Global Body in White Market by Vehicle Type, Construction (Monocoque, Frame Mounted), Manufacturing Method (Cold Stamping, Hot Stamping, Roll Forming), Material (Steel, Aluminum, Magnesium, CFRP), and Region - Global Forecast to 2027

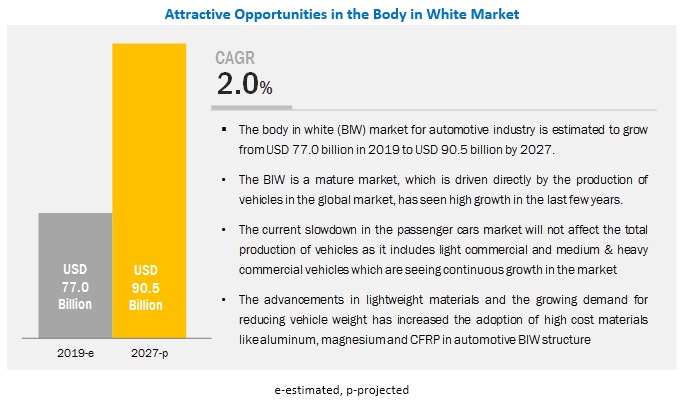

[151 Pages Report] The global body in white market for automotive size was valued at USD 77.0 billion in 2019 and is expected to reach USD 90.5 billion by 2027, at a CAGR of 2.0% during the forecast period 2022-2027. . Increasing global vehicle production of passenger cars, electric vehicles, light commercial vehicles and medium & heavy commercial vehicles along with a reduction in the vehicle weight to meet the fuel economy and emission standards are expected to boost the market. However, the high cost of manufacturing methods is considered as a restraining factor for the growth in the market.

Electric vehicles sales segment is estimated to witness the fastest growth during the forecast period

Increasing electric vehicle sales is another driver for the BIW revenue growth, as these vehicles require lightweight solutions in the form of material as well as manufacturing methods to achieve higher mileage by the battery. Majority of the BIW component manufacturers have introduced new lightweight solutions for their customers, which are in line with the electric vehicles manufacturing safety standards.

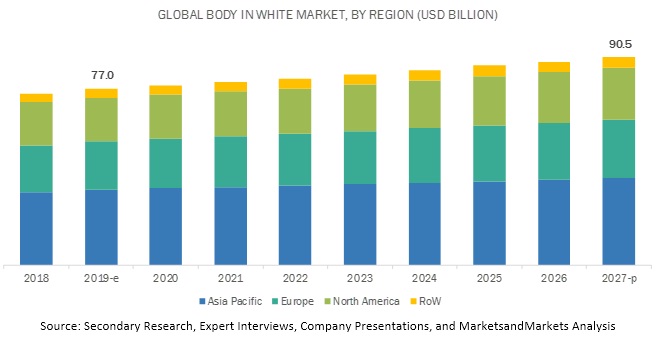

Asia Pacific is expected to be the largest market during the forecast period

The Asia Pacific region was the largest market for body in white in the world in 2018. This market has witnessed rapid year-on-year growth, even with a slowdown in the production of passenger cars; however, the other vehicle segments have been steadily growing, and there is no adverse impact on the market revenue with the increase in the adoption of lightweight solutions.

China has been the major contributor to the BIW market in the APAC region, with approximately 25 million cars produced every year. It is the largest revenue generator for the market. However, Japan is estimated to be the fastest-growing market with the adoption of strong emission regulations and purchase of electric vehicles with lightweight solutions, which makes the region the largest revenue market for BIW globally.

Europe market is expected to register the fastest growth during the forecast period

Europe is estimated to be the fastest-growing market during the forecast period. Germany is expected to lead the market due to the presence of large automakers and focus on R&D on new technology. The massive sales of electric vehicles in the region coupled with the projected boost in sales due to the presence of supporting regulations towards the manufacture and use of these automobiles is expected to subsequently drive the growth of the market during the forecast period.

Key Market Players

The body in white market is led by globally and regionally established players such as Gestamp Automoción (Spain), Voestalpine Group (Austria), Magna (Canada), Benteler International (Austria), CIE Automotive (Spain), Tower International (US), Martinrea International (Canada), Aisin Seiki (Japan), KIRCHHOFF Automotive (Germany), Dura Automotive (US), Thyssenkrupp (Germany), and JBM Auto (India). These companies have strong distribution networks at a global and regional level. In addition, these companies offer an extensive product range in this market. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units) |

|

Segments covered |

Vehicle Type, Construction, Manufacturing Method, Material |

|

Geographies covered |

Asia Pacific, Europe, North America and RoW (Brazil South Africa, and others) |

|

Companies Covered |

Gestamp Automoción (Spain), Voestalpine Group (Austria), Magna (Canada), Benteler International (Austria), CIE Automotive (Spain), Tower International (US), Martinrea International (Canada), Aisin Seiki (Japan), KIRCHHOFF Automotive (Germany), Dura Automotive (US), Thyssenkrupp (Germany) and JBM Auto (India). |

This research report categorizes the given market based on vehicle type, construction, manufacturing method, material and region

Based on vehicle type, it has been segmented as follows:

- Passenger Cars

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Electric Vehicles (BEV passenger cars)

Based on Construction Type, the given market has been segmented as follows:

- Monocoque

- Frame Mounted

Based on Manufacturing Method, the market has been segmented as follows:

- Cold Stamping

- Hot Stamping

- Roll Forming

- Other Methods

Based on Material Type, the market has been segmented as follows:

- Steel

- Aluminum

- Magnesium

- CFRP

Based on the region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- RoW (South America, and the Middle East & Africa)

Recent Developments

- In July 2019, Tower International Inc. was acquired by Autokiniton Global Group at a value of USD 900 million. Autokiniton agreed to buy all outstanding shares of Tower for USD 31 per share in cash.

- In June 2019, Gestamp inaugurated a new plant specializing in aluminum in Nitra (Slovakia). The company invested nearly EUR 130 million for the new facility that intends to serve Jaguar Land Rover who recently commenced operations in Slovakia. The plant manufactures several skin panels and structural parts for the body made mainly using aluminum together with steel.

- In June 2019, Benteler opened a new plant in Mos, Spain. The plant is part of the company’s Automotive Division and will produce rear-axle components for a new platform for its customer PSA, a global automotive manufacturer. Additionally, the production in Mos will focus on welding, painting, and laser cutting.

- In June 2019, CIE Automotive acquired 100% of the share capital of the companies Maquinados de Precisión de México S. de R.L de C.V. and Cortes de Precisión de Mexico S. de R.L de C.V. The facilities are located in Celaya, in the Mexican state of Guanajuato - the largest automobile corridor in Mexico - and were key suppliers of machining components to Tier I automotive companies.

- In May 2019, Voestalpine opened a new R&D facility in Donawitz, Austria. The facility will cater to the development of steel, which will serve as the base for new concepts in mobility, energy, and infrastructure.

- In May 2019, KIRCHHOFF Automotive opened its second plant in Piteºti, Romania. KIRCHHOFF Automotive invested around USD 10 million in the plant. The automatic servo presses with pressing forces from 250 to 630 tons are state-of-the-art for cold forming. The plant in Piteºti supplies European KIRCHHOFF Automotive locations as well as customers in Eastern Europe with stamping parts.

Critical Questions:

- Many component manufacturers are expanding the market through expansions into other markets; how will this help the market grow?

- How will developments in passenger cars, light commercial vehicles, medium & heavy commercial vehicles by leading manufacturers will change the dynamics of this market?

- The industry is focusing on light-weighting in electric vehicles and ICE vehicles. Which are the leading companies who are working light-weighting for electric vehicles, and what organic and inorganic strategies have been adopted by them?

- Analysis of your competition that includes major players in this market ecosystem. The major players are Gestamp Automoción, Voestalpine Group, Magna International, Benteler International, CIE Automotive, Tower International, Martinrea International, Aisin Seiki, KIRCHHOFF Automotive, Dura Automotive, Thyssenkrupp, and JBM Auto.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Ket Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Global Body in White Market is Expected to Increase With Increasing Vehicle Production During the Forecast Period (2019–2027)

4.2 Asia Pacific is Expected to Lead the Market

4.3 Global Market, By Construction Type, 2019 vs. 2027 (USD Billion)

4.4 Global Market, By Manufacturing Method, 2019 vs. 2027 (USD Billion)

4.5 Global Biw Market, By Materials Type, 2019 vs. 2027 (USD Billion)

4.6 Global Market, By Region, 2019 vs. 2027 (USD Billion)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Global Vehicle Production in Terms of Passenger Vehicles, Electric Vehicles, and Heavy Commercial Vehicles

5.2.1.2 Need for Reduction in Vehicle Curb Weight to Meet Emission Standards and Fuel Efficiency

5.2.2 Restraints

5.2.2.1 High Material Cost for Light Weight Solutions

5.2.2.2 Higher Investment and Operation Cost for Hot Stamping

5.2.3 Opportuniies

5.2.3.1 Advancements in Manufacturing Processes for High Strength Material and Reduction in Component Weight

5.2.3.2 Development of Ev-Specific Battery Trays Components for Biw

5.2.4 Challenges

5.2.4.1 Technical Challenges and Lower Formability in Joining Other Materials With Steel Components

5.2.4.2 High Composite Material Usage Could Lead to Lower Structural Integrity

6 Industry Trends (Page No. - 44)

6.1 Vehicle Emission Regulations and Safety Standards

6.2 Manufacturing Processes and Materials Used for Biw

6.3 Porter’s Five Forces Analysis

7 Global Body in White Market, By Vehicle Type (Page No. - 46)

7.1 Introduction

7.2 Research Methodology

7.3 Passenger Vehicles

7.3.1 The Vehicle Production has Seen A Huge Increase in Asia Pacific Owing to the Increased Mobility Needs and Nature of Emerging Economies in China and India

7.4 Light Commercial Vehicles (LCV)

7.4.1 North America Will Lead the Biw LCV Market in Terms of Volume and Value With the Increasing Transportation Demand for the Last Mile Delivery Through LCVs

7.5 Medium & Heavy Commercial Vehicles (MHCV)

7.5.1 Rise in Stringent Norms to Reduce Emissions in MHCV Segment Will Cause Oems to Shift to Lightweight Solutions in the Biw Structure

7.6 Electric Vehicles

7.6.1 to Provide More Miles Per Charge the Electric Vehicle Biw Structures are Made of Lightweight Materials That are Increasing the Biw Market Value

8 Global Body in White Market, By Consturction Type (Page No. - 55)

8.1 Introduction

8.2 Research Methodology

8.3 Monocoque

8.3.1 Monocoque Constructions are Slowly Being Adopted Into Bigger Vehicles Which Can Provide More Light Weight Solution

8.4 Frame Mounted

8.4.1 Frame Mounted Consrtuction Will See an Increase in Europe Due to the Increase in Efforts Related to Weight Reduction

9 Global Body in White Market, By Manufacturing Method (Page No. - 61)

9.1 Introduction

9.2 Research Methodology

9.3 Cold Stamping

9.3.1 Cold Stamping Will Continue to Be the Most Prominent and Economical Method of Stamping Globally for Biw Parts

9.4 Hot Stamping

9.4.1 Asia Pacific Will Be the Fastest Growing Adopter of Hot Stamping

9.5 Roll Forming

9.5.1 China has Been and Will Be the Largest Adopter of Roll Forming

9.6 Advanced Methods

9.6.1 The Market Penetration of Advanced Technology is Governed By the Nature of Materials That is Used for Biw Applications

10 Global Body in White Market, By Material Type (Page No. - 68)

10.1 Introduction

10.2 Research Methodology

10.3 Steel

10.3.1 Steel Will Have the Largest Market in Biw Due to Its Formability, But Will Have A Decrease in Application By A Small Margin Owing to Increasing Adoption of A Multimaterial Body

10.4 Aluminium

10.4.1 Aluminum Will Be the Fastest Growing Segment in North American Region Due to the High Buying Power of Consumers

10.5 Magnesium

10.5.1 Driven By Collaborations Between Oems and Tier 1 R&D Developments North America Will Be the Earliest Adopter of Magnesium for Biw

10.6 CFRP

10.6.1 The High Market Penetration of CFRP Will Be Solely Dependant on Superior Manufacturing Process and Increased Structural Integrity

11 Global Body in White Market, By Region (Page No. - 77)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.1.1 China Being the Largest Vehicle Producer is Expected to Lead the Biw Market

11.2.2 Japan

11.2.2.1 Japan With Strong Emission Norms is Not Expected to See Much Growth in Biw Market

11.2.3 South Korea

11.2.3.1 South Korea is Not Expected to Adopt New Methods Or Materials for Biw Market Advancements

11.2.4 India

11.2.4.1 India With Upcoming Emission Regulations is Expected to Adopt More Lightweight Solutions for Biw

11.3 North America

11.3.1 US

11.3.1.1 US Light Commercial Vehicle is Expected to Be the Largest Lightweight Adoption Market for Biw

11.3.2 Mexico

11.3.2.1 Mexico Market Will See an Increase in the Biw Market Owing to Its Exports to Other Countries

11.3.3 Canada

11.3.3.1 Canada is Expected to Be Stagnant With Not Much Increase in Biw Production

11.4 Europe

11.4.1 Germany

11.4.1.1 Germany Will Be the Largest and Fastest Growing Market for Biw Production

11.4.2 France

11.4.2.1 France Will Adopt the Euro Emission Standards With Major Market Growth in MHCV Segment

11.4.3 UK

11.4.3.1 UK Passenger Vehicle Segment Will See the Biggest Market Value for Biw Production

11.4.4 Spain

11.4.4.1 Spain MHCV Segment Will See the Fastest Adoption of Biw Lightweight Solutions

11.4.5 Russia

11.4.5.1 Russia Will Likely Adopt the Euro Emission Standards Which Will Be See A Large Market in Biw of Passenger Vehicles

11.4.6 Others

11.4.6.1 The Other European Countries Combined Will Largely See Growth in MHCV Segment With Adoption of Emission Norms for Heavy Duty Vehicles

11.5 Rest of the World

11.5.1 Brazil

11.5.1.1 Brazil is Expected to Continue Its Growth in Biw Market With the Increase in Its Vehicle Production

11.5.2 South Africa

11.5.2.1 South Africa With No Stringent Emission Norms in Vehicle Weight Reduction is Expected to Continue Its Growth According to Market Demand

11.5.3 Others

11.5.3.1 The Other Global Countries Adoption of Emission Norms is Stagnant, So Biw Market is Expected to Cater to the Demand of Vehicle Production

12 Competitive Landscape (Page No. - 105)

12.1 Overview

12.2 Competitive Scenario

12.2.1 Partnerships/Supply Contracts/Collaborations/Joint Ventures/ Agreements

12.3 Competitive Leadership Mapping for Body in White Market

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Companies

12.4 Strength of Product Portfolio

12.5 Business Strategy Excellence

13 Company Profiles (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Gestamp Automoción

13.2 Tower International

13.3 Martinrea International

13.4 Benteler International

13.5 Voestalpine Group

13.6 CIE Automotive

13.7 Magna International

13.8 Aisin Seiki

13.9 KIRCHHOFF Automotive

13.10 JBM Auto

13.11 Thyssenkrupp Group

13.12 Dura Automotive

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 144)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (79 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Impact of Market Dynamics

Table 3 Body in White Market Size, By Vehicle Type, 2018–2027 (000’ Units)

Table 4 Market Size, By Vehicle Type, 2018–2027 (USD Billion)

Table 5 Market: By Electric Vehicle, for Passenger Car, 2018-2027 (000' Units)

Table 6 Market Size: By Electric Vehicle, for Passenger Car, 2018-2027 (USD Million)

Table 7 Market: Passenger Vehicles, By Region, 2018–2027 (000’ Units)

Table 8 Market: Passenger Vehicles, By Region, 2018–2027 (USD Billion)

Table 9 Market: LCV, By Region, 2018–2027 (000’ Units)

Table 10 LCV Biw Market: Body in White Market, By Region, 2018–2027 (USD Billion)

Table 11 MHCV: Market, By Region, 2018–2027 (000’ Units)

Table 12 MHCV: Market, By Region, 2018–2027 (USD Billion)

Table 13 Electric Vehicle (Passenger Car): Market, By Region, 2018–2027 (000’ Units)

Table 14 Electric Vehicle (Passenger Car): Market, By Region, 2018–2027 (USD Million)

Table 15 Market: By Construction Type, 2018–2027 (000’ Units)

Table 16 Market, By Construction Type, 2018–2027 (USD Billion)

Table 17 Monocoque: Market, By Region, 2018–2027 (000’ Units)

Table 18 Monocoque: Market, By Region, 2018–2027 (USD Billion)

Table 19 Frame Mounted: Market, By Region, 2018–2027 (000’ Units)

Table 20 Frame Mounted: Market, By Region, 2018–2027 (USD Billion)

Table 21 Body in White Market, By Manufacturing Method, 2018–2027 (USD Billion)

Table 22 Cold Stamping: Market, By Region, 2018–2027 (USD Million)

Table 23 Hot Stamping: Market, By Region, 2018–2027 (USD Million)

Table 24 Roll Forming: Market, By Region, 2018–2027 (USD Million)

Table 25 Advanced Methods: Market, By Region, 2018–2027 (USD Million)

Table 26 Market, By Material Type, 2018-2027 (Tmt)

Table 27 Market, By Material Type, 2018-2027 (USD Billion)

Table 28 Steel: Market, By Region, 2018–2027 (Tmt)

Table 29 Steel: Market, By Region, 2018–2027 (USD Million)

Table 30 Aluminium: Market, By Region, 2018–2027 (Tmt)

Table 31 Aluminium: Market, By Region, 2018–2027 (USD Million)

Table 32 Magnesium: Market, By Region, 2018–2027 (Tmt)

Table 33 Magnesium: Market, By Region, 2018–2027 (USD Million)

Table 34 CFRP: Market, By Region, 2018–2027 (Tmt)

Table 35 CFRP: Market, By Region, 2018–2027 (USD Million)

Table 36 Body in White Market Size, By Region, 2018–2027 (000’ Units)

Table 37 Market Size, By Region, 2018–2027 (USD Billion)

Table 38 Asia Pacific: Market, By Country, 2018–2027 (000’ Units)

Table 39 Asia Pacific: Market, By Country, 2018–2027 (USD Billion)

Table 41 China: Market, By Vehicle Segment, 2018-2027 (USD Million)

Table 43 Japan: Market, By Vehicle Segment, 2018-2027 (USD Million)

Table 44 South Korea: Market, By Vehicle Segment, 2018-2027 (000’ Units)

Table 45 South Korea: Market, By Vehicle Segment, 2018-2027 (USD Million)

Table 46 India: Market, By Vehicle Segment, 2018-2027 (000’ Units)

Table 47 India: Market, By Vehicle Segment, 2018-2027 (USD Million)

Table 48 North America: Market, By Country, 2018–2027 (000’ Units)

Table 49 North America: Market, By Country, 2018–2027 (USD Billion)

Table 50 US : Body in White Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 51 US: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 52 Mexico: Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 53 Mexico: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 54 Canada : Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 55 Canada : Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 56 Europe: Market, By Country, 2018–2027 (000’ Units)

Table 57 Europe: Market, By Country, 2018–2027 (USD Billion)

Table 58 Germany: Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 59 Germany: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 60 France: Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 61 France: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 63 UK: Body in White Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 64 Spain: Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 65 Spain: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 67 Russia: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 69 Others: Market, By Vehicle Segment, 2018–2027 (USD Billion)

Table 71 RoW: Market, By Country, 2018–2027 (USD Billion)

Table 72 Brazil : Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 73 Brazil: Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 74 South Africa : Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 75 South Africa : Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 76 Others: Market, By Vehicle Segment, 2018–2027 (000’ Units)

Table 77 Others : Body in White Market, By Vehicle Segment, 2018–2027 (USD Million)

Table 78 New Product Developments/Expansion, 2016-2019

Table 79 Partnerships/Supply Contracts/Collaborations/Joint Ventures/ Agreements, 2016-2019

List of Figures (45 Figures)

Figure 1 Market Segmentation: Body in White Market

Figure 2 Market: Research Designs

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Global Vehicle Biw Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Dynamics

Figure 8 Global Biw Market, By Region, 2019–2027 (USD Billion)

Figure 9 Passenger Vehicles to Hold the Largest Share in Terms of Value During 2019-2027 (USD Billion)

Figure 10 Body in White Market Growth is Fueled By the Increasing Use of Light Weight Materials

Figure 11 The E-Mobility Push Combined With the Usage of Advanced Materials Will Drive The Biw Market for Electric Vehicles

Figure 12 Market Share, By Region, 2019

Figure 13 Frame Mounted Construction to Grow Faster Than Monocoque Because of Increased Weight Reduction Efforts in Heavy Duty Vehicles to Reduce The Emissions

Figure 14 The Usage of Materials Such as Aluminum and Magnesium Will Accelarate The Manufacturing Methods Such as Hot Stamping and Roll Forming,w While Cold Stamping Will Remain The Largest Market for Its Cost-Effectiveness

Figure 15 The Penetration of Advanced Materials in Biw Will Be Accelerated By Developments in Manufcaturing Processes and Falling Material Prices,

Figure 16 Europe Will Be The Fastest Growing Market Because of The Stringent Emission Norms

Figure 17 Market: Market Dynamics

Figure 18 Medium & Heavy Commercial Vehicles Expected to Grow at A Higher CAGR During The Forecast Period (2019–2027)

Figure 19 Key Primary Insights

Figure 20 Frame Mounted is Expected to Grow at The Highest CAGR During The Forecast Period (2019–2027)

Figure 21 Key Primary Insights

Figure 22 Hot Stamping Manufacturing Method Will Gain More Market for Creating Lightweight Parts for Biw Structure

Figure 23 Key Primary Insights

Figure 24 Aluminium Will Gain Prominence as The Material of Choice for Biw With Increased Material Composition During The Forecast Period 2019-2027.

Figure 25 Key Primary Insights

Figure 26 Europe is Projected to Be The Market With The Fastest Growth, Growing at A CAGR of 2.4%

Figure 27 Europe is Expected to Grow at A Highest CAGR During The Forecast Period for Biw Market (2019–2027)

Figure 28 Asia Pacific: Body in White Market Snapshot

Figure 29 North America: Market, By Country, 2019 vs. 2027 (USD Billion)

Figure 30 Europe: Market Snapshot

Figure 31 Rest of The World: Market, By Country, 2019 vs. 2027 (USD Billion)

Figure 32 Key Developments By Leading Players in The Market, 2016–2019

Figure 33 Ranking of Key Players for Body in White, 2018

Figure 34 Global Body in White Market: Competitive Leadership Mapping, 2018

Figure 40 CIE Automotive: Company Snapshot

Figure 41 Magna International: Company Snapshot

Figure 42 Aisin Seiki: Company Snapshot

Figure 43 KIRCHHOFF Automotive: Company Snapshot

Figure 44 JBM Auto: Company Snapshot

Figure 45 Thyssenkrupp Group: Company Snapshot

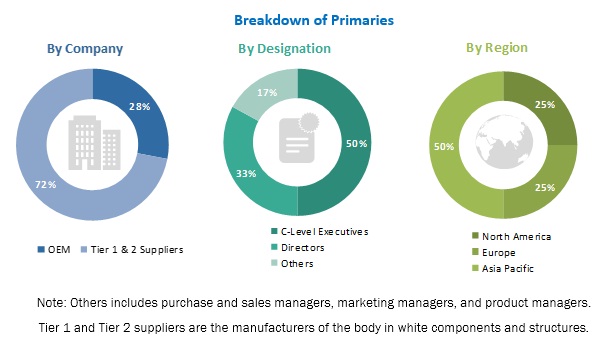

The study involved four major activities in estimating the current market size of the body in white market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of Automotive Component Manufacturers Association of India (ACMA), European Automobile Manufacturers Association (ACEA), Japan Automobile Manufacturers Association, Inc. (JAMA), Automotive manufacturing solutions (AMS), The international council on clean transportation (ICCT), Asociacion Mexicana De La Industria Automotriz Amia (AMIA) – Mexican Association of the Automotive Industry, Precision Metal forming Association (PMA), Material recycling association of India (MRAI), Fabricators & Manufacturers Association Intl. (FMA), Other component manufacturer associations], magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global body in white market.

Primary Research

Extensive primary research has been conducted after acquiring and understanding of the metal forming market for automotive scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (Maruti Suzuki, NIO, Ford, Tata Motors and others) and supply-side (Benteler, EDAG, Magna and others) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (Latin America, the Middle East, and Africa). Approximately 40% and 60% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, R&D, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the Global Body in white market. In this approach, the vehicle production statistics for each vehicle type (passenger car, LCV, MHCV) at the country and regional levels, respectively, have been considered.

To determine the market size, in terms of volume, by vehicle type, the vehicle production numbers have been considered. The average BIW weight for each vehicle segment has been estimated for all regions by model mapping major vehicles in each country. The value obtained is multiplied with the total vehicle production to get the total BIW weight in tons for each region. To estimate the market value, the material composition of the vehicle in each segment (obtained from primary and secondary research) is multiplied with the BIW weight, and the cost of the materials. The components which are manufactured through a method of forming are identified, and the total share in percentage is considered. The summation of the country-level market gives the regional market and further summation of the regional market provides the global metal forming market for automotive.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To segment and forecast the body in white market size in terms of value (USD million) and volume (units)

- To define, describe, and forecast the body in white market based on vehicle type, construction, manufacturing method, material and region

- To segment and forecast the market size by vehicle type (passenger cars, light commercial vehicles, medium & heavy commercial vehicles and electric vehicles)

- To segment and forecast the market by construction type (monocoque and frame-mounted)

- To segment and forecast the market by manufacturing method (cold stamping, hot stamping, roll forming and other methods)

- to segment and forecast the market by material type (steel, aluminum, magnesium, and CFRP)

- To forecast the market size with respect to key regions, namely, Asia Pacific, Europe, North America, and Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Hot Stamping for BIW, by Vehicle type

- BIW for Electric Vehicle, by Vehicle segment

- Steel for BIW, by Type of steels

- BIW market, by Components

- BIW Manufacturing process, by Advanced manufacturing methods

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Global Body in White Market