Dietary Fibers Market by Source (Fruits & Vegetables, Cereals & Grains, Legumes, Nuts & Seeds), Type (Soluble, Insoluble), Application (Functional Food & Beverages, Pharmaceuticals, Feed, Nutrition, Other Application) & Region - Global Forecast to 2027

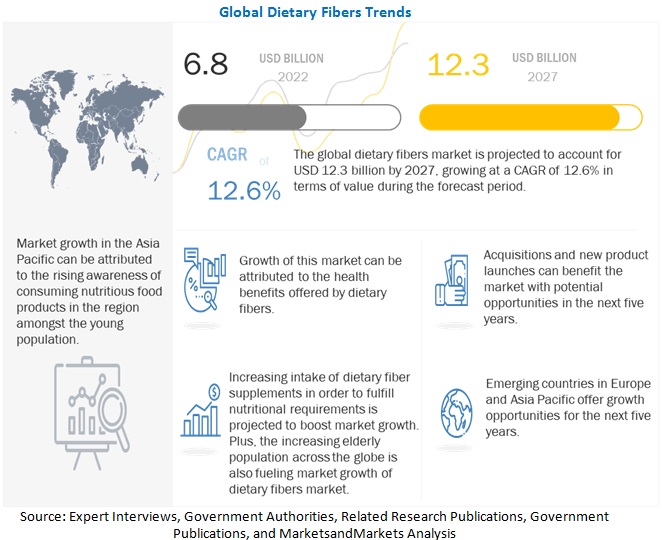

The global dietary fibers market is estimated at USD 6.8 billion in 2022. It is projected to reach USD 12.3 billion by 2027, recording a CAGR of 12.6% during the forecast period. Increasing elderly population across globe coupled with rise in the consumption of fortified food products have driven the dietary fiber market. Dietary fibers can enhance the structure and taste of food; therefore, they are used as one of the prominent food additive.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing demand for dietary fiber supplements

According to IOM, functional fiber “consists of isolated, non-digestible carbohydrates that have positive physiological effects in humans.” Therefore, it has been observed that many supplements consist of dietary and functional fibers. From the past few years, the supplement industry has grown manifold. Increasing health awareness among consumers around the world combined with sensitivity toward nutrient-rich products have been some of the major driving factors uplifted the growth supplement industry. This has helped to upsurge the demand for dietary fiber supplements from the past few years as a significant means of consumption of dietary fibers.

Restraint: Saturated water stability and reactivity

Humans unable to digest dietary fibers owing to the lack of required enzymes in the digestive tract. More specifically, dietary fibers are resistant to hydrolysis. As dietary fibers remain undigested, they surpass via body almost unchanged and can’t be utilized as a source of energy. These properties of fibers are helpful in the physiological roles that they play. While the same saturated water stability and least reactivity create a barrier when the dietary fibers are being used as ingredients. This characteristic can lead manufacturers to incorporate dietary fibers as an ingredient, which is expected to act as hindering factor in the growth of this market.

Opportunity: Growing applications in the form of fortified snacks, dairy products, and meat products

Snacks is one of the popular food categories and found wide array of products with various functional ingredients and it has been observed that, consumers are preferring healthy-snacking items that can provide nutrition and functional benefits. Hence, this segment has generated and expected to continue generate huge opportunities for the dietary fibers market in the next few years. Apart from this, it has been also observed that flour-based products, dairy products such as yogurt and cheese have been widely accepted by health-freak consumers around the world.

Challenge: Changing standards and guidelines across regional regulatory bodies

The definition of dietary fibers changes from one country to other, based on regulations in that particular country. For instance, in the United Kingdom, dietary fiber is defined by chemical properties and digestibility, however in the United States, ingredients that can be fermented in the colon are considered as dietary fiber. France's definition for dietary fiber is aligned with Codex's. In that, it considers the composition and polymerization of carbohydrates and their physiological properties. This can create challenge for international food and ingredients manufactures who want to sell and market their products on the global platform.

Increasing demand for nut-based superfoods

Superfoods such as almond, peanut, cashew, chia, flaxseeds are considered as wholesome and superfood. Flaxseeds have around 27 g of fiber per 100 g of serving. Peanuts are known to lower the risk of heart disease and diabetes. On the other hand, almond aid to relief constipation and various of skin conditions such as acne and eczema. Furthermore, almonds can cure gastroenteritis, renal aches, diabetes, face neuralgia, head lice, and gastric ulcers. Therefore, these superfoods are always in high demand for consumers around the world that has led manufacturers to introduce products enriched with these superfoods, which in turn anticipated to increase dietary fibers market growth in the upcoming years.

Growing awareness regarding nutrition-rich animal-feed products

Conventionally, dietary fiber has been considered antinutritional because of its side effects on feed consumption and nutrient digestibility. Soluble fibers such as pectin from sugar beet, beta-glucan from oats and barley, and arabinoxylan from rye and wheat can improve viscosity and mitigate the passage rate in young poultry and pigs. The fiber-rich raw materials for pet food and feed are easily available at low costs. The key objective of revitalizing pet food with dietary fiber is to enrich it with prebiotics that support the growth of good bacteria in the intestine. It also helps maintain healthy digestive and immune systems of animals. Hence, incorporating dietary fiber to help enhance gut and animal performance, which in turn expected to drive its application in animal nutrition.

Asia Pacific Dietary Fibers Trends

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is poised to be the fastest-growing market for dietary fibers, at a CAGR of 13.5%, in terms of value.

Increasing young population across region coupled with government instructions to include fiber-rich food in daily diets and growing per-capita income are some of the factors responsible for Asia Pacific dietary fibers market growth. Furthermore, fast-paced lifestyle has led consumers to opt for ready-to-eat products, which in turn helped manufacturers to introduce fiber-rich snacking products specifically for health-conscious consumers. In addition to this, Indian and Chinese governments are promoting the health benefits associated with the consumption of dietary fibers that is predicted to generate potential opportunities for dietary fibers manufacturers across the globe.

Key Market Players

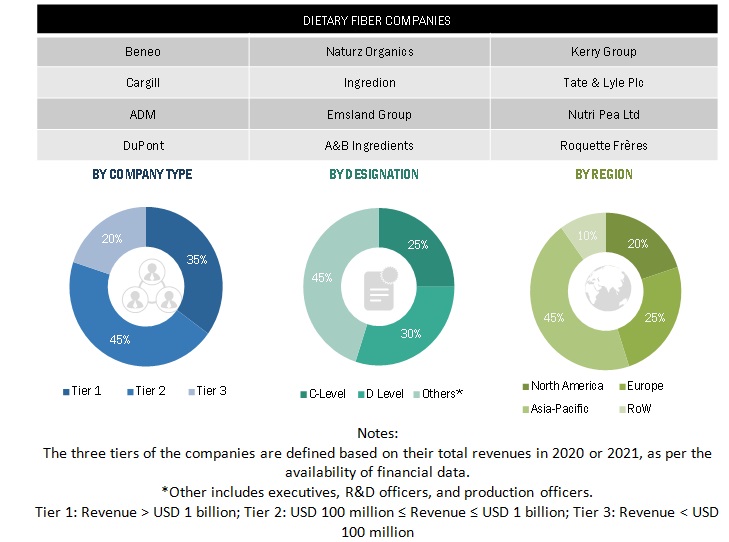

Key players in this market include Beneo (Germany), ADM (US), Tereos (France), Cargill (US), Dupont (US), Roquette Frères (France), Ingredion Incorporated (US), Kerry Group PLC (Ireland), The Green Labs LLC (US), Nexira (France), Tate & Lyle (UK), Nutri Pea Ltd (Canada), Herbafood Ingredients GmbH (Germany), Scoular (US), and Baolingbao Biology Co Ltd. (China).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

By source, type, application |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, South America |

|

Companies studied |

|

This research report categorizes the dietary fibers market based on source, application, type, and region.

Target Audience:

- Manufacturers of equipment used for processes, such as extraction, extrusion, canning, and baking

- Consumers using equipment for producing dietary fibers

- New companies and established players investing in the dietary fibers market

- Soluble & insoluble dietary fiber manufacturers and extractors

- Dietary fiber importers and exporters

- Dietary fiber traders, distributors, and suppliers

- Dietary fiber raw material suppliers

- Dietary fiber end-product manufacturers

- Commercial research & development (R&D) institutions and financial institutions

-

Regulatory bodies:

- The Federal Drug Administration (FDA)

- European Food Safety Authority (EFSA)

-

Associations and industry bodies:

- American Association of Cereal Chemists (AACC)

- Food & Agriculture Organization of the United Nations (FAO)

- United States Department of Agriculture (USDA)

- American Dietetic Association

Report Scope:

Dietary Fibers Market:

By Source

-

Fruits & Vegetables

- Apple

- Banana

- Pear

- Grapefruit

- Raspberry

- Garlic

- Okra

- Carrot

- Potato

- Beet

-

Cereals & Grains

- Corn

- Oats

- Wheat

- Rice

- Barley

-

Legumes

- Beans

- Soy

- Peas

-

Nuts & Seeds

- Almond

- Peanuts

- Psyllium

- Flaxseed

- Sunflowers

By Type

-

Soluble

- Inulin

- Pectin

- Polydextrose

- Beta-glucan

- Fructooligosaccharides (FOS)

- Galactooligosaccharides (GOS)

- Resistant Dextrin

- Resistant Maltodextrin

- Other Soluble Fibers

-

Insoluble

- Cellulose

- Hemicellulose

- Chitin & Chitosan

- Lignin

- Fiber/Bran

- Resistant Starch

By Application

-

Functional Food & Beverages

- Dairy Products

- Bakery & Confectionery Products

- Breakfast Cereals

- Meat Products

- Snacks

- Beverages

- Pharmaceuticals

- Feed

- Nutrition

- Other Applications

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In April 2021, Ingredion Incorporated acquired Germany-based KaTech, that provides advanced texture and stabilization solutions to the food and beverage industries. This acquisition expands Ingredion's Food Systems platform with a comprehensive suite of innovative solutions that assist food and beverage manufacturers with product formulation, ingredient functionality, and technical assistance.

- In March 2020, BENEO constructed its chicory root fiber manufacturing unit in Chile. This expansion to help BENNEO to solidify its position in the global dietary fibers market.

- In September 2019, Tate & Lyle opened a new Customer Innovation and Collaboration Center in Santiago, Chile. The new center includes application and rapid prototyping capabilities, which will allow Tate & Lyle's food scientists to collaborate with customers in the region to address the growing demand for solutions that help reduce sugar, fat, and calories and add fiber to consumer products.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the dietary fibers market?

North America dominated the dietary fibers market with largest share of 34.3% of the overall market in 2021

What is the current size of the global dietary fibers market?

The global Dietary fibers market is estimated at USD 6.8 Billion in 2022. It is projected to reach USD 12.3 Billion by 2027, recording a CAGR of 12.6% during the forecast period

Which are the key players in the market, and how intense is the competition?

Key players in this market include Beneo (Germany), ADM (US), Tereos (France), Cargill (US), Dupont (US), Roquette Frères (France), Ingredion Incorporated (US), Kerry Group PLC (Ireland), The Green Labs LLC (US), Nexira (France), Tate & Lyle (UK), Nutri Pea Ltd (Canada), Herbafood Ingredients GmbH (Germany), Scoular (US), and Baolingbao Biology Co Ltd. (China). Companies are aiming on growing their manufacturing and R&D facilities by entering into partnerships and agreements as well as by launching new products to mark their footprint in the global market. .

What is the leading application in the dietary fibers market?

The functional food & beverages segment was the highest revenue contributor to the market, with USD 2,684.0 million in 2021, and is estimated to reach USD 5,720.9 million by 2027, with a CAGR of 13.4%. The pharmaceuticals segment is estimated to reach USD 2,221.4 million by 2027, at a significant CAGR of 12.4% during the forecast period.

What is the estimated industry size of dietary fibers?

The global dietary fibers market was valued at USD 6,050.7 million in 2021, and is projected to reach USD 12,350.7 million by 2027, registering a CAGR of 12.6% from 2022 to 2027.

What is the leading source in the dietary fibers market?

The cereals & grains segment was the highest revenue contributor to the market, with USD 2,269.2 million in 2021, and is estimated to reach USD 4,770.8 million by 2027, with a CAGR of 13.2%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 DIETARY FIBERS: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 3 MARKET FOR DIETARY FIBERS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 DIETARY FIBERS MARKET SIZE ESTIMATION, BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION, TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 2 DIETARY FIBERS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 5 MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 6 MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

FIGURE 9 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 10 GROWING DEMAND FOR FUNCTIONAL FOODS TO DRIVE THE GLOBAL MARKET

4.2 DIETARY FIBERS MARKET: KEY COUNTRIES, 2021

FIGURE 11 US ACCOUNTED FOR LARGEST MARKET SHARE

4.3 MARKET FOR DIETARY FIBERS, BY SOURCE & REGION, 2021

FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE

4.4 MARKET FOR DIETARY FIBERS, BY TYPE, 2022 VS. 2027

FIGURE 13 SOLUBLE DIETARY FIBERS SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.5 MARKET FOR DIETARY FIBERS, BY APPLICATION, 2022 VS. 2027

FIGURE 14 FUNCTIONAL FOOD AND BEVERAGES SEGMENT EXPECTED TO DOMINATE MARKET IN 2022

4.6 NORTH AMERICA: MARKET FOR DIETARY FIBERS, BY APPLICATION & COUNTRY, 2021

FIGURE 15 US ACCOUNTED FOR LARGEST MARKET SHARE

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MARKET FOR DIETARY FIBERS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Health benefits offered by dietary fibers

TABLE 3 DIETARY FIBERS: SOURCES AND HEALTH BENEFITS

TABLE 4 DIETARY FIBER CONTENT OF DIFFERENT FOOD GROUPS

5.2.1.2 Growth in demand for fiber supplements

TABLE 5 COMMON DIETARY FIBER SUPPLEMENTS

5.2.1.3 Rise in consumer awareness through government health programs

5.2.2 RESTRAINTS

5.2.2.1 Saturated water stability and reactivity

5.2.3 OPPORTUNITIES

5.2.3.1 Rising applications in form of fortified snacks, flour products, meat products, and dairy products

TABLE 6 DIETARY FIBERS: FUNCTIONAL PROPERTIES IN DAIRY & BEVERAGE PRODUCTS

5.2.3.2 Rising consumer awareness about value-added products

5.2.4 CHALLENGES

5.2.4.1 Variable standards and guidelines across regional regulatory bodies

6 INDUSTRY TRENDS (Page No. - 77)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 17 DIETARY FIBERS MARKET: VALUE CHAIN ANALYSIS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 SOURCING

6.2.3 PRODUCTION & PROCESSING

6.2.4 PACKAGING AND STORAGE

6.2.5 LOGISTICS & DISTRIBUTION

6.2.6 MARKETING & SALES

6.3 TECHNOLOGY ANALYSIS

6.3.1 INVISIBLE FIBERS

6.3.2 EMERGING TECHNOLOGIES FOR EXTRACTION AND MODIFICATION

6.4 PRICING ANALYSIS

FIGURE 18 PRICING ANALYSIS, 2018–2026 (USD MILLION/KT)

6.5 PATENT ANALYSIS

FIGURE 19 PATENTS GRANTED FOR DIETARY FIBERS MARKET, 2011-2021

FIGURE 20 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DIETARY FIBERS MARKET, 2011-2021

TABLE 7 KEY PATENTS PERTAINING TO THIS MARKET, 2020

6.6 MARKET MAP

FIGURE 21 MARKET FOR DIETARY FIBERS: MARKET MAP

6.6.1 MANUFACTURERS

6.6.2 REGULATORY BODIES

6.6.3 END-USER COMPANIES

6.6.4 START-UPS/EMERGING COMPANIES

TABLE 8 MARKET FOR DIETARY FIBERS: ECOSYSTEM

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MARKET FOR DIETARY FIBERS: PORTER’S FIVE FORCES ANALYSIS

6.7.1 DEGREE OF COMPETITION

6.7.2 BARGAINING POWER OF SUPPLIERS

6.7.3 BARGAINING POWER OF BUYERS

6.7.4 THREAT OF SUBSTITUTES

6.7.5 THREAT OF NEW ENTRANTS

6.8 KEY EXPORT-IMPORT MARKETS

FIGURE 22 CEREALS: IMPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

FIGURE 23 CEREALS: EXPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

FIGURE 24 EDIBLE VEGETABLES: IMPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

FIGURE 25 EDIBLE VEGETABLES: EXPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

FIGURE 26 EDIBLE FRUITS & NUTS: IMPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

FIGURE 27 EDIBLE FRUITS & NUTS: EXPORT VALUE, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

6.9 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 10 DIETARY FIBERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 28 REVENUE SHIFT FOR DIETARY FIBERS MARKET

6.11 CASE STUDY ANALYSIS

6.11.1 DIETARY FIBERS AND INCIDENCES OF TYPE 2 DIABETES

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING DIETARY FIBER TYPES

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING TOP TWO PRODUCT TYPES

6.12.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR DIETARY FIBER APPLICATIONS

TABLE 16 KEY BUYING CRITERIA FOR DIETARY FIBERS APPLICATIONS

7 DIETARY FIBERS MARKET, BY SOURCE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 31 DIETARY FIBERS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 17 MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 18 MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 19 MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 20 MARKET, BY SOURCE, 2022–2027 (KT)

7.2 FRUITS & VEGETABLES

TABLE 21 FRUITS & VEGETABLES: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 FRUITS & VEGETABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 FRUITS & VEGETABLES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 24 FRUITS & VEGETABLES: MARKET, BY REGION, 2022–2027 (KT)

TABLE 25 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 26 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 27 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 28 FRUITS & VEGETABLES: MARKET, BY SUBTYPE, 2022–2027 (KT)

7.2.1 APPLE

7.2.1.1 High fiber content increases demand

7.2.2 BANANA

7.2.2.1 High nutritional content to result in higher demand

7.2.3 PEAR

7.2.3.1 Rise in awareness regarding diabetes

7.2.4 GRAPEFRUIT

7.2.4.1 Importance of gut health has resulted in fast growth

7.2.5 RASPBERRY

7.2.5.1 Awareness of antioxidant properties

7.2.6 GARLIC

7.2.6.1 High demand for inulin to drive demand for garlic

7.2.7 OKRA

7.2.7.1 Rising awareness about diet management to boost demand

7.2.8 CARROT

7.2.8.1 Rising awareness about fiber content to drive market for carrots

7.2.9 POTATO

7.2.9.1 Growing demand for starch-based food to fuel demand for potato

7.2.10 BEET

7.2.10.1 Rising demand for iron-rich food to drive market for beet

7.3 CEREALS & GRAINS

TABLE 29 CEREALS & GRAINS: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 CEREALS & GRAINS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 31 CEREALS & GRAINS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 32 CEREALS & GRAINS: MARKET, BY REGION, 2022–2027 (KT)

TABLE 33 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 34 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 35 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 36 CEREALS & GRAINS: MARKET, BY SUBTYPE, 2022–2027 (KT)

7.3.1 CORN

7.3.1.1 Rising demand for healthier diet to drive demand for corn

7.3.2 OATS

7.3.2.1 Higher awareness regarding healthy grains to drive demand

7.3.3 WHEAT

7.3.3.1 Multi-grain food products augmenting growth for wheat

7.3.4 RICE

7.3.4.1 Rice-based fibers in demand

7.3.5 BARLEY

7.3.5.1 Rising consumption of grain-based food to drive demand

7.4 LEGUMES

TABLE 37 LEGUMES: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 LEGUMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 39 LEGUMES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 40 LEGUMES: MARKET, BY REGION, 2022–2027 (KT)

TABLE 41 LEGUMES: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 42 LEGUMES: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 43 LEGUMES: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 44 LEGUMES: MARKET, BY SUBTYPE, 2022–2027 (KT)

7.4.1 BEANS

7.4.1.1 Growing application of beans for multiple food & beverage usage

7.4.2 SOY

7.4.2.1 Rising awareness regarding benefits provided by soy

7.4.3 PEAS

7.4.3.1 Growing application of peas across multiple industries

7.5 NUTS & SEEDS

TABLE 45 NUTS & SEEDS: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 NUTS & SEEDS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 47 NUTS & SEEDS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 48 NUTS & SEEDS: MARKET, BY REGION, 2022–2027 (KT)

TABLE 49 NUTS & SEEDS: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 50 NUTS & SEEDS: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 51 NUTS & SEEDS: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 52 NUTS & SEEDS: MARKET, BY SUBTYPE, 2022–2027 (KT)

7.5.1 ALMOND

7.5.1.1 Growing demand for superfoods to drive the market for almonds

7.5.2 PEANUTS

7.5.2.1 Rising awareness about nuts-based foods

7.5.3 PSYLLIUM

7.5.3.1 High fiber content to drive demand for psyllium

7.5.4 FLAXSEEDS

7.5.4.1 Rising awareness about nut- and seed-induced food products make flaxseeds appealing

7.5.5 SUNFLOWER SEEDS

7.5.5.1 Increasing application of natural products to drive market for sunflower seeds

8 DIETARY FIBERS MARKET, BY TYPE (Page No. - 121)

8.1 INTRODUCTION

TABLE 53 DIETARY FIBERS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 54 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 55 MARKET, BY TYPE, 2017–2021 (KT)

TABLE 56 MARKET, BY TYPE, 2022–2027 (KT)

8.2 SOLUBLE DIETARY FIBERS

TABLE 57 SOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 58 MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 59 MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 60 MARKET, BY SUBTYPE, 2022–2027 (KT)

8.2.1 INULIN

8.2.1.1 Growing applications across food & beverage industry will drive demand

8.2.1.2 Health benefits of inulin

TABLE 61 INULIN: SOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 INULIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 INULIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 64 INULIN: MARKET, BY REGION, 2022–2027 (KT)

8.2.2 PECTIN

8.2.2.1 Growing demand for plant-based fibers will drive demand

TABLE 65 PECTIN: MARKET FOR SOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 PECTIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 67 PECTIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 68 PECTIN: MARKET, BY REGION, 2022–2027 (KT)

8.2.3 POLYDEXTROSE

8.2.3.1 Increasing demand for healthy baked products will increase demand for polydextrose

8.2.3.2 Characteristics of polydextrose

TABLE 69 POLYDEXTROSE: MARKET FOR SOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 POLYDEXTROSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 POLYDEXTROSE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 72 POLYDEXTROSE: MARKET, BY REGION, 2022–2027 (KT)

8.2.4 BETA-GLUCAN

8.2.4.1 Functional and bioactive qualities of beta-glucan to increase its demand

TABLE 73 BETA-GLUCAN: SOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 BETA-GLUCAN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 75 BETA-GLUCAN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 76 BETA-GLUCAN: MARKET, BY REGION, 2022–2027 (KT)

8.2.5 FRUCTOOLIGOSACCHARIDES

8.2.5.1 Varied applications of fructooligosaccharides in health foods will drive market

8.2.5.2 Health benefits of fructooligosaccharides

TABLE 77 FRUCTOOLIGOSACCHARIDES: MARKET FOR SOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 FRUCTOOLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 79 FRUCTOOLIGOSACCHARIDES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 80 FRUCTOOLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (KT)

8.2.6 GALACTOOLIGOSACCHARIDES

8.2.6.1 Rising awareness regarding metabolism and gut health will drive demand

TABLE 81 GALACTOOLIGOSACCHARIDES: MARKET FOR SOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 82 GALACTOOLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 83 GALACTOOLIGOSACCHARIDES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 84 GALACTOOLIGOSACCHARIDES: MARKET, BY REGION, 2022–2027 (KT)

8.2.7 RESISTANT MALTODEXTRIN

8.2.7.1 Potential to fight obesity, diabetes, and heart disease will drive demand

TABLE 85 RESISTANT MALTODEXTRIN: MARKET FOR SOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 86 RESISTANT MALTODEXTRIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 87 RESISTANT MALTODEXTRIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 88 RESISTANT MALTODEXTRIN: MARKET, BY REGION, 2022–2027 (KT)

8.2.8 RESISTANT DEXTRIN

8.2.8.1 Applications in food, beverages, cosmetics, feed, and dairy will drive demand

TABLE 89 RESISTANT DEXTRIN: SOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 90 RESISTANT DEXTRIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 91 RESISTANT DEXTRIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 92 RESISTANT DEXTRIN: MARKET, BY REGION, 2022–2027 (KT)

8.2.9 OTHER SOLUBLE DIETARY FIBERS

8.2.9.1 Growing applications of fiber across verticals will drive this segment

TABLE 93 OTHER SOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 94 OTHER MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 95 OTHER MARKET, BY REGION, 2017–2021 (KT)

TABLE 96 OTHER MARKET, BY REGION, 2022–2027 (KT)

8.3 INSOLUBLE FIBERS

TABLE 97 INSOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 98 MARKET FOR INSOLUBLE DIETARY FIBERS, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 99 MARKET FOR INSOLUBLE DIETARY FIBERS, BY SUBTYPE, 2017–2021 (KT)

TABLE 100 MARKET FOR INSOLUBLE DIETARY FIBERS, BY SUBTYPE, 2022–2027 (KT)

8.3.1 CELLULOSE

8.3.1.1 Growing applications in gel-based format to drive demand

TABLE 101 CELLULOSE: MARKET FOR INSOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 102 CELLULOSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 103 CELLULOSE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 104 CELLULOSE: MARKET, BY REGION, 2022–2027 (KT)

8.3.2 HEMICELLULOSE

8.3.2.1 Growing application of hemicellulose as food supplement to drive demand

TABLE 105 HEMICELLULOSE: MARKET FOR INSOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 106 HEMICELLULOSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 HEMICELLULOSE: MARKET, BY REGION, 2017–2021 (KT)

TABLE 108 HEMICELLULOSE: MARKET, BY REGION, 2022–2027 (KT)

8.3.3 CHITIN & CHITOSAN

8.3.3.1 Rising use of chitin & chitosan in biomedical applications to drive demand

TABLE 109 CHITIN & CHITOSAN: INSOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 110 CHITIN & CHITOSAN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 111 CHITIN & CHITOSAN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 112 CHITIN & CHITOSAN: MARKET, BY REGION, 2022–2027 (KT)

8.3.4 LIGNIN

8.3.4.1 Usage of lignin in materials industry to drive demand

TABLE 113 LIGNIN: MARKET FOR INSOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 114 LIGNIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 115 LIGNIN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 116 LIGNIN: MARKET, BY REGION, 2022–2027 (KT)

8.3.5 FIBER/BRAN

8.3.5.1 Growing demand for fiber-based snack bars to drive demand

TABLE 117 FIBER/BRAN: MARKET FOR INSOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 118 FIBER/BRAN: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 119 FIBER/BRAN: MARKET, BY REGION, 2017–2021 (KT)

TABLE 120 FIBER/BRAN: MARKET, BY REGION, 2022–2027 (KT)

8.3.6 RESISTANT STARCH

8.3.6.1 Physiological properties of resistant starch to fuel its demand

TABLE 121 RESISTANT STARCH: MARKET FOR INSOLUBLE DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 122 RESISTANT STARCH: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 123 RESISTANT STARCH: MARKET, BY REGION, 2017–2021 (KT)

TABLE 124 RESISTANT STARCH: MARKET, BY REGION, 2022–2027 (KT)

8.3.7 OTHER INSOLUBLE DIETARY FIBERS

8.3.7.1 Rising demand for fiber-rich products for improving gut health to drive demand

TABLE 125 OTHER INSOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 126 OTHER INSOLUBLE DIETARY FIBERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 127 OTHER INSOLUBLE DIETARY FIBERS MARKET, BY REGION, 2017–2021 (KT)

TABLE 128 OTHER INSOLUBLE DIETARY FIBERS MARKET, BY REGION, 2022–2027 (KT)

9 DIETARY FIBERS MARKET, BY APPLICATION (Page No. - 160)

9.1 INTRODUCTION

TABLE 129 DIETARY FIBERS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 130 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 131 MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 132 MARKET, BY APPLICATION, 2022–2027 (KT)

9.2 FUNCTIONAL FOOD & BEVERAGES

TABLE 133 FUNCTIONAL FOOD & BEVERAGES: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 134 FUNCTIONAL FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 135 FUNCTIONAL FOOD & BEVERAGES: MARKET, BY REGION, 2017–2021 (KT)

TABLE 136 FUNCTIONAL FOOD & BEVERAGES: MARKET, BY REGION, 2022–2027 (KT)

9.2.1 DAIRY PRODUCTS

9.2.1.1 Increased demand for nutritious dairy products to drive demand for fibers

TABLE 137 DIETARY FIBER APPLICATIONS IN DAIRY PRODUCTS

9.2.2 BAKERY & CONFECTIONERY PRODUCTS

9.2.2.1 Growing applications of healthy ingredients to drive demand

9.2.3 BREAKFAST CEREALS

9.2.3.1 Rising demand for nutritious and wholegrain cereals to drive demand

9.2.4 MEAT PRODUCTS

9.2.4.1 Rising demand for processed yet healthy meat to drive demand

9.2.5 SNACKS

9.2.5.1 Increased demand for nutritious snack bars to drive demand

9.2.6 BEVERAGES

9.2.6.1 High demand for healthier alternatives to drive market for dietary fibers in beverages

9.3 PHARMACEUTICALS

9.3.1 AGING POPULATION TO DRIVE MARKET FOR DIETARY FIBERS IN PHARMACEUTICALS

TABLE 138 PHARMACEUTICALS: MARKET FOR DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 139 PHARMACEUTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 140 PHARMACEUTICALS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 141 PHARMACEUTICALS: MARKET, BY REGION, 2022–2027 (KT)

9.4 NUTRITION

9.4.1 WEIGHT MANAGEMENT

9.4.1.1 Increased focus on healthier lifestyles to drive demand

9.4.2 SPORTS NUTRITION

9.4.2.1 Increased adoption of plant-based diets by athletes to drive demand

TABLE 142 NUTRITION: MARKET FOR DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 143 NUTRITION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 144 NUTRITION: MARKET, BY REGION, 2017–2021 (KT)

TABLE 145 NUTRITION: MARKET, BY REGION, 2022–2027 (KT)

9.5 FEED

9.5.1 HIGH AWARENESS ABOUT NUTRIENT-RICH LIVESTOCK FEED

TABLE 146 FEED: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 147 FEED: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 148 FEED: MARKET, BY REGION, 2017–2021 (KT)

TABLE 149 FEED: MARKET, BY REGION, 2022–2027 (KT)

9.6 OTHER APPLICATIONS

9.6.1 RISING DEMAND FROM PERSONAL CARE AND COSMETICS INDUSTRIES

TABLE 150 OTHER APPLICATIONS: MARKET FOR DIETARY FIBERS, BY REGION, 2017–2021 (USD MILLION)

TABLE 151 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 152 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2021 (KT)

TABLE 153 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (KT)

10 DIETARY FIBERS MARKET, BY PROCESSING TREATMENT (Page No. - 177)

10.1 INTRODUCTION

10.2 EXTRUSION COOKING

10.2.1 HIGH PRODUCTIVITY AND SHORT COOKING TIME

10.3 CANNING

10.3.1 INCREASED SHELF-LIFE AND SOLUBLE FIBER CONTENT OF PRODUCTS

10.4 GRINDING

10.4.1 SIMPLE AND ECONOMICAL PROCESS WIDENS SCOPE FOR ULTRA-FINE GRINDING

10.5 BOILING

10.5.1 COST-EFFECTIVENESS AND INCREASE IN SOLUBLE FIBER CONTENT

10.6 FRYING

10.6.1 RISING DEMAND FOR RESISTANT STARCH IN FOOD PRODUCTS TO DRIVE DEMAND FOR FRYING

11 DIETARY FIBERS MARKET, BY REGION (Page No. - 181)

11.1 INTRODUCTION

FIGURE 34 DIETARY FIBERS MARKET GROWTH, 2022–2027

TABLE 154 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 155 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 156 MARKET, BY REGION, 2017–2021 (KT)

TABLE 157 MARKET, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 158 NORTH AMERICA: DIETARY FIBERS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 159 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 160 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 161 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 162 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 163 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 165 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 166 NORTH AMERICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 167 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 168 NORTH AMERICA: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 169 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 170 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 171 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 173 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 174 NORTH AMERICA: SOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 175 NORTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 176 NORTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 177 NORTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (KT)

TABLE 178 NORTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 179 NORTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 180 NORTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 181 NORTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (KT)

11.2.1 US

11.2.1.1 Rising usage as raw material in pharmaceuticals and food & beverages drives US market

TABLE 182 US: DIETARY FIBERS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 183 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising consumption of convenience food to drive market in Canada

TABLE 184 LIST OF DIETARY FIBERS ACCEPTED BY HEALTH CANADA’S FOOD DIRECTORATE

TABLE 185 CANADA: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 186 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Multiple health benefits of dietary fibers to drive market growth

TABLE 187 MEXICO: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 188 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

TABLE 189 EUROPE: DIETARY FIBERS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 190 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 191 EUROPE: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 192 EUROPE: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 193 EUROPE: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 194 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 195 EUROPE: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 196 EUROPE: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 197 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 198 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 EUROPE: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 200 EUROPE: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 201 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 202 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 203 EUROPE: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 204 EUROPE: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 205 EUROPE: SOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 206 EUROPE: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 207 EUROPE: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 208 EUROPE: MARKET, BY SUBTYPE, 2022–2027 (KT)

TABLE 209 EUROPE: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 210 EUROPE: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 211 EUROPE: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 212 EUROPE: MARKET, BY SUBTYPE, 2022–2027 (KT)

11.3.1 GERMANY

11.3.1.1 Germany to dominate market for dietary fibers

TABLE 213 GERMANY: MEAN DIETARY FIBER INTAKE

TABLE 214 GERMANY: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 215 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 France dominated by local and regional players

TABLE 216 FRANCE: MEAN DIETARY FIBER INTAKE

TABLE 217 FRANCE: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 218 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.3 ITALY

11.3.3.1 Popularity of high-fiber food & beverages due to increase in vegan population

TABLE 219 ITALY: DIETARY FIBERS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 220 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.4 UK

11.3.4.1 Higher consumption of dietary fiber due to increase in aging population

TABLE 221 UK: MEAN DIETARY FIBER INTAKE

TABLE 222 UK: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 223 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Recommended by Spanish government and health agencies to prevent and reduce cardiovascular diseases

TABLE 224 SPAIN: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 225 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 226 DENMARK: MEAN DIETARY FIBER INTAKE

TABLE 227 NORWAY: MEAN DIETARY FIBER INTAKE

TABLE 228 REST OF EUROPE: DIETARY FIBERS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 229 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 230 ASIA PACIFIC: MARKET FOR DIETARY FIBERS, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 231 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 232 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 233 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 234 ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 235 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 236 ASIA PACIFIC: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 237 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 238 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 239 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 240 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 241 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 242 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 243 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 245 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 246 ASIA PACIFIC: SOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 247 ASIA PACIFIC: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 248 ASIA PACIFIC: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 249 ASIA PACIFIC: MARKET, BY SUBTYPE, 2022–2027 (KT)

TABLE 250 ASIA PACIFIC: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 251 ASIA PACIFIC: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 252 ASIA PACIFIC: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 253 ASIA PACIFIC: MARKET, BY SUBTYPE, 2022–2027 (KT)

11.4.1 CHINA

11.4.1.1 China to be fastest-growing market in Asia Pacific

TABLE 254 CHINA: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 255 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Dietary fiber supplements and fortified food to drive market

TABLE 256 JAPAN: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 257 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Government initiatives and campaigns to drive consumer demand for dietary fiber-based food applications

TABLE 258 INDIA: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 259 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Change toward healthy lifestyle to create opportunities for manufacturers

TABLE 260 RECOMMENDED FIBER INTAKES PER DAY

TABLE 261 AUSTRALIA & NEW ZEALAND: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 262 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 263 REST OF ASIA PACIFIC: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 264 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 265 SOUTH AMERICA: DIETARY FIBERS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 267 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (KT)

TABLE 268 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 269 SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 270 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 271 SOUTH AMERICA: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 272 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 273 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 274 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 275 SOUTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 276 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 277 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 278 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 279 SOUTH AMERICA: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 280 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 281 SOUTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 282 SOUTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 283 SOUTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 284 SOUTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (KT)

TABLE 285 SOUTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 286 SOUTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 287 SOUTH AMERICA: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 288 SOUTH AMERICA: MARKET, BY SUBTYPE, 2022–2027 (KT)

11.5.1 BRAZIL

11.5.1.1 Rising health awareness to fuel market for dietary fibers

TABLE 289 BRAZIL: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 290 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.2 CHILE

11.5.2.1 Demand for fiber-enriched supplements and pharmaceutical products to drive market growth

TABLE 291 CHILE: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 292 CHILE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 293 REST OF SOUTH AMERICA: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 294 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 295 ROW: DIETARY FIBERS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 296 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 297 ROW: MARKET, BY REGION, 2017–2021 (KT)

TABLE 298 ROW: MARKET, BY REGION, 2022–2027 (KT)

TABLE 299 ROW: MARKET, BY SOURCE, 2017–2021 (USD MILLION)

TABLE 300 ROW: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 301 ROW: MARKET, BY SOURCE, 2017–2021 (KT)

TABLE 302 ROW: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 303 ROW: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 304 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 305 ROW: MARKET, BY APPLICATION, 2017–2021 (KT)

TABLE 306 ROW: MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 307 ROW: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 308 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 309 ROW: MARKET, BY TYPE, 2017–2021 (KT)

TABLE 310 ROW: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 311 ROW: SOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 312 ROW: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 313 ROW: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 314 ROW: MARKET, BY SUBTYPE, 2022–2027 (KT)

TABLE 315 ROW: INSOLUBLE DIETARY FIBERS MARKET, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 316 ROW: MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 317 ROW: MARKET, BY SUBTYPE, 2017–2021 (KT)

TABLE 318 ROW: MARKET, BY SUBTYPE, 2022–2027 (KT)

11.6.1 MIDDLE EAST

11.6.1.1 Growing need to maintain healthy lifestyles

TABLE 319 MIDDLE EAST: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 320 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Rising demand for organic and alternative food products

TABLE 321 AFRICA: MARKET FOR DIETARY FIBERS, BY TYPE, 2017–2021 (USD MILLION)

TABLE 322 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 254)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

FIGURE 37 DIETARY FIBERS MARKET SHARE (CONSOLIDATED)

12.3 STRATEGIES OF KEY PLAYERS

FIGURE 38 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2022

12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 39 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 40 DIETARY FIBERS MARKET, COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

12.5.5 PRODUCT FOOTPRINT

TABLE 323 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 324 COMPANY APPLICATION FOOTPRINT

TABLE 325 COMPANY REGIONAL FOOTPRINT

TABLE 326 OVERALL COMPANY FOOTPRINT

12.6 DIETARY FIBERS MARKET, START-UP/SME EVALUATION QUADRANT

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 41 MARKET FOR DIETARY FIBERS, COMPANY EVALUATION QUADRANT, 2021 (START-UP/SME)

12.6.4.1 Competitive benchmarking

TABLE 327 DIETARY FIBERS MARKET: DETAILED LIST OF KEY STARTUP/SME

TABLE 328 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME

12.7 COMPETITIVE SCENARIO

12.7.1 PRODUCT LAUNCHES

TABLE 329 MARKET FOR DIETARY FIBERS: PRODUCT LAUNCHES, MAY 2021

12.7.2 DEALS

TABLE 330 MARKET FOR DIETARY FIBERS: DEALS, APRIL 2021–MARCH 2022

12.7.3 OTHERS

TABLE 331 MARKET FOR DIETARY FIBERS: OTHERS, SEPTEMBER 2019- NOVEMBER 2021

13 COMPANY PROFILES (Page No. - 269)

(Business overview, Products offered, Recent Developments, MNM view)*

13.1 LEADING PLAYERS

13.1.1 BENEO

TABLE 332 BENEO: BUSINESS OVERVIEW

TABLE 333 BENEO: OTHERS

13.1.2 ADM

TABLE 334 ADM: BUSINESS OVERVIEW

FIGURE 42 ADM: COMPANY SNAPSHOT

13.1.3 CARGILL

TABLE 335 CARGILL: BUSINESS OVERVIEW

FIGURE 43 CARGILL: COMPANY SNAPSHOT

TABLE 336 CARGILL: OTHERS

13.1.4 DUPONT

TABLE 337 DUPONT: BUSINESS OVERVIEW

FIGURE 44 DUPONT: COMPANY SNAPSHOT

13.1.5 INGREDION INCORPORATED

TABLE 338 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 45 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 339 INGREDION INCORPORATED: DEALS

13.1.6 ROQUETTE FRERES

TABLE 340 ROQUETTE FRERES: BUSINESS OVERVIEW

13.1.7 KERRY GROUP PLC

TABLE 341 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 46 KERRY GROUP PLC: COMPANY SNAPSHOT

13.1.8 THE GREEN LABS LLC

TABLE 342 THE GREEN LABS LLC: BUSINESS OVERVIEW

13.1.9 NEXIRA

TABLE 343 NEXIRA: BUSINESS OVERVIEW

TABLE 344 NEXIRA: DEALS

13.1.10 TATE & LYLE

TABLE 345 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 47 TATE & LYLE: COMPANY SNAPSHOT

TABLE 346 TATE & LYLE: PRODUCT LAUNCHES

TABLE 347 TATE & LYLE: DEALS

TABLE 348 TATE & LYLE: OTHERS

13.1.11 NUTRI PEA LTD

TABLE 349 NUTRI PEA LTD: BUSINESS OVERVIEW

13.1.12 TEREOS

TABLE 350 TEREOS: BUSINESS OVERVIEW

FIGURE 48 TEREOS: COMPANY SNAPSHOT

13.1.13 HERBAFOOD INGREDIENTS GMBH

TABLE 351 HERBAFOOD INGREDIENTS GMBH: BUSINESS OVERVIEW

13.1.14 SCOULAR

TABLE 352 SCOULAR: BUSINESS OVERVIEW

13.1.15 BAOLINGBAO BIOLOGY CO LTD

TABLE 353 BAOLINGBAO BIOLOGY CO LTD: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 R & S BLUMOS

TABLE 354 R & S BLUMOS: BUSINESS OVERVIEW

13.2.2 J. RETTENMAIER & SÖHNE GMBH

TABLE 355 J. RETTENMAIER & SÖHNE GMBH: BUSINESS OVERVIEW

13.2.3 A & B INGREDIENTS

TABLE 356 A&B INGREDIENTS: BUSINESS OVERVIEW

13.2.4 BATORY FOODS

TABLE 357 BATORY FOODS: BUSINESS OVERVIEW

13.2.5 HENAN TAILIJIE BIOTECH CO LTD

TABLE 358 HENAN TAILIJIE BIOTECH CO LTD: BUSINESS OVERVIEW

13.2.6 SENSUS BV

TABLE 359 SENSUS BV: COMPANY OVERVIEW

13.2.7 AGRIFIBER

TABLE 360 AGRIFIBER: COMPANY OVERVIEW

13.2.8 COMET BIO

TABLE 361 COMET BIO: COMPANY OVERVIEW

13.2.9 ADVACARE PHARMA USA

TABLE 362 ADVACARE PHARMA USA: COMPANY OVERVIEW

13.2.10 INTERFIBER

TABLE 363 INTERFIBER: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT MARKET (Page No. - 322)

14.1 NUTRACEUTICAL INGREDIENTS

TABLE 364 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 365 NUTRACEUTICAL INGREDIENTS MARKET, BY REGION, 2020–2025 (USD MILLION)

14.2 DIETARY SUPPLEMENTS

TABLE 366 DIETARY SUPPLEMENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 367 DIETARY SUPPLEMENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 325)

15.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.2 AVAILABLE CUSTOMIZATIONS

15.3 RELATED REPORTS

15.4 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases, such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the dietary fibers market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. The following figure depicts the research design applied in drafting this report on the this market.

Secondary Research

In the secondary research process, various sources such as the Association of Health Food Nutrition and Dietetics (AFND), United States Department of Agriculture (USDA), US Food and Drug Administration (FDA), American Nutrition Association (ANA), and American Society for Nutrition were some of the organizations that were referred to, to identify and collect information for this study. The secondary sources include clinical studies and journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain key information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Extensive primary research was conducted after obtaining information about the dietary fibers market through secondary research. Several primary interviews were conducted with experts from the demand side (dietary fibers product suppliers, key opinion leaders, executives, and government organizations) and supply side (product suppliers, distributors, and exporters) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Middle East and Africa).

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the total size of the dietary fibers market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the key dietary fibers players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the dietary fibers market growth were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for dietary fibers on the basis of source, type, application, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the dietary fibers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European market into Italy, Belgium, the Netherlands, Poland, Portugal, and Ukraine

- Further breakdown of the Rest of Asia Pacific market into Indonesia, Malaysia, South Korea, Thailand, and Vietnam.

- Further breakdown of the Rest of South American market into Chile, Colombia, Paraguay, Uruguay, and Peru.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dietary Fibers Market