOR AGV, BY INDUSTRY, 2020–2025 (USD MILLION)

6.9.3.1 Automotive

6.9.3.1.1 Largest share of market during forecast period

6.9.3.2 Metal & heavy machinery

6.9.3.2.1 Growing demand for AGVs to ensure safety in material handling

6.9.3.3 Food & beverages

6.9.3.3.1 Increased global demand driving adoption of AGVs

6.9.3.4 Chemicals

6.9.3.4.1 Use of AGVs to ensure employee safety and manage workflow effectively

6.9.3.5 Healthcare

6.9.3.5.1 Wide use of AGVS to comply with clean environment requirements

6.9.3.6 3PL

6.9.3.6.1 Increased online retailing activities drives demand for AGVs

6.9.3.7 Semiconductors & electronics

6.9.3.7.1 Increased demand for AGVs in cleanroom applications

6.9.3.8 Aviation

6.9.3.8.1 Use of AGVs for manufacturing and assembly operations

6.9.3.9 E-commerce

6.9.3.9.1 Expected to grow at highest rate from 2021 to 2026

6.9.3.10 Others

6.10 INDUSTRY 4.0 MARKET FOR MACHINE CONDITION MONITORING

6.10.1 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE

FIGURE 51 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE

FIGURE 52 VIBRATION MONITORING SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR MACHINE CONDITION MONITORING FROM 2021 TO 2026

TABLE 123 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 124 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

6.10.1.1 Vibration monitoring

6.10.1.1.1 Significance of route-based monitoring services in vibration monitoring technique

FIGURE 53 INDUSTRY 4.0 MARKET FOR VIBRATION MONITORING, BY SYSTEM TYPE, 2020

6.10.1.2 Embedded systems

6.10.1.2.1 Wide adoption in oil & gas and power generation industries

6.10.1.3 Vibration analyzers and meters

6.10.1.3.1 Support effective machine condition monitoring

6.10.1.4 Thermography

6.10.1.4.1 High adoption due to ability to detect large number of defects

6.10.1.5 Oil analysis

6.10.1.5.1 Advantages of oil analysis make it prominent machine condition monitoring technique

FIGURE 54 ADVANTAGES OF OIL ANALYSIS TECHNIQUE

6.10.1.6 Corrosion monitoring

6.10.1.6.1 Defects detected by corrosion monitoring help prevent corrosion of equipment

6.10.1.7 Ultrasound emission

6.10.1.7.1 Ultrasound emission monitoring helps detect defects in electric equipment

6.10.1.8 Motor current analysis

6.10.1.8.1 Early detection of faults by motor current analysis monitoring technique

6.10.2 INDUSTRY 4.0 MARKET FOR MACHINE CONDITION MONITORING, BY OFFERING

FIGURE 55 MARKET FOR MACHINE CONDITION MONITORING, BY OFFERING

FIGURE 56 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET FOR MACHINE CONDITION MONITORING, BY OFFERING, FROM 2021 TO 2026

TABLE 125 MARKET FOR MACHINE CONDITION MONITORING, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 126 MARKET FOR MACHINE CONDITION MONITORING, BY OFFERING, 2021–2026 (USD MILLION)

6.10.2.1 Hardware

6.10.2.1.1 Vibration sensors

6.10.2.1.2 Accelerometers

6.10.2.1.2.1 Increased deployment in industrial plants to monitor machine acceleration

6.10.2.1.3 Proximity probes

6.10.2.1.3.1 Used for accurate displacement measurement of devices

6.10.2.1.4 Tachometers

6.10.2.1.4.1 Rising adoption to effectively monitor speed of rotating machines

6.10.2.1.5 Infrared sensors

6.10.2.1.5.1 Thermal infrared sensors

6.10.2.1.5.1.1 Increased use to detect possible heat-induced faults in machines

6.10.2.1.5.2 Quantum infrared sensors

6.10.2.1.5.2.1 High demand for quantum infrared sensors to identify temperature variations in machines

6.10.2.1.6 Spectrometers

6.10.2.1.6.1 Infrared spectrometers

6.10.2.1.6.1.1 Growing demand for infrared spectrometers to identify various materials

6.10.2.1.6.2 Ultraviolet spectrometers

6.10.2.1.6.2.1 Significant tools for oil analysis

6.10.2.1.6.3 Atomic spectrometers

6.10.2.1.6.3.1 Increasingly used to identify foreign particles in oil samples

6.10.2.1.6.4 Mass spectrometers

6.10.2.1.6.4.1 Used to identify contaminating compounds in lubricating oil samples

6.10.2.1.7 Ultrasound detectors

6.10.2.1.7.1 Sound pressure meters

6.10.2.1.7.1.1 Increased use for noise level measurements

6.10.2.1.7.2 Stethoscopes

6.10.2.1.7.2.1 Surging penetration in industries to monitor noise in machine components

6.10.2.1.7.3 Ultrasound leak detectors

6.10.2.1.7.3.1 Growing adoption for identification of leakage in vacuum and compressed air systems

6.10.2.1.8 Spectrum analyzers

6.10.2.1.8.1 Real-time spectrum analyzers

6.10.2.1.8.1.1 Increased adoption for motor current analysis

6.10.2.1.9 Corrosion probes

6.10.2.1.9.1 Growing use for corrosion rate measurements

6.10.2.1.10 Others

TABLE 127 MARKET FOR MACHINE CONDITION MONITORING HARDWARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 MARKET FOR MACHINE CONDITION MONITORING HARDWARE, BY TYPE, 2021–2026 (USD MILLION)

6.10.2.2 Software

TABLE 129 LIST OF MACHINE CONDITION MONITORING SOFTWARE PROVIDERS

6.10.2.2.1 Data integration

6.10.2.2.1.1 Eliminates need to maintain multiple data logs for monitoring equipment

6.10.2.2.2 Diagnostic reporting

6.10.2.2.2.1 Increased use to analyze overall health of industrial machines and plants

6.10.2.2.3 Order tracking analysis

6.10.2.2.3.1 Increasingly used for signal amplitude measurements

6.10.2.2.4 Parameter calculation

6.10.2.2.4.1 Increased deployment in industrial plants to evaluate reliability parameters of equipment

TABLE 130 INDUSTRY 4.0 MARKET FOR MACHINE CONDITION MONITORING SOFTWARE, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 131MARKET FOR MACHINE CONDITION MONITORING SOFTWARE, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

6.10.3 MARKET FOR MACHINE CONDITION MONITORING, BY DEPLOYMENT TYPE

FIGURE 57 MARKET FOR MACHINE CONDITION MONITORING, BY DEPLOYMENT TYPE

FIGURE 58 ON-PREMISES DEPLOYMENT SEGMENT TO ACCOUNT FOR LARGER SIZE OF MARKET FOR MACHINE CONDITION MONITORING BY DEPLOYMENT FROM 2021 TO 2026

TABLE 132 MARKET FOR MACHINE CONDITION MONITORING, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 133 MARKET FOR MACHINE CONDITION MONITORING, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

6.10.3.1 On-premises deployment

6.10.3.1.1 Limitations of on-premises deployment to impact market growth

FIGURE 59 LIMITATIONS OF ON-PREMISES DEPLOYMENT OF MACHINE CONDITION MONITORING SOLUTIONS AND SYSTEMS

6.10.3.2 Cloud deployment

6.10.3.2.1 Advantages over on-premises deployment to drive demand

FIGURE 60 ADVANTAGES OF CLOUD DEPLOYMENT OF MACHINE CONDITION MONITORING SYSTEMS AND SOLUTIONS

6.10.4 INDUSTRY 4.0 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING PROCESS

FIGURE 61 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING PROCESS

FIGURE 62 ONLINE CONDITION MONITORING SEGMENT TO LEAD MARKET FOR MACHINE CONDITION MONITORING FROM 2021 TO 2026

TABLE 134 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING PROCESS, 2017–2020 (USD MILLION)

TABLE 135 MARKET FOR MACHINE CONDITION MONITORING, BY MONITORING PROCESS, 2021–2026 (USD MILLION)

6.10.4.1 Online condition monitoring

6.10.4.1.1 Delivers real-time machinery health information to plant operators

TABLE 136 INDUSTRY 4.0 MARKET FOR ONLINE MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 137 MARKET FOR ONLINE MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

6.10.4.2 Portable condition monitoring

6.10.4.2.1 Cost-effective condition monitoring process

TABLE 138 MARKET FOR PORTABLE MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2017–2020 (USD MILLION)

TABLE 139 MARKET FOR PORTABLE MACHINE CONDITION MONITORING, BY MONITORING TECHNIQUE, 2021–2026 (USD MILLION)

6.10.5 MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY

FIGURE 63 MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY

TABLE 140 MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 141 MARKET FOR MACHINE CONDITION MONITORING, BY INDUSTRY, 2021–2026 (USD MILLION)

6.10.5.1 Oil & gas

6.10.5.1.1 Use of Industry 4.0 solutions to address machine condition monitoring requirements

6.10.5.2 Power generation

6.10.5.2.1 Investments in sustainable energy to increase adoption of machine condition monitoring systems and solutions

FIGURE 64 GLOBAL INVESTMENTS IN RENEWABLE ENERGY, 2010–2019 (USD BILLION)

6.10.5.3 Mining & metals

6.10.5.3.1 Use of vibration sensors to identify faults in mining machinery

6.10.5.4 Chemicals

6.10.5.4.1 Deployment of machine condition monitoring solutions and systems to monitor chemical processes

6.10.5.5 Automotive

6.10.5.5.1 IoT enables adoption of simple machine condition monitoring solutions

6.10.5.6 Aerospace & defense

6.10.5.6.1 Adoption of smart factory solutions for machine condition monitoring

6.10.5.7 Food & beverages

6.10.5.7.1 Rapid technological developments to fuel demand for machine condition monitoring systems and solutions

6.10.5.8 Marine

6.10.5.8.1 Predictive maintenance gaining significant importance in global marine industry

6.10.5.9 Others

7 GEOGRAPHIC ANALYSIS (Page No. - 228)

7.1 INTRODUCTION

FIGURE 65 INDUSTRY 4.0 MARKET IN US TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 143 MARKET, BY REGION, 2021–2026 (USD BILLION)

7.2 NORTH AMERICA

FIGURE 66 NORTH AMERICA: SNAPSHOT OF MARKET

7.2.1 US

7.2.1.1 Growing manufacturing base accounts for large size of market

7.2.2 CANADA

7.2.2.1 Demand from food & beverage processing industry to drive market

7.2.3 MEXICO

7.2.3.1 Growing government impetus propelling demand for Industry 4.0 technologies

TABLE 145 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD BILLION)

7.3 EUROPE

FIGURE 67 EUROPE: SNAPSHOT OF INDUSTRY 4.0 MARKET

7.3.1 GERMANY

7.3.1.1 Government initiatives to promote smart factories drives market growth

7.3.2 UK

7.3.2.1 Growing market for AI and blockchain propels growth of market

7.3.3 FRANCE

7.3.3.1 Increasing government efforts to boost use of AI and IoT technologies in manufacturing sector

7.3.4 REST OF EUROPE

7.3.4.1 Increasing manufacturing base offers lucrative growth opportunities

TABLE 146 INDUSTRY 4.0 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD BILLION)

TABLE 147 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD BILLION)

7.4 APAC

FIGURE 68 APAC: SNAPSHOT OF MARKET

7.4.1 CHINA

7.4.1.1 Increasing labor costs contribute to growth of market

7.4.2 JAPAN

7.4.2.1 Ongoing developments in smart manufacturing processes to boost market

7.4.3 INDIA

7.4.3.1 Make in India campaign to boost demand for Industry 4.0 solutions in manufacturing sector

7.4.4 SOUTH KOREA

7.4.4.1 Increasing government investments to spur market growth

7.4.5 REST OF APAC

7.4.5.1 Developing manufacturing sector to support market growth

TABLE 149 INDUSTRY 4.0 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD BILLION)

7.5 ROW

FIGURE 69 ROW: SNAPSHOT OF MARKET

7.5.1 SOUTH AMERICA

7.5.1.1 Increasing penetration of AI and IoT technologies in Brazil and Argentina to drive market growth

7.5.2 MIDDLE EAST & AFRICA

7.5.2.1 High adoption of advanced automation solutions in Middle East oil & gas sector

TABLE 151 MARKET IN ROW, BY REGION, 2021–2026 (USD BILLION)

7.6 IMPACT OF COVID-19 ON REGIONS

8 COMPETITIVE LANDSCAPE (Page No. - 244)

8.1 OVERVIEW

8.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 70 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN INDUSTRY 4.0 MARKET

8.3 MARKET SHARE ANALYSIS (2020)

TABLE 152 INDUSTRIAL ROBOTS MARKET: MARKET SHARE ANALYSIS

TABLE 153 INDUSTRIAL SENSORS MARKET: MARKET SHARE ANALYSIS

TABLE 154 INDUSTRIAL 3D PRINTING MARKET: MARKET SHARE ANALYSIS

TABLE 155 DIGITAL TWIN MARKET: MARKET SHARE ANALYSIS

TABLE 156 AI IN MANUFACTURING MARKET: MARKET SHARE ANALYSIS

8.4 COMPANY EVALUATION QUADRANT, 2020

8.4.1 STAR

8.4.2 PERVASIVE

8.4.3 EMERGING LEADER

8.4.4 PARTICIPANT

FIGURE 71 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

8.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2020

8.5.1 PROGRESSIVE COMPANY

8.5.2 RESPONSIVE COMPANY

8.5.3 DYNAMIC COMPANY

8.5.4 STARTING BLOCK

FIGURE 72 MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

TABLE 157 MARKET: COMPANY FOOTPRINT

TABLE 158 COMPANY INDUSTRY FOOTPRINT

TABLE 159 COMPANY REGION FOOTPRINT

8.6 COMPETITIVE SCENARIO

TABLE 160 MARKET: PRODUCT LAUNCHES, MARCH 2020−MARCH 2021

TABLE 161 MARKET: DEALS, MARCH 2020−MARCH 2021

9 COMPANY PROFILES (Page No. - 257)

(Business overview, Products offered, Recent developments & MnM View)*

9.1 KEY PLAYERS

9.1.1 3D SYSTEMS

TABLE 162 3D SYSTEMS: BUSINESS OVERVIEW

FIGURE 73 3D SYSTEMS: COMPANY SNAPSHOT

9.1.2 ABB

TABLE 163 ABB: BUSINESS OVERVIEW

FIGURE 74 ABB: COMPANY SNAPSHOT

9.1.3 ADVANTECH

TABLE 164 ADVANTECH: BUSINESS OVERVIEW

FIGURE 75 ADVANTECH: COMPANY SNAPSHOT

9.1.4 BASLER

TABLE 165 BASLER: BUSINESS OVERVIEW

FIGURE 76 BASLER: COMPANY SNAPSHOT

9.1.5 CISCO SYSTEMS

TABLE 166 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 77 CISCO SYSTEMS: COMPANY SNAPSHOT

9.1.6 COGNEX CORPORATION

TABLE 167 COGNEX CORPORATION: BUSINESS OVERVIEW

FIGURE 78 COGNEX CORPORATION: COMPANY SNAPSHOT

9.1.7 DAIFUKU

TABLE 168 DAIFUKU: BUSINESS OVERVIEW

FIGURE 79 DAIFUKU: COMPANY SNAPSHOT

9.1.8 EMERSON ELECTRIC

TABLE 169 EMERSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 80 EMERSON ELECTRIC: COMPANY SNAPSHOT

9.1.9 GENERAL ELECTRIC

TABLE 170 GENERAL ELECTRIC : BUSINESS OVERVIEW

FIGURE 81 GENERAL ELECTRIC: COMPANY SNAPSHOT

9.1.10 HONEYWELL INTERNATIONAL

FIGURE 82 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

9.1.11 IBM

TABLE 171 IBM: BUSINESS OVERVIEW

FIGURE 83 IBM: COMPANY SNAPSHOT

9.1.12 INTEL

TABLE 172 INTEL: BUSINESS OVERVIEW

FIGURE 84 INTEL: COMPANY SNAPSHOT

9.1.13 JOHN BEAN TECHNOLOGIES CORPORATION

TABLE 173 JOHN BEAN TECHNOLOGIES CORPORATION : BUSINESS OVERVIEW

FIGURE 85 JOHN BEAN TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

9.1.14 NVIDIA

TABLE 174 NVIDIA: BUSINESS OVERVIEW

FIGURE 86 NVIDIA: COMPANY SNAPSHOT

9.1.15 SIEMENS

TABLE 175 SIEMENS: BUSINESS OVERVIEW

FIGURE 87 SIEMENS: COMPANY SNAPSHOT

9.1.16 STRATASYS

TABLE 176 STRATASYS: BUSINESS OVERVIEW

FIGURE 88 STRATASYS: COMPANY SNAPSHOT

9.1.17 TECHMAN ROBOT

TABLE 177 TECHMAN ROBOT: BUSINESS OVERVIEW

9.1.18 UNIVERSAL ROBOTS

TABLE 178 UNIVERSAL ROBOTS : BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

9.2 OTHER PLAYERS

9.2.1 ADDVERB TECHNOLOGIES

9.2.2 AIBRAIN

9.2.3 ALGOLUX

9.2.4 BECKHOFF AUTOMATION

9.2.5 BIGCHAINDB GMBH

9.2.6 LOGILUBE

9.2.7 PRATITI TECHNOLOGIES

9.2.8 SCULPTEO

9.2.9 SIGFOX

10 ADJACENT AND RELATED MARKETS (Page No. - 326)

10.1 INTRODUCTION

10.2 LIMITATIONS

10.3 EXTENDED REALITY MARKET, BY REGION

TABLE 179 EXTENDED REALITY MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 180 EXTENDED REALITY MARKET, BY REGION, 2021–2026 (USD BILLION)

10.3.1 NORTH AMERICA

TABLE 181 EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 182 EXTENDED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.2 EUROPE

TABLE 183 EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 184 EXTENDED REALITY MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 APAC

TABLE 185 EXTENDED REALITY MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 186 EXTENDED REALITY MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.4 ROW

TABLE 187 EXTENDED REALITY MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 188 EXTENDED REALITY MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

11 APPENDIX (Page No. - 333)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

To estimate the size of the Industry 4.0 market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to to identify and collect information for this study on the Industry 4.0 market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCES |

WebLink |

|

International Federation of Robotics (IFR) |

www.ifr.org/ |

|

IEEE Robotics and Automation Society |

www.ieee-ras.org |

|

Processing Magazines |

www.processingmagazine.com |

|

Sensors Online |

www.sensorsmag.com |

|

International Federation of Robotics |

www.ifr.org |

|

3D Printing Association |

www.the3dprintingassociation.com |

|

Chinese Association of Automation |

https://www.caa.org.cn/ |

|

Association for the Advancement of Artificial Intelligence (AAAI) |

https://www.aaai.org/ |

Primary Research

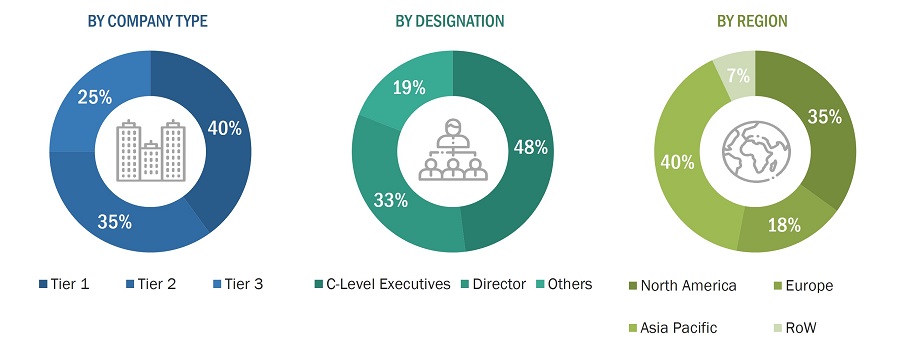

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using Industry 4.0 , were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of Industry 4.0 , which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the Industry 4.0 market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players’ annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Industry 4.0 Market Size: Botton Up Approach

- Identifying various Industry 4.0 technology manufacturers

- Analyzing the penetration of each component through secondary and primary research

- Analyzing integration of Industry 4.0 in different applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of Industry 4.0 s and their implementation in multiple industries; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Global Industry 4.0 Market Size: Top-Down Approach

The top-down approach has been used to estimate and validate the total size of the Industry 4.0 market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the Industry 4.0 market, further splitting the market on the basis of sustainability, technology, end-use industry, and region, and listing the key developments

- Identifying leading players in the Industry 4.0 market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the Industry 4.0 market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

"Industry 4.0 " refers to the latest stage in the evolution of industrial manufacturing processes, characterized by the seamless integration of digital technologies with human expertise. While previous industrial revolutions focused primarily on automation and machine-centric production, Industry 4.0 emphasizes the harmonious collaboration between humans and machines to achieve optimal results. This paradigm shift seeks to leverage advanced technologies such as artificial intelligence, robotics, the Internet of Things (IoT), and augmented reality to enhance productivity, innovation, and customization while maintaining a human-centric approach to manufacturing. Industry 4.0 aims to empower workers with smart tools and technologies, enabling them to perform tasks more efficiently, creatively, and safely, ultimately leading to more sustainable and resilient industrial ecosystems.

Key Stakeholders

- Industry 4.0 Manufacturers

- Industry 4.0 Suppliers

- Industry 4.0 Integrators

- Industry 4.0 distributors

- Industry 4.0 software solution providers

- Technology investors

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startups

- Educational Institutes and Universities

- Component Suppliers and Distributors

- Logistics and shipment companies

Report Objectives

- To define, describe, and forecast the Industry 4.0 market based on sustainability, technology, end-use industry and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a market value chain analysis.

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, and regulatory bodies, government agencies, and regulations pertaining to the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research & development (R&D) in the market

- To analyze the impact of the recession on the Industry 4.0 market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Industry 4.0 market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Industry 4.0 market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industry 4.0 Market