Top Trends in the Agricultural Biologicals Market Size, Share, Growth Trends, Analysis & Forecast by Agricultural Biologicals, Biocontrols, Bio fungicides, Bioinsecticides, Bio nematicides, Biostimulants, Biofertilizers, Inoculants, Pheromones, Biological Seed Treatment - Global Forecast to 2028

Top Trends in the Agricultural Biologicals Market Analysis, 2028

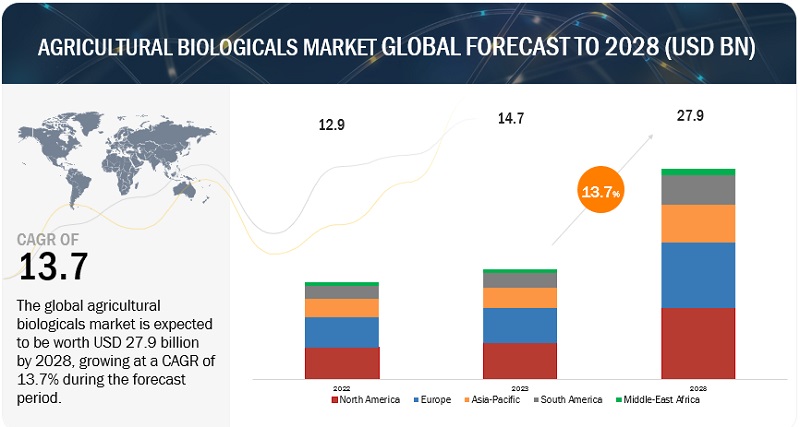

The global agricultural biologicals market is projected to grow at a CAGR of 13.7% from an estimated value of USD 14.7 billion in 2023 to reach USD 27.9 billion by 2028. Awareness of organic food products and concerns toward environmental safety and favorable regulations are the key drivers affecting the growth of the agricultural biologicals market. The role of agricultural biological products has become an integral part of integrated pest management practices (IPM) in developed markets, wherein the biological products are used in combination with new synthetic crop chemistries. Strategic developments such as expansions, new product launches, and agreements have been adopted by the majority of key players to strengthen the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Top Trends in the Agricultural Biologicals Market Dynamics

Drivers: Growing preference for organic products

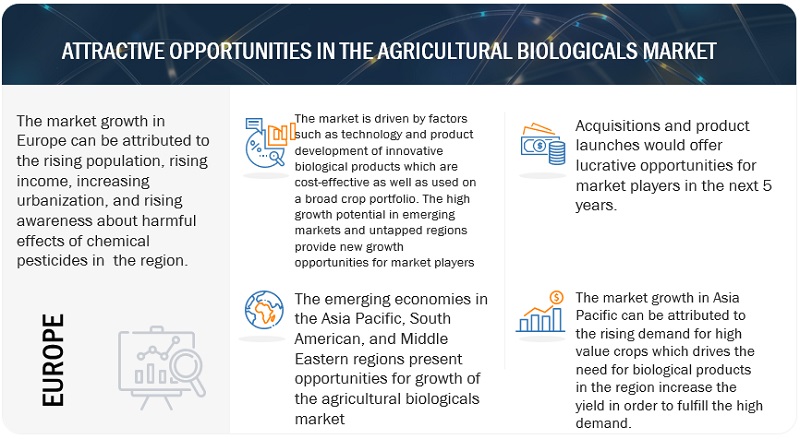

The rising awareness among consumers about the increasing use of pesticides and fertilizers in farm-grown vegetables has led to an increase in the adoption of organic food products. The absence of residues of pesticides, fertilizers, growth hormones, and antibiotics has encouraged consumers to opt for organic foods. This increasing consciousness has also promoted the concept of farm-to-table among consumers. According to a report published by FiBL on "The Organic Market in Europe 2021: Current Statistics'', the retail sales of organic food products have increased significantly in European countries in recent years. Some of the largest producers of organic products between 2018 and 2019 include Denmark, Sweden, Switzerland, Austria, and Luxembourg.

Restraints: Commercialization of low-quality biological products

Lack of transparency in patent protection laws in various countries has led to the prevalence of low-quality products. As the top trends in the agricultural biologicals market has limited barriers to entry, which has facilitated many competitors to commence operations, the nature of the market has become fragmented. This has been a factor in the introduction of low-quality products in the market by regional or local manufacturers to gain the advantage of the benefits of the growing demand for biologicals. The low prices of these products provided by small-scale domestic manufacturers also attract farmers. Similar product formulations from many competitors reduce consumer loyalty as well as the brand value of the products. The biologicals market is projected to be a niche market experiencing strong growth trends, which has to be capitalized on by developing products that are innovative and act on a wide range of crops providing better results. When a company does not develop its unique selling proposition in the biologicals market, it finds difficulty in expanding its presence other than in the regional market.

The regulatory framework for biologicals, being unclear across many regulatory bodies around the world, has allowed the entry of duplicate products. A product has been attempted to be defined appropriately only in the European Commission. According to Biological Products Industry Alliance, the purpose of agricultural biologicals is not considered the same by government authorities in different Asian countries. For instance, in China, they are mostly treated as fertilizers, while in Japan and South Korea, they are considered plant growth regulators. This restricts the market for biologicals, as it becomes difficult for the farmers to trust the products with such vagueness about their application.

Opportunity: Need for the development of broad-spectrum formulations in agricultural biologicals

The rise in the consumption of organic food has triggered organic farming which will create opportunities in the top trends in the agricultural biologicals market. Following the trends, certified organic growers use some plant essential oils, including mints, thyme, rosemary, clove, and citrus as pesticides. These plant-based oils have a broad spectrum of activity that can be used for integrated pest management in organic food production. When tested for pest management, such essential oils have shown good efficacy in countering insects and mites in combination with lethal neurotoxicity and sub-lethal repellence or deterrence. Certain plant-based essential oils such as rosemary and thyme were proven to have useful prophylactic activity against plant pathogenic fungi such as powdery mildew, while some others, including clove and citrus, are phytotoxic at optimal concentrations, which is why they can be used as herbicides. The results from ongoing field trials and commercial success using essential oil pesticides have presented growth opportunities for the biopesticides market.

To know about the assumptions considered for the study, download the pdf brochure

The US Environmental Protection Agency (EPA) had approved the dry formulation of Grandevo, a product of Marrone Bio Innovations Inc. (MBI)(US), an advanced biological broad-spectrum insecticide/miticide to protect crops against certain insects and mites. Grandevo was approved for use on ornamental plants and edible crops in field and greenhouse applications and facilitated flexibility through air and ground applications. Grandevo is based on a new species of Chromobacterium isolated from under a hemlock tree by Dr. Phyllis Martin at USDA-ARS. Grandevo was the first new broad-spectrum microbial insecticide to enter the market in nearly 50 years. The 'product's complex modes of action control pests through unique combinations of repellency, feeding disruption, reduced egg hatch, and a reduction in the ability of pests to reproduce. Grandevo is not limited by pre-defined spray windows, timing, or resistance spray restrictions, which provides flexibility to incorporate it into an Integrated Pest Management (IPM) program or to use it as a broad-spectrum foundation product. MBI currently has more than three dozen patents pending in the US and globally, which also contain broad-spectrum agri-biological formulations.

Challenges in the Top Trends in the Agricultural Biologicals Market: Supply of counterfeit and less-effective products

The supply of counterfeit biologicals, such as biofertilizers, biopesticides, and biostimulants is a major issue in the industry, as it is creating a negative image of the final products among farmers and hindering market growth. The cost of production of spurious products is extremely low, and it has been impossible for farmers to differentiate spurious biologicals from the original ones due to similar physical characteristics and identical chemical properties. To imitate a product, poor microbial load, contaminated products, or improper strains are used. Counterfeit products are being sold in Asian countries due to a highly fragmented market with unorganized players.

Furthermore, the supply of less-effective products, which is again affecting the sales of genuine products, is another concern that needs to be addressed. The effectiveness of biologicals depends on the production process of manufacturing, microorganism content, viable microorganism, and their storage. The supply of low-standard material by certain manufacturers can adversely affect the credibility of biofertilizers. Some local companies are also selling organic manure as biofertilizers and nitrogen fertilizers are mixed with water, and this liquid is sold as a biostimulant. Spurious manufacturers use these activities to their advantage due to the lack of knowledge and training among local farmers, which is hampering the image of branded products offered by global manufacturers.

Top Trends in the Agricultural Biologicals Market Eco System

Top Trends in the Agricultural Biologicals Market Analysis

The biocontrols segment is projected to dominate the agricultural biologicals market by trends during the forecast period.

Biocontrol products are known to improve the quality and yield of agricultural produce by protecting crops. These are completely natural and hence do not harm the environment. Biocontrol products are eco-friendly alternatives to chemical pesticides. Increased awareness among end-users regarding the residue levels of pesticides in food and the increased pest resistance to conventional crop protection chemicals are some of the key factors supporting the growth of the top trends in the agricultural biologicals market.

The bionematicides segment is projected to be the fastest-growing segment in the agricultural biologicals market by trends during the forecast period.

Increase in the loss of agricultural crops due to root-knot nematodes, globally, every year. In the coming years, the market for bionematicides poses great scope, as currently the market of it is not majorly commercialized. The increasing concerns towards preventing the loss caused by soil-borne insects is fueling the growth of the bionematicides market.

The bioinsecticides segment is projected to be the second-fastest growing segment in the agricultural biologicals market by trends during the forecast period.

There has been an emergence of various insects, with increasing climatic stress, hampering the growth of the plants, thus resulting in production losses. The application of bioinsecticides can be more beneficial in terms of sustainability and cost-effectiveness as compared to conventional chemicals. Also, the need to prevent crop losses and to adopt sustainability is driving the market for bioinsecticides.

Top Trends in the Agricultural Biologicals Market Regional Insights:

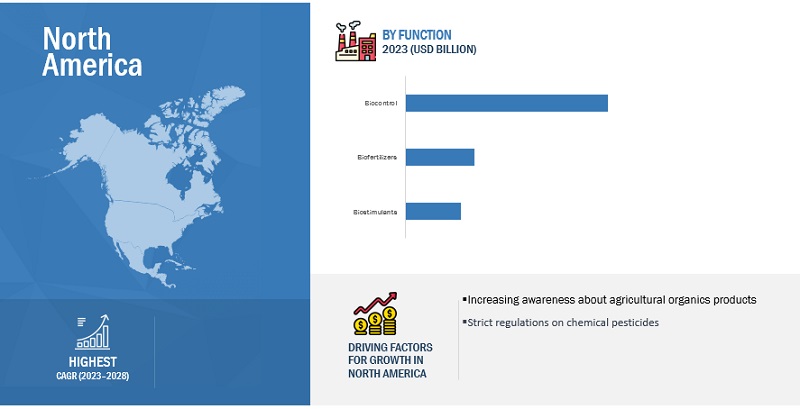

In 2022, the North American region emerged as the leading contributor to the growth of the Agricultural Biologicals market, holding the largest market share.

The growth of the organic industry, escalating costs of chemical fertilizers, and growing awareness about soil nutrient preservation are significant factors driving the expansion of the Agricultural Biologicals market. The North American region, characterized by its extensive research and development efforts and numerous patents awarded for biocontrol and biostimulants by key companies, can be attributed to the market's growth in this region.

United Stated Agricultural Biologicals Market Analysis:

The United States top trends in the agricultural biologicals market has been experiencing significant growth and innovation. Agricultural biologicals, which include biopesticides, biofertilizers, and biostimulants, are gaining popularity due to their perceived environmental and health benefits compared to traditional chemical inputs.

- Market Size and Growth: The agricultural biologicals market in the United States has been steadily growing over the past decade. Factors such as increasing awareness about sustainable agriculture practices, stringent regulations on chemical pesticide usage, and growing demand for organic products have been driving this growth. The market encompasses a wide range of products, including biopesticides, biofertilizers, and biostimulants, with each segment experiencing robust growth.

- Biopesticides: Biopesticides, which include microbial pesticides, plant-incorporated protectants, and biochemical pesticides, have gained traction as alternatives to synthetic chemical pesticides. Growing concerns about pesticide residues in food, pesticide resistance, and environmental pollution have spurred demand for biopesticides. The market for biopesticides in the US is expected to continue expanding as farmers increasingly adopt integrated pest management (IPM) practices.

- Biofertilizers: Biofertilizers, such as rhizobacteria, mycorrhizal fungi, and nitrogen-fixing bacteria, have gained attention for their ability to improve soil fertility and crop productivity in a sustainable manner. With increasing emphasis on soil health and fertility, biofertilizers are being integrated into conventional farming practices. The US biofertilizer market is expected to witness steady growth as farmers seek alternatives to synthetic fertilizers.

- Biostimulants: Biostimulants are substances or microorganisms applied to plants or soils to enhance nutrient uptake, improve stress tolerance, and promote growth and yield. These products have gained popularity among farmers seeking to maximize crop performance while minimizing chemical inputs. The US biostimulants market is poised for significant growth, driven by advancements in biotechnology and increasing awareness about the benefits of biostimulants in agriculture.

- Regulatory Environment: The regulatory landscape for agricultural biologicals in the United States is evolving, with government agencies such as the Environmental Protection Agency (EPA) and the Department of Agriculture (USDA) playing key roles in product registration and approval. Striking a balance between encouraging innovation in biological products and ensuring environmental and human safety remains a challenge for regulators.

- Key Players: The US agricultural biologicals market is characterized by the presence of a diverse range of companies, including multinational corporations, biotechnology firms, and startups. Key players in the market include Bayer CropScience, BASF SE, Corteva Agriscience, Syngenta AG, Marrone Bio Innovations, and Valent BioSciences Corporation, among others. These companies are investing in research and development to expand their product portfolios and gain a competitive edge in the market.

- Challenges and Opportunities: While the US agricultural biologicals market presents significant opportunities for growth and innovation, several challenges persist, including the high cost of biological products, limited awareness among farmers, and variability in product performance. However, ongoing advancements in biotechnology, increasing consumer demand for sustainable and organic products, and government initiatives to promote sustainable agriculture are expected to drive continued growth in the market.

Top Companies in Global Agricultural Biologicals Market

Key players in the agricultural biologicals market include BASF SE (Germany), Syngenta AG (Switzerland), Pro Farm Inc. (US), Isagro S.p.A. (Italy), UPL (India), Evogene Ltd (Israel), Bayer AG (Germany), and Vegalab S.A. (US).

Scope of the Top Trends in the Agricultural Biologicals Market Report

|

Report Metric |

Details |

|

Market valuation in 2023 |

USD 14.7 billion |

|

Revenue prediction in 2028 |

USD 27.9 billion |

|

Growth rate |

CAGR of 13.7% |

|

Segments covered |

Agricultural Biologicals, Biocontrols, Bioinsecticides, Biofungicides, Biostimulants, Biofertilizers, Bionematicides, Biological Seed Treatment, Agricultural Inoculants, Agricultural Pheromones |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of World (RoW) |

|

Key Companies covered |

BASF SE (Germany), Bayer AG (Germany), Syngenta AG (Switzerland), Pro Farm Group Inc. (US), Isagro S.p.A. (Italy), UPL (India), Evogene Ltd (Israel), Vegalab S.A. (US), Valent Biosciences (US), Stockton Bio-Ag (Israel), Biolchim SPA (Italy), Rizobacter (Argentina), Valagro SPA (Italy), Koppert Biological Systems (Netherlands), Lallemand Inc. (Canada), Haifa group (Israel), and Seipasa (Spain) |

This research report provides the top trends in the agricultural biologicals market such as:

- Agricultural biologicals

- Biocontrols

- Biostimulants

- Biofertilizers

- Biofungicides

- Bioinsecticides

- Bionematicides

- Agricultural Inoculants

- Pheromones

- Biological Seed Treatment

Recent Developments in the Top Trends in the Agricultural Biologicals Market:

- In April 2023, Syngenta AG (Switzerland) and Biotalys NV (Belgium) partnered to research, develop, and commercialize new biocontrol solutions to manage key pests in a broad variety of crops. The new solution will be based on Biotalys’ AGROBODYTM technology and will offer a new mode of action to broaden farmers’ access to novel technologies. This partnership helped the company come up with more innovative products under its solutions.

- In February 2023, Bayer AG and Kimitec partnered to accelerate the research and commercialization of biological crop protection solutions, including biostimulants. According to a global agreement, both businesses will work closely together to advance and create biological solutions generated from natural sources, such as crop protection products that deal with weeds, pests, and diseases as well as biostimulants that encourage plant growth.

- In January 2023, FBSciences Holdings, Inc., a pioneer in the development and marketing of naturally derived plants, soil, and climatic health solutions, has been acquired by Valent BioSciences LLC. With this acquisition, Sumitomo Chemical Co., Ltd., the parent company of Valent BioSciences, can now offer a wider range of integrated agricultural biological solutions, including biostimulants, biopesticides, and crop nutrition options.

- In May 2022, UPL acquired OptiCHOS, a naturally derived fungicide from BioCHOS, a spin-off of the Norwegian University of Life Sciences. BioCHOS was formulated as a biodegradable broad-spectrum disease control solution with low environmental and human impact. The product acquisition would help UPL expand its NPP portfolio and target markets suitable to the product to address farmers' needs.

- In November 2021, Evogene Ltd. launched its first product, LAV.211, an inoculant for yield improvement, under the brand, Result.

Frequently Asked Questions (FAQ):

Which players are involved in manufacturing of agricultural biologicals?

Key players in this market include competitors such as BASF SE (Germany), UPL (India), Valagro S.p.A (Italy), Gowan Group (US), and FMC Corporation (US). The agricultural biologicals market is highly competitive whit the leading companies working hard in order to maintain their market positions while there are many local and domestic companies arising in every region. The strong manufacturing countries such as China and India show a high rise in the development of new companies in the market which strongly are emerging as ey exporters.

What are biologicals in Agriculture?

Agricultural biologicals encompass a wide range of products sourced from naturally occurring microorganisms, plant extracts, beneficial insects, or other organic materials.

What are the potential challenges to the agricultural biologicals market?

The agricultural biologicals market faces challenges such as an underdeveloped regulatory framework in the global markets, which is leading to unstable perceptions of the producers regarding the product quality. Further the monitoring and quality control is also affected in these scenarios. It has also boosted the entry of many new players with any checks pertaining to the authenticity of the formulations and their effectiveness on the crops.

What are the key market trends in the food agricultural biologicals market?

The demands for clean label and organic food products in the market of developed regions such as Europe and North America are on an all-time high. Further the increasing demands for sustainability in agricultural practices is propelling the market. Other trends and details are covered in the report.

How big is the agricultural biologicals market?

The global agricultural biologicals market is projected to grow at a CAGR of 13.7% from an estimated value of USD 14.7 billion in 2023 to reach USD 27.9 billion by 2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINTRODUCTIONINCREASE IN ORGANIC AGRICULTURAL FARM AREASGROWING DEMAND FROM ORGANIC FOOD INDUSTRYHIGH COSTS ASSOCIATED WITH DEVELOPMENT OF SYNTHETIC CROP PROTECTION PRODUCTSCLIMATE CHANGE AND INCREASE IN ABIOTIC STRESSES ON PLANTS

-

5.3 MARKET DYNAMICSDRIVERS- Initiatives by government agencies and increasing awareness of sustainability in modern agriculture- Regulatory pressures and harmful effects associated with synthetic plant protection products- Growing preference for organic products- Limited entry barriers resulting in entry of several players- Hazards of using chemical fertilizers- Strong demand for high-value cash crops- Crop losses due to pest attacksRESTRAINTS- Technological and environmental constraints in use of biologicals- Poor infrastructure & high initial investment- Commercialization of low-quality biological products- Short shelf-life of biopesticidesOPPORTUNITIES- Advancements in microbial research- New target markets: Asia Pacific & Africa- Need for development of broad-spectrum formulations in agricultural biologicals- Rapid growth in biocontrol seed treatment solutionsCHALLENGES- Lack of awareness & low adoption rate of biologicals- Supply of counterfeit and less-effective products- Prevalence of uncertainty on regulatory framework of agricultural biologicals- High preference for agrochemicals among farmers

-

5.4 PATENT ANALYSISPATENT ANALYSIS FOR BIOFERTILIZERS MARKETPATENT ANALYSIS FOR BIOPESTICIDES MARKET

-

5.5 PATENT ANALYSIS FOR BIOSTIMULANTS

-

5.6 REGULATORY FRAMEWORKREGULATORY FRAMEWORK FOR BIOPESTICIDES- USEUROPE- European union- RussiaASIA PACIFIC- India- ChinaBRAZILREGULATORY FRAMEWORK FOR BIOSTIMULANTS- Austria- France- Germany- Italy- Ireland- Spain- UKREGULATORY FRAMEWORK FOR BIOFERTILIZERS- North America- Europe- Asia Pacific- South America- RoW

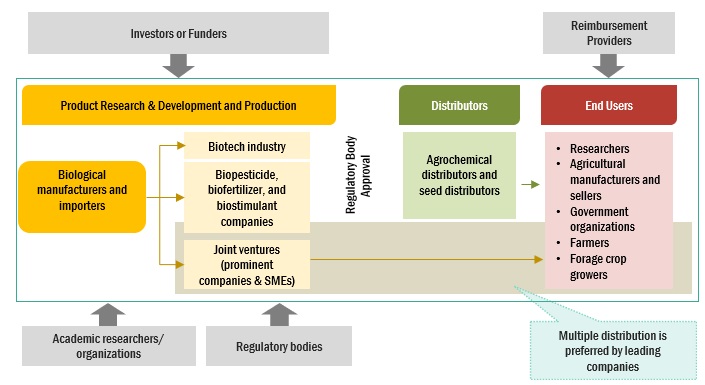

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTMANUFACTURINGDISTRIBUTIONMARKETING AND SALESPOST-SALES SERVICES

- 6.1 OVERVIEW

-

6.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

6.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

6.4 PRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Product launches & developments- Deals (Mergers, Agreements, Partnerships, Collaborations & Acquisitions)- Others (Expansions & Investments)COMPANY MARKET SHARE ANALYSIS

- 6.5 REGIONAL MARKET ANALYSIS

- 7.1 OVERVIEW

-

7.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

7.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

7.4 PRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Product launches & developments- Deals (Mergers, Agreements, Partnerships, Collaborations & Acquisitions)- Others (Expansions & Investments)COMPANY RANKING ANALYSIS

- 7.5 REGIONAL MARKET ANALYSIS

- 8.1 OVERVIEW

-

8.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

8.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Product launches & developments- Deals (Mergers, Agreements, Partnerships, Collaborations & Acquisitions)- Others (Expansions & Investments)COMPANY RANKING ANALYSIS

- 8.4 REGIONAL MARKET ANALYSIS

- 9.1 OVERVIEW

-

9.2 COMPETITIVE LANDSCAPEINTRODUCTIONKEY PLAYER EVALUATION QUADRANT (KEY PLAYERS)- Stars- Emerging Leaders- Pervasive Players- Participants

-

9.3 PRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Deals (Agreements, Mergers & Acquisitions, Partnerships & Collaborations)- Product launches, product approvals & registrations- Others (Expansion & Investments)

- 9.4 MARKET SHARE ANALYSIS

- 9.5 REGIONAL MARKET ANALYSIS

- 10.1 OVERVIEW

-

10.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

10.3 COMPETITIVE LEADERSHIP MAPPINGVISIONARY LEADERSINNOVATORSDYNAMIC DIFFERENTIATORSEMERGING COMPANIESCOMPETITIVE SCENARIO & TRENDS- Deals (Agreements, Mergers & Acquisitions, Partnerships & Collaborations)- Others (Expansions & Investments)- Product developments & registrations

- 10.4 COMPANY RANKING ANALYSIS, 2022

- 10.5 REGIONAL MARKET ANALYSIS

- 11.1 OVERVIEW

-

11.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

11.3 COMPETITIVE LEADERSHIP MAPPINGVISIONARY LEADERSINNOVATORSDYNAMIC DIFFERENTIATORSEMERGING COMPANIESCOMPETITIVE LANDSCAPE- Deals (Agreements, Mergers & Acquisitions, Partnerships & Collaborations)- Product launches, product approvals & registrations- Others (Expansions & Investments)COMPANY RANKING ANALYSIS

- 11.4 REGIONAL MARKET ANALYSIS

- 12.1 OVERVIEW

-

12.2 COMPETITIVE LANDSCAPEINTRODUCTIONCOMPETITIVE SCENARIO & TRENDSPRODUCT LAUNCHES, PRODUCT APPROVALS & REGISTRATIONSDEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS)OTHERS (EXPANSIONS & INVESTMENTS)COMPANY RANKING ANALYSIS, 2022

- 12.3 REGIONAL MARKET ANALYSIS

- 13.1 OVERVIEW

-

13.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

13.3 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.4 PRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Product launches, product approvals & registrationsDEALSOTHERSCOMPANY RANKING ANALYSIS

- 13.5 REGIONAL MARKET ANALYSIS

- 14.1 OVERVIEW

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

14.3 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 14.4 PRODUCT FOOTPRINT

-

14.5 MARKET SHARE ANALYSISCOMPETITIVE SCENARIO & TRENDS- Product launches, product approvals & registrationsDEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS)OTHERS

- 14.6 REGIONAL MARKET ANALYSIS

- 15.1 OVERVIEW

-

15.2 COMPETITIVE LANDSCAPEINTRODUCTION

-

15.3 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINTCOMPETITIVE SCENARIO & TRENDS- Product launches, product approvals & registrations- Deals (Mergers, Agreements, Partnerships, Collaborations & Acquisitions)- Others (Expansions & Investments)COMPANY RANKING ANALYSIS

- 15.4 REGIONAL MARKET ANALYSIS

-

16.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAYER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNGENTA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOVOZYMES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewUPL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCORTEVA AGRISCIENCE- Business Overview- Products/Solutions/Services offered- Recent developments- MnM viewFMC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRO FARM GROUP INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLALLEMAND INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVEGALAB SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVALENT BIOSCIENCES LLC- Business overview- Products/Solutions/Services offered- Recent development- MnM viewKOPPERT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTOCKTON BIO-AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIPL BIOLOGICALS LIMITED- Business overview- Products/Solutions/Services offered- MnM viewCERTIS USA LLC- Business overview- Products/Solutions/Services offered- MnM viewGOWAN COMPANY- Business overview- Products offered- MnM viewKAN BIOSYS- Business overview- Products/Solutions/Services offered- MnM viewSYMBORG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRIZOBACTER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIOMAX NATURALS- Business overview- Products/Solutions/Services offered- MnM viewBIOBEST GROUP NV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGRILIFE- Business overview- Products/Solutions/Services offered- MnM viewHAIFA NEGEV TECHNOLOGIES LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPIVOT BIO- Business overview- Products/Solutions/Services offered- MnM viewPRECISION LABORATORIES LLC- Business overview- Products/Solutions/Services offered- MnM view

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2022

- TABLE 2 PATENTS PERTAINING TO BIOFERTILIZERS, 2020–2022

- TABLE 3 LIST OF MAJOR PATENTS FOR BIOPESTICIDES, 2018-2019

- TABLE 4 LIST OF MAJOR PATENTS, 2012–2021

- TABLE 5 AGRICULTURAL BIOLOGICALS MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, 2018–2023

- TABLE 6 AGRICULTURAL BIOLOGICALS: COMPANY, BY FUNCTION FOOTPRINT

- TABLE 7 AGRICULTURAL BIOLOGICALS: COMPANY, BY TYPE FOOTPRINT

- TABLE 8 AGRICULTURAL BIOLOGICALS: COMPANY, BY REGIONAL FOOTPRINT

- TABLE 9 AGRICULTURAL BIOLOGICALS: COMPANY: OVERALL FOOTPRINT

- TABLE 10 AGRICULTURAL BIOLOGICALS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, 2018–APRIL 2023

- TABLE 11 AGRICULTURAL BIOLOGICALS MARKET: DEALS (MERGER, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITION), 2018–APRIL 2023

- TABLE 12 AGRICULTURAL BIOLOGICALS MARKET: EXPANSIONS & INVESTMENTS, 2018–APRIL 2023

- TABLE 13 AGRICULTURAL BIOLOGICALS MARKET: DEGREE OF COMPETITION

- TABLE 14 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 15 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 BIOCONTROLS MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, JANUARY 2018–APRIL 2023

- TABLE 17 BIOCONTROLS: COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 18 BIOCONTROLS: COMPANY CROP TYPE FOOTPRINT

- TABLE 19 BIOCONTROLS: COMPANY REGIONAL FOOTPRINT

- TABLE 20 BIOCONTROLS: OVERALL COMPANY FOOTPRINT

- TABLE 21 BIOCONTROLS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018–APRIL 2023

- TABLE 22 BIOCONTROLS MARKET: DEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), JANUARY 2018–APRIL 2023

- TABLE 23 BIOCONTROLS MARKET: EXPANSIONS & INVESTMENTS, JANUARY 2018–APRIL 2023

- TABLE 24 BIOCONTROL MARKET: DEGREE OF COMPETITION

- TABLE 25 BIOCONTROLS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 BIOCONTROLS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 BIOFERTILIZERS MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, JANUARY 2018–APRIL 2023

- TABLE 28 BIOFERTILIZERS: TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 29 BIOFERTILIZERS: FORM FOOTPRINT OF KEY PLAYERS

- TABLE 30 BIOFERTILIZERS: MODE OF APPLICATION FOOTPRINT OF KEY PLAYERS

- TABLE 31 BIOFERTILIZERS: REGION FOOTPRINT OF KEY PLAYERS

- TABLE 32 BIOFERTILIZERS: OVERALL FOOTPRINT OF KEY PLAYERS

- TABLE 33 BIOFERTILIZERS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2018–APRIL 2023

- TABLE 34 BIOFERTILIZERS MARKET: DEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), JANUARY 2018–APRIL 2023

- TABLE 35 BIOFERTILIZERS MARKET: EXPANSIONS & INVESTMENTS, JANUARY 2018–APRIL 2023

- TABLE 36 BIOFERTILIZERS MARKET: DEGREE OF COMPETITION

- TABLE 37 BIOFERTILIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 BIOFERTILIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 BIOSTIMULANTS MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, 2018-2023

- TABLE 40 BIOSTIMULANTS: COMPANY FOOTPRINT, BY CROP TYPE

- TABLE 41 BIOSTIMULANTS: COMPANY FOOTPRINT, BY FORMULATION TYPE

- TABLE 42 BIOSTIMULANTS: COMPANY FOOTPRINT, BY REGION

- TABLE 43 BIOSTIMULANTS: OVERALL COMPANY FOOTPRINT

- TABLE 44 BIOSTIMULANTS MARKET: DEALS (AGREEMENTS, MERGERS & ACQUISITIONS PARTNERSHIPS & COLLABORATIONS), 2018–2023

- TABLE 45 BIOSTIMULANTS MARKET: PRODUCT LAUNCHES, PRODUCT APPROVALS & REGISTRATIONS, 2018–2023

- TABLE 46 BIOSTIMULANTS MARKET: EXPANSIONS & INVESTMENTS, 2018–2023

- TABLE 47 BIOSTIMULANTS MARKET: DEGREE OF COMPETITION (COMPETITIVE), 2022

- TABLE 48 BIOSTIMULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 BIOSTIMULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 BIOINSECTICIDE: KEY STRATEGIES ADOPTED BY COMPANIES, 2018–2023

- TABLE 51 BIOINSECTICIDES MARKET: DEALS (AGREEMENTS, MERGERS & ACQUISITIONS, PARTNERSHIPS & COLLABORATIONS), 2018–2023

- TABLE 52 BIOINSECTICIDES MARKET: EXPANSIONS & INVESTMENTS, 2018–2023

- TABLE 53 BIOINSECTICIDES MARKET: PRODUCT DEVELOPMENTS & REGISTRATIONS, 2018–2023

- TABLE 54 BIOINSECTICIDES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 BIOINSECTICIDES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 BIOFUNGICIDES: KEY STRATEGIES ADOPTED BY COMPANIES, 2018–2023

- TABLE 57 BIOFUNGICIDES: DEALS (AGREEMENTS, MERGERS & ACQUISITIONS, PARTNERSHIPS & COLLABORATIONS), 2018–2023

- TABLE 58 BIOFUNGICIDES: PRODUCT LAUNCHES, PRODUCT APPROVALS & REGISTRATIONS, 2018–2023

- TABLE 59 BIOFUNGICIDE: OTHERS (EXPANSIONS & INVESTMENTS), 2018–2023

- TABLE 60 BIOFUNGICIDES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 BIOFUNGICIDES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 BIONEMATICIDES MARKET: TRENDS IN COMPANY STRATEGIES, 2018–APRIL 2023

- TABLE 63 BIONEMATICIDES MARKET: PRODUCT LAUNCHES, 2018–APRIL 2023

- TABLE 64 BIONEMATICIDES MARKET: DEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), JANUARY 2018–APRIL 2023

- TABLE 65 BIONEMATICIDES MARKET: EXPANSIONS & INVESTMENTS, JANUARY 2018–APRIL 2023

- TABLE 66 BIONEMATICIDES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 BIONEMATICIDES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 BIOLOGICAL SEED TREATMENT MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, 2018–APRIL 2023

- TABLE 69 BIOLOGICAL SEED TREATMENT: COMPANY TYPE FOOTPRINT

- TABLE 70 BIOLOGICAL SEED TREATMENT: COMPANY CROP FOOTPRINT

- TABLE 71 BIOLOGICAL SEED TREATMENT: COMPANY REGION FOOTPRINT

- TABLE 72 BIOLOGICAL SEED TREATMENT: PRODUCT FOOTPRINT (OVERALL)

- TABLE 73 BIOLOGICAL SEED TREATMENT MARKET: PRODUCT LAUNCHES, PRODUCT APPROVALS & REGISTRATIONS, 2018–APRIL 2023

- TABLE 74 BIOLOGICAL SEED TREATMENT MARKET: DEALS (MERGER, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), 2018–APRIL 2023

- TABLE 75 BIOLOGICAL SEED TREATMENT MARKET: EXPANSIONS & INVESTMENTS, JANUARY 2018–APRIL 2023

- TABLE 76 BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 STRATEGIES ADOPTED BY KEY PLAYERS IN AGRICULTURAL INOCULANTS MARKET

- TABLE 79 BIOLOGICAL SEED TREATMENT: COMPANY PRODUCT FOOTPRINT, BY TYPE

- TABLE 80 BIOLOGICAL SEED TREATMENT: COMPANY PRODUCT FOOTPRINT, BY MICROBE

- TABLE 81 BIOLOGICAL SEED TREATMENT: COMPANY PRODUCT FOOTPRINT, BY CROP TYPE

- TABLE 82 BIOLOGICAL SEED TREATMENT: COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 83 GLOBAL AGRICULTURAL INOCULANTS MARKET: DEGREE OF COMPETITION

- TABLE 84 AGRICULTURAL INOCULANTS MARKET: PRODUCT LAUNCHES, JANUARY 2018–APRIL 2023

- TABLE 85 AGRICULTURAL INOCULANTS MARKET: DEALS (MERGER, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), JANUARY 2018–APRIL 2023

- TABLE 86 AGRICULTURAL INOCULANTS MARKET: OTHERS, JANUARY 2018–APRIL 2023

- TABLE 87 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 AGRICULTURAL INOCULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 AGRICULTURAL PHEROMONES MARKET: KEY STRATEGIES ADOPTED BY COMPANIES, 2018–APRIL 2023

- TABLE 90 AGRICULTURAL PHEROMONES: COMPANY FUNCTION FOOTPRINT

- TABLE 91 AGRICULTURAL PHEROMONES: COMPANY CROP TYPE FOOTPRINT

- TABLE 92 AGRICULTURAL PHEROMONES: COMPANY REGION FOOTPRINT

- TABLE 93 AGRICULTURAL PHEROMONES: COMPANY PRODUCT FOOTPRINT

- TABLE 94 AGRICULTURAL PHEROMONES MARKET: PRODUCT LAUNCHES, PRODUCT APPROVALS & REGISTRATIONS, JANUARY 2018–APRIL 2023

- TABLE 95 AGRICULTURAL PHEROMONES MARKET: DEALS (MERGERS, AGREEMENTS, PARTNERSHIPS, COLLABORATIONS & ACQUISITIONS), 2018–2023

- TABLE 96 AGRICULTURAL PHEROMONES MARKET: EXPANSIONS & INVESTMENTS, 2018– APRIL 2023

- TABLE 97 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2022

- TABLE 98 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023–2028

- TABLE 99 BASF SE: BUSINESS OVERVIEW, 2022

- TABLE 100 BASF SE: PRODUCTS OFFERED

- TABLE 101 BASF SE: PRODUCT LAUNCHES

- TABLE 102 BASF SE: DEALS

- TABLE 103 BAYER AG: BUSINESS OVERVIEW, 2022

- TABLE 104 BAYER AG: PRODUCTS OFFERED

- TABLE 105 BAYER AG: PRODUCT LAUNCHES

- TABLE 106 BAYER AG: DEALS

- TABLE 107 SYNGENTA AG: BUSINESS OVERVIEW, 2022

- TABLE 108 SYNGENTA AG: PRODUCTS OFFERED

- TABLE 109 SYNGENTA AG: PRODUCT LAUNCHES

- TABLE 110 SYNGENTA AG: DEALS

- TABLE 111 NOVOZYMES: BUSINESS OVERVIEW, 2022

- TABLE 112 NOVOZYMES: PRODUCTS OFFERED

- TABLE 113 NOVOZYMES: PRODUCT LAUNCHES

- TABLE 114 NOVOZYMES: DEALS

- TABLE 115 NOVOZYMES: OTHER DEVELOPMENTS

- TABLE 116 UPL: BUSINESS OVERVIEW

- TABLE 117 UPL: PRODUCTS OFFERED

- TABLE 118 UPL: DEALS

- TABLE 119 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- TABLE 120 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 121 CORTEVA AGRISCIENCE: PRODUCT LAUNCHES

- TABLE 122 CORTEVA AGRISCIENCE: DEALS

- TABLE 123 CORTEVA AGRISCIENCE: OTHER DEVELOPMENTS

- TABLE 124 FMC CORPORATION: BUSINESS OVERVIEW, 2022

- TABLE 125 FMC CORPORATION: PRODUCTS OFFERED

- TABLE 126 FMC CORPORATION: PRODUCT LAUNCHES

- TABLE 127 FMC CORPORATION: DEALS

- TABLE 128 PRO FARM GROUP INC.: BUSINESS OVERVIEW, 2022

- TABLE 129 PRO FARM GROUP INC.: PRODUCTS OFFERED

- TABLE 130 PRO FARM GROUP INC.: PRODUCT LAUNCHES

- TABLE 131 PRO FARM GROUP INC.: OTHER DEVELOPMENTS

- TABLE 132 LALLEMAND INC.: BUSINESS OVERVIEW, 2022

- TABLE 133 LALLEMAND INC.: PRODUCTS OFFERED

- TABLE 134 LALLEMAND INC.: PRODUCT LAUNCHES

- TABLE 135 VEGALAB SA: BUSINESS OVERVIEW, 2022

- TABLE 136 VEGALAB SA: PRODUCTS OFFERED

- TABLE 137 VEGALAB SA: DEALS

- TABLE 138 VALENT BIOSCIENCES LLC: BUSINESS OVERVIEW, 2022

- TABLE 139 VALENT BIOSCIENCES LLC: PRODUCTS OFFERED

- TABLE 140 VALENT BIOSCIENCES LLC: DEALS

- TABLE 141 VALENT BIOSCIENCES LLC: OTHER DEVELOPMENTS

- TABLE 142 KOPPERT: BUSINESS OVERVIEW, 2022

- TABLE 143 KOPPERT: PRODUCTS OFFERED

- TABLE 144 KOPPERT: DEALS

- TABLE 145 KOPPERT: OTHER DEVELOPMENTS

- TABLE 146 STOCKTON BIO-AG: BUSINESS OVERVIEW, 2022

- TABLE 147 STOCKTON BIO-AG: PRODUCTS OFFERED

- TABLE 148 STOCKTON BIO-AG: DEALS

- TABLE 149 IPL BIOLOGICALS LIMITED: BUSINESS OVERVIEW, 2022

- TABLE 150 IPL BIOLOGICALS LIMITED: PRODUCTS OFFERED

- TABLE 151 CERTIS USA LLC: BUSINESS OVERVIEW

- TABLE 152 CERTIS USA LLC: PRODUCTS OFFERED

- TABLE 153 CERTIS USA LLC: DEALS

- TABLE 154 GOWAN COMPANY: BUSINESS OVERVIEW, 2022

- TABLE 155 GOWAN COMPANY: PRODUCTS OFFERED

- TABLE 156 GOWAN COMPANY: DEALS

- TABLE 157 KAN BIOSYS: BUSINESS OVERVIEW, 2022

- TABLE 158 KAN BIOSYS: PRODUCTS OFFERED

- TABLE 159 SYMBORG: BUSINESS OVERVIEW, 2022

- TABLE 160 SYMBORG: PRODUCTS OFFERED

- TABLE 161 SYMBORG: PRODUCT LAUNCHES

- TABLE 162 SYMBORG: OTHER DEVELOPMENTS

- TABLE 163 RIZOBACTER: BUSINESS OVERVIEW, 2022

- TABLE 164 RIZOBACTER: PRODUCTS OFFERED

- TABLE 165 RIZOBACTER: DEALS

- TABLE 166 RIZOBACTER: OTHERS

- TABLE 167 BIOMAX NATURALS: BUSINESS OVERVIEW, 2022

- TABLE 168 BIOMAX NATURALS: PRODUCTS OFFERED

- TABLE 169 BIOBEST GROUP NV: BUSINESS OVERVIEW, 2022

- TABLE 170 BIOBEST GROUP NV: PRODUCTS OFFERED

- TABLE 171 BIOBEST GROUP NV: PRODUCT LAUNCHES

- TABLE 172 BIOBEST GROUP NV: DEALS

- TABLE 173 AGRILIFE: BUSINESS OVERVIEW, 2022

- TABLE 174 AGRILIFE: PRODUCTS OFFERED

- TABLE 175 HAIFA NEGEV TECHNOLOGIES LTD: BUSINESS OVERVIEW

- TABLE 176 HAIFA NEGEV TECHNOLOGIES LTD: PRODUCTS OFFERED

- TABLE 177 HAIFA NEGEV TECHNOLOGIES LTD: PRODUCT LAUNCHES

- TABLE 178 HAIFA NEGEV TECHNOLOGIES LTD: OTHER DEVELOPMENTS

- TABLE 179 PIVOT BIO: BUSINESS OVERVIEW

- TABLE 180 PIVOT BIO: PRODUCTS OFFERED

- TABLE 181 PRECISION LABORATORIES LLC: BUSINESS OVERVIEW

- TABLE 182 PRECISION LABORATORIES LLC: PRODUCTS OFFERED

- FIGURE 1 TOP 10 TRENDS IN AGRICULTURAL BIOLOGICALS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 INDICATORS OF RECESSION

- FIGURE 4 WORLD INFLATION RATE, 2011–2021

- FIGURE 5 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 6 GLOBAL AGRICULTURAL BIOLOGICALS MARKET, 2021–2028 (USD MILLION)

- FIGURE 7 INCREASING DEMAND FOR BIOCONTROL TO DRIVE MARKET GROWTH

- FIGURE 8 SNAPSHOT: NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 9 SHIFT TOWARD SUSTAINABLE AGRICULTURE TO DRIVE MARKET GROWTH

- FIGURE 10 BIOCONTROLS: LARGEST SEGMENT IN MARKET

- FIGURE 11 BIOCONTROL ESTIMATED TO DOMINATE AGRICULTURAL BIOLOGICALS MARKET IN 2023

- FIGURE 12 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE FOR BIOSTIMUL ANTS IN 2023

- FIGURE 13 GROWTH OF ORGANIC AGRICULTURAL LAND FROM 1999 TO 2019

- FIGURE 14 ORGANIC RETAIL SALES, BY COUNTRY, 2019

- FIGURE 15 REDUCED INTRODUCTION OF NEW ACTIVE INGREDIENTS, 1950–2010

- FIGURE 16 TOP TRENDS IN AGRICULTURAL BIOLOGICALS MARKET

- FIGURE 17 EUROPE: ORGANIC MARKET SHARE, BY COUNTRY, 2018 VS. 2019

- FIGURE 18 AREA HARVESTED FOR FRUIT & VEGETABLE CROPS, 2015–2019 (MILLION HECTARE)

- FIGURE 19 PATENTS GRANTED FOR BIOFERTILIZERS MARKET, 2012–2022

- FIGURE 20 REGIONAL ANALYSIS OF PATENT GRANTED FOR BIOFERTILIZERS MARKET, 2012–2022

- FIGURE 21 NUMBER OF PATENTS APPROVED FOR BIOPESTICIDE STRAINS IN MARKET, 2012–2020

- FIGURE 22 REGIONAL ANALYSIS: PATENT APPROVAL FOR BIOPESTICIDE PRODUCTS, 2012–2020

- FIGURE 23 NUMBER OF PATENTS APPROVED BETWEEN 2011 AND 2021

- FIGURE 24 REGIONS WITH HIGHEST NUMBER OF PATENT APPROVALS, 2016–2022

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 AGRICULTURAL BIOLOGICALS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 28 BIOCONTROL MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 29 BIOFERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 30 BIOSTIMULANTS MARKET: COMPANY EVALUATION QUADRANT (KEY PLAYERS), 2021

- FIGURE 31 BIOINSECTICIDES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

- FIGURE 32 BIOINSECTICIDES MARKET: COMPANY RANKINGS, 2022

- FIGURE 33 BIOFUNGICIDES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

- FIGURE 34 BIOFUNGICIDES MARKET: COMPANY RANKINGS, 2022

- FIGURE 35 BIONEMATICIDES MARKET: COMPANY RANKINGS, 2022

- FIGURE 36 BIOLOGICAL SEED TREATMENT: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 37 BIOLOGICAL SEED TREATMENT MARKET: COMPANY RANKINGS, 2022

- FIGURE 38 AGRICULTURAL INOCULANTS MARKET: COMPANY EVALUATION QUADRANT, APRIL 2023 (KEY PLAYERS)

- FIGURE 39 AGRICULTURAL PHEROMONES MARKET: COMPANY EVALUATION QUADRANT, APRIL 2023 (KEY PLAYERS)

- FIGURE 40 AGRICULTURAL PHEROMONES MARKET: COMPANY RANKINGS, 2022

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- FIGURE 42 BAYER AG: COMPANY SNAPSHOT

- FIGURE 43 SYNGENTA AG: COMPANY SNAPSHOT

- FIGURE 44 NOVOZYMES: COMPANY SNAPSHOT

- FIGURE 45 UPL: COMPANY SNAPSHOT

- FIGURE 46 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 47 FMC CORPORATION: COMPANY SNAPSHOT

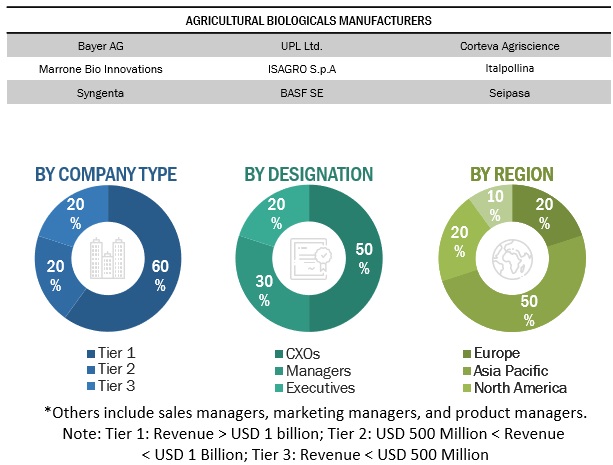

The study involves identifying the top trends in the agricultural biologicals market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The top trends in the agricultural biologicals market comprises several stakeholders in the supply chain, which include suppliers, manufacturers, and end-use product manufacturers. Various primary sources from both supply and demand sides of both markets have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies manufacturing biologicals. The primary sources from the supply side include research institutions involved in R&D, key opinion leaders, and manufacturing companies.

breakdown of primary interviews conducted

To know about the assumptions considered for the study, download the pdf brochure

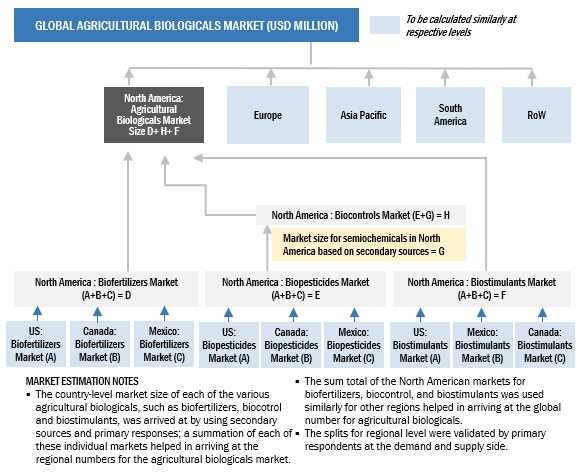

Top Trends in the Agricultural Biologicals Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets.

The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The 'industry's supply chain and market size were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Top Trends in the Agricultural Biologicals Market size estimation: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top Trends in the Agricultural Biologicals Market size estimation methodology: top-down approach

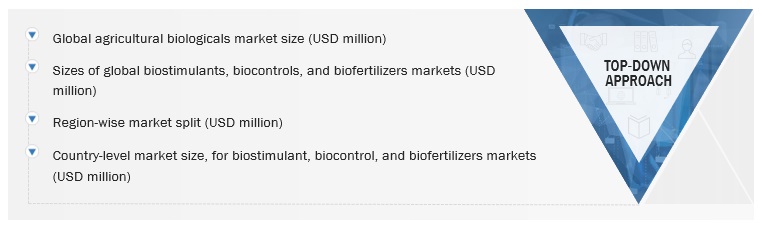

For the estimation of the concerned market, the size of the most appropriate immediate parent market was used to implement the top-down approach. To arrive at the market sizes of the biostimulants, bio-pesticides, biocontrols, and biofertilizers markets, the agricultural biologicals market was considered as the parent market. This data was again used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage shares that arrived from secondary and primary research.

Data Triangulation

In order to evaluate the overall agricultural biologicals market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition:

Agricultural biologicals are a group of products derived from microorganisms, plant extracts, or other biological matter. These products can be used as a substitute for agricultural chemical products. They provide crop protection from pests, diseases, and weeds and enhance the health and growth of plants. Farmers have started to rely on these agricultural biologicals, along with biotechnology and a variety of agronomic practices, to grow healthy and nutritious crops.

Agricultural microbial products are manufactured from microbes, such as bacteria, fungi, and other living microorganisms such as viruses and protozoa. When added to the soil and crops, these products improve the uptake of nutrients such as nitrogen and phosphate, promote growth & yield, help in insect control, and protect crops against diseases. Agricultural microbial products act as economic and environment-friendly substitutes for both fertilizers and pesticides.

According to the Environmental Protection Agency (EPA), biopesticides include naturally occurring substances that control pests (biochemical pesticides), microorganisms that control pests (microbial pesticides), and pesticide substances produced by plants containing added genetic material (plant-incorporated protectants) or PIPs. However, Plant-Incorporated Protectants (PIPs) have not been considered in the market study.

The National Center of Organic Farming (NCOF) defines biofertilizers as products containing carrier-based (solid or liquid) living microorganisms that are useful in agriculture, in terms of nitrogen fixation, phosphorus solubilization, or nutrient mobilization, for increasing the productivity of the soil and/or crop.

As defined by the European Biostimulant Industry Council (EBIC), plant biostimulants contain substance(s) and/(or) microorganism(s) whose function, when applied to plants or rhizosphere, is to stimulate nCatural processes to enhance or benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, and crop quality.

Biological seed treatment is the application of biological organisms and extracts on seeds to suppress, control, or repel plant pathogens, insects, or other pests that attack seeds, seedlings, or plants.

Key Stakeholders in the Top Trends in the Agricultural Biologicals Market:

- Global agricultural biological manufacturers

- Traders, distributors, and suppliers of agricultural inputs

- Agricultural biological traders and distributors

- Government and research organizations

- Industrial associations and research organizations

- Technology providers and Contract Research Organizations (CROs) for agricultural biological companies

- Agricultural institutes and universities

- Consumers, including farmers

- Government, legislative, and regulatory bodies

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Biopesticide Industry Alliance (BPIA)

- International Biocontrol Manufacturers Association (IBMA)

- Japan Biocontrol Association

- US Environmental Protection Agency (US EPA)

Top Trends in the Agricultural Biologicals Market Report Objectives

- To describe, segment, and project the global market size for the agricultural biologicals market

- To offer detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To evaluate the micro-markets, concerning individual growth trends, prospects, and their contribution to the total agricultural biologicals market

- To propose the size of the submarkets, in terms of value, for various regions

- To profile the major players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Top Trends in the Agricultural Biologicals Market