Poultry Processing Equipment Market by Type (Chicken, Turkey, Ducks), Equipment Type (Killing & Defeathering, Evisceration, Cut-ups, Deboning & Skinning, Marinating & Tumbling), Product Type, & by Region - Global Forecast to 2020

The global poultry processing equipment market size was valued at USD 2.95 billion in 2015; this is projected to grow at a CAGR of 4.7% from 2018, to reach USD 3.82 billion by 2020. The growth in the market is attributed to increasing consumption of processed food, the governments support for the use of equipment in developing countries, and the demand for food safety, safety of workers, the presence of small and medium enterprises in developing countries, rising raw material costs, and international trade rules. The increased preferences for meat consumption of the people worldwide have led to an increase in demand for processing machineries.

Market dynamics:

Drivers- Growth of fast food and restaurant chains

- Safety regulations generating need for sophisticated equipment

- Poultry processors need to upgrade & purchase new equipment

Restraints

- Increasing raw material and logistics cost

- High capital investment

Opportunities

- New target markets: Asia –pacific and RoW

Growth of fast food and restaurant chains drives the global poultry processing equipment market

Various multinational fast food chains are expanding their operation across the globe. These sectors require pre-processed poultry products in order to serve their customers in time and to maintain strict food-safety and hygiene guidelines. The growth in demand for processed food in bulk quantities forced poultry processing manufacturers to increase their production capacities and reduce their delivery time. The mechanization and automation of processes has become a necessity in order to maintain standard cut-up size and identical fillet size, which are pre-requisite in fast food and restaurant business.

The following are the major objectives of the study.

- Determining and projecting the size of the poultry processing equipment market with respect to poultry type, equipment type, product type and regional presence over a five-year period, ranging from 2015 to 2020

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different sub-segments and regions

- Identifying and profiling key market players in the poultry processing equipment market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by the players across the key regions

- Analyzing the regulatory frameworks across regions and their impact on the prominent market players

- Providing insights on key investments in product innovations and technology

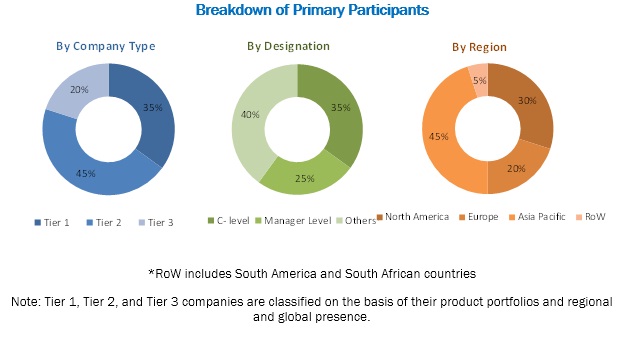

During this research study, major players operating in the poultry processing market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analysed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The poultry processing equipment market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the poultry processing equipment market include Marel HF (Iceland), Key Technology, Inc. (U.S.), John Bean Technologies Corporation (U.S.), CTB Inc. (U.S.), Baader Food Processing Machinery, Inc. (U.S.), Brower Equipment (US), Bayle S.A. (France), Prime Equipment Group, Inc. (US), and CG Manufacturing And Distribution Limited (Canada).

Major Market Developments

- In February 2016, CTB, Inc. acquired Holding Hamon Développement (France), which is a parent company of Serupa SAS and Mafrel SAS, involved in designing and manufacturing of buildings for poultry keeping, processing plants and industry.

- In November, 2015 JBT Corporation signed a co-operation agreement with The Baader Group (U.S.). This agreement will help in creating new fish and poultry processor offerings.

- In November 2015, Bayle S.A. (France) signed an agreement with Novateam (Mexico) in order to set up a complete slaughtering line in Panama, in the city of Capira. The automated equipment required in this facility will be provided by Bayle S.A. (France).

- In January 2016, Marel acquired MPS for a value of EUR 670 million. This acquisition improved Marel’s position as a leading global provider of advanced systems and solutions to the poultry, meat, and fish industries.

- In September, 2016, JBT Corporation acquired A&B Process Systems (U.S.) for a total value of USD 102 million. This acquisition will help JBT Corporation to improve its already comprehensive product portfolio of processing systems for the food and beverage industries.

Target Audience:

- Raw material and manufacturing equipment suppliers

- Suppliers

- Poultry farms

- Agriculture institutes

- R&D institutes

- Technology providers

- Poultry processing equipment manufacturers/suppliers

- Processed poultry manufacturers/suppliers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- Poultry products manufacturers/suppliers

- Retailers

- Research institutes and organizations

- Government bodies, venture capitalists, and private equity firms

Report Scope

By poultry type:

- Chicken

- Turkey

- Duck

- Others

By equipment type:

- Killing & defeathering

- Evisceration

- Cut-up

- Deboning & skinning

- Marinating & tumbling

- Others

By product type:

- Fresh processed

- Raw cooked

- Pre-cooked

- Raw fermented sausages

- Cured

- Dried

- Others

By Region:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Service Matrix which gives a detailed comparison of service provided by each company

Geographic Analysis

- Further breakdown of the Rest of World poultry processing equipment market into Middle-East and Latin America

- Further breakdown of Europe poultry processing equipment market into Russia, Austria, and Rest of Europe

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

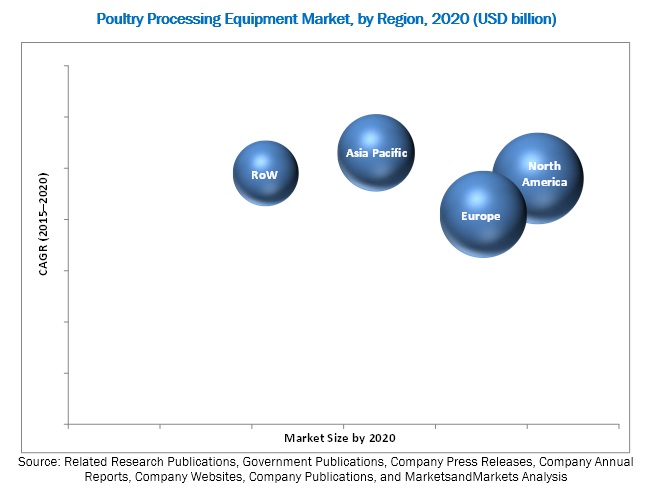

The overall poultry processing equipment market is projected to reach USD 3.82 billion by 2020, from USD 3.03 billion in 2015, at a CAGR of 4.7%. from 2015 to 2020. The market growth is driven by the growing fast food and restaurant chains, various safety regulations which are generating need for sophisticated equipment and rising poultry processors’ need to upgrade and purchase new equipment. In order to keep up with the increasing demand for processed poultry meat, poultry meat processors are required to increase their production capacity as well as their production rate. This will ensure that the processing activities are performed on time, and the processing companies are able to deliver better quality of products to the consumers

The practice of processing poultry has seen significant changes, owing to the developments made in the poultry processing equipment industry. Poultry processing is now carried out with the help of automated equipment that are equipped with latest technologies such as X-ray scanners, high-speed composite alloy cutting blades, and sensors among others. The mechanization of this process has not only influenced and reduced the labor-intensive work, but has also led to positive changes in the safety issues in the processing industries.

The poultry processing equipment market has been segmented on the basis of equipment type into killing & defeathering, evisceration, cut-up, deboning & skinning, marinating & tumbling and others. The Killing & defeathering segment dominated the global market in 2014. Killing & defeathering machine is pre-requisite in every automated poultry processing plant. The cost of this machine is generally expensive, depending upon processing speed and the degree of customization for varying flock size.

The poultry processing equipment market has been segmented on the basis of poultry type into chicken, turkey, duck and others. The chickens segment dominated the market in 2014, and this trend is projected to continue throughout the forecast period, from 2015 to 2020. Chicken is considered as the most common poultry type consumed globally, and looks positive to grow in the forecast period. Roasted and fried chicken are becoming the global favorites among various types of meat consumed. However, the requirement of less feed to produce a pound of chicken than the equal quantity of pork or beef is also a reason for the market to grow.

The poultry processing equipment market has been segmented on the basis of product type into fresh processed, raw cooked, pre-cooked, raw fermented sausages, cured, dried and others. The fresh processed segment dominated the global market in 2014. Fresh-processed poultry meat products are made by mixing various quantities of animal fat with the poultry meat and poultry body parts, which are processed and packed. These products are mainly used as savory and can be cooked easily, this factor makes the product more acceptable for the consumers and thus is expected to accelerate the market growth. However, products included in this category are patties, and kebabs among others.

The poultry processing equipment market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for food poultry processing equipment. The rise in per capita income of people in the region as well as shift of preferences of consumers towards value-added food is expected to accelerate the market growth.

Safety regulations needed for sophisticated equipment drive the growth of the market

Killing & defeathering

Killing & defeathering machine is pre-requisite in every automated poultry processing plant. Scalding is process of immersing the bird in warm water to loosen feathers. Defeathering is performed by mechanical pickers/pluckers equipped with rubber fingers that rub the feathers off the carcass. In continuous operation, this is done while the carcass is hanging upside down and moving forward in between two/three sets of drums or disks covered with rubber fingers.

Cut-up

In cutting process, the wings and legs/thighs are removed from the carcass and the back is cut away from the breast. Bones are not removed at this stage. At this point, parts can be packaged as consumer products, bulk-packed for delivery to other processors, or shipped to other parts of a plant for further processing.

Deboning and skinning

Within-plant processing of cut-up parts generally involves creation of a bone-out product. Various specialty tools are utilized for skinning the cut-ups. Deboning and skinning specialty product list for poultry includes whole leg de-boning, thigh/drumstick deboning, SK 14-430 poultry skinner, townsend no-load blades, and others. The deboning process involves cutting meat away from the bone.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry equipment’s for poultry processing?

Increasing raw material and logistics costs and capital investment are the major restraining factors for the poultry processing equipment market. The raw material required for manufacturing food processing equipment mainly includes steel, composite materials, and plastic, among others. The prices of these raw materials are constantly increasing. Thus, hampering the market growth. However hesitation among manufacturers to invest high capital is also lacking the market to grow.

Key players in the market include Marel HF (Iceland), Key Technology, Inc. (U.S.), John Bean Technologies Corporation (U.S.), CTB Inc. (U.S.), Baader Food Processing Machinery, Inc. (U.S.), Brower Equipment (US), Bayle S.A. (France), Prime Equipment Group, Inc. (US), and CG Manufacturing And Distribution Limited (Canada).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Scope of the Study

1.3.2 Years Considered in the Report

1.4 Currency Considered

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Population Growth

2.2.2.2 Ageing Population Growth

2.2.2.3 Poultry Meat Production (Developing Countries vs Developed Countries)

2.2.3 Supply-Side Analysis

2.2.3.1 Research & Development on Poultry Processing Equipment & Technology By Poultry Processing Equipment Manufacturers

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in this Market

4.2 Poultry Processing Equipment Market Size, By Equipment Type, 2014-2020, (USD Million)

4.3 Market in North America

4.4 Market Size, By Poultry Type, 2014-2020 (USD Million)

4.5 Life Cycle Analysis: Poultry Processing Equipment Market

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Poultry Processing Equipment Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of Fast Food and Restaurant Chains

5.3.1.2 Safety Regulations Generating Need for Sophisticated Equipment

5.3.1.3 Poultry Processors’ Need to Upgrade & Purchase New Equipment

5.3.2 Restraints

5.3.2.1 Increasing Raw Material and Logistic Costs

5.3.2.2 High Capital Investment

5.3.3 Opportunities

5.3.3.1 New Target Markets: Asia-Pacific and RoW

5.3.4 Challenges

5.3.4.1 Infrastructural Challenges in Developing Countries

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Supply Chain

6.3 Value Chain

6.4 Porter’s Five Forces Analysis: Poultry Processing Equipment Market

6.4.1 Intensity of Competitive Rivalry

6.4.2 Bargaining Power of Buyers

6.4.3 Bargaining Power of Suppliers

6.4.4 Threat of Substitutes

6.4.5 Threat of New Entrants

7 Regulatory Framework (Page No. - 49)

7.1 Introduction

7.2 North America

7.3 Europe

7.4 Asia-Pacific

7.5 Rest of the World

8 Poultry Processing Equipment Market, By Equipment Type (Page No. - 52)

8.1 Introduction

8.2 Killing & Defeathering

8.3 Evisceration

8.4 Cut-Up

8.5 Deboning & Skinning

8.6 Marinating & Tumbling

8.7 Other Equipment

9 Poultry Processing Equipment Market, By Poultry Type (Page No. - 60)

9.1 Introduction

9.2 Chicken Meat

9.3 Turkey Meat

9.4 Duck Meat

9.5 Others

10 Poultry Processing Equipment Market, By Product Type (Page No. - 66)

10.1 Introduction

10.2 Fresh Processed

10.3 Raw Cooked

10.4 Pre-Cooked

10.5 Raw Fermented Sausages

10.6 Cured

10.7 Dried

10.8 Others

11 Poultry Processing Equipment Market, By Region (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 Italy

11.3.4 U.K.

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 New Zealand

11.4.5 Thailand

11.4.6 Vietnam

11.4.7 Australia

11.4.8 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 South Africa

11.5.4 Egypt

11.5.5 Others in RoW

12 Competitive Landscape (Page No. - 117)

12.1 Overview

12.2 Competitive Situations & Trends

12.2.1 Agreements, & Contracts

12.2.2 New Product Launches

12.2.3 Mergers & Acquisitions

12.2.4 Joint Ventures & Expansions

13 Company Profiles (Page No. - 125)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Marel HF

13.3 Key Technology, Inc.

13.4 John Bean Technologies Corporation

13.5 CTB, Inc.

13.6 Baader Food Processing Machinery, Inc.

13.7 Brower Equipment

13.8 Bayle S.A.

13.9 Prime Equipment Group, Inc.

13.10 CG Manufacturing and Distribution Limited

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 148)

14.1 Company Developments

14.1.1 Agreements, & Contracts

14.1.2 New Product Launches

14.1.3 Mergers & Acquisitions

14.1.4 Joint Ventures & Expansions

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (89 Tables)

Table 1 Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 2 Killing & Defeathering Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 3 Evisceration Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 4 Cut-Up Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 5 Deboning & Skinning Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 6 Marinating & Tumbling Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 7 Other Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 8 Poultry Processing Equipment Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 9 Chicken Meat Processing Equipment Market Size, By Region, 2013–2020 (USD Billion)

Table 10 Turkey Meat Processing Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 11 Duck Meat Processing Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 12 Other Poultry Meat Processing Equipment Market Size, By Region, 2013–2020 (USD Million)

Table 13 Poultry Processing Equipment Market Size, By Product Type, 2013-2020 (USD Million)

Table 14 Fresh Processed Meat Market Size, By Region, 2013–2020 (USD Million)

Table 15 Raw Cooked Meat Market Size, By Region, 2013–2020 (USD Million)

Table 16 Pre-Cooked Meat Market Size, By Region, 2013–2020 (USD Million)

Table 17 Raw Fermented Sausages Market Size, By Region, 2013–2020 (USD Million)

Table 18 Cured Meat Market Size, By Region, 2013–2020 (USD Million)

Table 19 Dried Meat Market Size, By Region, 2013–2020 (USD Million)

Table 20 Others Market Size, By Region, 2013–2020 (USD Million)

Table 21 Poultry Processing Equipment Market Size, By Region, 2013-2020 (USD Million)

Table 22 North America: Market Size for Poultry Processing Equipment, By Equipment Type, 2013-2020 (USD Million)

Table 23 North America: Market Size For Poultry Processing Equipment, By Poultry Type, 2013-2020 (USD Million)

Table 24 North America: Market Size For Poultry Processing Equipment, By Product Type, 2013-2020 (USD Million)

Table 25 North America: Market Size For Poultry Processing Equipment, By Country, 2013–2020 (USD Million)

Table 26 U.S.: Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 27 U.S.: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 28 Canada: Market Size for Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 29 Canada: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 30 Mexico: Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 31 Mexico: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 32 Europe: Poultry Processing Equipment Market Size, By Type, 2013-2020 (USD Million)

Table 33 Europe: Market Size For Poultry Processing Equipment, By Poultry Type, 2013-2020 (USD Million)

Table 34 Europe: Market Size For Poultry Processing Equipment, By Product Type, 2013-2020 (USD Million)

Table 35 Europe: Market Size For Poultry Processing Equipment, By Country, 2013–2020 (USD Million)

Table 36 Germany: Market Size for Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 37 Germany: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 38 France: Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 39 France: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 40 Italy: Market Size for Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 41 Italy: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 42 U.K.: Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 43 U.K.: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 44 Spain: Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 45 Spain: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 46 Rest of Europe: Market Size for Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 47 Rest of Europe: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 48 Asia-Pacific: Poultry Processing Equipment Market Size, By Equipment Type, 2013-2020 (USD Million)

Table 49 Asia-Pacific: Market Size For Poultry Processing Equipment, By Poultry Type, 2013-2020 (USD Million)

Table 50 Asia-Pacific: Market Size For Poultry Processing Equipment, By Product Type, 2013-2020 (USD Million)

Table 51 Asia-Pacific: Market Size For Poultry Processing Equipment, By Country, 2013–2020 (USD Million)

Table 52 China: Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 53 China: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 54 Japan: Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 55 Japan: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 56 India: Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 57 India: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 58 New Zealand: Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 59 New Zealand: Market Size For Poultry Processing Equipment, By Poultry Type, 2013–2020 (USD Million)

Table 60 Thailand:Market Size For Poultry Processing Equipment, By Equipment Type, 2013–2020 (USD Million)

Table 61 Thailand: Market Size , By Poultry Type, 2013–2020 (USD Million)

Table 62 Vietnam: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 63 Vietnam: Market, By Poultry Type, 2013–2020 (USD Million)

Table 64 Australia: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 65 Australia: Market, By Poultry Type, 2013–2020 (USD Million)

Table 66 Rest of Asia-Pacific: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 67 Rest of Asia-Pacific: Market, By Poultry Type, 2013–2020 (USD Million)

Table 68 RoW: Poultry Processing Equipment Market Size, By Equipment Type, 2013-2020 (USD Million)

Table 69 RoW: Market Size, By Poultry Type, 2013-2020 (USD Million)

Table 70 RoW: Market Size, By Product Type, 2013-2020 (USD Million)

Table 71 RoW: Market Size, By Country, 2013–2020 (USD Million)

Table 72 Brazil: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 73 Brazil: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 74 Argentina: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 75 Argentina: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 76 South Africa: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 77 South Africa: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 78 Egypt: Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 79 Egypt: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 80 Others in RoW: Poultry Processing Equipment Market Size, By Equipment Type, 2013–2020 (USD Million)

Table 81 Others in RoW: Market Size, By Poultry Type, 2013–2020 (USD Million)

Table 82 Agreements & Contracts, 2011–2014

Table 83 New Product Launches, 2011–2016

Table 84 Mergers & Acquisitions, 2011–2016

Table 85 Joint Ventures & Expansions, 2011–2015

Table 86 Agreements & Contracts, 2011–2014

Table 87 New Product Launches, 2011–2016

Table 88 Mergers & Acquisitions, 2011–2016

Table 89 Joint Ventures & Expansions, 2011–2015

List of Figures (42 Figures)

Figure 1 Poultry Processing Equipment Market: Research Design

Figure 2 Growing Population to Contribute to Double-Digit Growth of Food Demand By 2030

Figure 3 Aging Population in the World Demand Poultry Foods

Figure 4 Poultry Meat Production (Developing Countries vs Developed Countries)

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market Size for Poultry Processing Equipment, By Equipment Type, 2015 vs 2020 (USD Million)

Figure 9 Chicken Meat is Projected to Be the Best Market for Investments During the Forecast Period

Figure 10 Fresh Processed Meat Segment Accounted for the Largest Share in 2014

Figure 11 Asia-Pacific Projected to Register High Growth Rate During the Forecast Period

Figure 12 Poultry Processing Equipment Market is Expected to Witness A High Adoption Rate

Figure 13 Killing & Defeathering Equipment is Projected to Be the Fastest-Growing Equipment Type During the Forecast Period

Figure 14 Chicken Meat to Capture Largest Share in the North American Market for Poultry Processing Equipment in 2015

Figure 15 Chicken to Dominate the Global Market Through 2020

Figure 16 Market for Poultry Processing Equipment in Asia-Pacific Region is Experiencing High Growth

Figure 17 Poultry Processing Equipment Market Dynamics

Figure 18 Supply Chain for the Poultry Processing Market

Figure 19 Value Chain Analysis for Poultry Processing Market

Figure 20 Porter’s Five Forces Analysis – Poultry Processing Equipment Market

Figure 21 Killing & Defeathering Segment to Exhibit the Fastest Growth Among Poultry Processing Equipments During the Forecast Period

Figure 22 North America is Projected to Dominate the Killing & Defeathering Segment Through 2020

Figure 23 Chicken Meat Segment to Exhibit Highest Growth Among Those Using Poultry Meat Processing Equipment During the Forecast Period

Figure 24 North America is Projected to Dominate the Chicken Meat Processing Equipment Market During the Forecast Period

Figure 25 Poultry Processing Equipment Market Size, By Product Type, 2015 vs 2020 (USD Million)

Figure 26 Fresh Processed Meat Market Size, By Region, 2015 vs 2020 (USD Billion)

Figure 27 Market For Poultry Processing Equipment, Geographic Snapshot (2015-2020)

Figure 28 North America: Market Snapshot

Figure 29 Asia-Pacific: Market Snapshot

Figure 30 Key Companies Preferred New Product Launches From 2011 to 2016

Figure 31 New Product Developments Have Led to Growth & Innovation (2011–2016)

Figure 32 New Product Development: the Key Strategy, 2011–2016

Figure 33 Annual Developments in the Market for Poultry Processing Equipment, 2011–2016

Figure 34 Geographical Revenue Mix of Top Five Players

Figure 35 Marel HF: Company Snapshot

Figure 36 Marel HF: SWOT Analysis

Figure 37 Key Technology, Inc.: Company Snapshot

Figure 38 Key Technology, Inc.: SWOT Analysis

Figure 39 John Bean Technologies Corporation: Company Snapshot

Figure 40 John Bean Technologies Corporation: SWOT Analysis

Figure 41 CTB, Inc.: SWOT Analysis

Figure 42 Baader Food Processing Machinery: SWOT Analysis

Growth opportunities and latent adjacency in Poultry Processing Equipment Market