Personal Protective Equipment Market

Personal Protective Equipment Market by Type (Hand & Arm Protection, Protective Clothing, Foot & Leg Protection), End-use Industry (Manufacturing, Construction, Oil & Gas, Healthcare, Transportation, Firefighting), & Region - Global Forecast to 2030

Updated on : December 16, 2025

PERSONAL PROTECTIVE EQUIPMENT MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

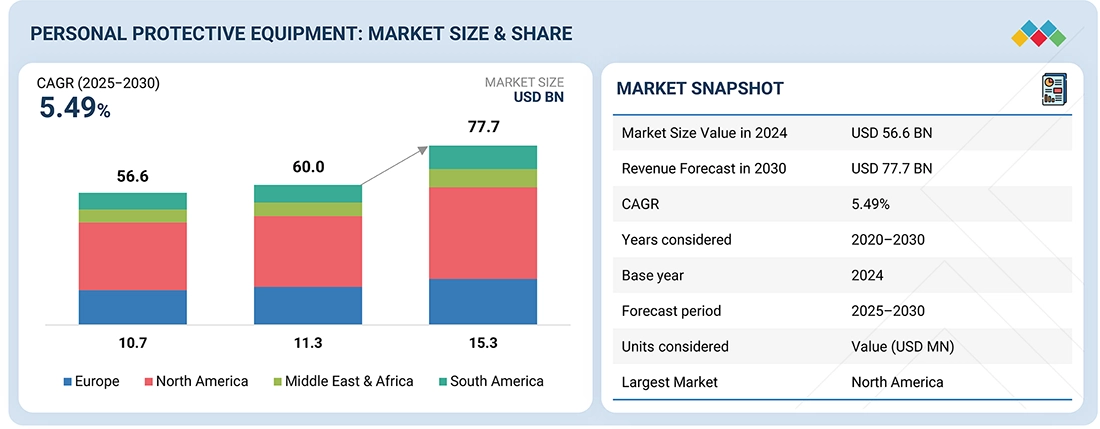

Personal Protective Equipment Market was valued at USD 56.64 billion in 2024 and is projected to reach USD 77.66 billion by 2030, growing at 5.49% cagr from 2025 to 2030. This growth is fueled by the surging demand for protective gear that is more comfortable, multi-functional, and compliant with safety regulations in hazardous industrial environments. Personal protective equipment plays a key role in minimizing contact with dangerous substances, boosting workers’ confidence, and maintaining the efficiency of operations. End-use industries such as construction, manufacturing, oil & gas, healthcare, firefighting, and transportation are supporting market expansion as these industries require high-performance personal protective equipment that can withstand unfavorable temperatures, mechanical dangers, and chemical exposure.

KEY TAKEAWAYS

-

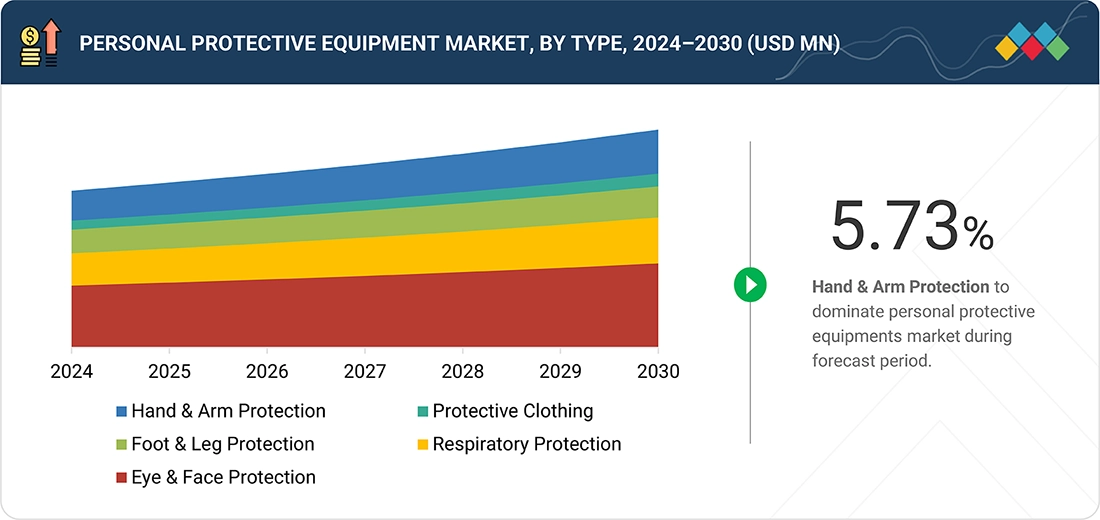

BY TYPEThe personal protective equipment market is segmented into hand & arm protection, protective clothing, foot & leg protection, respiratory protection, eye & face protection, head protection, and other types. Among these, the hand & arm protection segment accounted for the largest market share, in terms of value, in 2024. This dominance is due to the extensive application of hand & arm protection equipment in large industries such as manufacturing, construction, healthcare, and chemical processing. Heavy exposure to mechanical, thermal, and chemical risks in such industries generates demand for gloves, sleeves, and arm guards, rendering this equipment essential for worker safety.

-

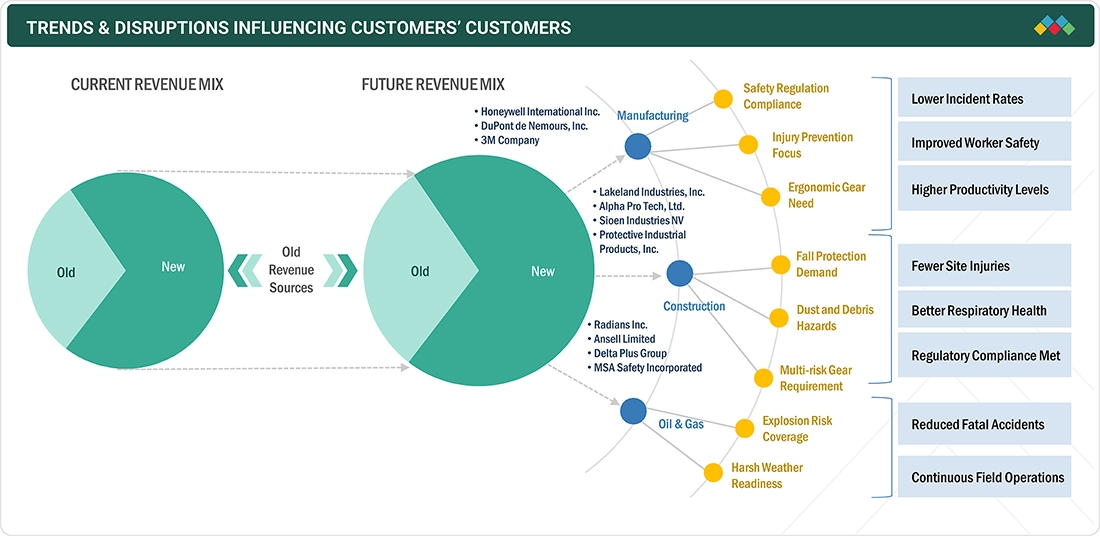

BY END-USE INDUSTRYThe personal protective equipment market is segmented into manufacturing, construction, oil & gas, healthcare, transportation, firefighting, food, and other end-use industries. The manufacturing industry is the largest end-user of the personal protective equipment market. This supremacy is mainly led by the high-risk nature of manufacturing operations, where workers are routinely exposed to hazards such as heavy machinery, chemicals, noise, and particulate matter. Strict regulatory standards, rising focus on worker safety, and operational continuity further contribute to sustained demand for personal protective equipment in this sector. Moreover, the size and complexity of manufacturing operations increase the demand for a broad range of PPE, supporting the industry’s market leadership position.

-

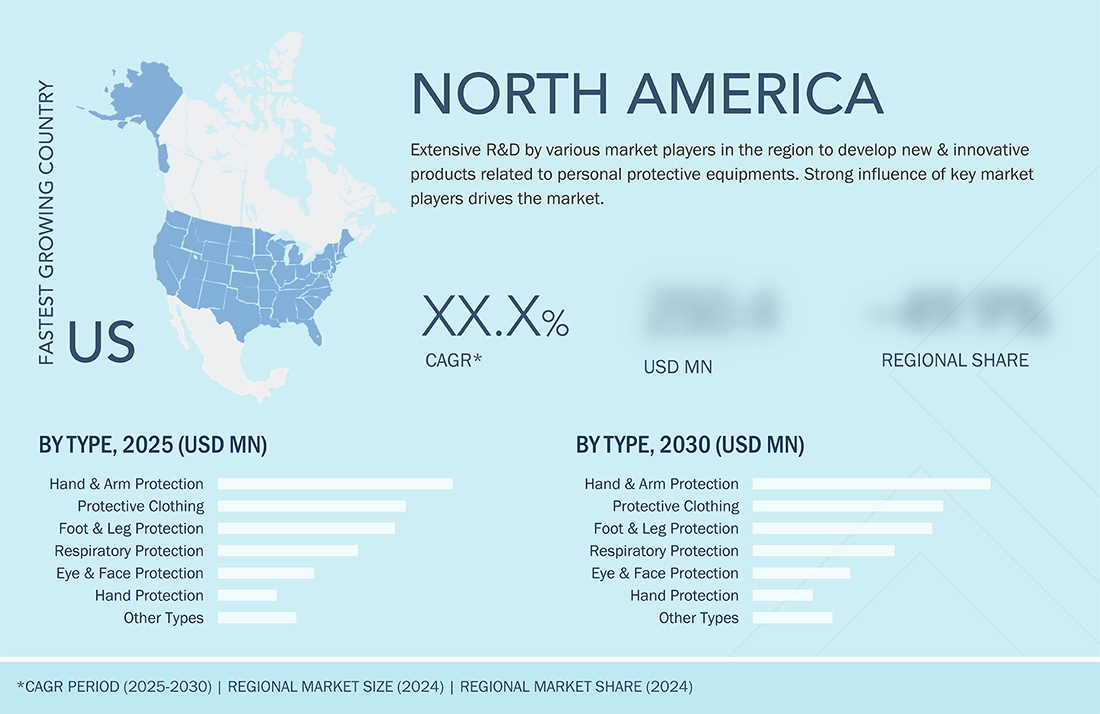

BY REGIONNorth America is the largest market for personal protective equipment and is projected to register a CAGR of 5.28% during the forecast period. This growth is primarily fueled by the strict occupational safety regulations imposed by agencies like OSHA, high consciousness of workplace safety standards, and high demand from major industries like manufacturing, healthcare, construction, and oil & gas. In addition, the presence of major industrial bases and ongoing capacity expansions across key industries continues to underscore North America’s leading position in the global personal protective equipment market.

-

COMPETITIVE LANDSCAPELeading market participants focus on innovation, sustainable product offerings, and strategic partnerships through collaborations, acquisitions, and new product developments. Major players such as Honeywell International Inc., DuPont de Nemours, Inc., Ansell Limited, MSA Safety Incorporated, and 3M Company are expanding their portfolios of personal protective equipment (PPE) to meet the growing demand for high-performance, durable, and eco-friendly safety solutions across industrial, healthcare, construction, and emergency response applications.

The growing popularity of industrial coatings is due to their essential protection, durability, and performance enhancements for equipment, machinery, and infrastructure across various industries. Given businesses’ desire for longer product life and reduced maintenance needs, there is a shift toward highly advanced coatings that resist corrosion, wear, and environmentally harsh conditions. As the world adopts stricter regulations concerning emissions and environmental degradation, firms are transitioning to greener technologies, including the use of waterborne and powder-based coating systems that emit low levels of volatile organic compounds (VOCs).

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the personal protective equipment market arises from evolving workplace safety standards, sustainability initiatives, and material innovation across diverse industries. PPE consumers include manufacturing companies, construction firms, healthcare institutions, oil & gas operators, and defense organizations, all of which depend on PPE for worker protection, operational safety, regulatory compliance, and performance efficiency. Developments such as stricter occupational health and safety regulations (e.g., OSHA, ISO standards), rising demand for eco-friendly and reusable materials, and advancements in smart, ergonomic, and fire-resistant PPE influence procurement decisions, cost structures, and compliance obligations for end users. Consequently, shifts in downstream sectors, including industrial automation, infrastructure growth, and expansion of healthcare and energy industries directly affect PPE demand volumes, product mix, and spending priorities, thereby shaping the strategic direction and innovation focus of PPE manufacturers and suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PERSONAL PROTECTIVE EQUIPMENT MARKET DYNAMICS

Level

-

Rising awareness about importance of workplace safety

-

Stringent regulations in developed countries

Level

-

Increased automation in end-use industries

-

Lack of awareness in developing countries

Level

-

Growing healthcare industry in emerging economies

-

Development of new materials and technologies

Level

-

Need for increased comfort and multi-functionality

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Industrial growth in Asia Pacific and Middle East & Africa

Rapid industrialization in the Asia Pacific and Middle East & Africa is a strong force behind the personal protective equipment market, with growing manufacturing, construction, and energy industries creating increased safety demands. India, China, and Vietnam are among the countries experiencing a boom in industrialization, with foreign direct investments and large-scale infrastructure projects driving labor-intensive industries. In the Middle East & Africa, nations such as Saudi Arabia and the UAE are investing heavily in oil & gas, industrial diversification, and smart cities under initiatives such as Saudi Vision 2030. Such projects increase employee exposure to hazards such as chemical, thermal, and mechanical harm, making the implementation of PPE compulsory. For instance, China’s “Made in China 2025” program focuses on upgrading its manufacturing base, which directly translates into increased safety compliance and PPE use.

Restraint: Lack of awareness in developing countries

Lack of awareness in developing countries remains a significant restraint in the personal protective equipment market, limiting both demand and proper usage. The lack of awareness of PPE can have serious consequences. Workers who are not properly protected from hazards are at increased risk of injury or illness. This can lead to lost productivity, increased healthcare costs, and even death. The International Labour Organization (ILO) reports that approximately 2.93 million workers die each year due to work-related accidents and diseases, underscoring the persistent challenges in safeguarding the health and safety of workers globally.

Opportunity: Development of new materials and technologies

The development of new materials and technologies for PPE is a rapidly growing field. This is due to the increasing demand for PPE, which can provide better protection from a wider range of hazards. Some of the most promising new materials and technologies for PPE includes Graphene which is a single layer of carbon atoms arranged in a hexagonal lattice. It is the strongest and thinnest material known to man. Graphene can be used to make PPE that is lightweight, flexible, and highly resistant to chemicals and radiation. Nanotechnology being controlling manipulation of matter on an atomic and molecular scale. And, Smart textiles which are embedded sensors and other technologies. They can be used to make PPE that monitors the wearer’s health and environment and provides alerts if there is a hazard.

Challenges: Need for increased comfort and multi-functionality

One of the major challenges for personal protective equipment manufacturers is to provide comfortable, multi-functional equipment. Due to the changing nature of applications, customers demand equipment with more functionality. Customers are focusing on acquiring multi-functional personal protective equipment that serves more than one function. To incorporate comfort as a permanent feature in personal protective equipment, new materials are being developed along with innovations in manufacturing techniques. Transporting humid air out of the fabric is the key to maintaining appropriate body temperature. This is expected to fulfill the customer’s desire for comfort in protective clothing and gloves, along with functionality.

Personal Protective Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Respiratory protection spanning disposable, reusable, and powered air-purifying respirators for pharma manufacturing, painting/metalwork, and high particulate or vapor exposure tasks | PAPR and Versaflo systems can integrate respiratory with head, eye, and face protection for comfort and compatibility, with reusable respirators offering up to APF 50 where configured appropriately |

|

Full-line PPE across eyewear, hearing, fall protection, respiratory, head, hand, footwear, first aid, and more for construction, manufacturing, and utilities | Portfolio covers hearing conservation (Howard Leight), fall arrest systems and services (Miller), and integrated safety programs from a single supplier for standardization and training efficiency |

|

Protective apparel for industrial and controlled environments needing breathable particle barriers without fiber shedding, including pharma and clean-manufacturing | Tyvek provides an inherent breathable barrier that does not rely on fragile films, delivering durability and comfort versus SMS or microporous film alternatives to reduce heat stress risk |

|

Chemical-resistant gloves and clothing for handling solvents, acids, and oils in chemical processing, pharma, maintenance, and food contact applications | ANSELL GRIP technology, cut-resistant liners, and specialized polymers deliver secure wet/oily handling with comfort and dexterity while maintaining chemical protection |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PERSONAL PROTECTIVE EQUIPMENT MARKET ECOSYSTEM

The personal protective equipment (PPE) ecosystem encompasses raw material suppliers, component manufacturers, assemblers, distributors, and end users. Raw material suppliers provide specialized fibers, fabrics, polymers, coatings, and filtration materials that form the foundation for PPE such as gloves, masks, suits, and helmets. Component manufacturers and assemblers integrate these materials using advanced fabrication, lamination, and finishing technologies to enhance properties such as flame resistance, chemical protection, breathability, comfort, and durability. Distributors and suppliers bridge PPE producers with critical end-use sectors—including healthcare, manufacturing, construction, oil & gas, defense, and mining ensuring reliable product availability, quality assurance, and regulatory compliance. End users rely on PPE for protection against physical, chemical, thermal, and biological hazards in their workplaces. The overall value chain is shaped by evolving safety standards, sustainability goals, innovations in lightweight and reusable materials, and the integration of smart technologies for enhanced worker safety and monitoring.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PERSONAL PROTECTIVE EQUIPMENT MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Personal Protective Equipments Market, By Type

The respiratory protection segment is estimated to be the second-fastest-growing segment of the personal protective equipment market during the forecast period. This growth is driven by increasing awareness of airborne risks and strict occupational safety standards in major industries. Growth is especially notable in industries like healthcare, manufacturing, construction, and mining, where dust, chemical, fume, and infectious agent exposure is an ever-present danger. Regulatory agencies like OSHA, NIOSH, and their international equivalents are increasingly mandating the use of certified respiratory protective devices, forcing end users to prioritize compliance.

Personal Protective Equipments Market, By End-Use

The manufacturing industry held the largest share of the global personal protective equipment market, in terms of value, in 2024. This is mainly due to the high risk of operation in the industry, where open flames, high temperatures, and heavy mechanical loads increase the risk of accidents and workforce injuries. In operations like grading, excavating, trenching, drilling, blasting, and handling hazardous materials, employees are exposed to severe conditions that require personal protective equipment to facilitate safety, risk management, and uninterrupted operations. As a result, manufacturing companies prefer PPE for compliance with strict workplace safety requirements, reduced downtime, and safeguard workers.

REGION

North America to be largest & region in global personal protective equipments market during forecast period

North America held the largest share of the global personal protective equipment market in 2024 because of robust regulatory compliance, advanced industrial infrastructure, and a robust occupational safety culture. The region’s mature manufacturing, construction, oil & gas, healthcare, and chemical industries consistently need high-quality PPE to comply with stringent safety standards set by regulatory organizations such as OSHA, NIOSH, and ANSI. The US leads the market with its large investments in the protection of employees, particularly in hazardous industries where there is high exposure to physical, chemical, and biological risks.

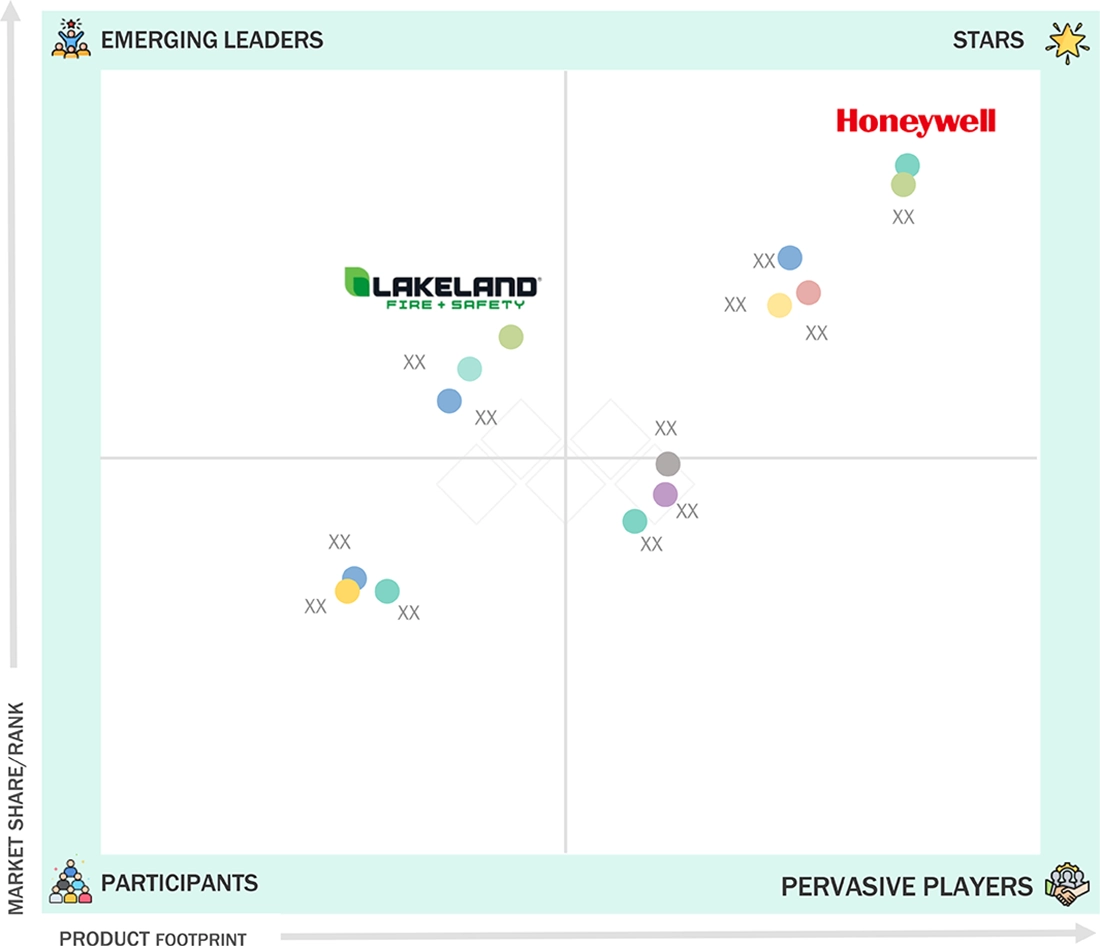

Personal Protective Equipment Market: COMPANY EVALUATION MATRIX

In the personal protective equipment (PPE) market, Honeywell International Inc. leads with a robust global presence and an extensive portfolio of advanced safety solutions, including respiratory protection, industrial helmets, eye and face protection, gloves, and protective clothing. The company’s emphasis on worker safety, comfort, and performance, coupled with its strong commitment to innovation and sustainability, has established it as a trusted partner across industries such as industrial manufacturing, healthcare, oil & gas, construction, and defense. Honeywell’s ongoing R&D investments in lightweight, ergonomic, and connected PPE technologies, such as smart wearables and sensor-integrated safety systems, enhance workplace protection while optimizing user experience and compliance. Through strategic collaborations with industrial clients, safety regulators, and technology providers, Honeywell continues to expand its reach and deliver high-performance, standards-compliant PPE solutions tailored to the evolving demands of modern workplaces.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PERSONAL PROTECTIVE EQUIPMENT MARKET PLAYERS

PERSONAL PROTECTIVE EQUIPMENT MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 56.6 Billion |

| Revenue Forecast in 2030 | USD 77.7 Billion |

| Growth Rate | CAGR of 5.49% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Hand & Arm Protection, Protective clothing, Foot & leg protection, Respiratory protection, Eye & face protection, Head protection, and Other types By End-Use: Manufacturing, Construction, Oil & Gas, Healthcare, Transportation, Firefighting, Food, and Other end-use industries. |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

| Leading Segment | Hand & Arm Protection growing at 5.73% CAGR |

| Leading Region | North America growing at 5.28% CAGR |

| Market Driver | Rising awareness about importance of workplace safety |

| Market Constraint | Increased automation in end-use industries |

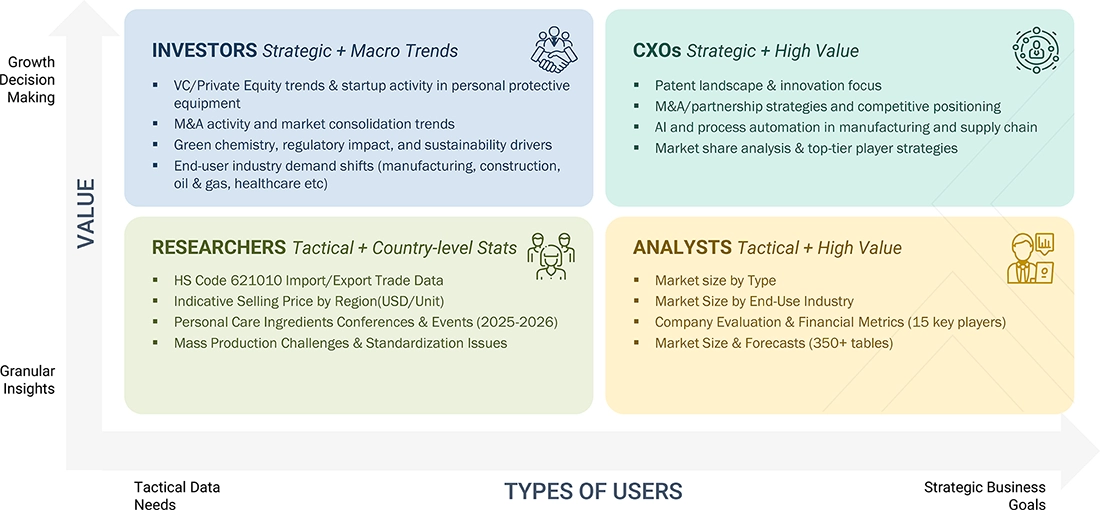

WHAT IS IN IT FOR YOU: Personal Protective Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America-based PPE Distributor |

|

|

| Asia Pacific-based PPE Supplier |

|

|

RECENT DEVELOPMENTS

- July 2024 : Lakeland Industries Inc. acquired LHD Group Deutschland GmbH, along with its subsidiaries in Australia and Hong Kong. This strategic acquisition enhanced Lakeland’s presence in the global PPE market by integrating LHD’s premium firefighter turnout gear and Total Care services, including maintenance and repair.

- May 2022 : Honeywell International Inc. launched two new NIOSH-certified respiratory offerings, DC365 & RU8500X series masks, to help meet the needs of healthcare workers

- May 2022 : 3M Company expanded its plant in Valley, Nebraska. The company is investing approximately USD 58 million to fund the 80,000-square-foot expansion that is expected to create approximately 50 new jobs at the facility

- August 2020 : DuPont de Nemours, Inc. collaborated with Home Depot (US) to donate rolls of Tyvek 1222A to Kaiser Permanente to manufacture PPE products.

Table of Contents

Methodology

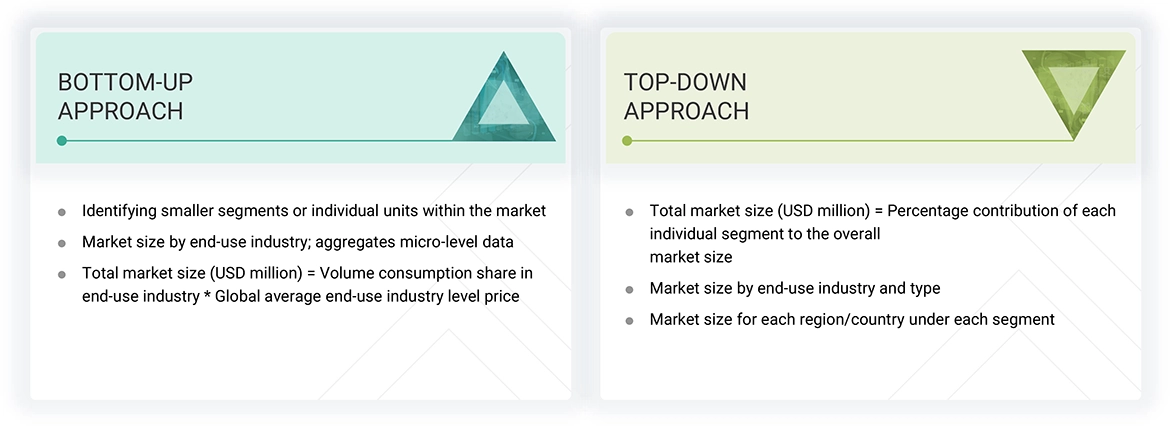

The study involved four major activities in estimating the market size for the personal protective equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

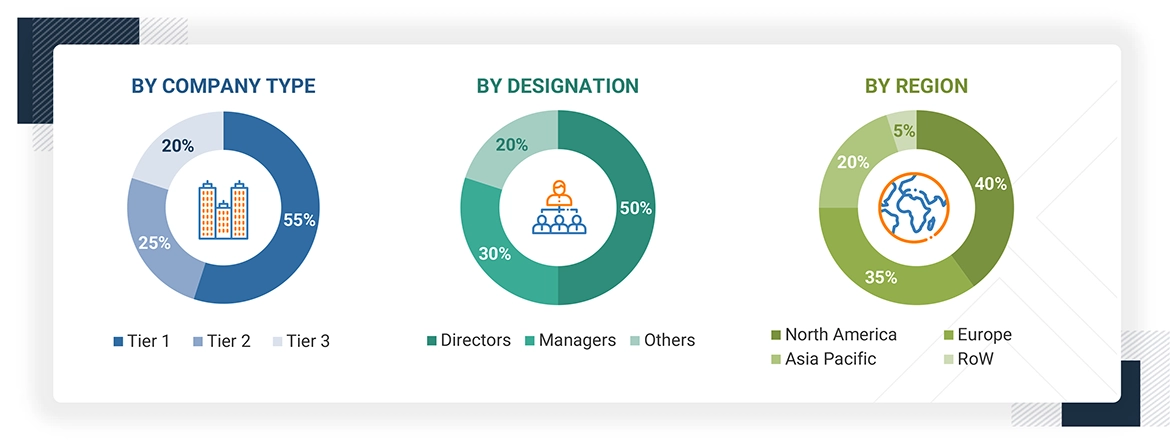

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The personal protective equipment market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the personal protective equipment market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Honeywell International Inc. | Senior Manager | |

| 3M Company | Innovation Manager | |

| DuPont de Nemours, Inc. | Vice-President | |

| Ansell Limited | Production Supervisor | |

| MSA Safety Incorporated | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the personal protective equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Personal Protective Equipment Market: Bottom-up and Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the personal protective equipment industry.

Market Definition

According to the International Safety Equipment Association, personal protective equipment (PPE) is worn to minimize exposure to hazards that can cause serious injuries. PPE protects workers from life-threatening hazards such as chemical burns, explosions, contamination, and falls from heights. It includes gloves, safety glasses and shoes, respirators, earplugs, hard hats, coveralls, and full-body suits. PPE is mainly used in healthcare, manufacturing, construction, oil & gas, mining, transportation, food, and firefighting sectors.

Stakeholders

- Personal protective equipment manufacturers

- Personal protective equipment distributors

- Raw material suppliers

- Service providers

- Government and research organizations

Report Objectives

- To define, describe, and forecast the market size for personal protective equipment in terms of value

- To provide detailed information about drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and forecast the personal protective equipment market by type and end-use industry

- To forecast the market based on key regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To track and analyze recent developments, such as product launches, deals, and other developments, in the market

- To analyze the opportunities for stakeholders in the market and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

Who are the major players in the personal protective equipment market?

The key players include: Honeywell International Inc. (US), 3M Company (US), DuPont de Nemours, Inc. (US), Ansell Limited (Australia), MSA Safety Incorporated (US), Lakeland Industries, Inc. (US), Delta Plus Group (France), Alpha Pro Tech, Ltd. (Canada), Sioen Industries NV (Belgium), Radians, Inc. (US), and Protective Industrial Products, Inc. (US).

What are the drivers and opportunities for the personal protective equipment market?

Major drivers include: Rising awareness about workplace safety, stringent regulations in developed countries, and industrial growth in Asia Pacific and Middle East & Africa. Opportunities include: Growing healthcare industry in emerging economies and the development of new materials and technologies.

Which strategies are the key players focusing on in the personal protective equipment market?

Key strategies include: Product launches, partnerships, collaborations, mergers & acquisitions, agreements, and expansions.

What is the expected growth rate of the personal protective equipment market between 2025 and 2030?

The market is projected to grow at a CAGR of 5.49% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the personal protective equipment market during the forecast period?

Major restraints include: Increased automation in end-use industries and lack of awareness in developing countries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Personal Protective Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Personal Protective Equipment Market