Liquid Fertilizers Market by Type (Nitrogen, Phosphorus, Potassium, and Micronutrients), Mode of Application (Soil, Foliar, and Fertigation), Major Compounds (CAN, UAN, MAP, DAP, and Potassium Nitrate), Crop Type, and Region - Global Forecast to 2025

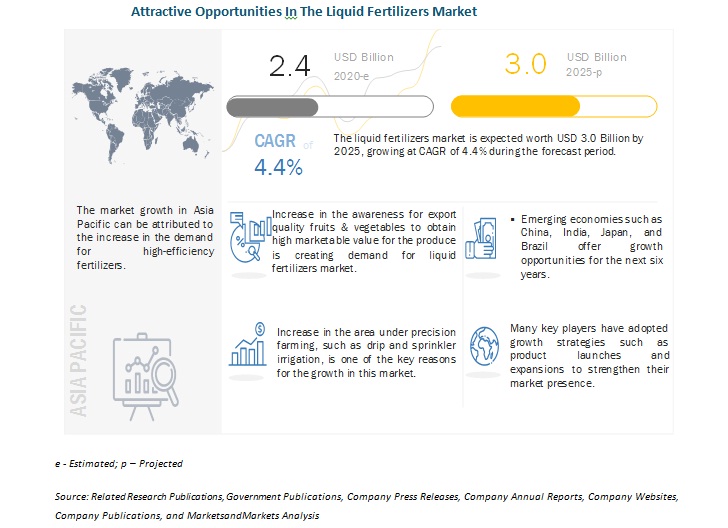

[311 Pages Report] The global liquid fertilizers market size is projected to reach USD 3.0 billion by 2025, recording a CAGR of 4.4%. The increase in demand for enhanced high-efficiency fertilizers, ease of use and application of liquid fertilizers, and adoption of precision farming and protected agriculture are some of the factors that are projected to drive the growth of the market.

Market Dynamics

Driver: Growth in demand for enhanced high-efficiency fertilizers

Enhanced, efficient application of liquid fertilizers ensures that crops and plants receive nutrients in an amount that is required at the right time and at the right place, with minimum wastage. Enhanced efficiency fertilizers (EEF) are growing substantially in the agriculture industry in various fields such as cereals and industrial crops, as a result of the emergence of new urease inhibitors and inexpensive polymer coating technologies. Such application of enhanced efficiency fertilizers also helps in reducing the negative impact of nutrients by way of leaching into water reservoirs.

Restraint: High handling costs

One of the major restraints in the growth of the liquid fertilizers market is the high storage cost of liquid fertilizers, along with the high cost of installation. Liquid fertilizers are water-soluble. The cost of mixing the nutrients in the water is high, and so is the cost of transportation, as fertilizers in the liquid form require distinctive handling and storage facilities. This is hindering the growth of the market around the globe, especially in regions such as Africa and the Middle East due to the lack of awareness about the application of liquid fertilizers.

Opportunity: New emerging economies

The increasing population in world has resulted in increasing demand for food, which will lead to further increase in the consumption of fertilizers. However, the major concerns in are the pollution and contamination of soil as well as their harmful effects on humans and the environment. To combat these harmful effects, governments are emphasizing on the use of fertilizers that are less harmful to the soil. Hence, there is an increase in the rate of awareness about liquid fertilizers among farmers, especially in China and India. Manufacturers, along with NGOs, educate farmers about their potential short-term and long-term benefits.

Challenge: Unfavorable regulatory standards

The fertilizer industry, like other industries, has its own share of regulatory and other state-level interventions, which propel and arrest its momentum. Policies unfavorable for the industry, including restrictions in terms of sourcing, production, and distribution norms; the end of subsidy support; the stipulation of the maximum retail price; and regulations concerning the quantum and direction of end use have a considerable impact on the overall industry.

Market Ecosystem

By crop type, the fruits & vegetables segment is projected to be the fastest-growing segment in the liquid fertilizers market during the forecast period.

The trend of consuming fruits has witnessed a growth in the past two decades, and this trend is projected to continue in the coming years. According to the FAO, China is the largest producer of fresh fruits and vegetables, which has surpassed the production and growth in the US and India in 2018. The increasing exports of fruits & vegetables have also led to an increase in the crop plantation area, which has resulted in a rise in their production levels. Hence, the crop protection chemicals market for fruits & vegetables is projected to witness significant growth. This, in turn, is projected to drive the market.

By type, the nitrogen segment is projected to dominate the market during the forecast period.

Nitrogen is one of the most-widely consumed nutrients among all the macro and microelements required for plant growth. It is used to build amino acids, which produce proteins, and take part in almost every biochemical reaction performed in a plant. Inadequate nitrogen (N) availability in the soil is a common problem that farmers often witness. Therefore, additional liquid nitrogen fertilization is required to eradicate this problem. Urea, ammonium nitrate, ammonium sulfate, and calcium nitrate are commonly available nutrient sources of liquid nitrogen. In addition, various combinations of nutrients are manufactured and used to provide nutrition to plants. Thus, the demand for liquid nitrogen fertilizers remains high globally.

By major compounds, the calcium ammonium nitrate (CAN) segment to be the fastest-growing segment in the market during the forecast period.

Calcium ammonium nitrate (CAN) is the most widely used nitrogen fertilizer due to its relatively high nutrient content and physical properties, such as high solubility, which helps in quickly dissolving into the soil. It contains calcium and magnesium, which help in improving the efficiency of absorbing nitrogen by the roots and reduce nitrogen losses, making the fertilization more profitable; this also protects subsoil waters against pollution by nitrogen compounds. CAN is used more in the case of acidic soils as it does not further acidify the soil. It is majorly used for wheat, barley, fruits, and vegetables. Increasing adoption of sprinkler and drip irrigation is projected to increase the demand for CAN fertilizers during the forecast period.

By mode of application, the fertigation segment is projected to be the fastest-growing segment in the liquid fertilizers market during the forecast period.

Fertigation is an agricultural technique, which includes water and fertilizer application through irrigation. This process provides an opportunity to maximize the yield and minimize environmental pollution. Moreover, through fertigation, a farmer can uniformly apply nutrients throughout the field, whenever required. This market is projected to grow due to the adoption of efficient irrigation systems globally.

The advantage of fertigation is that it requires less labor, time, energy, and water. This mode of application is gaining importance due to its reliability and efficacy. However, to get the desired results using this method, proper knowledge of the system and efficient management are required. Fertigation is used in fields of row crops, horticultural crops, fruit crops, vegetable crops, and ornamental & flowering crops. There has been a shift in farming practices toward holistic approaches that include both fertilizer and water application techniques, which is a key factor that is projected to drive the growth of this market in the next five years, particularly in North America and Europe.

The increasing demand for various crops in the Asia Pacific regions is driving the growth of the market.

The increasing agricultural practices and requirement of high-quality agricultural produce are factors that are projected to drive the nitrogenous fertilizers market growth in this region. Major crops produced in Asia include rice, sugar beet, fruits & vegetables, cereals, and grains; the region consumes 90% of the global rice produced. Asian countries, such as Korea, China, Japan, and recently Vietnam, are applying high levels of nitrogenous fertilizers per hectare, for both short-term and perennial crops. Hence, the demand for liquid fertilizers is high in the region.

Key Market Players

Key players in this market include Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (SQM) (Chile), The Mosaic Company (US), and EuroChem Group (Switzerland). These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD) & Volume (Thousand Tonnes) |

|

Segments covered |

Crop Type, Application, Type, and Major Compounds |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Nutrien, Ltd.(Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química Y Minera De Chile (SQM) (Chile), The Mosaic Company (US), EuroChem Group (Switzerland), CF Industries Holdings, Inc. (US), OCP Group (Morocco), OCI Nitrogen (Netherlands), Wilbur-Ellis (US), Compass Minerals (US), Kugler (US), Haifa Group (Israel), COMPO Expert GmbH (Germany), AgroLiquid (US), Plant Food Company, Inc. (US), Foxfarm Soil and Fertilizer Company (California), Agro Bio Chemicals (India), and Agzon Agro(India), BrandT (US), Nufarm (Australia), Plant Fuel Nutrients, LLC (US), Nutri-tech solutions (Australia) and Valagro SPA (Italy). . |

This research report categorizes the liquid fertilizers market on the basis of crop type, application, major compounds, type, and region.

On the basis of crop type, the market has been segmented as follows:

-

Cereals & Grains

- Corn

- Wheat

- Rice

- Others (sorghum, barley, and oats)

-

Oilseeds & Pulses

- Soybean

- Others (canola, cotton, and sunflower)

- Fruits & Vegetables

- Others (turf, ornamentals, and nursery plants)

On the basis of major compounds, the market has been segmented as follows:

- Calcium Ammonium Nitrate (CAN)

- Urea-Ammonium Nitrate (UAN)

- Potassium Nitrate

- Phosphorus Pentoxide (P205)

- Others (boron, chloride, and iron)

On the basis of application, the market has been segmented as follows:

- Soil

- Foliar

-

Fertigation

- Agricultural fields

- Hydroponics

- Others (starter solutions and aerial applications)

On the basis of type, the market has been segmented as follows:

- Nitrogen

- Phosphorus

- Potash

- Micronutrients

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

* RoW includes South Africa, Turkey, and Others in RoW.

Recent Developments:

- In September 2019, Nutrien, Ltd. acquired Ruralco Holdings Limited (Ruralco) in Australia. Through this acquisition, Nutrien would be able to provide significant benefits to its stakeholders, as well as enhance the delivery of its products and services to the Australian farmers.

- In June 2019, EuroChem Group expanded its fertilizer production facility by opening a third new fertilizer blending plant in Brazil. This production center was a new 27,000 m2 facility at Araguari in Minas Gerais, which was another step in the continued expansion of EuroChem’s subsidiary, Fertilizantes Tocantins (FTO). It is a major fertilizer distribution business in Brazil.

- In February 2018, Haifa Group expanded its presence in China by opening a subsidiary named Haifa Beijing Trading Company in China. This subsidiary would significantly help in expanding its offerings to the developing Chinese agricultural sector by providing the best plant nutrition solutions for the benefits of the Chinese growers.

- In March 2019, Yara International ASA launched Yaralix, a tool for precision farming, allowing the farmers to measure crop nitrogen requirements using their smartphones. The system consisted of a free-to-download-app that was designed to use the smartphone camera to determine nitrogen requirements for different crops in the early growth stages.

- In May 2018, Yara International ASA acquired Vale Cubatão Fertilizantes (Brazil), which has strengthened the company’s position in terms of Brazil’s nitrogen production assets, along with the fertilizer and industrial sectors in the region.

Frequently Asked Questions (FAQ):

What is the share of the key players in the Liquid Fertilizers Market?

The key global players, i.e., Nutrien Ltd, Yara International, ICL, and Eurochem contributed to more than 50% of the revenues in 2019, where Nutrien Ltd was the dominant player.

What are the factors constraining the growth of Liquid Fertilizers Market?

The growing demand for enhanced high-efficiency fertilizers are the factors challenging the market growth.

What are the challenges that can be faced by market players?

Unfavorable regulatory standards and high handling costs are the key challenges faced by market players in Liquid Fertilizers Market.

What makes cereals & grains the largest crop application for Liquid Fertilizers market?

Cereals & grains account for the largest consumption of nitrogen-based liquid fertilizers. Nitrogen used in liquid fertilizer solutions for cereals & grains aims to improve spray droplet retention and penetration of active ingredients into the plant foliage. With the increasing population, there will be greater demand for food grains, which can be met by using liquid fertilizers that are environmentally friendly. The liquid fertilizers market is projected to grow with the increase in the production of these crops with the concept of sustainable agriculture and environment-friendly farming practices gaining importance.

What are the factors responsible for the fastest growth of Liquid Fertilizers market in Asia Pacific?

Major crops produced in Asia include rice, sugar beet, fruits & vegetables, cereals, and grains; the region consumes 90% of the global rice produced. Asian countries, such as Korea, China, Japan, and recently Vietnam, are applying high levels of nitrogenous fertilizers per hectare, for both short-term and perennial crops. Hence, the demand for liquid fertilizers is high in the region.

What is the impact of COVID-19 on Liquid Fertilizers market?

There is minimal impact of COVID-19 on liquid fertilizer market worldwide. The companies have sufficient inventory with them, which is enough to meet the demand of farmers. But if the lockdown and logistics barriers pertain for longer time, companies won’t be able to import compounds from different countries. Therefore, after government relaxations, there is more scope for recovering losses incurred during COVID-19 pandemic. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 LIQUID FERTILIZERS: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2015-2019

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BASED ON PARENT (FERTILIZER) MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BASED ON CROP SPECIFIC FERTILIZER USE

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 8 LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 THE FRUITS & VEGETABLES SEGMENT IS PROJECTED TO BE THE

FASTEST-GROWING CROP TYPE SEGMENT FROM 2020 TO 2025 54

FIGURE 10 THE FOLIAR SEGMENT IS ESTIMATED TO DOMINATE THE MARKET IN 2020

FIGURE 11 ASIA PACIFIC ACCOUNTS FOR THE LARGEST SHARE IN THE GLOBAL MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 12 STRONG DEMAND FOR LIQUID FERTILIZERS DURING THE FORECAST PERIOD

4.2 LIQUID FERTILIZERS MARKET, BY TYPE

FIGURE 13 NITROGEN WAS THE MOST PREFERRED TYPE OF LIQUID FERTILIZER (IN TERMS OF VALUE) IN 2019

4.3 ASIA PACIFIC: LIQUID FERTILIZERS MARKET, BY CROP TYPE AND COUNTRY

FIGURE 14 LIQUID FERTILIZERS: CHINA DOMINATED THE LIQUID FERTILIZERS MARKET IN ASIA PACIFIC

4.4 LIQUID FERTILIZERS MARKET, BY MODE OF APPLICATION AND REGION

FIGURE 15 ASIA PACIFIC ACCOUNTED FOR A SIGNIFICANT SHARE ACROSS FOLIAR AND FERTIGATION APPLICATION METHODS OF LIQUID FERTILIZERS

4.5 MARKET SHARE: KEY COUNTRIES

FIGURE 16 CHINA AND INDIA: IMPORTANT MARKETS FOR THE LIQUID FERTILIZERS, 2019

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MACROINDICATORS

5.2.1 INCREASE IN PRODUCTION OF FRUITS & VEGETABLES

FIGURE 17 GLOBAL POPULATION PROJECTED TO REACH ~9.7 BILLION BY 2050

5.3 MARKET DYNAMICS

FIGURE 18 LIQUID FERTILIZERS: MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Growth in demand for enhanced high-efficiency fertilizers

5.3.1.2 Ease of use and application of liquid fertilizers

5.3.1.3 Adoption of precision farming and protected agriculture

5.3.1.4 Increase in environmental concerns

5.3.1.5 Rapid growth in greenhouse vegetable production

5.3.2 RESTRAINTS

5.3.2.1 High handling costs

5.3.2.2 Lack of awareness about application practices among farmers

5.3.3 OPPORTUNITIES

5.3.3.1 New emerging economies

5.3.3.2 Increase in the production and yield of crops

5.3.3.3 Need to improve pasture production

5.3.4 CHALLENGES

5.3.4.1 Growth in demand for high-efficiency fertilizers

5.3.4.2 Unfavorable regulatory standards

5.4 COVID-19 IMPACT ANALYSIS OF LIQUID FERTILIZERS MARKET

5.5 ECOSYSTEM/MARKET MAP

5.6 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF LIQUID FERTILIZERS (2019): A MAJOR CONTRIBUTION FROM R&D AND MANUFACTURING PHASE

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 20 REGULATORY APPROVALS ARE A VITAL COMPONENT OF THE SUPPLY CHAIN

5.7.1 PROMINENT COMPANIES

5.7.2 SMALL AND MEDIUM ENTERPRISES (SME)

5.7.3 END USERS

5.7.4 KEY INFLUENCERS

5.8 PATENT ANALYSIS

FIGURE 21 NUMBER OF PATENTS APPROVED FOR LIQUID FERTILIZERS, 2015-2019

FIGURE 22 GEOGRAPHICAL ANALYSIS: PATENT APPROVAL FOR LIQUID FERTILIZERS, 2015-2019

TABLE 2 LIST OF IMPORTANT PATENTS FOR LIQUID FERTILIZERS, 2015-2019

5.9 REGULATORY FRAMEWORK

5.9.1 NORTH AMERICA

5.9.1.1 US

5.9.1.2 Canada

5.9.2 EUROPE

5.9.3 AUSTRALIA

5.9.4 CHINA

6 LIQUID FERTILIZERS MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

TABLE 3 LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 4 MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 5 MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 6 MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (THOUSAND TONNES)

6.2 NITROGEN

6.2.1 NITROGEN TO BE A KEY SEGMENT IN ASIAN AND NORTH AMERICAN COUNTRIES

FIGURE 23 GLOBAL INCREASE/DECREASE IN NITROGEN FERTILIZER CONSUMPTION, BY REGION/SUBREGION, 2014-2018

TABLE 7 LIQUID NITROGEN FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 8 LIQUID NITROGEN FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 9 LIQUID NITROGEN FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (THOUSAND TONNES)

TABLE 10 LIQUID NITROGEN FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (THOUSAND TONNES)

6.3 PHOSPHORUS

6.3.1 LIQUID PHOSPHORUS FERTILIZERS GAINING IMPORTANCE FOR FRUITS & VEGETABLES CULTIVATION IN ASIA PACIFIC

TABLE 11 LIQUID PHOSPHORUS FERTILIZERS MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 12 LIQUID PHOSPHORUS FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 13 LIQUID PHOSPHORUS FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (THOUSAND TONNES)

TABLE 14 LIQUID PHOSPHORUS FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (THOUSAND TONNES)

6.4 POTASSIUM

6.4.1 MOST WIDELY USED LIQUID POTASSIUM SOURCES FOR AGRICULTURAL CROPS

TABLE 15 LIQUID POTASSIUM FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 16 LIQUID POTASSIUM FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 17 LIQUID POTASSIUM FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (THOUSAND TONNES)

TABLE 18 LIQUID POTASSIUM FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (THOUSAND TONNES)

6.5 MICRONUTRIENTS

6.5.1 BORON AND IRON-BASED MICRONUTRIENTS HOLDS SIGNIFICANT USAGE AMONG FARMERS IN THIS SEGMENT

TABLE 19 LIQUID MICRONUTRIENT FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 20 LIQUID MICRONUTRIENT FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 21 LIQUID MICRONUTRIENT FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (THOUSAND TONNES)

TABLE 22 LIQUID MICRONUTRIENT FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (THOUSAND TONNES)

7 LIQUID FERTILIZERS MARKET, BY CROP TYPE (Page No. - 89)

7.1 INTRODUCTION

7.2 MACRO INDICATORS

7.2.1 CROP CULTIVATION PATTERN

FIGURE 24 CORN & SOYBEAN CROP CULTIVATION AREA, 2013-2018 (MILLION HA)

7.3 CONNECTED MARKET: NPK (N + P2O5 + K2O) FERTILIZERS

FIGURE 25 GLOBAL NUTRIENTS (N + P2O5 + K2O) CONSUMPTION, 2009-2019

FIGURE 26 CEREALS & GRAINS TO DOMINATE THE LIQUID FERTILIZERS MARKET DURING THE FORECAST PERIOD

TABLE 23 LIQUID FERTILIZERS MARKET SIZE, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 24 MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

7.4 CEREALS & GRAINS

7.4.1 CEREALS & GRAINS TO ACCOUNT FOR THE LARGEST DEMAND IN ASIA AND NORTH AMERICA

TABLE 25 LIQUID FERTILIZERS MARKET SIZE FOR CEREALS & GRAINS, BY REGION, 2016-2019 (USD MILLION)

TABLE 26 MARKET SIZE FOR CEREALS & GRAINS, BY REGION, 2020-2025 (USD MILLION)

TABLE 27 MARKET SIZE FOR CEREALS & GRAINS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 28 MARKET SIZE FOR CEREALS & GRAINS, BY CROP TYPE, 2020-2025 (USD MILLION)

7.4.1.1 Corn

TABLE 29 MARKET SIZE FOR CORN, BY REGION, 2016-2019 (USD MILLION)

TABLE 30 MARKET SIZE FOR CORN, BY REGION, 2020-2025 (USD MILLION)

7.4.1.2 Wheat

TABLE 31 MARKET SIZE FOR WHEAT, BY REGION, 2016-2019 (USD MILLION)

TABLE 32 MARKET SIZE FOR WHEAT, BY REGION, 2020-2025 (USD MILLION)

7.4.1.3 Rice

TABLE 33 MARKET SIZE FOR RICE, BY REGION, 2016-2019 (USD MILLION)

TABLE 34 MARKET SIZE FOR RICE, BY REGION, 2020-2025 (USD MILLION)

7.4.1.4 Others

TABLE 35 MARKET SIZE FOR OTHER CEREAL & GRAIN CROPS, BY REGION, 2016-2019 (USD MILLION)

TABLE 36 MARKET SIZE FOR OTHER CEREAL & GRAIN CROPS, BY REGION, 2020-2025 (USD MILLION)

7.5 OILSEEDS & PULSES

7.5.1 HIGH APPLICATION OF NITROGEN FERTILIZERS GAINING IMPORTANCE FOR CASH-RICH OILSEED & PULSE CROPS

TABLE 37 LIQUID FERTILIZERS MARKET SIZE FOR OILSEEDS & PULSES, BY REGION, 2016-2019 (USD MILLION)

TABLE 38 MARKET SIZE FOR OILSEEDS & PULSES, BY REGION, 2020-2025 (USD MILLION)

TABLE 39 MARKET SIZE FOR OILSEEDS & PULSES, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 40 MARKET SIZE FOR OILSEEDS & PULSES, BY CROP TYPE, 2020-2025 (USD MILLION)

7.5.1.1 Soybean

TABLE 41 MARKET SIZE FOR SOYBEAN, BY REGION, 2016-2019 (USD MILLION)

TABLE 42 MARKET SIZE FOR SOYBEAN, BY REGION, 2020-2025 (USD MILLION)

7.5.1.2 Others

TABLE 43 MARKET SIZE FOR OTHER OILSEED & PULSE CROPS, BY REGION, 2016-2019 (USD MILLION)

TABLE 44 MARKET SIZE FOR OTHER OILSEED & PULSE CROPS, BY REGION, 2020-2025 (USD MILLION)

7.6 FRUITS & VEGETABLES

7.6.1 GROWERS NEED TO PRODUCE MORE CROPS IN A LIMITED AMOUNT OF ARABLE LAND, DUE TO WHICH THE APPLICATION OF LIQUID FERTILIZERS IN FRUITS AND VEGETABLES IS INCREASING

TABLE 45 LIQUID FERTILIZERS MARKET SIZE FOR FRUITS & VEGETABLES, BY REGION, 2016-2019 (USD MILLION)

TABLE 46 MARKET SIZE FOR FRUITS & VEGETABLES, BY REGION, 2020-2025 (USD MILLION)

7.7 OTHERS

TABLE 47 MARKET SIZE FOR OTHERS, BY REGION, 2016-2019 (USD MILLION)

TABLE 48 MARKET SIZE FOR OTHERS, BY REGION, 2020-2025 (USD MILLION)

8 LIQUID FERTILIZERS MARKET, BY MAJOR COMPOUND (Page No. - 109)

8.1 INTRODUCTION

FIGURE 27 UAN IS PROJECTED TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

8.2 UREA-AMMONIUM NITRATE (UAN)

8.2.1 UAN HAS BEEN GAINING GROWTH AS FOR ITS APPLICATION IN FERTIGATION METHODS

TABLE 51 LIQUID UAN FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 52 LIQUID UAN FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.3 DIAMMONIUM PHOSPHATE (DAP)

8.3.1 MOST WIDELY USED IN FRUIT & VEGETABLE GROWING REGIONS OF ASIA PACIFIC

TABLE 53 LIQUID DAP FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 54 LIQUID DAP FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.4 CALCIUM AMMONIUM NITRATE (CAN)

8.4.1 SUITABLE FOR EFFECTIVE UPTAKE OF NITROGEN ALONG THE CROP ROOTS

TABLE 55 LIQUID CAN FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 56 LIQUID CAN FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION) 8.5 POTASSIUM NITRATE

8.5.1 POTASSIUM NITRATE IS FREQUENTLY USED IN FOLIAR SPRAYS OR FERTIGATION, OWING TO ITS QUICK WATER-SOLUBILITY

TABLE 57 LIQUID POTASSIUM NITRATE FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 58 LIQUID POTASSIUM NITRATE FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.6 MONOAMMONIUM PHOSPHATE (MAP)

8.6.1 MOSTLY ADOPTED IN HIGHLY ALKALINE SOILS

TABLE 59 LIQUID MAP FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 60 LIQUID MAP FERTILIZERS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.7 OTHERS

TABLE 61 OTHER COMPOUNDS: LIQUID FERTILIZERS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 62 OTHER COMPOUNDS: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.8 HIGHLY AND LEAST IMPACTED COMPOUNDS DURING THE COVID-19 PANDEMIC

9 LIQUID FERTILIZERS MARKET, BY MODE OF APPLICATION (Page No. - 118)

9.1 INTRODUCTION

TABLE 63 MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 64 MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

9.2 SOIL

9.2.1 SOIL APPLICATION IS ONE OF THE MOST WIDELY USED METHODS FOR AGRICULTURAL CROPS IN THE LIQUID FERTILIZERS MARKET, PARTICULARLY IN THE ASIA PACIFIC COUNTRIES

TABLE 65 SOIL APPLICATION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 66 SOIL APPLICATION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.3 FOLIAR

9.3.1 FOLIAR APPLICATION IN THE LIQUID FERTILIZER MARKET HELPS IN CATERING TO THE NUTRITIONAL DEFICIENCIES IN PLANTS, WHICH IS ONE OF THE KEY DRIVING FACTORS FOR THE MARKET IN THE ASIA PACIFIC REGION

TABLE 67 FOLIAR APPLICATION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 68 FOLIAR APPLICATION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.4 FERTIGATION

9.4.1 FERTIGATION CONTINUES TO BE A LEADING SEGMENT IN THE LIQUID FERTILIZER MARKET IN THE ASIAN AND NORTH AMERICAN COUNTRIES

TABLE 69 FERTIGATION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 70 FERTIGATION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

9.5 OTHERS

TABLE 71 OTHER MODES OF APPLICATION MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 72 OTHER MODES OF APPLICATION MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

10 LIQUID FERTILIZERS MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 28 VIETNAM PROJECTED TO GROW AT THE HIGHEST CAGR IN THE LIQUID FERTILIZERS MARKET

TABLE 73 MARKET SIZE FOR LIQUID FERTILIZERS, BY REGION, 2016-2019 (USD MILLION)

TABLE 74 MARKET SIZE FOR LIQUID FERTILIZERS, BY REGION, 2020-2025 (USD MILLION)

TABLE 75 MARKET SIZE FOR LIQUID FERTILIZERS, BY REGION, 2016-2019 (THOUSAND TONNES)

TABLE 76 MARKET SIZE FOR LIQUID FERTILIZERS, BY REGION, 2020-2025 (THOUSAND TONNES)

10.2 NORTH AMERICA

TABLE 77 NORTH AMERICA: LIQUID FERTILIZERS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (THOUSAND TONNES)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (THOUSAND TONNES)

TABLE 81 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 84 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (THOUSAND TONNES)

TABLE 85 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

10.2.1 US

10.2.1.1 Established players in the market are focusing on developing liquid fertilizer products

TABLE 91 US: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 92 US: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 93 US: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 94 US: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growth in demand from the food processing industry for cereals & grains to drive the market

TABLE 95 CANADA: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Wider emphasis of the Mexican government on the application of nitrogenous liquid fertilizers on a variety of food crops impacts the demand for liquid fertilizers in the country

TABLE 99 MEXICO: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 100 MEXICO: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 101 MEXICO: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 102 MEXICO: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC SNAPSHOT

TABLE 103 ASIA PACIFIC: LIQUID FERTILIZERS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (THOUSAND TONNES)

TABLE 106 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (THOUSAND TONNES)

TABLE 107 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 114 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (THOUSAND TONNES)

TABLE 115 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

10.3.1 CHINA

10.3.1.1 High growth in nitrogen- and phosphorus-based liquid fertilizer consumption observed in the country

TABLE 117 CHINA: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 118 CHINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3.2 INDIA

10.3.2.1 Growth in the market for nitrogenous fertilizers to drive the adoption of innovative liquid fertilizers in the country

TABLE 121 INDIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 122 INDIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 123 INDIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 124 INDIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3.3 JAPAN

10.3.3.1 Advanced agricultural practices are driving the growth of the market

TABLE 125 JAPAN: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 126 JAPAN: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 127 JAPAN: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 128 JAPAN: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3.4 AUSTRALIA

10.3.4.1 Increase in consumption of liquid fertilizers and decreasing arable land are the key factors driving the market in the country

TABLE 129 AUSTRALIA: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 130 AUSTRALIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 131 AUSTRALIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 132 AUSTRALIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3.5 VIETNAM

10.3.5.1 Increase in agricultural productivity and improvement in farmer income are factors enhancing the demand for liquid fertilizers in the country

TABLE 133 VIETNAM: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 134 VIETNAM: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 135 VIETNAM: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 136 VIETNAM: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.3.6 REST OF ASIA PACIFIC

TABLE 137 REST OF ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 138 REST OF ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 139 REST OF ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 140 REST OF ASIA PACIFIC: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4 EUROPE

TABLE 141 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 142 EUROPE: LIQUID FERTILIZERS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (THOUSAND TONNES)

TABLE 144 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (THOUSAND TONNES)

TABLE 145 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 154 EUROPE: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2020-2025 (THOUSAND TONNES)

10.4.1 RUSSIA

10.4.1.1 The increase in the share of nitrogen in NPK consumption is projected to drive the growth of the market

TABLE 155 RUSSIA: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 156 RUSSIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 157 RUSSIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 158 RUSSIA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.2 SPAIN

10.4.2.1 Implementation of a strong irrigation system in the country to drive the growth of the market

TABLE 159 SPAIN: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 160 SPAIN: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 161 SPAIN: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 162 SPAIN: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.3 GERMANY

10.4.3.1 Reducing arable land in the country has increased the demand for liquid fertilizers in the country

TABLE 163 GERMANY: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 164 GERMANY: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 165 GERMANY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 166 GERMANY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.4 ITALY

10.4.4.1 The growth in demand for cereals and grains from the feed and food sectors to drive the growth in the market

TABLE 167 ITALY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 168 ITALY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 169 ITALY: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 170 ITALY: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

10.4.5 IRELAND

10.4.5.1 The need to achieve sustainability in food production is projected to drive growth in the market

TABLE 171 IRELAND: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 172 IRELAND: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 173 IRELAND: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 174 IRELAND: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.6 UK

10.4.6.1 High dependence of the feed industry on cereals produced domestically is a major factor driving the growth of the market

TABLE 175 UK: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 176 UK: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 177 UK: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 178 UK: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.7 UKRAINE

10.4.7.1 Increase in international demand for wheat to drive the growth of the market

TABLE 179 UKRAINE: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 180 UKRAINE: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 181 UKRAINE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 182 UKRAINE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.4.8 REST OF EUROPE

10.4.8.1 The need for gaining self-sufficiency in the production of cereals & grains is projected to drive growth in the market

TABLE 183 REST OF EUROPE: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 184 REST OF EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 185 REST OF EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 186 REST OF EUROPE: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.5 SOUTH AMERICA

FIGURE 30 SOUTH AMERICA SNAPSHOT

TABLE 187 SOUTH AMERICA: LIQUID FERTILIZERS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 188 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 189 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (THOUSAND TONNES)

TABLE 190 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (THOUSAND TONNES)

TABLE 191 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 192 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

TABLE 193 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 194 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 195 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 196 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (THOUSAND TONNES)

TABLE 197 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 198 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 199 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 200 SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 The use of essential liquid fertilizers grades has provided a great opportunity to the farmers for increasing their crop production in the country

TABLE 201 BRAZIL: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 202 BRAZIL: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 203 BRAZIL: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 204 BRAZIL: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Rise in government support to farmers for the usage of liquid fertilizers to contribute to the market growth during the forecast period

TABLE 205 ARGENTINA: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 206 ARGENTINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 207 ARGENTINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 208 ARGENTINA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 209 REST OF SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 210 REST OF SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 211 REST OF SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 212 REST OF SOUTH AMERICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 213 ROW: LIQUID FERTILIZERS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 214 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 215 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2016-2019 (THOUSAND TONNES)

TABLE 216 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY COUNTRY, 2020-2025 (THOUSAND TONNES)

TABLE 217 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 218 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 219 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (THOUSAND TONNES)

TABLE 220 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (THOUSAND TONNES)

TABLE 221 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2016-2019 (USD MILLION)

TABLE 222 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY MODE OF APPLICATION, 2020-2025 (USD MILLION)

TABLE 223 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 224 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

TABLE 225 ROW: LIQUID FERTILIZERS MARKET SIZE, BY MAJOR COMPOUND, 2016-2019 (USD MILLION)

TABLE 226 ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY MAJOR COMPOUND, 2020-2025 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 High growth in nitrogenous liquid fertilizers consumption observed in the country

TABLE 227 SOUTH AFRICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 228 SOUTH AFRICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 229 SOUTH AFRICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 230 SOUTH AFRICA: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.6.2 TURKEY

10.6.2.1 Growth in government support for the usage of liquid fertilizers

TABLE 231 TURKEY: LIQUID FERTILIZERS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 232 TURKEY: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 233 TURKEY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 234 TURKEY: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.6.3 OTHERS IN ROW

TABLE 235 OTHERS IN ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 236 OTHERS IN ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY TYPE, 2020-2025 (USD MILLION)

TABLE 237 OTHERS IN ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2016-2019 (USD MILLION)

TABLE 238 OTHERS IN ROW: MARKET SIZE FOR LIQUID FERTILIZERS, BY CROP TYPE, 2020-2025 (USD MILLION)

10.7 HIGHEST AND LEAST AFFECTED REGIONS DURING THE COVID-19 PANDEMIC IN THE MARKET

11 COMPETITIVE LANDSCAPE (Page No. - 208)

11.1 OVERVIEW

11.1.1 MARKET EVALUATION FRAMEWORK

FIGURE 31 LIQUID FERTILIZERS MARKET: TRENDS IN COMPANY STRATEGIES, 2017- 2020

11.2 COMPANY RANKING

FIGURE 32 LIQUID FERTILIZERS MARKET: COMPANY RANKINGS, 2019

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 DYNAMIC DIFFERENTIATORS

11.3.2 INNOVATORS

11.3.3 VISIONARY LEADERS

11.3.4 EMERGING COMPANIES

FIGURE 33 LIQUID FERTILIZERS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 34 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE LIQUID FERTILIZERS MARKET, 2017-2019

11.4 COMPETITIVE SCENARIO

11.4.1 MERGERS & ACQUISITIONS

TABLE 239 MERGERS & ACQUISITIONS, 2018-2019

11.4.2 EXPANSIONS

TABLE 240 EXPANSIONS, 2018-2019

11.4.3 NEW PRODUCT LAUNCHES

TABLE 241 NEW PRODUCT LAUNCHES, 2017-2019

11.4.4 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS

TABLE 242 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS, 2017-2019

12 COMPANY PROFILES (Page No. - 218)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 NUTRIEN LTD.

FIGURE 35 NUTRIEN LTD.: COMPANY SNAPSHOT

FIGURE 36 NUTRIEN LTD.: SWOT ANALYSIS

12.2 YARA INTERNATIONAL ASA

FIGURE 37 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

FIGURE 38 YARA INTERNATIONAL ASA: SWOT ANALYSIS

12.3 ISRAEL CHEMICAL LTD.

FIGURE 39 ISRAEL CHEMICAL LTD.: COMPANY SNAPSHOT

FIGURE 40 ISRAEL CHEMICALS LTD.: SWOT ANALYSIS

12.4 NUFARM

FIGURE 41 NUFARM: COMPANY SNAPSHOT

12.5 K+S AKTIENGESELLSCHAFT

FIGURE 42 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

FIGURE 43 K+S AKTIENGESELLSCHAFT: SWOT ANALYSIS

12.6 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM)

FIGURE 44 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM): COMPANY SNAPSHOT

FIGURE 45 SOCIEDAD QUÍMICA Y MINERA DE CHILE (SQM): SWOT ANALYSIS

12.7 THE MOSAIC COMPANY

FIGURE 46 THE MOSAIC COMPANY: COMPANY SNAPSHOT

12.8 EUROCHEM GROUP

FIGURE 47 EUROCHEM GROUP: COMPANY SNAPSHOT

12.9 CF INDUSTRIES HOLDINGS, INC.

FIGURE 48 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

12.10 OCP GROUP

FIGURE 49 OCP GROUP: COMPANY SNAPSHOT

12.11 OCI NITROGEN

FIGURE 50 OCI NITROGEN: COMPANY SNAPSHOT

12.12 WILBUR-ELLIS COMPANY

12.13 COMPASS MINERALS

12.14 KUGLER

12.15 VALAGRO SPA

12.16 HAIFA GROUP

12.17 COMPO EXPERT GMBH

12.18 AGROLIQUID

12.19 PLANT FOOD COMPANY, INC.

12.20 FOXFARM SOIL AND FERTILIZER COMPANY

12.21 AGRO BIO CHEMICALS

12.22 AGZON AGRO

12.23 BRANDT

12.24 PLANT FUEL NUTRIENTS, LLC.

12.25 NUTRI-TECH SOLUTIONS

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 274)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 CONTROLLED-RELEASE FERTILIZER MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

FIGURE 51 IMPROVING EFFICIENCY OF AVAILABILITY OF NUTRIENTS TO CROPS IS DRIVING THE GROWTH OF THE CONTROLLED-RELEASE FERTILIZERS MARKET

13.3.3 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE

TABLE 243 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 244 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (KT)

13.3.4 CONTROLLED-RELEASE FERTILIZERS MARKET, BY END USE

TABLE 245 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY END USE, 2018-2025 (USD MILLION)

13.3.4.1 Non-Agricultural

13.3.4.1.1 Higher purchasing power for fertilizers drives the demand for CRFs in non-agricultural end-use

TABLE 246 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN NON-AGRICULTURE APPLICATION, 2018-2025 (USD MILLION)

13.3.4.2 Agricultural

13.3.4.2.1 Agrarian economies are demanding application of CRFs for better yields in low-volume and high-value crops

TABLE 247 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE IN AGRICULTURAL APPLICATION, BY CROP TYPE, 2018-2025 (USD MILLION)

13.3.5 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TECHNOLOGY

13.3.5.1 Introduction

13.3.5.2 Polymer coating

13.3.5.3 Sulfur-based coating

13.3.5.4 Urea reaction product

13.3.6 CONTROLLED-RELEASE FERTILIZERS MARKET, BY END USE

TABLE 248 CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY MODE OF APPLICATION, 2018-2025 (USD MILLION)

13.3.7 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

13.3.7.1 North America

TABLE 249 NORTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 250 NORTH AMERICA CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (KT)

13.3.7.2 Europe

TABLE 251 EUROPE CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 252 EUROPE: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (KT)

13.3.7.3 Asia Pacific

TABLE 253 ASIA PACIFIC: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 254 ASIA PACIFIC: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (KT)

13.3.7.4 South America

TABLE 255 SOUTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 256 SOUTH AMERICA: CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2018-2025 (KT)

13.3.7.5 Rest of the World (RoW)

TABLE 257 ROW: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 258 ROW: CONTROLLED-RELEASE FERTILIZERS MARKET SIZE, BY TYPE, 2018-2025 (KT)

13.4 AGRICULTURAL CHELATES MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

FIGURE 52 INCREASE IN MICRONUTRIENT DEFICIENCIES HAS RESULTED IN THE GROWTH OF THE AGRICULTURAL CHELATES MARKET

13.4.3 AGRICULTURAL CHELATES MARKET, BY TYPE

TABLE 259 AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

13.4.4 AGRICULTURAL CHELATES MARKET, BY MICRONUTRIENT

TABLE 260 AGRICULTURAL CHELATES MARKET SIZE, BY MICRONUTRIENT, 2017-2025 (USD MILLION)

13.4.5 AGRICULTURAL CHELATES MARKET, BY END USE

TABLE 261 AGRICULTURAL CHELATES MARKET SIZE, BY END USE, 2017-2025 (USD MILLION)

13.4.6 AGRICULTURAL CHELATES MARKET, BY MODE OF APPLICATION

TABLE 262 AGRICULTURAL CHELATES MARKET SIZE, BY MODE OF APPLICATION, 2017-2025 (USD MILLION)

13.4.7 AGRICULTURAL CHELATES MARKET, BY CROP TYPE

TABLE 263 AGRICULTURAL CHELATES MARKET SIZE, BY CROP TYPE, 2017-2025 (USD MILLION)

13.4.8 AGRICULTURAL CHELATES MARKET, BY REGION

TABLE 264 AGRICULTURAL CHELATES MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

13.4.8.1 North America

TABLE 265 NORTH AMERICA: AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

13.4.8.2 Europe

TABLE 266 EUROPE: AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

13.4.8.3 Asia Pacific

TABLE 267 ASIA PACIFIC: AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

13.4.8.4 Rest of the World (RoW)

TABLE 268 ROW: AGRICULTURAL CHELATES MARKET SIZE, BY TYPE, 2017-2025 (USD MILLION)

14 APPENDIX (Page No. - 303)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

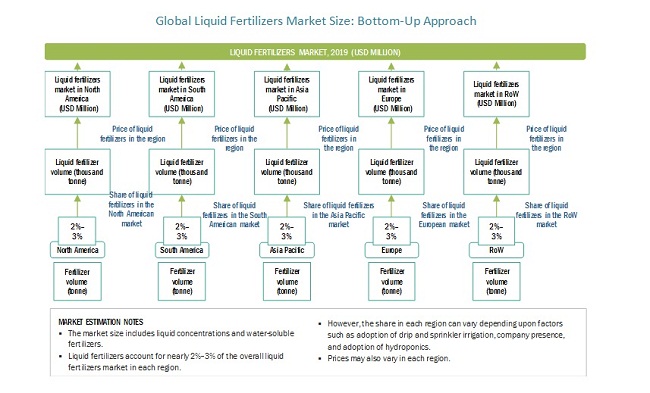

The study involves four major activities to estimate the current market size of the liquid fertilizers market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The liquid fertilizers market comprises several stakeholders such as manufacturers, importers and exporters, traders, distributors and suppliers of liquid fertilizers, and government & research organizations. It also includes manufacturers of fertilizers and seed companies. The demand-side of this market is characterized by the rising demand for liquid fertilizers in seed industries. The supply-side is characterized by the supply of raw materials in the liquid fertilizers market from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the liquid fertilizers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- Major regions were identified, along with countries contributing to the maximum share.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Global Liquid Fertilizers Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the liquid fertilizer market.

Report Objectives

- To define, segment, and project the global market size of the liquid fertilizers market.

- To understand the liquid fertilizers market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, collaborations, divestments, disinvestments, and agreements

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe liquid fertilizers market into Belgium, Denmark, Sweden, Norway, and the Netherlands

- Further breakdown of the Rest of Asia Pacific liquid fertilizers market into Thailand, South Korea, Malaysia, New Zealand

- Further breakdown of South America liquid fertilizers market into Chile, Colombia, Peru, Uruguay

- Further breakdown of the others in RoW liquid fertilizers market into the Middle Eastern and African countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Liquid Fertilizers Market