Soldier Systems Market by Type (Personal Protection, Respiratory Protective Equipment, Communication, Power & Data Transmission), End-User (Military, And Homeland Security) and Region - Global Forecast to 2027

Update: 11/22/2024

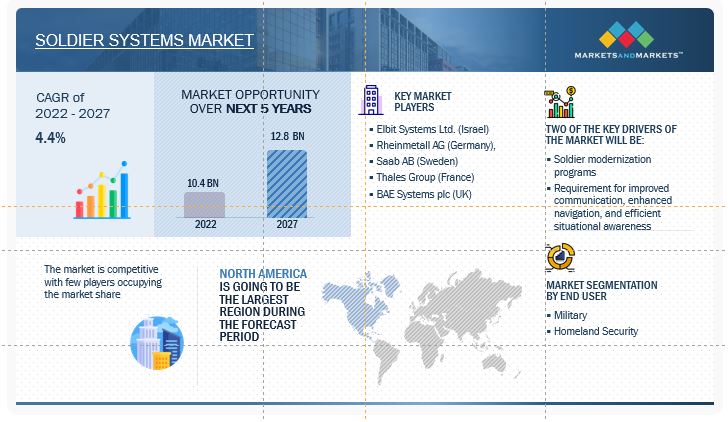

The Global Soldier Systems Market Size was valued at USD 10.4 Billion in 2022 and is estimated to reach USD 12.8 Billion by 2027, growing at a CAGR of 4.4% during the forecast period. The growth of the market is attributed to the increasing defense spending and the ongoing military modernization program worldwide to procure new system and upgrade the existing one.

Attractive Opportunities in Soldier System Market

Soldier Systems Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Soldier System Market Dynamics

Driver: Asymmetric warfare to encourage adoption of soldier system technologies

Asymmetrical warfare refers to conflicts between formal militaries and informal and less-equipped resilient opponents. The emergence of asymmetrical warfare can be attributed to various factors, such as alleged geopolitical conflicts in South Asian and Middle East countries. The increasing global instances of asymmetrical warfare have led countries to equip their infantry forces with advanced soldier system for identifying factors crucial for the success of ongoing missions due to less time required on battlefields. Companies dealing in soldier system focus on integrating these system with C4I technology to enhance soldiers’ situational awareness. Target is to enable soldiers to use information gathered from C4I technology at all command levels while planning and executing operations.

Restraint: Conventional warfare system to restrain growth of soldier system market.

An important factor restraining market growth is the increased financial instability in emerging economies. Higher inflation and low GDP compel developing countries, such as the Philippines, South Africa, and Sudan, to procure more conventional warfare system rather than spending on advanced soldier system. These countries procure basic warfare capabilities, such as armored vehicles, ships, and combat aircraft, and do not spend much on advanced technologies for developing next-generation soldier system. Growing economic concerns have resulted in a significant decline in these countries’ defense budgets and spending, hampering the Soldier System Industry growth.

Opportunity: Integrating nanotechnology into soldier subsystem to fuel market growth.

The increasing global incidences of asymmetric warfare have led to the development of system that protect soldiers against highly lethal ammunition and multiple strikes without compromising operational effectiveness. Bulletproof jackets and vests protect soldiers against medium- and low-energy small arms. However, the defense forces of various countries develop and create materials that are similar or superior to ballistic materials along with more flexibility and lesser thickness compared to the currently used Kevlar fabric and its other forms for manufacturing bulletproof jackets and vests. The advent of nanotechnology has made it possible to create flexible armor for soldiers by combining Kevlar fabric with shear thickening fluid (STF). The requirement for lightweight, flexible, and antiballistic textiles has led to the use of nanofibers and nanocomposite material in manufacturing armor for soldiers. These textiles protect soldiers against chemical and biological attacks, can self-decontaminate, and offer switchable camouflage patterns. Nanocomposites comprise matrix materials, usually polymers, by dispersing nanoparticles/fibers. These composites provide enhanced thermal, mechanical, and electrical properties to textiles used to manufacture soldiers’ armor. Researchers have developed a carbon nanotube (CNT)-coated smart yarn that conducts electricity. This yarn can be woven into textiles used for manufacturing soldiers’ clothing to detect their blood pressure or monitor their health. These technologies are useful in cases where wounded soldiers cannot send messages for medical assistance. In such cases, smart clothing detects the presence of albumin in the blood and sends distress signals through radio communication devices.

Challenge: Need for weight reduction on soldiers to challenge manufacturers of soldier system

Reducing the weight on soldiers without compromising their protection and combat performance is a major challenge for manufacturers of different components and subsystem of soldier system. Modernizing soldier system to protect, mobilize, and empower soldiers has resulted in an exponential increase in the total weight of these system. The combined weight of soldier system prevents troops from being agile, mobile, and effective. It even risks their lives as soldiers avoid carrying the lifesaving equipment due to its heavy weight. Defense agencies worldwide source and integrate the most affordable and lightweight soldier equipment with new and advanced technologies to reduce the weight burden on defense personnel. For instance, the US, through its Nett Warrior program, is making substantial progress in reducing the load carried by soldiers on battlefields while ensuring they are equipped with next-generation capabilities. The UK Ministry of Defence plans to reduce the load on soldiers from 70 kilograms to less than 25 kilograms under its Reducing the Burden on the Dismounted Soldier (RBDS) program. Defense ministries worldwide fund various R&D projects to reduce the weight and power consumption of equipment carried by soldiers on battlefields to counter this challenge.

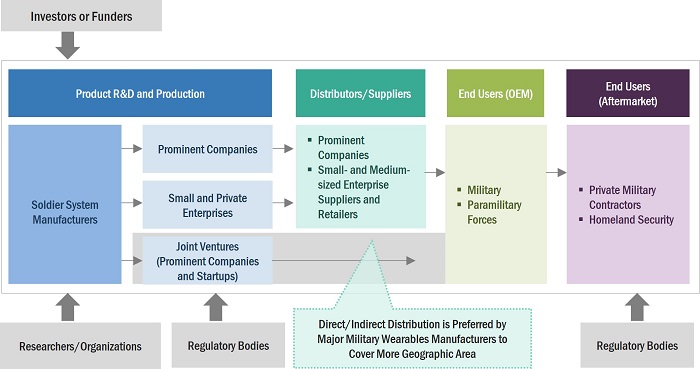

Soldier System Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of soldier system. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Elbit System Ltd. (Israel), Rheinmetall AG (Germany), Saab AB (Sweden), Thales Group (France), BAE System plc (UK), and Aselsan A.S. (Turkey) are the key players in this market.

Vision segment to dominate market share during the forecast period

Based on Type, the Soldier System market has been segmented into personal protection, respiratory protective equipment (RPE), communication, power & transmission, surveillance & target acquisition, navigation & health monitoring, vision, exoskeleton, and training & simulation. The Vision segment is expected to increase significantly in the upcoming years. The soldier modernization programs around the world are integrating the various advanced vision system with soldier wearables as to enhance the overall operational efficiency of the soldiers.

Military segment to lead the market for Soldier System during the forecast period

Based on End User, the Soldier System market has been segmented into Military and Homeland Security. This segment growth can be attributed to the increased deployment of soldier system in the military to ensure improved communication, enhanced navigation, and efficient situational awareness. The long operational duration results in severe mental and physical exhaustion, affecting the efficacy of the land forces; hence, soldier system are being adopted to monitor the vitals of the military personnel and the occurrence of factors that may lead to stress and critically affect the operational capabilities of the personnel.

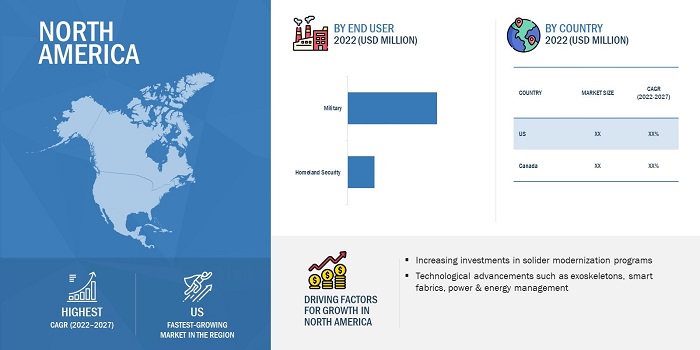

Northh America is projected to witness the highest market share during the forecast period

North America leads the Soldier System market. The demand for soldier system worldwide is now driven by technological advancements such as exoskeletons, smart fabrics, power & energy management, and communication & computing. The increasing necessity of governments in the area to counter the rising instances of terrorist attacks and continual military equipment modernization initiatives in the region are driving major regional defense manufacturers to produce technologically advanced soldier system. For instance, the US Army has implemented a new AR heads-up display technology that simulates modern fighting in the first person. Increased deployment of soldier system across the military sector is expected to benefit the soldier system market during the forecast period.

Soldier Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Soldier System Companies include BAE System plc (UK), Aselsan A.S. (Turkey), Elbit System Limited (Israel), Teledyne FLIR LLC (US), and General Dynamics Corporation (US) and among others.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

4.4% |

|

Estimated Market Size in 2022 |

USD 10.4 Billion |

|

Projected Market Size in 2027 |

USD 12.8 Billion |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By End User, By Type, and By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, Rest of the World |

|

Companies Covered |

BAE Systems plc, Aselsan A.S., Elbit Systems Ltd., General Dynamics Corporation, Teledyne FLIR LLC, Bionic Power Inc., L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Rheinmetall AG, Northrop Grumman Corporation,among others. |

Soldier Systems Market Highlights

This research report categorizes the Soldier system market based on Type, End User, and Region.

|

Segment |

Subsegment |

|

Soldier system Market, By Type |

|

|

Soldier system Market, By End User |

|

|

Soldier system Market, By Region |

|

Recent Developments

- In June 2022, Elbit System Ltd, unveils an innovative technological vision suite for military helicopters (a fifth-generation aircraft technology). The new suite integrates a sophisticated sensor array, an artificial intelligence (AI)-powered mission computer and a unique helmet-mounted display (HMD) system.

- In May 2022, BAE System plc, SIIDAS delivers network-centric warfare (a capable, highly effective aircraft self-protection system) and an unparalleled degree of situational awareness to pilots by integrating commercial electronic warfare (EW) sensors, countermeasures, and intelligent suite control.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Soldier System market?

Factors such as the emphasis on improving troops' situational awareness on the battlefield and the increased incidences of asymmetric warfare are positively driving the growth of the soldier system market. Furthermore, rising defence spending, particularly in emerging economies, and consequent expenditures in purchasing such system drive market growth. However, obstacles such as procurement process delays limit market growth to some extent, while lowering the weight of army system is a major challenge for industry participants. Meanwhile, increased terrorist attacks and a focus on counter-operations, as well as troop modernization initiatives launched by numerous governments throughout the world, provide significant growth potential for the soldier system industry. Companies are likewise eager to provide an integrated solution that spans numerous system.

What are the key sustainability strategies adopted by leading players operating in the Soldier System market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Soldier System market. The major players include BAE System plc (UK), Aselsan A.S. (Turkey), Elbit System Limited (Israel), Teledyne FLIR LLC (US), and General Dynamics Corporation (US) and among others. These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Soldier System market?

Some of the major emerging technologies and use cases disrupting the market include the Utilization of optical detection system, infrared cameras, laser range finders, exoskeletons, and respiratory protective gears.

Who are the key players and innovators in the ecosystem of the Soldier System market?

The key players in the Soldier System market include BAE System plc (UK), Aselsan A.S. (Turkey), Elbit System Limited (Israel), Teledyne FLIR LLC (US), and General Dynamics Corporation (US).

Which region is expected to hold the highest market share in the Soldier System market?

The Soldier System market in North America is projected to hold the highest market share during the forecast period due to the demand for technologically advanced military equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Lightweight and rugged wearable systems to combat challenges- Soldier modernization programs to fuel demand for advanced soldier systems- Asymmetric warfare to encourage adoption of soldier system technologiesRESTRAINTS- Conventional warfare systems to restrain growth of soldier system market- Supply chain disruptions to affect production of soldier systemsOPPORTUNITIES- Developing and integrating advanced technologies to enhance capabilities of current-generation soldier systems- Integrating nanotechnology into soldier subsystems to fuel market growth- Increased demand for improved and efficient soldier systems to reduce casualties suffered by troopsCHALLENGES- Lack of strategic clarity and technology readiness to pose challenges for market- Need for weight reduction on soldiers to challenge soldier system manufacturers

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR SOLDIER SYSTEM MANUFACTURERS

-

5.4 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.5 VALUE CHAIN ANALYSISRAW MATERIALRESEARCH & DEVELOPMENTMANUFACTURING AND QUALITY CONTROLDISTRIBUTION, AFTER-SALES SERVICES, AND END USERS

-

5.6 TECHNOLOGY ANALYSISRADIOFREQUENCYADDITIVE MANUFACTURING

-

5.7 CASE STUDY ANALYSISSMART CLOTHINGSITUATION AWARENESSTRAINING & SIMULATIONEXOSKELETONADVANCED BULLETPROOF VESTSNEXT-GENERATION SENSORSWEARABLE BATTERIES & ENERGY HARVESTERS

- 5.8 RECESSION IMPACT ANALYSIS

-

5.9 PORTER’S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS, 2022–2023

- 5.12 TARIFF REGULATORY LANDSCAPE FOR DEFENSE INDUSTRY

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSUNMANNED PLATFORM OPERATED BY SOLDIERSCOMBINED DAMAGE REDUCTIONBRAIN-COMPUTER INTERFACESINDIVIDUAL SITUATIONAL AWARENESS: DELIVERING DECISIONS AT COMMAND LEVELSAUGMENTED AND VIRTUAL REALITY FOR TRAINING & SIMULATIONMULTIBAND TACTICAL COMMUNICATION AMPLIFIERSMOBILE USER OBJECTIVE SYSTEM: CELL PHONE-LIKE CAPABILITY FOR SOFTWARE-DEFINED RADIOSNEAR FIELD COMMUNICATIONSMART CLOTHINGMICROELECTROMECHANICAL SYSTEMS AND NANOTECHNOLOGYNEXT-GENERATION SENSOR SYSTEMSIOT-BASED SOLDIER SYSTEM WEARABLESSMART BATTERIES

-

6.4 IMPACT OF MEGATRENDSIMPLEMENTATION OF INDUSTRY 4.0SHIFTING OF POWERADVANCEMENTS IN SUPPLY CHAIN FOR SOLDIER SYSTEM MANUFACTURE

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PERSONAL PROTECTIONHELMET- Advanced ballistic helmet- Lightweight helmet- HUD/HMD helmetCLOTHING- NBC suit- Thermal camouflage suit- G-suit- Immersion suit- Advanced ballistic suitVEST- By Type- By MaterialBOOTSGLOVES

-

7.3 RESPIRATORY PROTECTIVE EQUIPMENTAIR-PURIFYING RESPIRATORAIR-SUPPLYING RESPIRATOR

-

7.4 COMMUNICATIONTACTICAL MULTIBAND RADIOTACTICAL HEADSETSDISMOUNTED IFF

-

7.5 POWER & DATA TRANSMISSIONPORTABLE BATTERYPORTABLE SERVERWEARABLE PERSONAL AREA NETWORKRUGGED PORTABLE COMPUTERPERSONNEL RECOVERY DEVICES

-

7.6 SURVEILLANCE & TARGET ACQUISITIONMAN-PORTABLE SURVEILLANCE AND TARGET ACQUISITION RADARMAN-PORTABLE JAMMERSLASER RANGE FINDERSTARGET DESIGNATORS

-

7.7 NAVIGATION & HEALTH MONITORINGGPS/DGPS/AGPSCOMPASSBAROMETERALTIMETERBODY DIAGNOSTIC SENSOR

-

7.8 VISIONCAMERA- Thermal imaging- EO/IR imagingSCOPES- Binocular/Monocular- Optical sightsMODULES- Night vision goggles- Handheld display

-

7.9 EXOSKELETONPASSIVE EXOSKELETONBATTERY-POWERED EXOSKELETON

-

7.10 TRAINING & SIMULATIONAUGMENTED REALITY- Head-mounted display- Head-up displays- Handheld deviceVIRTUAL REALITY DEVICES- Head-mounted display- Gesture-tracking device

- 8.1 INTRODUCTION

-

8.2 MILITARYINFANTRY- Increasing adoption of soldier systems to improve night combat and load-carrying capabilities of infantry forceSPECIAL FORCES- Use of augmented reality-based helmets by special forces to enhance situational awareness

-

8.3 HOMELAND SECURITYPARAMILITARY FORCES- Health monitoring wearable devices to help paramilitary personnel combat and trainingPOLICE- Demand for body cameras to benefit law enforcement agencies

-

9.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

9.2 NORTH AMERICARECESSION IMPACT: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increased spending on innovative technologies and presence of private players to fuel market growthCANADA- Command & control devices to advance soldier protection systems

-

9.3 EUROPERECESSION IMPACT: EUROPEPESTLE ANALYSIS: EUROPEUK- Future soldier modernization to drive market growthFRANCE- Terrorist activities and inter conflict situations to lead to advanced soldier system procurementGERMANY- Advanced soldier system procurement under military modernization to drive market growthRUSSIA- Soldier systems under RATNIK program to boost combat effectivenessREST OF EUROPE- Developments in military equipment and wearables to augment market

-

9.4 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Rising R&D activities for soldier systems to augment marketINDIA- Enhanced capabilities for technological development in defense industry to drive marketJAPAN- Technological advancements and high defense budget to drive marketSOUTH KOREA- Increased investment in advanced and smart wearable products to improve defense capabilitiesAUSTRALIA- Demand for modern wearable technologies in military to fuel marketREST OF ASIA PACIFIC- Supply chain enhancement to meet raw material demand by soldier system manufacturers

-

9.5 MIDDLE EASTRECESSION IMPACT: MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTSAUDI ARABIA- Soldier modernization plan to be integral part of Saudi Vision 2030UAE- Procurement of advanced military equipment to strengthen security forcesISRAEL- Adoption of advanced integrated communication & navigation systems and combat equipment to drive marketTURKEY- Increased defense budgets to produce high-quality defense equipment for armed forcesREST OF MIDDLE EAST- Strengthening of military forces with advanced equipment to fuel market growth

-

9.6 REST OF THE WORLDREGIONAL RECESSION IMPACT ANALYSIS: REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDLATIN AMERICA- Increasing national security budgets and procuring advanced wearables for security forces to augment marketAFRICA- Military modernization programs to fuel market

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 10.3 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

- 10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- 10.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSBAE SYSTEMS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRHEINMETALL AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAAB AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewASELSAN A.S.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIONIC POWER INC.- Business overview- Products/Solutions/Services offeredL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSAFRAN SA- Business overview- Products/Solutions/Services offered- Recent developmentsULTRA-ELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developmentsINTERACTIVE WEAR AG- Business overview- Products/Solutions/Services offeredTT ELECTRONICS PLC- Business overview- Products/Solutions/Services offeredTE CONNECTIVITY LTD.- Business overview- Products/Solutions/Services offeredST ENGINEERING- Business overview- Products/Solutions/Services offeredVIASAT, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

11.3 OTHER PLAYERSGLENAIR INC.- Business overview- Products/Solutions/Services offeredEPSILOR-ELECTRIC FUEL LTD.- Business overview- Products/Solutions/Services offeredMILIPOWER SOURCE INC.- Business overview- Products/Solutions/Services offeredSAFARILAND- Business overview- Products/Solutions/Services offered

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 SOLDIER SYSTEM MARKET, BY SEGMENT

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- TABLE 4 CAPABILITIES OF SOLDIER SYSTEMS

- TABLE 5 SOLDIER MODERNIZATION PROGRAMS, BY COUNTRY/GROUP

- TABLE 6 LIMITATIONS OF EXISTING SOLDIER SYSTEMS

- TABLE 7 USE OF NANOTECHNOLOGY IN SOLDIER SYSTEMS

- TABLE 8 SOLDIER SYSTEM MARKET: ECOSYSTEM

- TABLE 9 SOLDIER SYSTEM MARKET: RECESSION IMPACT ANALYSIS

- TABLE 10 KEY BUYING CRITERIA FOR SOLDIER SYSTEM TECHNOLOGIES

- TABLE 11 SOLDIER SYSTEM MARKET: CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 PATENT ANALYSIS, 2019–2022

- TABLE 16 SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 17 SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 18 SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 19 SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 20 SOLDIER SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 21 SOLDIER SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 23 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 24 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 25 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 26 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 27 NORTH AMERICA: SOLDIER SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 28 US: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 29 US: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 30 US: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 31 US: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 32 CANADA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 33 CANADA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 34 CANADA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 35 CANADA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 36 EUROPE: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 37 EUROPE: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 38 EUROPE: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 39 EUROPE: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 40 EUROPE: SOLDIER SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 41 EUROPE: SOLDIER SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 42 UK: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 43 UK: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 44 UK: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 45 UK: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 46 FRANCE: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 47 FRANCE: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 48 FRANCE: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 49 FRANCE: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 50 GERMANY: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 51 GERMANY: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 52 GERMANY: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 53 GERMANY: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 54 RUSSIA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 55 RUSSIA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 56 RUSSIA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 57 RUSSIA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 58 REST OF EUROPE: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 59 REST OF EUROPE: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 60 REST OF EUROPE: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 61 REST OF EUROPE: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 62 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 63 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 67 ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 68 CHINA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 69 CHINA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 70 CHINA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 71 CHINA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 72 INDIA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 73 INDIA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 74 INDIA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 75 INDIA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 76 JAPAN: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 77 JAPAN: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 78 JAPAN: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 79 JAPAN: MILITARY WEARABLES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 80 SOUTH KOREA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 81 SOUTH KOREA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 82 SOUTH KOREA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 83 SOUTH KOREA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 84 AUSTRALIA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 85 AUSTRALIA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 86 AUSTRALIA: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 87 AUSTRALIA: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: SOLDIER SYSTEM MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 92 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 93 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 94 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 95 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 96 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 97 MIDDLE EAST: SOLDIER SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 98 SAUDI ARABIA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 99 SAUDI ARABIA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 100 SAUDI ARABIA: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 101 SAUDI ARABIA: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 102 UAE: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 103 UAE: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 104 UAE: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 105 UAE: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 106 ISRAEL: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 107 ISRAEL: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 108 ISRAEL: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 109 ISRAEL: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 110 TURKEY: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 111 TURKEY: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 112 TURKEY: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 113 TURKEY: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 114 REST OF MIDDLE EAST: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 116 REST OF MIDDLE EAST: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 117 REST OF MIDDLE EAST: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 118 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 119 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 120 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 121 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 122 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 123 REST OF THE WORLD: SOLDIER SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 124 LATIN AMERICA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 125 LATIN AMERICA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 126 LATIN AMERICA: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 127 LATIN AMERICA: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 128 AFRICA: SOLDIER SYSTEM MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 129 AFRICA: SOLDIER SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 130 AFRICA: SOLDIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 131 AFRICA: SOLDIER SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 132 SOLDIER SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 133 KEY DEVELOPMENTS BY LEADING MARKET PLAYERS IN SOLDIER SYSTEM MARKET, 2019–2022

- TABLE 134 COMPANY PRODUCT FOOTPRINT

- TABLE 135 COMPANY SERVICES/SOLUTION/PRODUCT FOOTPRINT

- TABLE 136 COMPANY REGION FOOTPRINT

- TABLE 137 SOLDIER SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 138 SOLDIER SYSTEM MARKET: PRODUCT LAUNCHES, JUNE 2021–JUNE 2022

- TABLE 139 SOLDIER SYSTEM MARKET: DEALS, JANUARY 2022–MAY 2022

- TABLE 140 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 141 BAE SYSTEMS PLC: PRODUCT LAUNCH

- TABLE 142 BAE SYSTEMS PLC: DEALS

- TABLE 143 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 144 ELBIT SYSTEMS LTD.: PRODUCT LAUNCH

- TABLE 145 ELBIT SYSTEMS LTD.: DEALS

- TABLE 146 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 147 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 148 RHEINMETALL AG: DEALS

- TABLE 149 SAAB AB: BUSINESS OVERVIEW

- TABLE 150 SAAB AB: PRODUCT LAUNCHES

- TABLE 151 SAAB AB: DEALS

- TABLE 152 THALES GROUP: BUSINESS OVERVIEW

- TABLE 153 THALES GROUP: DEALS

- TABLE 154 ASELSAN A.S.: BUSINESS OVERVIEW

- TABLE 155 ASELSAN A.S.: PRODUCT LAUNCHES

- TABLE 156 ASELSAN A.S.: DEALS

- TABLE 157 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- TABLE 158 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 159 TELEDYNE FLIR LLC: DEALS

- TABLE 160 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 161 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 162 BIONIC POWER INC.: BUSINESS OVERVIEW

- TABLE 163 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 164 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 165 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 166 LEONARDO S.P.A.: DEALS

- TABLE 167 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 168 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 169 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 170 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 171 SAFRAN SA: BUSINESS OVERVIEW

- TABLE 172 SAFRAN SA: DEALS

- TABLE 173 ULTRA-ELECTRONICS: BUSINESS OVERVIEW

- TABLE 174 ULTRA-ELECTRONICS: DEALS

- TABLE 175 INTERACTIVE WEAR AG: BUSINESS OVERVIEW

- TABLE 176 TT ELECTRONICS PLC: BUSINESS OVERVIEW

- TABLE 177 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

- TABLE 178 ST ENGINEERING: BUSINESS OVERVIEW

- TABLE 179 VIASAT, INC.: BUSINESS OVERVIEW

- TABLE 180 VIASAT, INC.: DEALS

- TABLE 181 GLENAIR INC.: COMPANY OVERVIEW

- TABLE 182 EPSILOR ELECTRIC FUEL LTD.: COMPANY OVERVIEW

- TABLE 183 MILIPOWER SOURCE INC.: COMPANY OVERVIEW

- TABLE 184 SAFARILAND: COMPANY OVERVIEW

- FIGURE 1 SOLDIER SYSTEM MARKET SEGMENTATION

- FIGURE 2 SOLDIER SYSTEM MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 OLD VS. NEW MARKET ESTIMATES

- FIGURE 4 RESEARCH PROCESS FLOW

- FIGURE 5 SOLDIER SYSTEM MARKET: RESEARCH DESIGN

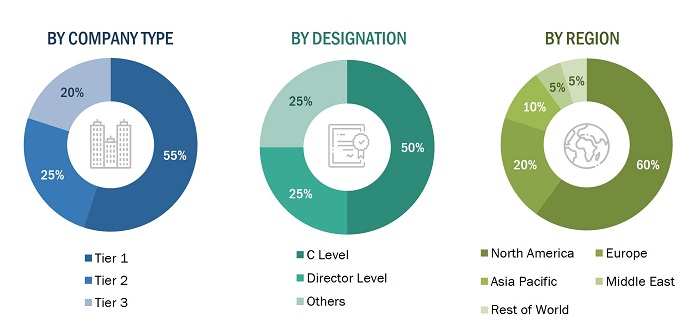

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

- FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- FIGURE 11 MILITARY SEGMENT TO DOMINATE SOLDIER SYSTEM MARKET FROM 2022 TO 2027

- FIGURE 12 TRAINING & SIMULATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 REGIONAL ANALYSIS: SOLDIER SYSTEM MARKET

- FIGURE 14 INCREASING MILITARY MODERNIZATION PROGRAMS TO DRIVE MARKET

- FIGURE 15 MILITARY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 VISION SUBSEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 VISION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

- FIGURE 18 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 SOLDIER SYSTEM MARKET: MARKET DYNAMICS

- FIGURE 20 NUMBER OF CASUALTIES DUE TO TERRORIST ATTACKS WORLDWIDE, 2010–2019

- FIGURE 21 SOLDIER SYSTEM MARKET: REVENUE SHIFT

- FIGURE 22 SOLDIER SYSTEM MARKET: ECOSYSTEM

- FIGURE 23 VALUE CHAIN ANALYSIS: SOLDIER SYSTEM MARKET

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS FOR SOLDIER SYSTEM MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SOLDIER SYSTEM TECHNOLOGIES

- FIGURE 26 SUPPLY CHAIN ANALYSIS OF SOLDIER SYSTEM MARKET

- FIGURE 27 TRAINING & SIMULATION SEGMENT PROJECTED TO GROW AT HIGHEST CAGR BETWEEN 2022–2027 (USD MILLION)

- FIGURE 28 MILITARY SEGMENT TO DOMINATE SOLDIER SYSTEM MARKET FROM 2022 TO 2027

- FIGURE 29 OVERVIEW OF REGIONAL RECESSION IMPACT

- FIGURE 30 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF SOLDIER SYSTEM MARKET IN 2022

- FIGURE 31 NORTH AMERICA: SOLDIER SYSTEM MARKET SNAPSHOT

- FIGURE 32 EUROPE: SOLDIER SYSTEM MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: SOLDIER SYSTEM MARKET SNAPSHOT

- FIGURE 34 MARKET SHARE OF TOP PLAYERS IN SOLDIER SYSTEM MARKET, 2021

- FIGURE 35 MARKET RANKING OF LEADING PLAYERS, 2021

- FIGURE 36 SOLDIER SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2021

- FIGURE 37 SOLDIER SYSTEM MARKET: STARTUP/SME EVALUATION MATRIX, 2021

- FIGURE 38 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 39 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 40 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 41 SAAB AB: COMPANY SNAPSHOT

- FIGURE 42 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 43 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 44 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 45 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 47 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 48 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 51 ULTRA-ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 52 TT ELECTRONICS PLC: COMPANY SNAPSHOT

- FIGURE 53 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

- FIGURE 54 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 55 VIASAT, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for the soldier system market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The soldier system market comprises several stakeholders, such as raw material providers, soldier system manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Soldier system market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the soldier systems market from the demand for such systems and components by end users in each country, and the average cost of integration for both brownfield and greenfield. These calculations led to the estimation of the overall market size.

Market Size Estimation Methodology: Top-down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the soldier system market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Soldier system market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 2)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soldier Systems Market

Interested in this report and access to the knowledge database. Please call 82-2-748-5570 around 4:30pm, Mar.8. Fri. (Korean Time). Thank you.