Collagen Peptides Market by Source (Bovine, Porcine, Marine & Poultry), Application (Food & Beverages, Nutritional Products, Cosmetics & Personal Care Products, Pharmaceuticals), Form (Dry, Liquid) and Region - Global Forecast to 2028

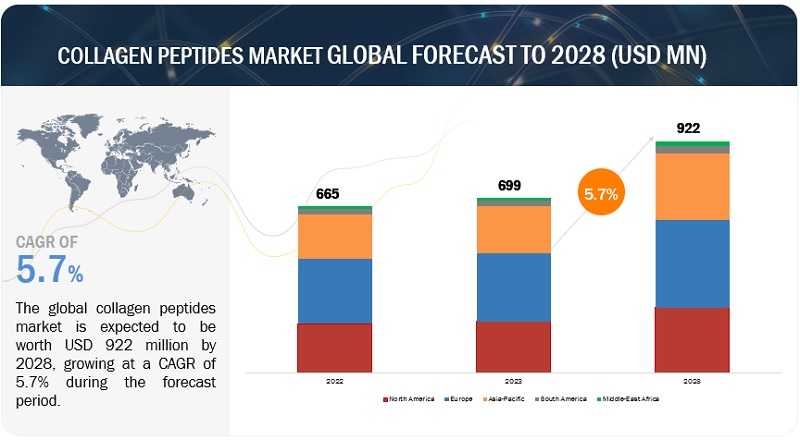

The global collagen peptides market size was USD 665 million in 2022 and is projected to grow from USD 699 million in 2023 to USD 922 million in 2028 at a CAGR of 5.7% in the 2023-2028 period. The value of collagen peptides has significantly risen due to its increased utilization in various sectors such as medical, cosmetics, food, and pharmaceutical applications. This growth is further driven by the growing awareness of consumer health in emerging markets like Asia Pacific, Middle East, Africa, and South America.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Collagen Peptides Market Dynamics

DRIVER : Increase demand for collagen peptides in the cosmetics and personal care products industry

Collagens present in the skin are responsible for skin structure. Collagen fibers present in the human skin get damaged with time, losing thickness and strength, resulting in skin aging. Collagen peptides are being used in cosmetic and personal care products. They are used in the form of creams and are used as nutritional supplements for the bones. They are also used for skin replacement and the augmentation of soft skin, among others. They are used in various personal care products, such as soaps, shampoos, body lotions, and facial creams

For cosmetic applications, collagen peptide is used for soft tissue augmentation, cosmetic surgery, and face and hand rejuvenation. It is used in dermal filler to improve volume deficiencies and to improve the contour of the face. As the population ages globally and per capita incomes rise, the demand for collagen peptides market used in cosmetics and personal care products is poised to rise in the coming times.

RESTRAINT : Cultural restrictions on the consumption of animal-sourced products

Collagen peptides are animal by-products formed from the collagen of slaughtered animals, which includes hoovers, hides, and bones of cattle, poultry, fish, and pigs. In certain regions of the world, the consumption of certain animal are forbidden due to religious reasons. For example, Muslim communities and Middle Eastern countries refrain from consuming pig and related product. In India, beef is forbidden among Hindus. Therefore, in these regions, market for collagen derived from cows and pigs is estimated to be negligible.

In India, the consumption of cattle-derived products is culturally forbidden. The Hindu community does not consume beef and beef-derived products. Hence, they prefer pork-based collagen peptides. The other example is the Jewish population, which largely prefers consuming kosher-certified products. Kosher guidelines also inhibit the consumption of pigs and pig-derived products. These cultural and regional outlooks pose a restraint for the growth of collagen peptides market.

Opportunity: Promotion of healthy diet by governments

Inadequate consumption of essential nutrients increases the risk of various chronic and cardiovascular diseases, such as hypertension (high blood pressure), cancer, obesity, and diabetes. With globalization and higher exposure to other cultures (especially Western lifestyles), consumers’ eating patterns have also changed, with an increase in snacking and eating meals in restaurants.

Government associations and organizations such as WHO, and FAO promote the consumption of healthy diet to propel consumer awareness, skills, preferences, attitutes, and behavior regarding diet and nutrition. These organizations have been involved in promoting healthy eating. For instance, in March 2019, the USDA announced the launch of the “Start Simple with MyPlate Campaign” to improve the busy lifestyle of Americans concerning health and well-being over time.

Hydrolyzed collagen has a wide application in nutritional foods and dietary supplements that are being consumed at a large scale by consumers. Government initiatives toward a healthy lifestyle would lead to an increase in the demand for these products, directly affecting the collagen peptides market.

Challenge: Ethical and sustainability concerns

Collagen peptides are primarily sourced from animal by-products, such as bovine hides, fish scales, or chicken cartilage. Ethical and sustainability concerns related to animal welfare, overfishing, and environmental impact can pose challenges for the collagen industry.

According to a survey conducted by Deloitte in March 2021 to study consumer attitudes and behaviors around sustainability, consumers are increasingly making conscious decisions with sustainability and the environment in mind. As consumers become more conscious of these issues, there is a growing demand for responsibly sourced collagen peptides, which requires careful attention to sourcing and production practices. Due to these factors, the manufacturers in the industry are challenged to lookout for alternate resources of collagen such as plant sources to keep up with the consumer trends related to sustainability.

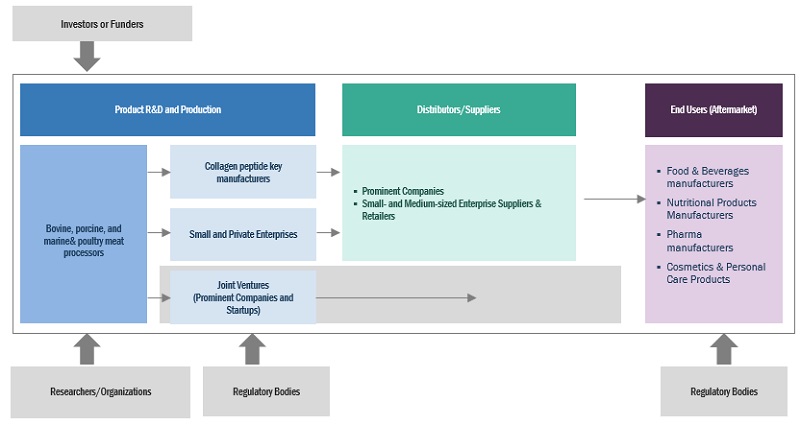

Collagen Peptides Market Ecosystem

Notable companies in this market include financially stable and well-recognized manufacturers of collagen peptides. They have been operating in the market for many years and hold a varied product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Significant companies in this collagen peptides market include Tessenderlo Group (Belgium), Gelita AG (Germany), Holista Colltech (Australia), Darling Ingredients (US), and Nitta Gelatin Inc. (Japan).

Technological advancements in collagen extraction and production to drive the demand for collagen peptides market

Technological advancements in collagen extraction and production have played a significant role in the growth of the collagen peptides market. Traditional methods of extracting collagen from animal sources, such as boiling or acid treatment, have been refined and optimized. Modern extraction techniques involve enzymatic hydrolysis, where specific enzymes are used to break down collagen into smaller peptides. This method is more efficient and yields higher-quality collagen peptides.

Technological advancements have made it easier to extract collagen from different sources, allowing for a wider range of collagen peptide products to cater to specific preferences and dietary requirements. Advances in purification and concentration techniques have enabled the production of collagen peptides with higher levels of purity and standardized molecular weight profiles. This ensures consistent quality and effectiveness in collagen peptide products. These advances in technology and manufacturing processes have made it easier and more cost-effective to extract collagen peptides from various sources. They have also contributed to the availability of collagen peptides in a wider range of products and have helped drive market growth.

Rise in consumer health awareness and increased use of collagen in the food and beverage industry to augment the market growth

Collagen peptides are used in diverse applications such as functional foods, therapeutic food, dietary supplements, sports nutrition, and beverages. They are also used as ingredients in various food & beverage products due to their versatile nature. The charcteristics in collagen peptides increase their integration in food products.

Moreover, collagen peptides market are increasingly being used by manufacturers to produce dairy products, as they provide a clean label to products. Collagen peptides offer multiple health benefits. They help to build and repair muscles, tendons, ligaments, and cartilage that get stressed during exercise. Protein helps in reducing post-exercise joint pain. It also helps in strengthening the joints and ligaments and improves the performance of athletes. Collagen used in dietary supplements is key to maintaining healthy and active lifestyles. Consumers have started opting for healthy diets, owing to the increasing awareness about health & wellness, and changing lifestyles. Thus, the market for collagen peptides has a bright future during to forecast period.

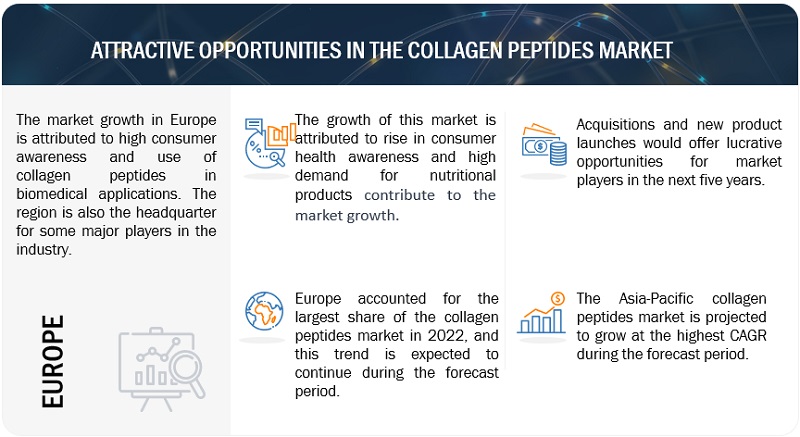

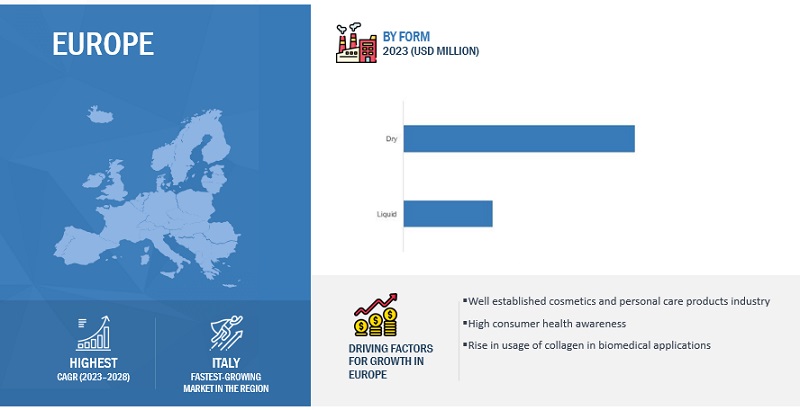

Europe is expected to dominate the market during the forecast period

Countries such as Germany, UK, France, Italy, Spain, and rest of Europe have been considered in this study. Some of the factors for the high demand of the market in the European region include high consumer awareness regarding health. The region also has a well-established cosmetics and personal care products industry in France and other European countries that is well known for research and innovation.

Moreover, Europe is one of the leading regions in the pharmaceutical industry. As a result, collagen peptides are widely used in biomedical applications. The headquarters of key players such as Gelita AG (Belgium), Tessenderlo Group (Belgium), Lapi Gelatine S.p.A (Italy) makes it a significant region in the collagen peptides market.

Key Players in Collagen Peptides Market

The key players in this include Tessenderlo Group (Belgium), Gelita AG (Germany), Holista Colltech (Australia), Darling Ingredients (US), and Nitta Gelatin Inc. (Japan). These players in this market are focusing on increasing their presence through agreements, partnerships, acquisitions, and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Collagen Peptides Market Report Scope

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 699 Million |

|

Revenue forecast in 2028 |

USD 922 Million |

|

CAGR |

5.7% from 2023 - 2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Source, By Application, By Form, and By Region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and Rest of the World |

|

Companies studied |

|

Collagen Peptides Market Segmentation

Market By Source

- Bovine

- Porcine

- Marine & Poultry

Market By Form

- Dry

- Liquid

Market By Application

- Food & Beverages

- Nutritional Products

- Cosmetics & Personal Care Products

- Pharmaceuticals

Market By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments in Collagen Peptides Market

- In December 2020, Gelita AG (Germany) acquired 65% of the shares in the Turkish gelatine producer SelJel (Turkey). The acquisition is part of the company’s growth strategy and will enable the company to meet the increasing demand for halal beef gelatine.

- In August 2023, Tessenderlo group (Belgium) entered into a joint venture with Hainan Xiangtai Group for the production and sale of fish collagen peptides based on PB Leiner’s technology. The new venture enables Tessenderlo Group, a world-leading gelatine and collagen solutions manufacturer, to produce and commercialize a robust premium SOLUGEL® fish collagen peptides product range, tapping into the worldwide increasing demand for qualitative marine collagen peptides.

Frequently Asked Questions (FAQ):

Which are the major companies in the collagen peptides market?

The key players in this include Tessenderlo Group (Belgium), Gelita AG (Germany), Holista Colltech (Australia), Darling Ingredients (US), and Nitta Gelatin Inc. (Japan).

What are the drivers and opportunities for the Collagen Peptides market?

Collagen peptides market to grow due to rising demand for cosmetics, personal care products, and technological advancements in extraction techniques.

Which region is expected to hold the highest market share?

The market in Europe is expected to have the largest market share in 2023, showcasing strong demand for collagen peptides in the region.

Which are the challenges that could restrict market growth of the collagen peptides market?

Sustainability and ethical concerns and insufficient processing technologies are some of the challenges that could restrict the market growth.

How big is the collagen peptides market?

The global collagen peptides market size was $699 million in 2023, and is projected to reach $922 million by 2028, growing at a CAGR of 5.7% from 2023 to 2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for collagen peptides in medical applications- Increasing use of collagen peptides in food & beverages- Increasing use of cosmetic and personal care products in collagen peptides- Technological advancements in collagen extraction and productionRESTRAINTS- Consumer shift toward vegan diets- Cultural restriction on consumption of animal-sourced proteinsOPPORTUNITIES- Promotion of healthy diets by governments- Immense opportunities in emerging economiesCHALLENGES- Insufficient processing technologies- Ethical and sustainability concerns

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.3 SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS: COLLAGEN PEPTIDES MARKET

-

6.5 FUNCTIONALITIES: COLLAGEN PEPTIDES MARKETBINDING AGENT- Water-binding properties help in production of low-fat meat productsTEXTURING AGENT- Collagen peptides provide unique mouthfeel and boost food nutritional profileANTIOXIDANT- Collagen peptides increasingly used in food & beverages as antioxidants

-

6.6 PRICING ANALYSIS: COLLAGEN PEPTIDES MARKETAVERAGE SELLING PRICE, BY SOURCE

-

6.7 MARKET MAP AND ECOSYSTEM: COLLAGEN PEPTIDES MARKETDEMAND SIDESUPPLY SIDEECOSYSTEM VIEW

-

6.8 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 TRADE DATA: COLLAGEN PEPTIDES MARKETFOR PEPTONES AND THEIR DERIVATIVES (2020)FOR PEPTONES AND THEIR DERIVATIVES (2021)FOR PEPTONES AND THEIR DERIVATIVES (2022)

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.13 REGULATORY FRAMEWORKNORTH AMERICA- USEUROPEAN FOOD SAFETY AUTHORITY (EFSA)ASIA PACIFIC- China- Japan- IndiaSOUTH AMERICA- BrazilMIDDLE EAST- UAE

-

6.14 CASE STUDIESGROWING DEMAND FOR COLLAGEN PEPTIDE-BASED SKINCARE PRODUCTSRISING CONCERNS REGARDING HUMAN HEALTH AND WELLNESS

- 7.1 INTRODUCTION

-

7.2 FOOD & BEVERAGESBEVERAGES- Use of collagen peptides to add functional benefitsDAIRY PRODUCTS- Easy digestibility and cold solubility to fuel demand for collagen peptides in dairy productsSNACKS, SOUPS, AND SAUCES- Use of collagen peptides to provide health benefitsMEAT PRODUCTS- Collagen peptides to increase protein content in meat productsCONFECTIONERY PRODUCTS- Collagen peptides to replace unhealthy ingredientsOTHER FOOD APPLICATIONS

-

7.3 NUTRITIONAL PRODUCTSDIETARY SUPPLEMENTS- Amino acids in collagen peptides to promote their useSPORTS NUTRITION- Collagen peptides to witness increased demand by athletes

-

7.4 COSMETICS AND PERSONAL CARE PRODUCTSCOLLAGEN PROTEIN TO BE RESPONSIBLE FOR SKIN STRENGTH AND ELASTICITY

-

7.5 PHARMACEUTICALSBIOTECHNOLOGICAL ADVANCEMENTS TO INCREASE USE OF COLLAGEN PEPTIDES

- 8.1 INTRODUCTION

-

8.2 BOVINEEASE OF AVAILABILITY AND BIO-COMPATIBILITY TO MAKE BOVINE MAJOR COLLAGEN SOURCE

-

8.3 PORCINENON-ALLERGENIC ATTRIBUTES OF PORCINE TO FUEL DEMAND FOR COLLAGEN PEPTIDES

-

8.4 MARINE & POULTRYINCREASED ABSORPTION AND EASY DIGESTIBILITY TO DRIVE DEMAND FOR COLLAGEN PEPTIDES SOURCED FROM MARINE & POULTRY

- 9.1 INTRODUCTION

-

9.2 DRYVERSATILITY OF POWDERED FORM OF COLLAGEN PEPTIDES TO MAKE IT POPULAR AMONG CONSUMERS

-

9.3 LIQUIDVARYING VISCOSITY TO ENABLE MANUFACTURERS TO USE THEM AS VARIABLE AGENTS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increase in chronic diseases and technological advancements to drive marketCANADA- Growth in processed meat sector to drive demand for collagen peptidesMEXICO- Growth of beef and pork to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISUK- Rise in health awareness to contribute to market growthGERMANY- Meat being staple in Germany to drive demand for collagen peptidesSPAIN- Growing food & beverage industry to facilitate use of collagen peptidesITALY- R&D activities to find new applications of collagen peptidesFRANCE- Growing cosmetics industry to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Wide coastal line to contribute to growth of marine-sourced collagen peptidesJAPAN- Increase in consumption of processed food to drive marketAUSTRALIA & NEW ZEALAND- Rising demand for anti-aging skin care products to drive market growthINDIA- Demand for healthier alternatives to ready-to-eat products to drive market growthREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Brazil to be leading producer of grass-fed cattleARGENTINA- Abundance of grassland and breeding of cows without chemicals to drive demand for bovine-sourced collagen peptidesREST OF SOUTH AMERICA

-

10.6 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISAFRICA- Usage of collagen peptides in medicines to address chronic diseasesMIDDLE EAST- Liberalization of trade to provide better-quality food products for citizens, driving collagen peptides market growth

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COLLAGEN PEPTIDES MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

-

11.7 COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY COMPANIESTESSENDERLO GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGELITA AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHOLISTA COLLTECH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDARLING INGREDIENTS- Business overview- Products/Services/Solutions offered- Recent developments- MnM view.NITTA GELATIN, INC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGELNEX- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLAPI GELATINE S.P.A.- Business overview- Products/Services/Solutions offered- MnM viewWEISHARDT- Business overview- Products/Services/Solutions offered- MnM viewCRESCENT BIOTECH- Business overview- Products/Services/Solutions offered- MnM viewFOODMATE CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewVISCOFAN DE GMBH- Business overview- Products/Services/Solutions offered- MnM viewBIOCELL TECHNOLOGY- Business overview- Products/Services/Solutions offered- MnM viewAMICOGEN, INC- Business overview- Products/Services/Solutions offered- MnM viewKAYOS- Business overview- Products/Services/Solutions offered- MnM viewNIPPI. INC- Business overview- Products/Services/Solutions offered- MnM view

-

12.2 OTHER PLAYERSASPEN NATURALS- Business overview- Products/Services/Solutions offered- MnM viewVITAL PROTEINS LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCHAITANYA AGRO BIOTECH PVT. LTD- Business overview- Products/Services/Solutions offered- MnM viewEWALD GELATINE GMBH- Business overview- Products/Services/Solutions offered- MnM viewPEPTECH COLAGENO DO BRASIL LTDA- Business overview- Products/Services/Solutions offered- MnM viewBSA PHARMA INC.NEW ALLIANCE FINE CHEM PRIVATE LIMITEDJELLICE GELATIN & COLLAGENRUDRA BIOVENTURES PRIVATE LIMITEDALPSPURE LIFESCIENCES PRIVATE LIMITED

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 COLLAGEN MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 MARINE COLLAGEN MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 COLLAGEN PEPTIDES MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 USAGE LEVEL OF COLLAGEN PEPTIDES IN FOOD & BEVERAGE APPLICATIONS

- TABLE 4 COLLAGEN PEPTIDES MARKET: AVERAGE SELLING PRICE, BY SOURCE, 2020–2022 (USD/TON)

- TABLE 5 COLLAGEN PEPTIDES MARKET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 COLLAGEN PEPTIDES MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 7 PATENTS PERTAINING TO COLLAGEN PEPTIDES, 2021–2023

- TABLE 8 KEY CONFERENCES AND EVENTS IN COLLAGEN PEPTIDES MARKET, 2023–2024

- TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2020 (KG)

- TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2021 (USD THOUSAND)

- TABLE 11 TOP 10 IMPORTERS AND EXPORTERS OF PEPTONES AND THEIR DERIVATIVES, 2022 (USD THOUSAND)

- TABLE 12 COLLAGEN PEPTIDES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 17 COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2018–2022 (USD MILLION)

- TABLE 21 FOOD & BEVERAGES: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2018–2022 (USD MILLION)

- TABLE 25 NUTRITIONAL PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY SUB-APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 COSMETICS & PERSONAL CARE PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 COSMETICS & PERSONAL CARE PRODUCTS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 PHARMACEUTICALS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 PHARMACEUTICALS: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 31 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 32 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 33 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 34 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (KT)

- TABLE 37 BOVINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (KT)

- TABLE 38 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (KT)

- TABLE 41 PORCINE: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (KT)

- TABLE 42 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (KT)

- TABLE 45 MARINE & POULTRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (KT)

- TABLE 46 COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 47 COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 48 DRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 DRY: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 LIQUID: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 LIQUID: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (KT)

- TABLE 55 COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (KT)

- TABLE 56 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 61 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 62 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 66 US: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 67 US: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 68 US: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 69 US: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 71 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 73 CANADA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 75 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 76 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 77 MEXICO: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 79 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 81 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 83 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 84 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 85 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 88 UK: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 89 UK: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 90 UK: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 91 UK: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 93 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 95 GERMANY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 97 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 98 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 99 SPAIN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 101 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 103 ITALY: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 105 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 106 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 107 FRANCE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 117 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 118 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 122 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 123 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 125 CHINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 127 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 128 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 129 JAPAN: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 131 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 135 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 136 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 137 INDIA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 147 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 148 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 151 SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 152 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 153 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 154 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 155 BRAZIL: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 157 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 158 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 159 ARGENTINA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (KT)

- TABLE 169 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (KT)

- TABLE 170 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2018–2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: COLLAGEN PEPTIDES MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 174 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 175 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 176 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 177 AFRICA: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST: COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 GLOBAL COLLAGEN PEPTIDE MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

- TABLE 183 COLLAGEN PEPTIDES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 184 COMPANY SOURCE FOOTPRINT

- TABLE 185 COMPANY APPLICATION FOOTPRINT

- TABLE 186 COMPANY REGIONAL FOOTPRINT

- TABLE 187 OVERALL COMPANY FOOTPRINT

- TABLE 188 GLOBAL COLLAGEN PEPTIDES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 189 GLOBAL COLLAGEN PEPTIDES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 190 COLLAGEN PEPTIDES MARKET: PRODUCT LAUNCHES, 2019-2022

- TABLE 191 COLLAGEN PEPTIDES MARKET: DEALS, 2019–2022

- TABLE 192 COLLAGEN PEPTIDES MARKET: OTHERS, 2019–2022

- TABLE 193 TESSENDERLO GROUP: BUSINESS OVERVIEW

- TABLE 194 TESSENDERLO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TESSENDERLO GROUP: PRODUCT LAUNCHES

- TABLE 196 TESSENDERLO GROUP: DEALS

- TABLE 197 TESSENDERLO GROUP: OTHERS

- TABLE 198 GELITA AG: BUSINESS OVERVIEW

- TABLE 199 GELITA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 GELITA AG: DEALS

- TABLE 201 HOLISTA COLLTECH: BUSINESS OVERVIEW

- TABLE 202 HOLISTA COLLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HOLISTA COLLTECH: OTHERS

- TABLE 204 DARLING INGREDIENTS: BUSINESS OVERVIEW

- TABLE 205 DARLING INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 DARLING INGREDIENTS: DEALS

- TABLE 207 DARLING INGREDIENTS: OTHERS

- TABLE 208 NITTA GELATIN, INC: BUSINESS OVERVIEW

- TABLE 209 NITTA GELATIN, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NITTA GELATIN, INC: DEALS

- TABLE 211 GELNEX: BUSINESS OVERVIEW

- TABLE 212 GELNEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 GELNEX: OTHERS

- TABLE 214 LAPI GELATINE S.P.A.: BUSINESS OVERVIEW

- TABLE 215 LAPI GELATINE S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 WEISHARDT: BUSINESS OVERVIEW

- TABLE 217 WEISHARDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 CRESCENT BIOTECH: BUSINESS OVERVIEW

- TABLE 219 CRESCENT BIOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 FOODMATE CO., LTD.: BUSINESS OVERVIEW

- TABLE 221 FOODMATE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 VISCOFAN DE GMBH: BUSINESS OVERVIEW

- TABLE 223 VISCOFAN DE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 BIOCELL TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 225 BIOCELL TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 AMICOGEN, INC: BUSINESS OVERVIEW

- TABLE 227 AMICOGEN, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 KAYOS: BUSINESS OVERVIEW

- TABLE 229 KAYOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 NIPPI, INC: BUSINESS OVERVIEW

- TABLE 231 NIPPI. INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 ASPEN NATURALS: BUSINESS OVERVIEW

- TABLE 233 ASPEN NATURALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 VITAL PROTEINS LLC: BUSINESS OVERVIEW

- TABLE 235 VITAL PROTEINS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 VITAL PROTEINS LLC: NEW PRODUCT LAUNCHES

- TABLE 237 CHAITANYA AGRO BIOTECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 238 CHAITANYA AGRO BIOTECH PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 EWALD GELATINE GMBH: BUSINESS OVERVIEW

- TABLE 240 EWALD GELATINE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 PEPTECH COLAGENO DO BRASIL LTDA: BUSINESS OVERVIEW

- TABLE 242 PEPTECH COLAGENO DO BRASIL LTDA: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 243 BSA PHARMA INC.: COMPANY OVERVIEW

- TABLE 244 NEW ALLIANCE FINE CHEM PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 245 JELLICE GELATIN & COLLAGEN: COMPANY OVERVIEW

- TABLE 246 RUDRA BIOVENTURES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 247 ALPSPURE LIFESCIENCES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 248 ADJACENT MARKETS TO COLLAGEN PEPTIDES

- TABLE 249 COLLAGEN MARKET, BY SOURCE, 2020–2030 (USD MILLION)

- TABLE 250 MARINE COLLAGEN MARKET, BY SOURCE, 2018–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 COLLAGEN PEPTIDES MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- FIGURE 4 INDICATORS OF RECESSION

- FIGURE 5 WORLD INFLATION RATE: 2011-2021

- FIGURE 6 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 7 RECESSION INDICATORS AND THEIR IMPACT ON MARKET

- FIGURE 8 COLLAGEN PEPTIDES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 9 COLLAGEN PEPTIDES MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 COLLAGEN PEPTIDES MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 COLLAGEN PEPTIDES MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 COLLAGEN PEPTIDES MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 13 INCREASING DEMAND FOR NUTRITIONAL PRODUCTS TO PROPEL MARKET

- FIGURE 14 BOVINE SEGMENT AND GERMANY TO ACCOUNT FOR LARGEST SHARES IN MARKET

- FIGURE 15 NUTRITIONAL PRODUCTS SEGMENT TO DOMINATE MARKET

- FIGURE 16 BOVINE TO DOMINATE MARKET

- FIGURE 17 DRY SEGMENT TO DOMINATE MARKET

- FIGURE 18 COLLAGEN PEPTIDES MARKET DYNAMICS

- FIGURE 19 COLLAGEN PEPTIDES MARKET: VALUE CHAIN

- FIGURE 20 COLLAGEN PEPTIDES MARKET: SUPPLY CHAIN

- FIGURE 21 GLOBAL: AVERAGE SELLING PRICE, BY SOURCE (USD/TON)

- FIGURE 22 MARKET MAP

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING BUYERS: COLLAGEN PEPTIDES MARKET

- FIGURE 24 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 25 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 26 TOP 10 APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 27 COLLAGEN PEPTIDES MARKET SIZE (VALUE), BY APPLICATION, 2023 VS. 2028

- FIGURE 28 COLLAGEN PEPTIDES MARKET SIZE, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 COLLAGEN PEPTIDES MARKET SIZE (VALUE), BY FORM, 2023 VS. 2028

- FIGURE 30 AUSTRALIA & NEW ZEALAND TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 32 NORTH AMERICAN COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 33 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 34 EUROPEAN COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: COLLAGEN PEPTIDES MARKET SNAPSHOT

- FIGURE 36 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 37 ASIA PACIFIC COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 ASIA PACIFIC: COLLAGEN PEPTIDES MARKET SNAPSHOT

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 40 SOUTH AMERICAN COLLAGEN PEPTIDE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 INFLATION: COUNTRY-LEVEL DATA (2018-2021)

- FIGURE 42 REST OF THE WORLD COLLAGEN PEPTIDES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

- FIGURE 44 GLOBAL COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 45 GLOBAL COLLAGEN PEPTIDES MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UPS/SMES)

- FIGURE 46 TESSENDERLO GROUP: COMPANY SNAPSHOT

- FIGURE 47 GELITA AG: COMPANY SNAPSHOT

- FIGURE 48 HOLISTA COLLTECH: COMPANY SNAPSHOT

- FIGURE 49 DARLING INGREDIENTS: COMPANY SNAPSHOT

- FIGURE 50 NITTA GELATIN, INC: COMPANY SNAPSHOT

- FIGURE 51 AMICOGEN, INC: COMPANY SNAPSHOT

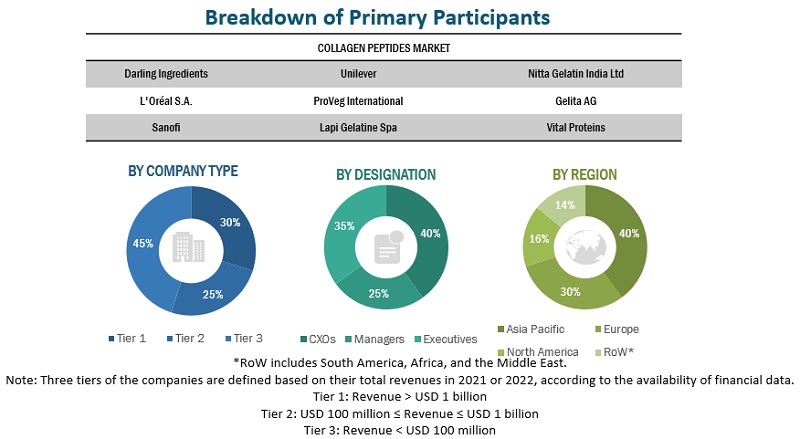

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the collagen peptides market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), China Food and Drug Administration (CFDA), United States Department of Agriculture (USDA), European Food and Fermentation Cultures Association (EFFCA), U.S Department of Agriculture (USDA), American Feed Industry Association (AFIA), Organization for Economic Co-operation and Development (OECD) and others were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The collagen peptides market comprises several stakeholders, including manufacturers and suppliers of collagen peptides, processors and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, collagen peptides distributors and wholesalers, importers & exporters of collagen peptides, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of collagen peptides companies catering collagen peptides in developing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

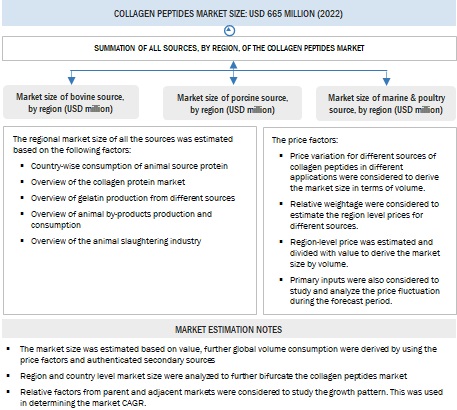

Market Size Estimation

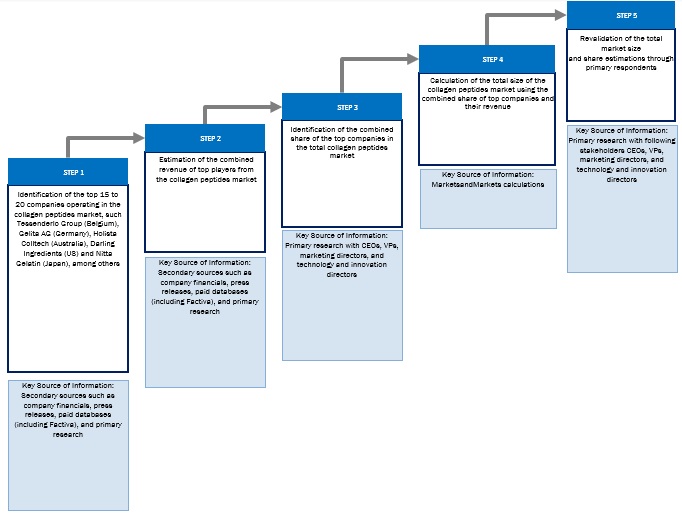

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The collagen peptides market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market size estimation: Top-Down approach

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the size of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the collagen peptides were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market size obtained for each segment.

Collagen Peptides Market Size Estimation: Supply Side

Collagen Peptides Market: Supply Side Calculation

Market size estimation methodology: Bottom-up approach

- The bottom-up approach was implemented for the data extracted from secondary research to validate the share of the market segments obtained.

- With the bottom-up approach, collagen peptides for each source and form for each country were added up to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on form and regions. From this, the market size is derived, in terms of volume, for each region and form of collagen peptides.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the collagen peptides market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall collagen peptide market estimation and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to GELATINE MANUFACTURERS OF EUROPE (GME), “Collagen peptides are a white, odorless powder that are neutral in taste and highly soluble in cold liquids. This powder emulsifies, foams, adds consistency, and binds. Similar to gelatine, collagen peptides are derived from Type 1 collagen through a hydrolysis process. This is the same type of collagen found in human skin and bone. Protein makes up 97% of this natural product. On a dry basis, collagen peptides contain 18 amino acids, including eight of the nine essential amino acids. The amino acids glycine, proline, and hydroxyproline are the most prevalent in collagen peptides, making up to 50% of its total amino acid content. This special mix of amino acids gives collagen peptides several functional properties.”

Key Stakeholders

- Supply-side: Meat processors, bovine, porcine, marine & poultry collagen extractors, collagen peptides market manufacturers.

- Demand-side: Food & beverage manufacturers, Nutritional products manufacturers, Cosmetics & personal care product manufacturers, and Pharma industries.

- Regulatory-side: Related government authorities, commercial research & development (R&D) institutes, and other regulatory bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the collagen peptides market based on source, form, application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the market.

Competitive Intelligence

- Identifying and profiling the key market players in the collagen peptides market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of the European collagen peptides market, by key country

- Further breakdown of the Rest of the South American market, by key country

- Further breakdown of the Rest of Asia Pacific market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Collagen Peptides Market

Good information for us. Thanks for sharing this article..