Food Antioxidants Market by Source (Fruits & Vegetables, Oils, Spices & Herbs, Botanical Extracts, Gallic Acid & Petroleum), Application (Fats & Oils, Prepared Meat & Poultry, Bakery & Confectionery), Type, Form and Region - Global Forecast to 2028

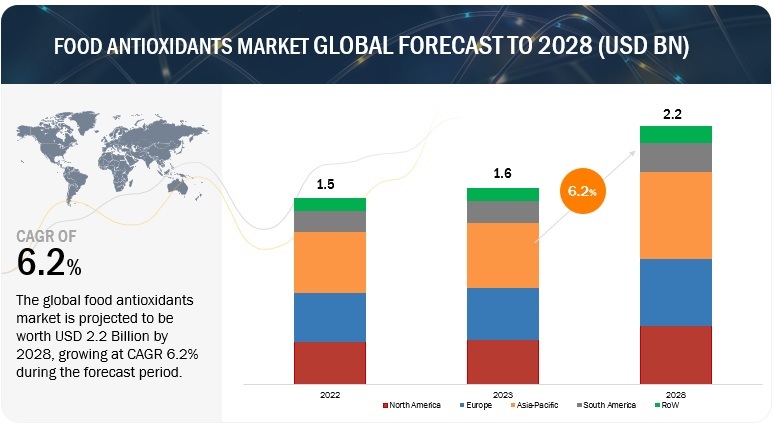

The global food antioxidants market size was valued at US$ 1.5 billion in 2022 and is poised to grow from US$ 1.6 billion in 2023 to US$ 2.2 billion by 2028, growing at a CAGR of 6.2% in the forecast period (2023-2028).

Antioxidants are substances that stop the oxidation process, which could harm organisms' cells and lead to the creation of free radicals. They can be acquired naturally from a variety of fruits and vegetables, including raspberries, spinach, and eggplant, or they can be produced artificially and used as additions for a variety of uses. In addition to being widely utilised as a preservative in many processed food goods, it is also widely employed as an additive for fuel, plastic, and latex. Additionally, it plays a crucial role in many pharmaceutical and cosmetic items. Also contributing to the market's growth throughout the projected period will be the world's growing population, and the high demand for processed foods, provides an explosive rise.

Key aspects of food antioxidants market:

- Types of Antioxidants: Food antioxidants can be categorized into natural and synthetic antioxidants. Natural antioxidants include vitamin E, vitamin C, carotenoids, and polyphenols found in fruits, vegetables, and herbs. Synthetic antioxidants such as butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), and propyl gallate are also commonly used in food preservation.

- Market Growth Drivers: The growth of the food antioxidants market is driven by several factors including increasing consumer awareness regarding the health benefits of antioxidants, rising demand for natural food additives, and the need for extending the shelf life of food products to minimize food waste. Additionally, the growth of the food and beverage industry globally contributes to the demand for antioxidants.

- Applications: Food antioxidants are used in a wide range of food and beverage products including oils and fats, processed meat products, bakery and confectionery items, beverages, and snacks. They help prevent rancidity in fats and oils, color deterioration, flavor loss, and nutrient degradation.

- Health Benefits and Consumer Trends: Antioxidants are known for their health benefits, including reducing the risk of chronic diseases such as cardiovascular diseases, cancer, and neurodegenerative disorders. Consumers are increasingly seeking out food products that contain natural antioxidants as part of their efforts to maintain a healthy lifestyle.

- Regulatory Landscape: The use of food antioxidants is subject to regulations and guidelines set by government agencies such as the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in Europe. These regulations specify permitted levels of antioxidants in various food products and ensure their safety for consumption.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Growth in the prepared food industry is likey to propel the market

Prepared foods are processed foods that are treated to ensure longer shelf life, reduce rancidity, and be easy to use. The prepared food industry is expected to witness substantial growth in the coming years due to factors such as high disposable income and a gradual increase in the number of working women, thereby positively impacting the food antioxidants market.

The rise in disposable incomes due to economic growth, especially in emerging countries such as India and China, has led to demand for convenience foods. As per a study published in the American Journal of Clinical Nutrition, ultra-processed food consumption grew from 53.5 percent of calories (2001–2002) to 57 percent at the end of (2017–2018) in the US. The rise in convenience and processed food consumption is attributed to its ease of use, variety, and all-season availability. Convenience and processed foods are consumed over an extended time, as they are pre-packaged and added with preservatives to prevent spoilage. Processed food is also convenient for transportation to distant places. Thus, it is crucial to maintain the quality, flavor, taste, and nutrient profile. The longevity of processed food is a major driver for the food antioxidants market.

Del Monte Foods announced a new snacking innovation, Del Monte Fruit Infusions, expanding the brand's presence in the produce refrigerated aisle. This new line of products launched in the US in 2021, incorporates fruit chunks infused with antioxidant premixes. These Del Monte Fruit Infusions snacks claim to offer an innovative and convenient snacking solution for on-the go jobs. Del Monte Fruit Infusions come in four refreshing flavors, each with a full serving of fruit and unique ingredients that claim to support different nutritional needs, like healthy digestion, hydration, energy, and antioxidant support. According to the company, this product is a healthy snacking choice as it is made with real fruit juice and does not contain added sugar, artificial sweeteners, artificial flavors, artificial certified colors, preservatives, or GMO ingredients.

Restraints: Strict regulatory compliances for synthetic antioxidants and low permissible usage limits in food products

Among food additives, there is limited awareness regarding food antioxidants and additives regulations. Owing to increased awareness about health and supporting research about toxicity and health challenges caused by few food additives, there are stricter regulations about manufacturing, registration, and usage of food additives. Several regulatory bodies are now setting stringent frameworks for the permissible usage of food additives. For example, FDA considers: 1) the composition and properties of the substance, 2) the amount that would typically be consumed, 3) immediate and long-term health effects, and 4) various safety factors associated with any food additive. Similarly, the European Union (EU) has set strict rules for the usage of food additives. Food additives must be approved by the EU and may only be used if they fulfill the criteria laid down in Regulation (EC) No 1333/2008. They must be safe when used, and there must be a technological need for their use. The use of food additives must not mislead the consumer and must be of benefit to the consumer. Misleading the consumer includes, but is not limited to, issues related to the nature, freshness, and quality of ingredients used, the naturalness of a product or of the production process, or the nutritional quality of the product, including its fruit and vegetable content.

On September 8, 2022, China’s National Health Commission (NHC) published on its website 18 draft National Food Safety Standards (GB standards) in relation to food additives for public comment. For the national standard for food additives – GB2760, the following major changes are proposed in the draft amendment-β-carotene and diacetyl tartaric acid mono- and di-glycerides as permitted food additives in distilled spirits; and it also adds a new warning requirement for food using excessive polyol(s) in its production that may cause diarrhea. However, the specific use level of polyol(s) that could trigger the additional labeling obligation is not yet specified in the draft standard.

In 2020, Guatemala launched New Central American Technical Regulations (RTCA) for Processed Food and Beverages. Food Additives. The RTCA aims to establish the food additives and their maximum permitted doses in different food categories. The new regulation creates special conditions applicable to the use of unauthorized food additives directly on food ingredients and raw materials. It establishes food categories in which transfers of food additives are not acceptable and a list of additives permitted by the Codex Alimentarius and those permitted by the previous regulation, and which are not adopted by the Codex Stan 192-1995.

In addition, the Central American Commission on Food Additives (CCAA) is established, which will aim to keep the list of additives contained in the Technical Regulations up to date, in turn, creating the procedure for updating the lists of additives permitted by the Regulation.

Opportunities: Popularity of long shelf life of products due to usage of antioxidants as preservatives boosts market

Awareness about food antioxidants is low, and emerging economies such as China and India are experiencing high industrialization. As these emerging economies grow and attain high disposable income, their demand for food antioxidants is also rising. The Asia Pacific region is exhibiting increased demand for prepared and functional foods & beverages, and hence, the region’s food antioxidants market is expected to grow. The demand for food antioxidants is expected to grow at a modest pace in early adopting countries such as Japan and Germany and at an exponential rate in new & emerging markets such as Thailand, Malaysia, and other Asian countries.

The growing global population is putting more pressure on producers for the manufacturing, extraction, and maintenance of scarce resources. High energy prices and rising raw material costs are impacting food prices, thus affecting low-income consumers. Pressure on food supplies is being exacerbated by water shortages, particularly across Africa and Northern Asia. Advances in science and technology are helping in extending the shelf life of foods to a greater extent. The need for marketing food preservatives to the smallest of food & beverage manufacturers is expected to augment the market size.

In emerging markets, where lifestyles are changing rapidly, the demand from workplaces and homes are competitively increasing, leading to a greater preference for convenience. Fast food is expected to increasingly become differentiated from junk food as quick and easy, but healthy options are preferred. Identifying ingredients with naturally high nutritional value could be a key opportunity for suppliers and manufacturers. An increase in the population of working women and the dominance of nuclear double-income families, especially in urban areas, are other trends shaping the changing lifestyles. Busy lifestyles and changing consumption patterns have led to an increased demand for processed, ready-to-cook, and ready-to-eat food, leading to increased brand-consciousness.

Natural antioxidants, such as Oryzanol, have gained immense popularity in India post the pandemic, and the Ricela Group has brought Gamma Oryzanol to India in the form of nutraceutical capsules. According to AP Organics Limited, it helps reduce high blood cholesterol and is effective for treating anxiety, managing sugar levels, helpful for patients of hypothyroidism, and plays an important role in preventing many lifestyle diseases. In 2022, Kemin Industries launched a clean label solution that has antioxidant potential and moisture retention properties that improves texture and extends the shelf life of foods. Kemin is exhibiting some of its latest clean-label innovations to aid shelf-life extension, microbial protection, textural quality, and yield enhancement solutions for a variety of foods. Among Kemin’s range of solutions, NaturFort is a versatile combination consisting of rosemary and green tea extracts that complement each other. The two extracts offer food protection with a positive impact on flavor, color, and odor. For the snack market, the clean label antioxidant solutions significantly delay or prevent lipid oxidation. In bakery solutions, mold inhibitors avoid short product lifespans. Kemin’s range of plant extracts and antioxidants also help dressings and sauce products remain fresher and safer for longer periods while retaining the clean label status.

Challenges: Health concerns associated with chemical preservatives limit market growth

A major challenge in the food antioxidants industry is the health hazards caused due to the consumption of synthetic antioxidants. Dried and dehydrated foods often contain phenolic antioxidants. This antioxidant helps in the prevention of lipid oxidation during processing and storage. Although various food products (including beverages) pass through several quality, safety, and regulatory mandates, consumers are concerned about synthetic food antioxidants used due to allergic reactions. The US FDA estimated that more than one million people with digestive issues are sensitive or allergic to phenols. Symptoms related to phenol allergy consumption include difficulty breathing, runny nose, wheezing, and stuffiness in the head. The Food and Drug Administration (FDA), in 2013, approved more than 3,000 food additives for use in the US. However, food additives may still threaten health despite being approved for human consumption.

For example, the antioxidant butylated hydroxyanisole (BHA) curbs spoilage in cereals, oils, and foods high in fat. However, when consumed in high dosages, BHA can induce tumors. The Asthma and Allergy Foundation of America in 2005 reported that two food preservatives—BHT and BHA—have been linked to chronic hives and various skin reactions. These preservatives are added to breakfast cereals and grain products to preserve color, flavor, and odor. Studies have shown that benzoates can cause hyperactivity and have toxic effects at higher concentrations causing skin irritations. Benzoates are also linked to various ailments, such as allergies, asthma, gastric irritation, and migraine headaches.

Food processors and manufacturers treat meat and fish with nitrites to preserve color and reduce the growth of botulism-causing bacteria. The reaction of nitrites with amino acids results in the formation of carcinogenic nitrosamines. The FDA regulates the number of nitrites used in food processing, keeping the level of chemical preservatives below the threshold for the formation of nitrosamines. Therefore, using a preservative should not result in deception or adversely affect the nutritional value of the food while following good manufacturing practices. This is thereby expected to restrict the market growth of food antioxidants, and better alternatives may be adopted more.

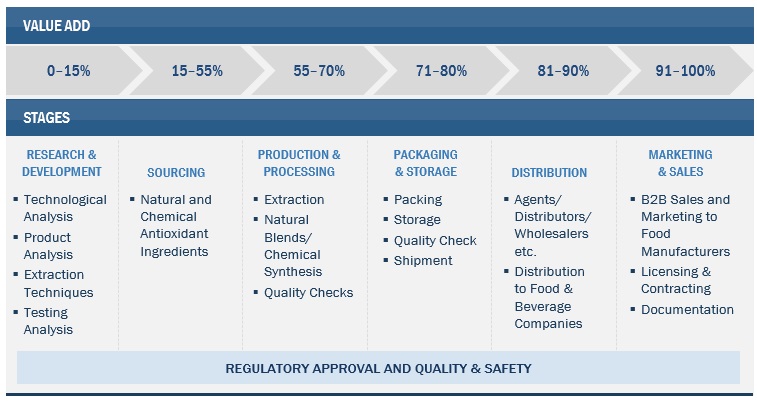

Food Antioxidants Market: Value Chain Analysis

Based on type, synthetic segment is estimated to account for the largest market share of the food antioxidants market.

In order to produce a variety of food products, butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), tert-butylhydroquinone (TBHQ), and propyl gallate (PG) are increasingly used. Synthetic antioxidants are made by a conventional industrial process using a variety of ingredients. As a result, its use as an addition is subject to some rigorous regulations from the governments of several nations. Synthetic antioxidants are frequently used to extend the shelf life of food goods and improve their texture, colour, and scent.

Based on source, the petroleum sub segment of the synthetic segment are anticipated to dominate the market.

Food antioxidants extracted from petroleum contain statins and vitamin E, which help prevent cholesterol, cardiovascular diseases and prevent food from free radical damage. Synthetic food antioxidants such as BHA, BHT, and TBHQ are commonly used in the food industry to prevent spoilage and extend the shelf life of processed foods. These antioxidants are derived from petroleum and are added to food products in small quantities. BHA and BHT are often used together and can be found in a wide range of products, including baked goods, snack foods, and cereal. TBHQ is also used as a preservative in many processed foods, including cooking oils and margarine.

Based on application, the prepared meat and poultry segment is projected to witness the highest CAGR during the forecast period.

Prepared meat & poultry products manufacturers use antioxidants for several reasons, primarily to preserve the quality and extend the shelf life of their products. Antioxidants are added to meat products to prevent or delay the oxidation process, which can cause meat to spoil and lose its flavor, texture, and nutritional value. Oxidation occurs when oxygen reacts with the fats in meat, causing them to become rancid and produce off-flavors and odors. To maintain the quality and freshness of meat for longer periods, exporters can incorporate antioxidants, which can either prevent or slow down the oxidation process. This becomes crucial for meat products that need to be transported over long distances or stored for extended periods before being sold. Commonly used antioxidants in the meat industry include Vitamin E, ascorbic acid (Vitamin C), and various plant-based extracts such as rosemary extract, green tea extract, and grape seed extract. Thus, the increase of prepared meat & poultry consumption potentially increase the usage of food antioxidants in the meat & poultry products.

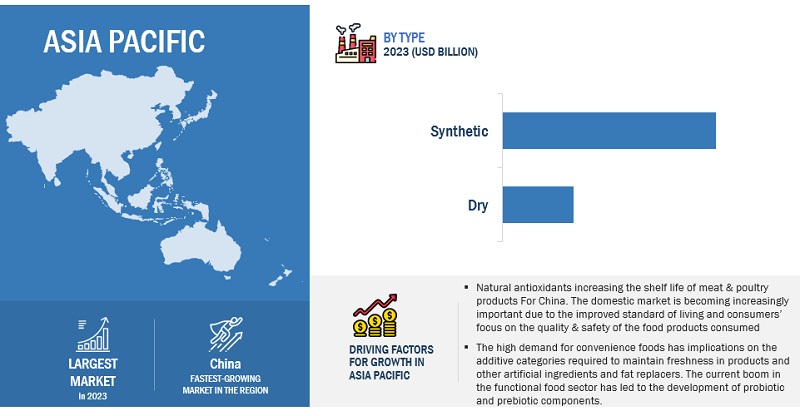

The Asia Pacific market is projected to contribute the largest share for the food antioxidants market.

In 2022, the Asia Pacific region dominated the global market for food antioxidants, largely as a result of the growing demand from food manufacturers in developed nations to move their production facilities to emerging markets, where labor costs are low and establishment and production costs are low. The market revenue growth in the area has been fueled by this trend as well as the increased need for natural and synthetic food antioxidants for producing various food products.

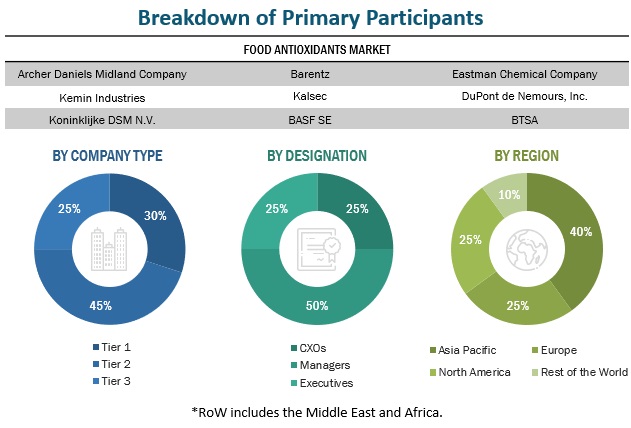

Key Market Players

Archer Daniels Midland (US), BASF SE (Germany), International Flavors & Fragrances Inc. (US), Eastman Chemical Company (US), and DSM (The Netherland) are among the key players in the global food antioxidant market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the food antioxidants market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Type, By Source, By Application, By Form, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Food Antioxidants Market:

By Type

- Natural

- Vitamin C

- Vitamin E

- Carotenoids

- Rosemary extracts

- Green tea extracts

- Other natural types*

- Synthetic

- Tert-Butylhydroquinone (TBHQ)

- Butylated Hydroxyanisole (BHA)

- Butylated Hydroxytoluene (BHT)

- Propyl Gallate (PG)

- Other Synthetic Types**

By Form

- Dry

- Liquid

By Source

- Fruits & Vegetables

- Oils

- Spices & Herbs

- Botanical Extracts

- Gallic Acid

- Petroleum-Derived

By Application

- Fats & Oils

- Prepared Foods

- Prepared Meat & Poultry

- Beverages

- Seafood

- Bakery & Confectionery

- Plant-Based Alternatives

- Nutraceuticals

- Other Applications***

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)****

* Other natural type includes acerola extracts and grapeseed extracts

** Other synthetic type includes potassium sorbate and calcium propionate

*** Other applications include margarines, dressings, infant milk formula, mayonnaise, tea, and coffee

****RoW includes the Middle East and Africa.

Recent Developments

- In July 2022, ADM announced it acquisition of Yerbalatina Phytoactives. This acquisition will expand ADM’s solutions capabilities in the food, beverage, and health industries with a range of more than 100 botanical products and solutions, including functional nutrition and health ingredients, organic food colorings, and organic nutritional extracts In August 2021, new product launch of GEA Ariete Homogenizer 3160 was designed by GEA to be a high-pressure homogenizer to process a wide range of products, including those with high viscosity and solid content. The GEA TriplexPanda Lab Homogenizer, on the other hand, was a laboratory-scale homogenizer that could be used for product development and testing. By extending its range of homogenizers, GEA would be able to offer its customers a wider range of options to meet their specific processing needs. This would help strengthen the company’s position as a leading supplier of food antioxidants.

- In February 2021, merger between International Flavors & Fragrances (IFF) and DuPont's Nutrition & Biosciences business, creating a global ingredients and solutions leader serving consumer-oriented food & beverage, home & personal care, and health & wellness markets. The combined company will continue to operate under the name IFF and trade on the New York Stock Exchange.

Frequently Asked Questions (FAQ):

How big is the food antioxidants market?

With a compound annual growth rate (CAGR) of 6.2% from 2023 to 2028, the food antioxidants market is expected to reach USD 2.2 billion from its estimated USD 1.6 billion in 2023.

Which players are involved in the manufacturing of the food antioxidants market?

Archer Daniels Midland (US), BASF SE (Germany), International Flavors & Fragrances Inc. (US), Eastman Chemical Company (US), and DSM (The Netherland) are among the key players in the global food antioxidant market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the food antioxidants market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for food antioxidants market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the food antioxidants market?

The future growth potential of the food antioxidants market is significant, driven by several key factors that reflect evolving consumer preferences, health trends, and technological advancements. Firstly, there is a growing awareness among consumers about the importance of antioxidants in maintaining health and preventing chronic diseases. Antioxidants are known for their ability to neutralize free radicals in the body, thereby reducing oxidative stress and lowering the risk of various health conditions such as cancer, heart disease, and aging-related disorders. As a result, there is increasing demand for foods and beverages fortified with natural antioxidants from sources such as fruits, vegetables, herbs, and spices. Secondly, the rising prevalence of lifestyle-related diseases and health concerns, coupled with aging populations in many regions, is driving the demand for functional foods and dietary supplements containing antioxidants. Consumers are seeking out products that offer additional health benefits beyond basic nutrition, and antioxidants are perceived as natural and safe ingredients that can support overall health and well-being.

Which segment by application accounted for the largest food antioxidants market share?

The prepared meat & poultry segment dominated the market for food antioxidants and was valued the largest at USD 0.6 billion in 2022. The global increase in meat consumption and the related food products is what is fueling the expansion. Humans need a variety of protein sources in their diets, and meat and poultry are regarded as excellent sources. Human bodies receive a necessary amount of protein from eating meat and poultry products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

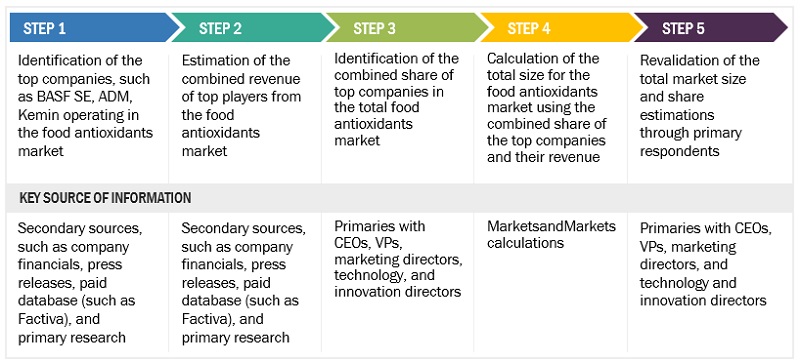

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food antioxidants market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, EU Commission, European Food Safety Authority, German Federal Institute of Risk Assessment, Food Safety and Standards Authority of India (FSSAI), and Japanese Ministry of Health, Labor and Welfare have been referred to, to identify and collect information for this study. The secondary sources also included food antioxidants annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Food Antioxidants market comprises of multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of food antioxidants from the demand side include distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

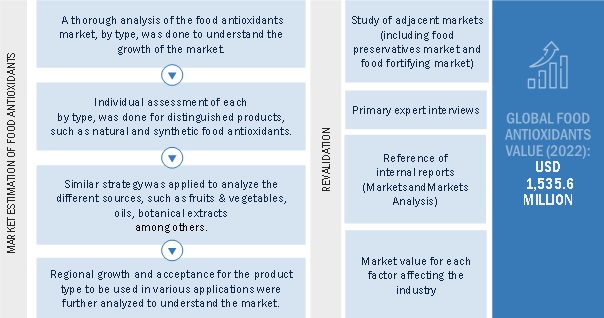

Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major food antioxidants manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the food antioxidants market has been arrived at.

Food Antioxidants Market Size Estimation, By Type (Supply Side)

Bottom-up approach:

- Based on the share of food antioxidants for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for food antioxidants was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of food antioxidants, are the demand for health & wellness products, growth in immunity concerts, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food antioxidants market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Antioxidants Market Size Estimation (Demand Side)

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food antioxidants market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Antioxidants in food can be either natural or artificial. Natural food antioxidants, which come from organic sources, have inherent antioxidant properties, in contrast to synthetic antioxidants, which come from petroleum-based sources. Fruits and vegetables (such as prunes, blueberries, raspberries, cabbage, spinach, apples, eggplant, and broccoli) oils (such as corn, almond, and soy), nuts and seeds (such as mustard), spices and herbs (such as oregano, clove, and cinnamon), petroleum-based products, and gallic acid all contain antioxidants.

Stakeholders

- Government, research organizations, and regulatory authorities

- Research professionals

- Tier 1 system dealers and food antioxidants suppliers

- Food antioxidant associations and industrial bodies

- Raw material suppliers and distributors

- Food antioxidant traders, distributors, and dealers

- Food antioxidant manufacturers

- Dairy co-operative societies and meat processors

-

Regulatory bodies, including government agencies and NGOs

- European Food Safety Authority (EFSA)

- World Health Organization (WHO)

- Food and Drug Administration (FDA)

- Food Standard Agency (FSA)

- Associations and government agencies

Report Objectives

Market Intelligence

- Determining and projecting the size of the food antioxidants market, with respect to type, source, application, form, and regions over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for significant countries related to the food antioxidants market

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the global food antioxidants market

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global food antioxidants market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for Food Antioxidants into the Poland, Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, and other EU and non-EU countries.

- Further breakdown of the Rest of South America market for Food Antioxidants into Colombia, Peru, Paraguay, Chile, and Venezuela

- Further breakdown of the Rest of Asia Pacific for Food Antioxidants into the Malaysia, Singapore, Philippines, Vietnam, South Korea, and other ASEAN countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Antioxidants Market

I would like to know which are some of the best factory-produced Natural Antioxidants Products in the USA, EU, Canada, and Australia. Does this report study cover these regions and products?