Soil Testing Equipment Market by End-user Industry (Agriculture, Construction, Environment), Type of Tests (Physical, Residual, Chemical), Site (Lab, On-Site), Degree of Automation (Automatic, Manual), and Region Global Forecast to 2025

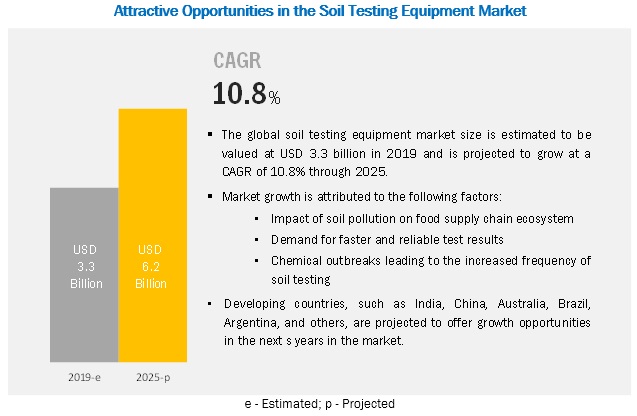

[175 Pages Report] The global soil testing equipment market size is estimated to be valued at USD 3.3 billion in 2019 and is projected to reach USD 6.2 billion by 2025, at a CAGR of 10.8% from 2019 to 2025. The need for proper farm management practices, industrialization, intensification of agriculture, and the need for faster & reliable test results have driven the market growth.

The rapid adoption of precision farming maximizes the yield and profitability of crops and gauge the soil fertility, leachability, and movement of nutrients, which would aid in optimizing soil formulation and quality. This has also allowed farmers or growers to segregate fields into zones, creating a site-specific approach to maximize yields and minimize input costs. Thus, these factors have resulted in driving the global soil testing equipment market growth.

By end-user industry, the construction segment is projected to account for the largest soil testing equipment market share

The construction industry in countries such as India has received substantial foreign direct investments (FDI) for the improvement of infrastructure in the light of rapid industrialization. Additionally, China is one of the worlds most significant players in the construction business due to the thriving residential and commercial sectors. The increasing global infrastructure spending is expected to fuel the growth of associated industries, including soil testing equipment. Technological advancement, coupled with rising awareness regarding the benefits of soil testing, is anticipated to drive the demand for requisite equipment.

By type of tests, the market for soil testing equipment market for residues is projected to account for the largest market size during the forecast period

Based on type of tests, the market has been segmented into physical, residual, and chemical tests. Physical tests include testing the soil for shear strength, leachability, plasticity, and porosity. Rapid urbanization in China and India are driving the market for physical tests. The growing awareness among consumers about the presence of chemical residues, such as pesticides and fertilizers in fresh fruits & vegetables, has been driving the market.

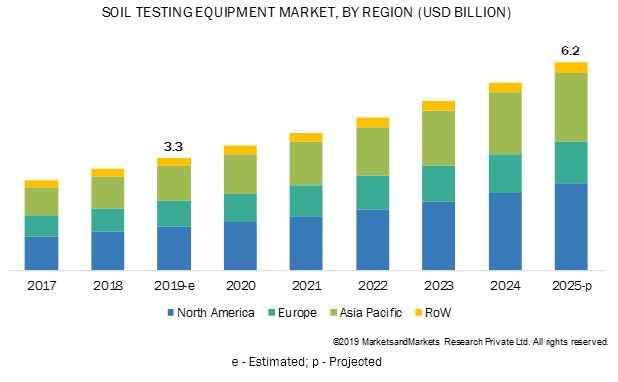

North America and Asia Pacific are projected to witness significant growth during the forecast period

North America, followed by Asia Pacific, is projected to grow at high rates from 2019 to 2025. The US is the leading market in the North American region. The market in this region is driven mainly by the presence of key players, growing funds for environmental protection, and growth in organic farming.

The Asia Pacific region is projected to grow at the second-fastest CAGR in the global soil testing equipment market, as some countries in this region offer profitable growth opportunities. Agricultural professionals in China are seeking modern practices of farming for sustainable development in the agricultural yield. Chinese scientists from domains, such as agronomy, agro-engineering, information technology, and geography, have been involved in the research on-farm management programs. The government of China has put in significant efforts to promote precision farming research and funded several projects. These factors are expected to drive growth of the global soil testing equipment industry.

Key Market Players

Key players in the soil testing equipment market include Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Merck Group (Germany), PerkinElmer Inc. (US), Controls S.p.A (Italy), LaMotte Company (US), Geotechnical Testing Equipment UK Ltd (UK), Sun Labtek Equipments (I) Pvt. Ltd (India), Martin Lishman Ltd (UK), S.W. Cole (UK), Ele International (UK), Gilson Company Inc. (US), Humboldt Mfg. Co. (US), EIE Instruments Pvt. Ltd (India), Eurofins Scientific (Luxemburg), Alfa Testing Equipment (US), Matest (Italy), M&L Testing Equipments (Canada), and Shambhavi Impex (India), among others. Manufacturers broadly adopted new product developments and acquisitions as their major strategies for the market.

Scope of Report

|

Report Metric |

Details |

|

Market Size for available years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

End-user Industry, Type of Tests, Site, Degree of automation, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Merck Group (Germany), PerkinElmer Inc. (US), Controls S.p.A (Italy), LaMotte Company (US), Geotechnical Testing Equipment UK Ltd (UK), Sun Labtek Equipments (I) Pvt. Ltd (India), Martin Lishman Ltd (UK), S.W. Cole (UK), Ele International (UK), Gilson Company Inc. (US), Humboldt Mfg. Co. (US), EIE Instruments Pvt. Ltd (India), Eurofins Scientific (Luxemburg), Alfa Testing Equipment (US), Matest (Italy), M&L Testing Equipments (Canada), and Shambhavi Impex (India) |

This research report categorizes the soil testing equipment market based on end-user industry, type of tests, site, degree of automation, and region

Based on end-user industry:

- Agriculture

- Construction

- Others

Based on type of tests:

- Physical

- Shear strength equipment

- Leachability equipment

- Plasticity equipment

- Permeability equipment

- Residual

- GC-MS

- ICP-MS

- Chemical

- pH meters

- Salinity testing equipment

- Test kits & reagents

Based on site:

- Laboratory

- On-site

Based on degree of automation:

- Manual

- Semi-automatic

- Automatic

Based on region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In September 2019, Ele International (UK) launched a new version of the software used for soil testing, complying with BS, ASTM, AASHTO standards. This software is designed especially for geotechnical laboratories. It will improve the quality and productivity of soil tests, such as permeability, triaxial, consolidation, residual, and California Bearing Ratio.

- In August 2018, Agilent (US) announced the acquisition of Young In Scientific Co. Ltd (South Korea), which aims at strengthening Agilents analytical capabilities in the environmental field as well as enhancing its direct reach in the South Korean market.

Key Questions addressed by the report

- What are the growth opportunities in the soil testing equipment market?

- What are the major and new product launches in the soil testing equipment market?

- What are the significant trends that are disrupting the soil testing equipment market?

- What are some of the major regulatory challenges and restraints that the industry faces?

- Which region is projected to emerge as a global leader by 2025?

Frequently Asked Questions (FAQ):

Who are the key players having a strong product portfolio along with business strategies in this industry?

The key players in the industry globally are, Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Merck Group (Germany), PerkinElmer Inc. (US), Controls S.p.A (Italy), LaMotte Company (US), and Geotechnical Testing Equipment UK Ltd (UK).

What are the factors constraining the growth of soil testing Market?

The key restarints identified to the soil testing market are adoption of advanced testing methods proportional to the price of sampling, and heavy duty on test kits.

What are the challenges that can be faced by market players?

The difficulty in standardizing the normal level of residual concentrations and varying test results with different test methods are the challenges that the players are going to fdacre in the exisiting market.

What factors make the construction segment occupy the largest market share for Soil Testing market?

India has received substantial foreign direct investments (FDI) for the improvement of infrastructure in the light of rapid industrialization. Additionally, China is one of the worlds most significant players in the construction business due to the thriving residential and commercial sectors. The increasing global infrastructure spending is expected to fuel the growth of associated industries, including soil testing equipment. Technological advancement, coupled with rising awareness regarding the benefits of soil testing, is anticipated to drive the demand for requisite equipment.

What are the factors repsonsible for the fastest growth of Soil Testing market in North America?

The market in this region is driven mainly by the presence of key players, growing funds for environmental protection, and growth in organic farming. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Takeaways

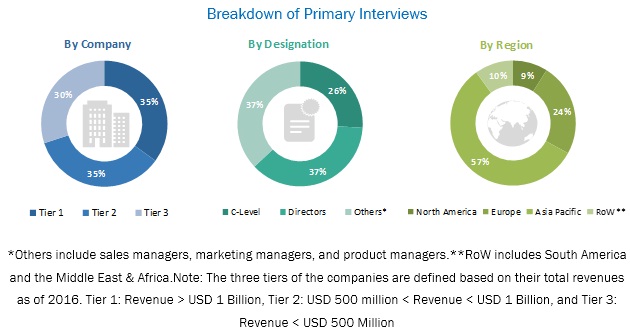

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations of the Study

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in the Soil Testing Equipment Market

4.2 Soil Testing Equipment Market: Major Regional Submarkets

4.3 North America: Soil Testing Equipment Market, By Type of Tests and Key Country

4.4 Soil Testing Equipment Market, By Type of Tests and Region

4.5 Soil Testing Equipment Market, By Type of Tests

4.6 Soil Testing Equipment Market, By Degree of Automation

4.7 Soil Testing Equipment Market, By Site

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Good Farm Management Program

5.2.1.1.1 Rapid Adoption of Precision Farming to Fuel the Demand for Soil Testing Equipment

5.2.1.2 Industrialization and Intensification of Agriculture Led to the Demand for Environmental Soil Testing

5.2.1.3 Demand for Faster and Reliable Test Results to Drive the Demand for Advanced Soil Testing Equipment

5.2.1.3.1 Chemical Outbreaks in the World Have Led to Increased Frequency of Residual Soil Testing

5.2.1.3.2 Growth in Techniques for On-Site Testing

5.2.1.4 Impact of Soil Pollution on Food Supply Chain Ecosystem

5.2.1.4.1 Budget Allocation and Spending on Food Safety

5.2.2 Restraints

5.2.2.1 Adoption of Advanced Testing Methods Proportional to the Price of Sampling

5.2.2.2 Heavy Duty on Test Kits

5.2.3 Opportunities

5.2.3.1 Development of Multi-Residual Testing Technologies

5.2.3.2 Growth in Potential in Emerging Markets of Asian, African, and Other Developing Countries

5.2.3.2.1 Government Initiatives and A Favorable Regulatory Scenario

5.2.4 Challenges

5.2.4.1 Difficulty in Standardizing the Normal Level of Residual Concentrations

5.2.4.1.1 Varying Test Results With Different Test Methods

6 Soil Testing Equipment Market, By End-Use Industry (Page No. - 55)

6.1 Introduction

6.2 Agriculture

6.2.1 Rising Cases of Soil Pollution and the Adoption of Preventive Measures to Drive the Growth of the Market

6.3 Construction

6.3.1 Strong Fdi in the Construction Industry in the Asia Pacific Region to Drive the Growth of the Market

6.4 Others

6.4.1 Growing Environmental Awareness in Countries Such as the US and the UK to Drive the Growth of the Market

7 Soil Testing Equipment Market, By Type of Tests (Page No. - 61)

7.1 Introduction

7.2 Physical Tests

7.2.1 Rapid Urbanization in China and India to Drive the Market for Physical Tests

7.2.1.1 Shear Strength Equipment

7.2.1.2 Leachability Equipment

7.2.1.3 Plasticity Equipment

7.2.1.4 Permeability Equipment

7.3 Residual Tests

7.3.1 Growing Awareness Among Consumers About the Presence of Pesticide Residues in Fresh Fruits & Vegetables to Drive the Growth of the Market

7.3.1.1 GC-MS

7.3.1.2 ICP-MS

7.4 Chemical Tests

7.4.1 Growing Adoption of Wastewater Irrigation Techniques Propelling the Growth of Chemical Tests

7.4.1.1 Ph Meters

7.4.1.2 Salinity Testing Equipment

7.4.1.3 Test Kits & Reagents

8 Soil Testing Equipment Market, By Degree of Automation (Page No. - 69)

8.1 Introduction

8.2 Manual

8.2.1 On-Site Soil Testing and A Certain Category of Tests Performed Using Manual Equipment

8.2.1.1 Sampling Kits

8.2.1.2 Sand Pouring Cylinder

8.2.1.3 Auger

8.2.1.4 Others

8.3 Automatic

8.3.1 Automatic Equipment Types, Such as Penetrometer, Permeability Apparatus, and Compactors, Driving the Soil Testing Equipment Market

8.3.1.1 Penetrometer

8.3.1.2 Permeability Apparatus

8.3.1.3 Compactor

8.3.1.4 Others (Load Frame and Split Spoon Sampler)

8.4 Semi-Automatic

8.4.1 Growing Availability of Semi-Automatic Equipment for Soil Testing and Better Infrastructure Driving the Market for Semi-Automatic Equipment

8.4.1.1 California Bearing Ratio Apparatus

8.4.1.2 Direct Shear Apparatus

8.4.1.3 Plastic Limit Device

8.4.1.4 Others

9 Soil Testing Equipment Market, By Site (Page No. - 75)

9.1 Introduction

9.2 Laboratory

9.2.1 Laboratory Equipment, Such as Consolidator, Direct Shear Apparatus, and Triaxial Shear Apparatus, Driving the Market

9.2.1.1 Consolidator

9.2.1.2 Direct Shear Apparatus

9.2.1.3 Triaxial Shear Test Apparatus

9.2.1.4 Others (Cone Penetrometer and California Bearing Ratio)

9.3 On-Site

9.3.1 Growing Need for Physical Tests Driving the Market for On-Site Testing Equipment

9.3.1.1 Penetration-Resistance Apparatus

9.3.1.2 Pressure Meter Apparatus

9.3.1.3 Plate-Bearing Apparatus

9.3.1.4 Others

10 Soil Testing Equipment Market, By Region (Page No. - 79)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Presence of A Large Number of Key Players and Research Funds for Technological Advancements Leading to Market Growth

10.2.2 Canada

10.2.2.1 Growing Urbanization and Government Initiatives for Environmental Soil Protection are Driving the Market

10.2.3 Mexico

10.2.3.1 Agricultural Investments Led to the Growth of the Soil Testing Equipment Market

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Farm Management Programs Have Enhanced the Need for Soil Testing in the Country

10.3.2 India

10.3.2.1 Advancing Precision Farming Technology and Urbanization Led to the Growth of the Soil Testing Equipment Market

10.3.3 Japan

10.3.3.1 Advancements in Precision Farming, Nutrient Mapping, and Field Robotics Have Driven the Market for Soil Testing Equipment

10.3.4 Australia & New Zealand

10.3.4.1 Growth in Organic Agricultural Land in the Two Countries Led the Market to Witness Growth

10.3.5 Rest of Asia Pacific

10.4 Europe

10.4.1 Germany

10.4.1.1 Environmental Protection Policies Propelled the Need for Soil Testing

10.4.2 UK

10.4.2.1 Growing Concerns for Soil Erosion and Pollution Compelled the Need for Soil Testing

10.4.3 France

10.4.3.1 The Intensification of Agriculture to Meet the Food Demand Increased the Frequency of Soil Testing

10.4.4 Italy

10.4.4.1 Environmental Regulations in Place and Fertilizer Cost Reduction Have Driven the Soil Testing Equipment Market

10.4.5 Spain

10.4.5.1 Stringent Regulatory Framework and R&D Initiatives are Promoting the Usage of Soil Testing Equipment

10.4.6 Rest of Europe

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.1.1 Increasing Industrial Activities Led to the Increased Frequency of Soil Testing to Adhere to International Environmental Standards

10.5.2 Argentina

10.5.2.1 Frequency and Advancements in Soil Testing are Driving the Market in the Country

10.5.3 South Africa

10.5.3.1 The Need for Agricultural Productivity to Meet the Food Demand Supply Led the Market

10.5.4 Middle East

10.5.4.1 Need for Construction and Sanitation Fuels the Demand for Soil Testing Equipment in the Region

10.5.5 Others in RoW

11 Competitive Landscape (Page No. - 125)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Ranking of Key Players, 2018

11.4 Competitive Scenario

11.4.1 New Product Launches

11.4.2 Acquisitions

12 Company Profiles (Page No. - 132)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Agilent Technologies

12.2 Thermo Fisher Scientific

12.3 Merck Group

12.4 Perkinelmer Inc.

12.5 Controls S.P.A

12.6 Lamotte Company

12.7 Geotechnical Testing Equipment UK Ltd

12.8 Sun Labtek Equipment (I) Pvt. Ltd

12.9 Martin Lishman Ltd

12.10 S.W. Cole

12.11 ELE International

12.12 Gilson Company Inc.

12.13 Humboldt MFG. Co.

12.14 Eie Instruments Pvt. Ltd.

12.15 Eurofins Scientific

12.16 Aimil Ltd.

12.17 Alfa Testing Equipment

12.18 Matest

12.19 M & L Testing Equipment

12.20 Shambhavi Impex

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 167)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (130 Tables)

Table 1 USD Exchange Rate, 20142018

Table 2 Environmental Quality Standards for Soil Pollution

Table 3 Chemical Outbreaks in the World, 20112015

Table 4 USDa Grants for Food Safety Research in 2018

Table 5 Soil Testing Equipment Market, By End-Use Industry, 20172025 (USD Million)

Table 6 Agriculture: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 7 Construction: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 8 Others: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 9 Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 10 Soil Testing Equipment Market Size for Physical Tests, By Subtype, 20172025 (USD Million)

Table 11 Soil Testing Equipment Market Size for Residual Tests, By Subtype, 20172025 (USD Million)

Table 12 Soil Testing Equipment Market Size for Chemical Tests, By Subtype, 20172025 (USD Million)

Table 13 Basic Engineering Principles of Soils Relating to Plasticity

Table 14 Soil Testing Equipment Market Size for Physical Tests, By Region, 20172025 (USD Million)

Table 15 Soil Testing Equipment Market Size for Physical Tests, By Subtype, 20172025 (USD Million)

Table 16 Soil Testing Equipment Market Size for Residual Tests, By Region, 20172025 (USD Million)

Table 17 Soil Testing Equipment Market Size for Chemical Tests, By Region, 20172025 (USD Million)

Table 18 Soil Testing Equipment Market Size, By Degree of Automation, 20172025 (USD Million)

Table 19 Manual: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 20 Compactors Used for Light and Heavy Soil

Table 21 Automatic: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 22 Semi-Automatic: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 23 Soil Testing Equipment Market Size, By Site, 20172025 (USD Million)

Table 24 Laboratory: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 25 On-Site: Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 26 Soil Testing Equipment Market Size, By Region, 20172025 (USD Million)

Table 27 North America: Soil Testing Equipment Market Size, By Country, 20172025 (USD Million)

Table 28 North America: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 29 North America: Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 30 North America: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 31 North America: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 32 North America: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 33 North America: Soil Testing Equipment Market Size, By Degree of Automation, 20172025 (USD Million)

Table 34 North America: Soil Testing Equipment Market Size, By Site, 20172025 (USD Million)

Table 35 US: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 36 US: Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 37 US: Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 38 US: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 39 US: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 40 Canada: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 41 Canada: Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 42 Canada: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 43 Canada: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 44 Canada: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 45 Mexico: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 46 Mexico: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 47 Mexico: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 48 Mexico: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 49 Asia Pacific: Soil Testing Equipment Market Size, By Country, 20172025 (USD Million)

Table 50 Asia Pacific: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 51 Asia Pacific: Soil Testing Equipment Market Size, By Site, 20172025 (USD Million)

Table 52 Asia Pacific: Soil Testing Equipment Market Size, By Degree of Automation, 20172025 (USD Million)

Table 53 China: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 54 China: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 55 China: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 56 China: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 57 India: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 58 India: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 59 India: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 60 India: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 61 Japan: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 62 Japan: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 63 Japan: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 64 Japan: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 65 Australia: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 66 Australia: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 67 Australia: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 68 Australia: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 69 New Zealand: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 70 New Zealand: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 71 New Zealand: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 72 New Zealand: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 73 Rest of Asia Pacific: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 74 Rest of Asia Pacific: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 75 Rest of Asia Pacific: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 76 Rest of Asia Pacific: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 77 Europe: Soil Testing Equipment Market Size, By Country, 20172025 (USD Million)

Table 78 Europe: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 79 Europe: Soil Testing Equipment Market Size, By Site, 20172025 (USD Million)

Table 80 Europe: Soil Testing Equipment Market Size, By Degree of Automation, 20172025 (USD Million)

Table 81 Germany: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 82 Germany: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 83 Germany: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 84 Germany: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 85 UK: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 86 UK: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 87 UK: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 88 UK: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 89 France: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 90 France: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 91 France: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 92 France: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 93 Italy: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 94 Italy: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 95 Italy: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 96 Italy: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 97 Spain: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 98 Spain: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Tests, 20172025 (USD Million)

Table 99 Spain: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 100 Spain: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 101 Rest of Europe: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 102 Rest of Europe: Soil Testing Equipment Market Size, By Type of Tests, 20172025 (USD Million)

Table 103 Rest of Europe: Soil Testing Equipment Market Size for Construction Industry, By Type of Tests, 20172025 (USD Million)

Table 104 Rest of Europe: Soil Testing Equipment Market Size for Other Industries, By Type of Tests, 20172025 (USD Million)

Table 105 RoW: Soil Testing Equipment Market Size, By Country, 20172025 (USD Million)

Table 106 RoW: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 107 RoW: Soil Testing Equipment Market Size, By Site, 20172025 (USD Million)

Table 108 RoW: Soil Testing Equipment Market Size, By Degree of Automation, 20172025 (USD Million)

Table 109 Brazil: Soil Testing Equipment Market Size, By End-Use Industry, 20192025 (USD Million)

Table 110 Brazil: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Test, 20192025 (USD Million)

Table 111 Brazil: Soil Testing Equipment Market Size for Construction Industry, By Type of Test, 20192025 (USD Million)

Table 112 Brazil: Soil Testing Equipment Market Size for Other Industries, By Type of Test, 20192025 (USD Million)

Table 113 Argentina: Soil Testing Equipment Market Size, By End-User Industry, 20172025 (USD Million)

Table 114 Argentina: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Test, 20192025 (USD Million)

Table 115 Argentina: Soil Testing Equipment Market Size for Construction, By Type of Test, 20192025 (USD Million)

Table 116 Argentina: Soil Testing Equipment Market Size for Other Industries, By Type of Test, 20192025 (USD Million)

Table 117 South Africa: Soil Testing Equipment Market Size, By End-Use Industry, 20192025 (USD Million)

Table 118 South Africa: Agriculture: Soil Testing Equipment Market Size, By Type of Test, 20192025 (USD Million)

Table 119 South Africa: Soil Testing Equipment Market Size for Construction Industry, By Type of Test, 20192025 (USD Million)

Table 120 South Africa: Soil Testing Equipment Market Size for Other Industries, By Type of Test, 20192025 (USD Million)

Table 121 Middle East: Soil Testing Equipment Market Size, By End-User Industry, 20192025 (USD Million)

Table 122 Middle East: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Test, 20192025 (USD Million)

Table 123 Middle East: Soil Testing Equipment Market Size for Construction Industry, By Type of Test, 20192025 (USD Million)

Table 124 Middle East: Soil Testing Equipment Market Size for Other Industries, By Type of Test, 20192025 (USD Million)

Table 125 Others: Soil Testing Equipment Market Size, By End-Use Industry, 20192025 (USD Million)

Table 126 Others: Soil Testing Equipment Market Size for Agriculture Industry, By Type of Test, 20192025 (USD Million)

Table 127 Others: Soil Testing Equipment Market Size for Construction Industry, By Type of Test, 20192025 (USD Million)

Table 128 Others: Soil Testing Equipment Market Size for Other Industries, By Type of Test, 20192025 (USD Million)

Table 129 New Product Launches

Table 130 Acquisitions

List of Figures (44 Figures)

Figure 1 Soil Testing Equipment Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Research Design: Soil Testing Equipment Market

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Soil Testing Equipment Market Snapshot, 20172025

Figure 8 Soil Testing Equipment Market, By Type of Tests, 20192025

Figure 9 Soil Testing Equipment Market, By Type of Tests, 2019 vs. 2025

Figure 10 Soil Testing Equipment Market, By Degree of Automation, 2019 vs. 2025

Figure 11 Soil Testing Equipment Market, By Site, 2019 vs. 2025

Figure 12 Soil Testing Equipment Market, By End-Use Industry, 2019 vs. 2025

Figure 13 Soil Testing Equipment Market Share and Growth (Value), By Region, 2018

Figure 14 Increased Adoption and Need for Soil Testing Propelling the Market

Figure 15 India is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 The US Accounted for the Largest Share in the North American Soil Testing Equipment Market in 2018

Figure 17 North America is Projected to Dominate the Market for Soil Testing Equipment Across All Segments, 2019 vs. 2025

Figure 18 The Chemical Segment is Projected to Dominate Soil Testing Equipment Market During the Forecast Period

Figure 19 North America Dominated the Manual Segment in 2018

Figure 20 North America Dominated the Laboratory Segment in 2018

Figure 21 Market Dynamics: Soil Testing Equipment Market

Figure 22 Us: Pesticide Usage, By Type, 1992 vs. 2014 (Gallon)

Figure 23 Global Synthetic Fertilizer Consumption, 20082018 (Million Mt)

Figure 24 Food Safety Improvements & Increased Budget Allocation By the Fda, 2015

Figure 25 Hazardous Chemical Usage, 20052030 (USD Million)

Figure 26 Australian Government Investment in R&D, 20152016 (USD Billion)

Figure 27 Soil Testing Equipment Market Size, By End-Use Industry, 2019 vs. 2025 (USD Million)

Figure 28 Growth of Organic Agricultural Land, By Region, 20112019

Figure 29 Soil Testing Equipment Market Size, By Type of Tests, 2019 vs. 2025 (USD Million)

Figure 30 Infrastructure Investment, 2014 vs. 2018

Figure 31 Soil Testing Equipment Market Size, By Degree of Automation, 2019 vs. 2025 (USD Million)

Figure 32 Soil Testing Equipment Market Size, By Site, 2019 vs. 2025 (USD Million)

Figure 33 India to Record the Highest Growth Rate During the Forecast Period in the Soil Testing Equipment Market

Figure 34 North America: Soil Testing Equipment Market Snapshot

Figure 35 Asia Pacific: Soil Testing Equipment Market Snapshot

Figure 36 Europe: Soil Testing Equipment Market Snapshot

Figure 37 Soil Testing Equipment Market, Competitive Leadership Mapping, 2018

Figure 38 Key Developments of the Leading Players in the Soil Testing Equipment Market, 20182019

Figure 39 Thermo Fisher Scientific Dominated the Soil Testing Equipment Market in 2018

Figure 40 Agilent Technologies: Company Snapshot

Figure 41 Thermo Fisher Scientific: Company Snapshot

Figure 42 Merck Group: Company Snapshot

Figure 43 Perkinelmer Inc.: Company Snapshot

Figure 44 Eurofins Scientific: Company Snapshot

The study involves four major activities to estimate the current size of the soil testing equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the soil testing equipment market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources (directories and databases), such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet (which acquired Avention), were used to identify and collect information useful for the study of the soil testing equipment market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, safety testing organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market includes several stakeholders in the supply chain-manufacturers, importers & exporters, traders, distributors, and suppliers of soil testing equipment. The demand side of the soil testing equipment market is characterized by testing laboratories, R&D companies, and government agencies. The supply side is characterized by the presence of key providers of soil testing equipment. Various primary sources from the supply and demand sides of both markets have been interviewed to obtain qualitative and quantitative information.

Following are the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the soil testing equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall soil testing equipment market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the soil testing equipment market, with respect to the end-user industry, type of tests, site, degree of automation, and region, over six years ranging from 2019 to 2025

- Identifying the attractive opportunities in the soil testing equipment market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling the key market players in the soil testing equipment market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the supply chain and regulatory frameworks across regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the soil testing equipment market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Segmental Analysis

- Detailed sub-segmental analysis for equipment type

- Market analysis for objective type

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific, by key country

- Further breakdown of the Rest of European, by key country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Soil Testing Equipment Market