Chatbot Market by Offering, Bot Communication (Text, Audio, & Video), Type, Business Function (Sales & Marketing, Contact Centers), Channel Integration, Vertical (Retail & eCommerce, Healthcare & Life Sciences) and Region - Global Forecast to 2028

Chatbot Market Summary

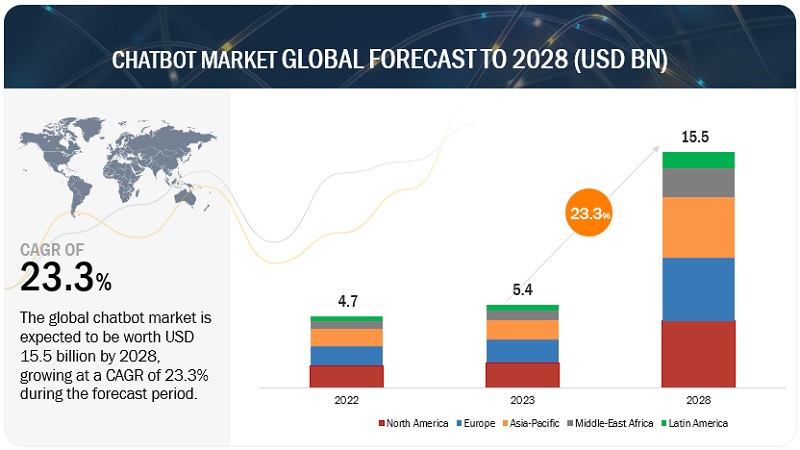

The global chatbot market size was estimated at USD 5.4 billion in 2023 and is projected to reach USD 15.5 billion by 2028, growing at a CAGR of 23.3% from 2023 to 2028. The rising advent of generative models in chatbots to gain an advantage in the coming years as generative models can improve chatbots’ natural language processing (NLP) capabilities, enabling them to understand better and respond to human language. Moreover, Generative models, specifically neural network-based language models like GPT-4 can help chatbots to better understand the preferences and behaviors of individual users, enabling them to provide more personalized recommendations and support.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Chatbot Market Dynamics

Driver: Rising usage of generative models in chatbots

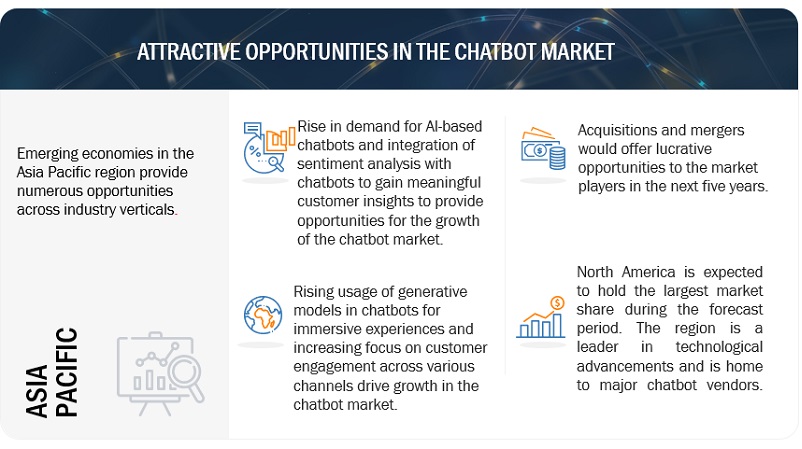

AI has witnessed significant advancements currently remarkably around generative AI and LLMs. These models, powered by deep learning techniques, are designed to generate new content based on patterns found in large datasets. For instance, ChatGPT, OpenAI’s chatbot based on GPT-3.5 large language model has amazed users with its ability to generate human-like text that understands every context. But beyond text-to-text, generative AI also includes text-to-image, text-to-video, text-to-3D, text-to-music, and others. Generative AI can transform businesses by allowing companies to create innovative ideas for products, services, and solutions more quickly and efficiently than ever before. Generative AI can authorize enterprises with the data-driven information essential for intelligent decision-making, truncated costs associated with development or marketing product cycles, and quickly identify alternative solutions to complex problems. With generative AI and its predictive capabilities in chatbots, businesses can harness the power of algorithms to make decisions faster and more accurately than before. By leveraging generative AI, companies can explore new possibilities and experiment with different ideas in a fraction of the time.

Restraint: Inability to recognize customer intent and respond effectively

Chatbot solution providers in the market are working toward developing a chatbot to meet user requirements. Software tools, such as APIs, are specifically developed to perform the generic use of chatbot solutions without integrating any specific functionality that fails to meet the specific user requirement and achieve the exact purpose of building a chatbot. Chatbots fed with specific data can assist customers only if posed with questions they are programmed to answer. Hence, if a customer poses a question that the chatbot has no information about, it will fail to understand the customer’s intent and demonstrate an inability to solve the posed query. The inability to recognize customer intent would be a restraining factor for market growth.

Opportunity: Initiatives toward development of self-learning chatbots to deliver human-like conversational experience

Chatbots can revise to changing conditions in the environment and learn from their actions, experiences, and decisions. These chatbots can analyze data in minimal time and help customers find the exact information they are looking for conveniently by offering support in multiple languages. Self-learning bots, with data-driven behavior, are powered by NLP technology and self-learning capability (supervised ML) and can enable the delivery of more human-like and natural communication. They can also learn from their mistakes. Various plans are being undertaken for the development of self-learning chatbots. Self-learning chatbots can provide more personalized and relevant responses to users, improving the overall customer experience. As the chatbot continues to learn from user interactions, it can provide more accurate and contextually relevant information, leading to higher customer satisfaction.

Challenge: Complex and time-consuming setup and maintenance

A chatbot can be tricky to install, and set up may require high costs. It will need about two weeks to set up a chatbot in any system and learn all its functionalities. Chatbots also need frequent optimization and maintenance to work properly. Whenever there is a change in anything at the company, users must reflect that change in their bot’s answers to clients. Users should also frequently look through the chats to see what improvements they should implement to their bot. Setting up and maintaining chatbot solutions often requires technical expertise, including knowledge of programming languages, natural language processing (NLP), and machine learning (ML). This can be a barrier for businesses without in-house technical resources or budget to hire outside experts. In some industries, such as healthcare and finance, chatbots must comply with strict regulatory requirements. This can add additional complexity and cost to the set up and maintenance of chatbot solutions.

By bot communication, Audio/Voice to register at the highest CAGR during the forecast period

By bot communication, the chatbot market is segmented into text ,audio /voice and video. Audio /voice segment to register at the highest CAGR during the forecast period. Audio/voice bot, also known as a voice assistant or voicebot, is a computer program designed to simulate a conversation with human users through spoken language instead of text. Audio/voice bots use speech recognition and NLP techniques to understand user input and provide appropriate responses conversationally. These bots can be accessed through voice-enabled devices, such as smart speakers or virtual assistants on smartphones. Audio/voice bots can perform various tasks, from playing music and setting reminders to providing weather forecasts and answering questions. They can be useful for individuals who prefer hands-free and eyes-free interaction with technology, as well as for businesses looking to improve their customer service or sales through voice-based interactions.

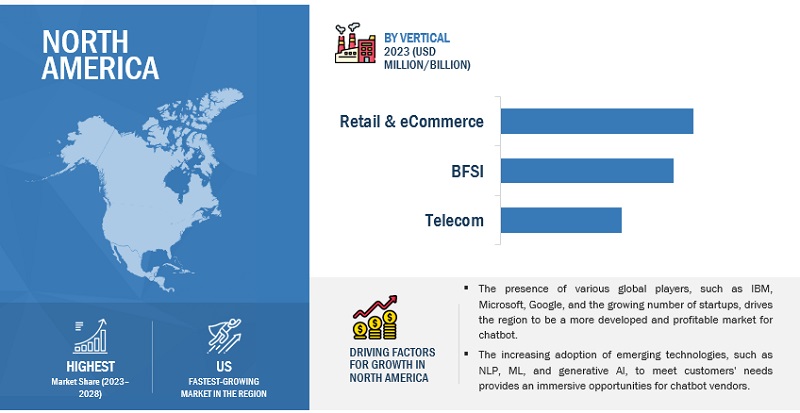

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the insight engine market. The major countries covered in North America are the US and Canada. The North American region, the primary adopter of AI technology, is the major revenue-generating region in the global chatbot market. North America secures the major share of the global chatbot market owing to the highest adoption of emerging technologies, such as natural language processing, voice recognition techniques, and chatbots. These factors are also responsible for adopting chatbot solutions across the region. Moreover, various industry verticals, such as IT and ITeS, telecom, healthcare, media and entertainment, retail, and BFSI, are adopting chatbot tools to resolve customers’ queries quickly.

Key Market Players

The chatbot market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Key players operating in the chatbot market include Google (US), Microsoft (US), IBM (US), AWS (US), Baidu (China), Oracle (US), SAP (Germany), OpenAI (US), Salesforce (US), Meta (US), Artificial Solutions (Sweden), ServiceNow (US), [24]7.ai (US), Kore.ai (US), Conversica (US), Inbenta (US), Creative Virtual (US), Avaamo (US), Haptik (India), Solvvy (US), Gupshup (US), Aivo (US), Personetics (US), LivePerson (US), Freshworks (India), Engati (US), Botsify (Pakistan), Yellow.ai (US), Drift (US), Intercom (US), Chatfuel (US), Landbot (Spain), Pandorabots (US), Customers.ai (US), Rasa (Germany), and BotsCrew (UK).

Scope of the Report

|

Report Metrics |

Details |

|

Market value in 2028 |

USD 15.5 Billion |

|

Market value in 2023 |

USD 5.4 Billion |

|

Market Growth Rate |

23.3% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Chatbot Market Drivers |

|

|

Chatbot Market Opportunities |

|

|

Segments covered |

By Offering, type, business function, bot communication, channel integration, vertical, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

|

Companies covered |

Google (US), Microsoft (US), IBM (US), AWS (US), Baidu (China), Oracle (US), SAP (Germany), OpenAI (US), Salesforce (US), Meta (US), Artificial Solutions (Sweden), ServiceNow (US), [24]7.ai (US), Kore.ai (US), Conversica (US) And many more |

This research report categorizes the chatbot market based on offering, type, business function, bot communication, channel integration, vertical, and region

By Offering:

-

Solutions

- Standalone

- Web-based

- Messaging-based

- Other Solutions (Live chat and Videobots)

-

Services

- Managed Services

- Professional Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

By Type:

- Menu-based

- Linguistic-based

- Keyword Recognition-based

- Contextual

- Hybrid

- Voicebots

By Bot Communication:

- Text

- Audio/Voice

- Video

By Channel Integration:

- Email and Website

- Mobile Apps

- Messaging Apps

- Telephone/ IVR

By Business Function:

- Information Technology Service Management (ITSM)

- Sales and Marketing

- Contact Centers

- Finance and Accounting

- HR

- Operations and Supply Chain

By Vertical:

- Retail and eCommerce

- Telecom

- BFSI

- Healthcare and Life Sciences

- Media and Entertainment

- Travel and Hospitality

- IT and ITES

- Energy and Utilities

- Government and Defense

- Other Verticals (Manufacturing, construction & real estate, Automotive, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Egypt

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In March 2023, Baidu announced that it would finish internal testing of a ChatGPT-style project called “ERNIE Bot” in March. ERNIE, short for “Enhanced Representation through Knowledge Integration,” is a sizable language model powered by AI.

- In March 2023, OpenAI introduced GPT-4 to scale up deep learning. GPT-4 is a sizable multimodal model that accepts image and text inputs and emits text outputs. GPT-4 performs at a human-level on academic and professional benchmarks despite being less capable than humans in many real-world scenarios.

- In February 2022, Google launched a new Chatbot service for testers named Bard. The company is firstly making it available using LaMDA’s lightweight variant.

- In February 2023, OpenAI introduced a chatbot called ChatGPT that can communicate with anyone, respond to follow-up inquiries, and correct tenuous assumptions.

- In January 2023, Microsoft launch of Azure OpenAI Service. It includes cutting-edge AI models such as GPT-3.5, Codex, and DALL•E 2. The companies to build cutting-edge applications owing to the infrastructure and enterprise-grade capabilities of Microsoft Azure.

Frequently Asked Questions (FAQ):

What is Chatbot?

According to IBM, a chatbot is a computer program that uses artificial intelligence (AI) and natural language processing (NLP) to understand customer questions and automate responses, simulating human conversation.

Which countries are considered in the European region?

The countries such as the UK, Germany, France, Spain, and Italy are the major economies in the region that leverage charbot solutions for better customer experience and reduce operational costs.

Which vertical is expected to witness a higher market share in the chatbot market?

Retail and eCommerce is the leading sector that leverages chatbot solutions for 24/7 customer support, answering product inquiries, and personalized product recommendations to customers.

Which are key verticals adopting Chatbot solutions and services?

Some of the key verticals like retail and eCommerce, healthcare and life sciences, BFSI, Telecom deploy chatbot solutions for better customer service, reduce oprational costs, and increasing efficiency.

Who are the key vendors in the Chatbot market?

IBM (US), Microsoft (US), Google (US), Meta (US), and AWS (US) are the top 5 vendors that offer chatbot solutions to enterprises to improve customer service, increase efficiency, and reduce costs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 BRIEF HISTORY OF CHATBOT

- 5.3 CHATBOT MARKET: ARCHITECTURE

-

5.4 CHATBOT MARKET DYNAMICSDRIVERS- Advancements in technology coupled with rising customer demand for self-service operations- Growth in need for 24×7 customer support at lower operational costs- Increase in focus on customer engagement through various channels- Rising usage of generative models in chatbotsRESTRAINTS- Inability to recognize customer intent and respond effectively- Accuracy concerns associated with voice authenticationOPPORTUNITIES- Initiatives toward development of self-learning chatbots to deliver human-like conversational experience- Rise in demand for AI-based chatbots to deliver enhanced customer experience- Integration of sentiment analysis with chatbots for meaningful customer insightsCHALLENGES- Lack of awareness about effect of chatbot technology on various applications- Complex and time-consuming setup and maintenance

-

5.5 CASE STUDY ANALYSISBFSI- Case Study 1: BankBazaar implemented Haptik’s chatbot to increase customer engagement and enhance customer reach- Case Study 2: Zurich Insurance Group worked with Spixii to develop Zara chatbot for quick notifications- Case Study 3: SIX Payment Services Ltd. partnered with Enterprise Bot to enhance customer service- Case Study 4: SEB Retail Bank enhances efficiency of internal and external support processes through IPsoft’s Amelia chatbotRETAIL AND ECOMMERCE- Case Study 1: Kore.ai retail virtual assistants to process orders across digital channels- Case Study 2: Haptik helps JioMart with end-to-end shopping experience on WhatsApp- Case Study 3: Snaps offers personalized engagement model to Nike for increasing customer engagement via mobile channelHEALTHCARE AND LIFE SCIENCES- Case Study 1: Tia selected RASA to incorporate HIPAA-compliant NLU and improve efficiency- Case Study 2: Kore.ai healthcare chatbots can automate routine tasks- Case Study 3: Netmeds partnered with Haptik to build chatbot capable of handling core challengesTRANSPORTATION AND LOGISTICS- Case Study 1: Amtrak developed chatbot to help customers- Case Study 2: Ubisend offers Vanarama, a leasing chatbot solution, to enable customers to browse and handle customer queriesTRAVEL AND HOSPITALITY- Case Study 1: Indigo boosts customer satisfaction to 87% with Yellow.ai- Case Study 2: OYO integrated Haptik’s Live Chat Agent tool to provide customer support and handle queries over WhatsAppTELECOM- Case Study 1: Elisa Estonia deployed MindTitan’s chatbot to analyze incoming chats and improve customer experienceMANUFACTURING- Case Study 1: L’Oréal partnered with Automat to develop messaging chatbot to increase customer engagement and enhance productivityENERGY AND UTILITIES- Case Study 1: ENN transitions to automated AI with IBM Watson AssistantGOVERNMENT- Case Study 1: The State of New Jersey and IBM Consulting helps citizens efficiently with IBM virtual agents

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.8 PRICING ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 KEY BENEFITS OF CHATBOT DEPLOYMENT ACROSS BUSINESSESSCALING OPERATIONSENHANCED CX AND EXSIGNIFICANT COST REDUCTIONLEAD GENERATIONPERSONALIZED RECOMMENDATIONS

- 5.12 CHATBOT ROADMAP UNTIL 2030

-

5.13 CHATBOT TOOLS AND FRAMEWORKDIALOGFLOW BY GOOGLEAMAZON LEXIBM WATSON ASSISTANTMICROSOFT BOT FRAMEWORKRASABOTPRESS

-

5.14 ECOSYSTEM ANALYSISCHATBOT CLOUD PLATFORM PROVIDERSCHATBOT API AND FRAMEWORK PROVIDERSCHATBOT BUILDING PLATFORM PROVIDERSCHATBOT END USERSCHATBOT REGULATORS

- 5.15 CURRENT AND EMERGING BUSINESS MODELS USED FOR CHATBOT DEVELOPMENT

-

5.16 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF CHATBOT MARKET

-

5.17 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.18 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.19 TECHNOLOGY ANALYSISMACHINE LEARNING AND CHATBOTDEEP LEARNING AND CHATBOTNATURAL LANGUAGE PROCESSING AND CHATBOTAUTOMATED SPEECH RECOGNITION AND CHATBOT

-

6.1 INTRODUCTIONOFFERINGS: CHATBOT MARKET DRIVERS

-

6.2 SOLUTIONSSTANDALONE- Provides cost-effective, flexible, and scalable chatbot solutionsWEB-BASED- Rapid growth in chatbots to drive business value and enhance customer experienceMESSAGING-BASED- Rising popularity of messaging apps to drive marketOTHER SOLUTIONS

-

6.3 SERVICESMANAGED SERVICESPROFESSIONAL SERVICES- Training and consulting- System integration and implementation- Support and maintenance

-

7.1 INTRODUCTIONTYPES: CHATBOT MARKET DRIVERS

-

7.2 MENU-BASEDSTREAMLINES CONVERSATION AND PROVIDES EFFICIENT USER EXPERIENCE

-

7.3 LINGUISTIC-BASEDADVANCES IN NLP TECHNOLOGY FOR CHATBOTS TO HELP ACCURATELY INTERPRET NATURAL LANGUAGE

-

7.4 KEYWORD RECOGNITION-BASEDPERSONALIZED RESPONSES BASED ON USER DATA TO HELP IMPROVE CUSTOMER SATISFACTION AND LOYALTY

-

7.5 CONTEXTUALPROVIDES PERSONALIZED EXPERIENCES TO CUSTOMERS BY UNDERSTANDING PREFERENCES

-

7.6 HYBRIDPROVIDES ADVANCED AND PERSONALIZED CHATBOT EXPERIENCES

-

7.7 VOICEBOTSINCREASING USAGE OF VOICE ASSISTANTS TO BOOST MARKET

-

8.1 INTRODUCTIONCHANNEL INTEGRATION: CHATBOT MARKET DRIVERS

-

8.2 EMAIL AND WEBSITEGROWING NEED TO PROVIDE PRODUCT RECOMMENDATIONS TO WEBSITE VISITORS

-

8.3 MOBILE APPSRISING NEED FOR PERSONALIZED RECOMMENDATIONS AND RESPONSES BASED ON USER BEHAVIOR AND PREFERENCES

-

8.4 TELEPHONE/IVRFACILITATES CONVERSATIONS BETWEEN CUSTOMERS AND BUSINESSES

-

8.5 MESSAGING APPSPROLIFERATION OF SMARTPHONES OFFERS OPPORTUNITIES FOR CHATBOT SOLUTION DEPLOYMENTSOCIAL MESSENGERENTERPRISE MESSENGER

-

9.1 INTRODUCTIONBOT COMMUNICATION: CHATBOT MARKET DRIVERS

-

9.2 TEXTHANDLES MULTIPLE CUSTOMER INTERACTIONS WITH REDUCED WAITING TIME

-

9.3 AUDIO/VOICEGROWING NEED FOR MORE PERSONALIZED INTERFACE AND BETTER MARKETING STRATEGIES TO BOOST MARKET

-

9.4 VIDEORISE OF REMOTE WORK AND VIRTUAL EVENTS TO PROPEL ADOPTION OF VIDEO CHATBOTS AMONG ENTERPRISES

-

10.1 INTRODUCTIONBUSINESS FUNCTIONS: CHATBOT MARKET DRIVERS

-

10.2 HUMAN RESOURCESHR APPLICATIONSRECRUITMENT- Provides effective onboarding process with real-time feedback analysisONBOARDING- Collects information from applicants and suggests long-term improvementsSURVEY- Provides efficient customer supportQUESTION ANSWERING- NLP enables chatbots to respond to users with human-like conversationsOTHER HR APPLICATIONS

-

10.3 SALES AND MARKETINGSALES AND MARKETING APPLICATIONSCUSTOMER ENGAGEMENT AND RETENTION- Provides instant, personalized, and convenient serviceBRANDING AND ADVERTISING- Provides personalized experiences and targeted messaging to potential customersCAMPAIGN MANAGEMENT- Improves user experience and helps create personalized interactionPERSONALIZED RECOMMENDATION- Collects and analyzes user data in real timeOTHER SALES AND MARKETING APPLICATIONS

-

10.4 FINANCE AND ACCOUNTINGFINANCE AND ACCOUNTING APPLICATIONSCUSTOMER SUPPORT- Provides cost-effective, flexible, and scalable chatbot systemsPROCUREMENT MANAGEMENT- Reduces costs associated with manual labor and increases efficiencyEXPENSE TRACKING AND REPORTING- Provides comprehensive view of financial performanceDATA PRIVACY AND COMPLIANCE- Ensures chatbots to be secure, trustworthy, and compliant with legal requirementsOTHER FINANCE AND ACCOUNTING APPLICATIONS

-

10.5 INFORMATION TECHNOLOGY SERVICE MANAGEMENTITSM APPLICATIONSINCIDENT MANAGEMENT- Provides regular updates on status and estimated resolution timeCOST OPTIMIZATION- Eliminates redundancy and reduces software licensing costsQUERY HANDLING- Provides better customer insightsKNOWLEDGE MANAGEMENT- Provides personalized responses to users based on history and preferencesOTHER ITSM APPLICATIONS

-

10.6 OPERATIONS AND SUPPLY CHAINOPERATIONS AND SUPPLY CHAIN APPLICATIONSWORKFLOW OPTIMIZATION- Offers effective business operations processSCHEDULING AND ROUTING- Rapid growth in chatbots drives business value and enhances efficiency and customer experienceINVENTORY MANAGEMENT- Improves efficiency and accuracy of ordersVENDOR ENGAGEMENT- Improves efficiency, reduces costs, and streamlines supply chainOTHER OPERATIONS AND SUPPLY CHAIN APPLICATIONS

-

10.7 CONTACT CENTERSCONTACT CENTERS APPLICATIONSAGENT PERFORMANCE MANAGEMENT- Improves agent performance and customer satisfactionAGENT WORKFORCE MANAGEMENT- Need to schedule training and assist firms to manage workforceQUESTION ANSWERING- Improves efficiency by providing fast and accurate answersCUSTOMER SUPPORT AND FEEDBACK- Enhances customer support services and builds stronger customer relationshipsOTHER CONTACT CENTER APPLICATIONS

-

11.1 INTRODUCTIONVERTICALS: CHATBOT MARKET DRIVERS

-

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCECHATBOT SOLUTIONS TO HELP REDUCE FRAUD, LEVERAGE INTELLIGENT, CUSTOMER-FOCUSED MARKETINGBANKING, FINANCIAL SERVICES, AND INSURANCE: CHATBOT USE CASES

-

11.3 ENERGY AND UTILITIESIMPROVES CUSTOMER SERVICE, INCREASES EFFICIENCY, AND REDUCES COSTSENERGY AND UTILITIES: CHATBOT USE CASES

-

11.4 RETAIL AND ECOMMERCECHATBOTS HELP IN RETAINING CUSTOMERS, COLLECTING FEEDBACK, AND DRIVING SALESRETAIL AND ECOMMERCE: CHATBOT USE CASES

-

11.5 IT AND ITESPROVIDES MORE PERSONALIZED AND RELEVANT EXPERIENCE FOR CUSTOMERS BY UNDERSTANDING PREFERENCESIT AND ITES: CHATBOT USE CASES

-

11.6 TRAVEL AND HOSPITALITYGROWING NEED TO PROVIDE ADVANCED AND PERSONALIZED CHATBOT EXPERIENCESTRAVEL AND HOSPITALITY: CHATBOT USE CASES

-

11.7 HEALTHCARE AND LIFE SCIENCESINCREASING NEED TO IMPROVE ACCURACY OF SYMPTOM COLLECTION AND AILMENT IDENTIFICATIONHEALTHCARE AND LIFE SCIENCES: CHATBOT USE CASES

-

11.8 MEDIA AND ENTERTAINMENTNEED TO IMPROVE AUDIENCE ENGAGEMENT WITH PERSONALIZED USER EXPERIENCEMEDIA AND ENTERTAINMENT: CHATBOT USE CASES

-

11.9 GOVERNMENT AND DEFENSEGOVERNMENT AGENCIES AND DEFENSE ORGANIZATIONS TO IMPROVE CUSTOMER SERVICEGOVERNMENT AND DEFENSE: CHATBOT USE CASES

-

11.10 TELECOMPROVIDES FAST AND EFFICIENT CUSTOMER SERVICESTELECOM: CHATBOT USE CASES

-

11.11 OTHER VERTICALSOTHER VERTICALS: CHATBOT USE CASES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: CHATBOT MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Growing application of chatbot across verticals to drive marketCANADA- Rising adoption of cutting-edge technologies to enhance customer services and fuel market growth

-

12.3 EUROPEEUROPE: CHATBOT MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Growing adoption of chatbots in eCommerce and rising number of startups to fuel market growthGERMANY- Growing adoption of cutting-edge digital technologies enables to adopt chatbot solutions in various verticalsFRANCE- Rising investments to adopt cutting-edge technologies and initiatives to support startupsITALY- Chatbot solutions fulfill customer requests in personalized waySPAIN- Rapid adoption of emerging technologies to enhance customer experienceREST OF EUROPE- Initiatives taken by government and rising application of chatbots across verticals to drive market

-

12.4 ASIA PACIFICASIA PACIFIC: CHATBOT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Growing chatbot solutions in various verticals to drive marketINDIA- Adoption of AI technology to drive marketJAPAN- Advancements in technologies and need to prevent data breaches to drive marketANZ- Rising need to reduce overall operational costs to drive marketSOUTH KOREA- Adoption of AI and related technologies to help create favorable environment for market growthASEAN- Growing data generation to boost demandREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: CHATBOT MARKET DRIVERSMIDDLE EAST AND AFRICA: RECESSION IMPACTUNITED ARAB EMIRATES- Chatbot solutions to offer customer support servicesSAUDI ARABIA- Chatbot solutions to improve operational efficiencySOUTH AFRICA- Emphasis on improving customer experience to drive demand for chatbotISRAEL- Rising need to reduce overall operational costs to drive marketEGYPT- Rapid evolution of digital products and services to grow marketREST OF MIDDLE EAST AND AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: CHATBOT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Focuses on technologies and applications to grow marketMEXICO- Demand for AI-based technologies to drive growthARGENTINA- Rising chatbot startups for better customer experience to spur market growthREST OF LATIN AMERICA

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

-

13.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

-

13.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

13.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES COMPETITIVE BENCHMARKING

-

13.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

13.8 CHATBOT MARKET PRODUCT LANDSCAPEIBM WATSON ASSISTANTAMAZON LEXGOOGLE DIALOGFLOWBLENDERBOT 3OPENAI GPT-4MICROSOFT BOT FRAMEWORK

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSMICROSOFT- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MNM viewGOOGLE- Business overview- Products offered- Recent developments- MNM viewAWS- Business overview- Products offered- Recent developments- MnM viewBAIDU- Business overview- Products offered- Recent developments- MnM viewOPENAI- Business overview- Products offered- Recent developmentsSALESFORCE- Business overview- Products offered- Recent developmentsMETA- Business overview- Products offered- Recent developmentsARTIFICIAL SOLUTIONS- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsSAP- Business overview- Products offered- Recent developmentsSERVICENOW- Business overview- Products offered- Recent developments

-

14.3 OTHER KEY PLAYERSAVAAMOCONVERSICAHAPTIKINBENTACREATIVE VIRTUALKORE.AI[24]7.AIAIVOPERSONETICSLIVEPERSONGUPSHUPFRESHWORKSSOLVVYPANDORABOTSINTERCOM

-

14.4 STARTUP/SME PLAYERSENGATIBOTSIFYYELLOW.AIDRIFTCHATFUELLANDBOT.IOCUSTOMERS.AIBOTSCREWRASA

- 15.1 INTRODUCTION

-

15.2 NLP MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- NLP market, by component- NLP market, by type- NLP market, by deployment mode- NLP market, by organization size- NLP market, by application- NLP market, by technology- NLP market, by vertical- NLP market, by region

-

15.3 SPEECH ANALYTICS MARKET - GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEWSPEECH ANALYTICS MARKET, BY COMPONENTSPEECH ANALYTICS MARKET, BY BUSINESS FUNCTIONSPEECH ANALYTICS MARKET, BY ORGANIZATION SIZESPEECH ANALYTICS MARKET, BY DEPLOYMENT MODESPEECH ANALYTICS MARKET, BY APPLICATIONSPEECH ANALYTICS MARKET, BY VERTICALSPEECH ANALYTICS MARKET, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 PRIMARY INTERVIEWS

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 IMPACT OF RECESSION ON GLOBAL CHATBOT MARKET

- TABLE 4 GLOBAL MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 6 PATENTS FILED, 2020–2023

- TABLE 7 CHATBOT MARKET: PRICING MODEL ANALYSIS, 2023

- TABLE 8 DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 CHATBOT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 17 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 19 CHATBOT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 STANDALONE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 STANDALONE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 WEB-BASED: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 WEB-BASED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MESSAGING-BASED: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 MESSAGING-BASED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 OTHER SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 29 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 MANAGED SERVICES: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: CHATBOT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 TRAINING AND CONSULTING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 TRAINING AND CONSULTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SUPPORT AND MAINTENANCE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 SUPPORT AND MAINTENANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CHATBOT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 41 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 MENU-BASED: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 MENU-BASED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 LINGUISTIC-BASED: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 LINGUISTIC-BASED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 KEYWORD RECOGNITION-BASED: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 KEYWORD RECOGNITION-BASED: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 CONTEXTUAL: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 CONTEXTUAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 HYBRID: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 HYBRID: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 VOICEBOTS: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 VOICEBOTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 55 MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 56 EMAIL AND WEBSITE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 EMAIL AND WEBSITE: CHATBOT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 MOBILE APPS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 MOBILE APPS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 TELEPHONE/IVR: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 TELEPHONE/IVR: CHATBOT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 63 MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 64 MESSAGING APPS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 MESSAGING APPS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 SOCIAL MESSENGER: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 SOCIAL MESSENGER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 ENTERPRISE MESSENGER: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 ENTERPRISE MESSENGER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 71 CHATBOT MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 72 TEXT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 TEXT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 AUDIO/VOICE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 AUDIO/VOICE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 VIDEO: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 VIDEO: CHATBOT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 CHATBOT MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 79 MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 80 HUMAN RESOURCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 81 HUMAN RESOURCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 MARKET FOR HR, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 83 MARKET FOR HR, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 SALES AND MARKETING: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 85 SALES AND MARKETING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 MARKET FOR SALES AND MARKETING, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 87 CHATBOT MARKET FOR SALES AND MARKETING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 FINANCE AND ACCOUNTING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 89 FINANCE AND ACCOUNTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 MARKET FOR FINANCE AND ACCOUNTING, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 91 MARKET FOR FINANCE AND ACCOUNTING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 ITSM: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 93 ITSM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 MARKET FOR ITSM, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 95 MARKET FOR ITSM, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 OPERATIONS AND SUPPLY CHAIN: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 97 OPERATIONS AND SUPPLY CHAIN: CHATBOT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 MARKET FOR OPERATIONS AND SUPPLY CHAIN, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 99 MARKET FOR OPERATIONS AND SUPPLY CHAIN, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 CONTACT CENTERS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 101 CONTACT CENTERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 MARKET FOR CONTACT CENTERS, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 103 MARKET FOR CONTACT CENTERS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 105 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 BFSI: CHATBOT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 107 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 ENERGY AND UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 109 ENERGY AND UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 111 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 IT AND ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 113 IT AND ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 115 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 117 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 119 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 121 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 122 TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 123 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 125 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 127 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: CHATBOT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: CHATBOT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: CHATBOT MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: CHATBOT MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 150 EUROPE: CHATBOT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 151 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 152 EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 153 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 155 EUROPE: MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: CHATBOT MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 157 EUROPE: MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 159 EUROPE: CHATBOT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 161 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 163 EUROPE: MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 165 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 167 EUROPE: MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 168 EUROPE: CHATBOT MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 169 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 171 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CHATBOT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: CHATBOT MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: CHATBOT MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 195 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 196 MIDDLE EAST AND AFRICA: CHATBOT MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 197 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 198 MIDDLE EAST AND AFRICA: MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 199 MIDDLE EAST AND AFRICA: MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 200 MIDDLE EAST AND AFRICA: MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 201 MIDDLE EAST AND AFRICA: MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 203 MIDDLE EAST AND AFRICA: CHATBOT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST AND AFRICA: MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 208 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 209 MIDDLE EAST AND AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 MIDDLE EAST AND AFRICA: MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 211 MIDDLE EAST AND AFRICA: MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 215 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: CHATBOT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: MARKET, BY CHANNEL INTEGRATION, 2017–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: MARKET, BY CHANNEL INTEGRATION, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: MARKET, BY MESSAGING APP, 2017–2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: MARKET, BY MESSAGING APP, 2023–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 228 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 229 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2023–2028 (USD MILLION)

- TABLE 230 LATIN AMERICA: CHATBOT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 231 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 232 LATIN AMERICA: MARKET, BY BOT COMMUNICATION, 2017–2022 (USD MILLION)

- TABLE 233 LATIN AMERICA: MARKET, BY BOT COMMUNICATION, 2023–2028 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 237 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY CHATBOT VENDORS

- TABLE 239 MARKET: DEGREE OF COMPETITION

- TABLE 240 MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 241 MARKET: PRODUCT FOOTPRINT ANALYSIS OF OTHER KEY PLAYERS, 2022

- TABLE 242 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 243 CHATBOT MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES PLAYERS, 2023

- TABLE 244 SERVICE/PRODUCT LAUNCHES, 2020–2023

- TABLE 245 DEALS, 2020–2023

- TABLE 246 COMPARATIVE ANALYSIS OF TRENDING CHATBOT PRODUCTS

- TABLE 247 MICROSOFT: BUSINESS OVERVIEW

- TABLE 248 MICROSOFT: PRODUCTS OFFERED

- TABLE 249 MICROSOFT: PRODUCT LAUNCHES

- TABLE 250 MICROSOFT: DEALS

- TABLE 251 IBM: BUSINESS OVERVIEW

- TABLE 252 IBM: PRODUCTS OFFERED

- TABLE 253 IBM: PRODUCT LAUNCHES

- TABLE 254 IBM: DEALS

- TABLE 255 GOOGLE: BUSINESS OVERVIEW

- TABLE 256 GOOGLE: PRODUCTS OFFERED

- TABLE 257 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 258 AWS: BUSINESS OVERVIEW

- TABLE 259 AWS: PRODUCTS OFFERED

- TABLE 260 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 261 AWS: DEALS

- TABLE 262 BAIDU: BUSINESS OVERVIEW

- TABLE 263 BAIDU: PRODUCTS OFFERED

- TABLE 264 BAIDU: PRODUCT LAUNCHES

- TABLE 265 BAIDU: DEALS

- TABLE 266 OPENAI: BUSINESS OVERVIEW

- TABLE 267 OPENAI: PRODUCTS OFFERED

- TABLE 268 OPENAI: PRODUCT LAUNCHES

- TABLE 269 OPENAI: DEALS

- TABLE 270 SALESFORCE: BUSINESS OVERVIEW

- TABLE 271 SALESFORCE: PRODUCTS OFFERED

- TABLE 272 SALESFORCE: DEALS

- TABLE 273 META: BUSINESS OVERVIEW

- TABLE 274 META: PRODUCTS OFFERED

- TABLE 275 META: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 276 META: DEALS

- TABLE 277 ARTIFICIAL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 278 ARTIFICIAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 279 ARTIFICIAL SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 ARTIFICIAL SOLUTIONS: DEALS

- TABLE 281 ARTIFICIAL SOLUTIONS: OTHERS

- TABLE 282 ORACLE: BUSINESS OVERVIEW

- TABLE 283 ORACLE: PRODUCTS OFFERED

- TABLE 284 ORACLE: PRODUCT LAUNCHES

- TABLE 285 ORACLE: DEALS

- TABLE 286 SAP: BUSINESS OVERVIEW

- TABLE 287 SAP: PRODUCTS OFFERED

- TABLE 288 SAP: DEALS

- TABLE 289 SERVICENOW: BUSINESS OVERVIEW

- TABLE 290 SERVICENOW: PRODUCTS OFFERED

- TABLE 291 SERVICENOW: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 292 SERVICENOW: DEALS

- TABLE 293 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 294 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 295 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 296 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 297 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 298 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 299 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 300 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 301 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 302 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 303 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 304 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 305 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 306 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 307 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 308 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 309 SPEECH ANALYTICS MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 310 SPEECH ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 311 SPEECH ANALYTICS MARKET, BY BUSINESS FUNCTION, 2017–2021 (USD MILLION)

- TABLE 312 SPEECH ANALYTICS MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

- TABLE 313 SPEECH ANALYTICS MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 314 SPEECH ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 315 SPEECH ANALYTICS MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 316 SPEECH ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 317 SPEECH ANALYTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 318 SPEECH ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 319 SPEECH ANALYTICS MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 320 SPEECH ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 321 SPEECH ANALYTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 322 SPEECH ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 CHATBOT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF CHATBOT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF CHATBOT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF CHATBOT MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF CHATBOT THROUGH OVERALL CHATBOT SPENDING

- FIGURE 8 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 9 STANDALONE SOLUTION TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 10 PROFESSIONAL SERVICES SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 11 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO LEAD MARKET IN 2023

- FIGURE 12 MOBILE APPS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 SOCIAL MESSENGER SEGMENT TO LEAD MARKET IN 2023

- FIGURE 14 TEXT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 15 MENU-BASED SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 16 CONTACT CENTERS SEGMENT TO BE LARGEST SEGMENT IN 2023

- FIGURE 17 CUSTOMER ENGAGEMENT AND RETENTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 18 CUSTOMER SUPPORT TO BE LARGEST FINANCE AND ACCOUNTING APPLICATION SEGMENT IN 2023

- FIGURE 19 RECRUITMENT SEGMENT AMONG HR APPLICATIONS TO DOMINATE MARKET IN 2023

- FIGURE 20 WORKFLOW OPTIMIZATION SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 21 INCIDENT MANAGEMENT SEGMENT AMONG ITSM APPLICATIONS TO DOMINATE MARKET IN 2023

- FIGURE 22 AGENT PERFORMANCE MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 23 HEALTHCARE AND LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR IN 2023

- FIGURE 24 NORTH AMERICA TO HOLD LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR IN 2023

- FIGURE 25 RISING USAGE OF GENERATIVE MODELS IN CHATBOTS FOR IMMERSIVE CUSTOMER EXPERIENCE TO DRIVE MARKET

- FIGURE 26 CHATBOT MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- FIGURE 27 HR BUSINESS FUNCTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 SOLUTIONS AND RETAIL AND ECOMMERCE SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- FIGURE 29 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 30 BRIEF HISTORY OF CHATBOT

- FIGURE 31 CHATBOT MARKET ARCHITECTURE

- FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CHATBOT MARKET

- FIGURE 33 CHATBOT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 TOTAL NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 35 TOP 10 PATENT APPLICANTS, 2020–2023

- FIGURE 36 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 37 CHATBOT ROADMAP UNTIL 2030

- FIGURE 38 CHATBOT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 39 CHATBOT MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 41 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 MESSAGING-BASED SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 TRAINING AND CONSULTING SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 VOICEBOTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 MESSAGING APPS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ENTERPRISE MESSENGER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 48 AUDIO/VOICE SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 49 HR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 RECRUITMENT APPLICATION TO HOLD LARGEST SHARE IN 2023

- FIGURE 51 CUSTOMER ENGAGEMENT AND RETENTION SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 52 CUSTOMER SUPPORT SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 53 INCIDENT MANAGEMENT SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 54 WORKFLOW OPTIMIZATION SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 55 AGENT PERFORMANCE MANAGEMENT SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 56 HEALTHCARE AND LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 BANKING, FINANCIAL SERVICES, AND INSURANCE: CHATBOT USE CASES

- FIGURE 58 ENERGY AND UTILITIES: CHATBOT USE CASES

- FIGURE 59 RETAIL AND ECOMMERCE: CHATBOT USE CASES

- FIGURE 60 IT AND ITES: CHATBOT USE CASES

- FIGURE 61 TRAVEL AND HOSPITALITY: CHATBOT USE CASES

- FIGURE 62 HEALTHCARE AND LIFE SCIENCES: CHATBOT USE CASES

- FIGURE 63 MEDIA AND ENTERTAINMENT: CHATBOT USE CASES

- FIGURE 64 GOVERNMENT AND DEFENSE: CHATBOT USE CASES

- FIGURE 65 TELECOM: CHATBOT USE CASES

- FIGURE 66 OTHER VERTICALS: CHATBOT USE CASES

- FIGURE 67 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 68 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 69 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 70 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 71 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 72 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 73 KEY CHATBOT MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 74 STARTUPS/SMES CHATBOT PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 75 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 76 IBM: COMPANY SNAPSHOT

- FIGURE 77 GOOGLE: COMPANY SNAPSHOT

- FIGURE 78 AWS: COMPANY SNAPSHOT

- FIGURE 79 BAIDU: COMPANY SNAPSHOT

- FIGURE 80 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 81 META: COMPANY SNAPSHOT

- FIGURE 82 ARTIFICIAL SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 83 ORACLE: COMPANY SNAPSHOT

- FIGURE 84 SAP: COMPANY SNAPSHOT

- FIGURE 85 SERVICENOW: COMPANY SNAPSHOT

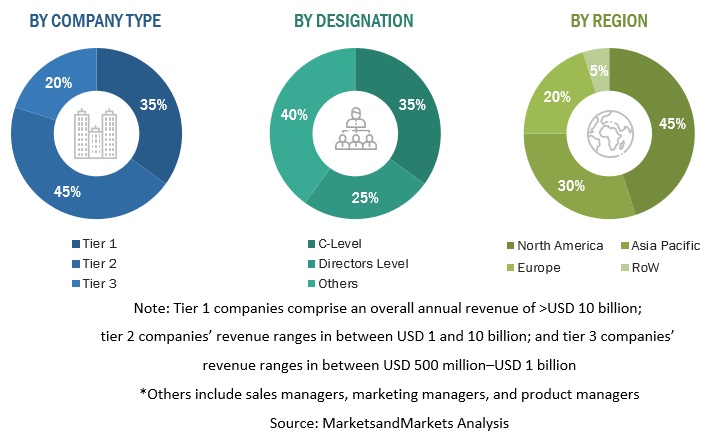

The study involved four major activities in estimating the current market size of chatbot market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the chatbot market.

Secondary Research

In the secondary research process, various secondary sources, such as Information Discovery and Delivery, Journal of Data Mining and Knowledge Discovery, and Data Science Journal, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from chatbot solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the chatbot market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the chatbot market. The bottom-up approach was used to arrive at the overall market size of the global chatbot market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to IBM, a leading AI and machine learning technology provider, chatbots are AI-powered virtual agents designed to converse with humans, typically over text or voice channels, to automate customer-facing interactions and improve customer experiences. Moreover, chatbots are computer programs designed to simulate conversation with human users, typically to provide customer service or engage with customers in a conversational manner. They can be powered by AI and natural language processing technology and used in various industries and applications.

Key Stakeholders

- Chatbot solution vendors

- Chatbot service vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the chatbot market by offering (solutions and services), type, business function, bot communication, channel integration, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the chatbot market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Chatbot market

- Further breakup of the European Chatbot market

- Further breakup of the Asia Pacific Chatbot market

- Further breakup of the Latin American Chatbot market

- Further breakup of the Middle East and Africa Chatbot market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chatbot Market