The study involved four major activities in estimating the current size of the semiconductor intellectual property (IP) market —exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include high-speed data converter technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

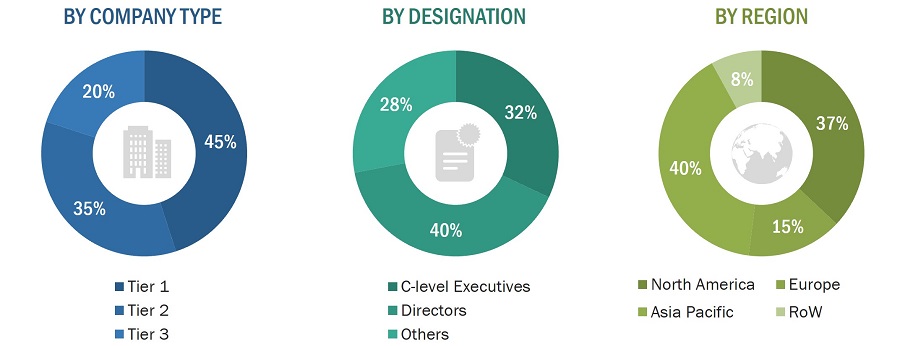

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the semiconductor intellectual property (IP) market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

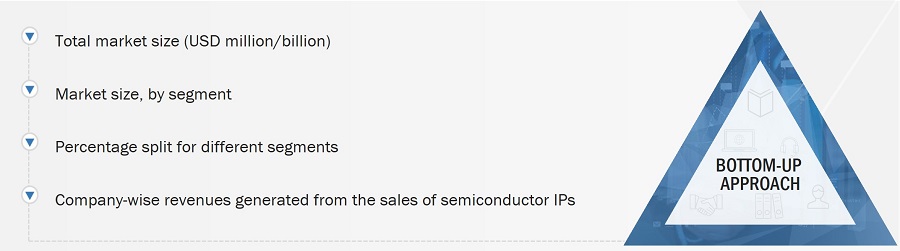

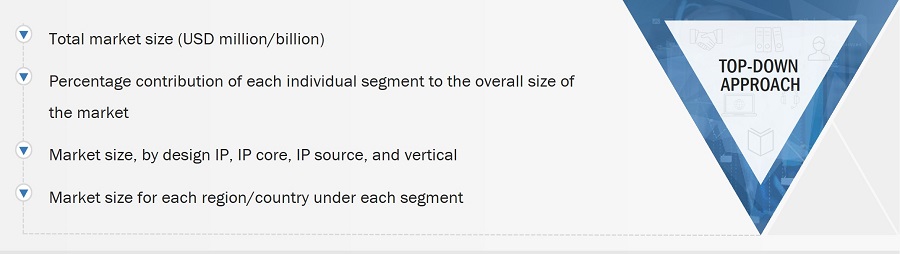

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the semiconductor intellectual property (IP) market and other dependent submarkets listed in this report.

-

Extensive secondary research has identified key players in the industry and market.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Semiconductor Intellectual Property (Ip) Market: Bottom-Up Approach

Semiconductor Intellectual Property (Ip) Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

Semiconductor intellectual property (IP) is a unit of logic, cell, or chip layout design utilized to manufacture integrated circuits (ICs) and complex circuits. Semiconductor IP is a predefined circuit that can be integrated into a large System-on-Chip (SoC) design. The development of new ICs requires the use of designed IP cores, also called IP blocks, which are licensed to manufacturers to make end products. The IP cores can be owned and used by anyone and developed in-house. They can be used as building blocks within semiconductor chips to add advanced features and characteristics by developing them according to the prescribed architectural design.

Key Stakeholders

-

IP suppliers

-

IP core developers

-

Integrated device manufacturers (IDMs)

-

IDM players

-

Third-party IP developers

-

IP licensors (licensing vendors)

-

Open-source IP vendors

-

IP aggregators

-

Electronic design automation (EDA) vendors

-

Non-pure-play (IDM) foundry vendors

-

Fabrication players

-

Raw material vendors

-

Semiconductor IP solution providers

-

System integrators

-

Original equipment manufacturers (OEMs)/Device manufacturers

-

Technology standard organizations, forums, alliances, and associations

-

Governments, financial institutions, and investment communities

-

Research organizations

-

Analysts and strategic business planners

-

Venture capitalists, private equity firms, and startups

Report Objectives

The following are the primary objectives of the study.

-

To forecast the size of the semiconductor intellectual property (IP) market, in terms of value, based on design IP, IP source, IP core, end user, interface type, vertical, and region

-

To describe and forecast the market, in terms of value, for various segments across four main regions: North America, Asia Pacific, Europe, and Rest of the World (RoW)

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To study the complete value chain and related industry segments and perform a value chain analysis of the semiconductor intellectual property (IP) market landscape

-

To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s Five Forces, import and export scenarios for products covered under HS code 8542 trade landscape, and case studies pertaining to the market under study

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

-

To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

-

To strategically profile the key players and provide a detailed competitive landscape of the semiconductor intellectual property (IP) market

-

To analyze strategic approaches adopted by the leading players in the semiconductor intellectual property (IP) market, including product launches/developments and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

User

Sep, 2019

Hello, I work in UMC IPDS (IP Development and Design Support) department, coordinating several outsourcing IP projects with ARM, Cadence, Synopsys, True Circuit, Mixel, Analog Bits, eSilicon etc. This article about IP market to 2023 is definitely an intesresting/worth-reading one for person like me so I expect to get the pdf version with details. Thank you for sharing. .

User

Sep, 2019

Like to know what IP verticals and corresponding IPs are considered for this report and correlation with the market size. Companies in US are offering customer centric IP design to grab the market share. I want to understand what value proposition these players are offering and what is the opportunity in that business style?.

User

Sep, 2019

We are into core IP design business offering soft Ips (both standard and application specific). We are trying to understand the market trend in semiconductor segment to identify business opportunity with machine learning. We want to understand how big the opportunity in next 2-3 years, speciafically in China market..

User

Nov, 2019

I am trying to migrate Kisel from being an RFIC design services provider to an RF silicon IP vendor. RF IP seems to be a non-exisiting market and is not included in your report. My special field of interst is therefore Mixed-signal and Analog IP. Best regards, Pelle Wijk.

User

Mar, 2019

Hello, we are a startup trying to get some high-level numbers on the size of the "soft" IP market (FPGA IP). I was hoping you might be able to provide an excerpt from this Report - perhaps from either Section 5.2.2 or Table 30/31. Thanks in advance!.