Text Analytics Market by Component (Software, Services), Application (Customer Experience Management, Marketing Management, Governance, Risk and Compliance Management), Deployment Model, Organization Size, Industry Vertical, Region - Global Forecast to 2022

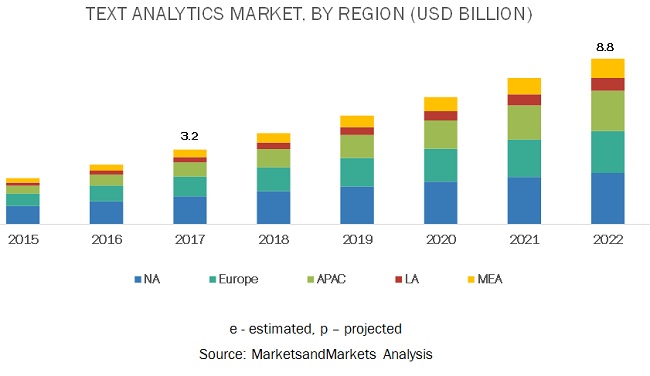

[155 Pages Report] The text analytics market projected to grow from $3.2 billion in 2016 To $8.8 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 17.2% during the forecast period. The major growth drivers of the market include the growing need for social media analytics, and increasing need of predictive analytics for businesses.

Key Market Dynamics in Text Analytics Market

Predictive analytics for businesses

Predictive analytics would continue to experience a significant growth and remain as one of the major factors driving the overall growth of the text analytics market, considering the disruptive evolution of Internet of Things (IoT) and big data technologies. By making use of the historical data, statistical algorithms, and Machine-to-Machine (M2M) learning, predictive analytics identifies the future outcomes and builds predictive models. The leading companies have come to learn that, by adding powerful text analytics software to their existing operations, they would be able to directly combine all these components, to map a large scale of data sets and incorporate valuable third-party data to improve the analysis and outcomes. This would further help companies improve the predictive models’ output by visually representing the outcomes and applying detailed processing and rich data visualization tools to visually witness outcomes and scenarios. Text analytics enables predictive analytics with accurate analysis of sentiment data, which might reveal spatial dependencies or trends that might be difficult to discover otherwise. The text analytics solutions assist users in taking imperative business decisions by analyzing the current data as well as the historic data to predict the future outcomes. Owing to such factors, the demand for predictive analytics among businesses is expected to be a huge driving factor for the text analytics market.

Lack of awareness, skilled workforce, and other operational challenges

Creating awareness among the end-users on how text analytics can turn large chunks of data into valuable information is directly responsible for increasing the overall adoption of text analytics. Limited text analytics software vendors have their presence in the market, offering text analytics solutions to analyze big data due to its complexities. With the advancement in technologies, software nowadays offers big data analytics and allows real-time analysis with a user-friendly interface. Text-based content still constitutes to a major chunk of information available within as well as outside the organizational boundaries. Text analytics, combined with big data, would assist organizations to analyze the vital information essential to an organization’s decision-making abilities, which may have remained unexplored until now. Awareness of the basic principles of location analytics and its benefits are expected to spur the customers’ interest toward the technology and increase the adoption of location analytics software and services, mainly in the developing economies of APAC and Latin America. However, most of the organizations that use text analytics struggle to fully utilize their potential, as they lack the expertise and skilled technicians who can handle and deal with digital data and multilingual capabilities. Lack of appropriate knowledge and awareness may hinder the future growth of this market.

Among verticals, the healthcare and life sciences segment to grow at the highest CAGR during the forecast period

Text analytics is segmented on the basis of verticals. The industry verticals include BFSI, telecommunication & IT, retail and ecommerce, healthcare and life sciences, manufacturing, government and defense, energy and utilities, media and entertainment, travel and hospitality, and others (education, research, construction & outsourcing). The healthcare and life sciences segment is the fastest growing segment in the text analytics market due to the growing demand to tackle big data and deliver valuable insights from it.

Among applications, governance, risk and compliance management to grow at a rapid pace during the forecast period

Based on applications, the market is segmented into customer experience management, marketing management, governance, risk and compliance management, document management, workforce management and others comprising of fraud detection and supply chain management. Among these, customer experience management is expected to dominate the market owing to increased prevalence to incorporate customer views about products and services to enhance business. However, governance, risk and compliance management application is expected to grow at the highest CAGR with increasing applications in BFSI, retail and e-commerce and telecommunications and IT and government sectors to meet federal regulations.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global text analytics market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. In APAC, the highest growth rate can be attributed to the growing technological investment among emerging countries. resulting in an increased demand for text analytics solutions used for automating the maintenance and plant safety process.

North America is expected to be the leading region in terms of adopting and developing text analytics. The rising investments in emerging technologies such as IoT, AI, ML, the increasing presence of text analytics vendors, and growing government support for regulatory compliance are the major factors expected to contribute to the market growth during the forecast period.

Key market players

Major vendors in the global text analytics market include SAP SE (Walldorf, Germany), International Business Machines Corporation (New York, U.S.), SAS Institute, Inc. (North Carolina, U.S.), OpenText Corporation (Ontario, Canada), Clarabridge, Inc. (Virginia, U.S.), Megaputer Intelligence, Inc. (Indiana, U.S.), Luminoso Technologies, Inc. (Massachusetts, U.S.), MeaningCloud LLC (New York, U.S.), KNIME.com AG (Zurich, Switzerland), Infegy, Inc. (Missouri, U.S.), Lexalytics, Inc. (Massachusetts, U.S.), and Averbis (Freiburg Germany). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global text analytics market further.

SAP SE was founded in 1972, and is headquartered in Germany. With the presence across the globe, SAP is a prominent player in the enterprise application software. Energy and natural resources, discrete manufacturing, consumer, public services, financial services, and professional services are the key industry verticals served by SAP’s innovative and advanced solutions. The company has its presence in Asia, Europe, MEA, North and Central America, South America, and South Pacific. The company has strong focus on R&D and it holds more than 6,800 validated patents across the world.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Components (Software, Services), Applications, Deployment Modes, Organization Size, Industry Verticals and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

SAP SE (Walldorf, Germany), International Business Machines Corporation (New York, U.S.), SAS Institute, Inc. (North Carolina, U.S.), OpenText Corporation (Ontario, Canada), Clarabridge, Inc. (Virginia, U.S.), Megaputer Intelligence, Inc. (Indiana, U.S.), Luminoso Technologies, Inc. (Massachusetts, U.S.), MeaningCloud LLC (New York, U.S.), KNIME.com AG (Zurich, Switzerland), Infegy, Inc. (Missouri, U.S.), Lexalytics, Inc. (Massachusetts, U.S.), and Averbis (Freiburg Germany) |

This research report categorizes the text analytics market based on components, solutions, services, deployment modes, organization size, vertical, and region.

Based on components, the text analytics market is divided into the following segments:

- Software

- Services

- Managed services

- Professional services

- Support and maintenance

- Consulting services

- System integration and deployment

Based on applications, the market is divided into the following segments:

- Customer experience management

- Marketing management

- Governance, risk, and compliance management

- Document management

- Workforce management

- Others

Based on deployment modes, the text analytics market is divided into the following segments:

- On-premises

- Cloud

Based on organization size, the market is divided into the following segments:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Based on Industry vertical, the text analytics market is divided into the following segments:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and Information Technology (IT)

- Retail and eCommerce

- Healthcare and life sciences

- Manufacturing

- Government and defense

- Energy and utilities

- Media and entertainment

- Travel and hospitality

- Others

Based on regions, the text analytics market is divided into the following segments:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent developments

- In November 2016, SAP launched SAP HANA 2, which makes use of the in-memory technology to perform text analytics. This provides text mining and the discovery of new insights from structured and unstructured data using a single platform to gain contextual insights.

- In August 2016, SAS entered into an agreement with Teradata Corp., making Teradata a global authorized reseller of SAS data management and analytics software. The agreement allowed the companies to identify, design, and source a portfolio of SAS’ analytics, data management, Hadoop, in-database, and in-memory solutions marketed by Teradata. This helped increase SAS’ client base.

- In July 2016, OpenText acquired Recommind, Inc., a provider of eDiscovery and information analytics. Through the acquisition, OpenText customers benefited from Recommind’s analytics solutions for eDiscovery, investigations, contract analysis, and information governance including Decisiv Search, Perceptiv, and Axcelerate.

Critical questions the report answers

- What are the current trends that are driving the text analytics market?

- In which vertical most of the industrial companies are deploying text analytics solutions?

- Where will all these developments take the industry in the mid- to long-term?

- Who are the top vendors in the market, and what is their competitive analysis?

- What are the drivers and challenges of the text analytics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Text Analytics Market Size Estimation

2.3 Microquadrant Description

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Text Analytics Market

4.2 Market Share, By Region

4.3 Market By Industry Vertical and Region

4.4 Life Cycle Analysis, By Region, 2017

5 Text Analytics Market Overview and Industry Trends (Page No. - 36)

5.1 Market Overview

5.1.1 Introduction

5.1.2 Market Dynamics

5.1.2.1 Drivers

5.1.2.1.1 Growing Need for Social Media Analytics

5.1.2.1.2 Predictive Analytics for Businesses

5.1.2.1.3 Rise in Highly Customized and Industry-Specific Applications

5.1.2.2 Restraints

5.1.2.2.1 Lack of Awareness, Skilled Workforce, and Other Operational Challenges

5.1.2.3 Opportunities

5.1.2.3.1 Enhancing Customer Service and Competitive Intelligence

5.1.2.3.2 Rising Significance of Big Data and IoT in Analytics Market

5.1.2.4 Challenges

5.1.2.4.1 Achieving Consistency in Business Semantics and Interpretations

5.1.2.4.2 Data Privacy and Security Concerns

5.1.2.4.3 Concerns About Positive RoI

5.2 Industry Trends

5.2.1 Introduction

5.2.2 Text Analytics Use Cases

5.2.2.1 Introduction

5.2.2.2 Use Case 1: Luminoso Technologies, Inc (Retail)

5.2.2.3 Use Case 2: Lexalytics, Inc. (Hospitality)

5.2.2.4 Use Case 3: Meaningcloud LLC. (BFSI)

5.2.3 Text Analytics Architecture

5.2.4 Technologies in Text Analytics

5.2.4.1 Big Data

5.2.4.2 Natural Language Processing

5.2.4.3 Artificial Intelligence

6 Text Analytics Market Analysis, By Component (Page No. - 45)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

6.3.2.1 Support and Maintenance

6.3.2.2 Consulting Services

6.3.2.3 System Integration and Deployment

7 Market Analysis, By Application (Page No. - 54)

7.1 Introduction

7.2 Customer Experience Management

7.3 Marketing Management

7.4 Governance, Risk, and Compliance Management

7.5 Document Management

7.6 Workforce Management

7.7 Others

8 Text Analytics Market Analysis, By Deployment Model (Page No. - 61)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Market Analysis, By Organization Size (Page No. - 65)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Text Analytics Market Analysis, By Industry Vertical (Page No. - 69)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Retail and Ecommerce

10.4 Government and Defense

10.5 Healthcare and Life Sciences

10.6 Manufacturing

10.7 Telecommunications and Information Technology

10.8 Energy and Utilities

10.9 Media and Entertainment

10.10 Travel and Hospitality

10.11 Others

11 Text Analytics Market Geographic Analysis (Page No. - 79)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 100)

12.1 Introduction

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Microquadrant

12.3 Competitive Benchmarking

13 Company Profiles (Page No. - 104)

(Business Overview, Product Offering and Business Strategy, Recent Developments, MnM View)*

13.1 SAP SE

13.2 International Business Machines Corporation

13.3 SAS Institute, Inc.

13.4 Opentext Corporation

13.5 Clarabridge, Inc.

13.6 Bitext Innovations S.L.

13.7 Lexalytics, Inc.

13.8 Megaputer Intelligence, Inc.

13.9 Luminoso Technologies, Inc.

13.10 Knime.Com AG

13.11 Infegy, Inc.

13.12 Averbis

13.13 Meaningcloud LLC

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 146)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (71 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2016

Table 2 Text Analytics Market Size and Growth, 2015–2022 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Component, 2015–2022 (USD Million)

Table 4 Software: Market Size, By Region, 2015-2022 (USD Million)

Table 5 Services: Market Size, By Service, 2015-2022 (USD Million)

Table 6 Services: Market Size, By Region, 2015-2022 (USD Million)

Table 7 Managed Services: Market Size, By Region, 2015-2022 (USD Million)

Table 8 Professional Services: Market Size, By Region, 2015-2022 (USD Million)

Table 9 Support and Maintenance: Market Size, By Region, 2015-2022 (USD Million)

Table 10 Consulting Services: Market Size, By Region, 2015-2022 (USD Million)

Table 11 System Integration and Deployment: Market Size, By Region, 2015-2022 (USD Million)

Table 12 Text Analytics Market Size, By Application, 2015–2022 (USD Million)

Table 13 Customer Experience Management: Market Size, By Region, 2015–2022 (USD Million)

Table 14 Marketing Management: Market Size, By Region, 2015–2022 (USD Million)

Table 15 Governance, Risk, and Compliance Management: Market Size, By Region, 2015–2022 (USD Million)

Table 16 Document Management: Market Size, By Region, 2015–2022 (USD Million)

Table 17 Workforce Management: Text Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 18 Others: Text Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 19 Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 20 On-Premises: Market Size, By Region, 2015-2022 (USD Million)

Table 21 Cloud: Market Size, By Region, 2015-2022 (USD Million)

Table 22 Market Size, By Organization Size, 2015-2022 (USD Million)

Table 23 Small and Medium-Sized Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 24 Large Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 25 Text Analytics Market Size, By Vertical, 2015–2022 (USD Million)

Table 26 Banking, Financial Services, and Insurance: Market Size, By Region, 2015–2022 (USD Million)

Table 27 Retail and Ecommerce: Market Size, By Region, 2015–2022 (USD Million)

Table 28 Government and Defense: Market Size, By Region, 2015–2022 (USD Million)

Table 29 Healthcare and Life Sciences: Text Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 30 Manufacturing: Text Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 31 Telecommunications and IT: Market Size, By Region, 2015–2022 (USD Million)

Table 32 Energy and Utilities: Market Size, By Region, 2015–2022 (USD Million)

Table 33 Media and Entertainment: Market Size, By Region, 2015–2022 (USD Million)

Table 34 Travel and Hospitality: Market Size, By Region, 2015–2022 (USD Million)

Table 35 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 36 Text Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 37 North America: Market Size, By Component, 2015–2022 (USD Million)

Table 38 North America: Market Size, By Service, 2015–2022 (USD Million)

Table 39 North America: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 40 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 41 North America: Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 42 North America: Text Analytics Market Size, By Organization Size, 2015–2022 (USD Million)

Table 43 North America: Market Size, By Industry Vertical, 2015–2022 (USD Million)

Table 44 Europe: Market Size, By Component, 2015–2022 (USD Million)

Table 45 Europe: Market Size, By Service, 2015–2022 (USD Million)

Table 46 Europe: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 47 Europe: Text Analytics Market Size, By Application, 2015–2022 (USD Million)

Table 48 Europe: Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 49 Europe: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 50 Europe: Market Size, By Industry Vertical, 2015–2022 (USD Million)

Table 51 Asia Pacific: Text Analytics Market Size, By Component, 2015–2022 (USD Million)

Table 52 Asia Pacific: Market Size, By Service, 2015–2022 (USD Million)

Table 53 Asia Pacific: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 54 Asia Pacific: Text Analytics Market Size, By Application, 2015–2022 (USD Million)

Table 55 Asia Pacific: Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 56 Asia Pacific: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 57 Asia Pacific: Market Size, By Industry Vertical, 2015–2022 (USD Million)

Table 58 Middle East and Africa: Text Analytics Market Size, By Component, 2015–2022 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 2015–2022 (USD Million)

Table 60 Middle East and Africa: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 61 Middle East and Africa: Market Size, By Application, 2015–2022 (USD Million)

Table 62 Middle East and Africa: Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 63 Middle East and Africa: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 64 Middle East and Africa: Market Size, By Industry Vertical, 2015–2022 (USD Million)

Table 65 Latin America: Text Analytics Market Size, By Component, 2015–2022 (USD Million)

Table 66 Latin America: Market Size, By Service, 2015–2022 (USD Million)

Table 67 Latin America: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 68 Latin America: Market Size, By Application, 2015–2022 (USD Million)

Table 69 Latin America: Market Size, By Deployment Model, 2015–2022 (USD Million)

Table 70 Latin America: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 71 Latin America: Market Size, By Industry Vertical, 2015–2022 (USD Million)

List of Figures (65 Figures)

Figure 1 Text Analytics Market: Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

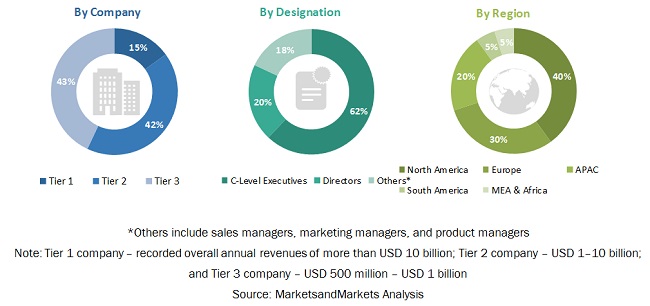

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Evaluation Criteria

Figure 9 Text Analytics Market: Assumptions

Figure 10 Market is Expected to Show a Significant Growth During the Forecast Period

Figure 11 Market Snapshot, By Component (2017 vs 2022)

Figure 12 Market Snapshot, By Service (2017–2022)

Figure 13 Market Snapshot, By Professional Service (2017–2022)

Figure 14 Market Snapshot, By Organization Size (2017 vs 2022)

Figure 15 Market Snapshot, By Application (2017)

Figure 16 Market Snapshot, By Deployment Model (2017–2022)

Figure 17 Market Snapshot, By Industry Vertical (2017 - 2022)

Figure 18 Text Analytics Market is Driven By Emergence of Multilingual Text Analytics to Break the Language Barrier, as Well As, Increase in Industry-Specific Text Analytics Applications

Figure 19 North America is Expected to Have the Largest Market Share During the Forecast Period

Figure 20 Retail and Ecommerce Vertical, and North America are Expected to Have the Largest Market Size in 2017

Figure 21 Asia Pacific to Have an Exponential Growth During the Forecast Period

Figure 22 Text Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Text Analytics Architecture

Figure 24 Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Consulting Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Governance, Risk, and Compliance Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Cloud-Based Deployment Model is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Small and Medium-Sized Enterprise Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Healthcare and Life Sciences Industry Vertical is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Regional Snapshot: Asia Pacific is Estimated to Have the Highest CAGR in the Text Analytics Market

Figure 32 North America: Market Snapshot

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Product Offerings (For All 25 Players)

Figure 35 Business Strategies (For All 25 Players)

Figure 36 SAP SE: Company Snapshot

Figure 37 SAP SE: Product Offering Scorecard

Figure 38 SAP SE: Business Strategy Scorecard

Figure 39 International Business Machines Corporation: Company Snapshot

Figure 40 International Business Machines Corporation: Product Offering Scorecard

Figure 41 International Business Machines Corporation: Business Strategy Scorecard

Figure 42 SAS Institute, Inc.: Company Snapshot

Figure 43 SAS Institute, Inc.: Product Offering Scorecard

Figure 44 SAS Institute, Inc.: Business Strategy Scorecard

Figure 45 Opentext Corporation: Company Snapshot

Figure 46 Opentext Corporation: Product Offering Scorecard

Figure 47 Opentext Corporation: Business Strategy Scorecard

Figure 48 Clarabridge, Inc.: Product Offering Scorecard

Figure 49 Clarabridge, Inc.: Business Strategy Scorecard

Figure 50 Bitext Innovations S.L.: Product Offering Scorecard

Figure 51 Bitext Innovations S.L.: Business Strategy Scorecard

Figure 52 Lexalytics, Inc.: Product Offering Scorecard

Figure 53 Lexalytics, Inc.: Business Strategy Scorecard

Figure 54 Megaputer Intelligence, Inc.: Product Offering Scorecard

Figure 55 Megaputer Intelligence, Inc.: Business Strategy Scorecard

Figure 56 Luminoso Technologies, Inc.: Product Offering Scorecard

Figure 57 Luminoso Technologies, Inc.: Business Strategy Scorecard

Figure 58 Knime.Com AG: Product Offering Scorecard

Figure 59 Knime.Com AG: Business Strategy Scorecard

Figure 60 Infegy, Inc.: Product Offering Scorecard

Figure 61 Infegy, Inc.: Business Strategy Scorecard

Figure 62 Averbis: Product Offering Scorecard

Figure 63 Averbis: Business Strategy Scorecard

Figure 64 Meaningcloud LLC: Product Offering Scorecard

Figure 65 Meaningcloud LLC: Business Strategy Scorecard

The study consists of four major activities to estimate the current market size of the text analytics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the text analytics market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

Various primary sources from both the supply and demand sides of the text analytics market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), technology and innovation directors, hedge fund managers, and related key executives from various vendors offering text analytics solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

For making market estimates and forecasting the text analytics market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global text analytics market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The global market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report objectives

- To define, describe, and forecast the text analytics market by component (software, services), by services (managed services, professional services [support and maintenance, consulting services, system integration and deployment], by application (customer experience management, marketing management, governance, risk and compliance management, document management, workforce management and others comprising of fraud detection and supply chain management), deployment mode (cloud and on-premises), organize size(large enterprises and Small and Medium-sized Enterprises [SMEs]), industry vertical BFSI, telecommunication & IT, retail and ecommerce, healthcare and life sciences, manufacturing, government and defense, energy and utilities, media and entertainment, travel and hospitality, and others (education, research, construction & outsourcing), and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the text analytics market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the text analytics market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the text analytics ecosystem

- To strategically profile key players and comprehensively analyze their market size and core competencies in the market

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the text analytics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American text analytics market

- Further breakup of the European text analytics market

- Further breakup of the APAC text analytics market

- Further breakup of the Latin American text analytics market

- Further breakup of the MEA text analytics market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Text Analytics Market

We are looking to become a bulk sms reseller. We work with marketing agencies and corporate, and deliver mail services. I would like to understand how text analytics tools can help solve our problems. I am also looking for some text analytics examples and information on who are the vendors offering text analytics tools.