Milking Robots Market Size, Share & Industry Growth Analysis Report by System Type (Single-stall Unit, Multi-stall Unit, Automated Milking Rotary). Herd Size (Below 100, Between 100 and 1,000, Above 1,000), Offering (Hardware, Software, Services), Species, Actuators and Region – Forecast to 2029

Updated on : October 22, 2024

Milking Robots Market Size & Growth

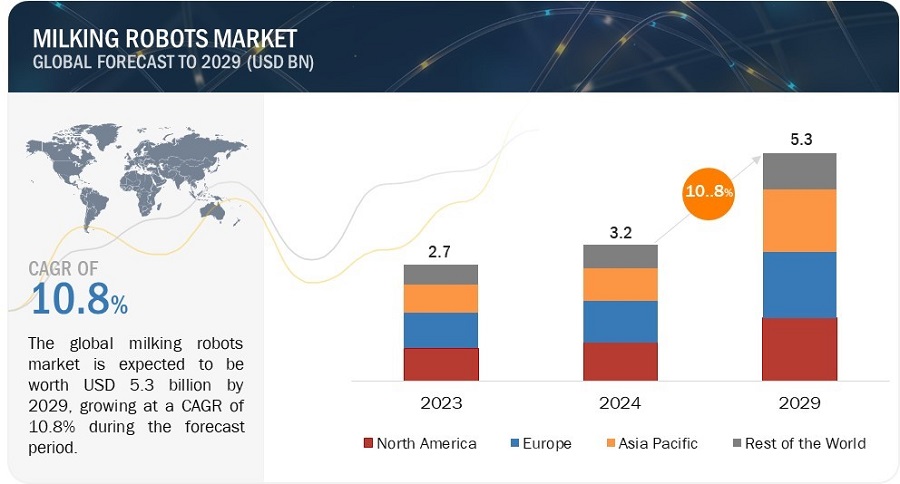

The global Milking Robots Market was valued at USD 3.16 billion in 2024 and is projected to grow from USD 3.64 billion in 2025 to USD 5.26 billion by 2029, at a CAGR of 10.8% during the forecast period.

This growth is driven by the reduction of labor and operational costs, the adoption of advanced technologies like IoT and AI, and the improved herd management that milking robots offer. These innovations meet the increasing demand for dairy products with enhanced efficiency and productivity on livestock farms.

Key Takeaways:

• The global Milking Robots Market was valued at USD 3.16 billion in 2024 and is projected to grow from USD 3.64 billion in 2025 to USD 5.26 billion by 2029, at a CAGR of 10.8% during the forecast period.

• By Product: Hardware components such as robotic arms and control units are crucial, as they drive demand through automation and efficient management of milking processes.

• By Application: Automated milking solutions are enhancing milk yield and reducing the dependency on manual labor, making them increasingly popular among dairy farms.

• By Technology: The integration of IoT and AI in dairy farming improves precision and boosts productivity, offering competitive advantages in the milking robots market.

• By End User: Medium-sized and commercial dairy farms are expected to offer lucrative growth opportunities due to increased adoption of multi-stall units and automated milking rotary systems.

• By Region: ASIA-PACIFIC is expected to grow fastest at 13.4% CAGR, driven by rising demand for dairy products and supportive government initiatives.

• Market Dynamics: Opportunities are abundant with rising demand for dairy products and growing per capita income in developing regions, despite challenges such as high initial investments and regulatory controls.

The milking robots market is poised for significant growth, supported by technological advancements and rising demand for dairy products. Long-term projections indicate a robust market expansion, particularly as automation continues to drive efficiency in dairy farming. Strategic investments and supportive government policies in emerging markets are expected to further bolster growth, presenting substantial opportunities for milking robots market players in the coming years.

Milking Robots Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Milking Robots Market Trends:

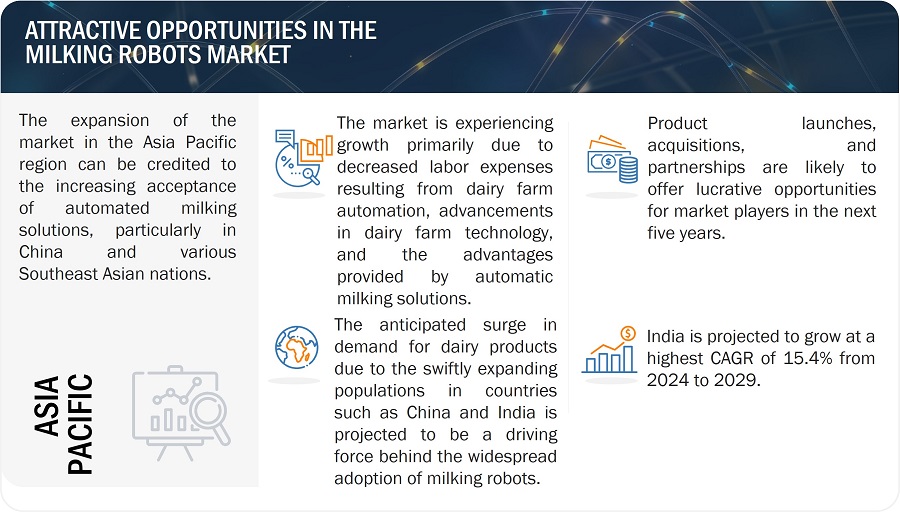

Driver: Cutting labor expenses due to surging adoption of automation in milking farms

The reduction in labor costs attributed to the adoption of automation in milking farms signifies a shift towards more efficient and streamlined processes. With the integration of automated technologies, tasks related to milking and farm management that were traditionally performed manually are now automated. Dairy farming, known for its labor-intensive nature, faces the challenge of rising labor and operational costs globally due to increased demand for dairy products and a subsequent surge in the number of dairy farms. According to the US Department of Agriculture Economic Research (USDA), farm wages saw a significant rise from an annual average of USD 13.32 per hour in 2017 to USD 27.57 per hour in 2022. This increase is influenced by a growth of 25.1% in net farm income from 2020 to 2021. The adoption of milking automation technologies, including milking robots, becomes crucial to address this challenge. Milking robots reduce manual effort and enhance milk yield by allowing more frequent milking of individual animals. This increased efficiency, coupled with the flexibility of not requiring a farmer's presence at every milking, is anticipated to alleviate labor and operational costs in dairy farms.

Restraint: Substantial initial expenditure

The substantial initial investment stands as a prominent obstacle hindering the growth of the milking robots market. The integration of hardware components and technologies, including automation and control devices, as well as sensing and monitoring devices, not only involves upfront installation expenses but also adds to ongoing operational costs. In addition to hardware, the utilization of cloud-based or on-premise software solutions, along with various services like maintenance and support, connectivity, system integration, consulting, managed services, and assisted professional services, significantly contributes to the overall high expenses associated with milking robots. This challenge is particularly pronounced in regions with a prevalence of small to medium-sized farms, where farm owners, especially in emerging economies like India, Brazil, and China, may be cautious about extensive investments in advanced and automated solutions due to potential financial risks, given the relatively low herd size and the unorganized nature of the livestock industry.

Opportunity: Growing adoption of milking robots in developing countries

The adoption of milking robots in developing countries is slow, mainly due to high installation costs, less awareness among farmers about the benefits of milking robots, and small herd size. Robotic milking presents several opportunities for the dairy industry. Firstly, it can improve milk quality and hygiene by ensuring consistent milking protocols, reducing contamination, and leading to safer, higher-quality milk. Secondly, it can boost dairy farm efficiency and productivity by saving time and labor, allowing farmers to focus on other tasks and potentially increase milk production. Thirdly, it can improve cow welfare by reducing stress on cows and leading to better animal health and longevity. Fourthly, it can support small-scale dairy farms in developing countries by making the technology accessible through smaller, more affordable robots. Finally, it can create new economic opportunities through robot manufacturing and installation.

Challenge: Integrating Milking Robots with Grazing Systems and the Need for Standardization

Grazing dairies providing pasture access introduce additional complexities when incorporating milking robots. The process involves enticing cows from pastures to the barn for milking and then returning them to the field for grazing. Managing the herd's movement in and out of the pasture poses a significant challenge for farmers implementing robotic milking systems. Additionally, dealing with the behavioral differences among individual animals during milking presents another substantial difficulty. These behavioral variations make maintaining a consistent milking frequency across the entire herd challenging, potentially affecting milk yield. Moreover, the adoption of milking robots may not be suitable for all cows, particularly those with unfavorable udder shapes and teat positions.

Milking robots Market Ecosystem

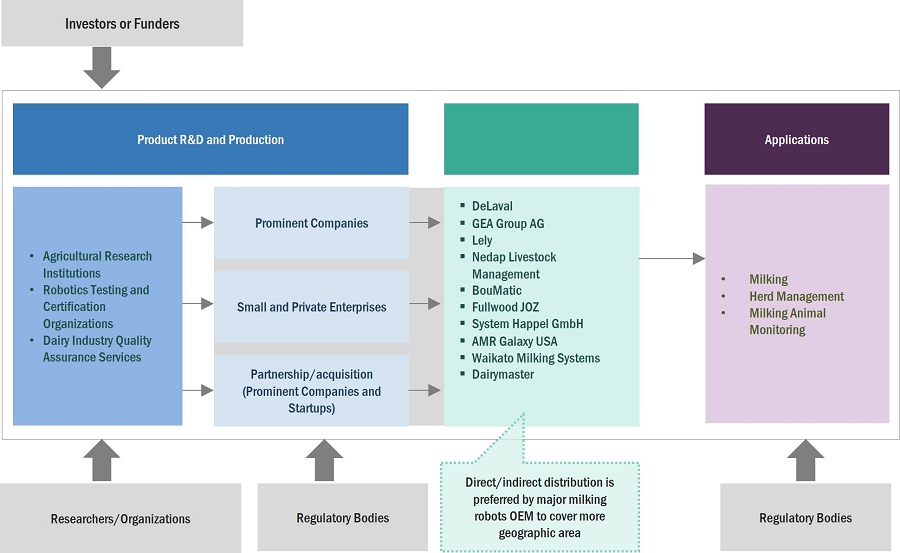

Prominent companies in this market include well-established, financially stable providers of milking robots products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this milking robots market include Lely (Netherlands), GEA Group AG (Germany), DeLaval (Sweden), Nedap Livestock Management (Netherlands), and BouMatic (US). Other key players include Fullwood JOZ (UK), Milkomax solutions laiteres inc. (Canada), System Happel GmbH (Germany), Waikato Milking Systems NZ LP (New Zealand), AMS Galaxy USA (US), and Dairymaster (Ireland).

Milking Robots Market Segmentation

By Farm Size, Farms with herd size above 1000 is likely to grow at the highest rate during the forecast period.

Robotic milking presents several opportunities for large dairy farms with a herd size above 1000 cows. Firstly, it can improve labor efficiency and cost savings by automating milking, reducing personnel needs and associated costs, which can be substantial with such large herds. Labor shortages are even more acute for large farms, making it difficult to find and retain reliable workers. Robots provide a consistent and reliable workforce, alleviating this pressure. Secondly, it can increase milk production and quality by allowing for more frequent and consistent milking schedules, optimizing cow health and potentially leading to higher milk yields. The gentle and automated process can also improve milk quality. Thirdly, it can improve herd management and animal welfare by providing continuous monitoring of individual cows, allowing for early detection of health problems and prompt intervention. This can improve overall herd health and reduce culling rates.

The dairy cattles are predominating the milking robots market

The dairy segment held the largest market share in 2023. Dairy cattle produce the maximum of the world milk production. When compared to other milking animals, dairy cattle have many advantages, including ease of milking, udder size, ability to store milk, and milk yield. Because of these advantages the majority of the dairy farmers prefer dairy cattle instead of other milking animal, as a result most companies in the milking robots market design milking systems specialized of dairy cattle only. This factor results in the dominance of dairy cattle segment in milking automation market. Milking animals such as goats and sheep accounts for only a small market share.

The automated milking rotaries segment is anticipated to achieve the highest growth

The growth of automated milking rotaries (AMR) is attributed to the machines' ability to efficiently milk large herds while demonstrating flexibility in various farming practices, including free stall, loose housing, and pasture-based dairying. Automated milking rotaries offer several advantages, including decreased reliance on manual labor, resulting in reduced labor costs, and enhanced milk yields owing to more frequent milking sessions.

Milking Robots Industry Regional Analysis

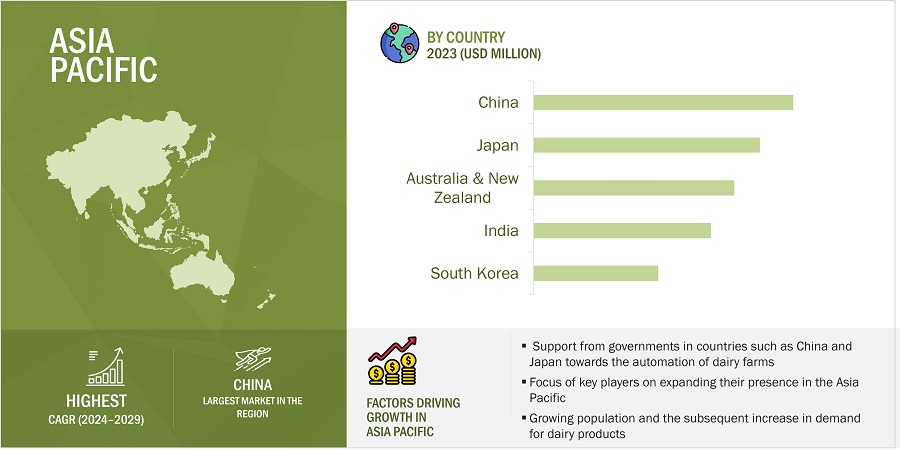

During the forecast period, the Asia Pacific region will likely experience the highest growth in the overall milking robots market.

Milking Robots Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is expected to exhibit the highest growth rate in the global milking robots industry share due to several key factors. Rapid population growth in the region's emerging economies and the subsequent rise in the demand for milk and other dairy products is exerting pressure on the suppliers of dairy products to become more efficient and productive, thus pushing the sales of milking robots and other automated milking solutions upward. However, the availability of inexpensive labor, higher input costs and the lack of large-scale dairy farms are some of the major factors that adversely affect the adoption of milking robots in the region. Rapid economic growth, and surging demand for milk in countries such as China, India, Malaysia, Japan, and Singapore are expected to drive the milking robots market growth in the region. This increased demand for milk products has triggered the adoption of automated milking systems on dairy farms in this region. Furthermore, automated milking rotaries (AMRs) reduces the amount of manual labor required in the milking process on dairy farms, thereby reducing the labor cost. With rapid industrialization, milk consumers are becoming aware of the quality and the type of dairy products they are consuming. Hence, dairy farm owners are adopting automated milking systems for increasing production to meet the growing demand for milk.

Top Milking Robots Companies - Key Market Players

- Lely (Netherlands),

- GEA Group AG (Germany),

- DeLaval (Sweden),

- Nedap Livestock Management (Netherlands),

- and BouMatic (US),

- Fullwood JOZ (UK),

- Milkomax solutions laiteres inc. (Canada),

- System Happel GmbH (Germany),

- Waikato Milking Systems NZ LP (New Zealand),

- AMS Galaxy USA (US),

- Dairymaster (Ireland) are some of the key players in the milking robots companies.

Milking Robots Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.2 billion |

|

Expected Market Size |

USD 5.3 billion |

|

Growth Rate |

CAGR of 10.8% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/ Billion) |

|

Segments Covered |

By system type, offering, herd size, actuators, species, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

Lely (Netherlands), GEA Group AG (Germany), DeLaval (Sweden), Nedap Livestock Management (Netherlands), BouMatic (US) 26 companies profiled |

Milking Robots Market Highlights

This research report categorizes the milking robots market share based on product, touch technology, aspect ratio, screen size, resolution, industry, application, and region.

|

Segment |

Subsegment |

|

By System Type: |

|

|

By Offering: |

|

|

By Herd Size: |

|

|

By Species: |

|

|

By Actuators: |

|

|

By Region: |

|

Recent Developments in Milking Robots Industry

- In October 2023, Lely, the robot manufacturer, and Konrad Pumpe GmbH, the innovative specialist in plant engineering, united forces through an official partnership. Lely integrated Konrad Pumpe GmbH's dosing systems into their feed range, available via Lely Centers. This expanded Konrad Pumpe GmbH's reach and empowered Lely Centers to offer farmers enhanced capabilities with the Lely Vector feeding system.

- >

- In August 2023, GEA and Unilever teamed up to diminish greenhouse gas emissions (GHG) in dairy farming by deploying GEA's new manure enricher solution, ProManure E2950. In the initial phase, four units were installed on Dutch farms supplying Unilever with milk. Over a year, data from these systems was scrutinized to gauge their impact on Unilever's carbon footprint. This evaluation allowed Unilever and GEA to assess and expand the system's potential to substantially curb GHG emissions throughout the milk production process, thereby enhancing Unilever's sustainability along its value chain.

- In June 2023, Fullwood JOZ extended its exclusive collaboration with Mueller, broadening its range to include cooling solutions for milking robots and traditional milking systems.

- In September 2022, Lely unveiled the next iteration of Lely Juno, their automated feed pushing solution, following the 2008 debut of the first-generation Juno. Evolving over time, it achieved market leadership with 13,000+ units across 45 countries. Continuous improvements focused on reducing running costs for end users.

- In August 2022, DeLaval launched an advanced milking technology, Flow-Responsive Milking. The technology reduces the milking time up to 10% by altering the vacuum applied to the milk flow profile.

Frequently Asked Questions (FAQs):

Which are the major companies in the milking robots market? What are their major strategies to strengthen their market presence?

The major companies in the milking robots market are – Lely (Netherlands), GEA Group AG (Germany), DeLaval (Sweden), Nedap Livestock Management (Netherlands), and BouMatic (US). Other key players include Fullwood JOZ (UK), Milkomax solutions laiteres inc. (Canada), System Happel GmbH (Germany), Waikato Milking Systems NZ LP (New Zealand), AMS Galaxy USA (US), and Dairymaster (Ireland).

What are the major strategies adopted by key players to strengthen their market presence?

The major strategies adopted by these players are product launches & developments, partnerships, and collaborations.

What are the new opportunities for emerging players in the milking robots market share?

New prospects in the milking robots market are driving significant global growth. The increased awareness of their benefits like efficiency, better animal care, improved milk quality, and data-driven insights, alongside technological advancements, underscores this momentum. Moreover, rising demand for organic dairy, government support, labor cost concerns, and emerging opportunities such as AI integration and new market exploration further propel this growth. Companies innovating in these areas stand to capitalize on the burgeoning market ahead.

Which system type is likely to drive the milking robots market share growth in the next five years?

The single-stall unit is dominating the market during the forecast period. These units offer a more affordable entry point for farmers seeking to adopt robotic milking technology, making it accessible to a wider range of dairy operations, including smaller and mid-sized farms. Moreover, they provide a flexible and scalable solution, allowing farmers to expand their robotic milking infrastructure as needed gradually. The single-stall unit's capacity to integrate advanced technologies, such as AI-driven monitoring and data collection, enhances its appeal by offering efficient and precise milking processes while contributing to improved herd management. This adaptability and technological integration have significantly contributed to the single-stall unit's role in propelling the growth of the milking robots market.

Which region will likely offer lucrative growth for the milking robots market by 2030?

During the forecast period, Europe is likely to dominate the market share of milking robots, primarily driven by the extensive adoption of dairy farm automation in Western Europe. Key players like DeLaval (Sweden), Dairymaster (Ireland), and Lely (Netherlands) play a significant role in the milking robots market across the continent, supplying their technology to global end-users. The market growth in Europe can be attributed to the rising automation trend and the presence of multiple influential market participants. Across Europe, a considerable segment of farms maintains a significant scale, managing herds that surpass 1000 in number. These larger-scale operations often leverage advanced technologies and streamlined processes to manage their substantial herds efficiently. Such farms typically benefit from economies of scale, allowing for optimized operations, from feeding and housing to healthcare and milking. Their size necessitates sophisticated management systems, including robust infrastructure and specialized equipment like milking robots, enabling efficient handling of the large herd size while meeting modern agricultural demands. Due to their scale and production capacity, these farms often play a substantial role in supplying dairy products, contributing significantly to the regional and sometimes international dairy market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Reduced labor and operational costs- Adoption of advanced technologies such as IoT and AI by dairy farmers- Improved herd management and increased milk yield to meet growing demand for dairy productsRESTRAINTS- High cost associated with initial investments- Increasing adoption of vegan diet- Lack of technical knowledge among farmersOPPORTUNITIES- Increasing demand for dairy products with rising population- Increasing per capita income of farmers in developing countries- Government-led investments to facilitate technical assistance to farmersCHALLENGES- Behavioral differences among individual animals- Regulatory control on livestock industry to reduce outbreak of diseases

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND OF MILKING ROBOTS OFFERED BY 3 KEY PLAYERS, BY SYSTEM TYPE (USD)AVERAGE SELLING PRICE (ASP) TREND OF MILKING ROBOTS, BY REGION, 2020–2029 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPING

-

5.7 TECHNOLOGY ANALYSISAUTOMATIC CATTLE TRAFFIC MANAGEMENTPARLOR MONITORINGADVANCED LINERS AND CLUSTERSADD-ON ROBOTIC SOLUTION

-

5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.11 CASE STUDY ANALYSISPENNER FARM SERVICES (CANADA) AND LELY NORTH AMERICA (NETHERLANDS) ASSIST FOLSON DAIRY FARMS (CANADA) TO INCREASE MILK YIELDNEWLANDS FAMILY FARM (US) INVESTS IN DELAVAL (SWEDEN) VMS V300 MILKING ROBOTS THAT FACILITATE AUTOMATIC SORTING OF ANIMALS ON FARMVAN ADRICHEM (NETHERLANDS) DEPLOYS LELY ASTRONAUT MILKING ROBOTS IN DAIRY FARMS TO ENHANCE LABOR EFFICIENCY

- 5.12 TARIFF ANALYSIS

-

5.13 REGULATORY LANDSCAPE AND STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.14 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 HARDWAREAUTOMATION AND CONTROL DEVICES- Robotic arm devices- Control and display units- Milk meters- Milk analyzers- Cleaning and detection systems- Other automation and control device typesSENSING AND MONITORING DEVICES- Sensors- RFID tags and readers- Camera systems- Other sensing and monitoring devices types

-

6.3 SOFTWARECLOUD-BASED- Facility of remote monitoring and real-time access to milking robot data to boost demandON-PREMISES- Reduced dependency on internet connectivity to drive market

-

6.4 SERVICESSYSTEM INTEGRATION AND CONSULTING SERVICES- Seamless integration of automated milking systems to boost demandMANAGED SERVICES- Handling of operations related to hardware installation and software functioning to foster segmental growthCONNECTIVITY SERVICES- Need for uninterrupted connectivity between device domain and end users to accelerate demandASSISTED PROFESSIONAL SERVICES- Requirement of apt information on climate conditions and supply chain management to drive demandMAINTENANCE AND SUPPORT SERVICES- Technical expertise provided by maintenance and support services to boost market

- 7.1 INTRODUCTION

-

7.2 SINGLE-STALL UNITREDUCED EXPENSES ASSOCIATED WITH INSTALLATION CONTROL SYSTEMS TO BOOST DEMAND

-

7.3 MULTI-STALL UNITINCREASING NUMBER OF MEDIUM-SIZED AND COMMERCIAL DAIRY FARMS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

-

7.4 AUTOMATED MILKING ROTARYREDUCED DEPENDENCY ON MANUAL LABOR DUE TO AUTOMATED FUNCTIONALITY TO BOOST MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 BELOW 100GROWING DEPLOYMENT OF MILKING ROBOTS IN BELOW 100-HERD SIZE FARMS FOR INCREASING MILK YIELD AND REDUCING LABOR COSTS TO DRIVE MARKET

-

8.3 BETWEEN 100 AND 1,000ABILITY TO MILK MULTIPLE COWS SIMULTANEOUSLY TO BOOST DEMAND

-

8.4 ABOVE 1,000RISING USE OF AUTOMATIC MILKING ROTARIES TO MILK CATTLE SIMULTANEOUSLY ACCORDING TO MILKING PERIOD AND DETECT ACCURATE MILKING POSITION TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 ELECTRICABILITY TO CONVERT ELECTRICAL ENERGY INTO CONTROLLED MECHANICAL MOTION TO DRIVE DEMAND

-

9.3 HYDRAULICINCREASING APPLICATION FOR CONTROLLING PRESSURE SYSTEMS ASSOCIATED WITH TEAT CUP MANIPULATION TO BOOST DEMAND

-

9.4 PNEUMATICCOST-EFFECTIVE NATURE OF PNEUMATIC ACTUATORS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 DAIRY CATTLEPRODUCTION OF SPECIALIZED MILKING SYSTEMS TO BOOST MARKET

-

10.3 GOATSIMPROVED MILK YIELD THROUGH BREEDING TO BOOST DEMAND

-

10.4 SHEEPNEED TO INCREASE MILK PRODUCTION USING MILKING SIMULATION PROCESS TO DRIVE DEMAND

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Development of advanced milking automation solutions to improve dairy farm productivity to boost demandCANADA- Increasing demand for domestically produced dairy products to offer lucrative growth opportunities for market playersMEXICO- Growing cattle imports from US to drive market

-

11.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEGERMANY- Government-led initiatives to support farmers to drive marketFRANCE- Rising number of farms with expanding average herd size to accelerate demandUK- Reduced costs of milking solutions due to technological developments to boost marketNETHERLANDS- Rising labor costs to drive demandDENMARK- Increasing herd size to drive market growthREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Increased consolidation of small farms to accelerate demandJAPAN- Shortage of labor with increasing aging labor population to drive marketAUSTRALIA & NEW ZEALAND- Low dependency on manual labor to boost demandINDIA- Emergence of commercial farms with modern technologies to offer growth opportunities to market playersSOUTH KOREA- Increasing awareness regarding benefits of milking robots to create lucrative opportunities for market playersREST OF ASIA PACIFIC

-

11.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- Government-led investments in developing livestock sector to drive market- GCC countries- Rest of Middle East & AfricaSOUTH AMERICA- Reduced reliance on manual labor to boost market

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2019–2023

- 12.3 REVENUE ANALYSIS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2023

-

12.5 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCTS/SOLUTIONS/SERVICES LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSDELAVAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGEA GROUP AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLELY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEDAP LIVESTOCK MANAGEMENT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOUMATIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFULLWOOD JOZ- Business overview- Products/Solutions/Services offered- Recent developmentsSYSTEM HAPPEL GMBH- Business overview- Products/Solutions/Services offeredAMS GALAXY USA- Business overview- Products/Solutions/Services offered- Recent developmentsWAIKATO MILKING SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsDAIRYMASTER- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSMIROBOTMILKPLANMILKWELL MILKING SYSTEMSCONNECTERRA B.V.ARECANUT ENGINEERSPROMPT DAIRYTECHAFIMILK LTD.VANSUN TECHNOLOGIES PRIVATE LIMITEDADF MILKING LTD.SEZER AGRICULTURE AND MILKING TECHNOLOGIESSTELLAPPS TECHNOLOGIESYUYAO YUHAI LIVESTOCK MACHINERY CO., LTD.BEIJING KINGPENG GLOBAL HUSBANDRY TECHNOLOGY CO., LTD.SHANGHAI RUIKE MACHINERY EQUIPMENT CO., LTD.DAVIESWAY PTY LTD.HOKOFARM GROUP

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE (ASP) OF MILKING ROBOTS OFFERED BY 3 KEY PLAYERS, BY SYSTEM TYPE (USD)

- TABLE 2 COMPANIES AND THEIR ROLES IN MILKING ROBOTS ECOSYSTEM

- TABLE 3 MILKING ROBOTS MARKET: LIST OF PATENTS, 2020–2023

- TABLE 4 IMPORT DATA FOR HS CODE 843410- COMPLIANT MILKING MACHINES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 5 EXPORT DATA FOR HS CODE 843410- COMPLIANT MILKING MACHINES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 MILKING ROBOT MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 7 MFN TARIFF FOR MILKING MACHINES EXPORTED BY FRANCE

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILKING MANAGEMENT

- TABLE 14 KEY BUYING CRITERIA FOR MILKING MANAGEMENT

- TABLE 15 MILKING ROBOT MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 16 MILKING ROBOTS MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 17 HARDWARE: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 18 HARDWARE: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 19 HARDWARE: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 20 HARDWARE: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 21 HARDWARE: MILKING ROBOT MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 22 HARDWARE: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 23 AUTOMATION AND CONTROL DEVICES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 24 AUTOMATION AND CONTROL DEVICES: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 25 SENSING AND MONITORING DEVICES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 26 SENSING AND MONITORING DEVICES: MILKING ROBOT MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 27 SOFTWARE: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 28 SOFTWARE: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 29 SOFTWARE: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 30 SOFTWARE: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 31 SOFTWARE: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 32 SOFTWARE: MILKING ROBOT MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 33 SERVICES: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 34 SERVICES: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 35 SERVICES: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 36 SERVICES: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 37 SERVICES: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 38 SERVICES: MILKING ROBOT MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 39 MILKING ROBOTS MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 40 MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 41 SINGLE-STALL UNIT: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 42 SINGLE-STALL UNIT: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 43 MULTI-STALL UNIT: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 44 MULTI-STALL UNIT: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 45 AUTOMATED MILKING ROTARY: MILKING ROBOT MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 46 AUTOMATED MILKING ROTARY: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 47 MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 48 MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 49 BELOW 100: MILKING ROBOT MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 50 BELOW 100: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 51 BELOW 100: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 52 BELOW 100: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 53 BELOW 100: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 54 BELOW 100: MILKING ROBOT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 BETWEEN 100 AND 1,000: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 56 BETWEEN 100 AND 1,000: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 57 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 58 BETWEEN 100 AND 1,000: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 59 BETWEEN 100 AND 1,000: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 60 BETWEEN 100 AND 1,000: MILKING ROBOT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 61 ABOVE 1,000: MILKING ROBOTS MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 62 ABOVE 1,000: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 63 ABOVE 1,000: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 64 ABOVE 1,000: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 65 ABOVE 1,000: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 ABOVE 1,000: MILKING ROBOT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 MARKET, BY SPECIES, 2020–2023 (USD MILLION)

- TABLE 68 MARKET, BY SPECIES, 2024–2029 (USD MILLION)

- TABLE 69 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 70 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 MARKET, BY REGION, 2020–2023 (UNITS)

- TABLE 72 MILKING ROBOT MARKET, BY REGION, 2024–2029 (UNITS)

- TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: MILKING ROBOT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 81 EUROPE: MILKING ROBOTS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 82 EUROPE: MILKING ROBOT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MILKING ROBOT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY HERD SIZE, 2024–2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 97 ROW: MILKING ROBOTS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 98 ROW: MILKING ROBOT MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 ROW: MARKET, BY HERD SIZE, 2020–2023 (USD MILLION)

- TABLE 100 ROW: MARKET, BY SERVICE TYPE, 2024–2029 (USD MILLION)

- TABLE 101 ROW: MARKET, BY SYSTEM TYPE, 2020–2023 (USD MILLION)

- TABLE 102 ROW: MARKET, BY SYSTEM TYPE, 2024–2029 (USD MILLION)

- TABLE 103 ROW: MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 104 ROW: MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: MILKING ROBOT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 107 MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- TABLE 108 MARKET SHARE ANALYSIS, 2023

- TABLE 109 COMPANY FOOTPRINT

- TABLE 110 COMPANY OFFERING FOOTPRINT

- TABLE 111 COMPANY SPECIES FOOTPRINT

- TABLE 112 COMPANY REGION FOOTPRINT

- TABLE 113 MARKET: LIST OF KEY START-UPS/SMES

- TABLE 114 MILKING ROBOT MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES, BY OFFERING

- TABLE 115 MARKET: COMPETITIVE BENCHMARKING OF START-UP/SMES, BY REGION

- TABLE 116 MARKET: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES, 2019–2023

- TABLE 117 MARKET: DEALS, 2019–2023

- TABLE 118 MILKING ROBOTS MARKET: OTHERS, 2019–2023

- TABLE 119 DELAVAL: COMPANY OVERVIEW

- TABLE 120 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 DELAVAL: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 122 DELAVAL: DEALS

- TABLE 123 DELAVAL: OTHERS

- TABLE 124 GEA GROUP AG: COMPANY OVERVIEW

- TABLE 125 GEA GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 GEA GROUP AG: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 127 GEA GROUP AG: DEALS

- TABLE 128 LELY: COMPANY OVERVIEW

- TABLE 129 LELY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 LELY: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 131 LELY: DEALS

- TABLE 132 LELY: OTHERS

- TABLE 133 NEDAP LIVESTOCK MANAGEMENT: COMPANY OVERVIEW

- TABLE 134 NEDAP LIVESTOCK MANAGEMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 NEDAP LIVESTOCK MANAGEMENT: DEALS

- TABLE 136 BOUMATIC: COMPANY OVERVIEW

- TABLE 137 BOUMATIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 BOUMATIC: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 139 BOUMATIC: DEALS

- TABLE 140 FULLWOOD JOZ: COMPANY OVERVIEW

- TABLE 141 FULLWOOD JOZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 FULLWOOD JOZ: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 143 FULLWOOD JOZ: DEALS

- TABLE 144 SYSTEM HAPPEL GMBH: COMPANY OVERVIEW

- TABLE 145 SYSTEM HAPPEL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 AMS GALAXY USA: COMPANY OVERVIEW

- TABLE 147 AMS GALAXY USA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 AMS GALAXY USA: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 149 WAIKATO MILKING SYSTEMS: COMPANY OVERVIEW

- TABLE 150 WAIKATO MILKING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 WAIKATO MILKING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES LAUNCHES

- TABLE 152 WAIKATO MILKING SYSTEMS: DEALS

- TABLE 153 DAIRYMASTER: COMPANY OVERVIEW

- TABLE 154 DAIRYMASTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 MILKING ROBOTS MARKET: SEGMENTATION

- FIGURE 2 MILKING ROBOT MARKET: RESEARCH DESIGN

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 MARKET, 2024—2029 (USD MILLION)

- FIGURE 7 ABOVE 1,000 SEGMENT TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

- FIGURE 9 AUTOMATED MILKING ROTARY TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 DAIRY CATTLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GLOBAL MILKING ROBOT MARKET DURING FORECAST PERIOD

- FIGURE 12 DEPLOYMENT OF AUTOMATION IN DAIRY FARMS TO REDUCE LABOR COSTS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 HARDWARE SEGMENT TO COMMAND MARKET IN 2029

- FIGURE 14 BELOW 100 SEGMENT TO SECURE LARGEST MARKET SHARE FROM 2024 TO 2029

- FIGURE 15 SINGLE-STALL UNIT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

- FIGURE 16 DAIRY CATTLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 GLOBAL MILKING ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MILKING ROBOTS SHIPMENT, 2019–2028 (THOUSAND UNITS)

- FIGURE 19 MILKING ROBOT MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 COUNTRY-WISE DATA ON CATTLE INVENTORY, 2022 (MILLION UNITS)

- FIGURE 22 MILKING ROBOT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 23 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 25 AVERAGE SELLING PRICE (ASP) TREND OF MILKING ROBOTS OFFERED BY 3 KEY PLAYERS, BY SYSTEM TYPE (USD)

- FIGURE 26 AVERAGE SELLING PRICE (ASP) TREND OF MILKING ROBOTS, BY REGION, 2020–2029 (USD)

- FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 MARKET: ECOSYSTEM MAPPING

- FIGURE 29 PATENTS GRANTED FOR MILKING ROBOT MARKET, 2013–2022

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MILKING ROBOTS, 2013–2022

- FIGURE 31 IMPORT DATA FOR HS CODE 843410-MILKING MACHINES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 843410-MILKING MACHINES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 33 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 34 WEIGHTED AVERAGE FOR PORTER’S FIVE FORCES

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILKING MANAGEMENT

- FIGURE 36 KEY BUYING CRITERIA FOR MILKING MANAGEMENT

- FIGURE 37 MILKING ROBOTS MARKET, BY OFFERING

- FIGURE 38 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 CAMERA SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 ASSISTED PROFESSIONAL SERVICES SEGMENT TO DOMINATE MARKET FROM 2023 TO 2029

- FIGURE 41 MARKET, BY SYSTEM TYPE

- FIGURE 42 AUTOMATED MILKING ROTARY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 ABOVE 1,000 SEGMENT TO REGISTER HIGHEST CAGR IN MILKING ROBOT MARKET FOR SINGLE-STALL UNIT DURING FORECAST PERIOD

- FIGURE 44 HERD SIZE OF ABOVE 1,000 TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 HERD SIZE BELOW 100 IN ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 46 MARKET, BY ACTUATOR

- FIGURE 47 MARKET, BY SPECIES

- FIGURE 48 DAIRY CATTLE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

- FIGURE 49 MARKET, BY REGION

- FIGURE 50 INDIA TO DISPLAY HIGHEST CAGR IN GLOBAL MILKING ROBOT MARKET DURING FORECAST PERIOD

- FIGURE 51 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 52 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 53 NORTH AMERICA: MILKING ROBOTS MARKET SNAPSHOT

- FIGURE 54 EUROPE: IMPACT OF RECESSION

- FIGURE 55 EUROPE: MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 57 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 58 ROW: IMPACT OF RECESSION

- FIGURE 59 ROW: MARKET SNAPSHOT

- FIGURE 60 MILKING ROBOTS MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS, 2019–2023

- FIGURE 61 MILKING ROBOT MARKET SHARE ANALYSIS, 2023

- FIGURE 62 MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 63 MARKET: START-UPS/SMES EVALUATION MATRIX, 2023

- FIGURE 64 DELAVAL: COMPANY SNAPSHOT

- FIGURE 65 GEA GROUP AG: COMPANY SNAPSHOT

- FIGURE 66 NEDAP LIVESTOCK MANAGEMENT: COMPANY SNAPSHOT

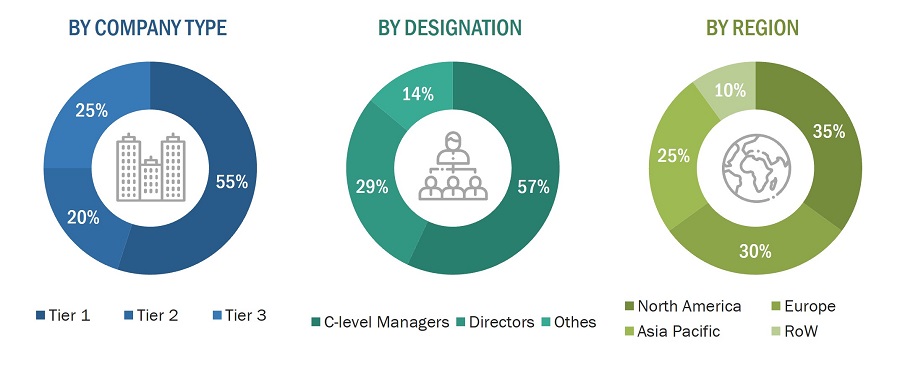

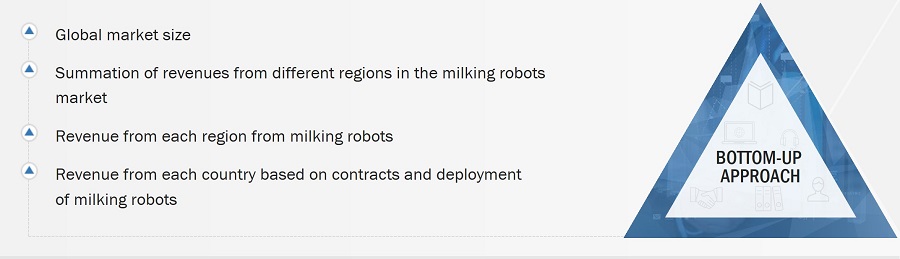

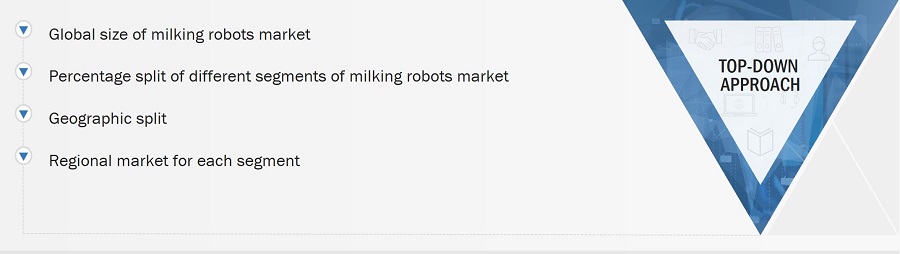

The study involved four major activities in estimating the market size of milking robots. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the commercial touch displays market. The secondary sources included the International Federation of Robotics (IFR), FAOstat, International Livestock Research Institute (ILRI), annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the milking robots market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the milking robots market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall commercial touch displays market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players' annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Milking Robots Market Size: Bottom-Up Approach

Global Milking Robots Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Milking robots are automatic milking systems deployed on dairy farms for reducing labor costs and enhancing milk quality and yield. Milking robots comprise a milking machine, a teat position sensor, a robotic arm for automatic teat cup application, and a gate system for controlling cow traffic. Milking robots are designed to make dairy farms more efficient and profitable without the help of manual labor. The milking robots market encompasses the industry involved in designing, producing, and implementing automated systems used for milking dairy animals, primarily cows. These robots are equipped with sensors, mechanical arms, and software to facilitate the autonomous milking process. They operate by identifying and attaching to the udders, milking the cows, and often incorporating features such as cleaning and monitoring cow health. The market includes various technological advancements, such as integration with data analytics and AI for optimizing milking efficiency and herd management. It caters to dairy farms seeking automation solutions to enhance productivity, animal welfare, and operational efficiency in milk production.

Key Stakeholders

- Technical universities

- Research institutes and organizations

- Market research and consulting firms

- Intellectual property vendors

- Dairy farm owners

- IT service providers

- System integrators

- Consulting service providers

- Network service providers

- Software service providers

- Data center vendors

- Internet service providers (ISPs)

- Milking robots/automated milking systems research labs

- Associations related to milking robots/automated milking robots

Report Objectives

- Define, analyze, and forecast the milking robots market, in terms of value, segmented based on offering, system type, herd size, and region

- Define, analyze, and forecast the market, in terms of volume

- Forecast the market size for various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and Rest of the World

- Provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the milking robots market

- Study the complete value chain and related industry segments and perform a value chain analysis of the market

- Strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data), regulatory environment, Porter’s five forces analysis and the ecosystem related to the milking robots market

- Analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the milking robots market

- Strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches/developments, expansions, acquisitions, and research and development (R&D) activities carried out by players in the milking robots market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Milking Robots Market

We have already achieved first successes in this market and would like to increase our network and awareness in this area. We are the pioneers with oil-free scroll compressors and want to finally enter the market and support the success of milking robots. What data is available in your report for milking robots ? Have you included country level data for milking robots.