Feed Antioxidants Market by Type Synthetic (BHT, BHA, Ethoxyquin, and Propyl Gallate) and Natural (Carotenoids, Tocopherols, Botanical Extracts, and Vitamins), Animal (Poultry, Swine, Aquaculture, Cattle, and Pets), Form, Region - Global Forecast to 2025

Feed Antioxidants Market

Global Feed Antioxidants Market is expected to grow at a CAGR of 4.9%

Drivers and Restraints:

Market dynamics for feed antioxidants continue to evolve on the basis key drivers and restraints. Factors such as the rise in demand for quality feed, improved technology for feed production, and an increase in the standardization of meat products stimulate the growth of the feed antioxidants market across the globe.

Key drivers for feed antioxidants include:

- Unpredictable crop harvest patterns, leading to the need for storage

- Increasing demand for animal-based products

- Significant growth opportunities in poultry and aquafeed sectors

- Quality control of feed additive products manufactured by Asian companies

Restraints and Challenges impeding the market include:

- High cost of natural antioxidants

- Quality control of feed additive products manufactured by Asian companies

The feed antioxidants market has been segmented into poultry, swine, ruminants, aquaculture, and pets. At a global level, there is a rising demand for feed antioxidants in poultry. As the demand from the livestock industry rises for protein-rich foods such as dairy products, eggs, and meat, the feed antioxidant industry will also benefit from as it grows consequently and proportionately with the livestock industry. The leading animal segment are ranked below.

Leading animal segments for feed antioxidants include:

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

Feed antioxidants are segmented into synthetic and natural antioxidants types. The major ones are enlisted below.

- BHT

- Ethoxyquin

- BHA

With advancement in new technological platforms required to manufacture feed antioxidants on a commercial scale, increasing awareness and adoption rate by the farmers and focus on sustainable agriculture, several agrochemical and specialty chemical manufacturers have developed feed antioxidants. The leading players in feed antioxidants are listed below.

Top players in feed antioxidants market include :

- Cargill (US)

- Archer Daniels Midland Company (US)

- Koninklijke DSM N.V. (Netherlands)

- BASF SE (Germany)

- Nutreco (Netherlands)

- Kemin (US)

- Adisseo (France)

- Perstorp (Sweden)

- Alltech (US)

- Novus International (US)

Top start-ups in feed antioxidants market include :

- Finoric LLC. (Japan)

- Global Nutritech (US)

- Jiaxing Suns agrochemicals Co., Ltd. (China)

- Cladan SA (Canada)

- Vitafor (Belgium)

- Megamix (US)

- AASC Ltd. (England)

- Advanced Animal Nutrition (India)

Case study:

Headline

Helped a leading agriculture biological solutions provider identify a USD 340.0 million revenue potential by tapping into the feed antioxidants market in Asia Pacific.

Client’s Problem statement

Our client, a leading provider of antioxidants solutions, was looking for opportunities to expand the company’s presence in the feed antioxidants market. Its product marketing team required an understanding on factors influencing the demand for feed antioxidants for different livestock applications to offer customized products, which would help it gain a larger market share.

MnM Approach

MNM identified the major players across regions and the trends prevailing in each of the markets to improve, as well as understand the changing revenue mix of our client’s clients in end-use applications, particularly for livestock such as poultry, swine, ruminants, aquaculture and pets. MNM also interviewed industry stakeholders to gain perspectives on regions that witness significant demand for feed antioxidants. A detailed analysis on the livestock feeding patterns and the corresponding demand for feed antioxidants was also undertaken. These steps helped MNM to offer insights on agricultural and feed antioxidants providers for making appropriate investment decisions and forming suitable alliances, which would help it gain a leading position in the market.

Revenue Impact (RI)

Our work has helped the client to tap into a USD 1.3 billion market, with projected revenues of USD 80 million in three years from our recommendations.

Tags

Feed, feed antioxidants, livestock, BHT, BHA, ethoxyquin competitive benchmarking, agriculture market entry strategy, go-to-market strate

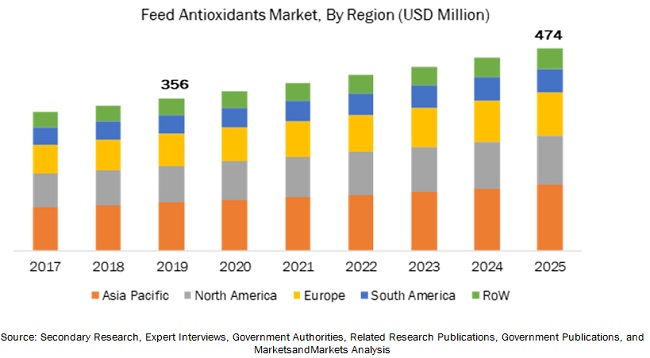

[186 Pages Report] The feed antioxidants market was estimated at USD 356 million in 2019 and is projected to reach USD 474 million by 2025. The global market is projected to grow at a rate of 4.9% during the forecast period. Factors such as the rise in demand for quality feed, improved technology for feed production, and an increase in the standardization of meat products stimulate the growth of the market across the globe.

The dry segment for feed antioxidants is projected to account for the largest market share, by form

The dry segment in the feed antioxidants market is estimated to witness a higher demand among livestock farmers, as they are easy to mix with feed, store, and handle. Most feed antioxidant manufacturers in the market provide the dry form of products in the form of powders, granules, and beadlets, considering the demand from end users.

The powder segment for dry feed antioxidants is projected to account for the largest market share, by form

The powder form of feed antioxidants dominated the dry segment, thereby fuelling the overall feed antioxidants market growth. Powders are estimated to witness higher demand as they are convenient to coat over the feed. In addition, as the size of the powder form is consistent, it helps to be coated on the feed easily. Antioxidants such as carotenoids, ethoxyquin, BHT, BHA, and TBHQ are available in this form. These antioxidants are preferred as they are also easy to use in combination with other feed antioxidants.

The poultry segment is projected to account for the largest feed antioxidants market share, by animal

In poultry production, one of the major factors for feed is the cost; hence, reducing feed costs per bird is a priority. Poultry production must be efficient as feed has to be converted into meat and eggs. Feed costs can be reduced by adding feed additives such as enzymes and antioxidants, which increase digestibility and prevent the loss of nutrients, with the result that the poultry gains more nutritional value from the same amount of feed, thus boosting the overall growth of the feed antioxidants market. Companies such as Cargill, Koninklijke DSM N.V., and Kemin provide feed antioxidants such as carotenoids, tocopherols, synthetic antioxidants, and citric acid, BHT, butylated hydroxyanisole (BHA), and tocopheryl acetate for the poultry industry.

The BHT segment is projected to account for the largest synthetic feed antioxidant market share

Synthetic antioxidants are generally produced as pure substances with consistent composition and are applied in well-defined mixtures with pure substances. Higher stability, easy availability, and low cost of production fuel the growth of the synthetic segment in the feed antioxidants market. Also, it protects fat-soluble vitamins and other nutrients against oxidative degradation, along with the loss of active ingredients in feed. Asia Pacific is projected to be the largest and fastest-growing BHT market. This is attributed to the growth of the feed industry in the region.

For the natural feed antioxidant market, the carotenoids segment is projected to account for the largest market share

The growing application of carotenoids in feed due to the modernization of livestock farming techniques in the swine, poultry, and aquaculture industries fuels the demand for feed antioxidants. Carotenoids help in meeting the rising demand for pork and poultry meat by enhancing the palatability of feed grades and in supplementing animals with the required nutrients for their growth.

Asia Pacific is projected to witness significant growth during the forecast period

The market for feed antioxidants is increasing globally and is largely driven by the increase in meat consumption. The market for feed antioxidants is projected to increase steadily up to 2025. Asia Pacific is estimated as the largest developed market for feed antioxidants. This region is a growing market and provides great future potential for producers. The region’s dominance of share and growth rate is attributed to the growing economies in the Asian countries, which are bound to record an increase in disposable incomes and trigger the demand for protein-rich products such as meat and dairy. The globally increasing cost of feed is the main factor leading to an increased demand for the feed antioxidants to prevent feed spoilage and enhance its shelf-life. Also, the hot and humid climate in certain parts of the world makes the use of feed antioxidants necessary.

Key Market Players

Key participants in the market include Cargill (US), Archer Daniels Midland Company (US), Koninklijke DSM N.V. (Netherlands), BASF SE (Germany), Nutreco (Netherlands), Kemin (US), Adisseo (France), Perstorp (Sweden), Alltech (US), Caldic (Canada), Novus International (US), Chemical Fine Sciences (India), Oxiris Chemical (Spain), VDH Chemicals (India), Zhejiang Medicine Co. Ltd. (China), BTSA (Spain), Bertol Company (Czech Republic), FoodSafe Technologies (US), Videka (US), Lallemand Animal Nutrition (Canada), and Industrial Tecnica Pecuária (Spain).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast units |

Value (USD million) and volume (ton) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

This research report categorizes the feed antioxidants market based on type, form, animal, and region.

Based on the Type, the market has been segmented as follows:

-

Synthetic

- BHT

- BHA

- Ethoxyquin

- Propyl gallate

- Others (TBHQ and phosphoric acid)

-

Natural

- Carotenoids

- Tocopherols

- Botanical extracts

- Vitamins

Based on Form, the Market has been segmented as follows

-

Dry

- Powders

- Beadlets

- Granules

- Liquid

Based on Animal, the market has been segmented as follows

- Poultry

- Cattle

- Swine

- Aquaculture

- Pets

Based on the Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (the Middle East & Africa)

Key Questions Addressed by the Report

- What are the growth opportunities in the feed antioxidants market?

- What are the major and new product launches in the feed antioxidants market?

- What are the significant trends that are disrupting the feed antioxidants market?

- What are some of the major regulatory challenges and restraints that the industry faces?

- Which region is projected to emerge as a global leader by 2025?

Frequently Asked Questions (FAQ):

Which is the major animal segment of feed antioxidants? How huge is the opportunity for their growth in the next five years?

The major animal segment in the feed antioxidants market is the poultry segment. Growing demand for poultry-based meat products in domestic and international markets is fuelling the feed antioxidant demand and will lead to USD 232.0 million opportunities until 2025.

Who are the key players operative in the global feed antioxidants market?

What are the key factors projecting the global feed antioxidants market size to 2025?

What are the drivers and opportunities for the feed antioxidants market?

Which region is expected to witness significant demand for feed antioxidants in the coming years?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.2.1 Increase in feed production

2.3.2.2 Increase in global meat consumption

2.3.3 SUPPLY-SIDE ANALYSIS

2.3.3.1 Number of new feed antioxidant products launched

2.3.3.2 Increase in environmental concerns

2.4 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

4.2 FEED ANTIOXIDANT MARKET, BY REGION

4.3 SYNTHETIC FEED ANTIOXIDANTS MARKET, BY TYPE

4.4 NATURAL FEED ANTIOXIDANT MARKET, BY TYPE

4.5 ASIA PACIFIC: FEED ANTIOXIDANT MARKET, BY ANIMAL AND COUNTRY

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Unpredictable crop harvest patterns leading to the need for storage

5.2.1.2 Growth in feed production

5.2.1.3 Implementation of innovative animal husbandry practices to improve meat quality

5.2.1.4 Growth in demand of animal-based products

5.2.2 RESTRAINTS

5.2.2.1 High cost of natural antioxidants

5.2.3 OPPORTUNITIES

5.2.3.1 Significant growth opportunities in the poultry and aquafeed sectors

5.2.4 CHALLENGES

5.2.4.1 Quality control of feed additive products manufactured by Asian companies

5.3 REGULATORY FRAMEWORK

5.3.1 THE FOOD AND AGRICULTURE ORGANIZATION (FAO)

5.3.2 THE EUROPEAN COMMISSION

5.4 SUPPLY CHAIN

6 FEED ANTIOXIDANTS MARKET, BY TYPE (Page No. - 54)

6.1 INTRODUCTION

6.2 SYNTHETIC ANTIOXIDANTS

6.2.1 BHA

6.2.1.1 BHA has been widely used to preserve the freshness, flavor, and color of feed

6.2.2 BHT

6.2.2.1 Demand for poultry feed boosts the market in the feed segment

6.2.3 ETHOXYQUIN

6.2.3.1 Factors such as the rising adoption of pets and the demand for preservatives in poultry, in the agricultural sector, are fueling its demand

6.2.4 PROPYL GALLATE

6.2.4.1 Rise in the adoption of pets in Asian countries to fuel the demand for propyl gallate

6.2.5 OTHER TYPES

6.3 NATURAL ANTIOXIDANTS

6.3.1 CAROTENOIDS

6.3.1.1 Growth in the application of carotenoids in feed due to the modernization of the pork, poultry, and aquaculture industries to fuel the market demand

6.3.2 TOCOPHEROLS

6.3.2.1 Increase in demand for superior-quality pork and other meat products drives the tocopherols segment

6.3.3 BOTANICAL EXTRACTS

6.3.3.1 Botanical extracts, with their therapeutic properties, are in demand for feed

6.3.4 VITAMINS

6.3.4.1 Vitamin E acts as an important antioxidant to protect cells and tissues and is involved in improving the immunity of animals

7 FEED ANTIOXIDANT MARKET, BY ANIMAL (Page No. - 72)

7.1 INTRODUCTION

7.2 POULTRY

7.2.1 GROWING DEMAND FOR POULTRY-BASED MEAT PRODUCTS IN DOMESTIC AND INTERNATIONAL MARKETS

7.3 SWINE

7.3.1 SWINE-BASED MEAT PRODUCTS ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET, ESPECIALLY IN FROZEN FOOD

7.4 RUMINANTS

7.4.1 ANTIOXIDANTS IN RUMINANTS FEED PREVENT CELL DAMAGE, RESULTING IN A HEALTHY IMMUNE SYSTEM

7.5 AQUACULTURE

7.5.1 INCREASE IN THE DEMAND FOR FISH AND FISH-BASED PRODUCTS FUELS THE DEMAND FOR FEED ANTIOXIDANTS IN AQUACULTURE

7.6 PETS

7.6.1 INCREASE IN THE HUMANIZATION OF PETS IS PROPELLING THE DEMAND FOR PET FOOD ANTIOXIDANTS TO BOOST THE IMMUNE SYSTEM OF PETS

7.6.2 CATS

7.6.3 DOGS

8 FEED ANTIOXIDANTS MARKET, BY FORM (Page No. - 84)

8.1 INTRODUCTION

8.2 DRY

8.2.1 POWDERS

8.2.1.1 Consistent size and convenience in application leads to largest market share

8.2.2 GRANULES

8.2.2.1 Properties such as extended shelf-life and delaying rancidity fuels the market demand

8.2.3 BEADLETS

8.2.3.1 Flexibility in using beadlets form of antioxidants in combination with other antioxidants is driving the demand

8.3 LIQUID

8.3.1 MORE ACCURATE DOSING AND UNIFORMITY OF LIQUID FEED ANTIOXIDANTS ARE LIKELY TO PROPEL THE MARKET

9 FEED ANTIOXIDANTS MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Companies are focusing on innovation and development of natural feed antioxidants

9.2.2 CANADA

9.2.2.1 Increase in demand for quality meat acts as a driving factor in the country

9.2.3 MEXICO

9.2.3.1 Support from government programs and the expanding livestock production to drive the consumption of feed antioxidants in Mexico

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Concerns regarding meat quality and safety to boost the demand for feed additives such as feed antioxidants in the country

9.3.2 FRANCE

9.3.2.1 Environmental and societal requirements for better livestock products with accurate efficacy and functional characteristics to drive the market in France

9.3.3 ITALY

9.3.3.1 Italy is one of the leading poultry meat producing countries in the EU, along with France, the UK, and Spain, thereby driving the demand for feed antioxidants

9.3.4 UK

9.3.4.1 Adoption of intensive feed farming solutions for animals to drive the market

9.3.5 SPAIN

9.3.5.1 Rising demand for feed antioxidants has been witnessed in the country to meet the increasing demand for meat and dairy products

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 The demand for superior-quality feed is driven by technological advancements in the feed additives market

9.4.2 INDIA

9.4.2.1 Inflow of foreign direct investment and availability of raw material make India a preferable destination for companies

9.4.3 JAPAN

9.4.3.1 Increase in feed production to have a direct impact on the usage of feed antioxidants

9.4.4 AUSTRALIA

9.4.4.1 Awareness of importance of safe feed ingredients is driving the antioxidants market

9.4.5 THAILAND

9.4.5.1 Favorable export of meat-based feed products to drive the demand for feed antioxidants in Thailand

9.4.6 INDONESIA

9.4.6.1 Technological advancements and growth in production units are driving the Indonesian feed antioxidant market

9.4.7 REST OF ASIA PACIFIC

9.4.7.1 Rise in awareness and importance of livestock nutrition for good-quality meat and animal-based protein

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.1.1 Growth in demand for meat and meat products in the domestic and international markets

9.5.2 ARGENTINA

9.5.2.1 Increase in meat exports by the country and the climate of the country are driving the usage of feed antioxidants

9.5.3 REST OF SOUTH AMERICA

9.5.3.1 Lack of awareness about the usage of feed antioxidants hindering the market growth

9.6 REST OF THE WORLD

9.6.1 MIDDLE EAST

9.6.1.1 Improvement in feed manufacturing in the region is expected to boost the demand for feed antioxidants

9.6.2 AFRICA

9.6.2.1 Investments in mills and poultry farms to fuel the market demand for feed antioxidants

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 VISIONARY LEADERS

10.2.2 DYNAMIC DIFFERENTIATORS

10.2.3 INNOVATORS

10.2.4 EMERGING COMPANIES

10.3 COMPETITIVE LEADERSHIP MAPPING (START-UP/SME)

10.3.1 PROGRESSIVE COMPANIES

10.3.2 STARTING BLOCKS

10.3.3 RESPONSIVE COMPANIES

10.3.4 DYNAMIC COMPANIES

10.4 MARKET SHARE ANALYSIS, 2018

10.5 COMPETITIVE SCENARIO

10.5.1 PARTNERSHIPS

10.5.2 EXPANSIONS

10.5.3 NEW PRODUCT LAUNCHES

10.5.4 ACQUISITIONS, AGREEMENTS, AND JOINT VENTURES

11 COMPANY PROFILES (Page No. - 141)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 CARGILL

11.2 BASF

11.3 ARCHER DANIELS MIDLAND COMPANY (ADM)

11.4 KONINKLIJKE DSM N.V.

11.5 NUTRECO

11.6 KEMIN

11.7 ADISSEO

11.8 PERSTORP

11.9 ALLTECH

11.10 NOVUS INTERNATIONAL

11.11 VDH CHEM TECH PVT.LTD.

11.12 BTSA

11.13 ZHEJIANG MEDICINE CO. LTD.

11.14 CAMLIN FINE SCIENCES

11.15 OXIRIS CHEMICALS

11.16 BERTOL COMPANY

11.17 FOODSAFE TECHNOLOGIES

11.18 CALDIC

11.19 INDUSTRIAL TECNICA PECUÁRIA

11.20 VIDEKA

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 APPENDIX (Page No. - 177)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (119 Tables)

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2014–2018

TABLE 2 MARKET SNAPSHOT, 2019 VS. 2025

TABLE 3 FEED ANTIOXIDANTS MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 4 MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 5 SYNTHETIC: FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 6 SYNTHETIC: MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 7 SYNTHETIC: MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 8 SYNTHETIC: MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 9 BHA MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 10 BHA MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 11 BHT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 BHT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 13 ETHOXYQUIN MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 14 ETHOXYQUIN MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 15 PROPYL GALLATE MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 16 PROPYL GALLATE MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 17 OTHER SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 OTHER SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 19 NATURAL FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 20 NATURAL FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 21 NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 22 NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 23 COMMON DIETARY SOURCES OF CAROTENOIDS IN VEGETABLE FOODS (MG/100 FRESH WEIGHT)

TABLE 24 CAROTENOIDS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 CAROTENOIDS MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 26 TOCOPHEROLS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 TOCOPHEROLS MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 28 BOTANICAL EXTRACTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 29 BOTANICAL EXTRACTS MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 30 VITAMINS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 31 VITAMINS MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 32 FEED ANTIOXIDANT MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 33 FEED ANTIOXIDANT MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 34 POULTRY FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 35 POULTRY FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 36 SWINE FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 37 SWINE FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 38 RUMINANTS FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 39 RUMINANTS FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 40 AQUACULTURE FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 41 AQUACULTURE FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 42 PET FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 43 PET FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 44 FEED ANTIOXIDANTS MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 45 FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (TON)

TABLE 46 DRY FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 47 DRY FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 48 DRY FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 49 POWDERED FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

TABLE 50 GRANULAR FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

TABLE 51 BEADLET FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

TABLE 52 LIQUID FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 53 LIQUID FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 54 FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 55 FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 56 SYNTHETIC FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

TABLE 57 SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017-2025 (TON)

TABLE 58 NATURAL FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017-2025 (USD MILLION)

TABLE 59 NATURAL FEED ANTIOXIDANT MARKET SIZE, BY REGION, 2017-2025 (TON)

TABLE 60 NORTH AMERICA: FEED ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2025 (TON)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 64 NORTH AMERICA: SYNTHETIC FEED ANTIOXIDANTS MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 66 NORTH AMERICA: NATURAL FEED ANTIOXIDANTS MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 68 NORTH AMERICA: FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY FORM, 2017–2025 (TON)

TABLE 70 NORTH AMERICA: DRY FEED ANTIOXIDANTS MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 71 EUROPE: FEED ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2025 (TON)

TABLE 73 EUROPE: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 74 EUROPE: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 75 EUROPE: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 76 EUROPE: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 77 EUROPE: FEED ANTIOXIDANTS MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY FORM, 2017–2025 (TON)

TABLE 79 EUROPE: DRY FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 80 EUROPE: FEED ANTIOXIDANT MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 82 ASIA PACIFIC: FEED ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2025 (TON)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 86 ASIA PACIFIC: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 88 ASIA PACIFIC: NATURAL FEED ANTIOXIDANTS MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 90 ASIA PACIFIC: FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY FORM, 2017–2025 (TONS)

TABLE 92 ASIA PACIFIC: DRY FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 93 SOUTH AMERICA: FEED ANTIOXIDANTS MARKET SIZE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 94 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2025 (TON)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 97 SOUTH AMERICA: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 99 SOUTH AMERICA: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 100 SOUTH AMERICA: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 101 SOUTH AMERICA: FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY FORM, 2017–2025 (TON)

TABLE 103 SOUTH AMERICA: DRY FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 104 ROW: FEED ANTIOXIDANTS MARKET SIZE, BY REGION, 2017–2025 (USD MILLION)

TABLE 105 ROW: MARKET SIZE, BY REGION, 2017–2025 (TON)

TABLE 106 ROW: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 107 ROW: SYNTHETIC FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 108 ROW: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 109 ROW: NATURAL FEED ANTIOXIDANT MARKET SIZE, BY TYPE, 2017–2025 (TON)

TABLE 110 ROW: FEED ANTIOXIDANTS MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 111 ROW: MARKET SIZE, BY FORM, 2017–2025 (TON)

TABLE 112 ROW: DRY FEED ANTIOXIDANT MARKET SIZE, BY FORM, 2017–2025 (USD MILLION)

TABLE 113 ROW: FEED ANTIOXIDANT MARKET SIZE, BY ANIMAL, 2017–2025 (USD MILLION)

TABLE 114 ROW: FEED ANTIOXIDANT MARKET SIZE, BY ANIMAL, 2017–2025 (TON)

TABLE 115 MARKET RANKING, 2018

TABLE 116 PARTNERSHIPS, 2018–2019

TABLE 117 EXPANSIONS, 2018

TABLE 118 NEW PRODUCT LAUNCHES, 2018

TABLE 119 ACQUISITIONS, AGREEMENTS, AND JOINT VENTURES, 2018–2019

LIST OF FIGURES (57 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

FIGURE 3 RESEARCH DESIGN

FIGURE 4 KEY DATA FROM PRIMARY SOURCES

FIGURE 5 MARKET DATA FROM PRIMARY SOURCES

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY MANUFACTURER LEVEL, DESIGNATION, AND KEY COUNTRY

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 9 FEED PRODUCTION TREND, 2013–2017 (MILLION TON)

FIGURE 10 MEAT CONSUMPTION, BY MEAT TYPE, 2014–2019 (MILLION TON)

FIGURE 11 DATA TRIANGULATION METHODOLOGY

FIGURE 12 FEED ANTIOXIDANT MARKET SNAPSHOT, 2017–2025 (USD MILLION)

FIGURE 13 MARKET SNAPSHOT, 2017–2025 (TON)

FIGURE 14 THE SYNTHETIC SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGH 2025 (USD MILLION)

FIGURE 15 THE BHT SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGH 2025 (USD MILLION)

FIGURE 16 THE CAROTENOIDS SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGH 2025 (USD MILLION)

FIGURE 17 THE DRY SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGH 2025 (USD MILLION)

FIGURE 18 THE POULTRY SEGMENT IS PROJECTED TO DOMINATE THE MARKET THROUGH 2025 (USD MILLION)

FIGURE 19 MARKET SHARE AND GROWTH (VALUE), BY REGION, 2018

FIGURE 20 GROWING DEMAND FOR LIVESTOCK FEED TO DRIVE THE MARKET

FIGURE 21 ASIA PACIFIC TO DOMINATE THE FEED ANTIOXIDANT MARKET FROM 2019 TO 2025

FIGURE 22 THE BHT SEGMENT IS ESTIMATED TO BE THE LARGEST AMONG SYNTHETIC FEED ANTIOXIDANTS THROUGHOUT THE FORECAST PERIOD

FIGURE 23 CAROTENOIDS ARE ESTIMATED TO FORM THE LARGEST NATURAL FEED ANTIOXIDANTS SEGMENT FROM 2019 TO 2025

FIGURE 24 THE POULTRY SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC FEED ANTIOXIDANTS MARKET IN 2018

FIGURE 25 CHINA, INDIA, AND CANADA ARE PROJECTED TO GROW AT HIGH RATES DURING THE FORECAST PERIOD

FIGURE 26 MARKET DYNAMICS

FIGURE 27 FEED PRODUCTION TREND, 2013–2017 (MILLION TON)

FIGURE 28 MEAT DEMAND, BY MEAT TYPE, 2005 VS. 2050 (MILLION TON)

FIGURE 29 FEED ANTIOXIDANTS: SUPPLY CHAIN

FIGURE 30 THE SYNTHETIC SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD (USD MILLION)

FIGURE 31 FEED ANTIOXIDANT MARKET, BY ANIMAL, 2019 VS. 2025 (USD MILLION)

FIGURE 32 MEAT CONSUMPTION SHARE, BY MEAT TYPE, 2018

FIGURE 33 US: PER CAPITA CONSUMPTION, 2013–2018 (USD MILLION)

FIGURE 34 PORK EXPORT VALUE AND SHARE, BY COUNTRY, 2018 (USD BILLION)

FIGURE 35 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE FEED ANTIOXIDANT MARKET DURING THE FORECAST PERIOD

FIGURE 36 COMPOUND FEED PRODUCTION FOR MAJOR COUNTRIES, 2016–2018 (MILLION METRIC TON)

FIGURE 37 NORTH AMERICA: FEED ANTIOXIDANTS MARKET SNAPSHOT

FIGURE 38 EUROPE: FEED ANTIOXIDANTS MARKET SNAPSHOT

FIGURE 39 MARKET SNAPSHOT

FIGURE 41 RISING FEED PRODUCTION IN AFRICA TO DRIVE THE FEED ANTIOXIDANT MARKET

FIGURE 42 FEED ANTIOXIDANTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 43 FEED ANTIOXIDANT MARKET: COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES), 2018

FIGURE 44 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE FEED ANTIOXIDANT MARKET, 2015–2019

FIGURE 45 ANNUAL DEVELOPMENTS IN THE FEED ANTIOXIDANT MARKET, 2018–2019

FIGURE 46 CARGILL: COMPANY SNAPSHOT

FIGURE 47 SWOT ANALYSIS: CARGILL

FIGURE 48 BASF: COMPANY SNAPSHOT

FIGURE 49 SWOT ANALYSIS: BASF

FIGURE 50 ARCHER DANIELS MIDLAND COMPANY (ADM): COMPANY SNAPSHOT

FIGURE 51 SWOT ANALYSIS: ADM

FIGURE 52 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

FIGURE 53 SWOT ANALYSIS: KONINKLIJKE DSM N.V.

FIGURE 54 NUTRECO: COMPANY SNAPSHOT

FIGURE 55 ADISSEO: COMPANY SNAPSHOT

FIGURE 56 PERSTORP: COMPANY SNAPSHOT

FIGURE 57 CAMLIN LIFE SCIENCES: COMPANY SNAPSHOT

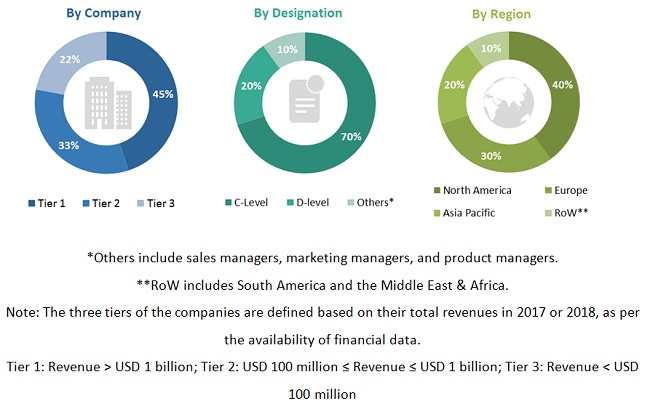

The study involves four major activities to estimate the current market size for feed antioxidants. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The feed antioxidants market comprises several stakeholders such as raw material suppliers, regulatory bodies, including government agencies and NGOs, compound feed manufacturers and integrators, livestock & dairy co-operative societies and meat processors, associations and government agencies, International Feed Industry Federation (IFIF), traders and distributors of feed antioxidants, associations and industry bodies, venture capitalists, and investors.

The demand-side of this market is characterized by the rising demand for feed antioxidant sources. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed antioxidant market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes, as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the feed industry.

Report Objectives

- To define, segment, and project the global market size for the feed antioxidant market

- To understand the structure of the feed antioxidant market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total feed additives market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific feed antioxidants market, by country

- Further breakdown of the Rest of Europe feed antioxidant market, by country

- Further breakdown of the Rest of the World feed antioxidant market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Feed Antioxidants Market