Meat Processing Equipment Market by Type (Cutting, Blending, Tenderizing, Filling, Slicing, Grinding, Smoking), Product Type (Fresh Processed, Raw Cooked, Precooked, Raw Fermented, Cured), Meat Type, Mode of Operation, & Region - Global Forecast to 2026

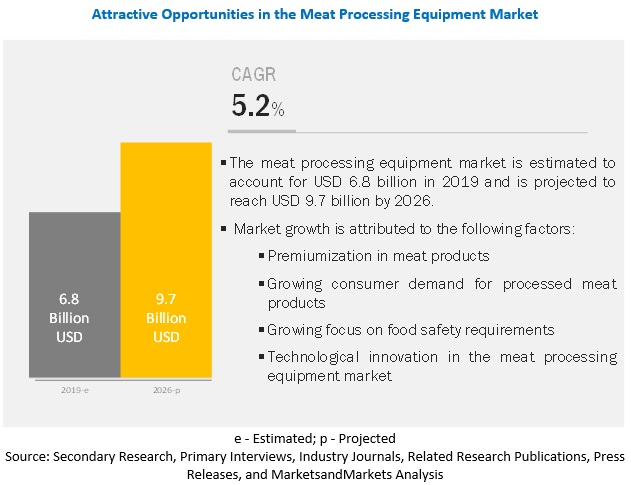

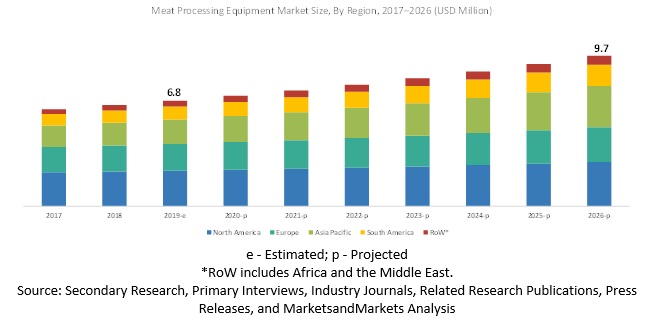

The meat processing equipment market is projected to grow from USD 6.8 billion in 2019 to USD 9.7 billion by 2026, recording a CAGR of 5.2% during the forecast period. This is attributed to the growing consumption of processed meat among consumers, premiumization in meat products, and rising food safety requirement.

The grinding equipment segment is estimated to account for the largest market share in 2019 in the market.

The grinding equipment segment, by type, is estimated to dominate the meat processing equipment market, by type, in terms of value, in 2019. The primary use of grinding equipment is to grind the large pieces of tenderized meat into smaller pieces. Some of the common grinders are used to separate bone pieces and connective tissues, such as tendons, from the muscle meat. The greater application of grinders for processing a wide range of products, such as minced meat, sausages, hamburgers, and other products, is driving the market for grinding equipment

By product type, the precooked meat segment is projected to grow at the highest rate during the forecast period.

Precooked meat products are obtained by mixing fatty tissues, head meat, liver, animal skin, blood, and other edible parts. There are two phases through which this is achieved. In the first phase, the raw meat is heated at a temperature range of around 80-degree Celsius; in the other phase, the meat is heated at a temperature of 80-100-degree Celsius to obtain the final product. As these products utilize a variety of meat parts, various products are offered in this category. This is the key factor driving the market for precooked meat, which, in turn, boosts the precooked meat equipment market

The processed pork segment in the meat processing equipment is estimated to dominate the market in 2019.

By meat type, the market for processed pork is estimated to dominate the meat processing equipment market in 2019. The demand for processed pork is high in major regions such as North America and Europe since processed pork is cheaper than processed beef and tastes better than processed mutton. Also, processed pork is available in a number of varieties such as ham, bacon, and sausages, which are very popular in the western countries, such as France and Germany, which account for a significant market share in the processed meat category.

North America is projected to account for the largest market share in the market during the forecast period.

The North American market accounted for the largest share in 2018 due to the rising demand for processed meat, the growing investment in meat processing facilities, and the presence of a large number of meat processors, such as Tyson Foods, Cargill Meat Solutions Corp., and JBS USA in this region. Also, the growing number of new product launches has resulted in the growth of the market in North America.

Key Market Players

The key players in the global market include GEA Group (Germany), JBT Corporation (US), Marel (Iceland), Illinois Tools Work (US), The Middleby Corporation (US), Bettcher Industries (US), Equipamientos Carnicos (Spain), Biro Manufacturing Company (US), Braher (Spain), RZPO (Russia), Bizerba (Germany), Riopel Industries (Canada), Minerva Omega Group (Italy), and Risco (Italy), Millard Manufacturing Corporation (US), Apache Stainless Equipment Corporation (US), Gee Gee Foods & Packaging (India), PSS Svidnik (Presovsky), Ross Industries Inc. (US), and Metalbud Nowicki (Poland). These players have broad industry coverage and strong operational and financial strength.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Type, Meat type, Product type, Mode of operation, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

GEA Group (Germany), JBT Corporation (US), Marel (Iceland), Illinois Tool Works (US), The Middleby Corporation (US), Bettcher Industries (US), Equipamientos Carnicos (US), Biro Manufacturing Company (US), Braher (Spain), RZPO (Russia), Bizerba (Germany), Riopel Industries (Germany), Minerva Omega Group (Italy), Risco (Italy), Millard Manufacturing Corporation (US), Apache Stainless Equipment Corporation (US), Gee Gee Foods & Packaging (India), PSS Svidnik (Presovsky), Ross Industries, Inc. (US), and Metalbud Nowicki (Poland) |

This research report categorizes the meat processing equipment market based on type, meat type, product type, mode of operation, and region.

Based on Type, the market has been segmented as follows:

- Cutting equipment

- Blending equipment

- Tenderizing equipment

- Filling equipment

- Slicing equipment

- Grinding equipment

- Smoking equipment

- Massaging equipment

- Other types (brine injectors, emulsifying machines, and ice flakers)

Based on Meat Type, the market has been segmented as follows:

- Processed beef

- Processed pork

- Processed mutton

- Other meat types (the meat of horses, rabbits, camels, and yaks)

Based on Product Type, the market has been segmented as follows:

- Fresh processed meat

- Raw cooked meat

- Precooked meat

- Raw fermented sausage

- Cured meat

- Dried meat

- Other product types (sun-drying meat, mincing, and grinding meat)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & Africa)

Recent Developments:

- In November 2019, Marel opened its new production center in Dongen, Netherlands, because the former location in Dongen no longer met contemporary standards. Therefore, the realization of the new product center was an initiative taken by the company to improve its efficiency.

- In October 2019, Marel acquired Cedar Creek Company (Australia), an Australian firm of specialized software and hardware for meat processors. This would aid the company to manufacture more innovative products and to expand its production line.

- In October 2019, Marel acquired a 50% stake in Curio (Iceland) with the objective of becoming a global supplier of advanced standard equipment for the meat industry.

- In June 2019, JBT (US) acquired Proseal (UK) and Prime Equipment Group (US), Inc. to expand its reach and its production line.

- In February 2019, GEA Group (Germany) launched a new injection system, Multijector 2mm, which would be used for brining bacon/pork to keep them fresh for a longer duration.

- In November 2018, Bettcher signed an agreement with Grasselli (Italy) for its innovative product design. The agreement includes the sale of equipment types, with service activities provided by Bettcher technicians.

- In July 2018, Bettcher launched Quantum Flex Trimmers for cutting meat at a greater speed to increase productivity.

- In February 2018, Minerva Omega Group acquired the Italian company ARSA (Italy) to expand its production line and its geographical reach.

- In February 2018, Marel launched Deboflex for deboning and cutting pork fore-ends.

Key questions addressed by the report:

- Who are the major market players in the market?

- What are the regional growth trends and the largest revenue-generating regions for the meat processing equipment market?

- Which are the key regions that are projected to witness significant growth in the market?

- What are the major types of meat processing equipment that are projected to gain maximum market revenue and share during the forecast period?

- On which meat products is this meat processing equipment majorly used, and which type of meat dominates the forecast period?

Frequently Asked Questions (FAQ):

What is the major meat type considered in the report?

The major meat type considered within the report are:

- Processed beef

- Processed pork

- Processed mutton

- Other meat types

What are the major countries profiled under South America for meat processing equipment market?

The major countries that are profiled under South America for meat processing equipment market are:

- Brazil

- Argentina

- Rest of South America

What are the types of meat processing equipment market that are considered?

In this report we have considered different types of processing equipment such as:

- Cutting

- Blending

- Slicing

- Tenderizing

- Filling

- Grinding

- Smoking

- Massaging

- Others

In Asia Pacific market, which countries are considered?

In Asia Pacific region, we have considered:

- China

- India

- Japan

- Vietnaam

- Thailand

- Australia & New Zealand

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Segmentation

1.2.2 Inclusions & Exclusions

1.3 Regions Covered

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Market Size Estimation

2.2.1 Approach One (Based on Global Market)

2.2.2 Approach Two (Based on Segmentation)

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Opportunities in the Market

4.2 Meat Processing Equipment Market: Major Regional Submarkets

4.3 North America: Meat Processing Equipment Market, By Key Type and Country

4.4 Market, By Meat Type and Region

4.5 Market, By Product Type

4.6 Market, By Type and Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Innovation in this Market

5.2.1.2 Premiumization in Meat Products

5.2.1.3 Growing Consumer Demand for Processed Meat Products

5.2.1.4 Growing Focus on Food Safety Requirements

5.2.2 Restraints

5.2.2.1 High Cost of Automated Equipment

5.2.2.2 Shifting Consumer Preferences From Red Meat to Alternative Meat Sources

5.2.3 Opportunities

5.2.3.1 Integration of Artificial Intelligence in the Market

5.2.3.2 Opportunity to Expand in the Emerging Markets of Asia Pacific

5.2.4 Challenges

5.2.4.1 Lower Adoption Rate of Advanced Meat Processing Equipment in Developing Nations

5.3 Value Chain

6 Meat Processing Equipment Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Cutting Equipment

6.2.1 Increasing Consumption of Processed Meat Cuts and Brisket Driving the Market Growth for Cutting Equipment

6.3 Slicing Equipment

6.3.1 Production of a Wide Range of Meat Products is Driving the Market for Automated Slicing Equipment

6.4 Blending Equipment

6.4.1 Multifunctionality of Grinding Equipment to InfluenceThe Market Growth of Blending Equipment

6.5 Tenderizing Equipment

6.5.1 Consumer Demand for Softened Meat Driving the Market Growth of Tenderizing Equipment

6.6 Filling Equipment

6.6.1 Filling of Meat Batters on a Large-Scale Driving the Market for Automated Filling Equipment

6.7 Grinding Equipment

6.7.1 Wide Application of Grinders to Perform Varied Functions

6.8 Smoking Equipment

6.8.1 Increase in Demand for Hygienically Processed Equipment

6.9 Massaging Equipment

6.9.1 Improved Brine Absorption and Protein Extraction Driving the Market for Massaging Equipment

6.10 Other Equipment

6.10.1 Rising Consumption of Flavored Meat Products Driving the Market for Injectors and Emulsifiers

7 Meat Processing Equipment Market, By Meat Type (Page No. - 53)

7.1 Introduction

7.2 Processed Beef

7.2.1 Consumer Preference for Processed Beef Products Owing to Their Inherent Rich Flavor

7.3 Processed Pork

7.3.1 Pork is Considered to be a Good Source of Proteins and Vitamins

7.4 Processed Mutton

7.4.1 Growing Demand From China and the Middle East Driving the Market for Processed Mutton

7.5 Other Meat Types

7.5.1 Horse Meat is the Most Consumed After Pork, Beef, and Mutton

8 Meat Processing Equipment Market, By Product Type (Page No. - 58)

8.1 Introduction

8.2 Fresh Processed Meat

8.2.1 Consumer Preference for Fresh Processed Meat Products

8.3 Raw Cooked Meat

8.3.1 Increasing Demand for Steamed and Baked Products

8.4 Precooked Meat

8.4.1 Rising Consumer Demand for Precooked Meat Products

8.5 Raw Fermented Sausages

8.5.1 Owing to the Presence of a Large Number of Additives, the Demand for These Products is Expected to Decline in the Coming Years

8.6 Cured Meat

8.6.1 Demand for Flavored Meat is Driving the Market for Cured Meat

8.7 Dried Meat

8.7.1 Longer Shelf-Life of Dried Meat Products to Drive the Market Growth

8.8 Other Product Types

8.8.1 Demand for Traditional Smoked and Cured Products in Asia Pacific and African Countries

9 Meat Processing Equipment Market, By Mode of Operation (Page No. - 65)

9.1 Introduction

9.2 Automatic

9.2.1 Manufacturing of Processed Meat in Large Volumes to Drive Market Growth

9.3 Semi-Automatic

9.3.1 Increase in the Efficiency of Workers Due to Semi-Automation is Driving the Market for Semi-Automatic Equipment

9.4 Manual

9.4.1 Large-Scale Demand and Lack of Adequate Labor are Leading to the Lower Adoption of Manual Meat Processing Equipment

10 Meat Processing Equipment, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Investment in Meat Processing Facilities and the Growing Consumer Demand for Convenient Meat Products Driving the Market for Meat rocessing Equipment in the Country

10.2.2 Canada

10.2.2.1 Rising Exports of Processed Meat to Other Countries Boosting the Demand for Meat Processing Equipment in Canada

10.2.3 Mexico

10.2.3.1 Increase in Safety Regulations for Processed Meat Products Driving the Market

10.3 Europe

10.3.1 Germany

10.3.1.1 Rise in Exports for Meat Processing Equipment

10.3.2 France

10.3.2.1 Rising Consumption of Convenient Meat Products Among the Younger Population

10.3.3 Italy

10.3.3.1 Presence of Small and Medium-Sized Meat Processing Equipment Manufacturers

10.3.4 Spain

10.3.4.1 Rising Production and Consumption of Processed Meat Products

10.3.5 UK

10.3.5.1 Rise in Demand for Premium Meat Products

10.3.6 Rest of Europe

10.3.6.1 Growing Consumer Demand for Diversified Meat Products

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Government Focus to Streamline Meat Processing Facilities

10.4.2 Australia & New Zealand

10.4.2.1 High Export Demand for Beef and Pork Meat Due to Adherence to Food Safety Norms

10.4.3 Japan

10.4.3.1 Rising Consumption of Convenience Meat Products Due to the Growing Number of Single Households

10.4.4 India

10.4.4.1 Rise in Exports of Processed Meat to Thailand and Japan

10.4.5 Vietnam

10.4.5.1 Rising Investments in Meat Processing Facilities

10.4.6 Thailand

10.4.6.1 Focus on the Development of Innovative Meat Products

10.4.7 Rest of Asia Pacific

10.4.7.1 Growth of Meat Processing Facilities

10.5 South America

10.5.1 Brazil

10.5.1.1 Growing Export of Processed Beef Products Expected to Drive the Demand for Meat Processing Equipment

10.5.2 Argentina

10.5.2.1 Growth in Centralized Meat Production and Processing Facilities

10.5.3 Rest of South America

10.5.3.1 Government Emphasis on Standardized Meat Processing Facilities

10.6 Rest of the World (RoW)

10.6.1 Middle East

10.6.1.1 Growing Demand for Processed Red Meat Such as Lamb and Beef

10.6.2 Africa

10.6.2.1 Growing Food Safety Regulations in the Country Prompting Processors to use Enhanced Meat Processing Equipment

11 Competitive Landscape (Page No. - 116)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Dynamic Differentiators

11.2.3 Innovators

11.2.4 Emerging Companies

11.3 Start-Up Microquadrants

11.3.1 Progressive Companies

11.3.2 Starting Blocks

11.3.3 Responsive Companies

11.3.4 Dynamic Companies

11.4 Market Share Analysis

11.5 Competitive Scenario

11.5.1 New Product/Technology Launches

11.5.2 Acquisitions

11.5.3 Agreements, Collaborations, and Partnerships

12 Company Profiles (Page No. - 122)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to Win)*

12.1 GEA Group

12.2 JBT Corporation

12.3 Marel

12.4 Illinois Tool Works

12.5 The Middleby Corporation

12.6 Bettcher Industries

12.7 Equipamientos Carnicos

12.8 Biro Manufacturing Company

12.9 Braher

12.10 RZPO

12.11 Bizerba

12.12 Riopel Industries

12.13 Minerva Omega Group

12.14 Risco

12.15 Millard Manufacturing Corporation

12.16 Apache Stainless Equipment Corporation

12.17 Gee Gee Foods & Packaging

12.18 PSS Svidnik

12.19 Ross Industries, Inc.

12.20 Metalbud Nowicki

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to Win Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (117 Tables)

Table 1 US Dollar Exchange Rates Considered, 2015–2018

Table 2 Market Snapshot, 2019 Vs. 2026

Table 3 Growth Rate of Meat and Other Alternative Sources, 2019–2027

Table 4 Market Size, By Type, 2017–2026 (USD Million)

Table 5 Meat Processing Cutting Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 6 Meat Processing Slicing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 7 Meat Processing Blending Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 8 Meat Processing Tenderizing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 9 Meat Processing Filling Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 10 Meat Processing Grinding Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 11 Meat Processing Smoking Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 12 Meat Processing Massaging Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 13 Other Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 14 Market Size for Meat Processing Equipment, By Meat Type, 2017-2026 (USD Million)

Table 15 Beef Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 16 Market Size for Processed Pork, By Region, 2017–2026 (USD Million)

Table 17 Market Size for Processed Mutton, By Region, 2017–2026 (USD Million)

Table 18 Market Size for Other Meat Types, By Region, 2017–2026 (USD Million)

Table 19 Market Size, By Product Type, 2017–2026 (USD Million)

Table 20 Fresh Processed Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 21 Raw Cooked Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 22 Precooked Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 23 Raw Fermented Sausage Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 24 Cured Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 25 Dried Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 26 Processing Equipment Market Size for Other Meat Product Types, By Region, 2017–2026 (USD Million)

Table 27 Market Size, By Mode of Operation, 2017–2026 (USD Million)

Table 28 Automatic Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 29 Semi-Automatic Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 30 Meat Production in the Middle East & Africa and Asia Pacific (Tones)

Table 31 Manual Meat Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 32 Market Size, By Region, 2017–2026 (USD Million)

Table 33 North America: Meat Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 34 North America: Market Size, By Type, 2017–2026 (USD Million)

Table 35 North America: Processed Pork Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 36 North America: Processed Beef Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 37 North America: Processed Mutton Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 38 North America: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 39 North America: Market Size, By Product Type, 2017–2026 (USD Million)

Table 40 North America: Market Size, By Mode of Operation, 2017–2026 (USD Million)

Table 41 US: Meat Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 42 US: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 43 Canada: Market Size For Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 44 Canada: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 45 Mexico: Market Size For Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 46 Mexico: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 47 Europe: Market Size For Meat Processing Equipment, By Country/Region, 2017–2026 (USD Million)

Table 48 Europe: Market Size, By Type, 2017–2026 (USD)

Table 49 Europe: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 50 Europe: Processed Beef Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 51 Europe: Processed Pork Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 52 Europe: Processed Mutton Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 53 Europe: Market Size for Meat Processing Equipment, By Product Type, 2017–2026 (USD Million)

Table 54 Europe: Market Size, By Mode of Operation, 2017–2026 (USD Million)

Table 55 Germany: Market Size For Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 56 Germany: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 57 France: Meat Processing Equipment Size, By Type, 2017–2026 (USD Million)

Table 58 France: Meat Processing Equipment Size, By Meat Type, 2017–2026 (USD Million)

Table 59 Italy: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 60 Italy: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 61 Spain: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 62 Spain: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 63 UK: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 64 UK: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 65 Rest of Europe: Meat Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 66 Rest of Europe: Market Size, By Meat Type, 2017–2026 (USD Million)

Table 67 Asia Pacific: Market Size for Meat Processing Equipment, By Country/Region, 2017–2026 (USD Million)

Table 68 Asia Pacific: Processed Beef Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 69 Asia Pacific: Processed Pork Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 70 Asia Pacific: Processed Mutton Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 71 Asia Pacific: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 72 Asia Pacific: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 73 Asia Pacific: Market Size for Meat Processing Equipment, By Product Type, 2017–2026 (USD Million)

Table 74 Asia Pacific: Market Size for Meat Processing Equipment, By Mode of Operation, 2017–2026 (USD Million)

Table 75 China: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 76 China: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 77 Australia & New Zealand: Meat Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 78 Australia & New Zealand: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 79 Japan: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 80 Japan: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 81 India: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 82 India: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 83 Vietnam: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 84 Vietnam: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 85 Thailand: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 86 Thailand: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 87 Rest of Asia Pacific: Meat Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 88 Rest of Asia Pacific: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 89 South America: Market Size for Meat Processing Equipment, By Country/Region, 2017–2026 (USD Million)

Table 90 South America: Processed Beef Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 91 South America: Processed Pork Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 92 South America: Processed Mutton Processing Equipment Market Size, By Country/Region, 2017–2026 (USD Million)

Table 93 South America: Market Size For Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 94 South America: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 95 South America: Market Size for Meat Processing Equipment, By Product Type, 2017–2026 (USD Million)

Table 96 South America: Market Size for Meat Processing Equipment, By Mode of Operation, 2017–2026 (USD Million)

Table 97 Brazil: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 98 Brazil: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 99 Argentina: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 100 Argentina: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 101 Rest of South America: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 102 Rest of South America: Meat Processing Equipment Market Size, By Meat Type, 2017–2026 (USD Million)

Table 103 RoW: Market Size For Meat Processing Equipment, By Region, 2017–2026 (USD Million)

Table 104 RoW: Processed Beef Processing Equipment Market Size, Region, 2017–2026 (USD Million)

Table 105 RoW: Processed Pork Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 106 RoW: Processed Mutton Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 107 RoW: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 108 RoW: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 109 RoW: Market Size for Meat Processing Equipment, By Product Type, 2017–2026 (USD Million)

Table 110 RoW: Market Size for Meat Processing Equipment, By Mode of Operation, 2017–2026 (USD Million)

Table 111 Middle East: Meat Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 112 Middle East: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 113 Africa: Market Size for Meat Processing Equipment, By Type, 2017–2026 (USD Million)

Table 114 Africa: Market Size for Meat Processing Equipment, By Meat Type, 2017–2026 (USD Million)

Table 115 New Product/Technology Launches, 2017–2019

Table 116 Acquisitions, 2017–2019

Table 117 Agreements, Collaborations, and Partnerships, 2017–2019

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Data Triangulation Methodology

Figure 3 Key Data From Primary Sources

Figure 4 Market Size for Meat Processing Equipment, By Type, 2019 Vs. 2026 (USD Million)

Figure 5 Market Size for Meat Processing Equipment, By Product Type, 2019 Vs. 2026 (USD Million)

Figure 6 Market Size For Meat Processing Equipment, By Mode of Operation, 2019 Vs. 2026 (USD Million)

Figure 7 Market Size for Meat Processing Equipment, By Meat Type, 2019 Vs. 2026 (USD Million)

Figure 8 Market Share (Value), By Region, 2018

Figure 9 Growing Premiumization of Meat Products Due to Consumer Demand for Varied Products is Expected to Drive the Market for Meat Processing Equipment

Figure 10 India is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 The US Accounted for the Largest Share in the North American Market and the Grinding Equipment Segment Dominated, on the Basis of Type, in 2018

Figure 12 North America is Projected to Dominate the Processed Beef Segment By 2026

Figure 13 The Market for Fresh Processed Meat Segment is Projected to Dominate During the Forecast Period

Figure 14 North America Accounted for Largest Share Across All Types in 2018

Figure 15 Market Dynamics

Figure 16 Meat Processing Equipment Market: Value Chain

Figure 17 YC-YCC Shift for Meat Processing Equipment

Figure 18 Market Share (Value), By Type, 2019 Vs. 2026

Figure 19 Market Share (Value), By Meat Type, 2019 Vs. 2026

Figure 20 Market Share (Value), By Product Type, 2019 Vs. 2026

Figure 21 Market Share (Value), By Mode of Operation, 2019 Vs. 2026

Figure 22 Market Share (Value), By Key Country, 2018

Figure 23 North America: Meat Processing Equipment Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Meat Processing Equipment Market: Competitive Leadership Mapping, 2019

Figure 26 Meat Processing Equipment Startup Market: Competitive Leadership Mapping, 2019

Figure 27 Market Share of Key Players in the Meat Processing Equipment Market

Figure 28 GEA Group: Company Snapshot

Figure 29 GEA Group: SWOT Analysis

Figure 30 JBT Corporation: Company Snapshot

Figure 31 JBT Corporation: SWOT Analysis

Figure 32 Marel: Company Snapshot

Figure 33 Marel: SWOT Analysis

Figure 34 Illinois Tool Works: Company Snapshot

Figure 35 Illinois Tool Works: SWOT Analysis

Figure 36 The Middleby Corporation: Company Snapshot

Figure 37 The Middleby Corporation: SWOT Analysis

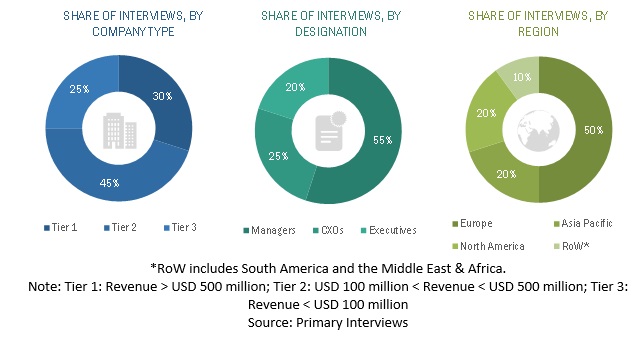

The study involved four major steps in estimating the size of the meat processing equipment market. Exhaustive secondary research was done to collect information on the market as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. These secondary sources included reports from the Food and Agriculture Organization (FAO), British Meat Processors Association (BMPA), Food Processing Suppliers Association (FPSA), American Association of Meat Processors (AAMP), and Agro & Food Processing Equipment & Technology Providers Association of India (AFTPAI). Secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall market comprises several stakeholders in the supply chain, which include meat processors, equipment manufacturers, and distributors. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders; executives; vice presidents; and CEOs in meat processing industries. The primary sources from the supply side include research institutions involved in R&D, key opinion leaders, and meat processing equipment suppliers and manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The meat processing equipment market size, in terms of value, was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the global market and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the market, with respect to type, meat type, product type, mode of operation, and regional markets, over seven years, ranging from 2019 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling the key market players in the meat processing equipment market

-

Providing a comparative analysis of the market leaders based on the following parameters:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights into key product innovations and investments in the meat processing equipment market

Geographical Analysis

- Further breakdown of other equipment types, by region

- Further breakdown of rest of Europe, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Meat Processing Equipment Market