Spray Drying Equipment Market by Type (Rotary Atomizer, Nozzle Atomizer, Fluidized, Centrifugal, Closed Loop), Cycle, Flow Type (Co-Current, Counter Current and Mixed), Operating Principle, Capacity, Drying Stage, Application - Global Forecast to 2027

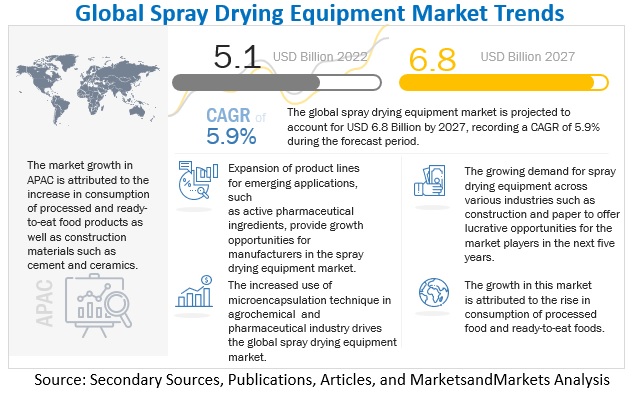

The spray drying equipment market is on the path to steady expansion, with a predicted CAGR of 5.9% in the next few years, propelling its market size to an impressive US$ 6.8 billion by 2027 from an estimated value of US$ 5.1 billion in 2022.This growth is driven by the increasing demand for processed food products and the rise in adoption of spray drying techniques in various industries, such as food, pharmaceuticals, and chemicals. With spray drying offering benefits like longer shelf life, reduced transportation costs, and enhanced product quality, this technology is gaining popularity among manufacturers worldwide. As a result, the market for spray drying equipment is poised to experience significant expansion in the coming years, providing opportunities for players in the industry to innovate and meet the demands of a growing market.

Spray drying equipment is a technology used to convert liquid or slurry-based feedstock into dry powder form. This equipment works by spraying the liquid feedstock into a hot gas stream, evaporating the liquid content and leaving behind the dry powder particles. Spray drying is commonly used in industries such as food, pharmaceuticals, chemicals, and ceramics to produce powdered products with desirable properties such as longer shelf life, improved stability, and increased solubility. Spray drying equipment includes components such as atomizers, dryers, air filters, and cyclones, among others. The market for spray drying equipment is on a steady rise, driven by the increasing demand for processed food products and the adoption of spray drying techniques in various industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: The growing consumption of processed foods and powdered supplements

The changes in consumer lifestyles over the last decade as a result of rapid urbanization have resulted in a high demand for processed and ready-to-eat food products. Consumers' busy lifestyles have been exacerbated by an increase in dual-income levels, living standards, and the demand for convenience have led to the increased consumption of processed food.

As a result, processed food manufacturers are turning to spray-drying technologies for products such as maltodextrin, which acts as a food additive in confectioneries and is widely used in sports and wellness products. The significant increase in demand for maltodextrin has resulted in an increase in the use of spray dryers among food additive manufacturers, which has positively impacted the spray drying equipment market.

Dedert successfully commissioned its latest Spray Drying and Evaporation plant for plant-based protein in June 2022. Dedert provided the specialty protein developed for its solubility functionality by EverGrain (by AB InBev). EverGrain's new protein production facility on AB InBev's St. Louis brewery campus was completed to upcycle grains saved during the brewing process into delicious, nutritious, and environmentally friendly ingredients. These barley-based ingredients can be found in a wide range of foods and beverages.

Restraints: The high installation and operational cost

Spray drying is available at a high cost due to the equipment required and the continuous operation. The primary auxiliary equipment is the same regardless of atomizer type or dryer capacity. Because of the large volume of hot air that circulates in the chamber without contacting the particles, spray dryers typically have low thermal efficiencies. Furthermore, spray dryers with two fluid nozzles require compressed gas for atomization. The high energy and pressure requirements add to the overhead costs. Aside from these factors, spray dryers have high maintenance costs, primarily due to the nozzles used. Rotary disc atomizers suffer from internal corrosion due to the number of moving parts in direct contact with the powders. One fluid and two fluid nozzles are especially prone to clogging and abrasion at the nozzle mouth. Finally, problems with the powder adhering to the internal chamber walls increase cleaning costs and results in added operational cost.

Opportunities: Innovative product development and application in the pharmaceuticals and ceramic industries

Spray drying is one of the most widely used technologies in pharmaceuticals today, primarily to precisely convert a liquid feed into powder while maintaining the active ingredient's purity, morphology, and stability. The most recent spray drying equipment market innovations have expanded the scope of spray-drying techniques in the pharmaceutical industry. One of the new areas of spray drying application is nasal drug delivery. The primary goal of nasal drug delivery is to deposit drug particles in the targeted tissues. A significantly small particle size of less than five micrometers in aerodynamic diameter is required for pulmonary applications of dry powders. Spray drying is a particle engineering technique which makes it possible to address specific needs and design particles accordingly and formulate sensitive APIs such as proteins or peptides.

The constant innovations in the field of spray drying, applications in bioceramics and biodegradable polymer industries are a key factor that is projected to create potential growth opportunities for global spray drying players in the coming years.

Challenges : Infrastructural challenges in developing countries

The saturated markets of developed countries encourage spray drying equipment manufacturers to look for untapped markets and new consumer bases. This necessitates significant investments in various aspects of business expansion, especially the establishment of new facilities in developing countries. Aside from internal facility investments, manufacturers must also spend more on the development of efficient supply chain management and the storage of raw materials and finished goods. Although low raw material and labor costs benefit businesses, the investment costs for infrastructure development pose a significant challenge. As a result, key players in the spray drying equipment market must collaborate with government organizations

In March 2021, The government of South Africa through the Department of Science and Innovation (DSI) awarded R25.9 million to the Council for Scientific and Industrial Research (CSIR) to establish South Africa's first pilot-scale Supercritical CO2 Encapsulation Facility (SCEF), which is expected to be operational in 2022. The facility will address the innovation gap in the industrialization of supercritical CO2-based encapsulation technologies by allowing local small, medium, and micro enterprises (SMMEs) and firms to conduct field trials and investigate market uptake of their technologies. The Supercritical CO2-based encapsulation technology has the distinct advantage of encapsulating sensitive actives used in animal and human health such as probiotics, proteins, and vitamins in an inert environment without exposure to moisture, oxygen, or solvents while operating at low temperatures, thereby preserving the materials' activity. This is critical in providing balanced nutrition for human health and livestock, improving feed digestibility, and reducing overall feed requirements, resulting in cost savings in production.

By spray drying equipment type, flexibility to change the nozzle size as per the requirements of final products encourages preference for nozzle atomizer among customers

In the nozzle atomizer spray dryer, the liquid is pressurized by a pump and forced through an orifice to break the liquid into fine droplets. According to the Journal of Environmental Science and Engineering, 2018, orifice sizes are usually in the range of 0.5–3.0 mm. As a result, the nozzle size is selected based on the amount of feed processed, pressure, viscosity, solid content, and particle size required. The increase in pressure drop across the orifice produces smaller droplets. Therefore, to reduce the particle size of a given feed rate, the nozzle is removed, and a smaller orifice is substituted. This, in turn, requires a higher pump pressure to achieve the same mass flow through the nozzle. The nozzle atomizer spray dryer is primarily used in the food and dairy industries. Although nozzles are considerably less complicated than other systems, they require a high-pressure pump. During the drying of abrasive materials, the nozzles can pose various problems. For instance, the abrasive materials might damage the nozzle surface or cause clogging of orifices.

By application, pharmaceuticals lead the application segment due to their versatility

The spray drying process in the pharmaceutical industry involves continuous production while maintaining consistency in quality. Some pharmaceutical products are produced in crystal form which is difficult to use. Crystalline products do not dissolve easily in water and are absorbed slowly. Therefore, they currently witness low demand due to their bioavailability. Spray dryers dry the crystal compound once it has been dissolved in water for easier absorption. Drugs that are offered in their crystal forms are difficult for the body to use. Therefore, spray dryers make them more readily available and usable for the body. Spray drying can offer commercial and medical advantages with encapsulation as it helps in providing particles with the ability to be controlled in a time-release pattern. The substance is spray-dried and then compressed into a capsule form. The prolonged release of antibiotics allows a reduction in the dosage or concentration and can be effective when treating chronic illnesses.

Another major advantage offered by the spray-dried processing of medicines is that the process used to develop spray-dried products helps reduce vitamin and mineral content loss.

The most recent application of spray dryers in the pharmaceutical industry is witnessed in drug inhalation. Some important drugs that are to be administered through inhalation require the particle size to be maintained at the micro-level. Spray dryers offer the manufacturers to modify the particle size as per their requirements. This technology is expensive and, at present, is used at smaller production scales. The cost of commercially producing directly inhaled drugs is being reviewed so that their overall costs can be reduced.

By source, the closed type has the fastest growth rate during the forecast period

The closed-cycle spray dryer process involves the recycling of the drying gas, which is used to heat the product in the drying chamber and is not emitted into the environment. This type of spray-drying process is preferred when there are environmental issues. The efficiency is also higher in the closed-cycle spray drying process. This type of drying process also absorbs lesser thermal energy and increases the overall quality of the final product. These types of spray dryers are primarily used in the pharmaceutical industry to produce special drugs and vaccines.

In case the product is dissolved or suspended in an organic solvent, or the product is oxygen-sensitive or toxic, a closed cycle spray drying equipment system is used that eliminates the risks of an explosion, emission of products, oxidization of products, and operators’ safety. Explosions caused by inflammable solvents are avoided using inert gases, such as nitrogen or argon, in a sealed system.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

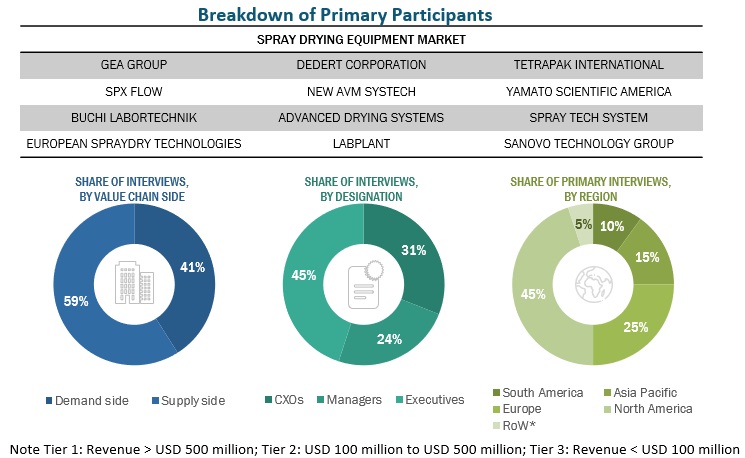

GEA Group (Germany), SPX Flow (US), Shandong Tianli Drying Technology and Equipment (China), Büchi Labortechnik (Switzerland), European Spraydry Technologies (UK), Dedert Corporation (US), Changzhou Lemar Drying Engineering (China), Acmefil Engineering Systems Pvt. Ltd (India), New AVM Systech (India), Advanced Drying Systems (India), Labplant (UK), Swenson Technology, Inc. (US), Yamato Scientific America (US), Tetra Pak International S.A (Switzerland), G Larsson Starch Technology Ab (Sweden).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 5.1 billion |

|

Revenue forecast in 2027 |

USD 6.8 billion |

|

Growth rate |

CAGR of 5.9% |

|

Market size available for years |

2022-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type, Flow Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

GEA Group (Germany), SPX Flow (US), Shandong Tianli Drying Technology and Equipment (China), Büchi Labortechnik (Switzerland), European Spraydry Technologies (UK), Dedert Corporation (US), Changzhou Lemar Drying Engineering (China), Acmefil Engineering Systems Pvt. Ltd (India), New AVM Systech (India), Advanced Drying Systems (India), Labplant (UK), Swenson Technology Inc. (US), Yamato Scientific America (US), Tetra Pak International S.A (Switzerland), G Larsson Starch Technology Ab (Sweden) |

|

Report Highlights |

|

This research report categorizes the spray drying equipment market, based on product type, cycle type, drying stage, flow type, capacity, operating principle, application, and region.

Target Audience:

- Spray drying equipment manufacturers and suppliers

- Intermediate suppliers such as traders and distributors of spray drying equipment

- Government and research organizations

- Technology providers

- Research and development organizations

- Processed food & beverages and pharmaceutical product manufacturers, processors, distributors, and traders

- Specialty chemicals and soap & detergent manufacturers and processors

- Ceramic, agriculture, and industrial dye & paint manufacturers and processors

- Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- Food and Drug Administration (FDA)

- European Food Safety Agency (EFSA)

- Food Processing Suppliers Association (FPSA)

- EUDRALEX (EU)

- International Conference on Harmonization (ICH)

Report Scope:

Spray drying equipment Market:

By Product Type

- Rotary Atomizer

- Nozzle Atomizer

- Fluidized

- Centrifugal

- Other Product Types

By Cycle Type

- Open Cycle

- Closed Cycle

By Drying Stage

- Single Stage

- Two-Stage

- Multi-Stage

By Flow Type

- Co-Current

- Counter Current

- Mixed

By Capacity

- Low Capacity (Less Than 100 Kg/Hr)

- Medium Capacity (100-1000 Kg/Hr)

- High Capacity (More Than 1000 Kg/Hr)

By Operating Principle

- Direct Heating

- Indirect Heating

By Application

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Animal Feed

- Other Applications

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World (RoW)

Recent Developments

- In August 2022, SPX FLOW, Inc. has announced a collaboration with Flottweg to design, supply, install, and commission end-to-end plant-based process solutions for customers in the nutrition, health, food, and beverage industries as a result of the collaboration.

- In June 2022, BÜCHI Labortechnik launched the Mini Spray Dryer S-300. The system is automated to regulates all parameters such as spray gas, drying gas, and pump speed. The instrument also monitors both the outlet and the newly manufactured product temperatures to ensure the ultimate protection of heat-sensitive samples.

- In June 2022, Dedert Corporation announced the successful commissioning of its latest Spray Drying and Evaporation plant for the plant-based protein factory EverGrain. The drying and evaporation technology is used for the specialty protein developed for its solubility functionality.

- In March 2021, Tetra Pak and Rockwell Automation announced a strategic partnership for Cheese and Powder Solutions. The combined business expertise will deliver data and technology to reduce variability and improve quality consistency, assisting in the production of finished products in demand-driven manufacturing environments in a sustainable and cost-effective manner.

Frequently Asked Questions (FAQ):

What is the expected market size for the global spray drying equipment market in the coming years?

The spray drying equipment market is anticipated to witness robust expansion, registering a significant CAGR of 5.9% during the forecast period and surpassing the estimated market value of US$ 5.1 billion in 2022 to reach US$ 6.8 billion by 2027.

What is the estimated growth rate (CAGR) of the global spray drying equipment market for the next five years?

As per the latest market research, the spray drying equipment industry is expected to witness a steady growth trajectory, exhibiting a CAGR of 5.9% in the upcoming year.

What are the major revenue pockets in the spray drying equipment market currently?

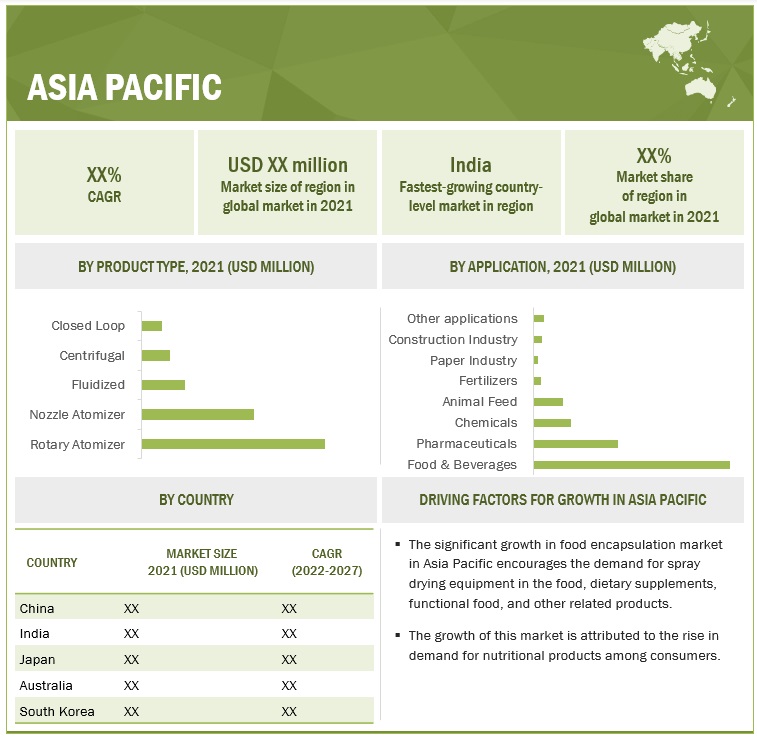

China and Japan accounted for a major market share in the Asia Pacific region. The growth potential of the infant formula and baby food markets in countries such as China, Japan, and India have resulted in an increase in demand for spray drying equipment. In recent years, the Asia Pacific food encapsulation market has grown significantly. Encapsulation is used in food, dietary supplements, functional food, and other products. The rise in consumer demand for nutritional products is attributed to the markets expansion. As the spray drying process is widely used in food encapsulation techniques, the Asia Pacific spray drying equipment market is expected to expand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 SPRAY DRYING EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SPRAY DRYING EQUIPMENT MARKET ESTIMATION, BY SIZE (SUPPLY SIDE)

FIGURE 5 SPRAY DRYING EQUIPMENT MARKET ESTIMATION (DEMAND SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 SPRAY DRYING EQUIPMENT MARKET ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 SPRAY DRYING EQUIPMENT MARKET ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 2 SPRAY DRYING EQUIPMENT MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 ROTARY ATOMIZER SPRAY DRYERS SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

FIGURE 10 FOOD & BEVERAGES SEGMENT TO BE MOST ATTRACTIVE APPLICATION IN 2022

FIGURE 11 CLOSED CYCLE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

FIGURE 12 CO-CURRENT FLOW TYPE TO OCCUPY MAJOR SHARE IN 2022

FIGURE 13 SINGLE-STAGE SEGMENT TO DOMINATE MARKET BY 2027

FIGURE 14 INDIRECT HEATING SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 OPPORTUNITIES IN SPRAY DRYING EQUIPMENT MARKET

FIGURE 16 RISE IN CONSUMPTION OF PROCESSED AND READY-TO-EAT FOODS LED TO INCREASE IN DEMAND FOR SPRAY DRYING EQUIPMENT

4.2 SPRAY DRYING EQUIPMENT MARKET, BY TYPE AND REGION

FIGURE 17 ROTARY ATOMIZER TO DOMINATE SPRAY DRYING EQUIPMENT MARKET IN 2022

4.3 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE AND COUNTRY

FIGURE 18 CHINA TO ACCOUNT FOR LARGEST SHARE IN 2022

4.4 SPRAY DRYING EQUIPMENT MARKET, BY KEY COUNTRY

FIGURE 19 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD FOR SPRAY DRYING EQUIPMENT

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.1.1 MACROECONOMIC INDICATORS

5.1.1.1 Increase in demand for multi-functional equipment

5.1.1.2 Major Companies investing heavily in food & beverages processing equipment

FIGURE 20 PRODUCT-WISE GLOBAL SALES DATA, 2020–2021 (USD BILLION)

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SPRAY DRYING EQUIPMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in consumption of processed and RTE foods

FIGURE 22 INCREASING SALES FOR CONVENIENCE FOODS, 2020 (CHANGE IN SALES)

5.2.1.2 Technological innovations and advancements in spray drying equipment

TABLE 3 VARIOUS APPLICATIONS OF NANO SPRAY DRYING TECHNOLOGY

5.2.1.3 Reduced thermal damage and increased shelf life of final products

5.2.2 RESTRAINTS

5.2.2.1 High installation and operational cost

5.2.2.2 Limited use with sugar-rich products

TABLE 4 GLASS TRANSITION TEMPERATURE OF SUGAR-RICH PRODUCTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in encapsulation applications of food products

TABLE 5 APPLICATIONS OF ENCAPSULATED OILS USING SPRAY DRYING TECHNIQUE IN FUNCTIONAL FOOD PRODUCTS

5.2.3.2 Innovative applications in pharmaceutical and ceramic industries

5.2.4 CHALLENGES

5.2.4.1 Infrastructural challenges in developing countries

5.2.4.2 Low energy efficiency of spray dryers

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 REGISTRATION

6.2.3 MANUFACTURING

6.2.4 DISTRIBUTION

6.2.5 MARKETING AND SALES

6.2.6 POST-SALES SERVICES

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 SPRAY DRYING EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

6.4 MARKET MAPPING AND ECOSYSTEM OF SPRAY DRYING EQUIPMENT MARKET

6.4.1 DEMAND SIDE

6.4.2 SUPPLY-SIDE

FIGURE 25 SPRAY DRYING EQUIPMENT MARKET ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 6 SPRAY DRYING EQUIPMENT MARKET: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN SPRAY DRYING EQUIPMENT MARKET

FIGURE 26 REVENUE SHIFT IMPACTING SPRAY DRYING EQUIPMENT MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 ELECTROSTATIC SPRAY DRYING

6.6.2 AUTOMATION

6.7 PRICING ANALYSIS

6.7.1 SELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF PRODUCT TYPE

FIGURE 27 SELLING PRICE OF KEY PLAYERS FOR SPRAY DRYING EQUIPMENT PRODUCT TYPE

TABLE 7 SELLING PRICE OF KEY PLAYERS FOR PRODUCT TYPE

FIGURE 28 AVERAGE SELLING PRICE IN KEY REGIONS, BY PRODUCT TYPE, 2019–2021 (USD)

TABLE 8 ROTARY ATOMIZER: AVERAGE SELLING PRICE, BY REGION, 2019–2021 (USD)

TABLE 9 NOZZLE ATOMIZER: AVERAGE SELLING PRICE, BY REGION, 2019–2021 (USD)

TABLE 10 FLUIDIZED: AVERAGE SELLING PRICE, BY REGION, 2019–2021 (USD)

TABLE 11 CENTRIFUGAL: AVERAGE SELLING PRICE, BY REGION, 2019–2021 (USD)

TABLE 12 CLOSED LOOP: AVERAGE SELLING PRICE, BY REGION, 2019–2021 (USD)

6.8 SPRAY DRYING EQUIPMENT MARKET: PATENT ANALYSIS

FIGURE 29 NUMBER OF PATENTS GRANTED FOR SPRAY DRYING EQUIPMENT MARKET, 2011–2021

FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 31 TOP PATENT APPLICANTS FOR SPRAY DRYING EQUIPMENT MARKET, 2019–2022

FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SPRAY DRYING EQUIPMENT MARKET, 2019–2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 13 LIST OF FEW PATENTS IN SPRAY DRYING EQUIPMENT MARKET, 2019–2022

6.9 TRADE ANALYSIS: SPRAY DRYING EQUIPMENT MARKET

6.9.1 EXPORT SCENARIO: SPRAY DRYING EQUIPMENT

FIGURE 33 SPRAY DRYING EQUIPMENT EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT DATA OF SPRAY DRYING EQUIPMENT FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.9.2 IMPORT SCENARIO: SPRAY DRYING EQUIPMENT

FIGURE 34 SPRAY DRYING EQUIPMENT IMPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 15 IMPORT DATA OF SPRAY DRYING EQUIPMENT FOR KEY COUNTRIES, 2021 (VALUE)

6.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 16 KEY CONFERENCES AND EVENTS IN SPRAY DRYING EQUIPMENT MARKET

6.11 TARIFF AND REGULATORY LANDSCAPE

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.11.2 REGULATORY FRAMEWORK

6.11.2.1 International organization for standardization

6.11.2.2 North America

6.11.2.2.1 USFDA

6.11.2.3 Europe

6.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 21 SPRAY DRYING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.12.1 DEGREE OF COMPETITION

6.12.2 BARGAINING POWER OF SUPPLIERS

6.12.3 BARGAINING POWER OF BUYERS

6.12.4 THREAT FROM SUBSTITUTES

6.12.5 THREAT FROM NEW ENTRANTS

6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

6.13.2 BUYING CRITERIA

FIGURE 36 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

TABLE 23 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

6.14 CASE STUDIES: SPRAY DRYING EQUIPMENT MARKET

6.14.1 SHACHI ENGINEERING: COLOURTEX

6.14.2 SHACHI ENGINEERING: ZEST AROMA

7 SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 37 SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 24 SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 25 SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

7.2 ROTARY ATOMIZER

7.2.1 ABILITY TO PRODUCE FINE AND SMALL GRANULES FROM COARSE DROPLETS DRIVES MARKET

TABLE 26 ROTARY ATOMIZER: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 ROTARY ATOMIZER: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 NOZZLE ATOMIZER

7.3.1 FLEXIBILITY TO CHANGE NOZZLE SIZE AS PER REQUIREMENTS OF FINAL PRODUCTS ENCOURAGES PREFERENCE FOR NOZZLE ATOMIZER AMONG CUSTOMERS

TABLE 28 NOZZLE ATOMIZER: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 NOZZLE ATOMIZER: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 FLUIDIZED

7.4.1 FLUIDIZED SPRAY DRYERS CONSIDERED TO BE SUITABLE FOR HEAT-SENSITIVE PRODUCTS

TABLE 30 FLUIDIZED SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 FLUIDIZED SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 CENTRIFUGAL

7.5.1 CENTRIFUGAL SPRAY DRYERS USED TO REDUCE DRYING TIME OF FINAL POWDERED PRODUCTS

TABLE 32 CENTRIFUGAL SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 CENTRIFUGAL SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 CLOSED LOOP

7.6.1 SAFE APPLICATION OF CLOSED LOOP SPRAY DRYERS IN MANUFACTURING OF FLAMMABLE AND TOXIC PRODUCTS TO DRIVE MARKET

TABLE 34 CLOSED LOOP SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 CLOSED LOOP SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

TABLE 36 SOME PATENTS FOR SPRAY DRYING TECHNOLOGY IN VARIOUS SEGMENTS

FIGURE 38 SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 37 SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 38 SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 FOOD & BEVERAGES

8.2.1 INCREASE IN ENCAPSULATION TECHNIQUE FOR DEVELOPMENT OF FOOD FORMULATION TO DRIVE DEMAND IN FOOD INDUSTRY

TABLE 39 FOOD & BEVERAGES: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 FOOD & BEVERAGES: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PHARMACEUTICALS

8.3.1 ADOPTION OF NOVEL DRUG ENCAPSULATION TO DRIVE DEMAND FOR SPRAY DRYING

TABLE 41 PHARMACEUTICALS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 42 PHARMACEUTICALS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 CHEMICALS

8.4.1 PRODUCTION OF DYES USED IN FABRICS AND METAL INDUSTRIES DRIVES DEMAND FOR SPRAY DRYING EQUIPMENT

TABLE 43 CHEMICALS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 CHEMICALS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 ANIMAL FEED

8.5.1 SPRAY DRYING EQUIPMENT USED TO PRODUCE COARSE GRAIN FOR FEED PRODUCTS BY TAKING OUT MOISTURE FROM LIQUID FEEDS

TABLE 45 ANIMAL FEED: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 ANIMAL FEED: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 FERTILIZERS

8.6.1 INCREASED SOLUBILITY OF FOLIAR FERTILIZER WITH HELP OF SPRAY DRYING DRIVES MARKET

TABLE 47 FERTILIZERS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 FERTILIZERS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 PAPER INDUSTRY

8.7.1 APPLICATION OF SPRAY DRYERS FOR WASTEWATER FREE PAPER PRODUCTION DRIVES MARKET

TABLE 49 PAPER INDUSTRY: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 PAPER INDUSTRY: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 CONSTRUCTION INDUSTRY

8.8.1 USE OF ROTARY ATOMIZER SPRAY DRYING EQUIPMENT IN CEMENT PRODUCTION TO DRIVE MARKET

TABLE 51 CONSTRUCTION INDUSTRY: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 CONSTRUCTION INDUSTRY: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHER APPLICATIONS

TABLE 53 OTHER APPLICATIONS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 OTHER APPLICATIONS: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY (Page No. - 115)

9.1 INTRODUCTION

FIGURE 39 SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022 VS. 2027 (USD MILLION)

TABLE 55 SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 56 SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

9.2 LOW CAPACITY (LESS THAN 100 KG/HR)

9.2.1 COST-EFFECTIVENESS OF LOW-CAPACITY SPRAY DRYERS FOR USE IN R&D LABORATORIES DRIVES MARKET

TABLE 57 LOW CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 LOW CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MEDIUM CAPACITY (100–1,000 KG/HR)

9.3.1 HIGH RETURN ON INVESTMENT IN LONG TERM ENCOURAGES SMALL-SCALE PROCESSED FOOD & BEVERAGES MANUFACTURERS TO USE MEDIUM CAPACITY SPRAY DRYERS

TABLE 59 MEDIUM CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 MEDIUM CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HIGH CAPACITY (MORE THAN 1,000 KG/HR)

9.4.1 HIGH INVESTMENT RETURN AND OUTPUT TO DRIVE GROWTH IN CONSTRUCTION INDUSTRY

TABLE 61 HIGH CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 HIGH CAPACITY SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10 SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE (Page No. - 120)

10.1 INTRODUCTION

FIGURE 40 SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 63 SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2017–2021 (USD MILLION)

TABLE 64 SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022–2027 (USD MILLION)

10.2 OPEN CYCLE

10.2.1 COST-EFFECTIVENESS FINDS APPLICATION IN MAJORITY OF NON-REACTIVE PRODUCTS

TABLE 65 OPEN CYCLE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 OPEN CYCLE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 CLOSED CYCLE

10.3.1 PRECISE SPRAY DRYING OF HEAT-SENSITIVE AND REACTIVE SUBSTANCES DRIVES MARKET

TABLE 67 CLOSED CYCLE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 CLOSED CYCLE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

11 SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE (Page No. - 125)

11.1 INTRODUCTION

FIGURE 41 SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022 VS. 2027 (USD MILLION)

TABLE 69 SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2017–2021 (USD MILLION)

TABLE 70 SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022–2027 (USD MILLION)

11.2 SINGLE-STAGE

11.2.1 MILK POWDERS AND PRODUCTS REQUIRING HIGH HEAT FOR DRYING INCREASE DEMAND

TABLE 71 SINGLE-STAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 SINGLE-STAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 TWO-STAGE

11.3.1 TWO-STAGE SPRAY DRYERS USE FLUID BED TO RETAIN SOME MOISTURE IN FINAL DRIED PRODUCTS

TABLE 73 TWO-STAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 TWO-STAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 MULTISTAGE

11.4.1 PRODUCTS DERIVED FROM OILS AND DISPERSION LIQUIDS REQUIRING MORE THAN ONE STAGE TO OBTAIN DESIRED DRYNESS ENCOURAGE DEMAND

TABLE 75 MULTISTAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 MULTISTAGE: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

12 SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE (Page No. - 131)

12.1 INTRODUCTION

FIGURE 42 SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 77 SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2017–2021 (USD MILLION)

TABLE 78 SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022–2027 (USD MILLION)

12.2 CO-CURRENT

12.2.1 ABILITY TO REDUCE THERMAL DEGRADATION OF FINAL PRODUCT INCREASES DEMAND FOR CO-CURRENT SPRAY DRYERS

TABLE 79 CO-CURRENT SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 80 CO-CURRENT SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 COUNTER-CURRENT

12.3.1 PRODUCTION OF DETERGENTS AND CERAMICS FOR IMPROVED HEAT UTILIZATION TO SAVE ENERGY COSTS

TABLE 81 COUNTER-CURRENT SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 82 COUNTER-CURRENT SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 MIXED

12.4.1 MIXED FLOW SPRAY DRYERS USE BOTH COUNTER-CURRENT AND CO-CURRENT MECHANISMS TO OBTAIN MAXIMUM DRYING OF FINAL PRODUCT

TABLE 83 MIXED SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 84 MIXED SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

13 SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE (Page No. - 137)

13.1 INTRODUCTION

FIGURE 43 SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022 VS. 2027 (USD MILLION)

TABLE 85 SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2017–2021 (USD MILLION)

TABLE 86 SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022–2027 (USD MILLION)

13.2 DIRECT HEATING

13.2.1 HIGH EFFICIENCY OF DIRECT HEATING MAKES IT PREFERABLE FOR NON-SENSITIVE BY-PRODUCTS

TABLE 87 DIRECT HEATING: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 88 DIRECT HEATING: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 INDIRECT HEATING

13.3.1 REDUCTION OF CONTAMINANTS IN FOOD, FEED, AND PHARMACEUTICAL PRODUCTS THROUGH APPLICATION OF INDIRECT HEATING DRIVES MARKET

TABLE 89 INDIRECT HEATING: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 90 INDIRECT HEATING: SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

14 SPRAY DRYING EQUIPMENT MARKET, BY REGION (Page No. - 141)

14.1 INTRODUCTION

FIGURE 44 SPRAY DRYING EQUIPMENT MARKET SHARE (VALUE), BY KEY COUNTRY, 2022

TABLE 91 SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 92 SPRAY DRYING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA SPRAY DRYING EQUIPMENT MARKET: SNAPSHOT

TABLE 93 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2017–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2017–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2017–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2017–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.2.1 US

14.2.1.1 Increase in use of spray drying technology in food & beverages industry to drive market

TABLE 109 US: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 110 US: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.2.2 CANADA

14.2.2.1 Use of spray drying equipment in drug and pharmaceutical industry in Canada for production of powdered drugs and medicines

TABLE 111 CANADA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 112 CANADA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.2.3 MEXICO

14.2.3.1 Production of milk concentrates to drive growth of spray drying equipment market in Mexico

TABLE 113 MEXICO: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 114 MEXICO: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

TABLE 115 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 116 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 118 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2017–2021 (USD MILLION)

TABLE 120 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2017–2021 (USD MILLION)

TABLE 122 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2017–2021 (USD MILLION)

TABLE 124 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2017–2021 (USD MILLION)

TABLE 126 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 128 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 129 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 130 EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Innovation to reduce energy and production costs of powdered products in spray drying technologies to drive market

TABLE 131 GERMANY: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 132 GERMANY: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3.2 FRANCE

14.3.2.1 High demand for cosmetics powders across regions to drive growth

TABLE 133 FRANCE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 134 FRANCE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3.3 UK

14.3.3.1 Production of coffee mixes to cater to requirements of customers to drive demand for spray drying equipment in market

TABLE 135 UK: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE,2017–2021 (USD MILLION)

TABLE 136 UK: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3.4 ITALY

14.3.4.1 Use of spray drying equipment for production of customized set of APIs in pharmaceutical sector offers growth potential for manufacturers

TABLE 137 ITALY: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 138 ITALY: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Increased investments in establishment of spray dryer plants across ceramic and pharmaceutical industry to drive growth

TABLE 139 SPAIN: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 140 SPAIN: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.3.6 REST OF EUROPE

TABLE 141 REST OF EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 142 REST OF EUROPE: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC SPRAY DRYING EQUIPMENT MARKET: SNAPSHOT

TABLE 143 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2017–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2017–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2017–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2017–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.4.1 CHINA

14.4.1.1 High demand for baby foods among domestic consumers to drive market growth in China

TABLE 159 CHINA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 160 CHINA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4.2 JAPAN

14.4.2.1 Expansion of Japanese dairy industry to drive market growth

TABLE 161 JAPAN: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 162 JAPAN: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4.3 INDIA

14.4.3.1 Increased consumption of processed and RTE foods placed India among emerging regions

TABLE 163 INDIA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 164 INDIA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4.4 SOUTH KOREA

14.4.4.1 Development of spray drying labs in industrial and chemical sectors to drive demand for spray drying equipment

TABLE 165 SOUTH KOREA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 166 SOUTH KOREA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4.5 AUSTRALIA

14.4.5.1 Spray drying equipment witnesses high demand in resins and polymers industries

TABLE 167 AUSTRALIA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 168 AUSTRALIA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.4.6 REST OF ASIA PACIFIC

TABLE 169 REST OF ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.5 REST OF THE WORLD

TABLE 171 ROW: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 172 ROW: SPRAY DRYING EQUIPMENT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 173 ROW: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 174 ROW: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 175 ROW: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2017–2021 (USD MILLION)

TABLE 176 ROW: SPRAY DRYING EQUIPMENT MARKET, BY DRYING STAGE, 2022–2027 (USD MILLION)

TABLE 177 ROW: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2017–2021 (USD MILLION)

TABLE 178 ROW: SPRAY DRYING EQUIPMENT MARKET, BY CYCLE TYPE, 2022–2027 (USD MILLION)

TABLE 179 ROW: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2017–2021 (USD MILLION)

TABLE 180 ROW: SPRAY DRYING EQUIPMENT MARKET, BY OPERATING PRINCIPLE, 2022–2027 (USD MILLION)

TABLE 181 ROW: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2017–2021 (USD MILLION)

TABLE 182 ROW: SPRAY DRYING EQUIPMENT MARKET, BY FLOW TYPE, 2022–2027 (USD MILLION)

TABLE 183 ROW: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2017–2021 (USD MILLION)

TABLE 184 ROW: SPRAY DRYING EQUIPMENT MARKET, BY CAPACITY, 2022–2027 (USD MILLION)

TABLE 185 ROW: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 186 ROW: SPRAY DRYING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.5.1 SOUTH AMERICA

14.5.1.1 Increase in consumption of dairy products to offer growth potential for spray drying equipment manufacturers in this sector

TABLE 187 SOUTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 188 SOUTH AMERICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.5.2 MIDDLE EAST

14.5.2.1 Increase in consumption of convenience food and processed food products to drive market

TABLE 189 MIDDLE EAST: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 190 MIDDLE EAST: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

14.5.3 AFRICA

14.5.3.1 Use of spray drying equipment to produce agrochemicals drives growth in food industry

TABLE 191 AFRICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 192 AFRICA: SPRAY DRYING EQUIPMENT MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 185)

15.1 OVERVIEW

15.2 MARKET SHARE ANALYSIS

TABLE 193 SPRAY DRYING EQUIPMENT MARKET SHARE (CONSOLIDATED)

15.3 KEY PLAYER STRATEGIES

15.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2019–2021 (USD MILLION)

15.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

15.5.1 STARS

15.5.2 PERVASIVE PLAYERS

15.5.3 EMERGING LEADERS

15.5.4 PARTICIPANTS

FIGURE 48 SPRAY DRYING EQUIPMENT MARKET, COMPANY EVALUATION QUADRANT, 2022 (OVERALL MARKET)

15.5.5 PRODUCT FOOTPRINT

TABLE 194 COMPANY BY PRODUCT SOURCE FOOTPRINT

TABLE 195 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 196 COMPANY REGIONAL FOOTPRINT

TABLE 197 OVERALL COMPANY FOOTPRINT

15.6 SPRAY DRYING EQUIPMENT MARKET, STARTUP/SME EVALUATION QUADRANT

15.6.1 PROGRESSIVE COMPANIES

15.6.2 STARTING BLOCKS

15.6.3 RESPONSIVE COMPANIES

15.6.4 DYNAMIC COMPANIES

FIGURE 49 SPRAY DRYING EQUIPMENT MARKET, COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

15.6.5 COMPETITIVE BENCHMARKING

TABLE 198 SPRAY DRYING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUP/SME

TABLE 199 SPRAY DRYING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME

15.7 COMPETITIVE SCENARIO

15.7.1 PRODUCT LAUNCHES

TABLE 200 SPRAY DRYING EQUIPMENT MARKET: PRODUCT LAUNCHES, JULY 2019–JUNE 2022

15.7.2 DEALS

TABLE 201 SPRAY DRYING EQUIPMENT MARKET: DEALS, FEBRUARY 2019–AUGUST 2022

TABLE 202 SPRAY DRYING EQUIPMENT MARKET: OTHERS, DECEMBER 2018–JANUARY 2022

16 COMPANY PROFILES (Page No. - 200)

16.1 GEA GROUP

(Business overview, Products offered, Recent developments, Deals, MNM view, Key strengths, Strategic undertaken, and Weaknesses and competitive threats)*

TABLE 203 GEA GROUP: BUSINESS OVERVIEW

FIGURE 50 GEA GROUP: COMPANY SNAPSHOT

TABLE 204 GEA GROUP: DEALS

TABLE 205 GEA GROUP: OTHERS

16.2 SPX FLOW

TABLE 206 SPX FLOW: BUSINESS OVERVIEW

FIGURE 51 SPX FLOW: COMPANY SNAPSHOT

TABLE 207 SPX FLOW: DEALS

16.3 SHANDONG TIANLI DRYING TECHNOLOGY AND EQUIPMENT

TABLE 208 SHANDONG TIANLI DRYING TECHNOLOGY AND EQUIPMENT: BUSINESS OVERVIEW

16.4 BÜCHI LABORTECHNIK

TABLE 209 BÜCHI LABORTECHNIK: BUSINESS OVERVIEW

TABLE 210 BÜCHI LABORTECHNIK: PRODUCT LAUNCHES

TABLE 211 BÜCHI LABORTECHNIK: OTHERS

16.5 EUROPEAN SPRAYDRY TECHNOLOGIES

TABLE 212 EUROPEAN SPRAYDRY TECHNOLOGIES: BUSINESS OVERVIEW

16.6 TETRA PAK INTERNATIONAL S.A.

TABLE 213 TETRA PAK INTERNATIONAL S.A.: BUSINESS OVERVIEW

TABLE 214 TETRA PAK INTERNATIONAL S.A.: DEALS

16.7 DEDERT CORPORATION

TABLE 215 DEDERT CORPORATION: BUSINESS OVERVIEW

TABLE 216 DEDERT CORPORATION: DEALS

16.8 CHANGZHOU LEMAR DRYING ENGINEERING

TABLE 217 CHANGZHOU LEMAR DRYING ENGINEERING: BUSINESS OVERVIEW

16.9 ACMEFIL ENGINEERING SYSTEMS PVT. LTD

TABLE 218 ACMEFIL ENGINEERING SYSTEMS PVT. LTD.: BUSINESS OVERVIEW

16.10 NEW AVM SYSTECH

TABLE 219 NEW AVM SYSTECH: BUSINESS OVERVIEW

16.11 ADVANCED DRYING SYSTEMS

TABLE 220 ADVANCED DRYING SYSTEMS: BUSINESS OVERVIEW

16.12 LABPLANT

TABLE 221 LABPLANT: BUSINESS OVERVIEW

16.13 SWENSON TECHNOLOGY, INC.

TABLE 222 SWENSON TECHNOLOGY, INC.: BUSINESS OVERVIEW

16.14 YAMATO SCIENTIFIC AMERICA

TABLE 223 YAMATO SCIENTIFIC AMERICA: BUSINESS OVERVIEW

TABLE 224 YAMATO SCIENTIFIC AMERICA: OTHERS

16.15 G LARSSON STARCH TECHNOLOGY AB

TABLE 225 G LARSSON STARCH TECHNOLOGY AB: BUSINESS OVERVIEW

TABLE 226 G LARSSON STARCH TECHNOLOGY AB: DEALS

16.16 HEMRAJ ENGINEERING (INDIA) LLP

TABLE 227 HEMRAJ ENGINEERING (INDIA) LLP: BUSINESS OVERVIEW

TABLE 228 HEMRAJ ENGINEERING (INDIA) LLP: DEALS

16.17 SAKA ENGINEERING SYSTEMS PRIVATE LIMITED

TABLE 229 SAKA ENGINEERING SYSTEMS PVT. LTD.: BUSINESS OVERVIEW

16.18 FREUND VECTOR CORPORATION

TABLE 230 FREUND VECTOR CORPORATION: BUSINESS OVERVIEW

16.19 SANOVO TECHNOLOGY GROUP

TABLE 231 SANOVO TECHNOLOGY GROUP: BUSINESS OVERVIEW

16.20 SICCADANIA GROUP

TABLE 232 SICCADANIA GROUP: BUSINESS OVERVIEW

TABLE 233 SICCADANIA GROUP: DEALS

16.21 RAJ PROCESS EQUIPMENT AND SYSTEMS PRIVATE LTD.

16.22 SHACHI ENGINEERING

16.23 SPRAY TECH SYSTEMS

16.24 SHREE SAI EQUIPMENT & SERVICES

16.25 SHANGHAI PILOTECH INSTRUMENT & EQUIPMENT CO. LTD.

*Details on Business overview, Products offered, Recent developments, Deals, MNM view, Key strengths, Strategic undertaken, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 ADJACENT MARKETS (Page No. - 245)

17.1 INTRODUCTION

17.2 LIMITATIONS

17.3 DAIRY PROCESSING EQUIPMENT MARKET

17.3.1 MARKET DEFINITION

17.3.2 MARKET OVERVIEW

17.3.3 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE

TABLE 234 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 235 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

17.3.4 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION

TABLE 236 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 237 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

17.4 BEVERAGE PROCESSING EQUIPMENT MARKET

17.4.1 MARKET DEFINITION

17.4.2 MARKET OVERVIEW

17.4.3 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE

TABLE 238 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE, 2017–2025 (USD MILLION)

17.4.4 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

TABLE 239 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2017–2025 (USD MILLION)

18 APPENDIX (Page No. - 251)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 CUSTOMIZATION OPTIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the spray drying equipment market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Food and Agriculture Organization (FAO), Food Processing Suppliers Association (FPSA), EUDRALEX (EU), and International Conference on Harmonization (ICH), were referred to identify and collect information for this study. The secondary sources also included spray drying equipment manufacturers’ annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders, which include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include manufacturers of food & beverage products, animal feed, agricultural fertilizers, pharmaceuticals, and energy, as well as research institutions involved in R&D activities and government agencies. The primary sources from the supply side include spray drying equipment manufacturers, suppliers, distributors, importers, and exporters.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the spray drying equipment market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer markets were also considered to validate further the market details of spray drying equipment.

-

Bottom-up approach:

- The market size was analyzed based on the share of each type of spray drying equipment and its application at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include the penetration rate of spray drying equipment in distinguished application sectors, such as food & beverages, feed, agriculture, pharmaceuticals, cosmetics, personal care, and ceramics; function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the spray drying equipment market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The following sections (bottom-up and top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall spray drying equipment market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for spray drying equipment market based on product type, cycle type, drying stage, flow type, capacity, operating principle, application, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the spray drying equipment market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe’s spray drying equipment market, by key country

- Further breakdown of the spray drying equipment market for food application by region

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Spray Drying Equipment Market