Time-of-Flight (ToF) Sensor Market by Resolution (QQVGA, HQVGA, QVGA, & VGA), Application (Augmented Reality & Virtual Reality, LIDAR, Machine Vision, 3D Imaging & Scanning, and Robotics & Drone), Product Type, Vertical and Geography - Global Forecast to 2025

Updated on : October 06 , 2023

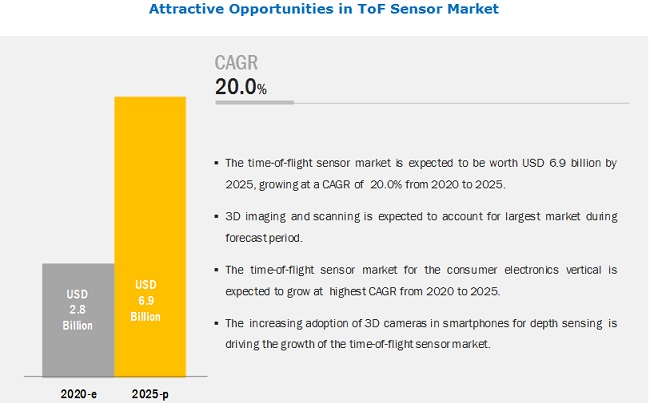

The overall time-of-flight (ToF) sensor market is expected to grow from USD 2.8 billion in 2020 to USD 6.9 billion by 2025, at a CAGR of 20.0%. The growth of this market is mainly driven by the increasing demand for ToF sensors from automotive industry and growing adoption of 3D cameras in smartphones and increasing use of such smartphones. The rising adoption of 3D machine vision systems in various industries and growing deployment of Industry 4.0 provide major opportunities for the growth of the ToF sensor market.

“3D imaging and scanning to hold largest share of ToF sensor market during forecast period”

3D scanning technology is used to capture a 3D model of an object. It uses depth sensing to accurately capture the area and dimensions of the object, and this mapped data can be used for designing purposes. In the coming years, the demand for 3D scanning technology would increase due to the ease of usage. Time-of-flight is an active type of 3D imaging and scanning technology. ToF is faster, more reliable, and more power-efficient technique than that of other two techniques of 3D imaging, namely, stereo vision and structured light. Due to the low cost, the demand for ToF technology is likely to increase for 3D imaging and scanning applications.

“Largest share of consumer electronics in ToF sensor market is due to growing demand for smartphones”

The consumer electronics vertical is the largest adopter of ToF sensors. Consumer electronic devices in which ToF sensors are utilized include smartphones, cameras, tablets, wearables, scanners, commercial drones, and service robots. ToF image sensors are largely adopted for smartphone and tablet applications. High reliability, low-power consumption, low cost, and easy integration are the drivers for the integration of 3D sensing technology in consumer electronics. The rising demand for these consumer electronic devices is surging the demand for ToF sensors, which, in turn, gives an impetus to further advancements in ToF technology.

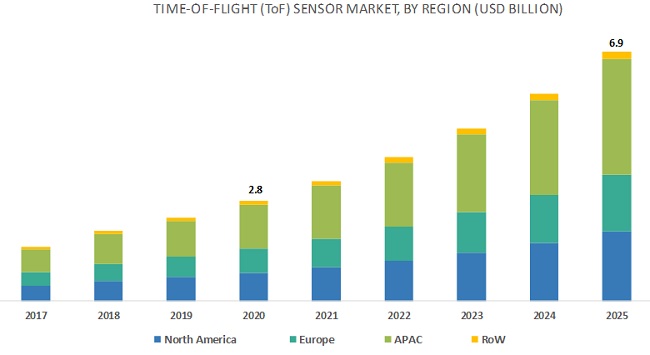

“Market in APAC expected to grow significantly during forecast period”

The ToF sensor market in APAC is expected to grow at the highest CAGR during the forecast period owing to the rapid industrialization and growing. The easy availability of low-cost labor has led to increased manufacturing of different electronic components and devices in this region. As a result, APAC is likely to emerge as a global manufacturing hub. This, in turn, is expected to increase demand for ToF sensors for monitoring and inspection applications in the manufacturing industry of the region.

Top time-of-flight (ToF) sensor Companies - Key Market Players:

The ToF sensor market is currently dominated by Texas Instruments Incorporated (US), STMicroelectronics NV (Switzerland), Infineon Technologies AG (Germany), Panasonic Corporation (Japan), Teledyne Technologies Incorporated (US), Keyence Corporation (Japan), pmd Technologies AG (Germany), Sharp Corporation (Japan), Sony Corporation (Japan), and Melexis NV (Belgium). A few of the major strategies adopted by these players to compete in the ToF sensor market are product launches and developments, partnerships, collaborations, agreements, and acquisitions.

Other players operating in the ToF sensor market are ams AG (Austria), Boardcom Inc. (US), OMRON Corporation (Japan), Renesas Electronics (Japan), ESPROS Photonics (Switzerland), Adafruit (US), SparkFun Electronics (US), Terabee (France), Chirp Microsystems (US), LUCID Vision Labs (Canada), Artilux (Taiwan), MikroElektronika (Serbia), Sentric Controls Sdn Bhd (Malaysia), Quanergy Systems (Canada), and BECOM Systems (Austria). These players have adopted strategies such as product developments and launches, partnerships, and collaborations to grow in the ToF sensor market.

Time-of-flight (ToF) sensor Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.8 billion in 2020 |

| Projected Market Size | USD 6.9 billion by 2025 |

| Growth Rate | CAGR of 20.0% |

|

Market size available for years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

Value (USD million/billion), shipment (million units) |

|

Segments covered |

Product type, display resolution, application, vertical, and region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Texas Instruments Incorporated (US), STMicroelectronics NV (Switzerland), Infineon Technologies AG (Germany), Panasonic Corporation (Japan), Teledyne Technologies Incorporated (US), Keyence Corporation (Japan), pmd Technologies AG (Germany), Sharp Corporation (Japan), Sony Corporation (Japan), Melexis NV (Belgium), ams AG (Austria), Boardcom Inc. (US), OMRON Corporation (Japan), Renesas Electronics (Japan), ESPROS Photonics (Switzerland), Adafruit (US), SparkFun Electronics (US), Terabee (France), Chirp Microsystems (US), LUCID Vision Labs (Canada), Artilux (Taiwan), MikroElektronika (Serbia), Sentric Controls Sdn Bhd (Malaysia), Quanergy Systems (Canada), and BECOM Systems (Austria) |

This report categorizes the ToF sensor market into the following segments.

By Product Type

- RF-modulated Light Sources with phase detectors

- Range-gated Imagers

- Direct ToF Imagers

By Display Resolution

- Quarter-QVGA (QQVGA)

- Half Quarter Video Graphics Array (HQVGA)

- Quarter Video Graphics Array (QVGA)

- Video Graphics Array (VGA)

By Application:

- AR & VR

- LiDAR

- Machine Vision

- 3D Imaging & Scanning

- Robotics & Drone

By Application:

- Automotive

- Consumer Electronics

- Gaming & Entertainment

- Industrial

- Healthcare

- Aerospace & Defense

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, and Sweden)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Malaysia, Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Key Questions Addressed by the Report

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming trends in the ToF sensor market?

- What are the opportunities for existing market players and those who are planning to enter the market?

- How adoption of inorganic strategies, such as acquisitions and partnerships, will have a positive impact on the growth of the market for ToF sensors? Which players are likely to adopt these strategies in the near future to create position or increase share in this market?

- What are the current investment trends in the ToF sensor market?

Frequently Asked Questions (FAQ):

What are the opportunities for new market entrants?

The increase in the demand for 3D cameras and 3 vision sensors in smartphones push consumers to explore options to enhance their image quality experience by bringing ToF cameras. Therefore, this will presents a greater opportunity to the industry players in the consumer electronics market.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

Texas Instruments's image sensor, STMicroelectronics's FlightSense technology, and Infineon’s REAL3 image sensor are some of the major companies providing 3D vision sensors. Launch of Infineon's the REAL3 ToF image sensor chip in smartphones is expected to further drive the ToF sesor market.

Which region is expected to witness significant demand for ToF sensor in the coming years?

The ToF sensor market in APAC is foreseen to augment at a high rate owing to the increasing number of consumer electronics in the region. In the consumer electronics vertical, ToF sensors are used in smartphones and tablets, cameras, computers, and wearable electronics. The demand for ToF sensors is expected to increase with the growing deployment of advanced cameras with depth sensing and 3D imaging capabilities in smartphones.

Where will all these developments in the ToF senor market take the industry in the mid to long term?

With the rapid rise in mobile devices in the last five years, smartphones are going to gain a significant amount of market traction in the coming years. One of the perks of this technology is its cost-effectiveness. It is way too expensive to constantly upgrade the mobile and laptops for better quality

What are the upcoming solutions for ToF sesor?

Augmented reality based solutions is gaining more traction as it provides high quality virtual images an videos to the user’s smartphones, tablets, or consoles with the help of image sensors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Geographic Scope

1.4 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis(Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in Time-of-Flight Sensor Market

4.2 Time-of-Flight Sensor Market, By Resolution

4.3 Time-of-Flight Sensor Market, By Application

4.4 Time-of-Flight Sensor Market in APAC, By Vertical and Country

4.5 Time-of-Flight Sensor Market, By Country

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of ToF Sensors in Automobile Applications

5.2.1.2 Increasing Demand for Smartphones Enabled With 3D Cameras

5.2.2 Restraints

5.2.2.1 Extra Costs Associated With Sensor Solutions

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of 3D Machine Vision Systems Across Various Industries

5.2.3.2 Growing Deployment of Industry 4.0

5.2.4 Challenges

5.2.4.1 Fluctuations in Raw Material Prices

5.3 Value Chain Analysis

6 Time-of-Flight Sensor Market, By Device Type (Page No. - 46)

6.1 Introduction

6.2 RF-Modulated Light Sources With Phase Detectors

6.3 Range-Gated Imagers

6.4 Direct Time-of-Flight Imagers

7 Time-of-Flight Sensor Market, By Resolution (Page No. - 49)

7.1 Introduction

7.2 Quarter Quarter Video Graphics Array

7.2.1 Aptness of QQVGA ToF Sensors for Handheld Devices

7.3 Half Quarter Video Graphics Array

7.3.1 Emergence of HQVGA ToF Sensors in Smartphone and Gaming Applications

7.4 Quarter Video Graphics Array

7.4.1 High Adopttion of QVGA ToF Sensors in Electronic Devices

7.5 Video Graphics Array

7.5.1 VGA Holds Second-Largest Market for ToF Sensors

8 Time-of-Flight Sensor Market, By Application (Page No. - 53)

8.1 Introduction

8.2 AR and VR

8.2.1 Increasing Use of AR and VR Technology-Based Systems in Education, Healthcare, and Entertainment Applications Drives Demand for ToF Sensors

8.3 LiDAR

8.3.1 Increasing Adoption of LiDAR Technology in Automobiles, Retail Stores, and Manufacturing Plants to Surge Demand for ToF Sensors

8.4 Machine Vision

8.4.1 Growing Deployment of Time-of-Flight Sensors in 3D Machine Vision Systems Propel ToF Sensor Market Growth

8.5 3D Imaging and Scanning

8.5.1 Rising Deployment of ToF Sensors in 3D Imaging and Scanning Applications Would Enable This Application to Account for Largest Market Size

8.6 Robotics and Drone

8.6.1 Engaging Participation of Companies in Developing and Promoting 3D ToF Sensor-Based Industrial Robotics Driving Adoption of ToF Sensors for Robotics and Drone Applications

9 Time-of-Flight Sensor Market, By Vertical (Page No. - 68)

9.1 Introduction

9.2 Automotive

9.2.1 Adoption of ToF Sensors to Enhance In-Cab Applications

9.3 Consumer Electronics

9.3.1 Consumer Electronics Vertical to Witness Highest Growth Rate During Forecast Period

9.3.1.1 Smartphones and Tablets

9.3.1.2 Wearables

9.4 Gaming & Entertainment

9.4.1 Use of Gaming Consoles Enabled With Gesture and Motion Tracking Sensors to Accelerate ToF Sensor Market Growth

9.5 Industrial

9.5.1 Implementation of ToF Sensors in Industrial Automation Processes to Fuel ToF Sensor Market Growth During Forecast Period

9.6 Healthcare

9.6.1 Deployment of High-Resolution 3D Cameras in Increasing Number of Treatments and Procedures to Foster ToF Sensor Market Growth

9.7 Aerospace & Defense

9.7.1 Need for 3D Machine Vision Systems in Aerospace & Defense Vertical Boosts Adoption of ToF Sensors

10 Geographic Analysis (Page No. - 85)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US to Remain Largest Market for ToF Sensors in North America

10.2.2 Canada

10.2.2.1 Manufacturing and Automotive Industries Likely to Fuel Demand for ToF Sensors in Canada

10.2.3 Mexico

10.2.3.1 Improvement in Manufacturing Infrastructure in Mexico Create Demand for ToF Sensors

10.3 Europe

10.3.1 UK

10.3.1.1 Automotive Industry and Industrial Automation to Drive Growth of ToF Sensor Market in UK

10.3.2 Germany

10.3.2.1 Germany Held Largest Share of European ToF Sensor Market in 2019

10.3.3 France

10.3.3.1 Automotive and Healthcare Companies to Drive Growth of ToF Sensor Market in France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 China Held Largest Share of ToF Sensor Market in APAC in 2019

10.4.2 Japan

10.4.2.1 Presence of Well-Established Automotive and Consumer Electronics Industries Projected to Augment Growth of ToF Sensor Market in Japan

10.4.3 South Korea

10.4.3.1 Flourished Consumer Electronics Industry in Country to Propel Growth of ToF Sensor Market in South Korea

10.4.4 India

10.4.4.1 ToF Sensor Market in India Expected to Grow at Highest Rate From 2020 to 2025

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East and Africa

10.5.1.1 ToF Sensor Market in Middle East and Africa Projected to Grow at Higher CAGR Than That of in South America From 2020 to 2025

10.5.2 South America

10.5.2.1 South America Held Smaller Share of ToF Sensor Market in 2019 Than That of Middle East and Africa

11 Competitive Landscape (Page No. - 114)

11.1 Introduction

11.2 Market Player Ranking Analysis

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Strength of Product Portfolio (25 Companies)

11.4.2 Business Strategy Excellence (25 Companies)

11.5 Competitive Scenario

11.6 Competitive Situations and Trends

11.6.1 Product Launches and Developments

11.6.2 Acquisitions

11.6.3 Collaborations/Agreements/Partnerships

11.6.4 Expansions

12 Company Profiles (Page No. - 127)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Players

12.1.1 Texas Instruments Incorporated

12.1.2 STMicroelectronics N.V.

12.1.3 Infineon Technologies

12.1.4 Panasonic Corporation

12.1.5 Melexis

12.1.6 Teledyne Technologies Incorporated

12.1.7 pmd Technologies AG

12.1.8 Keyence Corporation

12.1.9 Sharp Corporation

12.1.10 Sony Corporation

12.2 Right to Win

12.2.1 STMicroelectronics (Switzerland)

12.2.2 Texas Instruments (US)

12.2.3 Infineon Technologies (Germany)

12.2.4 Panasonic Corporation (Japan)

12.2.5 Melexis (Belgium)

12.3 Other Companies

12.3.1 AMS AG

12.3.2 Broadcom Inc. (Avago)

12.3.3 Omron Corporation

12.3.4 Renesas Electronics

12.3.5 Espros Photonics

12.3.6 Adafruit Industries

12.3.7 Sparkfun Electronics

12.3.8 Terabee

12.3.9 Chirp Microsystems, Inc. (Tdk Corporation)

12.3.10 Lucid Vision Labs, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 168)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (105 Tables)

Table 1 Time-of-Flight Sensor Market, By Device Type, 2017–2025 (USD Million)

Table 2 Market, By Resolution, 2017–2025 (USD Million)

Table 3 Market, By Application, 2017–2025 (USD Million)

Table 4 Market for AR and VR Applications, By Region, 2017–2025 (USD Million)

Table 5 Market in North America for AR and VR Applications, By Country, 2017–2025 (USD Million)

Table 6 Market in Europe for AR and VR Applications, By Country, 2017–2025 (USD Million)

Table 7 Market in APAC for AR and VR Applications, By Country, 2017–2025 (USD Million)

Table 8 Market in RoW for AR and VR Applications, By Region, 2017–2025 (USD Million)

Table 9 Market for LiDAR Applications, By Region, 2017–2025 (USD Million)

Table 10 Market in North America for LiDAR Applications, By Country, 2017–2025 (USD Million)

Table 11 Market in Europe for LiDAR Application, By Country, 2017–2025 (USD Million)

Table 12 Market in APAC for LiDAR Applications, By Country, 2017–2025 (USD Million)

Table 13 Time-of-Flight Sensor Market in RoW for LiDAR Applications, By Region, 2017–2025 (USD Million)

Table 14 Market for Machine Vision Applications, By Region, 2017–2025 (USD Million)

Table 15 Market in North America for Machine Vision Applications, By Country, 2017–2025 (USD Million)

Table 16 Market in Europe for Machine Vision Applications, By Country, 2017–2025 (USD Million)

Table 17 Market in APAC for Machine Vision Applications, By Country, 2017–2025 (USD Million)

Table 18 Market in RoW for Machine Vision Applications, By Region, 2017–2025 (USD Million)

Table 19 Market for 3D Imaging and Scanning Applications, By Region, 2017–2025 (USD Million)

Table 20 Market in North America for 3D Imaging and Scanning Applications, By Country, 2017–2025 (USD Million)

Table 21 Market in Europe for 3D Imaging and Scanning Applications, By Country, 2017–2025 (USD Million)

Table 22 Market in APAC for 3D Imaging and Scanning Applications, By Country, 2017–2025 (USD Million)

Table 23 Market in RoW for 3D Imaging and Scanning Applications, By Region, 2017–2025 (USD Million)

Table 24 Market for Robotics and Drone Applications, By Region, 2017–2025 (USD Million)

Table 25 Market in North America for Robotics and Drone Applications, By Country, 2017–2025 (USD Million)

Table 26 Market in Europe for Robotics and Drone Applications, By Country, 2017–2025 (USD Million)

Table 27 Time-of-Flight Sensor Market in APAC for Robotics and Drone Applications, By Country, 2017–2025 (USD Million)

Table 28 Market in RoW for Robotics and Drone Applications, By Region, 2017–2025 (USD Million)

Table 29 Market, By Vertical, 2017–2025 (USD Million)

Table 30 Market for Automotive Vertical, By Region, 2017–2025 (USD Million)

Table 31 Market in North America for Automotive Vertical, By Country, 2017–2025 (USD Million)

Table 32 Market in Europe for Automotive Vertical, By Country, 2017–2025 (USD Million)

Table 33 Market in APAC for Automotive Vertical, By Country, 2017–2025 (USD Million)

Table 34 Market in RoW for Automotive Vertical, By Region, 2017–2025 (USD Million)

Table 35 Market for Consumer Electronics Vertical, By Region, 2017–2025 (USD Million)

Table 36 Time-of-Flight Sensor Market in North America for Consumer Electronics Vertical, By Country, 2017–2025 (USD Million)

Table 37 Market in Europe for Consumer Electronics Vertical, By Country, 2017–2025 (USD Million)

Table 38 Market in APAC for Consumer Electronics Vertical, By Country, 2017–2025 (USD Million)

Table 39 Market in RoW for Consumer Electronics Vertical, By Region, 2017–2025 (USD Million)

Table 40 Market for Gaming & Entertainment Vertical, By Region, 2017–2025 (USD Million)

Table 41 Time-of-Flight Sensor Market in North America for Gaming & Entertainment Vertical, By Country, 2017–2025 (USD Million)

Table 42 Time-of-Flight Sensor Market in Europe for Gaming & Entertainment Vertical, By Country, 2017–2025 (USD Million)

Table 43 Market in APAC for Gaming & Entertainment Vertical, By Country, 2017–2025 (USD Million)

Table 44 Time-of-Flight Sensor Market in RoW for Gaming & Entertainment Vertical, By Region, 2017–2025 (USD Million)

Table 45 Time-of-Flight Sensor Market for Industrial Vertical, By Region, 2017–2025 (USD Million)

Table 46 Market in North America for Industrial Vertical, By Country, 2017–2025 (USD Million)

Table 47 Market in Europe for Industrial Vertical, By Country, 2017–2025 (USD Million)

Table 48 Time-of-Flight Sensor Market in APAC for Industrial Vertical, By Country, 2017–2025 (USD Million)

Table 49 Time-of-Flight Sensor Market in RoW for Industrial Vertical, By Region, 2017–2025 (USD Million)

Table 50 Time-of-Flight Sensor Market for Healthcare Vertical, By Region, 2017–2025 (USD Million)

Table 51 Time-of-Flight Sensor Market in North America for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 52 Time-of-Flight Sensor Market in Europe for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 53 Time-of-Flight Sensor Market in APAC for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 54 Time-of-Flight Sensor Market in RoW for Healthcare Vertical, By Region, 2017–2025 (USD Million)

Table 55 Time-of-Flight Sensor Market for Aerospace & Defense Vertical, By Region, 2017–2025 (USD Million)

Table 56 Time-of-Flight Sensor Market in North America for Aerospace & Defense Vertical, By Country, 2017–2025 (USD Million)

Table 57 Time-of-Flight Sensor Market in Europe for Aerospace & Defense Vertical, By Country, 2017–2025 (USD Million)

Table 58 Time-of-Flight Sensor Market in APAC for Aerospace & Defense Vertical, By Country, 2017–2025 (USD Million)

Table 59 Time-of-Flight Sensor Market in RoW for Aerospace & Defense Vertical, By Region, 2017–2025 (USD Million)

Table 60 Time-of-Flight Sensor Market, in Terms of Value and Volume, 2017–2025

Table 61 Time-of-Flight Sensor Market, By Region, 2017–2025 (USD Million)

Table 62 Time-of-Flight Sensor Market in North America, By Application, 2017–2025 (USD Million)

Table 63 Time-of-Flight Sensor Market in North America, By Vertical, 2017–2025 (USD Million)

Table 64 Time-of-Flight Sensor Market in North America, By Country, 2017–2025 (USD Million)

Table 65 Time-of-Flight Sensor Market in US, By Application, 2017–2025 (USD Million)

Table 66 Time-of-Flight Sensor Market in US, By Vertical, 2017–2025 (USD Million)

Table 67 Time-of-Flight Sensor Market in Canada, By Application, 2017–2025 (USD Million)

Table 68 Time-of-Flight Sensor Market in Canada, By Vertical, 2017–2025 (USD Million)

Table 69 Time-of-Flight Sensor Market in Mexico, By Application, 2017–2025 (USD Million)

Table 70 Time-of-Flight Sensor Market in Mexico, By Vertical, 2017–2025 (USD Million)

Table 71 Time-of-Flight Sensor Market in Europe, By Application, 2017–2025 (USD Million)

Table 72 Time-of-Flight Sensor Market in Europe, By Vertical, 2017–2025 (USD Million)

Table 73 Time-of-Flight Sensor Market in Europe, By Country, 2017–2025 (USD Million)

Table 74 Time-of-Flight Sensor Market in UK, By Application, 2017–2025 (USD Million)

Table 75 Time-of-Flight Sensor Market in UK, By Vertical, 2017–2025 (USD Million)

Table 76 Time-of-Flight Sensor Market in Germany, By Application, 2017–2025 (USD Million)

Table 77 Time-of-Flight Sensor Market in Germany, By Vertical, 2017–2025 (USD Million)

Table 78 Time-of-Flight Sensor Market in France, By Application, 2017–2025 (USD Million)

Table 79 Time-of-Flight Sensor Market in France, By Vertical, 2017–2025 (USD Million)

Table 80 Time-of-Flight Sensor Market in Rest of Europe, By Application, 2017–2025 (USD Million)

Table 81 Time-of-Flight Sensor Market in Rest of Europe, By Vertical, 2017–2025 (USD Million)

Table 82 Time-of-Flight Sensor Market in APAC, By Application, 2017–2025 (USD Million)

Table 83 Time-of-Flight Sensor Market in APAC, By Vertical, 2017–2025 (USD Million)

Table 84 Time-of-Flight Sensor Market in APAC, By Country, 2017–2025 (USD Million)

Table 85 Time-of-Flight Sensor Market in China, By Application, 2017–2025 (USD Million)

Table 86 Time-of-Flight Sensor Market in China, By Vertical, 2017–2025 (USD Million)

Table 87 Time-of-Flight Sensor Market in Japan, By Application, 2017–2025 (USD Million)

Table 88 Time-of-Flight Sensor Market in Japan, By Vertical, 2017–2025 (USD Million)

Table 89 Time-of-Flight Sensor Market in South Korea, By Application, 2017–2025 (USD Million)

Table 90 Time-of-Flight Sensor Market in South Korea, By Vertical, 2017–2025 (USD Million)

Table 91 Time-of-Flight Sensor Market in India, By Application, 2017–2025 (USD Million)

Table 92 Time-of-Flight Sensor Market in India, By Vertical, 2017–2025 (USD Million)

Table 93 Time-of-Flight Sensor Market in Rest of APAC, By Application, 2017–2025 (USD Million)

Table 94 Time-of-Flight Sensor Market in Rest of APAC, By Vertical, 2017–2025 (USD Million)

Table 95 Time-of-Flight Sensor Market in RoW, By Application, 2017–2025 (USD Million)

Table 96 Time-of-Flight Sensor Market in RoW, By Vertical, 2017–2025 (USD Million)

Table 97 Time-of-Flight Sensor Market in RoW, By Region, 2017–2025 (USD Million)

Table 98 Time-of-Flight Sensor Market in Middle East & Africa, By Application, 2017–2025 (USD Million)

Table 99 Time-of-Flight Sensor Market in Middle East & Africa, By Vertical, 2017–2025 (USD Million)

Table 100 Time-of-Flight Sensor Market in South America, By Application, 2017–2025 (USD Million)

Table 101 Time-of-Flight Sensor Market in South America, By Vertical, 2017–2025 (USD Million)

Table 102 Product Launches and Developments (2016–2019)

Table 103 Acquisitions (2017)

Table 104 Collaborations/Agreements/Partnerships (2016–2019)

Table 105 Expansions (2016–2019)

List of Figures (44 Figures)

Figure 1 Time-of-Flight Sensor Market Segmentation

Figure 2 Time-of-Flight) Sensor Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Time-of-Flight Sensor Market, 2017–2025 (USD Billion)

Figure 8 Time-of-Flight Sensor Market, By Resolution (2020 vs 2025)

Figure 9 3D Imaging and Scanning Application to Capture Largest Size of Time-of-Flight Sensor Market in 2025

Figure 10 Time-of-Flight Sensor Market for Consumer Electronics Vertical to Grow at Highest CAGR From 2020 to 2025

Figure 11 APAC to Hold Largest Share of Time-of-Flight Sensor Market in 2020

Figure 12 Increasing Adoption of 3D Cameras in Smartphones to Boost Time-of-Flight Sensor Market During Forecast Period

Figure 13 Market for QVGA Time-of-Flight Sensors to Grow at Highest CAGR From 2020 to 2025

Figure 14 3D Imaging and Scanning Application to Hold Largest Size of Time-of-Flight Sensor Market in 2025

Figure 15 Consumer Electronics and China Accounted for Largest Share of Time-of-Flight Sensor Market in APAC in 2019

Figure 16 India to Exhibit Highest CAGR in Time-of-Flight Market From 2020 to 2025

Figure 17 Impact of Drivers and Opportunities on Time-of-Flight Sensor Market

Figure 18 Impact of Challenges and Restraints on Time-of-Flight Sensor Market

Figure 19 Global Mobile Subscriptions From 2011 to 2017 (Billion)

Figure 20 Major Value Added By Raw Material Suppliers and Original Equipment Manufacturers & System Integrators

Figure 21 Time-of-Flight Market, By Device Types

Figure 22 QVGA Time-of-Flight Sensor Market to Grow at Highest CAGR During Forecast Period

Figure 23 AR & VR Applications to Exhibit Highest CAGR in Time-of-Flight Sensor Market From 2020 to 2025

Figure 24 APAC to Lead Time-of-Flight Sensor Market for 3D Scanning and Imaging Applications From 2020 to 2025

Figure 25 Consumer Electronics Vertical to Lead Time-of-Flight Sensor Market From 2020 to 2025

Figure 26 APAC to Dominate Time-of-Flight Sensor Market for Industrial Vertical From 2020 to 2025

Figure 27 Geographic Snapshot: Time-of-Flight Sensor Market in APAC to Exhibit Highest CAGR From 2020 to 2025

Figure 28 APAC to Lead Overall Time-of-Flight Sensor Market During Forecast Period

Figure 29 North America: Time-of-Flight Sensor Market Snapshot

Figure 30 Europe: Time-of-Flight Sensor Market Snapshot

Figure 31 APAC: ToF Sensor Market Snapshot

Figure 32 Companies Adopted Product Launches and Developments as Key Growth Strategies During 2016–2019

Figure 33 Ranking Analysis of Top 5 Players in Time-Of-Flight Market, 2018

Figure 34 Time-of-Flight Sensor Market (Global) Competitive Leadership Mapping, 2019

Figure 35 Evaluation Framework: Time-of-Flight Sensor Market

Figure 36 Texas Instruments Incorporated: Company Snapshot

Figure 37 STMicroelectronics N.V.: Company Snapshot

Figure 38 Infineon Technologies: Company Snapshot

Figure 39 Panasonic Corporation: Company Snapshot

Figure 40 Melexis: Company Snapshot

Figure 41 Teledyne Technologies Incorporated: Company Snapshot

Figure 42 Keyence Corporation: Company Snapshot

Figure 43 Sharp Corporation: Company Snapshot

Figure 44 Sony Corporation: Company Snapshot

The study involved 4 major activities in estimating the current size of the time-of-flight (ToF) sensor market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts from across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, the market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the ToF sensor market begins with capturing data on the revenues of key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the ToF sensor market. Vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology includes studying annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

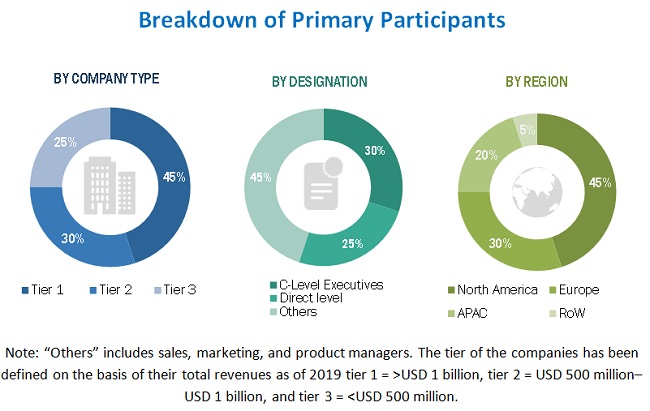

The ToF sensor market’s supply chain comprises several stakeholders, such as suppliers of raw material, original equipment manufacturers (OEMs), device manufacturers, and system integrators. The supply side is characterized by advancements in ToF sensors and their applications in diverse end-user industries. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the ToF sensor market and various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Key players providing ToF sensors to different industries have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides of ToF sensors.

Research Objective

- To define and forecast the overall ToF sensor market, by product type, display resolution, application, vertical, and geography, in terms of value

- To forecast the overall ToF sensor market, in terms of volume

- To describe and forecast the market size for various segments with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the ToF sensor market

- To provide a detailed overview of the ToF sensor value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall ToF sensor market

- To analyze opportunities in the overall ToF sensor market for stakeholders by identifying high-growth segments

- To strategically profile key players, comprehensively analyze their market ranking and core competencies, and provide a detailed competitive landscape of market leaders

- To analyze competitive developments such as product launches and developments, agreements, partnerships, collaborations, acquisitions, expansions, and research and development (R&D) activities in the overall ToF sensor market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions:

- What will be the new verticals in which ToF sensors would be used?

- Who are the key players in the market, and how intense is the competition?

Growth opportunities and latent adjacency in Time-of-Flight (ToF) Sensor Market