Customer Experience Management (CEM) Market by Offering (Solutions, Services), Touchpoint, Deployment Type, Organization Size, Vertical (Travel & Hospitality, BFSI, Retail, Healthcare, IT & Telecom) and Region - Global Forecast to 2028

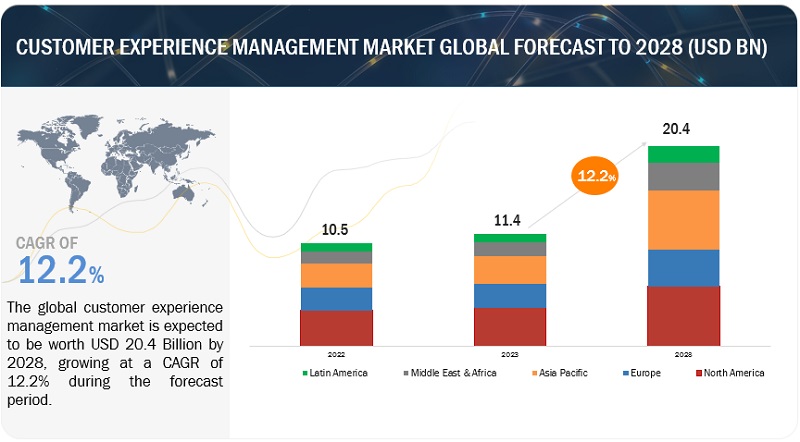

The global Customer Experience Management (CEM) Market size was valued at $11.4 billion in 2023 and is poised to reach $20.4 billion by 2028, growing at a CAGR of 12.2% from 2023 to 2028.

This surge is driven by the increasing focus on personalized customer journeys, AI-powered insights, and omnichannel engagement platforms across industries worldwide.. Businesses realize that delivering exceptional customer interactions, personalized journeys, and seamless multichannel experiences is essential for fostering loyalty and maintaining a competitive edge. Integrating advanced technologies such as AI, analytics, and cloud platforms amplifies the impact of customer experience management size. As companies focus on understanding and meeting customer expectations, the market is witnessing substantial expansion, reflecting the ongoing commitment to creating meaningful and enduring customer connections in an ever-changing business landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Customer Experience Management Market Trends

Driver: Empowering Loyalty and Growth through Personalized Interactions and Cutting-edge Technologies

Pursuing personalized interactions, data-driven insights, and seamless multichannel engagement has become a cornerstone for businesses aiming to foster loyalty and growth. The infusion of cutting-edge technologies like AI, analytics, and integrated platforms amplifies the impact of customer experience management strategies. As companies strive to align with customer needs and preferences, the market experiences robust growth, reflecting the continuous endeavor to cultivate meaningful and enduring relationships that drive success in today's dynamic business landscape.

Restraint: Investment Barriers and Data Security Concerns

The requirement for significant investments in technology infrastructure, talent acquisition, and training acts as a barrier for smaller businesses seeking to adopt comprehensive customer experience management industry solutions. Moreover, ensuring data privacy and security in an increasingly digitized landscape remains a critical concern, with potential breaches undermining customer trust and damaging brand reputation posing a significant restraint in CEM market.

Opportunity: Harnessing Advanced Technologies and Data-driven Insights to Elevate Customer Experiences

As customers increasingly demand personalized, seamless, and engaging experiences across various touchpoints, the market presents a wide scope for innovation. Integrating advanced technologies such as AI, machine learning, and predictive analytics opens avenues for predictive and proactive customer engagement. Additionally, the rising trend of omnichannel strategies further accentuates the potential for businesses to provide consistent experiences across diverse platforms. Moreover, the increasing emphasis on data-driven decision-making allows companies to gain deep insights into customer behaviors and preferences, refining strategies and strengthening customer relationships. This landscape of evolving consumer expectations, technological advancements, and data-driven insights creates a fertile ground for businesses to revolutionize their approaches and elevate their market presence through customer experience management.

Challenge: Navigating Dynamic Consumer Preferences and Complex Data Realities

As consumer preferences shift and adapt to technological innovations and market trends, businesses face the constant challenge of staying aligned with these dynamic expectations. This necessitates continuously updating strategies, tools, and platforms to ensure they remain relevant and effective. Moreover, the vast array of customer touchpoints across digital and physical landscapes adds complexity, requiring seamless integration to provide consistent experiences. Additionally, while data is valuable, managing and harnessing it effectively for actionable insights can be challenging, particularly in a landscape that demands stringent data privacy and security compliance.

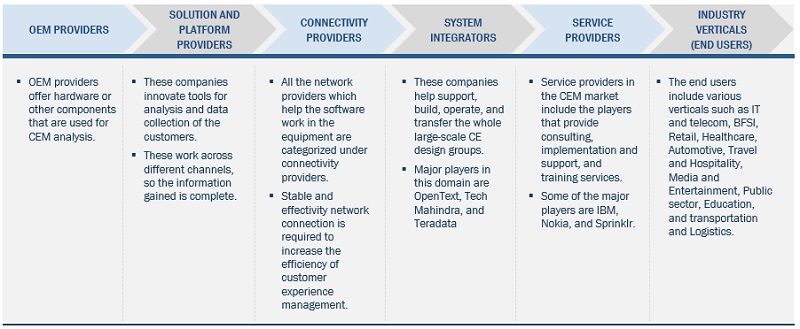

Customer Experience Management Market Ecosystem

The major players in the CX management market are Adobe, IBM, Oracle, Avaya, Nice, Nokia, and so on. The market is driven by prominent companies that have established themselves as leaders in the industry. These companies are well-established, financially stable, and have a proven track record of providing innovative solutions and services in customer experience management. Their diverse product portfolio spans infrastructure, solutions, applications, and services, enabling them to cater to the market’s evolving needs. With state-of-the-art technologies and extensive capabilities, these companies are at the forefront of driving the advancement of customer experience management technology.

By deployment type, the cloud segment to constitute a larger market size during the forecast period

During the forecast period, the cloud deployment segment is anticipated to establish a significant presence in the market, constituting a larger market size. Businesses increasingly recognize the advantages of cloud-based solutions, which offer scalability, flexibility, and streamlined resource access. The cloud deployment model enables organizations to implement and manage customer experience management solutions, ensuring real-time insights and personalized engagements across various touchpoints. This aligns well with customers’ evolving demands for seamless interactions in an omnichannel environment. As companies focus on optimizing operations, enhancing agility, and catering to digitally-savvy consumers, the cloud deployment segment emerges as a central driver of customer experience management market growth.

By organization size, the large enterprise segment to lead the market during the forecast period

During the forecast period, the market is anticipated to be led by the large enterprise segment in terms of organization size. This can be attributed to large enterprises' substantial resources and capabilities, allowing them to invest in comprehensive customer experience management solutions. As these organizations aim to enhance customer satisfaction and loyalty through tailored interactions and seamless engagements, adopting advanced technologies, data analytics, and integrated platforms becomes paramount. The ability to allocate significant budgets for technology implementation, talent acquisition, and training positions large enterprises as frontrunners in shaping the customer experience management landscape. Their capacity to navigate complex business environments and the resources to deploy customer-centric strategies cements their role as drivers of growth and innovation in the market.

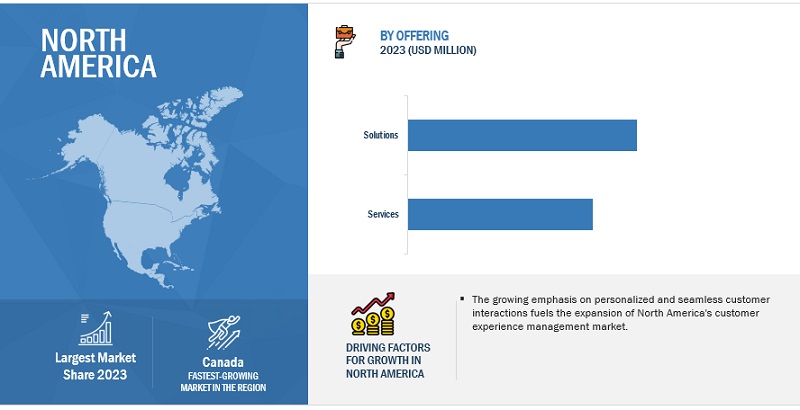

By region, North America to dominate market during the forecast period

Throughout the forecast period, North America is anticipated to maintain a dominant customer experience management market position. This stronghold can be attributed to the region's advanced technological infrastructure, mature market ecosystem, and persistent focus on delivering exceptional customer interactions. As businesses across industries recognize the pivotal role of customer experience in fostering loyalty and competitiveness, North American companies are investing significantly in cutting-edge technologies, data analytics, and personalized engagement strategies. Moreover, the region's consumer base is accustomed to seamless digital experiences, further driving the demand for innovative customer experience management solutions. With a strong commitment to customer-centricity and robust adoption of emerging technologies, North America is poised to retain its leadership in shaping the customer experience management landscape.

Customer Experience Management Market Companies:

The major companies in customer experience management market are Adobe (US), IBM (US), Oracle (US), Avaya (US), Nice (Israel), Nokia (Finland), SAP (Germany), OpenText (Canada), Tech Mahindra (India), Verint Systems (US), Zendesk (US), Teradata (US), Sprinklr (US), Medallia (US), InMoment (US), SAS (US), Clarabridge (US), Sitecore (US), NGDATA (Belgium), Amperity (US), Mixpanel (US), Segment.io (US), Skyvera (US), MindTouch (US), Algonomy (US), and Sogolytics (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering, touchpoint, Deployment type, Organisation Size, Verticals |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

List of top Customer Experience Management Market Companies |

Adobe (US), IBM (US), Oracle (US), Avaya (US), Nice (Israel), Nokia (Finland), SAP (Germany), OpenText (Canada), Tech Mahindra (India), Verint Systems (US), Zendesk (US), Teradata (US), Sprinklr (US), Medallia (US), InMoment (US), SAS (US), Clarabridge (US), Sitecore (US), NGDATA (Belgium), Amperity (US), Mixpanel (US), Segment.io (US), Skyvera (US), MindTouch (US), Algonomy (US), and Sogolytics (US) |

This research report categorizes the customer experience management market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Omnichannel

- Machine learning

- Analytics

- Workforce optimization

-

Services

-

Professional services

- Deployment & integration

- Support & maintenance

- Consulting & training

- Managed services

-

Professional services

Based on Touchpoint:

- Websites

- Stores

- Call centers

- Mobile apps

- Social media

- Emails

- Virtual assistants

- Other touchpoints (loyalty programs, surveys, sales representatives, seminars, trade shows, public speaking, and training)

Based on Deployment type:

- On-Premises

- Cloud

Based on Organisation Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Based on Vertical:

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Automotive

- Travel & hospitality

- Media & entertainment

- Public sector

- Other verticals (education, transportation, and logistics)

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- Australia and New Zealand (ANZ)

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East and Africa (MEA)

- United Arab Emirates (UAE)

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- May 2023 - Oracle announced the rollout of its cloud-based retail solutions at Prada Group. The luxury brand integrates its physical and digital products to better connect with its clients and use data to provide an ever-more-tailored experience.

- April 2023 - To help customers accelerate their cloud-centric digital transformation, OpenText unveiled OpenText Cloud Editions (CE) 23.2, which includes around 75,000 advancements from the previous year.

- May 2022 - At its flagship conference, Zendesk introduced new products intended to make conversations the focal point of CRM. Along with this, the company unveiled a brand-new employee experience solution to assist companies in modernizing internal processes and improving the hybrid work environment.

- March 2022 - As part of its sales and marketing division's digital transformation, Adobe announced that BMW Group, one of the top worldwide auto and motorcycle manufacturers, has expanded its cooperation with Adobe. BMW Group, which owns the brands BMW, Rolls-Royce, MINI, and BMW Motorrad, is using Adobe Experience Cloud to create personalized digital experiences as it works towards its three-year goal of selling a quarter of all its vehicles online. Using a data-driven, individualized strategy, BMW Group will provide customers with seamless online and offline experiences, including personalized vehicles, doorstep delivery, and unique post-purchase services.

Frequently Asked Questions (FAQ):

What is customer experience management?

customer experience management (CEM) refers to strategically designing and managing the interactions and touchpoints that customers have with a brand or business throughout their journey. CEM focuses on creating positive and meaningful customer experiences by understanding their needs, preferences, and expectations and tailoring business processes and strategies accordingly. This involves continuously collecting and analyzing customer feedback, data, and insights to improve products, services, and interactions. Customer experience management aims to enhance customer satisfaction, build loyalty, and ultimately drive business growth by delivering consistent and exceptional experiences that resonate with customers and exceed their expectations.

What is the market size of the customer experience management market?

The global customer experience management market is estimated to be worth USD 11.4 billion in 2023 and is projected to reach USD 20.4 billion by 2028, at a CAGR of 12.2% during the forecast period.

What are the major drivers in the customer experience management market?

Rising customer expectations in the digital age drive businesses to deliver personalized, seamless, and engaging experiences across all touchpoints. To gain a competitive edge, companies harness data-driven insights and employ advanced analytics and AI technologies to decode customer behaviors and preferences. The omnichannel engagement has become essential as customers interact with brands through diverse platforms. Moreover, aligning employee engagement with superior customer interactions underlines the significance of internal culture in shaping external experiences. By excelling in customer experience management, businesses foster loyalty and create a robust ecosystem for innovation and revenue growth. In this era of evolving consumer behaviors and technological advancements, businesses must remain agile and adaptable to navigate changing customer expectations, maintaining their market relevance and driving industry innovation.

Who are the major players operating in the customer experience management market?

The major players in the customer experience management market are Adobe (US), IBM (US), Oracle (US), Avaya (US), Nice (Israel), Nokia (Finland), SAP (Germany), OpenText (Canada), Tech Mahindra (India), Verint Systems (US), Zendesk (US), Teradata (US), Sprinklr (US), Medallia (US), InMoment (US), SAS (US), Clarabridge (US), Sitecore (US), NGDATA (Belgium), Amperity (US), Mixpanel (US), Segment.io (US), Skyvera (US), MindTouch (US), Algonomy (US), and Sogolytics (US).

Which key technology trends prevail in the customer experience management market?

In the customer experience management market, many key technology trends are steering the evolution of customer interactions. Artificial Intelligence (AI) and Machine Learning (ML) are driving automation and personalization, enabling businesses to anticipate customer needs and tailor experiences on a large scale. Data analytics and insights are offering deeper understandings of customer behaviors, guiding strategic decision-making for enhanced engagement. The integration of omnichannel platforms ensures consistent interactions across touchpoints, accommodating the preferences of today's interconnected consumers. Chatbots and virtual assistants powered by AI are transforming customer support, providing instantaneous responses and bolstering customer satisfaction.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased need to establish learning behavior with customers- Demand for enhanced customer satisfaction and responsiveness- Need for companies to drive increased customer loyalty- Focus on establishing coordination among customer contact channels and customer experience management personnel- Growing emphasis on customer lifetime value- Rising demand for customer experience management solutions- Need for better customer engagement strategy- Need for CEM solutions to reduce customer churn rates- Need to maintain customer engagement through omnichannelsRESTRAINTS- Use of incomplete data while calculating CE matrix- Data synchronization complexitiesOPPORTUNITIES- Growth in collection of information using single platform- Increasing use of insights to predict customer intents- Increasing extraction of information extracted from CEM solutions for optimal strategiesCHALLENGES- Lack of innovation- Difficulty in ensuring CE RoI- Concerns over data privacy and security- Difficulty in getting different CE feedback through channels- Lack of synchronization in customer experience data collected from different touchpoints within various domains

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEM ANALYSISPORTER’S FIVE FORCES MODEL- Threat of new entrants- Threat of substitutes- Bargaining power of suppliers- Bargaining power of buyers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Big data and analytics- Cloud computing- Artificial intelligence and machine learning- Natural language processingTRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERSPATENT ANALYSISAVERAGE SELLING PRICE ANALYSISUSE CASESKEY CONFERENCES AND EVENTS IN 2023–2024KEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaEVOLUTION OF CUSTOMER EXPERIENCE MANAGEMENT TECHNOLOGY- Manual Interaction (Pre-digital Era)- Emergence of Digital Channels (Late 20th Century)- Customer Relationship Management (CRM) Systems (1990s–Early 2000s)- Multichannel Engagement (Mid-2000s–Early 2010s)- Analytics and Data-driven Insights (Mid-2010s)- Omnichannel Experience (Late 2010s)- Artificial Intelligence and Personalization (Late 2010s–Early 2020s)- Real-time Engagement (Early 2020s)- Predictive and Prescriptive Analytics (Present and Beyond)FUTURE DIRECTION OF CUSTOMER EXPERIENCE MANAGEMENT MARKET- Hyper-Personalization- Predictive Customer Service- Emotional and Sentimental Analysis- Seamless Omnichannel Experience- Voice and Natural Language Interfaces- Augmented Reality (AR) and Virtual Reality (VR)- Collaborative Customer Experience- Human-AI Collaboration- Data Integration and Unified Customer Profiles- Ethical AI and PrivacyIMPACT OF CUSTOMER EXPERIENCE MANAGEMENT ON ADJACENT NICHE TECHNOLOGIES- Big Data and Analytics- Augmented Reality (AR) and Virtual Reality (VR)- Chatbots and Natural Language Processing- Biometric Identification- Robotics and Automation

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSRISING CUSTOMER EXPECTATION FOR TAILORED EXPERIENCES TO FUEL MARKETSOLUTIONS: MARKET DRIVERSOMNICHANNEL- Demand for unified customer experience across all channels to propel marketMACHINE LEARNING- Need for machine learning's data-driven insights and personalized integration to revolutionize marketANALYTICS- Need to leverage data insights for enhanced customer interactions and informed decision-making to drive marketWORKFORCE OPTIMIZATION- Focus on enhancing efficiency and employee-customer interactions to boost growth

-

6.3 SERVICESRISING EMPHASIS ON PERSONALIZED INTERACTION AND CUSTOMER SATISFACTION TO BOOST MARKETSERVICES: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERSPROFESSIONAL SERVICES- Need to enhance customer interaction and drive loyalty to foster growth- Deployment & integration- Support & maintenance- Consulting & trainingMANAGED SERVICES- Need to facilitate seamless operations to drive market

- 7.1 INTRODUCTION

-

7.2 WEBSITESDEMAND FOR PERSONALIZED INTERACTIONS AND ELEVATED CUSTOMER SATISFACTION TO FOSTER GROWTH

-

7.3 STORESSTORES TO FACILITATE PERSONALIZED INTERACTIONS AND FOSTER LOYALTY

-

7.4 CALL CENTERSFOCUS ON PERSONALIZING TRANSACTIONS TO DRIVE MARKET

-

7.5 MOBILE APPSFOCUS ON PERSONALIZING TRANSACTIONS TO DRIVE MARKET

-

7.6 SOCIAL MEDIAFOCUS ON FOSTERING REAL-TIME ENGAGEMENT TO DRIVE MARKET EXPANSION

-

7.7 EMAILSFOCUS ON FOSTERING CUSTOMER INTERACTION AND ENGAGEMENT TO DRIVE MARKET EXPANSION

-

7.8 VIRTUAL ASSISTANTSVIRTUAL ASSISTANTS TO OFFER PERSONALIZED INTERACTIONS AND STREAMLINED PROCESSES

- 7.9 OTHER TOUCHPOINTS

- 8.1 INTRODUCTION

-

8.2 ON-PREMISESNEED TO STRENGTHEN LOCALIZED CONTROL AND DATA COMPLIANCE TO DRIVE MARKETON-PREMISES: MARKET DRIVERS

-

8.3 CLOUDADOPTION OF SCALABLE SOLUTIONS TO TRANSFORM CUSTOMER SERVICE TO PROPEL GROWTHCLOUD: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 LARGE ENTERPRISESLARGE ENTERPRISES TO LEAD MARKET WITH TECHNOLOGY, ANALYTICS, AND PERSONALIZED INTERACTIONS FOR ENHANCED CUSTOMER SATISFACTION AND LOYALTYLARGE ENTERPRISES: MARKET DRIVERS

-

9.3 SMALL AND MEDIUM-SIZED ENTERPRISESGROWING ADOPTION OF AGILE STRATEGIES TO STRENGTHEN PERSONALIZED INTERACTION TO BOOST GROWTHSMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 IT & TELECOMNEED FOR IMPROVED SATISFACTION AND LOYALTY IN IT & TELECOM SECTOR TO DRIVE MARKETIT & TELECOM: MARKET DRIVERS

-

10.3 BFSIRISING DEMAND TO USE DATA INSIGHTS IN BFSI SECTOR TO BOOST GROWTHBFSI: DRIVERS

-

10.4 RETAILOMNICHANNEL EXPERIENCES, PERSONAL INTERACTIONS, AND STREAMLINED PROCESSES IN RETAIL TO BOOST MARKETRETAIL: MARKET DRIVERS

-

10.5 HEALTHCAREFOCUS ON IMPROVING PATIENT-CENTRIC CARE TO DRIVE MARKET EXPANSIONHEALTHCARE: DRIVERS

-

10.6 AUTOMOTIVEINCREASING INNOVATION AND PERSONALIZATION IN AUTOMOTIVE SECTOR TO FOSTER GROWTHAUTOMOTIVE: MARKET DRIVERS

-

10.7 TRAVEL & HOSPITALITYRISING ADOPTION OF TAILORED SERVICES IN TRAVEL & HOSPITALITY SECTOR TO DRIVE MARKETTRAVEL & HOSPITALITY: MARKET DRIVERS

-

10.8 MEDIA & ENTERTAINMENTNEED FOR IMMERSIVE CONTENT AND SEAMLESS EXPERIENCES TO BOOST GROWTHMEDIA & ENTERTAINMENT: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERS

-

10.9 PUBLIC SECTORFOCUS ON ENHANCING DIGITAL SERVICES IN PUBLIC SECTOR TO LEAD TO MARKET EXPANSIONPUBLIC SECTOR: MARKET DRIVERS

- 10.10 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: MARKET REGULATIONSUS- Adoption of latest technologies and presence of major players to contribute to market growthCANADA- Rising investments in technology to boost adoption of CEM solutions

-

11.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: MARKET REGULATIONSUK- Need for businesses to cater to changing customer demand to drive marketGERMANY- Increasing presence of companies offering digital customer experience management solutions to propel growthFRANCE- Rising digital transformation to lead to adoption of customer experience management servicesITALY- Growing digitalization and tailored customer interactions to propel marketSPAIN- Integration of advanced technology and customer-centric strategies to drive market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: MARKET REGULATIONSAUSTRALIA & NEW ZEALAND- Focus of businesses on adopting customer-centric approaches to drive marketINDIA- Growing demand for enhanced personalized experiences to boost market growthCHINA- Rapid adoption of digital transformation solutions and changing customer demands to drive marketJAPAN- Strong commitment toward innovation and promoting customer-centric values to boost growthREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: MARKET REGULATIONSUAE- Increasing awareness regarding importance of advanced technologies to drive marketSAUDI ARABIA- Fast-paced adoption of cloud-based services to drive marketSOUTH AFRICA- Adoption of strategic approaches to build differentiated experiences for customers to lead marketREST OF THE MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: MARKET REGULATIONSBRAZIL- Growing presence of companies focusing on enhancing customer experience to boost growthMEXICO- Adoption of cloud-based services by organizations to propel marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.3 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHESDEALS

- 12.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 12.5 HISTORICAL REVENUE ANALYSIS

-

12.6 COMPANY EVALUATION MATRIX OVERVIEW

-

12.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: METHODOLOGY AND DEFINITIONSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 12.9 COMPANY MARKET RANKING ANALYSIS

-

12.10 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.1 MAJOR PLAYERSORACLE- Business overview- Products offered- Recent developments- MnM viewADOBE- Business overview- Products offered- Recent developments- MnM viewSAP- Business overview- Products offered- Recent developments- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewAVAYA- Business overview- Products offered- Recent developments- MnM viewOPENTEXT- Business overview- Products offered- Recent developmentsNICE- Business overview- Products offered- Recent developmentsSAS- Business overview- Products offered- Recent developmentsVERINT SYSTEMS- Business overview- Products offered- Recent developmentsTERADATA- Business overview- Products offered- Recent developmentsTECH MAHINDRANOKIAINMOMENTZENDESKSITECORESPRINKLRMEDALLIA

-

13.2 STARTUPS/SMESMIXPANELNGDATAALGONOMYSKYVERAAMPERITYCLARABRIDGEMINDTOUCHSOGOLYTICSSEGMENT.IO

- 14.1 LIMITATIONS

-

14.2 SOCIAL MEDIA ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWSOCIAL MEDIA ANALYTICS MARKET, BY COMPONENTSOCIAL MEDIA ANALYTICS MARKET, BY APPLICATIONSOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODESOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZESOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICALSOCIAL MEDIA ANALYTICS MARKET, BY REGION

-

14.3 CUSTOMER ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEWCUSTOMER ANALYTICS MARKET, BY COMPONENTCUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODECUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZECUSTOMER ANALYTICS MARKET, BY APPLICATIONCUSTOMER ANALYTICS MARKET, BY DATA SOURCECUSTOMER ANALYTICS MARKET, BY INDUSTRY VERTICALCUSTOMER ANALYTICS MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON CUSTOMER EXPERIENCE MANAGEMENT MARKET

- TABLE 5 USE CASE 1: ORACLE

- TABLE 6 USE CASE 2: ORACLE

- TABLE 7 USE CASE 3: SAP

- TABLE 8 USE CASE 4: OPENTEXT

- TABLE 9 USE CASE 5: INMOMENT

- TABLE 10 USE CASE 6: MEDALLIA

- TABLE 11 USE CASE 7: SITECORE

- TABLE 12 USE CASE 8: CLARABRIDGE

- TABLE 13 USE CASE 9: NOKIA

- TABLE 14 USE CASE 10: ORACLE

- TABLE 15 USE CASE 11: OPENTEXT

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 18 KEY BUYING CRITERIA OF TOP THREE VERTICALS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 24 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 25 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 SOLUTIONS: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 28 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 29 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 32 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 CONSULTING & TRAINING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 CONSULTING & TRAINING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 44 MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 45 ON-PREMISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 ON-PREMISES: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 50 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 51 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 56 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 57 IT & TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 IT & TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 RETAIL: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 TRAVEL & HOSPITALITY: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 PUBLIC SECTOR: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 PUBLIC SECTOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 US: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 92 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 93 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 94 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 95 US: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 96 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 97 US: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 98 US: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 99 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 100 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 CANADA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 104 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 106 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 107 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 108 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 109 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 110 CANADA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 111 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 112 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 113 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 118 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 120 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 122 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 UK: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 130 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 131 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 132 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 133 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 134 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 135 UK: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 136 UK: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 137 UK: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 138 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 139 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 140 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 CHINA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 156 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 158 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 159 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 160 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 161 CHINA: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 162 CHINA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 164 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 165 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 166 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 195 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 196 MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 197 MARKET: DEALS, 2020–2023

- TABLE 198 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 199 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 200 COMPANY FOOTPRINT, BY PRODUCT

- TABLE 201 COMPANY FOOTPRINT, BY OFFERING

- TABLE 202 COMPANY FOOTPRINT, BY INDUSTRY

- TABLE 203 COMPANY FOOTPRINT, BY REGION

- TABLE 204 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- TABLE 205 ORACLE: BUSINESS OVERVIEW

- TABLE 206 ORACLE: PRODUCTS OFFERED

- TABLE 207 ORACLE: PRODUCT LAUNCHES

- TABLE 208 ORACLE: DEALS

- TABLE 209 ADOBE: BUSINESS OVERVIEW

- TABLE 210 ADOBE: PRODUCTS OFFERED

- TABLE 211 ADOBE: PRODUCT LAUNCHES

- TABLE 212 ADOBE: DEALS

- TABLE 213 SAP: BUSINESS OVERVIEW

- TABLE 214 SAP: PRODUCTS OFFERED

- TABLE 215 SAP: PRODUCT LAUNCHES

- TABLE 216 SAP: DEALS

- TABLE 217 IBM: BUSINESS OVERVIEW

- TABLE 218 IBM: PRODUCTS OFFERED

- TABLE 219 IBM: PRODUCT LAUNCHES

- TABLE 220 IBM: DEALS

- TABLE 221 AVAYA: BUSINESS OVERVIEW

- TABLE 222 AVAYA: PRODUCTS OFFERED

- TABLE 223 AVAYA: PRODUCT LAUNCHES

- TABLE 224 AVAYA: DEALS

- TABLE 225 OPENTEXT: BUSINESS OVERVIEW

- TABLE 226 OPENTEXT: PRODUCTS OFFERED

- TABLE 227 OPENTEXT: PRODUCT LAUNCHES

- TABLE 228 OPENTEXT: DEALS

- TABLE 229 NICE: BUSINESS OVERVIEW

- TABLE 230 NICE: PRODUCTS OFFERED

- TABLE 231 NICE: PRODUCT LAUNCHES

- TABLE 232 NICE: DEALS

- TABLE 233 SAS: BUSINESS OVERVIEW

- TABLE 234 SAS: PRODUCTS OFFERED

- TABLE 235 SAS: PRODUCT LAUNCHES

- TABLE 236 SAS: DEALS

- TABLE 237 VERINT SYSTEMS: BUSINESS OVERVIEW

- TABLE 238 VERINT SYSTEMS: PRODUCTS OFFERED

- TABLE 239 VERINT SYSTEMS: PRODUCT LAUNCHES

- TABLE 240 VERINT SYSTEMS: DEALS

- TABLE 241 TERADATA: BUSINESS OVERVIEW

- TABLE 242 TERADATA: PRODUCTS OFFERED

- TABLE 243 TERADATA: OTHERS

- TABLE 244 TERADATA: DEALS

- TABLE 245 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 246 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 247 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

- TABLE 248 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 249 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 250 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 251 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 252 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 253 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 254 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 255 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 256 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 257 CUSTOMER ANALYTICS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 258 SOLUTIONS: CUSTOMER ANALYTICS MARKET, BY TYPE, 2018–2025 (USD MILLION)

- TABLE 259 SERVICES: CUSTOMER ANALYTICS MARKET, BY TYPE, 2018–2025 (USD MILLION)

- TABLE 260 CUSTOMER ANALYTICS MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

- TABLE 261 CUSTOMER ANALYTICS MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

- TABLE 262 CUSTOMER ANALYTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

- TABLE 263 CUSTOMER ANALYTICS MARKET, BY DATA SOURCE, 2018–2025 (USD MILLION)

- TABLE 264 CUSTOMER ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 265 CUSTOMER ANALYTICS MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 CUSTOMER EXPERIENCE MANAGEMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SPENDING-SIDE ANALYSIS)

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (1/2)

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (SUPPLY-SIDE ANALYSIS) (2/2)

- FIGURE 6 MARKET: RECESSION IMPACT

- FIGURE 7 MARKET, 2021–2028

- FIGURE 8 MAJOR SEGMENTS IN MARKET, 2023

- FIGURE 9 MARKET: REGIONAL SHARE AND KEY DRIVING FACTORS, 2023

- FIGURE 10 GROWING NEED TO ENHANCE CUSTOMER LOYALTY TO DRIVE MARKET

- FIGURE 11 SOLUTIONS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 12 MANAGED SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 13 DEPLOYMENT & INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 RETAIL SEGMENT TO LEAD MARKET IN 2023

- FIGURE 15 CLOUD SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 17 SOLUTIONS SEGMENT AND AUSTRALIA & NEW ZEALAND TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 18 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 CUSTOMER EXPERIENCE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 REVENUE SHIFT IN MARKET

- FIGURE 22 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 3 YEARS

- FIGURE 23 NUMBER OF PATENTS GRANTED, 2018–2022

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 30 LARGE ENTERPRISES TO ACCOUNT FOR HIGHER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 31 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 MARKET SHARE ANALYSIS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS, 2020–2022

- FIGURE 38 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 39 RANKING OF KEY PLAYERS IN CUSTOMER EXPERIENCE MANAGEMENT MARKET, 2023

- FIGURE 40 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- FIGURE 42 ADOBE: COMPANY SNAPSHOT

- FIGURE 43 SAP: COMPANY SNAPSHOT

- FIGURE 44 IBM: COMPANY SNAPSHOT

- FIGURE 45 AVAYA: COMPANY SNAPSHOT

- FIGURE 46 OPENTEXT: COMPANY SNAPSHOT

- FIGURE 47 NICE: COMPANY SNAPSHOT

- FIGURE 48 VERINT SYSTEMS: COMPANY SNAPSHOT

- FIGURE 49 TERADATA: COMPANY SNAPSHOT

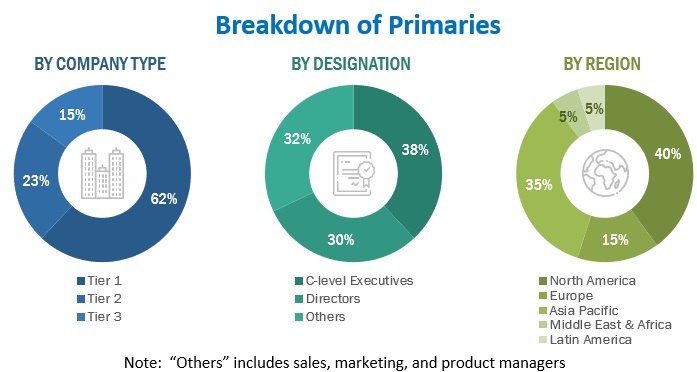

The research study involved 4 major activities in estimating the Customer Experience Management Market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the customer experience management market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the customer experience management market. The first approach involved estimating the market size by summating companies’ revenue generated through customer experience management solutions & services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Customer experience management (CEM) refers to an organization's strategic approach and set of practices to actively oversee, optimize, and enhance all aspects of its customer interactions. CEM encompasses a broad spectrum of activities, including understanding customer preferences, expectations, and behaviors; designing tailored experiences across various touchpoints; measuring and analyzing customer feedback and sentiments; and continuously refining processes to ensure consistent, positive, and memorable customer interactions. The ultimate goal of CEM is to create and maintain a seamless, personalized, and delightful journey for customers, fostering strong relationships, loyalty, and advocacy.

Key Stakeholders

- CEM solution providers

- System integrators

- Value-added resellers (VARs)

- Distributors and resellers of CEM solutions

- Cloud service providers

- Investors and venture capitalists

- Professional and managed service providers

- Government associations

- Technology consultants

- Independent software vendors (ISVs)

- IT agencies

The main objectives of this study are as follows:

- To define, describe, and forecast the customer experience management market based on segments based on offerings, solutions, services, touchpoints, deployment type, organization size, and vertical with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Experience Management (CEM) Market