Lecithin and Phospholipids Market by Source (Soy, Sunflower, Rapeseed, Egg), Type (Fluid, De-Oiled, Modified), Application (Feed, Food (Confectionery Products, Convenience Food, Baked Goods) Industrial, Healthcare), Nature & Region - Global Forecast to 2027

The global lecithin and phospholipids market size was valued at $5.5 billion in 2022 and is poised to grow $7.5 billion in 2027, expanding at a CAGR of 6.3% in the forecast period (2022-2027).

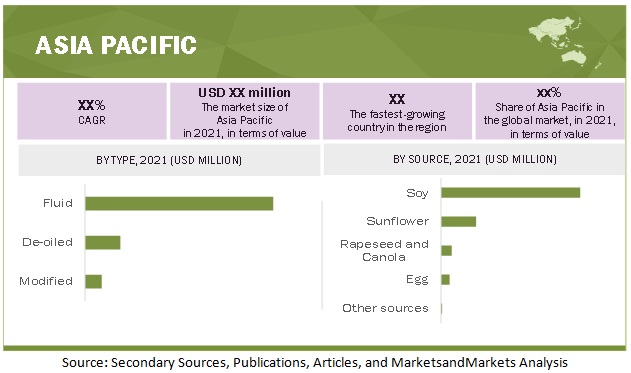

The Asia Pacific region is predicted to hold the biggest market share globally in 2022. Lecithin is being used more frequently in bakery and confectionery, convenience meals, and feed products as a result of the growing desire for natural ingredients. The demand for lecithin as a food additive in the food and beverage sector appears to be driven by the rising number of eating establishments and foodservice businesses.

To know about the assumptions considered for the study, Request for Free Sample Report

The global lecithin and phospholipids industry is driven by shifting consumer preferences to convenience food, changing work culture, and expansion of the retail industry globally. However, health issues associated with the consumption of genetically modified (GM) products are expected to restrain the market growth.

The market for lecithin and phospholipids is expected to grow in the coming years, driven by increasing demand for natural and healthy food ingredients, rising popularity of functional food and dietary supplements, and growing awareness about the health benefits of phospholipids. These ingredients are used in a variety of applications such as functional foods, infant formula, pharmaceuticals, cosmetics, and animal feed. The Asia-Pacific region is projected to be the largest market for lecithin and phospholipids, due to the growing demand from countries such as China and India.

Lecithin and Phospholipids Market Dynamics

Drivers: Growing demand for natural food additives and increasing consumers awareness about clean-label products

Increase in consumer awareness about the ill effects of the consumption of chemical ingredients and the presence of natural or organic ingredients as alternatives in the market drive the demand for natural fruit & vegetable additives. “Additive-free” and “natural” have become part of a consumer’s checklist while buying food & beverage products.

Ingredient labeling has become mandatory in developed economies such as the US and EU countries due to the rising consumer awareness. Consumers look for natural ingredients and products that taste good and have fewer calories. Although artificial or non-organic ingredients have found approval among consumers and have gained a significant market presence, there is a need to replace these artificial ingredients with natural alternatives.

The demand for natural food additives is increasing, owing to which manufacturers are launching various products with natural ingredients that can provide an advantage to drive consumption. As lecithin, a type of food emulsifier, is of natural origin, it is poised to witness an increase in adoption by the industry, thereby driving its market growth.

Restraints: Replicability of lecithin & phospholipids by synthetic alternatives

Despite their important role in food safety and shelf-life extension, the preference for synthetic emulsifiers such as mono- & diglycerides and their derivatives, sorbitan esters, stearoyl lactylates, and polyglycerol esters over natural emulsifiers such as lecithin & phospholipid is proving to be a challenge for the market.

There is limited availability of natural sources. Natural emulsifiers such as lecithin & phospholipids are yet to be manufactured on a larger scale; the commercialization of manufacturing processes of lecithin and phospholipids is also yet to happen. Once natural lecithin & phospholipids are widely commercialized, their share in the global food emulsifiers market would instantly increase. Good and reliable sources of high-quality natural emulsifiers are being studied, and many tests are being conducted to check their efficacy to maintain food quality.

Opportunities: Emerging markets and changing consumer lifestyles

The trend of consumer preference for low-fat products is rapidly rising, and marketing campaigns are planned around highlighting their use and health benefit claims. Cargill (US) produces lecithin that functions as a low-fat dressing, gaining the attention of those who aim to produce low-fat food products.

The demand for low-fat products may be driven by the increase in processed food production and innovation in almost all segments, such as meat products, dairy, and bakery & confectionery products. However, the demand for the usage of lecithin is expected to grow continually in early adopting countries such as Japan, and exponential growth is projected in new and emerging markets such as Australia and other Asia Pacific countries.

In addition, Asia provides a cost advantage in terms of production and processing. High demand, coupled with low cost of production, is a key feature, which would aid lecithin suppliers.

Challenges: Volatile price of raw materials

Manufacturers of lecithin & phospholipids use egg and plant sources which include soy, sunflower, and rapeseed for the production of lecithin & phospholipids. These raw materials are available in large quantities. However, the fluctuating prices of raw materials hinder the manufacturers’ profit margin. End-use manufacturers, especially food manufacturers, demand high-quality lecithin that can be sourced at low prices.

The increase in prices of raw materials subsequently increases the processing cost of lecithin, resulting in a higher selling price. Furthermore, as substitutes for lecithin such as xanthan gum and potato starch are readily available in the market, this is expected to be a threat for lecithin being replaced by these substitutes. This restricts the growth of the lecithin market.

By source, soy was the largest segment in the global lecithin market.

The soy segment is estimated to dominate the market for lecithin, by source, in terms of value, in 2022. Soy is widely preferred among manufacturers owing to the sufficient availability of soybean and the cheap extraction process. Soy lecithin is growing in popularity in the feed application. It is also used as a replacement for cocoa butter in the chocolate industry, owing to the rising prices of cocoa butter. Hence, the abundant supply of raw materials is expected to lead to optimal production planning, leading to the market's growth.

By source, soy was the largest segment in the global phospholipids market.

The soy segment is estimated to dominate the market for phospholipids, by source, in terms of value, in 2022. Increased demand for natural sources in the cosmetics and pharmaceutical industries has boosted the demand for soy-based phospholipids at a global level. Moreover, the increase in demand for naturally sourced ingredients in the food & beverage industry as an emulsifier across the globe is one of the major factors driving the demand for soy in the phospholipids market.

By type, fluid is the largest segment in the global lecithin market.

The lecithin market is estimated to be dominated by fluid type in 2022. The growing demand for fluid lecithin from the feed industry in European countries is expected to create export opportunities for manufacturers in regions such as Asia Pacific and South America. Apart from this, fluid lecithin is used in paints, varnishes, and textiles. Thus, increased demand in industrial applications is expected to boost the sales of fluid lecithin during the forecast period.

By application, feed is the largest segment in lecithin market in 2021

The feed segment is estimated to dominate the lecithin market in 2022. This segment is estimated to be the largest, and this trend is expected to continue through the forecast period owing to factors such as a shift in preference to protein-rich diets in emerging economies such as China and increasing demand for soy lecithin in the feed segment. Moreover, fluid lecithin works as a milk replacer where the feed is administered in liquid form to the animals.

By nature, GMO is the largest segment in lecithin market in 2021

The GMO segment is estimated to dominate the lecithin market in 2022. GM oilseeds such as soybean, sunflower, and rapeseed are used for extracting lecithin, a natural emulsifier utilized in various industries. Today, 90% of commercially available lecithin is extracted from soy and sunflower. Lecithin has a dual function in food as an emulsifier and healthy ingredient. Because of its lipid-friendly and hydrophilic properties, lecithin is used in many foods and other areas of the industry.

By region, Asia Pacific is projected to grow at the highest CAGR during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific accounted for 33.9% of the lecithin market in 2021. In the Asia Pacific region, lecithin is gaining popularity due to busy lifestyles, urging consumers to opt for on-the-go and RTE products. The demand for lecithin is expected to increase in the coming years due to the growing population and increasing per-capita income of consumers, based on a World Bank report. Moreover, export opportunities of non-GMO lecithin from countries such as India to the European market are expected to drive the lecithin market in the region.

Lecithin and Phospholipids Market Key Players:

Key players in this market include Cargill (US), ADM (US), DuPont (US), IMCD Group B.V. (US), Bunge Limited (US), STERN-WYWIOL GRUPPE (Germany), Wilmar International Ltd. (Singapore), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US).

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Lecithin & phospholipids product manufacturers

- Health food & beverage product manufacturers

- Lecithin & phospholipids product distributors

- Marketing directors

- Key executives from various key companies and organizations in lecithin & phospholipids market

Scope of the Report

|

Report Metric |

Details |

|

Estimated value by 2027 |

USD 7.5 Billion |

|

Market Revenue in 2022 |

USD 5.5 Billion |

|

Growth Rate |

CAGR of 6.3 % from 2022 to 2027 |

|

Research Duration Considered |

2020-2027 |

|

Historical Base Year |

2021 |

|

Report Coverage |

This report segments the lecithin & phospholipids market on the basis of source, type, application, nature, and region. In terms of insights, this research report focuses on various levels of analyses—competitive landscape, end-use analysis, and company profiles—which together comprise and discuss the basic views on the emerging & high-growth segments of the lecithin & phospholipids market, high-growth regions, countries, drivers, restraints, opportunities, and challenges. |

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Key companies profiled |

Cargill (US), ADM (US), DuPont (US), IMCD Group B.V. (US), Bunge Limited (US), STERN-WYWIOL GRUPPE (Germany), Wilmar International Ltd. (Singapore), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US), VAV Life Sciences Pvt. Ltd. (India), Sodrugestvo Group (Luxembourg), Kewpie Corporation (Japan), Fismer Lecithin (Germany), Lipoid GmbH (Germany), Sime Darby Oils (Netherlands), Lecital (Austria), Lasenor Emul, S.L., (Spain), Sun Nutrafoods (India), Lecilite Ingredients Pvt. Ltd. (India) |

Report Segmentation

This research report categorizes lecithin market based on source, type, nature, application and region.

|

By Source |

By Type |

By Nature |

By Application |

By Region |

|

|

|

|

|

This research report categorizes phospholipids market based on source, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

Recent Developments

- In December 2021, The IMCD Group BV acquired Polychem Handelsges.m.b.H. to serve customers and partners throughout Southeast Europe (SEE). Besides broadening the global network of technical ers by establishing the first laboratory in this region, it provides further regional development in SEE emerging markets.

- In November 2021, Vav Life Sciences expanded its production capacity to meet overseas demand and boost sales by 3.5 times. Moreover, Vav Life Sciences invested USD 2 million to enhance production capacity at the EU GMP site to meet overseas demand.

- In November 2021, ADM acquired SOJA PROTEIN, one of the leading European providers of non-GMO soy ingredients. The addition represents a significant expansion of ADM’s global alternative protein capabilities and its ability to meet the growing demand for plant-based foods and beverages.

- In April 2021, Vav Life Sciences agreed with US-based contract development and manufacturing organization that enables them to manufacture and supply highly purified synthetic phospholipids for m-RNA-LNP technology-based vaccines.

- In March 2021, Lecico, a subsidiary of Avril Group (France), signed an exclusive distribution partnership agreement with Ciranda for the North American market.

Frequently Asked Questions (FAQ):

How big is the lecithin and phospholipids market?

The global lecithin and phospholipids market was valued at $5.5 Billion in 2022 and is projected to reach $7.5 billion by 2027, growing at a cagr 6.3% from 2022 to 2027.

What is the estimated growth rate (CAGR) of the global lecithin and phospholipids market for the next five years?

The global lecithin and phospholipids market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2027

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for lecithin and phospholipids market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

Which players are involved in the manufacturing of lecithin and phospholipids market?

Key players in this market include Cargill (US), ADM (US), DuPont (US), IMCD Group B.V. (US), Bunge Limited (US), STERN-WYWIOL GRUPPE (Germany), Wilmar International Ltd. (Singapore), Sonic Biochem (India), Avril Group (France), American Lecithin Company (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 LECITHIN MARKET SEGMENTATION

FIGURE 2 PHOSPHOLIPIDS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 INCLUSIONS AND EXCLUSIONS

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 VOLUME UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 LECITHIN & PHOSPHOLIPIDS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPROACH ONE – BOTTOM-UP (BASED ON THE LECITHIN & PHOSPHOLIPIDS MARKET, BY REGION)

2.2.1 APPROACH TWO – TOP-DOWN (BASED ON THE GLOBAL MARKET)

FIGURE 5 TOP–DOWN APPROACH (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 2 LECITHIN MARKET SNAPSHOT, 2022 VS. 2027

TABLE 3 PHOSPHOLIPIDS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 12 COVID-19 IMPACT ON THE LECITHIN MARKET, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 13 COVID-19 IMPACT ON THE PHOSPHOLIPIDS MARKET, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 14 LECITHIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 PHOSPHOLIPIDS MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 LECITHIN MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 17 LECITHIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 18 LECITHIN MARKET, BY NATURE, 2022 VS. 2027 (USD MILLION)

FIGURE 19 LECITHIN MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 BRIEF OVERVIEW OF THE LECITHIN & PHOSPHOLIPIDS MARKET

FIGURE 20 GROWING DEMAND FOR NATURAL FOOD ADDITIVES AND INCREASING CONSUMER AWARENESS ABOUT CLEAN-LABEL PRODUCTS PROPELING THE MARKET FOR LECITHIN & PHOSPHOLIPIDS

4.2 ASIA PACIFIC: LECITHIN MARKET, BY PRODUCT AND COUNTRY

FIGURE 21 CHINA AND SOY SEGMENTS ACCOUNTED FOR THE LARGEST SHARES IN THE ASIA PACIFIC LECITHIN MARKET IN 2021

4.3 PHOSPHOLIPIDS MARKET, BY APPLICATION

FIGURE 22 NUTRITION & SUPPLEMENTS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 LECITHIN MARKET, BY APPLICATION

FIGURE 23 FEED SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 LECITHIN MARKET, BY TYPE AND REGION

FIGURE 24 ASIA PACIFIC TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 LECITHIN MARKET, BY SOURCE

FIGURE 25 SOY SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 26 COVID-19 IMPACT ON THE LECITHIN MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

FIGURE 27 COVID-19 IMPACT ON THE PHOSPHOLIPIDS MARKET: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS

5 LECITHIN & PHOSPHOLIPIDS MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 LECITHIN & PHOSPHOLIPIDS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for natural food additives and increasing consumers awareness about clean-label products

TABLE 4 UNDERSTANDING CLEAN-LABEL PURCHASES

5.2.1.2 Multifunctionality in various end-use industries

FIGURE 29 GROWTH OF THE DIETARY SUPPLEMENTS MARKET (2016–2021)

5.2.1.3 Growing phospholipids demand in the pharmaceutical and personal care industries

FIGURE 30 GROWTH OF THE GLOBAL COSMETICS MARKET (2014–2019)

5.2.1.4 Increasing lecithin usage in convenience foods

5.2.2 RESTRAINTS

5.2.2.1 Replicability of lecithin & phospholipids by synthetic alternatives

5.2.2.2 Health concerns and allergies associated with the consumption of soy products

TABLE 5 ESTIMATED US POPULATION SHOWING ALLERGIC REACTION TO SPECIFIC FOODS, 2018–2019

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets and changing consumer lifestyles

5.2.3.2 Growing investment in industrial applications of lecithin & phospholipids

5.2.3.3 Growing demand for clean-label products fueling the plant-based lecithin market growth

5.2.4 CHALLENGES

5.2.4.1 Volatile price of raw materials

5.2.4.2 Rising health concerns regarding GMO and allergens

5.3 COVID-19 IMPACT ON THE LECITHIN & PHOSPHOLIPIDS ECOSYSTEM

6 LECITHIN & PHOSPHOLIPIDS INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RAW MATERIAL SOURCING

6.2.2 MANUFACTURING OF LECITHIN & PHOSPHOLIPIDS

6.2.3 QUALITY AND SAFETY CONTROLLERS

6.2.4 PACKAGING

6.2.5 MARKETING & DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 31 VALUE CHAIN ANALYSIS OF THE LECITHIN & PHOSPHOLIPIDS MARKET: MANUFACTURING AND QUALITY & SAFETY CONTROLLERS ARE THE KEY CONTRIBUTORS

6.3 TECHNOLOGY ANALYSIS

6.4 TRADE DATA: LECITHIN & PHOSPHOLIPIDS MARKET

6.4.1 LECITHIN AND OTHER PHOSPHOLIPIDS

TABLE 6 TOP IMPORTERS OF LECITHIN AND OTHER PHOSPHOLIPIDS, 2019 (KG)

6.4.2 LECITHIN AND OTHER PHOSPHOLIPIDS

TABLE 7 TOP EXPORTERS OF LECITHIN AND OTHER PHOSPHOLIPIDS, 2019 (KG)

6.5 PRICING ANALYSIS: LECITHIN & PHOSPHOLIPIDS MARKET

TABLE 8 AVERAGE SELLING PRICE (ASP) OF LECITHIN, BY SOURCE, 2020–2022 (USD/KG)

TABLE 9 AVERAGE SELLING PRICE (ASP) OF LECITHIN, BY REGION, 2020–2022 (USD/KG)

6.6 MARKET MAP AND ECOSYSTEM OF THE LECITHIN & PHOSPHOLIPIDS MARKET

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

FIGURE 32 LECITHIN & PHOSPHOLIPIDS MARKET MAP

TABLE 10 LECITHIN & PHOSPHOLIPIDS MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS IMPACTING BUYERS

FIGURE 33 LECITHIN & PHOSPHOLIPIDS MARKET: TRENDS IMPACTING BUYERS

6.8 LECITHIN: PATENT ANALYSIS

FIGURE 34 LECITHIN: NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 35 LECITHIN: TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 36 LECITHIN: TOP 10 APPLICANTS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 11 SOME PATENTS PERTAINING TO LECITHIN, 2019–2021

6.9 PHOSPHOLIPIDS: PATENT ANALYSIS

FIGURE 37 PHOSPHOLIPIDS: NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 38 PHOSPHOLIPIDS: TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 39 PHOSPHOLIPIDS: TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

TABLE 12 SOME PATENTS PERTAINING TO PHOSPHOLIPIDS, 2019–2021

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 LECITHIN & PHOSPHOLIPIDS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.10.1 INTENSITY OF COMPETITIVE RIVALRY

6.10.2 BARGAINING POWER OF SUPPLIERS

6.10.3 BARGAINING POWER OF BUYERS

6.10.4 THREAT OF SUBSTITUTES

6.10.5 THREAT OF NEW ENTRANTS

6.11 CASE STUDIES

TABLE 14 RISING REGULATORY POLICIES FOR LECITHIN & PHOSPHOLIPIDS

TABLE 15 GROWING DEMAND FOR NON-GMO PRODUCTS

7 REGULATORY FRAMEWORK (Page No. - 88)

7.1 US

7.1.1 DIRECT FOOD SUBSTANCES AFFIRMED AS ‘GENERALLY RECOGNIZED AS SAFE’

7.1.2 MULTIPURPOSE ADDITIVES

7.1.3 TYPES OF LECITHIN ALLOWED IN ORGANIC PROCESSED PRODUCTS

7.2 EUROPE

7.2.1 REGULATION (EC) NO 1333/2008 ON FOOD ADDITIVES

TABLE 16 SPECIFICATIONS ON REGULATION (EC) NO 1333/2008

7.2.2 COMMISSION IMPLEMENTING REGULATION (EU) 2017/1007 OF 15 JUNE 2017 CONCERNING THE AUTHORIZATION OF PREPARATION LECITHINS AS FEED ADDITIVES FOR ALL ANIMAL SPECIES

7.3 INDIA

7.3.1 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

8 LECITHIN MARKET, BY SOURCE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 40 LECITHIN MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 17 LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 18 LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 19 LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 20 LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

8.2 COVID-19 IMPACT ON THE LECITHIN MARKET, BY SOURCE

8.2.1 OPTIMISTIC SCENARIO

TABLE 21 OPTIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 22 REALISTIC SCENARIO: LECITHIN MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 23 PESSIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

8.3 SOY

8.3.1 INCREASING INDUSTRY-SPECIFIC DEMANDS OF SOY TO DRIVE THE MARKET GROWTH

TABLE 24 SOY-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 SOY-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 SOY-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 27 SOY-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

8.4 SUNFLOWER

8.4.1 GROWING TREND OF A MACRO-NUTRIENTS RICH DIET

TABLE 28 SUNFLOWER-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 SUNFLOWER-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 SUNFLOWER-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 31 SUNFLOWER-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

8.5 RAPESEED & CANOLA

8.5.1 SIGNIFICANT HEALTH BENEFITS TO INCREASE THE MARKET GROWTH

TABLE 32 RAPESEED- & CANOLA-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 RAPESEED- & CANOLA-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 RAPESEED- & CANOLA-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 35 RAPESEED- & CANOLA-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

8.6 EGG

8.6.1 LESSER CHOLESTEROL LEVELS PROJECTING THE LECITHIN MARKET

TABLE 36 EGG-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 EGG-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 EGG-BASED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 39 EGG-BASED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

8.7 OTHER SOURCES

TABLE 40 OTHER LECITHIN SOURCES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 OTHER LECITHIN SOURCES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 OTHER LECITHIN SOURCES MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 43 OTHER LECITHIN SOURCES MARKET SIZE, BY REGION, 2022–2027 (TON)

9 LECITHIN MARKET, BY TYPE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 41 LECITHIN MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 44 LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 47 LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

9.2 COVID-19 IMPACT ON THE LECITHIN MARKET, BY TYPE

9.2.1 OPTIMISTIC SCENARIO

TABLE 48 OPTIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY TYPE, 2020–2023 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 49 REALISTIC SCENARIO: LECITHIN MARKET SIZE, BY TYPE, 2020–2023 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 50 PESSIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY TYPE, 2020–2023 (USD MILLION)

9.3 FLUID LECITHIN

9.3.1 DEVELOPING COUNTRIES TO PROVIDE LUCRATIVE OPPORTUNITIES FOR FLUID LECITHIN MANUFACTURERS

TABLE 51 FLUID LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 FLUID LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 FLUID LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 54 FLUID LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

9.4 DE-OILED LECITHIN

9.4.1 DE-OILED LECITHIN IS AN IDEAL ADDITIVE WITH IMPROVED FUNCTIONAL PROPERTIES

TABLE 55 DE-OILED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 DE-OILED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 57 DE-OILED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 58 DE-OILED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

9.5 MODIFIED

9.5.1 GREAT EMULSIFYING AND HYDROPHILIC PROPERTIES TO INCREASE THE MARKET GROWTH

9.5.1.1 Chemical Modification

9.5.1.2 Enzymatic Hydrolysis

TABLE 59 MODIFIED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MODIFIED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 MODIFIED LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 62 MODIFIED LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

10 LECITHIN MARKET, BY APPLICATION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 42 LECITHIN MARKET (VALUE), BY APPLICATION, 2022 VS. 2027

TABLE 63 LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 64 LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 65 FOOD & BEVERAGES: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 FOOD & BEVERAGES: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

10.2 COVID-19 IMPACT ON THE LECITHIN MARKET, BY APPLICATION

10.2.1 OPTIMISTIC SCENARIO

TABLE 67 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 68 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 69 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

10.3 FEED

10.3.1 INCREASING DEMAND FOR ANIMAL PROTEIN OWING TO MARKET GROWTH

TABLE 70 FEED: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 FEED: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 FOOD & BEVERAGES

10.4.1 SIGNIFICANT GROWTH IN THE CONFECTIONERY AND CONVENIENCE FOOD INDUSTRIES

TABLE 72 FOOD & BEVERAGES: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 F00D & BEVERAGES: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4.1.1 Confectioneries

TABLE 74 CONFECTIONERIES: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 CONFECTIONERIES: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4.1.2 Convenience foods

TABLE 76 CONVENIENCE FOODS: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 CONVENIENCE FOODS: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4.1.3 Bakery products

TABLE 78 BAKERY PRODUCTS: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 BAKERY PRODUCTS: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4.1.4 Other food & beverages

TABLE 80 OTHER FOOD & BEVERAGES: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 OTHER FOOD & BEVERAGES: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 INDUSTRIAL

10.5.1 INCREASING AGRICULTURAL BENEFITS OF LECITHIN TO ENHANCE THE MARKET GROWTH

TABLE 82 INDUSTRIAL: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 INDUSTRIAL: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.6 HEALTHCARE

10.6.1 INCREASING NUMBER OF HEALTH-CONSCIOUS CONSUMERS OPTING FOR LECITHIN-ENRICHED PRODUCTS

TABLE 84 HEALTHCARE: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 HEALTHCARE: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 LECITHIN MARKET, BY NATURE (Page No. - 126)

11.1 INTRODUCTION

FIGURE 43 LECITHIN MARKET (VALUE), BY NATURE, 2022 VS. 2027

TABLE 86 LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 87 LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

11.2 COVID-19 IMPACT ON THE LECITHIN MARKET, BY NATURE

11.2.1 OPTIMISTIC SCENARIO

TABLE 88 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY NATURE, 2020–2023 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 89 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY NATURE, 2020–2023 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 90 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE LECITHIN MARKET, BY NATURE, 2020–2023 (USD MILLION)

11.3 GMO

11.3.1 RESISTANCE TO DISEASE ENHANCING THE GMO LECITHIN MARKET

TABLE 91 GMO: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 GMO: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.4 NON-GMO

11.4.1 RISING AWARENESS OF HARMFUL CONSEQUENCES OF EATING GMO FOOD

TABLE 93 NON-GMO: LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 NON-GMO: LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12 LECITHIN MARKET, BY REGION (Page No. - 131)

12.1 INTRODUCTION

FIGURE 44 CHINA TO RECORD THE HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 95 LECITHIN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 LECITHIN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 LECITHIN MARKET SIZE, BY REGION, 2018–2021 (TON)

TABLE 98 LECITHIN MARKET SIZE, BY REGION, 2022–2027 (TON)

12.2 COVID-19 IMPACT ON THE LECITHIN MARKET, BY REGION

12.2.1 OPTIMISTIC SCENARIO

TABLE 99 OPTIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.2.2 REALISTIC SCENARIO

TABLE 100 REALISTIC SCENARIO: LECITHIN MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.2.3 PESSIMISTIC SCENARIO

TABLE 101 PESSIMISTIC SCENARIO: LECITHIN MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

12.3 NORTH AMERICA

TABLE 102 NORTH AMERICA: LECITHIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 103 NORTH AMERICA: LECITHIN MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 NORTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 107 NORTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

TABLE 108 NORTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 111 NORTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 112 NORTH AMERICA: LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 115 NORTH AMERICA: LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: LECITHIN MARKET, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: LECITHIN MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

12.3.1 US

12.3.1.1 Increasing demand for high-protein food products

TABLE 118 US: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 119 US: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Booming food industry to drive lecithin market growth

TABLE 120 CANADA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 121 CANADA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Increasing large-scale consumption of poultry products to drive market growth

TABLE 122 MEXICO: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 123 MEXICO: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4 EUROPE

TABLE 124 EUROPE: LECITHIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 125 EUROPE: LECITHIN MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 126 EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 127 EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 128 EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 129 EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

TABLE 130 EUROPE: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 131 EUROPE: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 EUROPE: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 133 EUROPE: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 134 EUROPE: LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 135 EUROPE: LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 136 EUROPE: LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 137 EUROPE: LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 139 EUROPE: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

12.4.1 UK

12.4.1.1 Growing food & beverage industry to contribute to lecithin market growth

TABLE 140 UK: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 141 UK: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.2 GERMANY

12.4.2.1 Increasing processed food products’ demand to escalate market growth

TABLE 142 GERMANY: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 143 GERMANY: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.3 SPAIN

12.4.3.1 Increasing low-fat food products’ demand to drive lecithin market growth

TABLE 144 SPAIN: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 145 SPAIN: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.4 ITALY

12.4.4.1 Rising artisanal products’ demand to escalate lecithin market growth

TABLE 146 ITALY: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 147 ITALY: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.5 FRANCE

12.4.5.1 Growing concerns regarding food quality and health

TABLE 148 FRANCE: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 149 FRANCE: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.6 NETHERLANDS

12.4.6.1 Rising awareness about food emulsifiers to project market growth

TABLE 150 NETHERLANDS: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 151 NETHERLANDS: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.4.7 REST OF EUROPE

12.4.7.1 Growing service industries to enable adequate opportunities for lecithin manufacturers

TABLE 152 REST OF EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 153 REST OF EUROPE: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: LECITHIN MARKET SNAPSHOT

TABLE 154 ASIA PACIFIC: LECITHIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: LECITHIN MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 159 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

TABLE 160 ASIA PACIFIC: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 163 ASIA PACIFIC: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 164 ASIA PACIFIC: LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 169 ASIA PACIFIC: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

12.5.1 CHINA

12.5.1.1 Growth in demand for bakery products fueling the demand for lecithin

TABLE 170 CHINA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 171 CHINA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.5.2 JAPAN

12.5.2.1 Rapid expansion of convenience store chains over last decade

TABLE 172 JAPAN: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 173 JAPAN: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.5.3 AUSTRALIA & NEW ZEALAND

12.5.3.1 Increasing use of lecithin as fat replacers to drive market growth

TABLE 174 AUSTRALIA & NEW ZEALAND: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 175 AUSTRALIA & NEW ZEALAND: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.5.4 INDIA

12.5.4.1 Consumers opting for healthy and high-quality products

TABLE 176 INDIA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 177 INDIA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.5.5 REST OF ASIA PACIFIC

12.5.5.1 Increasing trade of raw materials to drive market growth

TABLE 178 REST OF ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.6 SOUTH AMERICA

FIGURE 46 SOUTH AMERICA: LECITHIN MARKET SNAPSHOT

TABLE 180 SOUTH AMERICA: LECITHIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 181 SOUTH AMERICA: LECITHIN MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 182 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 183 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 184 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 185 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

TABLE 186 SOUTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 187 SOUTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 188 SOUTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 189 SOUTH AMERICA: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 190 SOUTH AMERICA: LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 191 SOUTH AMERICA: LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 192 SOUTH AMERICA: LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 193 SOUTH AMERICA: LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 195 SOUTH AMERICA: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 High consumption of bakery products by the millennial generation to contribute to lecithin market growth

TABLE 196 BRAZIL: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 197 BRAZIL: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Increasing fast-paced society to escalate the market growth

TABLE 198 ARGENTINA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 199 ARGENTINA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.6.3 REST OF SOUTH AMERICA

12.6.3.1 Increasing awareness of healthy snacks to drive market growth

TABLE 200 REST OF SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 201 REST OF SOUTH AMERICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.7 REST OF THE WORLD

TABLE 202 REST OF THE WORLD: LECITHIN MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 203 REST OF THE WORLD: LECITHIN MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 204 REST OF THE WORLD: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 205 REST OF THE WORLD: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 206 REST OF THE WORLD: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (TON)

TABLE 207 REST OF THE WORLD: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (TON)

TABLE 208 REST OF THE WORLD: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 209 REST OF THE WORLD: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 210 REST OF THE WORLD: LECITHIN MARKET SIZE, BY TYPE, 2018–2021 (TON)

TABLE 211 REST OF THE WORLD: LECITHIN MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 212 REST OF THE WORLD: LECITHIN MARKET SIZE, BY NATURE, 2018–2021 (USD MILLION)

TABLE 213 REST OF THE WORLD: LECITHIN MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 214 REST OF THE WORLD: LECITHIN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 215 REST OF THE WORLD: LECITHIN MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 216 REST OF THE WORLD: LECITHIN MARKET FOR FOOD & BEVERAGES, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 217 REST OF THE WORLD: LECITHIN MARKET SIZE, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

12.7.1 AFRICA

12.7.1.1 Increasing demand for processed food to contribute to lecithin market growth

TABLE 218 AFRICA: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 219 AFRICA: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

12.7.2 MIDDLE EAST

12.7.2.1 Significant increase in demand for premium food products

TABLE 220 MIDDLE EAST: LECITHIN MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 221 MIDDLE EAST: LECITHIN MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

13 PHOSPHOLIPIDS MARKET, BY SOURCE (Page No. - 182)

13.1 INTRODUCTION

FIGURE 47 PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 222 PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 223 PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 224 PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 225 PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

13.2 COVID-19 IMPACT ON THE PHOSPHOLIPIDS MARKET, BY SOURCE

13.2.1 OPTIMISTIC SCENARIO

TABLE 226 OPTIMISTIC SCENARIO: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

13.2.2 REALISTIC SCENARIO

TABLE 227 REALISTIC SCENARIO: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

13.2.3 PESSIMISTIC SCENARIO

TABLE 228 PESSIMISTIC SCENARIO: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2020–2023 (USD MILLION)

13.3 SOY

TABLE 229 SOY-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 230 SOY-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 231 SOY-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (TONS)

TABLE 232 SOY-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (TONS)

13.4 EGG

TABLE 233 EGG-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 234 EGG-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 235 EGG-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (TONS)

TABLE 236 EGG-BASED PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (TONS)

13.5 OTHER PHOSPHOLIPID SOURCES

TABLE 237 OTHER PHOSPHOLIPID SOURCES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 238 OTHER PHOSPHOLIPID SOURCES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 239 OTHER PHOSPHOLIPID SOURCES MARKET SIZE, BY REGION, 2018–2021 (TONS)

TABLE 240 OTHER PHOSPHOLIPID SOURCES MARKET SIZE, BY REGION, 2022–2027 (TONS)

14 PHOSPHOLIPIDS MARKET, BY APPLICATION (Page No. - 192)

14.1 INTRODUCTION

FIGURE 48 PHOSPHOLIPIDS MARKET, BY APPLICATION, 2022 VS. 2027

TABLE 241 PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 242 PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 243 PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (TONS)

TABLE 244 PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (TONS)

14.2 COVID-19 IMPACT ON THE PHOSPHOLIPIDS MARKET, BY APPLICATION

14.2.1 OPTIMISTIC SCENARIO

TABLE 245 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE PHOSPHOLIPIDS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

14.2.2 REALISTIC SCENARIO

TABLE 246 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE PHOSPHOLIPIDS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

14.2.3 PESSIMISTIC SCENARIO

TABLE 247 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE PHOSPHOLIPIDS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

14.3 NUTRITION & SUPPLEMENTS

14.3.1 INCREASING CONSUMPTION OF POTATO CHIPS ANTICIPATED TO BOOM THE MARKET GROWTH

TABLE 248 NUTRITION & SUPPLEMENTS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 249 NUTRITION & SUPPLEMENTS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

14.4 PHARMACEUTICALS

14.4.1 INCREASING CONSUMPTION OF POTATO CHIPS ANTICIPATED TO BOOST THE MARKET GROWTH

TABLE 250 PHARMACEUTICALS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 251 PHARMACEUTICALS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

14.5 OTHER APPLICATIONS

14.5.1 INCREASING CONSUMPTION OF POTATO CHIPS ANTICIPATED TO BOOM THE MARKET GROWTH

TABLE 252 OTHER APPLICATIONS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 253 OTHER APPLICATIONS: PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

15 PHOSPHOLIPIDS MARKET, BY REGION (Page No. - 200)

15.1 INTRODUCTION

FIGURE 49 CHINA TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 254 PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 255 PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

15.2 COVID-19 IMPACT ON THE PHOSPHOLIPIDS MARKET, BY REGION

15.2.1 OPTIMISTIC SCENARIO

TABLE 256 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

15.2.2 REALISTIC SCENARIO

TABLE 257 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

15.2.3 PESSIMISTIC SCENARIO

TABLE 258 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE PHOSPHOLIPIDS MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

15.3 NORTH AMERICA

TABLE 259 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 260 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 261 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 262 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 263 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 264 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

TABLE 265 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 266 NORTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

15.3.1 UNITED STATES

15.3.1.1 Growing health concerns and new product launches in emerging issues, such as stress management, to drive the demand for phospholipids

TABLE 267 US: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 268 US: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.3.2 CANADA

15.3.2.1 Large pharmaceutical industry, coupled with the growing mental cognitive issues, to drive the phospholipids market growth

TABLE 269 CANADA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 270 CANADA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.3.3 MEXICO

15.3.3.1 Flourishing personal care products market and prevalence of Alzheimer’s disease and other forms of dementia driving the demand for phospholipids

TABLE 271 MEXICO: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 272 MEXICO: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4 EUROPE

TABLE 273 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 274 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 275 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 276 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 277 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 278 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

TABLE 279 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 280 EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

15.4.1 UNITED KINGDOM

15.4.1.1 Rising consumption of dietary and food supplements coupled with a well-established market for cosmetics

TABLE 281 UK: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 282 UK: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.2 GERMANY

15.4.2.1 Rise in pharmaceuticals, brain nutrition, and other nutritional and dietary supplements to drive the demand for phospholipids

TABLE 283 GERMANY: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 284 GERMANY: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.3 SPAIN

15.4.3.1 Aging population with rising problems, such as dementia, and the growing nutrition sector driving the demand for phospholipids

TABLE 285 SPAIN: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 286 SPAIN: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.4 ITALY

15.4.4.1 Increasing demand for food supplements among the consumers in the country

TABLE 287 ITALY: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 288 ITALY: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.5 FRANCE

15.4.5.1 Rising awareness toward cognitive health supplement products to drive the growth of phospholipids

TABLE 289 FRANCE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 290 FRANCE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.6 NETHERLANDS

15.4.6.1 Rapidly growing nutraceutical and dietary supplements market and the increased focus on R&D in the cosmetics industry present significant business opportunities for phospholipids

TABLE 291 NETHERLANDS: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 292 NETHERLANDS: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.4.7 REST OF EUROPE

TABLE 293 REST OF EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 294 REST OF EUROPE: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.5 ASIA PACIFIC

TABLE 295 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 296 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 297 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 298 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 299 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 300 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

TABLE 301 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 302 ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

15.5.1 CHINA

15.5.1.1 Innovation in R&D for Alzheimer’s disease and a post-pandemic boost in the nutritional and dietary supplements segment to drive the growth

TABLE 303 CHINA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 304 CHINA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.5.2 JAPAN

15.5.2.1 Rising mental cognitive issues to drive the demand for phospholipid products

TABLE 305 JAPAN: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 306 JAPAN: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.5.3 AUSTRALIA & NEW ZEALAND

15.5.3.1 New product launches in the market to drive the growth

TABLE 307 AUSTRALIA & NEW ZEALAND: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 308 AUSTRALIA & NEW ZEALAND: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.5.4 INDIA

15.5.4.1 Presence of a significant number of players and new business opportunities in the post-pandemic era to drive demand

TABLE 309 INDIA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 310 INDIA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.5.5 REST OF ASIA PACIFIC

TABLE 311 REST OF ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 312 REST OF ASIA PACIFIC: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.6 SOUTH AMERICA

TABLE 313 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 314 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 315 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (TONS)

TABLE 316 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (TONS)

TABLE 317 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 318 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 319 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 320 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

TABLE 321 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 322 SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

15.6.1 BRAZIL

15.6.1.1 Usage of phospholipids in personal care & beauty products and increased stress & mental anxiety issues due to the pandemic to drive the growth of phospholipids

TABLE 323 BRAZIL: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 324 BRAZIL: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.6.2 ARGENTINA

15.6.2.1 Large domestic pharmaceutical market, coupled with a significant geriatric population, to be key contributors to the growth of phospholipids

TABLE 325 ARGENTINA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 326 ARGENTINA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.6.3 REST OF SOUTH AMERICA

TABLE 327 REST OF SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 328 REST OF SOUTH AMERICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.7 REST OF THE WORLD

TABLE 329 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 330 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 331 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 332 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 333 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (TONS)

TABLE 334 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (TONS)

TABLE 335 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 336 REST OF THE WORLD: PHOSPHOLIPIDS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

15.7.1 MIDDLE EAST

15.7.1.1 High popularity of beauty and cosmetic products and R&D in the treatment of diseases present new business opportunities for phospholipids

TABLE 337 MIDDLE EAST: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 338 MIDDLE EAST: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

15.7.2 AFRICA

15.7.2.1 Cosmetics and healthcare segment to drive the demand for phospholipids

TABLE 339 AFRICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2018–2021 (USD MILLION)

TABLE 340 AFRICA: PHOSPHOLIPIDS MARKET SIZE, BY SOURCE, 2022–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 238)

16.1 OVERVIEW

16.2 MARKET SHARE ANALYSIS, 2021

TABLE 341 LECITHIN & PHOSPHOLIPIDS MARKET SHARE ANALYSIS, 2021

16.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 50 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

16.4 COVID-19-SPECIFIC COMPANY RESPONSE

16.4.1 ADM

16.4.2 CARGILL

16.4.3 DUPONT

16.4.4 BUNGE LIMITED

16.4.5 IMCD GROUP B.V.

16.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

16.5.1 STARS

16.5.2 PERVASIVE PLAYERS

16.5.3 EMERGING LEADERS

16.5.4 PARTICIPANTS

FIGURE 51 LECITHIN & PHOSPHOLIPIDS MARKET, COMPANY EVALUATION QUADRANT, 2021

16.6 LECITHIN PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 342 COMPANY FOOTPRINT, BY LECITHIN SOURCE

TABLE 343 COMPANY FOOTPRINT, BY LECITHIN TYPE

TABLE 344 COMPANY FOOTPRINT, BY LECITHIN APPLICATION

TABLE 345 COMPANY FOOTPRINT, BY LECITHIN NATURE

TABLE 346 COMPANY REGIONAL, BY LECITHIN REGIONAL FOOTPRINT

TABLE 347 OVERALL COMPANY FOOTPRINT, LECITHIN MARKET

16.7 PHOSPHOLIPIDS PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 348 COMPANY FOOTPRINT, BY PHOSPHOLIPIDS SOURCE

TABLE 349 COMPANY FOOTPRINT, BY PHOSPHOLIPIDS APPLICATION

TABLE 350 COMPANY REGIONAL, BY PHOSPHOLIPIDS REGIONAL FOOTPRINT

TABLE 351 OVERALL COMPANY FOOTPRINT, PHOSPHOLIPIDS MARKET

16.8 LECITHIN & PHOSPHOLIPIDS MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

16.8.1 PROGRESSIVE COMPANIES

16.8.2 STARTING BLOCKS

16.8.3 RESPONSIVE COMPANIES

16.8.4 DYNAMIC COMPANIES

FIGURE 52 LECITHIN & PHOSPHOLIPIDS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 352 LECITHIN: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

TABLE 353 PHOSPHOLIPIDS: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

16.9 COMPETITIVE SCENARIO

16.9.1 NEW PRODUCT LAUNCHES

TABLE 354 LECITHIN & PHOSPHOLIPIDS MARKET: NEW PRODUCT LAUNCHES, 2018-2021

16.9.2 DEALS

TABLE 355 LECITHIN & PHOSPHOLIPIDS MARKET: DEALS, 2018-2022

16.9.3 OTHERS

TABLE 356 LECITHIN & PHOSPHOLIPIDS MARKET: OTHERS, 2019-2021

17 COMPANY PROFILES (Page No. - 255)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

17.1 KEY PLAYERS

17.1.1 CARGILL

TABLE 357 CARGILL: BUSINESS OVERVIEW

FIGURE 53 CARGILL: COMPANY SNAPSHOT

TABLE 358 CARGILL: PRODUCTS OFFERED

TABLE 359 CARGILL: NEW PRODUCT LAUNCHES

17.1.2 ADM

TABLE 360 ADM: BUSINESS OVERVIEW

FIGURE 54 ADM: COMPANY SNAPSHOT

TABLE 361 ADM: PRODUCTS OFFERED

TABLE 362 ADM: DEALS

17.1.3 DUPONT

TABLE 363 DUPONT: BUSINESS OVERVIEW

FIGURE 55 DUPONT: COMPANY SNAPSHOT

TABLE 364 DUPONT: PRODUCTS OFFERED

TABLE 365 DUPONT: DEALS

TABLE 366 DUPONT: OTHERS

17.1.4 IMCD GROUP BV.

TABLE 367 IMCD GROUP BV: BUSINESS OVERVIEW

FIGURE 56 IMCD GROUP BV: COMPANY SNAPSHOT

TABLE 368 IMCD GROUP BV: PRODUCTS OFFERED

TABLE 369 IMCD GROUP B.V.: DEALS

17.1.5 BUNGE LIMITED

TABLE 370 BUNGE LIMITED: BUSINESS OVERVIEW

FIGURE 57 BUNGE LIMITED: COMPANY SNAPSHOT

TABLE 371 BUNGE LIMITED: PRODUCTS/OFFERED

TABLE 372 BUNGE LIMITED: DEALS

17.1.6 STERN-WYWIOL GRUPPE

TABLE 373 STERN-WYWIOL GRUPPE: BUSINESS OVERVIEW

TABLE 374 STERN-WYWIOL GRUPPE: PRODUCTS OFFERED

TABLE 375 STERN-WYWIOL GRUPPE: NEW PRODUCT LAUNCHES

17.1.7 WILMAR INTERNATIONAL LTD

TABLE 376 WILMAR INTERNATIONAL LTD: BUSINESS OVERVIEW

FIGURE 58 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

TABLE 377 WILMAR INTERNATIONAL LTD: PRODUCTS OFFERED

17.1.8 SONIC BIOCHEM

TABLE 378 SONIC BIOCHEM: BUSINESS OVERVIEW

TABLE 379 SONIC BIOCHEM: PRODUCTS OFFERED

17.1.9 AVRIL GROUP

TABLE 380 AVRIL GROUP: BUSINESS OVERVIEW

TABLE 381 AVRIL GROUP: PRODUCTS OFFERED

TABLE 382 AVRIL GROUP: DEALS

17.1.10 AMERICAN LECITHIN COMPANY

TABLE 383 AMERICAN LECITHIN COMPANY: BUSINESS OVERVIEW

TABLE 384 AMERICAN LECITHIN COMPANY: PRODUCTS OFFERED

17.2 OTHER PLAYERS

17.2.1 VAV LIFE SCIENCES PVT LTD.

TABLE 385 VAV LIFE SCIENCES PVT LTD.: BUSINESS OVERVIEW

TABLE 386 VAV LIFE SCIENCES PVT LTD.: PRODUCTS OFFERED

TABLE 387 VAV LIFE SCIENCES PVT LTD.: DEALS

TABLE 388 VAV LIFE SCIENCES PVT LTD.: OTHERS

17.2.2 SONDRUGESTVO GROUP

TABLE 389 SONDRUGESTVO GROUP: BUSINESS OVERVIEW

TABLE 390 SONDRUGESTVO GROUP: PRODUCTS OFFERED

17.2.3 KEWPIE CORPORATION

TABLE 391 KEWPIE CORPORATION: BUSINESS OVERVIEW

FIGURE 59 KEWPIE CORPORATION: COMPANY SNAPSHOT

TABLE 392 KEWPIE CORPORATION: PRODUCTS OFFERED

17.2.4 FISMER LECITHIN

TABLE 393 FISMER LECITHIN: BUSINESS OVERVIEW

TABLE 394 FISMER LECITHIN: PRODUCTS OFFERED

TABLE 395 FISMER LECITHIN: DEALS

17.2.5 LIPOID GMBH

TABLE 396 LIPOID GMBH: BUSINESS OVERVIEW

TABLE 397 LIPOID GMBH: PRODUCTS OFFERED

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

17.3 OTHER PLAYERS

17.3.1 SIME DARBY OILS

17.3.2 LECITAL

17.3.3 LASENOR EMUL, S.L.,

17.3.4 SUN NUTRAFOODS

17.3.5 LECILITE INGREDIENTS PVT. LTD.

18 ADJACENT AND RELATED MARKETS (Page No. - 298)

18.1 INTRODUCTION

TABLE 398 ADJACENT MARKETS TO LECITHIN & PHOSPHOLIPIDS MARKET

18.2 LIMITATIONS

18.3 FOOD EMULSIFIERS MARKET

18.3.1 MARKET DEFINITION

18.3.2 MARKET OVERVIEW

TABLE 399 FOOD EMULSIFIERS MARKET, BY SOURCE, 2020–2025 (USD MILLION)

18.4 DE-OILED LECITHIN MARKET

18.4.1 MARKET DEFINITION

18.4.2 MARKET OVERVIEW

TABLE 400 DE-OILED LECITHIN MARKET SIZE, BY SOURCE, 2016–2023 (USD MILLION)

19 APPENDIX (Page No. - 301)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

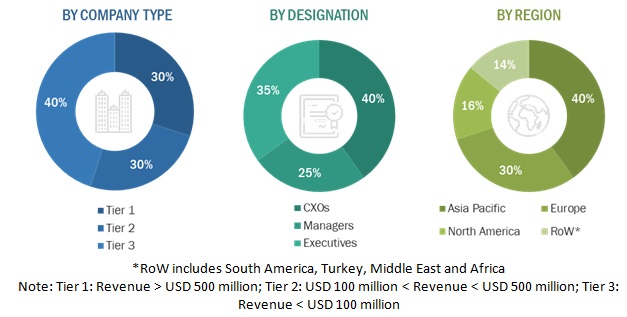

The study involved four major activities in estimating lecithin & phospholipids market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of processed food & beverage manufacturers, and government & research organizations. The supply side is characterized by the presence of lecithin & phospholipids product manufacturer, distributors, marketing directors, research officers and quality control officers, and key executives from various key companies and organizations operating in lecithin & phospholipids market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Lecithin and Phospholipids Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of lecithin & phospholipids market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of lecithin & phospholipids market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Lecithin Granules and Granulated Lecithin are impacting in the Lecithin & Phospholipids Market:

Lecithin Granules are a type of lecithin that is derived from soybeans or other sources, and are used in a variety of food and industrial applications. They are often used as an emulsifier and stabilizer in foods, and can also be used as a supplement to support brain and liver health.

Granulated Lecithin, on the other hand, is a highly refined form of lecithin that is used in a variety of industrial applications, including cosmetics, pharmaceuticals, and animal feed. It is often used as a natural emulsifier and dispersant, and can also be used to improve the texture and stability of various products.

Overall, the Lecithin and Phospholipids market is driven by the growing demand for natural and functional ingredients in various industries, including food, pharmaceuticals, and cosmetics. As a result, both Lecithin Granules and Granulated Lecithin are likely to continue to be important products in this market.

Manufacturers seeking new business opportunities in Organic Lecithin Market:

The organic lecithin market is a growing sector that presents many opportunities for manufacturers looking to expand their business. Organic lecithin is a natural emulsifier that is widely used in the food, pharmaceutical, and cosmetic industries. It is derived from soy, sunflower, or rapeseed and is available in various forms such as liquid, powder, and granules. Here are some potential business opportunities for manufacturers in the organic lecithin market:

Develop new organic lecithin products: There is a growing demand for organic and clean label products in the food industry. Manufacturers can capitalize on this trend by developing new organic lecithin products such as organic emulsifiers, organic food supplements, and organic cosmetics.

Offer customized organic lecithin solutions: Manufacturers can offer customized organic lecithin solutions to their customers based on their specific needs. For example, they can provide organic lecithin with different phospholipid contents, different colors, and flavors to meet customer requirements.

Expand their distribution network: Organic lecithin is used in various industries, and manufacturers can expand their distribution network to reach more customers. They can collaborate with distributors, wholesalers, and retailers to ensure their products are readily available to customers.

Invest in research and development: As the organic lecithin market grows, there will be a need for new and innovative products. Manufacturers can invest in research and development to create new organic lecithin products that meet customer demands and preferences.

Focus on sustainability: Consumers are increasingly conscious of the environmental impact of products. Manufacturers can focus on sustainability by sourcing organic lecithin from sustainable sources, reducing waste, and using environmentally friendly packaging.

In summary, the organic lecithin market presents many opportunities for manufacturers looking to expand their business. By developing new products, offering customized solutions, expanding their distribution network, investing in research and development, and focusing on sustainability, manufacturers can take advantage of the growing demand for organic lecithin in various industries.

Report Objectives

- Determining and projecting the size of the lecithin market, with respect to its source, type, nature, application and regional markets, from 2021 to 2026

- Determining and projecting the size of the phospholipids market, with respect to its source, application and regional markets, from 2021 to 2026

- To describe and forecast lecithin & phospholipids market, in terms of value, by region–North America, Europe, Asia Pacific, South America and the Rest of the World—along with their respective countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of lecithin & phospholipids market

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in lecithin & phospholipids market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific lecithin & phospholipids market, by key country

- Further breakdown of the Rest of European lecithin & phospholipids market, by key country

- Further breakdown of the Rest of South America lecithin & phospholipids market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lecithin and Phospholipids Market