Enterprise Collaboration Market by Component (Solutions (Enterprise Video, Project Management and Analytics, Unified Messaging, Business Process Management), Services), Deployment Type, Organization Size, End-User, and Region - Global Forecast to 2026

Updated on : April 17, 2023

Enterprise Collaboration Market Forecast & Statistics, Global Size

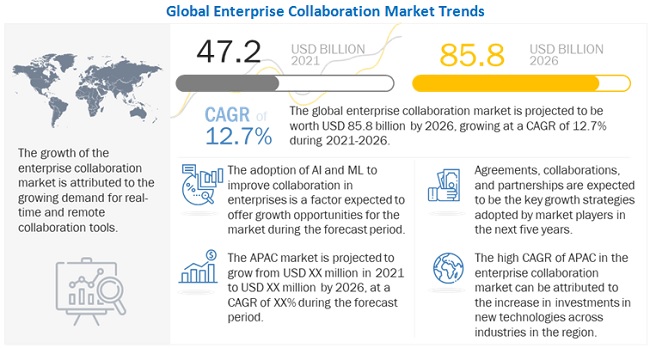

The global Enterprise Collaboration Market size as per revenue was surpassed $47.2 billion in 2021 and is anticipated to exhibit a CAGR of 12.7% to reach over $85.8 billion by the end of 2026.

Growing demand for real-time and remote collaboration tools, adoption of cloud-based services to accelerate collaboration, demand for a workplace connectivity platform, need for project and task management solutions, and need to increase competitive advantage are expected to be the major factors driving the growth of the Enterprise Collaboration Market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Owing to the outbreak of COVID-19, various countries follow strict lockdowns, shutdowns, and mobility restrictions to avoid the spread of the virus. Vendors have experienced high demand for enterprise collaboration solutions during 2020. Closure of borders, stringent lockdowns, and supply chain issues act as restraining factors for the onsite deployment of Enterprise Collaboration networks. Enterprises have reduced their operational spending and are now focusing more on business continuity and sustainability. SMEs are expected to accelerate the deployment of enterprise collaboration solutions during the second quarter of 2021.

Market Dynamics

Driver: Growing demand for real-time and remote collaboration tools

Enterprise collaboration tools help organizations by providing seamless communication between employees. This improves the operational efficiency and productivity of the employees, thereby helping organizations to meet their business goals. Enterprise collaboration tools provide data synchronization and collaboration solutions across organizations and include features such as checking official emails, calendars, and contacts. Furthermore, video conferencing helps to provide employees with more engaging communication and share ideas.

Restraint: Network connectivity and infrastructure issues

The developing and underdeveloped nations in the world still use legacy telecom infrastructure, which is not capable of delivering low latency and high-capacity connectivity. The lack of high-speed internet makes it very difficult to implement enterprise collaboration tools such as video conferencing and cloud services. Thus, organizations in such countries rely more on audio-based communication to avoid the frustration of low-quality video and intermittent disconnections.

Opportunity: Growing adoption of AI and ML to improve collaboration capabilities

Advanced technologies such as AI and ML are being implemented into enterprise collaboration tools to enhance collaborative capabilities. Ai-based enterprise collaboration tools are able to track the activities of employees and the contents being shared. This is used to deliver anticipated business insights to the employees and help get the work done quicker. Organizations can also leverage video analytics to gain insights regarding various business applications, including consumer behavior, employee retention, office utilization, and performance optimization, by correlating visual analytics with production checkpoints.

Challenge: Poor internet speed affecting the quality of service

Poor internet speed can lead to a poor collaboration experience. Since all the services offered by collaboration tools are online, having a slow connection will cause delayed message delivery, slower file transfers, low-quality audio and video conferencing, and interrupted connections to remote workspaces. A poor connection may cause disturbances or low-quality video, which can cause misunderstanding and lead to a waste of time and effort.

By Component, the Solutions segment to have a higher growth during the forecast period

The Solutions component of the Enterprise Collaboration Market is expected to have a higher growth rate during the forecast period. Enterprise collaboration solutions include enterprise video, unified messaging, enterprise social network, portals and intranet platforms, file sharing and synchronization, project management, and analytics and business process management. These solutions help to increase knowledge sharing among employees and enhance productivity for organizations.

By Deployment Mode, the Cloud segment to dominate the market during the forecast period

Cloud-based deployment offers a pay-per-use service model, which provides organizations with the flexibility to pay cloud service vendors only when services are used, as against the upfront capital expenditure involved in an on-premises deployment. Cloud-deployed platforms reduce the costs associated with upgrading and updating solutions, as extra costs are borne by service providers. Thus, the use of cloud-based enterprise collaboration solutions provides flexibility to organizations to adjust to the dynamic business environment.

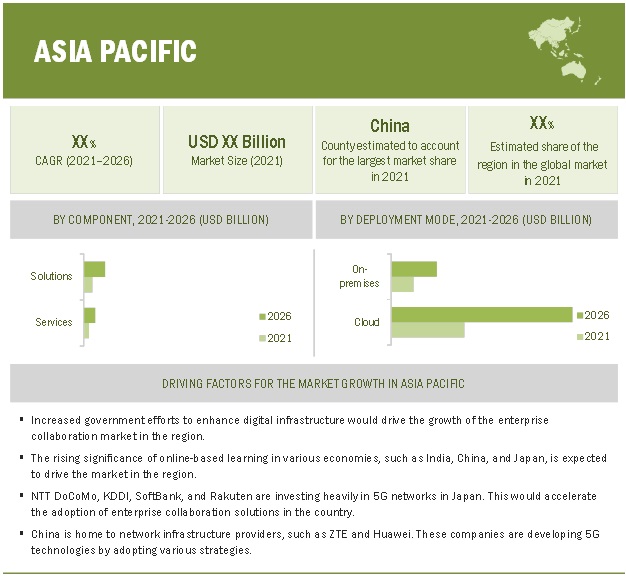

By region, Asia Pacific to record the highest growth during the forecast period

The APAC Enterprise Collaboration Market is estimated to have strong growth in the future. Government initiatives to promote the digital infrastructure are responsible for driving the adoption of enterprise collaboration solutions in the region. The region also has the highest student population, and with advancing technologies, there is a growing demand for eLearning and distance education. This drives the enterprise collaboration market to meet diversified educational requirements across various countries in the APAC region, such as Australia and New Zealand (ANZ), Japan, China, Singapore, and India.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering enterprise collaboration solutions and services. It profiles major vendors in the global Enterprise Collaboration Market. The major vendors in the Enterprise Collaboration Market include IBM (US), Microsoft (US), Cisco (US), Adobe (US), Google (US), Citrix (US), Slack (US), Facebook (US), Salesforce (US), and Atlassian (Australia). These players have adopted various strategies to grow in the global Enterprise Collaboration Market.

The study includes an in-depth competitive analysis of these key players in the Enterprise Collaboration Market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2021 |

USD 47.2 billion |

|

Market size value in 2026 |

USD 85.8 billion |

|

Growth rate |

CAGR of 12.7% |

|

Enterprise Collaboration Market Drivers |

|

|

Enterprise Collaboration Market Opportunities |

|

|

Segments covered |

By component, deployment mode, organization size, end user, and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Cisco (US), Adobe (US), Google (US), Citrix (US), Slack (US), Facebook (US), Salesforce (US), Atlassian (Australia), Igloo (Canada), Jive (US), VMware (US), SAP (Germany) and many more. |

This research report categorizes the Network probe Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solution

- Enterprise Video

- Unified Messaging

- Enterprise Social Network

- File Sharing and Synchronization

- Portals and Intranet Platforms

- Project Management and Analytics

- Business Process Management

-

Services

- Managed Services

- Professional Services

By Organization Size:

- SMEs

- Large Enterprises

By Deployment Mode:

- On-premises

- Cloud

By End Users:

- IT and Telecommunication

- BFSI

- Public Sector

- Healthcare and Life Sciences

- Education

- Energy and Utilities

- Retail and Consumer Goods

- Manufacturing

- Travel and Hospitality

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Nordic Countries

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- UAE

- KSA

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In June 2021, Microsoft collaborated with Morgan Stanley to help accelerate its digital transformation. Microsoft would provide Morgan Stanley with Microsoft Azure, which offers data privacy and would help in the cloud transformation of the firm.

- In May 2021, Google partnered with SpaceX to deliver secure global connectivity by using SpaceX’s Starlink to provide high speed connection across Google Cloud’ infrastructure. This would provide businesses with seamless and secure access to the cloud.

- In December 2020, Adobe acquired Workfront, a leading provider of Collaborative Work Management Tools. The companies would provide a single system to support planning, collaboration, and management for organizations to enhance productivity.

- In August 2020, Cisco acquired BabbleLabs, a company that designs and develops communication software, to improve the user’s video meeting experience. With the help of advanced AI techniques, the company distinguishes human speech from unwanted noise, enhancing the quality of communication and conferencing applications. This feature would further help Cisco to deliver high quality meeting experience from anywhere and on any device through the Webex application.

Frequently Asked Questions (FAQ):

What is the market demand for Enterprise Collaboration Market?

What is growth rate of the Enterprise Collaboration Market?

What are the key trends affecting the global Enterprise Collaboration Market?

Who are the key players in Enterprise Collaboration Market?

What are the major revenue pockets in the Enterprise Collaboration Market currently?

What is the future of Enterprise Collaboration industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.7 YEARS CONSIDERED FOR THE STUDY

1.8 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.9 STAKEHOLDERS

1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 58)

2.1 RESEARCH DATA

FIGURE 6 ENTERPRISE COLLABORATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 RESEARCH METHODOLOGY: APPROACH 1-SUPPLY SIDE ANALYSIS REVENUE OF THE SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF THE ENTERPRISE COLLABORATION VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): ENTERPRISE COLLABORATION MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 IMPLICATION OF COVID-19 ON THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 IMPACT ON THE MARKET

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 68)

FIGURE 12 ENTERPRISE COLLABORATION MARKET: GROWTH TREND, 2020-2026

FIGURE 13 LEADING SEGMENTS IN THE MARKET, 2022

FIGURE 14 MARKET: HOLISTIC VIEW

4 PREMIUM INSIGHTS (Page No. - 71)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ENTERPRISE COLLABORATION MARKET

FIGURE 15 INCREASING INVESTMENTS IN REMOTE WORKING ENVIRONMENTS, AND DEMAND FOR REAL TIME AND REMOTE COLLABORATION TOOLS ARE DRIVING THE DEMAND OF MARKET

4.2 NORTH AMERICA MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 16 SOLUTIONS AND CLOUD MODE OF DEPLYMENT TO ACCOUNT FOR THE HIGH MARKET SHARES IN NORTH AMERICA IN 2021

4.3 ASIA PACIFIC MARKET, BY COMPONENT AND DEPLOYMENT MODE

FIGURE 17 SOLUTIONS AND CLOUD MODE OF DEPLYMENT TO ACCOUNT FOR THE LARGE MARKET SHARES IN ASIA PACIFIC IN 2021

FIGURE 18 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 ENTERPRISE COLLABORATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for real-time and remote collaboration tools

FIGURE 20 PERCENTAGE OF PEOPLE HOLDING UP REMOTE WORKING ENVIRONMENT

5.2.1.2 Adoption of cloud-based services to accelerate collaboration

FIGURE 21 GLOBAL CLOUD SERVICES MARKET (USD BILLION), 2018-2021

5.2.1.3 Demand for a workplace connectivity platform

5.2.1.4 Need for project and task management solutions

5.2.1.5 Need to increase competitive advantage

5.2.2 RESTRAINTS

5.2.2.1 Network connectivity and infrastructure issues

5.2.2.2 High capital expenditure

5.2.2.3 Lack of all-in-one collaboration solution applications

FIGURE 22 ALL-IN-ONE ENTERPRISE COLLABORATION PLATFORM

5.2.3 OPPORTUNITIES

5.2.3.1 Need for collaboration tools to aid the ‘work-from-home’ policy

FIGURE 23 ZOOM: GROWTH IN QUARTERLY REVENUE, 2018-2020 (USD MILLION)

5.2.3.2 Rise of 5G to accelerate the adoption of enterprise collaboration

FIGURE 24 PERCENTAGE OF GLOBAL CONNECTIONS, 2018-2023

5.2.3.3 Growing adoption of AI and ML to improve collaboration capabilities

5.2.4 CHALLENGES

5.2.4.1 Data privacy and security risks within the enterprises

5.2.4.2 Poor internet speed affecting the quality of service

5.3 INDUSTRY TRENDS

5.3.1 ECOSYSTEM

TABLE 3 ENTERPRISE COLLABORATION MARKET: ECOSYSTEM

5.3.2 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.3.3 PATENT ANALYSIS

FIGURE 26 TOP OWNERS (US), BY DOCUMENT COUNT

FIGURE 27 NUMBER OF PATENTS BY PUBLISHING YEAR, 2010-2020

5.3.4 AVERAGE SELLING PRICE

TABLE 4 PRICING ANALYSIS

5.3.5 TECHNOLOGY TRENDS

5.3.5.1 Introduction

5.3.5.2 Artificial Intelligence and Machine Learning

5.3.5.3 Augmented and Virtual Reality

5.3.5.4 Facial Recognition and Voice Recognition

5.3.5.5 Cloud Services

5.3.5.6 5G Network

5.3.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 ENTERPRISE COLLABORATION MARKET PORTER’S FIVE FORCES MODEL

5.3.6.1 Threat of new entrants

5.3.6.2 Threat of substitutes

5.3.6.3 Bargaining power of buyers

5.3.6.4 Bargaining power of suppliers

5.3.6.5 Competition rivalry

5.3.7 CASE STUDY ANALYSIS

5.3.7.1 Case study 1: Mitel helped Carleton University with mass notification requirements

5.3.7.2 Case study 2: Atlassian solved NCR’s need to have an all-in-one solution

5.3.7.3 Case study 3: Slack helps Trivago build a better employee experience

5.3.7.4 Case study 4: Cisco provided training solutions for A.T. Kearney

5.3.7.5 Case study 5: Microsoft helps Toyota Motors North America to improve employee engagement

5.3.8 REGULATORY IMPACT

5.4 COVID-19 MARKET OUTLOOK FOR ENTERPRISE COLLABORATION

FIGURE 28 GROWING DEMAND FOR REAL-TIME AND REMOTE COLLABORATION TOOLS TO ACCELERATE GROWTH OF THE MARKET

FIGURE 29 KEY ISSUES: NETWORK INFRASTRUCTURE ISSUES TO RESTRICT THE MARKET

6 ENTERPRISE COLLABORATION MARKET, BY COMPONENT (Page No. - 95)

6.1 INTRODUCTION

FIGURE 30 ENTERPRISE COLLABORATION SOLUTIONS

FIGURE 31 SOLUTIONS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: MARKET DRIVERS

6.2.3 SOLUTIONS: COVID-19 IMPACT

FIGURE 32 PROJECT MANAGEMENT AND ANALYTICS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 8 ENTERPRISE COLLABORATION MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4 ENTERPRISE VIDEO

TABLE 12 ENTERPRISE VIDEO MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 ENTERPRISE VIDEO MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4.1 Video conferencing

6.2.4.2 Web casting

6.2.4.3 Content management

6.2.5 UNIFIED MESSAGING

TABLE 14 UNIFIED MESSAGING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 UNIFIED MESSAGING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.6 ENTERPRISE SOCIAL NETWORK

TABLE 16 ENTERPRISE SOCIAL NETWORK MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 ENTERPRISE SOCIAL NETWORK MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.7 FILE SHARING AND SYNCHRONIZATION

TABLE 18 FILE SHARING AND SYNCHRONIZATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 FILE SHARING AND SYNCHRONIZATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.8 PORTALS AND INTRANET PLATFORMS

TABLE 20 PORTALS AND INTRANET PLATFORMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 PORTALS AND INTRANET PLATFORMS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.9 PROJECT MANAGEMENT AND ANALYTICS

TABLE 22 PROJECT MANAGEMENT AND ANALYTICS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 PROJECT MANAGEMENT AND ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.10 BUSINESS PROCESS MANAGEMENT

TABLE 24 BUSINESS PROCESS MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 BUSINESS PROCESS MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: ENTERPRISE COLLABORATION MARKET DRIVERS

6.3.2 SERVICES: MARKET SCENARIO; COVID-19

FIGURE 33 PROFESSIONAL SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 26 MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

TABLE 30 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.3.1 IT consulting and development

6.3.3.2 Integration and implementation

6.3.3.3 Support and maintenance

6.3.4 MANAGED SERVICES

TABLE 32 MANAGED SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MANAGED SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 ENTERPRISE COLLABORATION MARKET, BY DEPLOYMENT MODE (Page No. - 114)

7.1 INTRODUCTION

FIGURE 34 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISE: MARKET DRIVERS

7.2.2 ON-PREMISE: MARKET SCENARIO; COVID-19

TABLE 36 ON-PREMISE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 ON-PREMISE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CLOUD

7.3.1 CLOUD: MARKET DRIVERS

7.3.2 CLOUD: MARKET SCENARIO; COVID-19

TABLE 38 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 ENTERPRISE COLLABORATION MARKET, BY ORGANIZATION SIZE (Page No. - 120)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: MARKET SCENARIO; COVID-19

FIGURE 35 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 40 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 41 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 42 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 44 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 ENTERPRISE COLLABORATION MARKET, BY END USER (Page No. - 126)

9.1 INTRODUCTION

FIGURE 36 IT AND TELECOMMUNICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

9.2 IT AND TELECOMMUNICATION

9.2.1 IT AND TELCOM: MARKET DRIVERS

TABLE 48 MARKET: IT AND TELECOM VERTICAL WITH REMOTE WORK PLANS

9.2.2 IT AND TELECOM: MARKET SCENARIO; COVID-19

TABLE 49 IT AND TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 IT AND TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3.1 BFSI: MARKET DRIVERS

TABLE 51 ENTERPRISE COLLABORATION MARKET: BFSI VERTICAL WITH REMOTE WORK PLANS

9.3.2 BFSI: MARKET SCENARIO; COVID-19

TABLE 52 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 PUBLIC SECTOR

9.4.1 PUBLIC SECTOR: MARKET DRIVERS

9.4.2 PUBLIC SECTOR: MARKET SCENARIO; COVID-19

TABLE 54 PUBLIC SECTOR: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 PUBLIC SECTOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 HEALTHCARE AND LIFE SCIENCES

9.5.1 HEALTHCARE AND LIFESCIENCES: MARKET DRIVERS

9.5.2 HEALTHCARE AND LIFE SCIENCES: MARKET SCENARIO; COVID-19

TABLE 56 HEALTHCARE AND LIFE SCIENCES: ENTERPRISE COLLABORATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 EDUCATION

9.6.1 EDUCATION: MARKET DRIVERS

9.6.2 EDUCATION: MARKET SCENARIO; COVID-19

TABLE 58 EDUCATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 ENERGY AND UTILITIES

9.7.1 ENERGY AND UTILITIES: MARKET DRIVERS

9.7.2 ENERGY AND UTILITIES: MARKET SCENARIO; COVID-19

TABLE 60 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 ENERGY AND UTILITIES: ENTERPRISE COLLABORATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 RETAIL AND CONSUMER GOODS

9.8.1 RETAIL AND CONSUMER GOODS: MARKET DRIVERS

9.8.2 RETAIL AND CONSUMER GOODS: MARKET SCENARIO; COVID-19

TABLE 62 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 MANUFACTURING

9.9.1 MANUFACTURING: MARKET DRIVERS

9.9.2 MANUFACTURING: MARKET SCENARIO; COVID-19

TABLE 64 MANUFACTURING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.10 TRAVEL AND HOSPITALITY

TABLE 66 TRAVEL AND HOSPITALITY: ENTERPRISE COLLABORATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.11 OTHERS

TABLE 68 OTHERS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 ENTERPRISE COLLABORATION MARKET, BY REGION (Page No. - 145)

10.1 INTRODUCTION

FIGURE 37 NORTH AMERICA TO LEAD THE MARKET FROM 2021 TO 2026

FIGURE 38 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 70 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

TABLE 72 USE CASES; NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 39 NORTH AMERICA: ENTERPRISE COLLABORATION MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 89 UNITED STATES: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 90 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 91 UNITED STATES: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.2.4 CANADA

TABLE 103 CANADA: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 114 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 115 CANADA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.3 EUROPE

TABLE 117 USE CASES - EUROPE

10.3.1 EUROPE: ENTERPRISE COLLABORATION MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 118 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 134 UNITED KINGDOM: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 143 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 144 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 145 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 146 UNITED KINGDOM: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 147 UNITED KINGDOM: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 148 GERMANY: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 149 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 150 GERMANY: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 151 GERMANY: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 153 GERMANY: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 154 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 155 GERMANY: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 156 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 157 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 158 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 159 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 160 GERMANY: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 161 GERMANY: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.3.5 FRANCE

TABLE 162 FRANCE: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 163 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 164 FRANCE: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 165 FRANCE: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 166 FRANCE: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 167 FRANCE: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 168 FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 169 FRANCE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 170 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 171 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 172 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 173 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 174 FRANCE: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 175 FRANCE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.3.6 NORDIC COUNTRIES

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

TABLE 176 USE CASES - ASIA PACIFIC

10.4.1 ASIA PACIFIC: ENTERPRISE COLLABORATION MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.3 CHINA

TABLE 193 CHINA: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 194 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 195 CHINA: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 196 CHINA: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 197 CHINA: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 198 CHINA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 199 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 200 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 201 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 202 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 203 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 204 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 205 CHINA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 206 CHINA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.4.4 JAPAN

TABLE 207 JAPAN: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 208 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 209 JAPAN: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 210 JAPAN: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 211 JAPAN: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 212 JAPAN: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 213 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 214 JAPAN: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 215 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 216 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 217 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 218 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 219 JAPAN: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 220 JAPAN: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.4.5 INDIA

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST & AFRICA

TABLE 221 USE CASES - MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: ENTERPRISE COLLABORATION MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 222 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 223 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 224 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 225 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 226 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 228 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 229 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 230 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 233 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 234 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 236 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 237 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.3 UNITED ARAB EMIRATES

TABLE 238 UNITED ARAB EMIRATES: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 239 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 240 UNITED ARAB EMIRATES: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 241 UNITED ARAB EMIRATES: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 242 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 243 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 244 UNITED ARAB EMIRATES: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 245 UNITED ARAB EMIRATES: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 246 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 247 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 248 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 249 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 250 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 251 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 252 KINGDOM OF SAUDI ARABIA: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 253 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 254 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 255 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 256 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 257 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 258 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 259 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 260 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 261 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 262 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 263 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 264 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 265 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.5.5 SOUTH AFRICA

10.5.6 REST OF THE MIDDLE EAST & AFRICA

10.6 LATIN AMERICA

TABLE 266 USE CASES - LATIN AMERICA

10.6.1 LATIN AMERICA: ENTERPRISE COLLABORATION MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 267 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 268 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 269 LATIN AMERICA: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 272 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 276 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 279 LATIN AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 280 LATIN AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 281 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 282 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 283 BRAZIL: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 284 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 285 BRAZIL: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 286 BRAZIL: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 287 BRAZIL: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 288 BRAZIL: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 289 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 290 BRAZIL: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 291 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 292 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 293 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 294 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 295 BRAZIL: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 296 BRAZIL: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.6.4 MEXICO

TABLE 297 MEXICO: ENTERPRISE COLLABORATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 298 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 299 MEXICO: MARKET SIZE, BY SOLUTIONS, 2017–2020 (USD MILLION)

TABLE 300 MEXICO: MARKET SIZE, BY SOLUTIONS, 2021–2026 (USD MILLION)

TABLE 301 MEXICO: MARKET SIZE, BY SERVICES, 2017–2020 (USD MILLION)

TABLE 302 MEXICO: MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 303 MEXICO: MARKET SIZE, BY PROFESSIONAL SERVICES, 2017–2020 (USD MILLION)

TABLE 304 MEXICO: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 305 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 306 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 307 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 308 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 309 MEXICO: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 310 MEXICO: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 236)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY MARKET DEVELOPMENTS

11.3.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 311 NEW PRODUCT LAUNCHES, 2018–2021

11.3.2 BUSINESS EXPANSIONS

TABLE 312 BUSINESS EXPANSIONS, 2018–2019

11.3.3 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 313 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2018-2021

11.3.4 MERGERS AND ACQUISITIONS

TABLE 314 MERGERS AND ACQUISITIONS, 2018–2021

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS, 2021

TABLE 315 GEOSPATIAL ANALYTICS MARKET: DEGREE OF COMPETITION

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 42 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS

11.6 COMPANY EVALUATION MATRIX

11.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 316 PRODUCT FOOTPRINT WEIGHTAGE

11.6.1.1 Stars

11.6.1.2 Emerging leaders

11.6.1.3 Pervasive players

11.6.1.4 Participants

FIGURE 43 ENTERPRISE COLLABORATION MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 317 COMPANY PRODUCT FOOTPRINT

TABLE 318 COMPANY APPLICATION FOOTPRINT

FIGURE 44 COMPANY INDUSTRY FOOTPRINT

TABLE 319 COMPANY REGION FOOTPRINT

11.8 MARKET RANKING OF TOP FIVE KEY PLAYERS

FIGURE 45 RANKING OF KEY PLAYERS IN THE ENTERPRISE COLLABORATION MARKET, 2021

11.8.1 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 46 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.8.1.1 Progressive companies

11.8.1.2 Responsive companies

11.8.1.3 Dynamic companies

11.8.1.4 Starting blocks

FIGURE 47 ENTERPRISE COLLABORATION MARKET (GLOBAL): STARTUP/ SME EVALUATION MATRIX, 2021

12 COMPANY PROFILES (Page No. - 255)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 KEY PLAYERS

12.1.1 IBM

TABLE 320 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 321 IBM: PRODUCTS OFFERED

TABLE 322 IBM: ENTERPRISE COLLABORATION MARKET: NEW PRODUCT LAUNCHES

12.1.2 MICROSOFT

TABLE 323 MICROSOFT: BUSINESS OVERVIEW

FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

TABLE 324 MICROSOFT: PRODUCTS OFFERED

TABLE 325 MICROSOFT: MARKET: NEW PRODUCT LAUNCHES

TABLE 326 MICROSOFT: MARKET: DEALS

12.1.3 GOOGLE

TABLE 327 GOOGLE: BUSINESS OVERVIEW

FIGURE 50 GOOGLE: COMPANY SNAPSHOT

TABLE 328 GOOGLE: PRODUCTS OFFERED

TABLE 329 GOOGLE: MARKET: NEW PRODUCT LAUNCHES

TABLE 330 GOOGLE: MARKET: DEALS

12.1.4 CISCO

TABLE 331 CISCO: BUSINESS OVERVIEW

FIGURE 51 CISCO: COMPANY SNAPSHOT

TABLE 332 CISCO: PRODUCTS OFFERED

TABLE 333 CISCO: ENTERPRISE COLLABORATION MARKET: NEW PRODUCT LAUNCHES

TABLE 334 CISCO: MARKET: DEALS

TABLE 335 CISCO: MARKET: OTHERS

12.1.5 ADOBE

TABLE 336 ADOBE: BUSINESS OVERVIEW

FIGURE 52 ADOBE: COMPANY SNAPSHOT

TABLE 337 ADOBE: PRODUCTS OFFERED

TABLE 338 ADOBE: MARKET: NEW PRODUCT LAUNCHES

TABLE 339 ADOBE: MARKET: DEALS

12.1.6 CITRIX

TABLE 340 CITRIX: BUSINESS OVERVIEW

FIGURE 53 CITRIX: COMPANY SNAPSHOT

TABLE 341 CITRIX: PRODUCTS OFFERED

TABLE 342 CITRIX: ENTERPRISE COLLABORATION MARKET: NEW PRODUCT LAUNCHES

TABLE 343 CITRIX: MARKET: DEALS

12.1.7 SLACK

TABLE 344 SLACK: BUSINESS OVERVIEW

FIGURE 54 SLACK: COMPANY SNAPSHOT

TABLE 345 SLACK: PRODUCTS OFFERED

TABLE 346 SLACK: MARKET: NEW PRODUCT LAUNCHES

TABLE 347 SLACK: MARKET: DEALS

TABLE 348 SLACK: MARKET: OTHERS

12.1.8 FACEBOOK

TABLE 349 FACEBOOK: BUSINESS OVERVIEW

FIGURE 55 FACEBOOK: COMPANY SNAPSHOT

TABLE 350 FACEBOOK: PRODUCTS OFFERED

TABLE 351 FACEBOOK: ENTERPRISE COLLABORATION MARKET: DEALS

TABLE 352 FACEBOOK: MARKET: NEW PRODUCT LAUNCHES

12.1.9 SALESFORCE

TABLE 353 SALESFORCE: BUSINESS OVERVIEW

FIGURE 56 SALESFORCE: COMPANY SNAPSHOT

TABLE 354 SALESFORCE: PRODUCTS OFFERED

TABLE 355 SALESFORCE: MARKET: NEW PRODUCT LAUNCHES

TABLE 356 SALESFORCE: MARKET: DEALS

TABLE 357 SALESFORCE: MARKET: OTHERS

12.1.10 ATLASSIAN

TABLE 358 ATLASSIAN: BUSINESS OVERVIEW

FIGURE 57 ATLASSIAN: COMPANY SNAPSHOT

TABLE 359 ATLASSIAN: PRODUCTS OFFERED

TABLE 360 ATLASSIAN: ENTERPRISE COLLABORATION MARKET: DEALS

12.1.11 IGLOO

TABLE 361 IGLOO: BUSINESS OVERVIEW

TABLE 362 IGLOO: PRODUCTS OFFERED

TABLE 363 IGLOO: MARKET: NEW PRODUCT LAUNCHES

12.1.12 JIVE

TABLE 364 JIVE: BUSINESS OVERVIEW

TABLE 365 JIVE: PRODUCTS OFFERED

TABLE 366 JIVE: MARKET: NEW PRODUCT LAUNCHES

12.1.13 VMWARE

TABLE 367 VMWARE: BUSINESS OVERVIEW

FIGURE 58 VMWARE: COMPANY SNAPSHOT

TABLE 368 VMWARE: PRODUCTS OFFERED

TABLE 369 VMWARE: ENTERPRISE COLLABORATION MARKET: NEW PRODUCT LAUNCHES

TABLE 370 VMWARE: MARKET: DEALS

TABLE 371 VMWARE: MARKET: OTHERS

12.1.14 SAP

TABLE 372 SAP: BUSINESS OVERVIEW

FIGURE 59 SAP: COMPANY SNAPSHOT

TABLE 373 SAP: PRODUCTS OFFERED

TABLE 374 SAP: MARKET: NEW PRODUCT LAUNCHES

TABLE 375 SAP: MARKET: DEALS

TABLE 376 SAP: MARKET: OTHERS

12.1.15 MITEL

TABLE 377 MITEL: BUSINESS OVERVIEW

TABLE 378 MITEL: PRODUCTS OFFERED

TABLE 379 MITEL: ENTERPRISE COLLABORATION MARKET: NEW PRODUCT LAUNCHES

TABLE 380 MITEL: MARKET: DEALS

12.1.16 RINGCENTRAL

12.1.17 TIBCO SOFTWARE

12.1.18 ZOHO

12.1.19 JALIOS

12.1.20 JAMESPOT

12.1.21 BOX

12.2 OTHER PLAYERS

12.2.1 BYNDER

12.2.2 AXERO

12.2.3 BLUEKIWI

12.2.4 WHALLER

12.2.5 DROPBOX

12.2.6 KALTURA

12.2.7 ASANA

12.2.8 CLICKUP

12.2.9 CHANTY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 330)

13.1 ADJACENT/RELATED MARKETS

13.1.1 VIDEO CONFERENCING MARKET

13.1.1.1 Market definition

13.1.1.2 Market overview

13.1.1.3 Video conferencing market, by component

TABLE 381 VIDEO CONFERENCING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 382 HARDWARE: VIDEO CONFERENCING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 383 SOLUTION: VIDEO CONFERENCING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 384 SERVICES: VIDEO CONFERENCING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13.1.1.4 Video Conferencing Market, By Deployment Mode

TABLE 385 VIDEO CONFERENCING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

13.1.1.5 Video Conferencing Market, By Applications

TABLE 386 VIDEO CONFERENCING MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

13.1.1.6 Video conferencing market, by vertical

TABLE 387 VIDEO CONFERENCING MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

13.1.1.7 Video conferencing market, by region

TABLE 388 VIDEO CONFERENCING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 389 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 390 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY HARDWARE, 2020–2026 (USD MILLION)

TABLE 391 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 392 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 393 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 394 NORTH AMERICA: VIDEO CONFERENCING MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.1.2 ENTERPRISE VIDEO MARKET

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.3 Enterprise video market, by component

TABLE 395 ENTERPRISE VIDEO MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 396 ENTERPRISE VIDEO MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13.1.2.4 Enterprise video market, by deployment mode

TABLE 397 ENTERPRISE VIDEO MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 398 ENTERPRISE VIDEO MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

13.1.2.5 Enterprise video market, by application

TABLE 399 ENTERPRISE VIDEO MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 400 ENTERPRISE VIDEO MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

13.1.2.6 Enterprise video market, by region

TABLE 401 ENTERPRISE VIDEO MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 402 ENTERPRISE VIDEO MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Enterprise collaboration market. Exhaustive secondary research was done to collect information on the logistics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Enterprise collaboration market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the network probe market Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the network probe market. The primary sources from the demand side included network probe end users, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Mobile and wireless backhaul Market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the Mobile and wireless backhaul Market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering mobile and wireless backhaul networks were identified, such as Ericsson, Huawei, Nokia, NEC, and ZTE. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer mobile and wireless backhaul was identified through similar sources. Then through primaries, the data on revenue generated through specific mobile and wireless backhaul components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the Enterprise Collaboration Market by component, organization size, deployment mode, end user, and region.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Enterprise Collaboration Market

- To analyze the impact of COVID-19 on the Enterprise Collaboration Market

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall Enterprise Collaboration Market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Enterprise Collaboration System Market & Its Impact on the Enterprise Collaboration Market

The Enterprise Collaboration System (ECS) market is expected to have a significant impact on the Enterprise Collaboration market by providing more advanced and efficient tools for communication and collaboration within organizations.

As organizations continue to adopt remote and hybrid work models, the need for effective collaboration and communication has become more critical than ever before. This has led to an increased demand for ECS solutions that can facilitate remote collaboration and enable employees to work together seamlessly regardless of their location.

Moreover, the ECS market is constantly evolving with the emergence of new technologies, such as artificial intelligence (AI) and machine learning (ML), which are being integrated into collaboration platforms to enhance their functionality and user experience.

As the ECS market continues to grow and evolve, it is likely to drive further innovation and improvements in the broader Enterprise Collaboration market. Organizations will have access to more advanced and sophisticated ECS solutions that can streamline workflows, improve team productivity, and foster a culture of collaboration and knowledge sharing.

New Business Opportunities in Enterprise Collaboration System Market:

The Enterprise Collaboration System (ECS) market is a rapidly growing industry that is creating new business opportunities for organizations that specialize in collaboration software and related services. Some of the new business opportunities in this market include:

- Developing AI-powered collaboration tools: As AI and machine learning technologies continue to advance, there is an opportunity for businesses to develop intelligent collaboration tools that can automate tasks, provide personalized recommendations, and improve overall efficiency.

- Offering cloud-based collaboration services: With the rise of remote work, there is a growing demand for cloud-based collaboration services that allow teams to work together from anywhere. Organizations can capitalize on this trend by offering secure, reliable cloud-based collaboration services that can be accessed from any device.

- Providing consulting and implementation services: Many organizations struggle with implementing effective collaboration solutions, which creates a business opportunity for companies that can provide consulting and implementation services.

- Developing industry-specific collaboration solutions: There is an opportunity for businesses to develop collaboration solutions that are tailored to specific industries, such as healthcare, finance, and manufacturing. These solutions can address the unique collaboration challenges and requirements of each industry, providing a competitive advantage to the organizations that use them.

- Creating integrations and add-ons: Many organizations use multiple collaboration tools to manage their workflows, which creates an opportunity for businesses to develop integrations and add-ons that can connect these tools and provide a more seamless user experience.

Some of the top companies in the Enterprise Collaboration System (ECS) Market are Microsoft Corporation, Slack Technologies Inc, Cisco Systems Inc, Zoom Video Communications Inc, Google LLC, Atlassian Corporation Plc, IBM Corporation, Citrix Systems Inc, Dropbox, Inc, and Box Inc.

Industries Getting Impacted in the Future by Enterprise Collaboration System Market:

The Enterprise Collaboration System (ECS) market is expected to have a significant impact on various industries, as it provides advanced tools and solutions for collaboration and communication. Some of the industries that are likely to be impacted in the future by the ECS market include:

- Healthcare: The healthcare industry is likely to benefit from the ECS market as it can improve communication and collaboration between healthcare professionals, patients, and caregivers.

- Finance: The finance industry is highly regulated and requires secure and efficient communication and collaboration between teams. ECS solutions can provide secure document-sharing, messaging, and video conferencing capabilities that can help financial organizations improve their operations and comply with regulatory requirements.

- Education: The education industry can benefit from ECS solutions as they can enable remote and hybrid learning, providing students and teachers with tools for collaboration, communication, and content sharing.

- Manufacturing: The manufacturing industry relies heavily on collaboration between teams and suppliers to ensure efficient production and supply chain management. ECS solutions can help manufacturing organizations improve collaboration and communication between teams, streamline processes, and improve overall efficiency.

- Retail: The retail industry is becoming increasingly digitized, with more customers shopping online and expecting a seamless experience across all channels. ECS solutions can help retailers improve communication and collaboration between teams, enable remote work, and enhance customer service through live chat and other tools.

Enterprise Collaboration System Market Trends:

The Enterprise Collaboration System (ECS) market is constantly evolving, with new technologies and trends emerging all the time. Some of the key trends that are expected to shape the future of the ECS market include:

- Artificial intelligence and machine learning: AI and machine learning are increasingly being integrated into collaboration tools to automate routine tasks, provide personalized recommendations, and improve the overall user experience. This trend is expected to continue in the future, with more advanced AI-powered collaboration solutions becoming available.

- Cloud-based collaboration: Cloud-based collaboration solutions are becoming increasingly popular as more organizations adopt remote and hybrid work models. These solutions offer greater flexibility and accessibility, allowing teams to collaborate from anywhere and on any device.

- Integration with other business systems: Collaboration tools are increasingly being integrated with other business systems, such as project management and customer relationship management (CRM) software. This enables teams to collaborate more effectively across different departments and functions.

- Mobile-first collaboration: With more people working on mobile devices, mobile-first collaboration solutions are becoming increasingly important. These solutions are designed specifically for mobile devices, with features and interfaces optimized for small screens and touch-based interactions.

- Security and compliance: As collaboration tools become more widely used, security and compliance are becoming increasingly important. Organizations are looking for solutions that offer robust security features, such as encryption and access controls, as well as compliance with industry and regulatory requirements.

Overall, the future of the ECS market is expected to be characterized by greater automation, flexibility, and integration with other business systems. Security and compliance will also be increasingly important as collaboration tools become more widely used and valuable to organizations.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enterprise Collaboration Market

Gather insights into Enterprise collaboration market, Enterprise Social Software market, Team collaboration software market, Mobile unified communication and collaboration market.

Need insights into landscape and growth of Enterprise collaboration market.

Indepth understanding of the market entry strategy.

Gather insights into Enterprise Collaboration System, Enterprise Social Network and Social Networking.

Interested in Unified Communications and related apps,like Attendant Console, ACD, Directory services, IP fax server.

Analyse the Market size and growth for Online productivity and collaboration tools to make proper IR materials.

Understand the Slack Technologies in the market.