Dairy Ingredients Market by Type (Proteins, Milk Powder, Milk Fat Concentrate, Lactose & Its Derivatives), Application (Infant Formulas, Sports Nutrition, Dairy Products and Bakery & Confectionery), Livestock, Form, and Region - Global Forecast to 2026

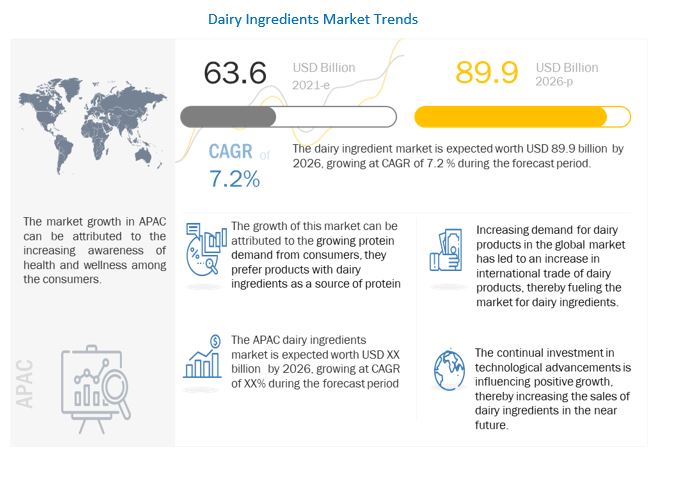

[314 Pages Report] The dairy ingredients market size was estimated to account for a value of USD 63.6 billion in 2021 and is projected to grow at a CAGR of 7.2% from 2021, to reach a value of USD 89.9 billion by 2026. The growth of this market can be attributed to the growing protein demand from consumers, they prefer products with dairy ingredients as a source of protein. The market growth in APAC can be attributed to the increasing awareness of health and wellness among the consumers. The continual investment in technological advancement is influencing growth, thereby increasing the sales of dairy ingredients in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Dairy-derived ingredients originate from real milk and have real value to consumers from a taste and nutrition perspective. Dairy ingredients derived from milk are available in various types, formats, sizes, and find wide application in food & beverage applications worldwide. Whey products are natural, functional, and high in nutrition, becoming the ingredient of choice for sports and performance product manufacturers. Citing the consumer inclination toward functional foods, whey ingredients are being incorporated in baked goods, confectionery items, beverages, dairy foods, meat products, and most importantly, nutraceuticals. Whey protein isolates and demineralized whey proteins are experiencing bolstering demand due to the high protein level and versatile functionality. Asia Pacific is the largest and fastest-growing market for dairy ingredients.

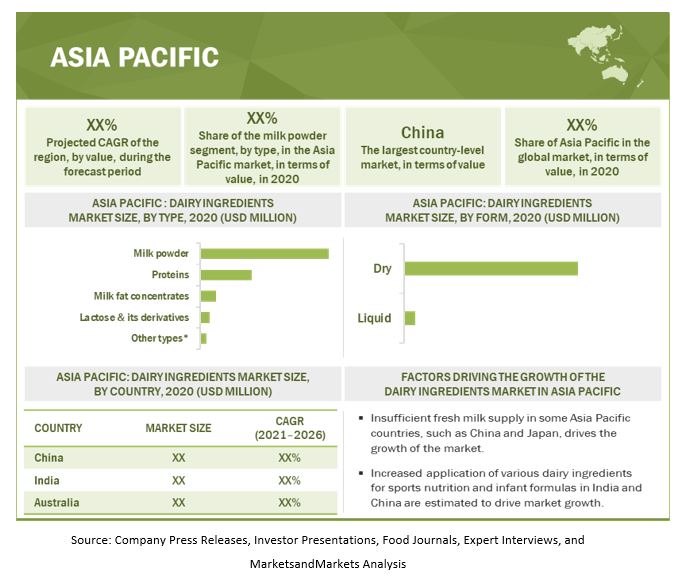

Countries such as India and China drive the growth in the region. India is slowly adopting plant-based dairy alternatives; however, it is still consuming staple dairy products. Lifestyle and consumer preferences are changing mostly due to double-income profiles; hence, successful manufacturers ought to continue innovation, alongside ‘clean label’ solutions are transforming the taste and texture of dairy alternatives. China has incorporated new standards for dairy permeate imports, benefitting the dairy sector. The dairy industry in China has a health halo, subsequently driving strong demand for fluid milk. The bakery & confectionery, dairy, infant formulas, and sports nutrition industries are some of the major application segments of dairy ingredients. According to NIH, about 65% of the human population has a reduced ability to digest lactose. Advancements in the research pertaining to dairy ingredients for easy extraction from various sources apart from cows are expected to boost the market further.

By livestock, the cows segment is projected to dominate the dairy ingredients market during the forecast period.

Based on livestock, the cow’s segment is projected to account for a larger share in the dairy ingredients market. This growth is due to the large population of cows globally, leading to high milk production. The other livestock-based dairy ingredients are highly region-specific; hence, the market is limited globally. The extraction of dairy ingredients from cow milk is comparatively easy and cheap than other sources.

By application, the bakery & confectionery segment is projected to dominate the dairy ingredients market during the forecast period.

Based on applications, the bakery & confectionery segment accounted for the largest share in 2021 due to the multiple applications of dairy ingredients in the bakery industry. Non-fat dried milk and skim milk powder are popular substitutes for fresh fluid milk in the bakery and confectionery sector. Dairy ingredients are also used as claims on packaging to valorize baked goods better. Whey protein ingredients cater to delivering functionality and performance. Since fitness has become the new trend dairy formulations, mostly whey protein are gaining popularity among the younger generation.

Market Dynamics

Driver: Increasing awareness about health and wellness

Consumer preferences are gradually shifting from junk and fast food to nutritional diets. This shift to healthy diets is being witnessed due to the increasing aging population, coupled with the rising health issues. This has led to increased demand for protein-based ingredients, such as dairy ingredients, for use in nutritional foods. This health and wellness trend will act as a key driving factor, which is set to fuel the consumption of dairy ingredients.

Owing to the growing consumer awareness toward health gain, the demand for protein in the daily diet is increasing, which has exponentially propelled the market for dairy proteins. In 2019, the International Food Information Council Foundation (IFICF) conducted a consumer survey in North America about diet preferences. About 48% of consumers said that they often include dairy products in their daily meals as a source of protein. The below diagram depicts the share of each category in the daily meals of North American consumers.

Restraints : Growing demand for alternatives, such as plant protein

The most popular alternatives for dairy are plant-based beverages, which are gaining popularity as substitutes for milk and milk products. Consumers are adopting a dairy-free diet due to the increasing incidences of lactose intolerance, allergies from milk or milk-based products, and a shift toward vegan diets and healthy lifestyles. The growing demand for dairy alternatives is posing a challenge for the growth of the dairy ingredients market.

Peas, beans, nuts, soy, seeds, and lentils are rich sources of plant proteins. Hence, plant protein is an active substitute for dairy ingredients, leading to competition in different segments, such as snack bars and beverages. Soy is being increasingly used in baked goods, beverages, and dairy products. The markets for products containing soy protein and various ingredients are primarily driven by natural health benefits. The growth in the demand for plant protein is because consumers perceive plant protein as an economical source of protein compared to dairy ingredients. Plant proteins also help manufacturers in controlling costs, thereby increasing profitability. For instance, soy protein can easily be incorporated into various foodstuffs without changing taste and quality.

Opportunities : Emerging markets in Asia Pacific and South America: New growth frontiers

The changing consumption patterns due to the influence of westernized lifestyles in developing economies have led to the demand for whey proteins and milk powders by various consumers. Developing countries, such as China, India, Brazil, and countries in the Middle East & Africa, in the coming years, will experience a strong surge in demand for various dairy ingredients. This demand may be driven by increased production of processed foods and innovation in segments, such as infant formula, processed meat products, dairy, bakery products, and functional food & beverages. These regions provide a cost advantage in terms of production and processing. High demand, coupled with a low cost of production, is a key feature that is expected to aid dairy ingredient suppliers.

Challenges : High capital investment in manufacturing dairy ingredients

Dairy ingredient manufacturers require high capital investments to install processing equipment. This processing equipment has high installation costs and requires timely maintenance, which is a costly addition affecting the operating margins of dairy ingredient processors. Hence, high capital investment challenges market growth.

The increasing demand for dairy ingredients in Asia Pacific is driving the growth of the dairy ingredients market.

The global dairy ingredients market is dominated by Asia Pacific, which accounted for the largest share. Nowadays, a sedentary lifestyle and a hectic daily routine run parallel to the consumer focus on health, resulting in an extreme workout and heightened dependence on protein supplements. Dairy protein ingredients are being consumed for weight loss and muscle gain and provide maximum nutrition and nourishment. Veganism has captured a large section of the market in Europe and the US; however, dairy being a staple in India, retains its position as the major protein supplement. Globally, whey is being incorporated in the regular diet as natural bioactive substances have a positive influence on an individual’s health.

To know about the assumptions considered for the study, download the pdf brochure

Globally, the Asia Pacific market for dairy ingredients accounted for the largest share of nearly 32.84% in 2020.

The Asia Pacific region is projected to witness the highest growth during the forecast period. A large amount of milk is produced in the country, which gives the dairy ingredients market the potential to grow in the coming years. Owing to this large production, the region has immense potential for exports of dairy ingredients. Rapid urbanization, changing lifestyles, and the inclination of consumers toward nutritious food and beverages also contribute to the growth of the dairy ingredients market. Owing to the increasing consumer demands for convenience food and dairy products in the region, many major players are entering the market.

Key Market Players

The key players in this market include FrieslandCampina (Netherlands), Groupe Lactalis (France), Arla Foods (Denmark), Saputo (Canada), Fonterra Co-operative Group (New Zealand), Dairy Farmers of America (US), Kerry Group (Ireland), Ornua (Ireland), AMCO Proteins (US), Prolactal (Austria), Valio (Finland), Glanbia (Ireland), Hoogwegt Group (Netherlands), Batory Foods (US), Ingredia SA (France), Agropur (Quebec), and Euroserum (France). Major players in this market are focusing on increasing their presence through new product launches, expansions & investments, mergers & acquisitions, partnerships, collaborations, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017-2026 |

|

Base year considered |

The base year considered for most company profiles is 2021. Wherever recent financial data was not available, the data for 2020 has been considered. |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) and Volume (tons) |

|

Segments covered |

Type, Livestock, Application, Form, and Region |

|

Geographies covered |

North America, Europe, South America, Asia Pacific, RoW |

|

Companies covered |

FrieslandCampina (The Netherlands), Groupe Lactalis (France), Arla Foods (Denmark), Saputo (Canada), Fonterra Co-operative Group (New Zealand), Dairy Farmers of America (US), Kerry Group (Ireland), Ornua (Ireland), AMCO Proteins (US), Prolactal (Austria), Valio (Finland), Glanbia (Ireland), Hoogwegt Group (The Netherlands), Batory Foods (US) and Ingredia SA (France). |

This research report categorizes the dairy ingredients market based on type, livestock, application, form, and region.

Based on type, the dairy ingredients market has been segmented as follows:

-

Proteins:

- Whey protein concentrates

- Whey protein isolates

- Casein & caseinates

- Milk protein concentrates

- Milk protein isolates

- Milk protein hydrolysates

- Milk Powder:

- Skimmed milk powder

- Whole milk powder

- Milk fat concentrates

- Lactose & its derivatives

- Other types (milk and whey peptides, dairy protein fractions, other proteins, and colostrums)

Based on livestock, the dairy ingredients market has been segmented as follows:

- Cows

- Other livestock (Buffaloes, goats, sheep, and camels)

Based on application, the dairy ingredients market has been segmented as follows:

- Bakery & confectionery

- Dairy products

- Sports nutrition products

- Infant formulas

- Other applications (Convenience food, beverages, meat, poultry & seafood, and other processed food)

Based on form, the dairy ingredients market has been segmented as follows:

- Dry

- Liquid

Based on the region, the dairy ingredients market has been segmented as follows:

- North America

- Europe

- South America

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes South Africa, the Middle East, and other countries from Africa.

Recent Developments:

- In Jan 2021, Fonterra and Royal DSM, a global science-based company active in health, nutrition, and sustainable living, teamed up to work on reducing on-farm greenhouse gas emissions in New Zealand.

- In March 2021, FrieslandCampina International Holding B.V and the Arabian Food Industries Company signed a joint venture agreement to focus on the export of cheese to Africa and the Middle East.

- In May 2021, Ehrmann and FrieslandCampina have signed an agreement for the acquisition by Ehrmann of FrieslandCampina's Russian subsidiary Campina LLC. Both companies hold strong positions in different segments of the Russian dairy market. This strategic transaction accelerates Ehrmann’s position in Russia and allows FrieslandCampina to focus on consumer markets elsewhere.

- In August 2021, Glanbia Nutritionals, a wholly owned subsidiary of Glanbia plc, acquired Foodarom, a Canadian-based custom flavor designer and manufacturer servicing the food, beverage, and nutritional product industries, with turn-key flavors and formulation support.

FAQs:

Which region is projected to account for the largest share in the dairy ingredients market?

The Asia Pacific region accounted for the largest size in the global dairy ingredients market in 2020 and is projected to reach USD 32.1 billion by 2026. The Asia Pacific region is projected to grow at the highest CAGR of 8.7% during the forecast period in the global dairy ingredients market.

What is the current size of the dairy ingredients market?

The dairy ingredients market is estimated to be valued at USD 63.6 billion in 2021. It is projected to reach USD 89.9 billion by 2026, recording a CAGR of 7.2% during the forecast period.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Royal FrieslandCampina N.V. (The Netherlands), Fonterra Co-operative Group Limited (New Zealand), Arla Foods (Denmark), Glanbia (Ireland), Kerry Group (Ireland), Dairy Farmers of America (US), Groupe Lactalis (France) they lead the market because of their innovative products that are introduced because of research and development carried out by these companies, usage of different distribution channels to meet the demand for consumers and their merger and acquisition strategies. These factors are projected to contribute to market growth.

What is the COVID-19 impact on the dairy ingredients market?

The outbreak of COVID-19 has brought severe medical, social, and economic challenges. The COVID-19 pandemic has placed unprecedented stresses on food supply chains, with bottlenecks in farm labor, processing, transport, and logistics, as well as momentous shifts in demand, simultaneously affecting farm production, food processing, transport and logistics, and demand. A rapid and unexpected disruption in supply chains during the pandemic resulted in manufacturers, suppliers, and retailers struggling to ensure a continued supply of dairy ingredients in the market. Even though the demand for dairy ingredients has not been affected, the supply has significantly impacted the COVID-19 pandemic. .

What is the leading application in the dairy ingredients market?

The bakery & confectionery segment was the highest revenue contributor to the market, with USD 13,673.9 million in 2020, and is estimated to reach USD 21,344.5 million by 2026, with a CAGR of 7.8%. The infant formula segment is estimated to reach USD 18,532.3 million by 2026, at a significant CAGR of 7.3% during the forecast period.

What is the estimated industry size of dairy ingredients?

The global dairy ingredients market was valued at USD 58,372.1 million in 2020, and is projected to reach USD 89,944.7 million by 2026, registering a CAGR of 7.2% from 2021 to 2026.

What is the leading type in the dairy ingredients market?

The milk powder segment was the highest revenue contributor to the market, with USD 30,450.5 million in 2020, and is estimated to reach USD 50,768.5 million by 2026, with a CAGR of 8.5%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED FOR THE STUDY, 2016–2018

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 DAIRY INGREDIENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 58)

TABLE 2 DAIRY INGREDIENTS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 3 DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021 VS. 2026 (USD MILLION)

FIGURE 4 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 5 DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 6 DAIRY INGREDIENTS MARKET SHARE AND GROWTH (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DAIRY INGREDIENTS MARKET

FIGURE 7 INCREASING AWARENESS ABOUT HEALTH & WELLNESS AND GROWING APPLICATIONS IN NUTRITION & CONVENIENCE FOODS ARE DRIVING THE MARKET FOR DAIRY INGREDIENTS

4.2 DAIRY INGREDIENTS MARKET: BY TYPE

FIGURE 8 MILK POWDER TYPE SEGMENT DOMINATED THE DAIRY INGREDIENTS MARKET IN 2020

4.3 DAIRY INGREDIENTS MARKET, BY FORM AND REGION

FIGURE 9 ASIA PACIFIC TO DOMINATE THE DAIRY INGREDIENTS SEGMENT IN 2020

4.4 DAIRY INGREDIENTS MARKET, BY LIVESTOCK

FIGURE 10 COWS SEGMENT DOMINATED THE DAIRY INGREDIENTS MARKET, BY LIVESTOCK

4.5 UNITED STATES HOLDS THE LARGEST MARKET SHARE IN THE DAIRY INGREDIENTS MARKET

FIGURE 11 UNITED STATES AND CHINA ARE THE MJOR MARKET SHARE HOLDERS IN THE DAIRY INGREDIENTS MARKET, BY REGION, IN 2020

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

FIGURE 12 MILK PROCESSING TO OBTAIN MILK POWDER: PROCESS FLOW DIAGRAM

FIGURE 13 MILK PROCESSING TO OBTAIN MILK PROTEIN CONCENTRATE AND WHEY PROTEIN CONCENTRATE: PROCESS FLOW DIAGRAM

5.2 MACROECONOMIC INDICATORS

5.2.1 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS SUCH AS ASIA PACIFIC AND SOUTH AMERICA

FIGURE 14 GDP GROWTH RATE IN ASIAN COUNTRIES, 2020–2021

5.2.2 INCREASING POPULATION DENSITY

TABLE 3 GLOBAL POPULATION DENSITY, 2019

FIGURE 15 POPULATION GROWTH TRENDS, 1950–2050

5.2.3 EFFECTS OF RAPID URBANIZATION AND WESTERNIZATION

FIGURE 16 MOST URBANIZED COUNTRIES, 2020

5.3 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS: DAIRY INGREDIENTS MARKET

5.3.1 DRIVERS

5.3.1.1 Increasing awareness about health and wellness

FIGURE 18 PERCENTAGE OF CONSUMERS SEEKING HEALTH BENEFITS FROM FOOD IN NORTH AMERICA, 2019

FIGURE 19 HIGH DEMAND FOR PROTEIN WITNESSED IN THE DAILY DIET OF CONSUMERS IN NORTH AMERICA IN 2018 (%)

5.3.1.1.1 Increasing application in the nutrition and convenience food sectors

FIGURE 20 SOLID COMPONENTS IN MILK (EXCLUDING FAT) (%)

TABLE 4 MILK PROTEIN CONCENTRATION (G/L)

5.3.1.2 Increasing dairy production

FIGURE 21 WORLD DAIRY PRODUCTION, 2018–2021 (THOUSAND TONS)

5.3.1.2.1 Growing demand for dairy products

FIGURE 22 MAJOR MARKETS OF UNITED STATES DAIRY EXPORTS, 2020 (USD MILLION)

FIGURE 23 TOP TEN COUNTRIES EXPORTING DAIRY PRODUCTS, 2020 (USD MILLION)

5.3.1.3 Technological advancements to enhance production efficiency

5.3.1.4 Abolition of milk quota in the EU

5.3.2 RESTRAINTS

5.3.2.1 Growing demand for alternatives, such as plant protein

FIGURE 24 FAMILIARITY AND INTEREST IN PLANT-BASED DIETS IN NORTH AMERICA, 2020 (%)

5.3.2.2 Health risks associated with whey protein

5.3.2.3 Consumer predisposition toward vegan food

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging markets in Asia Pacific and South America: New growth frontiers

FIGURE 25 DAIRY PRODUCTION IN INDIA, 2015–2019 (MILLION TONS)

5.3.3.2 Favorable government initiatives and schemes to promote regional dairy sectors

5.3.4 CHALLENGES

5.3.4.1 High capital investment in manufacturing dairy ingredients

5.3.4.2 Adulteration of dairy products creates a challenge to manufacture quality ingredients

5.3.4.3 Increasing incidences of lactose intolerance and allergies

TABLE 5 PERCENTAGE OF POPULATION WITH LACTOSE INTOLERANCE, BY ETHNICITY/GEOGRAPHIC REGION

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 85)

6.1 INTRODUCTION

6.2 VALUE CHAIN

FIGURE 26 VALUE CHAIN ANALYSIS OF THE DAIRY INGREDIENTS MARKET: PROCESSING IS ONE OF THE KEY CONTRIBUTORS

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 INPUTS

6.2.3 PROCESSING

6.2.4 LOGISTICS & DISTRIBUTION

6.2.5 MARKETING & SALES

6.3 TRADE DATA: DAIRY INGREDIENTS MARKET

TABLE 6 TOP FIVE IMPORTERS AND EXPORTERS OF WHEY AND PRODUCT CONSISTING OF NATURAL MILK CONSTITUENTS, 2020 (KG)

6.4 PRICING ANALYSIS: DAIRY INGREDIENTS MARKET

TABLE 7 GLOBAL DAIRY INGREDIENTS AVERAGE SELLING PRICE (ASP), BY TYPE, 2019–2021 (USD/TONS)

TABLE 8 GLOBAL DAIRY INGREDIENTS AVERAGE SELLING PRICE (ASP), BY REGION, 2019–2021 (USD/TONS)

6.5 MARKET MAP AND ECOSYSTEM THE DAIRY INGREDIENTS MARKET

6.5.1 DEMAND SIDE

6.5.2 SUPPLY SIDE

FIGURE 27 DAIRY INGREDIENTS: MARKET MAP

TABLE 9 DAIRY INGREDIENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.6 TRENDS IMPACTING BUYERS

FIGURE 28 DAIRY INGREDIENTS MARKET: TRENDS IMPACTING BUYERS

6.7 REGULATORY FRAMEWORK

6.7.1 NORTH AMERICA: REGULATORY FRAMEWORK

6.7.1.1 Justice Law, Canada

6.7.2 EUROPE: REGULATORY FRAMEWORK

6.7.3 ASIA PACIFIC: REGULATORY FRAMEWORK

6.7.4 SOUTH AMERICA: REGULATORY FRAMEWORK

6.8 PATENT ANALYSIS

FIGURE 29 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2020

FIGURE 30 TOP 10 APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 10 SOME OF THE PATENTS PERTAINING TO DAIRY INGREDIENTS, 2020–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 DAIRY INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.1 CASE STUDIES

6.10.1 INCREASE IN CONCERN REGARDING HUMAN HEALTH AND WELLNESS

7 DAIRY INGREDIENTS MARKET, BY TYPE (Page No. - 99)

7.1 INTRODUCTION

FIGURE 31 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 12 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 14 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 15 DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (KT)

7.1.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET, BY TYPE

7.1.1.1 Realistic Scenario

TABLE 16 REALISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2018–2021 (USD BILLION)

7.1.1.2 Pessimistic Scenario

TABLE 17 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2018–2021 (USD BILLION)

7.1.1.3 Optimistic Scenario

TABLE 18 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2018–2021 (USD BILLION)

7.2 PROTEINS

7.2.1 DAIRY PROTEINS ARE VIEWED AS THE BEST SOURCE OF PROTEIN FOR MAINTAINING A HEALTHY AND BALANCED DIET

TABLE 19 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 20 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 21 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 22 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 23 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 PROTEINS: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.2.2 WHEY PROTEIN CONCENTRATES

7.2.2.1 Whey protein concentrates are one of the ideal sources of proteins

7.2.3 WHEY PROTEIN ISOLATES

7.2.3.1 Whey protein isolates find wide applications in sports drinks

7.2.4 CASEIN & CASEINATES

7.2.4.1 Casein & caseinates have multiple functions in the food and non-food sectors

7.2.5 MILK PROTEIN CONCENTRATES

7.2.5.1 Milk protein concentrates are ingredients for protein-enriched food & beverage products owing to their high-protein and low-lactose ratio

TABLE 25 FUNCTIONAL PROPERTIES OF MILK PROTEIN CONCENTRATES AND THEIR APPLICATIONS IN THE FINAL PRODUCT

7.2.6 MILK PROTEIN ISOLATES

7.2.6.1 Milk protein isolates can be an alternative for whey proteins, as they are less expensive

TABLE 26 COMPOSITION OF MILK PROTEIN ISOLATES

7.2.7 MILK PROTEIN HYDROLYSATES

7.2.7.1 Milk protein hydrolysates are popular ingredients for infant formulas

7.3 MILK POWDER

7.3.1 LONGER SHELF-LIFE AND STABILITY OF MILK POWDER DRIVE THE MARKET

TABLE 27 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 28 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 29 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 31 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MILK POWDER: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3.2 SKIMMED MILK POWDER

7.3.2.1 Skimmed milk powder is used to manufacture products at high temperatures

7.3.3 WHOLE MILK POWDER

7.3.3.1 Whole milk powder is a popular dairy ingredient among ice cream, confectionery, and yogurt manufacturers

7.4 MILK FAT CONCENTRATES

7.4.1 MILK FAT CONCENTRATES ARE IDEAL FOR THE PREPARATION OF FOOD PRODUCTS WITH RICH, CREAMY TEXTURES WITHOUT HIGH CALORIES

TABLE 33 MILK FAT CONCENTRATES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 34 MILK FAT CONCENTRATES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 35 MILK FAT CONCENTRATES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MILK FAT CONCENTRATES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 LACTOSE & ITS DERIVATIVES

7.5.1 LACTOSE IS AN EXCELLENT SOURCE OF PROBIOTICS TO ENHANCE GUT HEALTH

TABLE 37 LACTOSE & ITS DERIVATIVES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 38 LACTOSE & ITS DERIVATIVES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 39 LACTOSE & ITS DERIVATIVES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 LACTOSE & ITS DERIVATIVES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 OTHER TYPES

7.6.1 MILK AND WHEY PEPTIDES, COLOSTRUM, AND OTHER DAIRY PROTEIN FRACTIONS ARE EXCELLENT SOURCES OF ACTIVE BIOLOGICAL INGREDIENTS

TABLE 41 OTHER TYPES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020(USD MILLION)

TABLE 42 OTHER TYPES: DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 43 OTHER TYPES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 OTHER TYPES: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 DAIRY INGREDIENTS MARKET, BY FUNCTIONALITY (Page No. - 119)

8.1 INTRODUCTION

8.2 EMULSIFICATION, FOAMING, AND THICKENING

8.3 COLOR, FLAVOR, AND TEXTURE

8.4 GELATION

8.5 SOLUBILITY AND HEAT STABILITY

TABLE 45 SELECTED FUNCTIONAL PROPERTIES OF DAIRY INGREDIENTS AND THEIR APPLICATIONS IN THE FINAL PRODUCTS

TABLE 46 DAIRY INGREDIENTS’ ROLE IN VARIOUS FOOD APPLICATIONS

TABLE 47 TYPE OF DAIRY INGREDIENTS USED IN THE FOOD INDUSTRY

9 DAIRY INGREDIENTS MARKET, BY FORM (Page No. - 125)

9.1 INTRODUCTION

FIGURE 32 DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021 VS. 2026 (USD BILLION)

TABLE 48 DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD BILLION)

TABLE 49 DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD BILLION)

9.1.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET, BY FORM

9.1.1.1 Realistic Scenario

TABLE 50 REALISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2018–2021 (USD BILLION)

9.1.1.2 Pessimistic Scenario

TABLE 51 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2018–2021 (USD BILLION)

9.1.1.3 Optimistic Scenario

TABLE 52 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2018–2021 (USD BILLION)

9.2 DRY

9.2.1 INCREASED POPULARITY OF DRY DAIRY INGREDIENTS DUE TO THEIR HIGH SHELF LIVES

TABLE 53 DRY: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 54 DRY: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.3 LIQUID

9.3.1 LIQUID DAIRY INGREDIENTS ARE POPULARLY USED IN INFANT FORMULAS AND BEVERAGES

TABLE 55 LIQUID: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 LIQUID: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 DAIRY INGREDIENTS MARKET, BY LIVESTOCK (Page No. - 131)

10.1 INTRODUCTION

FIGURE 33 DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021 VS. 2026 (USD MILLION)

TABLE 57 DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 58 DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET, BY LIVESTOCK

10.1.1.1 Realistic Scenario

TABLE 59 REALISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2018–2021 (USD MILLION)

10.1.1.2 Pessimistic Scenario

TABLE 60 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2018–2021 (USD MILLION)

10.1.1.3 Optimistic Scenario

TABLE 61 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2018–2021 (USD MILLION)

10.2 COWS

10.2.1 ABUNDANCE AND AVAILABILITY OF COW MILK DRIVE THE DEMAND AND SUPPLY

TABLE 62 COWS: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 COWS: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 OTHER LIVESTOCK

10.3.1 UNORGANIZED SECTOR OF BUFFALO AND CAMEL MILK PRODUCTION INDICATING GROWTH OPPORTUNITIES

TABLE 64 OTHER LIVESTOCK: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 OTHER LIVESTOCK: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 DAIRY INGREDIENTS MARKET, BY APPLICATION (Page No. - 137)

11.1 INTRODUCTION

FIGURE 34 DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 66 DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 67 DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.1.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET, BY APPLICATION

11.1.1.1 Realistic Scenario

TABLE 68 REALISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2018–2021 (USD BILLION)

11.1.1.2 Pessimistic Scenario

TABLE 69 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2018–2021 (USD BILLION)

11.1.1.3 Optimistic Scenario

TABLE 70 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET SIZE, BY APPLICATION, 2018–2021 (USD BILLION)

11.2 BAKERY & CONFECTIONERY

11.2.1 MULTI-FUNCTIONALITY OF DAIRY INGREDIENTS IN THE BAKERY INDUSTRY TO DRIVE THE MARKET GROWTH

TABLE 71 BAKERY & CONFECTIONERY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 BAKERY & CONFECTIONERY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3 DAIRY PRODUCTS

11.3.1 MILK POWDER REPLACES FRESH MILK DURING THE PRODUCTION OF DAIRY PRODUCTS

TABLE 73 DAIRY PRODUCTS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 74 DAIRY PRODUCTS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4 SPORTS NUTRITION PRODUCTS

11.4.1 DOMINANCE OF WHEY PROTEIN AS A PREFERRED PROTEIN SOURCE FOR EFFECTIVE SPORTS NUTRITION

TABLE 75 SPORTS NUTRITION PRODUCTS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 76 SPORTS NUTRITION PRODUCTS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.5 INFANT FORMULAS

11.5.1 BUSIER & SEDENTARY LIFESTYLES OF PARENTS TO DRIVE THE INFANT FORMULAS MARKET

TABLE 77 INFANT FORMULAS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 78 INFANT FORMULAS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.6 OTHER APPLICATIONS

11.6.1 INCREASING APPLICABILITY OF DAIRY INGREDIENTS TO DRIVE THE MARKET GROWTH

TABLE 79 OTHER APPLICATIONS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 OTHER APPLICATIONS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12 DAIRY INGREDIENTS MARKET, BY REGION (Page No. - 149)

12.1 INTRODUCTION

FIGURE 35 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2021–2026

FIGURE 36 DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021 VS 2026 (USD MILLION)

TABLE 81 DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.1.1 COVID-19 IMPACT ON THE DAIRY INGREDIENTS MARKET, BY REGION

12.1.1.1 Optimistic Scenario

TABLE 83 OPTIMISTIC SCENARIO: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.2 Realistic Scenario

TABLE 84 REALISTIC SCENARIO: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.1.1.3 Pessimistic Scenario

TABLE 85 PESSIMISTIC SCENARIO: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

12.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 86 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 89 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 90 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MILK POWDER INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: MILK POWDER INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 NORTH AMERICA: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 103 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 105 NORTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 The US is one of the leading exporters of whey proteins in the world

TABLE 106 US: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 107 US: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Surplus production of skimmed milk powders in the country to drive demand

TABLE 108 CANADA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 CANADA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Favorable government regulations and legislations support the Mexican dairy ingredients market

TABLE 110 MEXICO: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 MEXICO: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3 EUROPE

TABLE 112 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 115 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 116 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 119 EUROPE: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MILK POWDER INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: MILK POWDER INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 EUROPE: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 EUROPE: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Fast-growing sports nutrition sector augments the demand for dairy ingredients in Germany

TABLE 132 GERMANY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 GERMANY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.2 UK

12.3.2.1 Large-scale employment in the dairy sector spurs the dairy ingredients market in the UK

TABLE 134 UK: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 135 UK: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Significant steps taken by the French government to support the market for dairy ingredients

TABLE 136 FRANCE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 FRANCE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.4 POLAND

12.3.4.1 Dairy proteins witness high demand from Polish consumers

TABLE 138 POLAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 POLAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.5 ITALY

12.3.5.1 The rise in popularity of ready-to-eat food & beverages has increased the demand for dairy ingredients

TABLE 140 ITALY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 ITALY: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.6 IRELAND

12.3.6.1 Aging population demanding more functional and fortified foods

TABLE 142 IRELAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 IRELAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.7 NETHERLANDS

12.3.7.1 Increase in the processing units driving the dairy ingredients market

TABLE 144 NETHERLANDS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 NETHERLANDS: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.3.8 REST OF EUROPE

12.3.8.1 Favorable government initiatives and legislations uplift the dairy ingredients market

TABLE 146 REST OF EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 REST OF EUROPE: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SNAPSHOT

TABLE 148 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 151 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 152 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 ASIA PACIFIC: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 155 ASIA PACIFIC: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 ASIA PACIFIC: MILK POWDER MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 157 ASIA PACIFIC MILK POWDER MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 158 ASIA PACIFIC: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 159 ASIA PACIFIC: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 160 ASIA PACIFIC: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 161 ASIA PACIFIC: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 162 ASIA PACIFIC: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 ASIA PACIFIC: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 164 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 165 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 166 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 167 ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increase in application in infant nutrition driving market growth

TABLE 168 CHINA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 169 CHINA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.2 INDIA

12.4.2.1 The well-established dairy industry in India supports the growth of the dairy ingredients market

TABLE 170 INDIA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 INDIA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Global partnerships and agreements influence the Japanese dairy ingredients market

TABLE 172 JAPAN: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 173 JAPAN: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.4 AUSTRALIA

12.4.4.1 Hefty export and import activities drive the dairy ingredients market

TABLE 174 AUSTRALIA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 175 AUSTRALIA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.5 NEW ZEALAND

12.4.5.1 High milk production in New Zealand opens growth opportunities for the export of dairy ingredients

TABLE 176 NEW ZEALAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 177 NEW ZEALAND: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Rapid demand for functional food is projected to augment the dairy ingredients market

TABLE 178 REST OF ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 180 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 182 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KT)

TABLE 183 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (KT)

TABLE 184 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 185 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 186 SOUTH AMERICA: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 187 SOUTH AMERICA: DAIRY PROTEIN INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 188 SOUTH AMERICA: MILK POWDER MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 189 SOUTH AMERICA: MILK POWDER MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 190 SOUTH AMERICA: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 191 SOUTH AMERICA: MILK FAT CONCENTRATES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 192 SOUTH AMERICA: LACTOSE & ITS DERIVATIVES MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 193 SOUTH AMERICA: LACTOSE & ITS DERIVATIVES MARKET SIZE, B Y COUNTRY, 2021–2026 (USD MILLION)

TABLE 194 SOUTH AMERICA: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 195 SOUTH AMERICA: OTHER DAIRY INGREDIENTS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 196 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 197 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 198 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 199 SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Favorable import-export regulations fuel the demand for dairy ingredients

TABLE 200 BRAZIL: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 201 BRAZIL: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Rising cases of obesity and heart diseases to drive market growth

TABLE 202 ARGENTINA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 203 ARGENTINA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

12.5.3.1 The rising popularity of whole milk powder bolsters the market growth

TABLE 204 REST OF SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 205 REST OF SOUTH AMERICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

TABLE 206 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 207 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 208 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 209 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (KT)

TABLE 210 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 211 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 212 REST OF THE WORLD: PROTEIN DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 213 REST OF THE WORLD: PROTEIN DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 214 REST OF THE WORLD: MILK POWDER DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 215 REST OF THE WORLD: MILK POWDER DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 216 REST OF THE WORLD: MILK FAT CONCENTRATES DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 217 REST OF THE WORLD: MILK FAT CONCENTRATES DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 218 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 219 REST OF THE WORLD: LACTOSE & ITS DERIVATIVES DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 220 REST OF THE WORLD: LACTOSE & ITS DERIVATIVES DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 221 REST OF THE WORLD: OTHER TYPE OF DAIRY INGREDIENTS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 222 REST OF THE WORLD: OTHER TYPE OF DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2017–2020 (USD MILLION)

TABLE 223 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY LIVESTOCK, 2021–2026 (USD MILLION)

TABLE 224 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2017–2020 (USD MILLION)

TABLE 225 REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY FORM, 2021–2026 (USD MILLION)

12.6.1 MIDDLE EAST

12.6.1.1 Health & wellness trend to drive the Middle Eastern dairy ingredients market

TABLE 226 MIDDLE EAST: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 227 MIDDLE EAST: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Growing dairy ingredients market improves the health of consumers and helps combat malnutrition

TABLE 228 AFRICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 229 AFRICA: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 230 OTHERS IN REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 231 OTHERS IN REST OF THE WORLD: DAIRY INGREDIENTS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 226)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS

TABLE 232 DAIRY INGREDIENTS MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

13.3 KEY PLAYER STRATEGIES

13.4 REVENUE ANALYSIS OF KEY PLAYERS, 2016-2020

FIGURE 39 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2016-2020 (USD BILLION)

13.5 COVID-19-SPECIFIC COMPANY RESPONSE

13.6 COMPANY EVALUATION QUADRANTS

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 40 DAIRY INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020

13.6.5 PRODUCT FOOTPRINT

TABLE 233 COMPANY FOOTPRINT, BY APPLICATION

TABLE 234 COMPANY FOOTPRINT, BY PRODUCT TYPE

TABLE 235 COMPANY FOOTPRINT, BY REGION

TABLE 236 OVERALL COMPANY FOOTPRINT

13.7 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

FIGURE 41 DAIRY INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020

13.8 COMPETITIVE SCENARIO

13.8.1 DEALS

TABLE 237 DAIRY INGREDIENTS MARKET: DEALS, 2021

13.8.2 OTHER DEVELOPMENTS

TABLE 238 DAIRY INGREDIENTS MARKET: OTHER DEVELOPMENTS, 2021

14 COMPANY PROFILES (Page No. - 240)

(Business overview, Products offered, Recent Developments, MNM view)*

14.1 ROYAL FRIESLANDCAMPINA N.V.

TABLE 239 FRIESLANDCAMPINA: COMPANY OVERVIEW

FIGURE 42 FRIESLANDCAMPINA: COMPANY SNAPSHOT

TABLE 240 DAIRY INGREDIENTS MARKET: DEALS, 2018-2021

TABLE 241 DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2021

14.2 FONTERRA CO-OPERATIVE GROUP LIMITED

TABLE 242 FONTERRA CO-OPERATIVE GROUP LIMITED: COMPANY OVERVIEW

FIGURE 43 FONTERRA CO-OPERATIVE GROUP: COMPANY SNAPSHOT

TABLE 243 FONTERRA CO-OPERATIVE GROUP LIMITED: DAIRY INGREDIENTS MARKET: DEALS, 2021-2018

TABLE 244 FONTERRA CO-OPERATIVE GROUP LIMITED: DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2018

14.3 ARLA FOODS

TABLE 245 ARLA FOODS: COMPANY OVERVIEW

FIGURE 44 ARLA FOODS: COMPANY SNAPSHOT

TABLE 246 ARLA FOODS: DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2020-2018

TABLE 247 ARLA FOODS: DAIRY INGREDIENTS MARKET: DEALS, 2020-2018

TABLE 248 ARLA FOODS: DAIRY INGREDIENTS MARKET: OTHERS, APRIL 2021-2019

14.4 GLANBIA PLC

TABLE 249 GLANBIA: BUSINESS OVERVIEW

FIGURE 45 GLANBIA: COMPANY SNAPSHOT

TABLE 250 GLANBIA: DAIRY INGREDIENTS MARKET: DEALS, 2021-2018

TABLE 251 DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019

TABLE 252 GLANBIA DAIRY INGREDIENTS MARKET: OTHERS, APRIL 2020

14.5 KERRY GROUP PLC

TABLE 253 KERRY GROUP:BUSINESS OVERVIEW

FIGURE 46 KERRY GROUP: COMPANY SNAPSHOT

TABLE 254 KERRY GROUP, DAIRY INGREDIENTS MARKET: DEALS, 2021-2018

TABLE 255 KERRY GROUP, DAIRY INGREDIENTS MARKET: OTHERS, 2021-2019

14.6 DAIRY FARMERS OF AMERICA

TABLE 256 DAIRY FARMERS OF AMERICA: BUSINESS OVERVIEW

FIGURE 47 DAIRY FARMERS OF AMERICA: COMPANY SNAPSHOT

TABLE 257 DAIRY FARMERS OF AMERICA, DAIRY INGREDIENTS MARKET: DEALS, 2020-2018

TABLE 258 DAIRY FARMERS OF AMERICA, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2021

14.7 GROUPE LACTALIS

TABLE 259 GROUP LACTALIS: BUSINESS OVERVIEW

FIGURE 48 GROUPE LACTALIS: COMPANY SNAPSHOT

TABLE 260 GROUP LACTALIS, DAIRY INGREDIENTS MARKET: DEALS, 2020-2018

14.8 ORNUA

TABLE 261 ORNUA: BUSINESS OVERVIEW

FIGURE 49 ORNUA: COMPANY SNAPSHOT

TABLE 262 ORNUA, DAIRY INGREDIENTS MARKET: DEALS, 2021

TABLE 263 ORNUA, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2021

TABLE 264 ORNUA, DAIRY INGREDIENTS MARKET: OTHERS, APRIL 2019-2021

14.9 SAPUTO INC.

TABLE 265 SAPUTO: BUSINESS OVERVIEW

FIGURE 50 SAPUTO: COMPANY SNAPSHOT

TABLE 266 SAPUTO, DAIRY INGREDIENTS MARKET: DEALS, 2018-2021

14.10 VOLAC INTERNATIONAL LTD.

TABLE 267 VOLAC INTERNATIONAL: BUSINESS OVERVIEW

TABLE 268 VOLAC INTERNATIONAL, DAIRY INGREDIENTS MARKET: DEALS, 2021

TABLE 269 VOLAC INTERNATIONAL, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2018

14.11 EPI INGREDIENTS

TABLE 270 EPI INGREDIENTS: BUSINESS OVERVIEW

TABLE 271 EPI INGREDIENTS, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2018-2021

14.12 PROLACTAL

TABLE 272 PROLACTAL: BUSINESS OVERVIEW

TABLE 273 PROLACTAL, DAIRY INGREDIENTS MARKET: DEALS, 2021-2020

14.13 HOOGWEGT GROUP B.V.

TABLE 274 HOOGWEGT: BUSINESS OVERVIEW

TABLE 275 HOOGWEGT, DAIRY INGREDIENTS MARKET: DEALS, 2019-2021

14.14 BATORY FOODS

TABLE 276 BATORY FOODS: BUSINESS OVERVIEW

TABLE 277 BATORY FOODS, DAIRY INGREDIENTS MARKET: DEALS, OCTOBER 2019-2021

14.15 VALIO

TABLE 278 VALIO: BUSINESS OVERVIEW

TABLE 279 VALIO, DAIRY INGREDIENTS MARKET: DEALS, 2018-2021

TABLE 280 VALIO, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019

14.16 INGREDIA SA

TABLE 281 INGREDIA SA: BUSINESS OVERVIEW

TABLE 282 INGREDIA SA, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019-2021

TABLE 283 INGREDIA SA, DAIRY INGREDIENTS MARKET: DEALS, 2018-2019

14.17 CAYUGA DAIRY INGREDIENTS

TABLE 284 CAYUGA DIRY INGREDIENT: BUSINESS OVERVIEW

TABLE 285 CAYUGA DIRY INGREDIENT, DAIRY INGREDIENTS MARKET: DEALS, 2018-2021

14.18 AMCO PROTEINS

TABLE 286 AMCO PROTEIN: BUSINESS OVERVIEW

TABLE 287 AMCO PROTEIN, DAIRY INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019

14.19 VALFOO

TABLE 288 VALFOO: BUSINESS OVERVIEW

14.20 INTERFOOD

TABLE 289 INTERFOOD: BUSINESS OVERVIEW

TABLE 290 INTERFOOD, DAIRY INGREDIENTS MARKET: DEALS, 2020-2021

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT MARKETS (Page No. - 298)

15.1 INTRODUCTION

TABLE 291 ADJACENT MARKETS TO DAIRY INGREDIENTS

15.2 LIMITATIONS

15.3 DAIRY ALTERNATIVES MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 292 DAIRY ALTERNATIVES MARKET SIZE, BY SOURCE, 2018–2026 (USD MILLION)

TABLE 293 DAIRY ALTERNATIVES MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 294 DAIRY ALTERNATIVES MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

15.3.3 DAIRY PROCESSING EQUIPMENT MARKET

15.3.3.1 Market definition

15.3.3.2 Market overview

TABLE 295 DAIRY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 296 DAIRY PROCESSING EQUIPMENT MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 297 DAIRY PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

15.3.4 INFANT FORMULA INGREDIENTS MARKET

15.3.4.1 Market definition

15.3.4.2 Market overview

TABLE 298 INFANT FORMULA INGREDIENTS MARKET SIZE, BY INGREDIENT, 2017–2025 (USD MILLION)

TABLE 299 INFANT FORMULA INGREDIENTS MARKET SIZE, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 300 INFANT FORMULA INGREDIENTS MARKET SIZE, BY REGION, 2017–2025 (USD BILLION)

16 APPENDIX (Page No. - 304)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

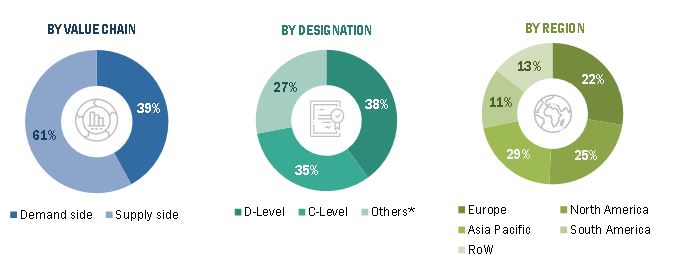

The study involves four major activities to estimate the current market size of the dairy ingredients market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources, such as the United States Food and Drug Administration (USFDA), Organization for Economic Co-operation and Development (OECD), Global Dairy Trade, American Dairy Products Institute (ADPI), and Food and Agricultural Organization (FAO), were referred to identify and collect information for this study. Secondary sources include clinical studies and medical journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, including raw material suppliers, equipment suppliers, and dairy ingredient manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include dairy ingredients manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the dairy ingredients market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The revenues of major dairy ingredients players were determined through primary and secondary research, used as the basis for market estimation.

- Based on market share analysis of key industry players from all regions, we arrived at the final market size of the dairy ingredients market.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall dairy ingredients market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market size of the dairy ingredients market

- To understand the dairy ingredients market by identifying its various sub-segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across the key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, collaborations, and agreements

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe dairy ingredients market into Italy, Poland, Belgium, Sweden, and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific dairy ingredients market into Taiwan, South Korea, Indonesia, Malaysia, Thailand, the Philippines, Bangladesh, Singapore, and Vietnam.

- Further breakdown of the South America dairy ingredients market into Chile, Peru, Uruguay, Venezuela, and Colombia.

- Further breakdown of the Row dairy ingredients market into Nigeria, Kenya, Ethiopia, Tanzania, Morocco, Egypt, and DR Congo.

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dairy Ingredients Market