Feed Enzymes Market by Type (Phytase, Carbohydrase, and Protease), Livestock (Poultry, Swine, Ruminants, and Aquatic Animals), Source (Microorganism, Plant, and Animal), Form (Dry and Liquid), and Region - Global Forecast to 2025

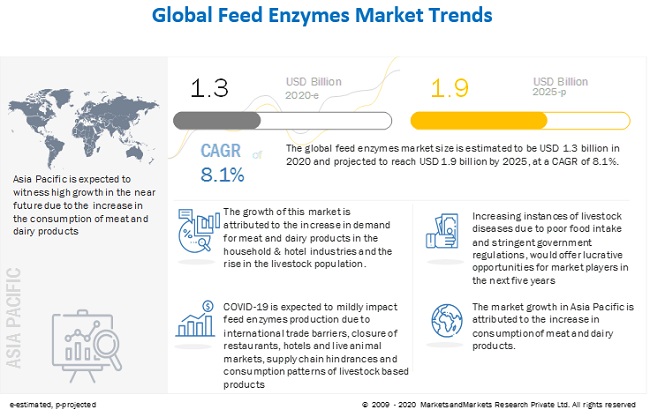

[266 Pages Report] The global feed enzymes market size is estimated to account for USD 1.3 billion in 2020 and is projected to reach USD 1.9 billion by 2025, recording a CAGR of 8.1% during the forecast period. The market is driven primarily by the growing concern regarding animal health and the demand for an increase in the nutrient uptake of feed.

COVID-19 Impact on the Global Feed Enzymes Market

The feed enzymes market includes major Tier I and II suppliers like Cargill, Incorporated, BASF SE, DuPont, Bluestar Adisseo Co., Ltd., and Koninklijke DSM NV. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses as well. Though this pandemic situation has impacted their businesses as well, there is no significant impact on the global operations and supply chain of their feed enzymes. Multiple manufacturing facilities of players are still in operation.

- In April 2020, BASF SE took the decision to stop its “smart Verbund project,” which was in the initial phase with a planned investment of USD 10 billion. They started the construction on a plant complex in Zhanjiang, China, in November 2019, which had stopped due to the outbreak.

- On February 20, 2020, BEC Feed Solutions stated it had commenced work to redevelop its Carole Park location into a new state-of-the-art manufacturing facility. The new facility will feature a manufacturing plant equipped with integrated technology unique to the premix industry, a new warehouse, and adjoining contemporary two-story office building, which will significantly increase their production.

Market Dynamics

Driver: Provision of feed cost-efficiency

Feed production accounts for a major operational cost, which involves 50%–60% of the total cost in livestock production. Therefore, reducing feed costs per livestock remains a priority for every livestock rearer. The potential to improve the digestibility of feed depends largely on the nutritional value of the diet itself. It has been shown that feed can account for up to 90% of the variance in response to enzyme addition. By improving digestibility, the nutrient density of diets and production costs can be reduced. By considering the overall effect of enzymes on the indigestible dietary fraction, feed enzymes are used to maintain livestock performance, while reducing feed costs.

Restraint: Higher inclusion rates of enzymes to have adverse effects

Although feed enzymes significantly impact the growth of the livestock industry, there are physiological limits imposed by the conditions to enzyme responses in the digestive tract of livestock. Excessive levels of feed enzymes could affect the levels of endogenous enzymes in the gastrointestinal tract, with adverse effects on health. Variations in the level of this effect depend on many factors, such as age, type of diet, and enzyme inclusion rates in feed products. Feed enzymes may trigger several side effects, including vomiting, gas, diarrhea, and swelling of the legs and feet. In addition, some animals may experience allergic reactions to digestive enzymes. For instance, Bromelain, the enzyme from pineapple, has anti-platelet properties. If this enzyme is fed to livestock in excessive quantities along with feed, it could increase the risk of bleeding as acts as a blood thinner.

Opportunity: Innovation in phytase production processes

Through preliminary research, it is known that some fungi are able to grow in POME (palm oil mill effluent) and have the ability to produce phytase enzymes. The utilization of phytase enzymes containing feed products for monogastric and digastric livestock could increase the efficiency of nutrient uptake and livestock resistance to disease attacks. Palm oil mill effluent (POME) is one type of waste that has not been used widely in enzyme production. Some fungi that grow on POME indicate their capability of producing phytase. Most of the POME is disposed of and pollutes the environment. Besides, POME is one of the wastes that contain large concentrations of carbohydrates, proteins, nitrogen compounds, lipids, and minerals. Therefore, they also act as an excellent raw material for bioconversion by biotechnological techniques.

Challenge: High R&D investments

The feed industry needs high R&D investments and enzyme development and manufacturing capabilities to produce high-quality feed enzymes at globally competitive prices. They require enhanced infrastructural strength that comprises equipped labs for molecular techniques, such as metagenomics and genomics, which are used to discover new enzymes. This initially requires high investments, and the majority of the manufacturers have a limited number of R&D facilities. Therefore, this challenge can be overcome by collaborating with different R&D companies that have qualified and experienced teams. Some manufacturers also acquire companies to increase their R&D capabilities by adopting various technologies. For instance, Advanced Enzyme Technologies acquired Evoxx Technologies, to increase their R&D capabilities with the adoption of ‘Directed Evolution’ technology, which helps it create desired enzyme molecules. High investments in R&D activities is also projected to help manufacturers to launch new products frequently, thereby enabling them to produce new types of enzymes.

Based on type, the carbohydrase segment is the fastest-growing market during the forecast period

Carbohydrase, are preferred by most animal feed manufacturers and livestock producers to be used as an enzyme. Thus, the segment is estimated to be the fastest-growing in the feed enzymes market during the forecast period.

The inclusion of carbohydrase in the feed offers many advantages to the livestock. Monogastric animals are typically able to digest around 90% of available starch, but carbohydrase helps them improve this percentage. Carbohydrase enzymes are also very effective in increasing the amount of energy made available from feed ingredients.

The microorganism segment, by source, is projected to dominate the market during the forecast period.

The microorganism segment dominated the market during the forecast period, owing to the higher use of these sources to extract feed enzymes. Microorganisms remain highly prominent and suitable hosts to produce stable and industrially important feed enzymes. Enzymes extracted from microorganisms are of great importance in the manufacturing of animal feed. Currently, molecular techniques, such as metagenomics and genomics, are used to discover microbial enzymes, which are used in the feed industry to improve feed quality.

Based on livestock, the swine segment is projected to be the second-largest market during the forecast period

After poultry, the swine segment dominates the market during the forecast period. Since swine livestock is unable to utilize all components of its diet fully, specific enzymes can be added to the feed to help break down complex carbohydrates, protein, and phytate, through carbohydrase, protease, and phytase. Carbohydrases are the most effective in the diet of starters. The main carbohydrate in the swine diet is glucose, provided by starch in corn. More than 95% of the starch in corn can be digested. However, not all carbohydrates in corn are starch. The more complex carbohydrates are called fibers and are not well-utilized by pigs. Enzymes enable the digestion of such unutilized fibers.

The recent COVID-19 pandemic is expected to impact the feed enzyme industry moderately. The entire supply chain is disrupted due to a limited supply of enzymes. Even though the demand for feed has been relatively stable, the supply has been significantly impacted by the COVID-19 pandemic. The movement restrictions and illnesses are resulting in labor shortages and reduced supply of raw materials. The disruption in supply routes has further led to delays in feed supply. However, the demand for feed enzymes in the livestock industry is likely to increase in the first and second quarters of the year 2020 as many farmers resorted to panic buying of feed additives in anticipation of potential shortages. Several concerns, such as international trade barriers, closure of restaurants, hotels, live animal markets, supply chain hindrances, consumption patterns of livestock-based products, have encouraged breeders to stock their feed supplies and feed enzymes. This has led to an increase in demand for feed enzymes during the first week of April 2020.

Asia Pacific is projected to witness the highest growth in the global market during the forecast period.

In terms of value, the Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Factors such as the presence of a large livestock population (FAO 2016) & their growth rate, the increase in the number of feed mills (which further reflects the growth in feed production, particularly in countries, such as, India and Japan), are projected to drive market growth in the coming years.

Key Market Players

Many domestic and global players provide feed enzymes to improve animal health and performance. Major manufacturers have their presence in the European and Asian countries. The key companies in this market are Cargill, Incorporated (US), BASF SE (Germany), DuPont (US), Bluestar Adisseo Co., Ltd. (China), Koninklijke DSM NV (Netherlands) and Kemin Industries, Inc. Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the market.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) & Volume (KT) |

|

Segments covered |

Type, Livestock, Source, Form, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

The major market players include BASF SE (Germany), DuPont (US), Koninklijke DSM NV (Netherlands), Bluestar Addisseo (China) and Cargill (US) (Total 25 companies) |

The study categorizes the global market based on type, livestock, source, form at the regional and global levels.

By Type

- Phytase

- Carbohydrase

- Protease

- Others (lipase, mannanase, and á-galactosidase)

By Livestock

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Others (equine and pets)

By Source

- Microorganism

- Plant

- Animal

By Form

- Dry

- Liquid

By Region

- Asia Pacific

- Europe

- North America

- South America

- Rest of the World

Recent Developments

- In February 2020, BEC Feed Solutions set up a new manufacturing facility to redevelop and expand its Carole Park location. The new facility will feature a manufacturing plant equipped with integrated technology unique to the premix industry, a new warehouse, and adjoining contemporary two-storied office building.

- In January 2020, Nutrex BE invested in a completely new base of operations in Olen that will house their new headquarters, innovation center and state-of-the-art production facilities. The investment in Olen is needed to develop and produce new products and further expand production capacity.

- In December 2019, Nutrex BE decided to merge with Agrimex, a supplier of high-quality additives, premixes, and raw materials to the animal feed industry in Europe, and would continue together with all their activities in the animal feed sector under the name Nutrex.

Frequently Asked Questions (FAQ):

What is the competitive scenario of the top players in feed enzymes market?

There is an increase in new product developments, expansions and mergers & aquisitions by the key players such as DowDuPont and BASF SE

Which are the major opportunity areas of feed enzymes market?

The growing concern regarding animal health and the demand for an increase in the nutrient uptake of feed.

Which segment is projected to account for the largest share in this market based on livestock?

Poultry, among all other livestocks is projected to hold the largest market during the forecast period since it is one of the most demanded meat across the globe. According to OECD-FAO Agricultural Outlook 2017–26, the global poultry meat production is expected to increase by about 11% over the next decade. The production of poultry for meat is also likely to be dominating more than half the growth of all the additional meat produced by 2025.

Which type of enzyme is largely adopted in this market?

Phytase account for the largest share in terms of value in 2019. Phytase, are preferred by most animal feed manufacturers and livestock producers to be used as an enzyme. The inclusion of phytase in the feed offers many advantages to the livestock such as the highest activity at low pH; also, it improves bone health, enables body weight gain, improves digestive efficiency, breaks down indigestible phytic acid (found in grains and oilseeds), and thus, aid in the release of digestible phosphorus, calcium, and other nutrients that aid the growth of animals.

Why does Asia Pacific account for the fastest growth in feed enzymes market?

The presence of a large livestock population and their growth rate, the increase in the number of feed mills in the region, which further reflects the growth in feed production, particularly in countries, such as, India and Japan, are projected to drive market growth in the coming years.

What is the impact of COVID-19 on the Feed Enzymes market?

The feed enzymes market includes major Tier I and II suppliers like Cargill, Incorporated, BASF SE, DuPont, Bluestar Adisseo Co., Ltd., and Koninklijke DSM NV. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. COVID-19 has impacted their businesses as well. Though this pandemic situation has impacted their businesses as well, there is no significant impact on the global operations and supply chain of their feed enzymes, several large manufacturing facilities of players are still in operation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

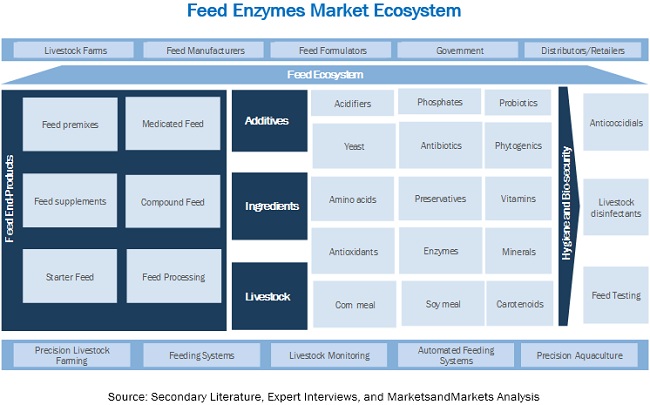

The study involved four major activities in estimating the feed enzymes market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, and segmentation, according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

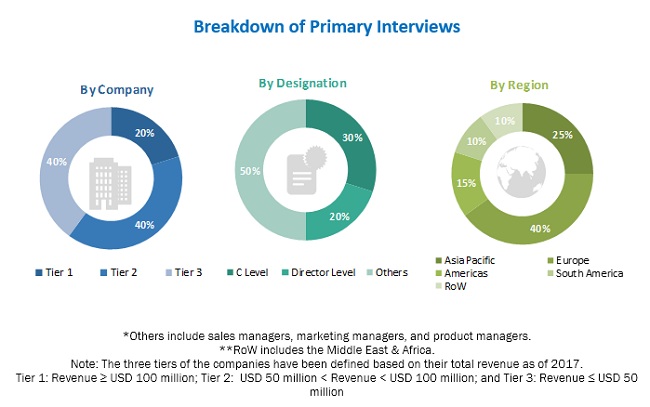

Primary Research

The market comprises several stakeholders, which include feed manufacturers, additive manufacturers & suppliers, animal nutritionists, feed enzyme manufacturers, raw material producers, and poultry farmers in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include research institutions, enzyme distributors and suppliers, government agencies, animal nutrition associations, and cooperative farm societies. The primary sources from the supply side include feed enzyme manufacturers, feed additive manufacturers, microbial extraction service providers, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

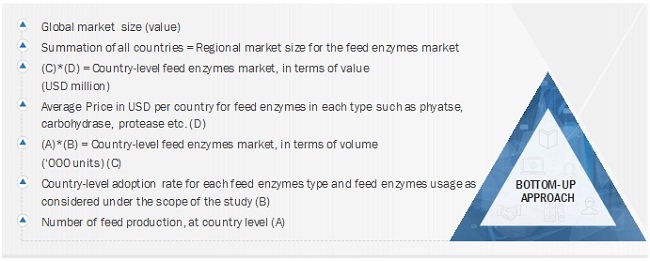

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the global market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Feed Enzymes Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size – using the market size estimation process, as explained above, the total market was split into several segments and sub-segments. To complete the overall market engineering process and to arrive at the exact statistics for each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the feed enzymes market, in terms of type, livestock, source, form, and region

- To describe and forecast the feed enzymes market, in terms of value and volume, by region–Asia Pacific, Europe, North America, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of feed enzymes

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as acquisitions, expansions, product launches, and agreements & partnerships, in the market

- This research report categorizes the market based on type, livestock, source, form, and region.

Target Audience

- Feed additive manufacturers and traders

- Feed product distributors

- Enzyme manufacturers and distributors

- Feed manufacturers

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies

- Associations and industry bodies: Food and Agriculture Organization (FAO), International Feed Industry Federation (IFIF), International Fishmeal and Fish Oil Organization (IFFO), Association of Poultry Processors, and EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA)

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further country-wise breakdown of the market into Asia Pacific, Europe, and South America based on site of operation

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Growth opportunities and latent adjacency in Feed Enzymes Market