Network Analytics Market by Component (Network Intelligence Solutions and Services), Application (Network Performance Management, Customer Analysis, and Quality Management), Deployment Type, Organization Size, End-User, and Region - Global Forecast to 2024

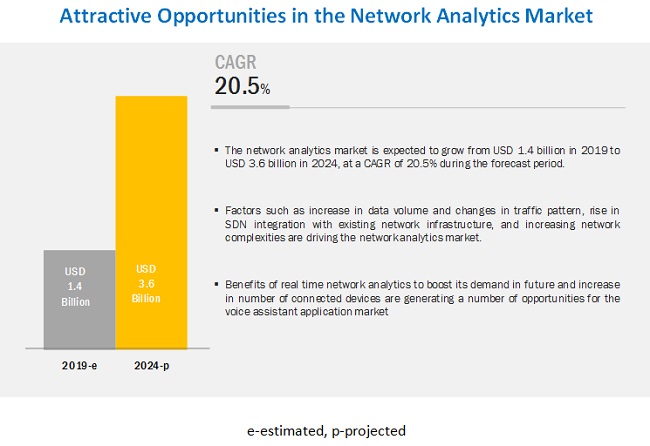

[164 Pages Report] The Network Analytics Market size is projected to reach USD 3.6 billion by 2024, at a CAGR of 20.5% during the forecast period. Major factors expected to drive the growth of the network analytics market include addressing of network complexity arising due to the advent of new technologies, such as 5G, IoT, and cloud; increase in data volume and changes in traffic patterns, and rise in SDN integration with existing network infrastructures.

By deployment type, on-premises to hold a larger market size during the forecast period

Based on the deployment type, the global network analytics market is segmented into on-premises and cloud types. The system installed on the premises of the individual or the organization rather than at a remote facility can be termed as the on-premises deployment of solutions. On-premises solutions are delivered on one-time license fee and an annual service agreement, which also include free upgrade. The organizations that can afford high cost or includes data criticality, opt for on-premises deployment as such deployments requires vast infrastructure and own data centers. Therefore, usually, large enterprises choose on-premises deployment over cloud wherein SMEs often face the dilemma amongst hosted or on-premises network analytics solutions. On-premises deployments require dedicated IT staff for maintenance and support; high end IT and networking infrastructure; and it also brings in better control over system and data. It is also accompanied by various drawbacks such as high deployment costs which could not always be possible for every organization to make investments. However, the growth of the on-premises deployment model is getting affected by the rapid development of cloud computing solutions in the market.

Professional services segment to grow at a higher CAGR during the forecast period

Communication Service Providers (CSPs) are assisted by professional services to evaluate network environment, assess requirements for network analytics, and seek technical support and knowledge from market professionals. Professional services offers a complete set of detailed procedures and insights for enhancing the business aspects and assure the continuity of the company. The facilities provide the complete planning and execution of strategies to implement sustainable network infrastructure in the network analytics market. The system integration services provided by the solution providers offer cohesive services to the end-users to efficiently implement and integrate network analytics solutions into their existing IT and network infrastructure systems. The demand for these services in the market could increase rapidly due to the need for organizations to comply with the different network and radiation regulations across the globe.

Professional services include designing, planning, upgrades, and technology consulting services. Deployment and integration services begin with collecting customers’ requirements, and then deploying, integrating, testing, and rolling out the solutions.

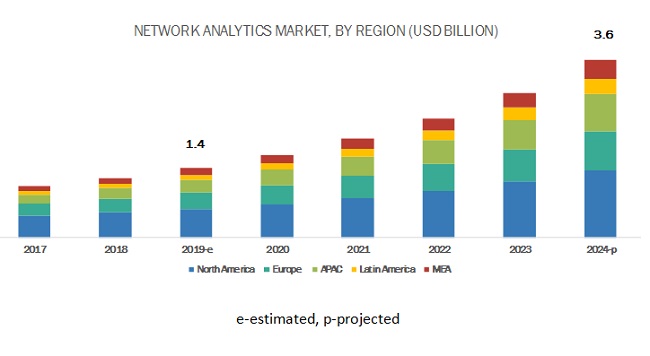

North America to account for the largest market size during the forecast period.

North America is expected to hold the largest market size during the forecast period. The US has emerged as the largest market for network analytics owing to the large-scale implementation of network analytics tools by organizations and enterprises in the country. The high pace of development of infrastructure in the US, along with the high growth of Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML) and cloud computing, can be attributed to the fast growth of the network analytics market in the US.

North America is technologically advanced region in the world due to rapid adoption of emerging technologies by the organizations in the region. Moreover, US and Canada are prominent countries contributing to technological development in this region, for instance, US organizations are heavily investing into network analytics to improve the network efficiency and provide better customer experience by gaining their insights through network traffic. The North American region houses the headquarters of close to 60% of the vendors operating in the network analytics market. The region holds a major share of the market with more significant investments in network intelligence by cloud operators and CSPs. North America will remain the leader in market due to the rise in demand for high-speed networks, intense competition among major players in the networking industry to provide better customer experience and higher adoption rates of cloud computing as compared to other regions. The region witnessed an increase in network analytics solutions that leverage new technologies such as IoT, AI, ML, cloud computing, data analytics, and deep learning.

Key Market Players

Key and emerging market players include Cisco (US), Broadcom (US), IBM (US), HPE (US), Ericsson (Sweden), Huawei (China), SAS Institute (US), Nokia (Finland), Netscout (US), Accenture (Ireland), Sandvine (Canada), Ciena (US), TIBCO Software (US), Juniper Networks (US), SevOne (US), Nivid Technologies (US), Fortinet (US), Extreme Networks (US), Innowireless (South Korea), Actix (UK) and NetVelocity (US). These players have adopted various strategies to grow in the network analytics market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2019 |

USD 1.4 Billion |

|

Market size value in 2024 |

USD 3.6 Billion |

|

Growth rate |

CAGR of 20.5% |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Network Intelligence Solutions and Services), Application (Customer Analysis, Risk Management and Fault Detection, Network Performance Management, Compliance Management, and Quality Management), Deployment Type (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), End-User (Cloud Service Providers, Managed Service Providers and Telecom Providers) and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Cisco (US), Broadcom (US), IBM (US), HPE (US), Ericsson (Sweden), Huawei (China), SAS Institute (US), Nokia (Finland), Netscout (US), Accenture (Ireland), Sandvine (Canada), Ciena (US), TIBCO Software (US), Juniper Networks (US), SevOne (US), Nivid Technologies (US), Fortinet (US), Extreme Networks (US), Innowireless (South Korea), Actix (UK) and NetVelocity (US) |

The research report categorizes the Network analytics market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

- Network Intelligence Solutions

-

Services

- Professional Services

- Managed Services

By Application

- Customer Analysis

- Risk Managemet and Fault Detection

- Network Performance Management

- Compiance Management

- Quality Management

- Others (Network Control And Optimization, Network Design And Capacity Planning, and Threat Management)

By Deployment Type

- On-Premises

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By End-User

- Cloud Service Providers

- Managed Service Providers

- Telecom Providers

- Others (Internet Service Providers (ISPs), Satellite Communication Providers and Cable Network Providers)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the network analytics market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is the projected market value of the global network analytics market?

What is the estimated growth rate of the global network analytics market?

Which deployment type of the network analytics market expected to witness the larger market size?

Which region of the network analytics market expected to witness the largest market size?

Who are the key players operative in the global network analytics market?

What are the top driving factors in network analytics market?

Driving factors for the growth of network analytics market includes:

- The growth of the network analytics market includes addressing of network complexity arising due to the advent of new technologies, such as 5G, IoT, and cloud;

- Increase in data volume and changes in traffic patterns, and

- Rise in SDN integration with existing network infrastructures.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Breakup of Primaries

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Competitive Leadership Mapping Methodology

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in the Global Network Analytics Market

4.2 Network Analytics Market, By Deployment Type, 2019

4.3 Market in North America, By Component and Country

4.4 Market in Europe, By Organization Size and Country

4.5 Market in Asia Pacific, By Application and Country

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Addressing Network Complexity Arising Due to the Advent of New Technologies, Such as 5G, IoT, and Cloud

5.2.1.2 Increase in Data Volume and Changes in Traffic Patterns

5.2.1.3 Rise in Sdn Integration With Existing Network Infrastructures

5.2.2 Restraints

5.2.2.1 High CAPEX and OPEX

5.2.3 Opportunities

5.2.3.1 Benefits of Real-Time Network Analytics to Boost Its Demand in Future

5.2.3.2 Increase in the Number of Connected Devices

5.2.4 Challenges

5.2.4.1 Lack of Budget Among SMEs

5.2.4.2 Privacy and Security Concerns

5.3 Use Cases

5.4 Regulatory Landscape

5.4.1 Health Insurance Portability and Accountability Act

5.4.2 General Data Protection Regulation

5.4.3 Gramm–Leach–Bliley Act

5.4.4 The International Organization for Standardization (ISO) Standard 27001

5.4.5 Health Level Seven International

5.5 Ecosystem and Architecture

5.6 Technologies Impacting Network Analytics Market

5.6.1 Artificial Intelligence

5.6.2 Machine Learning

5.6.3 Internet of Things

6 Network Analytics Market, By Component (Page No. - 49)

6.1 Introduction

6.2 Network Intelligence Solutions

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting Services

6.3.1.1.1 Technicalities Involved in Implementing Network Analytics Solutions to Boost the Growth of Consulting Services

6.3.1.2 Support and Maintenance Services

6.3.1.2.1 Growing Deployment of Network Analytics Tools to Drive the Demand for Support and Maintenance Services

6.3.2 Managed Services

6.3.2.1 Cost Reduction Associated With Managed Services to Boost Their Growth Across the Network Analytics Market

7 Network Analytics Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Customer Analysis

7.2.1 Increased Need to Understand Customer Behavior for Better Strategy Planning to Drive the Network Analytics Market

7.3 Risk Management and Fault Detection

7.3.1 Rise in the Number of Data Attacks to Encourage Organizations to Use Network Analytics Solutions

7.4 Network Performance Management

7.4.1 Increased Demand for Reliable and Scalable Secure Networks to Boost the Adoption of Network Analytics Solutions for Network Performance Management

7.5 Compliance Management

7.5.1 Growing Demand for Effective Risk Mitigation and Protection Against Internal and External Threats

7.6 Quality Management

7.6.1 Need to Maintain the Quality of Product and Service Offerings and Ensure the Availability of the Offerings to Foster the Adoption of Network Analytics for Quality Management

7.7 Others

8 Network Analytics Market, By Deployment Type (Page No. - 66)

8.1 Introduction

8.2 On-Premises

8.2.1 Benefits of Better Control Over System and Data to Drive the Demand for On-Premises Network Analytics Solutions

8.3 Cloud

8.3.1 Low Cost and Easy Deployment to Drive the Growth of Cloud Deployment Across the Network Analytics Market

9 Network Analytics Market, By Organization Size (Page No. - 70)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Benefits of Improved Network Security and Traffic to Drive the Adoption of Network Analytics Among Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Growing Adoption of Advanced Technologies to Drive the Adoption of Network Intelligence Solutions Among Large Enterprises

10 Network Analytics Market, By End User (Page No. - 74)

10.1 Introduction

10.2 Cloud Service Providers

10.2.1 Complex Cloud Infrastructure to Increase the Adoption of Network Analytics Solutions Across Cloud Service Providers

10.3 Managed Service Providers

10.3.1 Network Analytics Solutions to Improve Customer Analysis and Network Performance

10.4 Telecom Service Providers

10.4.1 Expanding Subscriber Base and Increasing Network Congestion to Drive the Demand for Network Analytics Tools

10.5 Others

11 Network Analytics Market, By Region (Page No. - 80)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Demand for High-Performance Networks and Reliable Connectivity Solutions to Drive the Market in the US

11.2.2 Canada

11.2.2.1 Rising Adoption of Innovative Delivery Methods to Drive the Market in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Increasing Need for Steady Performance in Abnormal Conditions to Drive the Demand for Network Analytics in the UK

11.3.2 Germany

11.3.2.1 New Government Regulations and Digitalization to Fuel the Market Growth in Germany

11.3.3 France

11.3.3.1 Supportive Government Initiatives and Increased Spending to Boost the Market Growth in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Broad Internet User Base and Widespread Adoption of Wi-Fi Technology to Fuel the Market Growth in China

11.4.2 Japan

11.4.2.1 Expansion in 5G and Focus on Cloud to Support the Adoption of Network Analytics Tools in Japan

11.4.3 India

11.4.3.1 Strategic Collaborations and Developed Infrastructure to Drive the Market Growth in India

11.4.4 Australia and New Zealand

11.4.4.1 Support From Government and Wide Applications of IoT Devices to Drive the Market in ANZ

11.4.5 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Supportive Government Initiatives to Boost Higher Adoption in UAE, Qatar, and Saudi Arabia

11.5.2 Africa

11.5.2.1 Business Transformations and Supportive Policies to Drive Market Traction in Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Increasing Adoption of Wireless Internet Connectivity By Enterprises to Drive the Market in Brazil

11.6.2 Mexico

11.6.2.1 Wireless Internet Connectivity Initiatives to Fuel the Market Growth in Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 117)

12.1 Competitive Leadership Mapping

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Strength of Product Portfolio

12.3 Business Strategy Excellence

12.4 Market Ranking for the Network Analytics Market, 2018

13 Company Profiles (Page No. - 122)

13.1 Introduction

13.2 Ericsson

13.3 Huawei

13.4 Cisco

13.5 Nokia

13.6 Netscout

13.7 Accenture

13.8 IBM

13.9 Juniper Networks

13.10 SevOne

13.11 SAS Institute

13.12 Sandvine

13.13 Fortinet

13.14 TIBCO Software

13.15 Broadcom

13.16 Nivid Technologies

13.17 Extreme Networks

13.18 HPE

13.19 Ciena

13.20 Netvelocity

13.21 Innowireless

13.22 Actix

14 Appendix (Page No. - 157)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (111 TAbles)

Table 1 Inclusions and Exclusions

Table 2 United States Dollar Exchange Rate, 2016–2018

Table 3 Use Case 1: HPE

Table 4 Use Case 2: HPE

Table 5 Use Case 3: Extreme Networks

Table 6 Use Cases 4: Extreme Networks

Table 7 Use Case 5: Loom Systems

Table 8 Use Case 6: Netcracker

Table 9 Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 10 Network Intelligence Solutions: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Services: Market Size, By Type, 2017–2024 (USD Million)

Table 12 Services: Market Size, By Region, 2017–2024 (USD Million)

Table 13 Professional Services Market Size, By Type, 2017–2024 (USD Million)

Table 14 Professional Services Market Size, By Region, 2017–2024 (USD Million)

Table 15 Consulting Services Market Size, By Region, 2017–2024 (USD Million)

Table 16 Support and Maintenance Services Market Size, By Region, 2017–2024 (USD Million)

Table 17 Managed Services Market Size, By Region, 2017–2024 (USD Million)

Table 18 Network Analytics Market Size, By Application, 2017–2024 (USD Million)

Table 19 Customer Analysis: Market Size, By Region, 2017–2024 (USD Million)

Table 20 Risk Management and Fault Detection: Market Size, By Region, 2017–2024 (USD Million)

Table 21 Network Performance Management: Market Size, By Region, 2017–2024 (USD Million)

Table 22 Compliance Management: Market Size, By Region, 2017–2024 (USD Million)

Table 23 Quality Management: Market Size, By Region, 2017–2024 (USD Million)

Table 24 Other Applications: Market Size, By Region, 2017–2024 (USD Million)

Table 25 Network Analytics Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 26 On-Premises: Market Size, By Region, 2017–2024 (USD Million)

Table 27 Cloud: Market Size, By Region, 2017–2024 (USD Million)

Table 28 Market Size, By Organization Size, 2017–2024 (USD Million)

Table 29 Small and Medium-Sized Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 30 Large Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 31 Network Analytics Market Size, By End User, 2017–2024 (USD Million)

Table 32 Cloud Service Providers: Market Size, By Region, 2017–2024 (USD Million)

Table 33 Managed Service Providers: Market Size, By Region, 2017–2024 (USD Million)

Table 34 Telecom Service Providers: Market Size, By Region, 2017–2024 (USD Million)

Table 35 Other End Users: Market Size, By Region, 2017–2014 (USD Million)

Table 36 Network Analytics Market Size, By Region, 2017–2024 (USD Million)

Table 37 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 38 North America: Market Size, By Service, 2017–2024 (USD Million)

Table 39 North America: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 40 North America: Market Size, By Application, 2017–2024 (USD Million)

Table 41 North America: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 42 North America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 43 North America: Market Size, By End User, 2017–2024 (USD Million)

Table 44 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 45 United States: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 46 United States: Market Size, By Service, 2017–2024 (USD Million)

Table 47 United States: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 48 United States: Market Size, By Application, 2017–2024 (USD Million)

Table 49 United States: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 50 United States: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 51 United States: Market Size, By End User, 2017–2024 (USD Million)

Table 52 Europe: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 53 Europe: Market Size, By Service, 2017–2024 (USD Million)

Table 54 Europe: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 55 Europe: Market Size, By Application, 2017–2024 (USD Million)

Table 56 Europe: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 57 Europe: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 58 Europe: Market Size, By End User, 2017–2024 (USD Million)

Table 59 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 60 United Kingdom: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 61 United Kingdom: Market Size, By Service, 2017–2024 (USD Million)

Table 62 United Kingdom: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 63 United Kingdom: Market Size, By Application, 2017–2024 (USD Million)

Table 64 United Kingdom: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 65 United Kingdom: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 66 United Kingdom: Market Size, By End User, 2017–2024 (USD Million)

Table 67 Asia Pacific: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market Size, By Service, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 70 Asia Pacific: Market Size, By Application, 2017–2024 (USD Million)

Table 71 Asia Pacific: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 72 Asia Pacific: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 73 Asia Pacific: Market Size, By End User, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 75 China: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 76 China: Market Size, By Service, 2017–2024 (USD Million)

Table 77 China: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 78 China: Market Size, By Application, 2017–2024 (USD Million)

Table 79 China: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 80 China: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 81 China: Market Size, By End User, 2017–2024 (USD Million)

Table 82 Middle East and Africa: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 83 Middle East and Africa: Market Size, By Service, 2017–2024 (USD Million)

Table 84 Middle East and Africa: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 85 Middle East and Africa: Market Size, By Application, 2017–2024 (USD Million)

Table 86 Middle East and Africa: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 87 Middle East and Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 88 Middle East and Africa: Market Size, By End User, 2017–2024 (USD Million)

Table 89 Middle East and Africa: Market Size, By Subregion, 2017–2024 (USD Million)

Table 90 Middle East: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 91 Middle East: Market Size, By Service, 2017–2024 (USD Million)

Table 92 Middle East: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 93 Middle East: Market Size, By Application, 2017–2024 (USD Million)

Table 94 Middle East: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 95 Middle East: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 96 Middle East: Market Size, By End User, 2017–2024 (USD Million)

Table 97 Latin America: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 98 Latin America: Market Size, By Service, 2017–2024 (USD Million)

Table 99 Latin America: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 100 Latin America: Market Size, By Application, 2017–2024 (USD Million)

Table 101 Latin America: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 102 Latin America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 103 Latin America: Market Size, By End User, 2017–2024 (USD Million)

Table 104 Latin America: Market Size, By Country, 2017–2024 (USD Million)

Table 105 Brazil: Network Analytics Market Size, By Component, 2017–2024 (USD Million)

Table 106 Brazil: Market Size, By Service, 2017–2024 (USD Million)

Table 107 Brazil: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 108 Brazil: Market Size, By Application, 2017–2024 (USD Million)

Table 109 Brazil: Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 110 Brazil: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 111 Brazil: Market Size, By End User, 2017–2024 (USD Million)

List of Figures (44 Figures)

Figure 1 Network Analytics Market: Research Design

Figure 2 Research Methodology

Figure 3 Market: Top-Down and Bottom-Up Approaches

Figure 4 Competitive Leadership Mapping: Criteria Weightage

Figure 5 Market: Regional Snapshot

Figure 6 Network Analytics Market: Growth Trend

Figure 7 Asia Pacific to Grow at the Highest Growth Rate During the Forecast Period

Figure 8 Increase in Data Volume and Changes in Traffic Pattern to Drive the Market Growth During the Forecast Period

Figure 9 On-Premises Segment to Hold A Higher Share in the Network Analytics Market in 2019

Figure 10 Network Intelligence Solutions and United States to Dominate the North American Network Analytics Market in 2019

Figure 11 Large Enterprises and United Kingdom to Dominate the European Network Analytics Market in 2019

Figure 12 Network Performance Management and China to Account for the Highest Shares in the Asia Pacific Market in 2019

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 14 Ecosystem of Network Analytics

Figure 15 Architecture of Network Analytics

Figure 16 Network Analytics Market: Technologies Impacting Network Analytics

Figure 17 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 18 Professional Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 19 Support and Maintenance Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 20 Customer Analysis Segment to Register the Highest CAGR During the Forecast Period

Figure 21 Cloud Segment to Register A Higher CAGR During the Forecast Period

Figure 22 Small and Medium-Sized Enterprises Segment to Register A Higher CAGR During the Forecast Period

Figure 23 Telecom Service Providers Segment to Register the Highest CAGR During the Forecast Period

Figure 24 North America to Exhibit the Largest Market Size in the Network Analytics Market During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Network Analytics Market (Global), Competitive Leadership Mapping

Figure 28 Market Ranking, 2018

Figure 29 Ericsson: Company Snapshot

Figure 30 Ericsson: SWOT Analysis

Figure 31 Huawei: Company Snapshot

Figure 32 Huawei: SWOT Analysis

Figure 33 Cisco: Company Snapshot

Figure 34 Cisco: SWOT Analysis

Figure 35 Nokia: Company Snapshot

Figure 36 Nokia: SWOT Analysis

Figure 37 Netscout: Company Snapshot

Figure 38 Netscout: SWOT Analysis

Figure 39 Accenture: Company Snapshot

Figure 40 IBM: Company Snapshot

Figure 41 Juniper Networks: Company Snapshot

Figure 42 SAS Institute: Company Snapshot

Figure 43 Fortinet: Company Snapshot

Figure 44 Broadcom: Company Snapshot

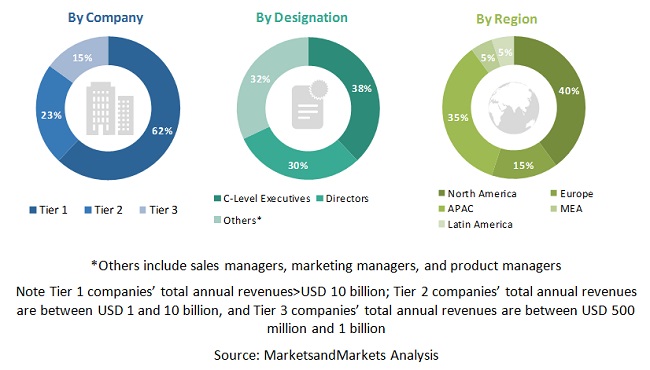

The study involved four major activities in estimating the current size of the network analytics market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the network analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred, to identify and collect information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by Harvard Business Review and other recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both the supply and demand sides of the network analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing network analytics solutions in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the network analytics market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global network analytics market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The global market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the network analytics market by component (network intelligence solutions and services), application (customer analysis, risk management and fault detection, network performance management, compliance management, and quality management), deployment type (on-premises and cloud), organization size (SMEs and large enterprises), end-user (cloud service providers, managed service providers and telecom providers) and region

- To provide detailed information related to the significant factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the market subsegments for individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market

- To forecast the revenue of the market segments for five major regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To profile the key players and comprehensively analyze their recent developments and positioning in the market

- To analyze the competitive developments, such as mergers and acquisitions, new product developments, and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakup of the North American network analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the MEA market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Network Analytics Market

I am looking to build a market opportunity business plan for Network & 5G Data Analytics in terms of spend patterns primarily not only for EMEA but also US and APAC regions