Smart Process Application Market by Solution (ECM, BPM, Customer Experience Management, Business Intelligence and analytics, Enterprise Mobility), by Service, by Deployment Type, by Organization Size, by Verticals, & by Region - Global Forecast to 2020

[176 Pages Report] Smart Process Application market to grow from $24.35 billion in 2015 to $43.28 billion in 2020. This represents a Compound Annual Growth Rate (CAGR) of 12.19% from 2015 to 2020.

There has been an increasing incorporation of Smart Process Application solutions by end users as these solutions help them to automate business processes and enhance the efficiency of its operations. Smart process application solutions enable enterprises to automate their workflows which results in better interaction between human and processes resulting in efficient business operations.

One of the major factors that have helped the smart process application market to grow is the potential cost savings that an enterprise can incur due to adoption of these solutions. Enterprises are looking for solutions that enable them to increase their business agility. Smart process application solutions not only save cost but also help enterprises to deal with the changes in the operating environment without affecting the profit margins of the company. These factors have greatly contributed towards the growth of market and have emerged as one of the major drivers for the market.

Major players include in smart process application market are EMC Corporation, OpenText, Appian, SAP, KANA, Lexmark International, Salesforce.com, Kofax and others. These players provide innovative smart process application solutions in the form of individual components as well as suites, which get delivered via on premise or via cloud.

The report provides in-depth analysis of the global adoption trends, future growth potential, key issues and opportunities in the considered market. Furthermore, it provides a comprehensive Business case analysis along with the information on major market drivers, restraints, opportunities, challenges and key issues in smart process application market.

The report also consists of MarketsandMarkets views of the key players and analysts insights on various developments that are taking place in the market space. The forecast period for market research report is 2015-2020. The research report covers complete Smart Process Application market categorized into following segments:

On the basis of type of deployment type:

- On-premises

- Cloud

On the basis of solutions:

- Enterprise Content Management

- Business Process Management

- Customer Experience Management

- Business Intelligence and Analytics

- Enterprise Mobility

On the basis of service:

- Support and Maintenance Services

- Professional Services

- Managed Services

On the basis of organization size:

- Small Sized Businesses

- Medium Sized Businesses

- Large Enterprises

On the basis of vertical:

- BFSI

- Telecom & IT

- Public Sector, Energy, and Utilities

- Media and Entertainment

- Manufacturing

- Retail

- Healthcare

- Academia and Education

- Transportation and Logistics

- Others

On the basis of geographical region:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

The smart process applications are special type of application software that is designed to enable the organizations to smartly handle the process that are informative, unstructured, and human intensive in efficient and compliant manner.

The revenue from the Smart process application market has been consistent over the past one year and is expected to gain traction in the next five years, due to increasing new product launches and mergers and acquisition by the existing players. The major areas of opportunities for these applications include increasing business complexity and customer on boarding that will play a crucial role in the growth of smart process application market.

North America (NA) is expected to continue to hold its market position with highest regional market share, followed by the Europe region. However, the APAC region is expected to witness the highest growth rate in the market. It is expected that verticals such as BFSI, public sector, energy and utilities, manufacturing, retail, healthcare and telecom & IT will occupy the leading market share in the overall smart process application market.

Technological developments in ICT, connectivity, mobile devices and increasing business agility will remain the main drivers behind increased adoption of smart process application solutions. Through these solutions, organizations can avail benefits such as structured process and accelerated processing times to better manage and grow their business.

The prominent solution developers in this domain are EMC Corporation, OpenText, Appian, SAP, KANA, Lexmark International, Salesforce.com, and Kofax. These players along with the others present in the market are expected to make a big impact in this rapidly growing marketplace in the next 5 years.

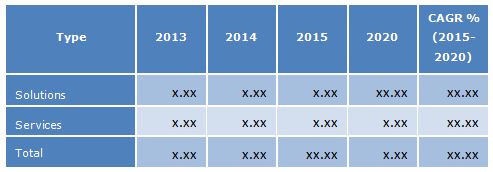

MarketsandMarkets expects the smart process application market to grow from $24.35 billion in 2015 to $43.28 billion in 2020. This represents a Compound Annual Growth Rate (CAGR) of 12.19% from 2015 to 2020. The table and figures below highlight the overall market opportunity in the market (2015-2020)

Smart Process Application Market Size, by Types 2015 - 2020 ($Billion)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Markets Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1.1 Secondary Data

2.1.1.1 Key Data Taken From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data Taken From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Break Down of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Crackdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities

4.2 Smart process application market, by sub-market

4.3 Total smart process application market

4.4 Market Potential

4.5 Life cycle analysis, By Region, 2015

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Services

5.2.3 By Deployment Type

5.2.4 By Organization Size

5.2.5 By Vertical

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Technological Developments in Ict, Connectivity and Mobile Devices

5.3.1.2 Increasing Business Agility

5.3.1.4 Limitation With Traditional Business Applications

5.3.2 Restraints

5.3.2.1 Operational Issues

5.3.2.2 Misconcption About Smart process application Solutions

5.3.3 Opportunities

5.3.3.1 Increasing Business Complexity

5.3.3.2 Enhancing Customer Onboarding

6 Industry Trends (Page No. - 48)

6.1 Value Chain Analysis

6.2 Evolution of smart process application market

6.3 Porter’s Five Forces Analysis

6.2.1 Bargaining Power of Suppliers

6.2.2 Bargaining Power of Buyers

6.2.3 Threat From New Entrants

6.2.4 Threat From Subsitutes

6.2.5 Intensity of Rivalry

7 Smart Process Application Market By Solution (Page No. - 52)

7.1 Introduction

7.2 Enterprise Content Management

7.3 Business Process Management

7.4 Customer Experience Management

7.5 Business Intelligence and Analytics

7.6 Enterprise Mobility

8 Smart Process Application Market By Services (Page No. - 58)

8.1 Introduction

8.2 Support and Maintenance Services

8.3 Professional Services

8.4 Managed Services

9 Smart Process Application Market By Deployment Type (Page No. - 72)

9.1 Introduction

9.2 On-Premise

9.3 Cloud

10 Smart Process Application Market, By Organization Size (Page No. - 102)

10.1 Introduction

10.2 Small Sized Businesses

10.3 Medium Sized Businesses

10.4 Large Enterprises

11 Smart Process Application Market By Vertical (Page No. - 108)

10.1 Introduction

10.2 BFSI

10.3 Telecom and IT

10.4 Public Sector, Energy and Utilities

10.5 Media and Entertainment

10.6 Manufacturing

10.7 Retail

10.8 Healthcare

10.9 Academia and Education

10.10 Transportation and Logistics

10.11 Others

12 Smart Process Application Market By Regions (Page No. - 120)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

12 Competitive Landscape (Page No. - 129)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 New Alliances, Contracts, Partnerships, and Agreements

12.2.3 Mergers and Acquisitions

12.2.4 Expansions

12.2.5 Others

13 Company Profiles (Page No. - 141)

13.1 Introduction

13.2 EMC Corporation

13.2.1 Business Overview

13.2.2 Products and Services

13.2.3 Key Strategies

13.2.4 Recent Developments

13.2.5 SWOT Analysis

13.2.6 MNM View

13.3 Opentext Corp

13.3.1 Business Overview

13.3.2 Solutions

13.3.3 Key Strategies

13.3.4 Recent Developments

13.3.5 SWOT Analysis

13.3.6 MNM View

13.4 SAP

13.4.1 Business Overview

13.4.2 Products

13.4.3 Key Strategies

13.4.4 Recent Developments

13.4.5 SWOT Analysis

13.4.6 MNM View

13.5 Lexmark International

13.5.1 Business Overview

13.5.2 Products

13.5.3 Key Strategies

13.5.4 Recent Developments

13.5.5 MNM View

13.6 Pegasystems Inc

13.6.1 Business Overview

13.6.2 Products

13.6.3 Key Strategies

13.6.4 Recent Developments

13.6.5 MNM View

13.7 Appian

13.7.1 Business Overview

13.7.2 Products

13.7.3 Key Strategies

13.7.4 Recent Developments

13.7.5 MNM View

13.8 IBM

13.8.1 Business Overview

13.8.2 Products

13.8.3 Key Strategies

13.8.4 Recent Developments

13.8.5 SWOT Analysis

13.8.6 MNM View

13.9 Salesforce.Com

13.9.1 Business Overview

13.9.2 Products

13.9.3 Key Strategies

13.9.4 Recent Developments

13.9.5 MNM View

13.10 Kana

13.10.1 Business Overview

13.10.2 Products

13.10.3 Key Strategies

13.10.4 Recent Developments

13.10.5 SWOT Analysis

13.10.6 MNM View

13.11 Kofax Limited

13.11.1 Business Overview

13.11.2 Products

13.11.3 Key Strategies

13.11.4 Recent Developments

13.11.5 MNM View

14 Appendix (Page No. - 169)

14.1 Discussion Guide

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customizations

14.4 Related Reports

List of Tables (63 Tables)

Table 1 Smart Process Application Market: Assumptions

Table 2 Smart process application Market Size and Growth, By Sub-Segment, 2013-2020 ($Billion, Y-O-Y %)

Table 3 Technological Development in ICT is Expected to Be the Major Driving Factor for the Growth of Market

Table 4 Operational Issues is Expected to Confine the Growth of Market

Table 5 Increasing Customer Experience Provide Significant Opportunity for Vendors in the Market

Table 6 Smart process application market Market Size, By Solution, 2013-2020 ($Billion)

Table 7 Enterprise Content Management Market Size, By Region, 2013-2020 ($Million)

Table 8 Business Process Management Market Size, By Region, 2013-2020 ($Million)

Table 9 Customer Experience Management Market Size, By Region, 2013-2020 ($Million)

Table 10 Business Intelligence and Analytics Market Size, By Region, 2013-2020 ($Billion)

Table 11 Enterprise Mobility Market Size, By Region, 2013-2020 ($Billion)

Table 12 Smart Process Application Market Size, By Service, 2013-2020 ($Billion)

Table 13 Support and Maintenance Services Market Size, By Region, 2013-2020 ($Million)

Table 14 Professional Services Market Size, By Region, 2013-2020 ($Million)

Table 15 Managed Services Market Size, By Region, 2013-2020 ($Million)

Table 16 Smart Process Application Market Size, By Deployment Type, 2013-2020 ($Billion)

Table 17 On-Premise Market Size, By Region, 2013-2020 ($Million)

Table 18 Cloud Market Size, By Region, 2013-2020 ($Million)

Table 19 Smart process application Market Size, By Organization Size, 2013-2020 ($Billion)

Table 20 Large Enterprises Market Size, By Region, 2013-2020 ($Million)

Table 21 Medium Sized Businesses Market Size, By Region, 2013-2020 ($Million)

Table 22 Small Sized Businesses Market Size, By Region, 2013-2020 ($Million)

Table 23 Smart process application market Size, By Vertical, 2013-2020 ($Billion)

Table 24 BFSI Market Size, By Region, 2013-2020 ($Million)

Table 25 Telecom and IT Market Size, By Region, 2013-2020 ($Million)

Table 26 Public Sector, Energy and Utilities Market Size, By Region, 2013-2020 ($Million)

Table 27 Media and Entertainment Market Size, By Region, 2013-2020 ($Million)

Table 28 Manufacturing Market Size, By Region, 2013-2020 ($Million)

Table 29 Retail Market Size, By Region, 2013-2020 ($Million)

Table 30 Healthcare Market Size, By Region, 2013-2020 ($Million)

Table 31 Academia and Education Market Size, By Region, 2013-2020 ($Million)

Table 32 Transportation and Logistics Market Size, By Region, 2013-2020 ($Million)

Table 33 Others Market Size, By Region, 2013-2020 ($Million)

Table 34 Smart Process Application Market Size, By Region, 2013-2020 ($Billion)

Table 35 North America: Market Size, By Solution, 2013-2020 ($Million)

Table 36 North America: Market Size, By Service, 2013-2020 ($Million)

Table 37 North America: Market Size, By Service, 2013-2020 ($Million)

Table 38 North America: Market Size, By Organization Size, 2013-2020 ($Million)

Table 39 North America: Market Size, By Deployment Type, 2013-2020 ($Million)

Table 40 Europe: Market Size, By Solution, 2013-2020 ($Million)

Table 41 Europe: Market Size, By Service, 2013-2020 ($Million)

Table 42 Europe: Market Size, By Vertical, 2013-2020 ($Million)

Table 43 Europe: Market Size, By Organization Size, 2013-2020 ($Million)

Table 44 Europe: Market Size, By Deployment Type, 2013-2020 ($Million)

Table 45 APAC: Market Size, By Solution, 2013-2020 ($Million)

Table 46 APAC: Market Size, By Service, 2013-2020 ($Million)

Table 47 APAC: Market Size, By Vertical, 2013-2020 ($Million)

Table 48 APAC: Market Size, By Organization Size, 2013-2020 ($Million)

Table 49 APAC: Market Size, By Deployment Type, 2013-2020 ($Million)

Table 50 MEA: Market Size, By Solution, 2013-2020 ($Million)

Table 51 MEA: Market Size, By Service, 2013-2020 ($Million)

Table 52 MEA: Market Size, By Vertical, 2013-2020 ($Million)

Table 53 MEA: Market Size, By Organization Size, 2013-2020 ($Million)

Table 54 MEA: Market Size, By Deployment Type, 2013-2020 ($Million)

Table 55 LA: Market Size, By Solution, 2013-2020 ($Million)

Table 56 LA: Market Size, By Service, 2013-2020 ($Million)

Table 57 LA: Market Size, By Vertical, 2013-2020 ($Million)

Table 58 LA: Market Size, By Organization Size, 2013-2020 ($Million)

Table 59 LA: Market Size, By Deployment type, 2013-2020 ($Million)

Table 60 New Product Launches, 2012–2015

Table 61 Agreements, Partnerships, Collaborations, and Joint Ventures, 2012–2015

Table 62 Mergers and Acquisitions, 2012–2015

Table 63 Expansions, 2012–2015

List of Figures (63 Figures)

Figure 1 Global Smart Process Application Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Solution Segment is Covering the Maximum Share of Smart process application market (2015 vs. 2020)

Figure 7 BFSI is Expected to Lead the Smart Process Application Market (2015 vs. 2020)

Figure 8 Professional Services is Dominating the Smart process application Service Market (2015 vs. 2020)

Figure 9 Large Enterprises Market is the Market Leader for Smart process application Organization Size Market (201 vs. 2020)

Figure 10 NA Will Have the Largest Market Share for Market in 2015

Figure 11 Increasing Demand for Business Agility By Enterprises is Driving the Market

Figure 12 Service Market to Grow at the Highest Rate Among the Segments in 2020

Figure 13 Public Sector, Energy and Utilities and BPM Hold the Maximum Share in the Market (2015)

Figure 14 APAC Will Grow With the Highest CAGR Than Other Regional Markets Between 2015 to 2020

Figure 15 APAC Region Will Be the Most Lucrative Market During the Period 2015–2020

Figure 16 Smart Process Application Market Segmentation: By Solution

Figure 17 Market Segmentation: By Service

Figure 18 Market Segmentation: By Deployment Type

Figure 19 Market Segmentation: By Organization Size

Figure 20 Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Region

Figure 22 Drivers, Restraints, Opportunities, and Challenges in the Smart Process Application Market

Figure 23 Value Chain: Smart process application market

Figure 24 Smart process application: Evolution

Figure 25 Porter’s Five Forces Analysis

Figure 26 Solution Market is Dominated By BPM Solutions

Figure 27 APAC Will Grow With the Highest CAGR During the Forecast Period

Figure 28 BPM to Witness the Highest Growth in APAC Region

Figure 29 APAC Region Will Be the Most Attractive Market for CEM

Figure 30 NA Region Will Be the Most Lucrative Market for Business Intelligence and Analytics

Figure 31 APAC Region Will Be the Strong Market for Enterprise Mobility

Figure 32 Professional Service Accounts for the Maximum Share in the Service Market

Figure 33 NA Region Dominates the Support and Maintenance Services Market Throughout the Forecast Period

Figure 34 Professional Service Market Will Gain More Traction in the NA Region

Figure 35 APAC Region Will Be the Most Lucrative Market for Managed Services in 2020

Figure 36 On-Premise Accounts for the Maximum Share in the Deployment Market

Figure 37 NA Region Dominates the On-Premise Market Throughout the Forecast Period

Figure 38 APAC is Expected to Be A Lucrative Region for the Cloud Market

Figure 39 Large Enterprises Accounts for the Maximum Share in the Organization Size Market

Figure 40 NA Region Dominates the Large Enterprises Market Throughout the Forecast Period

Figure 41 APAC is Expected to Be A Lucrative Region for the Medium Sized Businesses Market

Figure 42 APAC Region is Expected to Have the Largest Share in 2020

Figure 43 BFSI is the Largest Adopter of Smart process application Solutions

Figure 44 APAC is Expected to Show High Growth Rate for Smart process application Adoption in BFSI

Figure 45 Telecom and IT in APAC is Expected to Show High Growth Rate Among All Other Regions

Figure 46 APAC Has the Highest Market Share in Public Sector, Energy and Utilities Vertical

Figure 47 Media and Entertainment in Will Gain Traction in APAC Region

Figure 48 APAC Has the Highest Market Share in Manufacturing Vertical

Figure 49 APAC Will Show High Growth Rate for Retail Vertical

Figure 50 APAC Has the Highest Market Share in Healthcare Vertical

Figure 51 NA Has the Highest Market Share in Academia and Education Vertical

Figure 52 NA Has the Highest Market Share in Transportation and Logistics Vertical

Figure 53 NA Has the Highest Market Share in Others Vertical

Figure 54 NA Has the Maximum Market Share of the Global Smart Process Application Market

Figure 55 Regional Snapshot: APAC is Emerging as A New Hotspot

Figure 56 APAC: an Attractive Destination for Smart process application

Figure 57 NA Market Snapshot: Presence of Major Industries is A Factor Contributing Towards Growth in This Region

Figure 58 BPM Market is Expected to Dominate the smart process application market in NA

Figure 59 Enterprise Mobility Market is Expected to Grow With the Highest CAGR During 2015-2020

Figure 60 APAC Market Snapshot: Growth is Driven By BPM Solutions

Figure 61 APAC Represents Huge Growth Opportunities for Enterprise Mobility

Figure 62 Emerging Markets of MEA Presents Growth Prospects for BPM Market

Figure 63 BPM Market is Expected to Gain Traction in the LA Region

Growth opportunities and latent adjacency in Smart Process Application Market