LiDAR Drone Market by LiDAR Type (Topographic, Bathymetric), By Component (LiDAR Lasers, UAV Cameras), Drone Type (Rotary-wing, Fixed-wing), Range (Short-range, Medium-range, Long-range), Application, Region - Global Forecast to 2027

LiDAR Drone Market

LiDAR Drone Market and Top Companies

- Phoenix Aerial Systems (US) − Phoenix Aerial Systems, which was founded in May 2012, rebranded itself to Phoenix LiDAR Systems in November 2016. The company deals in LiDAR drone technologies used for various surveying applications. The offerings of Phoenix LiDAR Systems include LiDAR systems and LiDAR based fixed-wing drones. The LiDAR systems offered by the company are equipped with LiDAR sensors manufactured by RIEGL Laser Measurement Systems GmbH (Austria) and Velodyne LiDAR, Inc. (US). The company also offers LiDAR services and software for planning, data acquisition, and post-processing of the acquired data.

- RIEGL Laser Measurement Systems GmbH (Austria) −RIEGL Laser Measurement Systems GmbH develops and manufactures laser rangefinders, distance meters, and scanners. The company deals in LiDAR systems used in terrestrial, industrial, mobile, airborne, and bathymetric applications. It also offers LiDAR systems that can be deployed on drones. LiDAR drones and LiDAR scanners offered by RIEGL Laser Measurement Systems GmbH are used in precision farming, corridor mapping, environment surveying, landslide monitoring, archeology, construction, forestry monitoring, and mining applications.

- Velodyne LiDAR, Inc. (US) − Velodyne LiDAR, Inc. develops and sells LiDAR systems. The LiDAR systems offered by the company are used in drones that are employed in agriculture & forestry, construction, oil & gas, telecommunication, utilities, and wind energy sectors. The company has offices in countries such as the US, China, and Germany. Moreover, it has strong distribution networks in North America, South America, Europe, the Middle East, Africa, Asia Pacific, and Australia.

- Teledyne Optech (Canada) − Teledyne Optech is a part of Teledyne Technologies, Inc. (US). The company designs, develops, and manufactures advanced LiDAR instruments. The LiDAR systems offered by Teledyne Optech are used in large-area mapping, powerline and transportation corridor monitoring, natural resource management, engineering and infrastructure modeling, urban mapping, and defense & security applications. The company has its corporate offices in Canada, the US, and China.

- UMS Skeldar (Switzerland) - UMS Skeldar is a joint venture between UMS AERO Group (Switzerland) and Saab AB (Sweden). It provides drone solutions for complex applications. The LiDAR drone product portfolio of the company consists of V-200 Skeldar and R- 350 tactical drones with high payload capacity. These drones employ visual detection and ranging (ViDAR) technology and can be used for advanced complex applications, including reconnaissance, identification, target acquisition, and electronic warfare. Moreover, these drones can be used for other civilian applications such as inspections, mapping, forestry monitoring, agriculture, and wildlife protection.

- LiDARUSA (US) – LiDARUSA develops economical drones and mobile mapping systems equipped with the latest scanning, navigation, and imaging tools. The company offers lightweight and easy to operate LiDAR systems, integrated with Matrice 200 and 210 drone series of DJI (China). The LiDAR scanners used by the company in its products are manufactured by RIEGL Laser Measurement Systems GmbH (Austria) and Velodyne LiDAR, Inc. (US). The products offered by LiDARUSA can be used in agriculture, mining, forestry monitoring, corridor mapping, and archeology applications.

LiDAR Drone Market and Top Applications

- Corridor Mapping − LiDAR drones are used to create 3D maps of terrains using short-range, medium-range, or long-range lasers. They are used for corridor mapping by surveying and creating a 3D point cloud of roads, railways, power lines, and mines. The final output of LiDAR scanning is used to generate digital terrain models (DTMs) and digital surface models (DSMs) that contain the elevation profiles of the surveyed areas.

- Archeology − Traditional archeology requires hundreds of man-hours for poring over old sites and tromping through muddy fields. The increasing adoption of LiDAR drones for archeology has made these activities a matter of a few days. LiDAR drones have increased the quality of documentation of archeological surveys.

- Construction − The use of LiDAR drones in the construction sector for designing, surveying, and mapping applications has led to the creation of new workflows, processes, and applications to decrease associated risks. These drones offer 3D models of land while penetrating through vegetation covers, thereby enabling construction companies to plan efficiently.

- Environment − LiDAR drones have been extensively used in the environment application for surveying and monitoring environmental resources. The micro-topographical data is collected by LiDAR drones for the environment assessment of an area. Environment assessment is very important to measure and understand the impact of human activities on the environment.

- Entertainment − Companies operating in the LiDAR drone market have been deploying their LiDAR drones for entertainment applications. LiDAR drones are used to create digital terrain maps (DTMs) of a particular area. This data can be used to create virtual environments, which are extremely close to the real world and are used in video games, movies, etc.

LiDAR Drone Market and Top Types

- Rotary-wing LiDAR Drones − Rotary-wing LiDAR drones, also known as multi-rotor LiDAR drones, comprise a central body and side propellers. These propellers enable drones to take flight. They are also used to maneuver drones. Usually, rotary-wing LiDAR drones have 4 rotors. The number of these rotors can reach to 6 or 8. The motion of inflight drones is controlled by propellers by varying the relative speed of each rotor.

- Fixed-wing LiDAR Drones − Fixed-wing LiDAR drones are traditional UAVs that have a designing process similar to that of an airplane. These types of LiDAR drones are less popular. They are mainly used in agriculture and oil & gas mapping applications. Fixed-wing LiDAR drones have significant range and high stability. They recover safely from motor power loss and have a linear flight.

Updated on : October 22, 2024

LiDAR Drone Market Size & Share

The LiDAR Drone Market is witnessing robust growth, driven by increasing demand for high-precision mapping and surveying solutions across various sectors, including agriculture, construction, and environmental monitoring. This technology offers unparalleled accuracy in data collection, allowing users to generate detailed topographic maps and 3D models efficiently. Key trends shaping the market include the integration of advanced sensors and artificial intelligence, which enhance data processing capabilities and improve the overall usability of LiDAR systems. Additionally, the rising awareness of the benefits of LiDAR technology over traditional surveying methods is further fueling market expansion. As we look to the future, the LiDAR Drone Market is expected to continue its upward trajectory, with advancements in drone technology and increasing applications in urban planning, disaster management, and natural resource management, positioning it as a vital tool in the evolving landscape of data collection and analysis.

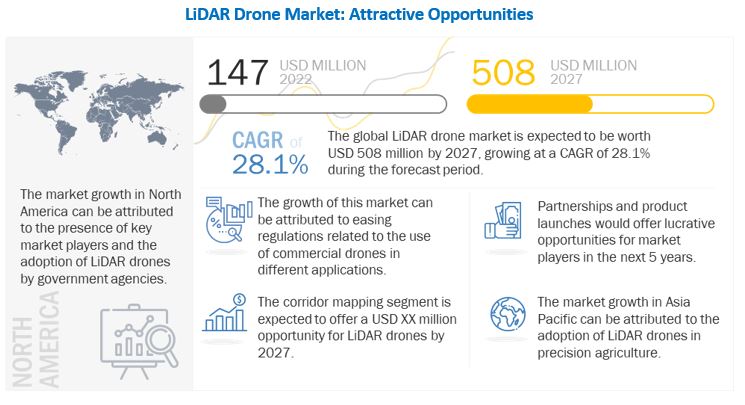

The global LiDAR drone market size is projected to grow from USD 147 million in 2022 to USD 508 million by 2027; growing at a Compound Annual Growth Rate (CAGR) of 28.1% from 2022 to 2027.

The market growth is driven by factors including adoption of LiDAR drone in mining, corridor mapping, and precision agriculture applications; and easing of regulations related to use of commercial drones. Additionally, government initiatives encouraging use of LiDAR drones for large-scale surveys and emergence of 4D LiDAR sensors are factors expected to create growth opportunities during the forecast period. However, high purchasing and operational costs of LiDAR drones, and issues related to drone safety and security are challenging the LiDAR drone industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

LiDAR Drone Market Dynamics :

Adoption of LiDAR drones in mining applications

Mines across the world are under continuous production. The processes require the accurate collection and processing of large amounts of information. Inaccurate measurements in coal or iron mines lead to inefficient operations and may affect the desired output and quality of products. There are four types of mining, namely, underground, placer, in-situ, and open pit. Traditional measurement methods use GNSS, total station, and other equipment that require surveyors to go on site and perform measurements. These methods are time-consuming and typically not safe. Additionally, the data generated through these methods cannot be visualized globally, thus, restricting digital updates in modern mines. LiDAR drone technology has emerged as an effective solution to overcome the challenges of difficult topography, hazardous conditions, and other mine site issues. LiDAR is cutting-edge technology in the field of surveying and mapping. LiDAR integrated drones enable the measurement of three-dimensional coordinates of objects on the ground, penetrate vegetation, and apply a point cloud filtering method to generate a high-precision digital terrain model.

Stringent regulations and restrictions related to use of drones in various countries

The popularity of LiDAR drones is increasing worldwide owing to their growing use in a wide range of applications for accurate data acquisition. Although a few countries have relaxed regulations related to the use of drones, several countries have stringent policies regulating the use of drones. Hence, permissions from different government entities are required for flying them. Moreover, drone operators must incur huge registration fees and seek approvals before each flight. Some countries such as Algeria, Barbados, Brunei, Cote d’Ivoire, Cube, Iran, Kenya, Kuwait, Kyrgyzstan, Madagascar, Morocco, Nicaragua, Saudi Arabia, Senegal, Sri Lanka, Syria, and Uzbekistan have restricted the use of drones. These kinds of policies act as restraining factors for the growth of the LiDAR drone market.

Emergence of 4D LiDAR sensors

4D LiDAR sensors have all features of 3D LiDAR sensors, along with cameras. 4D LiDAR-based drones can be used in a number of applications such as battle damage assessment, mission planning, and environment management. The videos from these cameras can be merged with LiDAR technology for capturing multi-megapixel images at a speed of up to 30 frames per second with accurate depth for each pixel. As a result, these cameras can process real-time data by 100x, thereby providing the exact location of the targeted objects and their motion with respect to their surrounding environments. The emergence of 4D LiDAR sensors is expected to act as an opportunity for the growth of the LiDAR drone market.

High purchasing and operational costs of LiDAR drones

LiDAR drones are complicated systems that require high input power from batteries for surveying applications. The power consumed by LiDAR drones depends on the components installed on them. The cost of these drones varies from USD 50,000 to USD 300,000. LiDAR sensors are high-cost sensors deployed on drones with high payloads to carry them safely. The use of heavyweight drones increases their overall purchasing and operational costs. High-end LiDAR drones have several components such as LiDAR sensors, UAV cameras, global positioning systems (GPS), global navigation satellite systems (GNSS), initial measurement units (IMUs), and heavy batteries installed on them, which increases their overall costs.

LiDAR lasers to dominate LiDAR drone market by component throughout the forecast period

LiDAR lasers are among the main components of LiDAR drones. They are extensively used for carrying out different types of surveys. LiDAR lasers are used to scan the environment. They record the time taken by the reflected signals from objects to reach the detectors. The measurement of time-of-flight (ToF) reflection time can be used for distances ranging from a few meters to several kilometers. During the scanning process, LiDAR laser systems gather information and 3D images of the surrounding environments.

Bathymetric LiDAR to grow at a highest CAGR between 2022 and 2027

Bathymetric LiDAR is preferred over other bathymetry methods, including sonar owing to considerable accuracy in various applications. A bathymetric LiDAR system employs two lasers of different wavelengths. The wavelength of the green channel is optimal for penetrating water and therefore measuring the water depth. The red return signal gives the height of the plane above the water. The water depth is calculated from the time difference between the two return signals. As the green laser pulse travels through the water column and reflects off the seafloor, it undergoes absorption, scattering, and refraction.

Short-range LiDAR drones to record for largest market share in 2027

The growth of short-range LiDAR drones segment can be attributed to the increased global demand for short-range LiDAR drones, which are lightweight and offer highly detailed data acquisition. Short-range LiDAR drones have gained traction over the last few years owing to their increased use by surveyors, as no additional permissions are required to fly them. Short-range LiDAR drones operate with high accuracy in a range of less than 200m and are suitable for carrying out small-scale surveys. These short-range LiDAR drones are lightweight and offer improved maneuverability with increased battery life.

Market in APAC to grow significantly during the forecast period

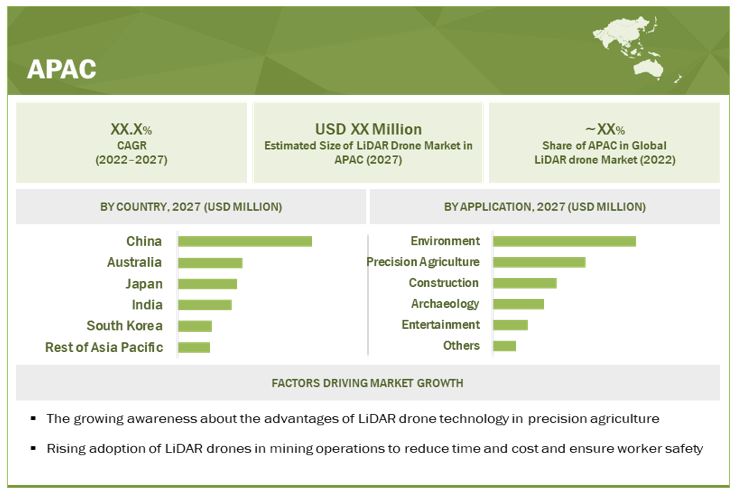

The LiDAR drone market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The fastest growth of the LiDAR drone market in Asia Pacific can be attributed to the growing opportunities for LiDAR drones for surveying and mapping operations in infrastructural development projects, forest management, and mining activities in the region. Moreover, moderate government policies related to the use of LiDAR drones, easy availability of low-cost LiDAR drones, and the presence of local players in the region are expected to drive the growth of the LiDAR drone market in Asia Pacific during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in LiDAR Drone Industry

The LiDAR drone companies such as Velodyne Lidar, Inc.(US), RIEGL Laser Measurement Systems GmbH (Austria), Teledyne Optech Inc. (Canada), Phoenix LiDAR Systems (US), Microdrones (Germany), YellowScan (France), UMS Skeldar (Switzerland), LIDARUSA (US), SICK AG (Germany), and GeoCue Group (US).

LiDAR Drone Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 147 Million |

| Projected Market Size | USD 508 Million |

| Growth Rate | 28.1% At a CAGR |

|

Market size available for years |

2018—2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Million), Volume (Million Units) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Short-range LiDAR drones |

| Highest CAGR Segment | Bathymetric LiDAR |

This report categorizes the LiDAR Drone market based on LiDAR type, drone type, components, drone range, application, and region.

LiDAR Drone Market, LiDAR Type:

- Topographic

- Bathymetric

LiDAR Drone Market, by Drone Type:

- Rotary-wing LiDAR Drones

- Fixed-wing LiDAR Drones

LiDAR Drone Market, by Component:

- LiDAR Lasers

- Navigation and positioning systems

- UAV cameras

- Others

LiDAR Drone Market, by Drone Range:

- Short-range LiDAR Drones

- Medium-range LiDAR Drones

- Long-range LiDAR Drones

LiDAR Drone Market, by Application:

- Corridor mapping

- Archaeology

- Construction

- Environment

- Enterntainment

- Precision Agriculture

- other

LiDAR Drone Market, by region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

See Also

- UK LiDAR Drone Market to Grow at a CAGR 27.3% from 2022 to 2027

- Germany LiDAR Drone Market to Grow at a CAGR 27.7% from 2022 to 2027

Recent Developments in LiDAR Drones Market

- In June 2022, Phoenix LiDAR systems launched the HydroRANGER, which provides dual-purpose topographic and bathymetric measurements for complete scene mapping of shoreline systems.

- In May 2022, YellowScan announced the addition of Dat Hop Co. Ltd., a supplier of products and solutions for the geospatial industry and hydrographic survey solutions in Vietnam, to its YellowScan Global Partners Network. Through this, YellowScan aims to strengthen its presence in the Asia Pacific region.

- In December 2021, RIEGL Laser Measurement Systems GmbH released the new version of the software suite, which is used for processing RIEGL kinematic laser scan data.

- In June 2021, Velodyne introduced the Velabit LiDAR sensor for safety-critical applications, used in infrastructure, automobile, sidewalk, industry, and UAV mapping.

- In February 2021, Phoenix LiDAR Systems announced a partnership with NORDIC UNMANNED (Norway) to provide the best industry-leading products (LiDAR, UAVs, UAS, photogrammetry, 3D measurements). NORDIC UNMANNED is the only listed drone operator in Europe.

Frequently Asked Questions (FAQs):

Which are the major companies in the LiDAR drone market? What are their major strategies to strengthen their market presence?

Velodyne Lidar, Inc.(US), RIEGL Laser Measurement Systems GmbH (Austria), Teledyne Optech Inc.(Canada), Phoenix LiDAR Systems (US), and Microdrones (Germany). These companies have adopted organic as well as inorganic growth strategies such as product launches, and partnerships to gain competitive advantage in the market.

Which is the potential market for LiDAR Drone in terms of the region?

APAC is the region with high growth opportunities owing to the presence of countries such as China and South Korea, India, Australia. Rising adoption innovative technologies in industries in China, South Korea, and Japan also facilitate growth to the market.

What are the opportunities for new market entrants?

Factors such as development of 4D scanning, use of cloud computing in the LiDAR drones are creating opportunities for the players in the market.

Which applications are expected to drive the growth of the market in the next six years?

Corridor mapping, environment, and precision agriculture are applications with highest opportunities for LiDAR drone adoption. LiDAR drones flying at low altitudes are preferable for corridor mapping applications, as they collect data accurately. They are used to carry out corridor mapping for the transportation sector to support the planning and management of roads or railway tracks, which require high spatial resolution and accurate mapping. LiDAR drones have been extensively used in the environment application for surveying and monitoring environmental resources. LiDAR drones collect micro-topographical data for the environmental assessment of an area. Additionally, LiDAR drones are widely adopted for monitoring agricultural farms and providing crop viability, crop categorization, and crop mapping inputs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LIDAR DRONE MARKET: GEOGRAPHIC SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2.1 RESEARCH DATA

FIGURE 2 LIDAR DRONE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 List of key primary interview participants

2.1.3.3 Breakdown of primaries

2.1.3.4 Key data from primary sources

2.1.3.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 3 LIDAR DRONE MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 LIDAR DRONE MARKET, 2018–2027 (USD MILLION)

FIGURE 8 TOPOGRAPHIC LIDAR TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

FIGURE 9 LIDAR LASERS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 10 ROTARY-WING LIDAR DRONES TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 11 CORRIDOR MAPPING TO HOLD LARGEST SHARE OF MARKET IN 2027

FIGURE 12 NORTH AMERICA EXPECTED TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

FIGURE 13 ADOPTION OF LIDAR DRONES IN MINING APPLICATIONS TO BOOST MARKET GROWTH

4.2 MARKET, BY LIDAR TYPE

FIGURE 14 TOPOGRAPHIC LIDAR TO HOLD LARGER MARKET SIZE IN 2027

4.3 MARKET, BY COMPONENT

FIGURE 15 LIDAR LASERS TO DOMINATE MARKET IN 2027

4.4 MARKET, BY DRONE TYPE

FIGURE 16 ROTARY-WING LIDAR DRONES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.5 MARKET IN NORTH AMERICA, BY COUNTRY AND APPLICATION

FIGURE 17 US AND CORRIDOR MAPPING TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2027

4.6 MARKET, BY COUNTRY

FIGURE 18 US TO HOLD LARGEST SHARE OF LIDAR DRONE MARKET IN 2027

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Adoption of LiDAR drones in mining applications

5.2.1.2 Easing of regulations related to use of commercial drones

5.2.1.3 Growing demand for LiDAR drones for corridor mapping and precision agriculture applications

FIGURE 20 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Easy availability of low-cost and lightweight photogrammetry systems

5.2.2.2 Stringent regulations and restrictions related to use of drones in various countries

FIGURE 21 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives encourage use of LiDAR drones for large-scale surveys

5.2.3.2 Emergence of 4D LiDAR sensors

FIGURE 22 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 High purchasing and operational costs of LiDAR drones

5.2.4.2 Issues related to drone safety and security

FIGURE 23 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: MAJOR VALUE ADDITION BY MANUFACTURERS OF LIDAR DRONE COMPONENTS AND THEIR INTEGRATORS AND DISTRIBUTORS

5.4 LIDAR DRONE MARKET: ECOSYSTEM

FIGURE 25 LIDAR DRONE MARKET: ECOSYSTEM

TABLE 1 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICES OF LIDAR DRONE COMPONENTS OFFERED BY TOP COMPANIES, 2021

TABLE 3 INDICATIVE PRICES OF LIDAR DRONES

5.5.1 AVERAGE SELLING PRICES OF KEY PLAYERS

FIGURE 26 AVERAGE SELLING PRICES OF KEY PLAYERS, BY COMPONENT

TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS, BY COMPONENT (USD)

5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE (AI)-POWERED LIDAR

5.7.2 LIDAR DRONE TECHNOLOGIES

5.7.2.1 2D LiDAR Drones

5.7.2.2 3D LiDAR Drones

5.7.2.3 4D LiDAR Drones

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON LIDAR DRONE MARKET, 2021

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.10 CASE STUDIES

5.10.1 VENTUS-TECH USED YELLOWSCAN’S SURVEYOR SYSTEM TO GENERATE PRECISE MAPPING DATA

5.10.2 GEODETICS USES VELODYNE COST-EFFICIENT LIDAR SENSORS

5.10.3 GEOTERRA AND FLYTHRU PARTNERED WITH NEATH PORT TALBOT COUNCIL AND EARTH SCIENCE TO SOLVE YSTALYFERA MOUNTAINSIDE ISSUE

5.10.4 SENSEFLY FIXED-WING DRONES HELPED PUBLIC POWER CORPORATION S.A. (PPC) CALCULATE LIGNITE VOLUMES

5.10.5 WITH HONEYWELL, IMU LIDAR USA ACHIEVED GREATER LOCATION ACCURACY ON GROUND AND IN AIR

5.11 TRADE ANALYSIS

FIGURE 29 IMPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 30 EXPORT DATA, BY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS, 2012–2022

FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 8 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 9 LIST OF FEW PATENTS IN LIDAR DRONE MARKET, 2020–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 10 LIDAR DRONE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATIONS AND STANDARDS

TABLE 11 REGULATIONS AND STANDARDS FOR LIDAR DRONES

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.1 INTRODUCTION

FIGURE 33 TOPOGRAPHIC LIDAR TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

TABLE 15 MARKET, BY LIDAR TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY LIDAR TYPE, 2022–2027 (USD MILLION)

6.2 TOPOGRAPHIC LIDAR

6.2.1 HIGHLY ADOPTED IN MAPPING AND SURVEYING APPLICATIONS

6.3 BATHYMETRIC LIDAR

6.3.1 PRODUCE HIGH-QUALITY UNDERWATER DATA

7.1 INTRODUCTION

FIGURE 34 LIDAR LASERS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 17 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 LIDAR LASERS

7.2.1 KEY COMPONENTS IN MEASURING LARGE DISTANCES

TABLE 19 LIDAR LASERS: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 20 LIDAR LASERS: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

7.3 NAVIGATION AND POSITIONING SYSTEMS

7.3.1 OBTAIN ACCURATE GEOGRAPHICAL INFORMATION IN LIDAR DRONES

TABLE 21 NAVIGATION AND POSITIONING SYSTEMS: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 22 NAVIGATION AND POSITIONING SYSTEMS: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

7.4 UAV CAMERAS

7.4.1 COMBINE LIDAR DATA AND CAMERA IMAGES FOR ACCURATE, COLORED IMAGES

TABLE 23 UAV CAMERAS: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 24 UAV CAMERAS: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

7.5 OTHERS

TABLE 25 OTHERS: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 26 OTHERS: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

8.1 INTRODUCTION

FIGURE 35 ROTARY-WING LIDAR DRONES TO GROW AT HIGHER CAGR FROM 2022 TO 2027

TABLE 27 LIDAR DRONE MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 28 LIDAR DRONE MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

8.2 ROTARY-WING LIDAR DRONES

8.2.1 ROTARY-WING LIDAR DRONES ARE LOW-COST AND HIGHLY FLEXIBLE

TABLE 29 ROTARY-WING LIDAR DRONES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 30 ROTARY-WING LIDAR DRONES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 31 ROTARY-WING LIDAR DRONES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 ROTARY-WING LIDAR DRONES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 33 ROTARY-WING LIDAR DRONES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 ROTARY-WING LIDAR DRONES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 FIXED-WING LIDAR DRONES

8.3.1 FIXED-WING LIDAR DRONES HAVE SIGNIFICANT RANGE AND HIGH STABILITY

TABLE 35 FIXED-WING LIDAR DRONES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 36 FIXED-WING LIDAR DRONES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 37 FIXED-WING LIDAR DRONES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 FIXED-WING LIDAR DRONES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 39 FIXED-WING LIDAR DRONES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 FIXED-WING LIDAR DRONES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.1 INTRODUCTION

FIGURE 36 MEDIUM-RANGE LIDAR DRONES PROJECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 41 MARKET, BY RANGE, 2018–2021 (USD MILLION)

TABLE 42 MARKET, BY RANGE, 2022–2027 (USD MILLION)

9.2 SHORT-RANGE LIDAR DRONES

9.2.1 USED TO CONDUCT SMALL-SCALE SURVEYS

9.3 MEDIUM-RANGE LIDAR DRONES

9.3.1 SUITABLE FOR MEDIUM-SCALE MAPPING APPLICATIONS

9.4 LONG-RANGE LIDAR DRONES

9.4.1 RISING DEPLOYMENT TO SCAN LARGE AREAS

10.1 INTRODUCTION

FIGURE 37 CORRIDOR MAPPING TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

TABLE 43 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 45 RECENT PROJECTS INVOLVING USE OF LIDAR DRONES

10.2 CORRIDOR MAPPING

10.2.1 INCREASED ADOPTION OF LIDAR DRONES TO SURVEY DIFFICULT TERRAINS

TABLE 46 CORRIDOR MAPPING: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 47 CORRIDOR MAPPING: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 48 CORRIDOR MAPPING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 CORRIDOR MAPPING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 ARCHAEOLOGY

10.3.1 LIDAR DRONES HELP IN SITE DOCUMENTATION AND 3D MODELING OF ARCHAEOLOGICAL SITES

TABLE 50 ARCHAEOLOGY: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 51 ARCHAEOLOGY: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 52 ARCHAEOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 ARCHAEOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 CONSTRUCTION

10.4.1 LIDAR DRONES EMPLOYED TO SURVEY ROAD AND RAILWAY LINES

TABLE 54 CONSTRUCTION: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 55 CONSTRUCTION: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 56 CONSTRUCTION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 CONSTRUCTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 ENVIRONMENT

10.5.1 RISING USE OF LIDAR DRONES FOR ENVIRONMENTAL ASSESSMENT

TABLE 58 ENVIRONMENT: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 59 ENVIRONMENT: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 60 ENVIRONMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 ENVIRONMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 ENTERTAINMENT

10.6.1 VIDEO GAMES INDUSTRY EXPECTED TO DRIVE GROWTH OF UAV LIDAR TECHNOLOGY

TABLE 62 ENTERTAINMENT: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 63 ENTERTAINMENT: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 64 ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 PRECISION AGRICULTURE

10.7.1 USE OF LIDAR DRONES FOR CROP MONITORING AND CATEGORIZATION

TABLE 66 PRECISION AGRICULTURE: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 67 PRECISION AGRICULTURE: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 68 PRECISION AGRICULTURE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 PRECISION AGRICULTURE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHERS

10.8.1 ADOPTION OF LIDAR FOR OPERATIONAL INSPECTION AND MONITORING INDUSTRIES

TABLE 70 OTHERS: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 71 OTHERS: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 72 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.1 INTRODUCTION

FIGURE 38 LIDAR DRONE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 74 LIDAR DRONE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 LIDAR DRONE MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: LIDAR DRONE MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 US to continue dominating LiDAR drone market during forecast period

FIGURE 40 CONSTRUCTION SPENDING IN US (2017–2021), USD BILLION

11.2.2 CANADA

11.2.2.1 Adoption of LiDAR drones in government projects to drive market growth

11.2.3 MEXICO

11.2.3.1 Archaeology and forestry offer market opportunities

11.3 EUROPE

FIGURE 41 EUROPE: MARKET SNAPSHOT

TABLE 82 EUROPE: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Deployment of LiDAR drones for mapping and surveying applications

11.3.2 GERMANY

11.3.2.1 LiDAR drones to enhance military aerial vehicle capabilities

11.3.3 FRANCE

11.3.3.1 Prominent LiDAR drone providers offer improved survey solutions

11.3.4 ITALY

11.3.4.1 Infrastructure planning and inspection to offer opportunities

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC: LIDAR DRONE MARKET SNAPSHOT

TABLE 88 ASIA PACIFIC: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Manufacturing capabilities in the country to drive market growth

11.4.2 JAPAN

11.4.2.1 Expansion of Japan-based LiDAR drone players to drive market growth

11.4.3 SOUTH KOREA

11.4.3.1 Smart city initiatives expected to create growth opportunities

11.4.4 INDIA

11.4.4.1 Growing adoption of advanced technologies in agriculture

11.4.5 AUSTRALIA

11.4.5.1 Increased adoption of LiDAR drones for mining operations

11.4.6 REST OF ASIA PACIFIC

11.5 ROW

TABLE 94 ROW: MARKET, BY DRONE TYPE, 2018–2021 (USD MILLION)

TABLE 95 ROW: MARKET, BY DRONE TYPE, 2022–2027 (USD MILLION)

TABLE 96 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 97 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 98 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 99 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Oil & gas industry to drive adoption of LiDAR drones

11.5.2 SOUTH AMERICA

11.5.2.1 Surge in adoption of LiDAR drones for archaeological surveys

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 100 OVERVIEW OF STRATEGIES ADOPTED BY VENDORS OF MARKET

12.3 MARKET SHARE ANALYSIS, 2021

FIGURE 43 MARKET: MARKET SHARE ANALYSIS, 2021

12.4 KEY COMPANY EVALUATION QUADRANT, 2021

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

FIGURE 44 LIDAR DRONE MARKET: KEY COMPANY EVALUATION QUADRANT, 2021

12.5 LIDAR DRONE MARKET: COMPANY FOOTPRINT

TABLE 101 COMPANY FOOTPRINT

TABLE 102 COMPONENT FOOTPRINT OF COMPANIES

TABLE 103 APPLICATION FOOTPRINT OF COMPANIES

TABLE 104 REGIONAL FOOTPRINT OF COMPANIES

12.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 45 LIDAR DRONE MARKET: SME EVALUATION QUADRANT, 2021

12.6.5 START-UP EVALUATION MATRIX

TABLE 105 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 106 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 COMPETITIVE SCENARIOS AND TRENDS

12.7.1 LIDAR DRONE MARKET: PRODUCT LAUNCHES, 2019–2022

12.7.2 LIDAR DRONE MARKET: DEALS, 2019–2022

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 PHOENIX LIDAR SYSTEMS

TABLE 107 PHOENIX LIDAR SYSTEMS: BUSINESS OVERVIEW

TABLE 108 PHOENIX LIDAR SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.2 RIEGL LASER MEASUREMENT SYSTEMS GMBH

TABLE 109 RIEGL LASER MEASUREMENT SYSTEMS GMBH: BUSINESS OVERVIEW

TABLE 110 RIEGL LASER MEASUREMENT SYSTEMS GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.3 VELODYNE LIDAR, INC.

TABLE 111 VELODYNE LIDAR, INC.: BUSINESS OVERVIEW

FIGURE 46 VELODYNE LIDAR, INC.: COMPANY SNAPSHOT

TABLE 112 VELODYNE LIDAR, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.4 TELEDYNE OPTECH

TABLE 113 TELEDYNE OPTECH: BUSINESS OVERVIEW

TABLE 114 TELEDYNE OPTECH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.5 UMS SKELDAR

TABLE 115 UMS SKELDAR: BUSINESS OVERVIEW

TABLE 116 UMS SKELDAR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.6 LIDARUSA

TABLE 117 LIDARUSA: BUSINESS OVERVIEW

TABLE 118 LIDARUSA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.7 YELLOWSCAN

TABLE 119 YELLOWSCAN: BUSINESS OVERVIEW

TABLE 120 YELLOWSCAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.8 GEODETICS, INC.

TABLE 121 GEODETICS: BUSINESS OVERVIEW

TABLE 122 GEODETICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.9 ONYXSCAN

TABLE 123 ONYXSCAN: BUSINESS OVERVIEW

TABLE 124 ONYXSCAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.10 SICK AG

TABLE 125 SICK AG: BUSINESS OVERVIEW

FIGURE 47 SICK AG: COMPANY SNAPSHOT

TABLE 126 SICK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.11 DELAIR

TABLE 127 DELAIR: BUSINESS OVERVIEW

TABLE 128 DELAIR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.1.12 MICRODRONES

TABLE 129 MICRODRONES: BUSINESS OVERVIEW

TABLE 130 MICRODRONES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

13.2 OTHER PLAYERS

13.2.1 LIVOX

TABLE 131 LIVOX: BUSINESS OVERVIEW

13.2.2 ROUTESCENE

TABLE 132 ROUTESCENE: BUSINESS OVERVIEW

13.2.3 NEXTCORE

TABLE 133 NEXTCORE: BUSINESS OVERVIEW

13.2.4 GREENVALLEY INTERNATIONAL (GVI)

TABLE 134 GREENVALLEY INTERNATIONAL (GVI): BUSINESS OVERVIEW

13.2.5 SURESTAR

TABLE 135 SURESTAR: BUSINESS OVERVIEW

13.2.6 BENEWAKE (BEIJING) CO., LTD.

TABLE 136 BENEWAKE (BEIJING) CO., LTD.: BUSINESS OVERVIEW

13.2.7 SABRE ADVANCED 3D SURVEYING SYSTEMS

TABLE 137 SABRE ADVANCED 3D SURVEYING SYSTEMS: BUSINESS OVERVIEW

13.2.8 CEPTON, INC.

TABLE 138 CEPTON, INC.: BUSINESS OVERVIEW

13.2.9 DRAGANFLY INC.

TABLE 139 DRAGANFLY INC.: BUSINESS OVERVIEW

13.2.10 GEOCUE GROUP INC.

TABLE 140 GEOCUE GROUP INC.: BUSINESS OVERVIEW

13.2.11 VOLATUS AEROSPACE CORP.

TABLE 141 VOLATUS AEROSPACE CORP.: BUSINESS OVERVIEW

13.2.12 MODUS

TABLE 142 MODUS: BUSINESS OVERVIEW

13.2.13 PRECISIONHAWK

TABLE 143 PRECISIONHAWK: BUSINESS OVERVIEW

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14.1 INTRODUCTION

14.2 ADJACENT MARKET: LIMITATIONS

14.3 TOF SENSOR MARKET, BY APPLICATION

TABLE 144 TIME-OF-FLIGHT SENSOR MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

14.4 AR AND VR

14.4.1 INCREASING USE OF AR AND VR TECHNOLOGY-BASED SYSTEMS IN EDUCATION, HEALTHCARE, AND ENTERTAINMENT APPLICATIONS DRIVES DEMAND FOR TOF SENSORS

14.5 LIDAR

14.5.1 INCREASING ADOPTION OF LIDAR TECHNOLOGY IN AUTOMOBILES, RETAIL STORES, AND MANUFACTURING PLANTS TO SURGE DEMAND FOR TOF SENSORS

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

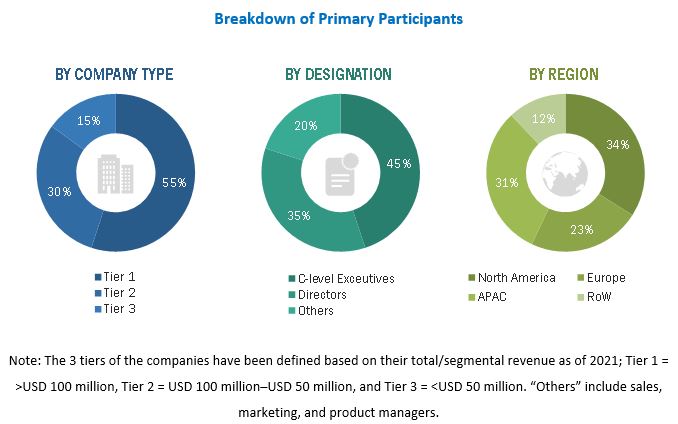

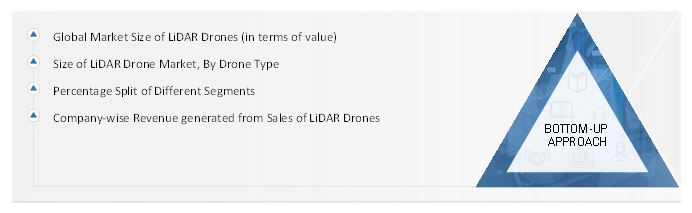

The study involved four major activities in estimating the size for LiDAR Drone market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, LiDAR Drone-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the LiDAR drone market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the ball valves market.

- Identifying different types of LiDAR drones

- Analyzing the global penetration of each type of LiDAR drone through secondary and primary research

- Analyzing the global penetration of LiDAR drones based on component through secondary and primary research

- Identifying the ratio of different types of LiDAR drones in different applications

- Conducting multiple discussion sessions with key opinion leaders to understand different types of LiDAR drones and their implementation in multiple applications. This further enabled the analysis of the scope break-up of the work carried out by each major company

- Verifying and cross-checking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

The bottom-up procedure has been employed to arrive at the overall size of the ball valves market.

- Focusing on the top-line investments and expenditures being made in the ecosystem of the LiDAR drone market; Splitting the LiDAR drone market based on LiDAR type, component, drone type, range, application, and geography, and listing key developments in the key market areas

- Identifying all major players in the LiDAR drone market based on type and component through secondary research that was then fully verified through a brief discussion with the industry experts

- Analyzing revenue, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with several industry experts to validate the information and identify the key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall size of the LiDAR Drone market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the LiDAR drone market size, in terms of value, by LiDAR type, component, drone type, by range, and application

-

To describe and forecast the market size, in terms of value, by region—North America, Europe,

Asia Pacific (APAC), and the Rest of the World (RoW) - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the process flow of the LiDAR drone market

- To analyze opportunities for stakeholders in the LiDAR drone market by identifying its high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships of leading players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in LiDAR Drone Market