Contact Lenses Market Size by Usage (Daily Wear, Extended Wear), Design (Monovision, Spherical, Multifocal, Toric), Material (PMMA, Hybrid, Silicone Hydrogel), Application (Orthokeratology, Decorative Lens), Distribution Channel, Region - Global Forecast to 2025

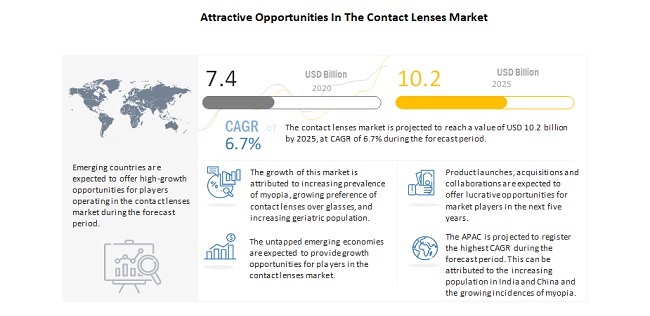

The size of global contact lenses market in terms of revenue was estimated to be worth $7.4 billion in 2020 and is poised to reach $10.2 billion by 2025, growing at a CAGR of 6.7% from 2020 to 2025. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Market growth is driven mainly by the growing prevalence of myopia, increasing preference for contact lenses over prescription eyeglasses, and the growing geriatric population worldwide. The untapped emerging economies are expected to provide growth opportunities for players in the global market. On the other hand, the shortage of ophthalmologists and regulatory barriers are expected to challenge market growth to a certain extent in the coming years. In this report, the global market is segmented based on products and distribution channels.

To know about the assumptions considered for the study, Request for Free Sample Report

Contact Lenses Market Dynamics

Driver: Growing prevalence of myopia

Contact lenses are used to correct vision defects such as myopia, hyperopia, astigmatism, and presbyopia. While their prevalence has risen across the globe, myopia is still the most common worldwide. According to the WHO, the prevalence of myopia is highest in East Asian countries such as China, Japan, South Korea, and Singapore. By 2050, myopia and high myopia are both expected to affect ~4,949 million and ~925 million people, respectively, globally. The growing prevalence of myopia and increasing spending on ophthalmic products, such as contact lenses, as a corrective measure for refractive errors, are expected to drive the growth of the contact lenses industry in the future.

Opportunity: Potential of emerging markets

With a huge population base, developing countries worldwide, including BRIC, Mexico, and South Africa, provide potential growth opportunities for contact lens manufacturers. More than half the world’s population resides in India and China. The geriatric population is expected to increase from 548 million in 2019 to nearly 1.3 billion by 2050, which will drive the prevalence of age-related eye diseases in the region. Increasing awareness of eye disorders, changing lifestyles, growing per capita spending, and market saturation in developed economies are also encouraging market players to expand their presence in these emerging economies.

Challenge: Shortage of ophthalmologists

Although the demand for ophthalmologists has increased significantly—proportional to the growth in the global population—their number has not. This is particularly evident in developing countries. India, for example, has one ophthalmologist for every 90,000 people, while the US has a ratio of 1:15,800. The average number of ophthalmologists per million people varies with the level of economic development, ranging from an average of 9 per million in low-income countries to an average of 79 per million in high-income countries. The global estimated mean for ophthalmologist density was 31.7 per million population. Only 13 countries have more than 100 ophthalmologists per million people (Source: World Bank).

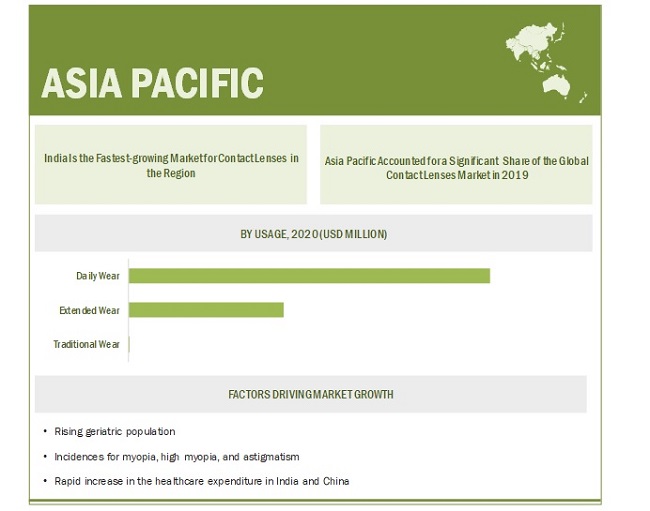

The daily wear contact lenses will have the highest growth rate in the contact lenses industry, by usage, during the forecast period

The contact lenses market, by usage, is segmented into daily wear, extended wear, and traditional contact lenses. The daily wear contact lenses segment had the largest share in 2019. The large share of this segment can be attributed to their advantages—easy wearability, no requirement of lens cleaning (in the case of disposable daily wear contact lenses), and no requirement of overnight wear. These contact lenses do not have the issue of day-to-day accumulation of lens deposits and are more affordable than other types of contact lenses.

The spherical contact lenses had the largest share of the contact lenses industry, by design, in 2019.

Based on the design, the contact lenses market is segmented into spherical, toric, multifocal, monovision, and cosmetic. In 2019, spherical contact lenses accounted for the largest market share of the global market. The large share of this segment can be attributed to the higher adoption of these lenses by optometrists and patients to treat myopia (nearsightedness) or hyperopia (farsightedness) and the rising prevalence of these ailments. However, the multifocal contact lenses segment is estimated to register the highest growth rate during the forecast period.

Retail stores are the largest distribution channel of the contact lenses industry.

Based on the distribution channel, the global contact lenses market is segmented into retail stores, hospitals & clinics, and e-commerce. In 2019, retail stores accounted for the largest share of the global market, followed by hospitals & clinics and e-commerce. The large share of retail stores can be attributed to rising disposable income and the demand for cosmetic contact lenses. Moreover, these stores dispense OTC daily wear disposable contact lenses, resulting in a higher sales volume.

Asia Pacific market to witness the highest growth in the contact lenses industry during the forecast period

The contact lenses market is divided into five regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. These regions are analyzed further at the country levels. North America held the largest share of the global market in 2019, followed by Europe and the Asia Pacific. The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. The Asia Pacific market is driven primarily by the increasing cases of eye diseases, growing geriatric population, and increasing technological advancements in contact lenses.

To know about the assumptions considered for the study, download the pdf brochure

The market is dominated by a few globally established players such as Johnson & Johnson (US), CooperVision (US), Alcon (Switzerland), Carl Zeiss Meditec AG (Germany), and Hoya Corporation (Japan).

Scope of the Contact Lenses Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$7.4 billion |

|

Projected Revenue Size by 2025 |

$10.2 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.7% |

|

Market Driver |

Growing prevalence of myopia |

|

Market Opportunity |

Potential of emerging markets |

The study categorizes the contact lenses market to forecast revenue and analyze trends in each of the following submarkets:

By Products

-

By usage

- Daily Wear

- Extended Wear

- Traditional Wear

-

By design

- Spherical

- Toric

- Multifocal

- Monovision

- Cosmetic

-

By material

- Silicone hydrogel

- Hydrogel

- Gas permeable

- Hybrid

- PMMA

-

By color variation

- Opaque contact lenses

- Enhanced contact lenses

- Visibility tinted contact lenses

-

By application

- Conventional

- Orthokeratology

- Decorative

By Distribution Channel

- Retail stores

- Hospitals & clinics

- E-commerce

Recent Developments of Contact Lenses Industry

- In August 2020, Bausch+Lomb launched -2.75 cylinder for Biotrue ONE Day for Astigmatism daily disposable contact lenses

- In August 2020, Menicon announced the opening of the Menicon Future Device Research Laboratory in Japan

- In July 2020, Bausch + Lomb signed an agreement with KATT DG (Canada).

- In May 2020, SEED Co., Ltd. announced the acquisition of a 90.6% stake in Sensimed AG (a medical device company)

- In July 2019, Johnson & Johnson announced the launch of the Surgical Vision Experience Center at the Johnson & Johnson Institute in Jacksonville, Florida

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global contact lenses market?

The global contact lenses market boasts a total revenue value of $10.2 billion by 2025.

What is the estimated growth rate (CAGR) of the global contact lenses market?

The global contact lenses market has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $7.4 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 CONTACT LENSES MARKET

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 COUNTRY-LEVEL ANALYSIS OF THE GLOBAL MARKET

FIGURE 8 APPROACH 4: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ASSUMPTIONS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 10 CONTACT LENSES INDUSTRY, BY USAGE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY DESIGN, 2020 VS. 2025 (USD MILLION)

FIGURE 12 GLOBAL CONTACT LENSES INDUSTRY, BY MATERIAL, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY DISTRIBUTION CHANNEL, 2020 VS. 2025 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL CONTACT LENSES INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 CONTACT LENSES MARKET OVERVIEW

FIGURE 16 EMERGING COUNTRIES TO OFFER GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ASIA PACIFIC: MARKET, BY USAGE AND COUNTRY (2019)

FIGURE 17 DAILY WEAR CONTACT LENSES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 INDIA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL MARKET (2020?2025)

FIGURE 19 NORTH AMERICA TO DOMINATE THE GLOBAL MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS: IMPACT ANALYSIS

FIGURE 20 CONTACT LENSES MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of myopia

TABLE 1 MYOPIA: GLOBAL PATIENT POPULATION AND PREVALENCE, 2000-2050

5.2.1.2 Growing geriatric population

FIGURE 21 GROWTH IN THE GERIATRIC POPULATION, BY REGION, 2015-2050

5.2.1.3 Increasing preference for contact lenses over prescription eyeglasses

5.2.1.4 Impact Analysis

5.2.2 OPPORTUNITIES

5.2.2.1 Untapped emerging markets

TABLE 2 GROWING GERIATRIC POPULATION IN DEVELOPING REGIONS, 2000-2050

5.2.2.2 Impact Analysis

5.2.3 CHALLENGES

5.2.3.1 Shortage of ophthalmologists

5.2.3.2 Impact Analysis

5.3 REGULATORY SCENARIO FOR THE GLOBAL MARKET

5.3.1 NORTH AMERICA

5.3.1.1 US

TABLE 3 US FDA: MEDICAL DEVICE CLASSIFICATION

5.3.1.2 Canada

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.3.1 Japan

5.3.3.2 China

5.3.3.3 Singapore

5.4 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4.1 COVID-19: IMPACT ON PLAYERS

6 TECHNOLOGICAL SCENARIO (Page No. - 49)

6.1 KEY TECHNOLOGIES IN THE CONTACT LENSES MARKET

TABLE 4 KEY TECHNOLOGIES IN THE GLOBAL MARKET

6.1.1 HYDRACLEAR TECHNOLOGY

6.1.2 ASD TECHNOLOGY

6.1.3 LACREON TECHNOLOGY

6.1.4 PEG TECHNOLOGY

6.1.5 PC TECHNOLOGY

6.1.6 OPTIMIZED TORIC LENS GEOMETRY TECHNOLOGY

6.1.7 DIGITAL ZONE OPTICS LENS DESIGN TECHNOLOGY

6.1.8 LIGHTSTREAM LENS TECHNOLOGY

6.1.9 SMART CONTACT LENS TECHNOLOGY

6.1.10 LIGHT INTELLIGENT/ADAPTIVE TECHNOLOGY

6.2 GLOBAL MARKET: FUTURE OUTLOOK

7 CONTACT LENSES MARKET, BY PRODUCT TYPE (Page No. - 54)

7.1 INTRODUCTION

TABLE 5 GLOBAL CONTACT LENSES INDUSTRY, BY COUNTRY, 2018-2025 (USD MILLION)

7.2 GLOBAL MARKET, BY USAGE

TABLE 6 GLOBAL MARKET, BY USAGE, 2018-2025 (USD MILLION)

7.2.1 DAILY WEAR CONTACT LENSES

7.2.1.1 Daily wear contact lenses accounted for the largest market share in 2019

TABLE 7 MAJOR BRANDS OF DAILY WEAR CONTACT LENSES

TABLE 8 DAILY WEAR CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.2 EXTENDED WEAR CONTACT LENSES

7.2.2.1 Better clinical performance and extended wearability to drive segment growth

TABLE 9 MAJOR BRANDS OF EXTENDED WEAR CONTACT LENSES

TABLE 10 EXTENDED WEAR CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.2.3 TRADITIONAL CONTACT LENSES

7.2.3.1 Market for traditional contact lenses is expected to be cannibalized by daily and extended wear contact lenses

TABLE 11 TRADITIONAL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3 GLOBAL MARKET, BY DESIGN

TABLE 12 GLOBAL MARKET, BY DESIGN, 2018-2025 (USD MILLION)

7.3.1 SPHERICAL CONTACT LENSES

7.3.1.1 The rising prevalence of myopia is driving the growth of the spherical contact-lenses market

FIGURE 22 NUMBER OF PEOPLE WITH MYOPIA (MILLION) AND PREVALENCE OF MYOPIA (%), WORLDWIDE, 2000-2050

TABLE 13 MAJOR BRANDS OF SPHERICAL CONTACT LENSES

TABLE 14 SPHERICAL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.2 TORIC CONTACT LENSES

7.3.2.1 Growing prevalence of astigmatism to drive the growth of the toric contact-lenses market

TABLE 15 MAJOR BRANDS OF TORIC CONTACT LENSES

TABLE 16 TORIC CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.3 MULTIFOCAL CONTACT LENSES

7.3.3.1 Multifocal contact lenses to register the highest growth rate during the forecast period

TABLE 17 MAJOR BRANDS OF MULTIFOCAL CONTACT LENSES

TABLE 18 MULTIFOCAL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.4 MONOVISION CONTACT LENSES

7.3.4.1 Preference for multifocal lenses to slow the adoption of monovision contact lenses

TABLE 19 MONOVISION CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.3.5 COSMETIC CONTACT LENSES

7.3.5.1 The growing trend of changing eye appearance is driving the demand for cosmetic contact lenses

TABLE 20 COSMETIC CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4 GLOBAL MARKET, BY MATERIAL

TABLE 21 CONTACT-LENSES MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

7.4.1 SILICONE HYDROGEL CONTACT LENSES

7.4.1.1 High oxygen permeability of silicone hydrogel contact lenses has driven their adoption

TABLE 22 MAJOR BRANDS OF SILICONE HYDROGEL CONTACT LENSES

TABLE 23 SILICONE HYDROGEL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.2 HYDROGEL CONTACT LENSES

7.4.2.1 The contact-lenses market is experiencing a notable shift from hydrogel to silicone hydrogel contact lenses

TABLE 24 HYDROGEL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.3 GAS-PERMEABLE CONTACT LENSES

7.4.3.1 Gas-permeable contact lenses have replaced non-porous PMMA contact lenses in recent years

TABLE 25 GAS-PERMEABLE CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.4 HYBRID CONTACT LENSES

7.4.4.1 Increasing number of refractive surgeries drive the growth of hybrid contact lenses

TABLE 26 HYBRID CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.4.5 POLYMETHYL METHACRYLATE CONTACT LENSES

7.4.5.1 Growing demand for hydrogel and silicone hydrogel lenses to significantly decrease the adoption of PMMA lenses

TABLE 27 POLYMETHYL METHACRYLATE CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.5 CONTACT-LENSES MARKET, BY COLOR VARIATION

TABLE 28 CONTACT-LENSES MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

7.5.1 OPAQUE CONTACT LENSES

7.5.1.1 Opaque lenses held the largest share of the market, by color variation

TABLE 29 OPAQUE CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.5.2 ENHANCED CONTACT LENSES

7.5.2.1 Growing adoption of enhanced/tinted lenses in the entertainment sector is a key market driver

TABLE 30 ENHANCED CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.5.3 VISIBILITY TINTED CONTACT LENSES

7.5.3.1 Easy availability and the emergence of local players drive the market

TABLE 31 VISIBILITY TINTED CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6 CONTACT-LENSES MARKET, BY APPLICATION

TABLE 32 CONTACT-LENSES MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

7.6.1 CONVENTIONAL CONTACT LENSES

7.6.1.1 The increasing prevalence of myopia is one of the major factors supporting the demand for conventional contact lenses

TABLE 33 CONVENTIONAL CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6.2 ORTHOKERATOLOGY CONTACT LENSES

7.6.2.1 Technological advancements and the rising prevalence of myopia drive demand for contact lenses in orthokeratology

TABLE 34 ORTHOKERATOLOGY CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7.6.3 DECORATIVE CONTACT LENSES

7.6.3.1 Decorative contact-lenses market to register a high growth rate during the forecast period

TABLE 35 DECORATIVE CONTACT-LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

8 CONTACT LENSES MARKET, BY DISTRIBUTION CHANNEL (Page No. - 79)

8.1 INTRODUCTION

TABLE 36 CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

8.1.1 IMPACT OF COVID-19 ON THE MARKET, BY DISTRIBUTION CHANNEL

8.1.2 RETAIL STORES

8.1.2.1 Retail stores accounted for the largest share of the contact-lenses market in 2019

TABLE 37 CONTACT-LENSES MARKET FOR RETAIL STORES, BY COUNTRY, 2018-2025 (USD MILLION)

8.1.3 HOSPITALS & CLINICS

8.1.3.1 Growing number of hospitals in developing countries to drive the growth of the hospitals & clinics segment

TABLE 38 CONTACT-LENSES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2018-2025 (USD MILLION)

8.1.4 E-COMMERCE

8.1.4.1 Growing trend of online purchases to drive the market

FIGURE 23 SHARE OF CONTACT LENS PURCHASES MADE ONLINE IN THE US, 2013-2016

TABLE 39 CONTACT-LENSES MARKET FOR E-COMMERCE, BY COUNTRY, 2018-2025 (USD MILLION)

9 CONTACT LENSES MARKET, BY REGION (Page No. - 84)

9.1 INTRODUCTION

TABLE 40 GLOBAL CONTACT LENSES INDUSTRY, BY REGION, 2020?2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 24 SHARE OF THE GERIATRIC POPULATION (65 AND ABOVE) IN THE TOTAL US POPULATION, 2010-2050

FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY COLOR VARIATION, 2018-2025(USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.2.1 US

9.2.1.1 US to dominate the contact lenses market during the forecast period

TABLE 48 US: KEY MACROINDICATORS FOR THE MARKET

TABLE 49 US: IMPACT OF COVID-19

TABLE 50 US: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 51 US: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 52 US: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 53 US: MARKET, BY COLOR VARIATION, 2018-2025(USD MILLION)

TABLE 54 US: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 55 US: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising prevalence of myopia in Canadian children will drive demand for refractive correction

TABLE 56 CANADA: KEY MACROINDICATORS FOR THE CONTACT LENSES CONTACT LENSES INDUSTRY

TABLE 57 CANADA: IMPACT OF COVID-19

TABLE 58 CANADA: CONTACT LENSES MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 59 CANADA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 60 CANADA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 61 CANADA: MARKET, BY COLOR VARIATION, 2018-2025(USD MILLION)

TABLE 62 CANADA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 63 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3 EUROPE

FIGURE 26 EUROPE: MARKET SNAPSHOT

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.1 UK

9.3.1.1 Growing preference for contact lenses over prescription eyeglasses in the UK is a major factor driving market growth

TABLE 71 UK: KEY MACROINDICATORS FOR THE CONTACT LENSES MARKET

TABLE 72 UK: IMPACT OF COVID-19

TABLE 73 UK: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 74 UK: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 75 UK: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 76 UK: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 77 UK: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 78 UK: CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 The rising prevalence of refractive errors will ensure a steady demand for corrective lenses in the German market

TABLE 79 GERMANY: KEY MACROINDICATORS FOR THE MARKET

TABLE 80 GERMANY: IMPACT OF COVID-19

TABLE 81 GERMANY: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Shortage of trained ophthalmologists is a major challenge in France

TABLE 87 FRANCE: KEY MACROINDICATORS FOR THE CONTACT LENSES MARKET

TABLE 88 FRANCE: IMPACT OF COVID-19

TABLE 89 FRANCE: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 94 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Inflexible regulations for medical devices in Italy increase challenges for contact lens manufacturers

TABLE 95 ITALY: KEY MACROINDICATORS FOR THE CONTACT LENSES MARKET

TABLE 96 ITALY: IMPACT OF COVID-19

TABLE 97 ITALY: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 98 ITALY: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 99 ITALY: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 100 ITALY: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 101 ITALY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 102 ITALY: CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 The percentage population using contact lenses in Spain is very low, indicating high growth opportunities for manufacturers

TABLE 103 SPAIN: KEY MACROINDICATORS FOR THE MARKET

TABLE 104 SPAIN: IMPACT OF COVID-19

TABLE 105 SPAIN: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 106 SPAIN: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 107 SPAIN: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 108 SPAIN: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 109 SPAIN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 110 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 111 SHARE OF GERIATRIC POPULATION IN ROE COUNTRIES

TABLE 112 ROE: CONTACT LENSES MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 113 ROE: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 114 ROE: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 115 ROE: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 116 ROE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 117 ROE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: CONTACT LENSES MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 124 ASIA PACIFIC: CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan accounted for the largest share of the APAC market in 2019

TABLE 125 JAPAN: KEY MACROINDICATORS FOR THE GLOBAL MARKET

TABLE 126 JAPAN: IMPACT OF COVID-19

9.4.1.2 Japan: Market overview

9.4.1.2.1 General overview

9.4.1.2.2 Regulatory scenario

9.4.1.2.3 Shift from two-week to daily lenses

9.4.1.2.4 Large target patient population

FIGURE 28 JAPAN: SHARE OF AGING POPULATION (65 AND ABOVE), 2009-2019

9.4.1.2.5 Daily disposables and cosmetic contact lenses observe slow growth in 2020 but retain strong potential

9.4.1.2.6 Slow-down in store-based sales in 2020

TABLE 127 JAPAN: CONTACT LENSES MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 128 JAPAN: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 129 JAPAN: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 130 JAPAN: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 131 JAPAN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 The contact lenses industry in China is highly regulated, serving as a major challenge for market players to compete in China

TABLE 133 CHINA: KEY MACROINDICATORS FOR THE CONTACT LENSES MARKET

TABLE 134 CHINA: IMPACT OF COVID-19

TABLE 135 CHINA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 136 CHINA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 137 CHINA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 138 CHINA: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 139 CHINA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 140 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increasing incidences of cataracts and refractive errors drive the growth of the market in India

TABLE 141 INDIA: KEY MACROINDICATORS FOR THE GLOBAL MARKET

TABLE 142 INDIA: IMPACT OF COVID-19

TABLE 143 INDIA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 144 INDIA: CONTACT LENSES MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 145 INDIA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 146 INDIA: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 147 INDIA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 148 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Growing geriatric population to support market growth in Australia

TABLE 149 AUSTRALIA: KEY MACROINDICATORS FOR THE CONTACT LENSES MARKET

TABLE 150 AUSTRALIA: IMPACT OF COVID-19

TABLE 151 AUSTRALIA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 152 AUSTRALIA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 153 AUSTRALIA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 154 AUSTRALIA: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 155 AUSTRALIA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 156 AUSTRALIA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 157 ROAPAC: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 158 ROAPAC: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 159 ROAPAC: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 160 ROAPAC: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 161 ROAPAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 162 ROAPAC: CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 163 LATIN AMERICA: CONTACT LENSES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Growth of the healthcare industry to drive the contact lenses market in Brazil

TABLE 170 BRAZIL: KEY MACROINDICATORS FOR THE GLOBAL MARKET

TABLE 171 BRAZIL: IMPACT OF COVID-19

TABLE 172 BRAZIL: MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 173 BRAZIL: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 175 BRAZIL: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 176 BRAZIL: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 177 BRAZIL: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.5.2 REST OF LATIN AMERICA

TABLE 178 ROLATAM: CONTACT LENSES MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 179 ROLATAM: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 180 ROLATAM: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 181 ROLATAM: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 182 ROLATAM: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 183 ROLATAM: CONTACT LENSES INDUSTRY, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MIDDLE EAST AND AFRICA HOLD THE SMALLEST MARKET SHARE

TABLE 184 MEA: CONTACT LENSES MARKET, BY USAGE, 2018-2025 (USD MILLION)

TABLE 185 MEA: MARKET, BY DESIGN, 2018-2025 (USD MILLION)

TABLE 186 MEA: MARKET, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 187 MEA: MARKET, BY COLOR VARIATION, 2018-2025 (USD MILLION)

TABLE 188 MEA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 189 MEA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 142)

10.1 OVERVIEW

FIGURE 29 PRODUCT LAUNCHES AND ACQUISITIONS-KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2017 TO AUGUST 2020

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 30 MARKET EVALUATION FRAMEWORK: 2019 SAW MARKET CONSOLIDATION THROUGH PARTNERSHIPS, COLLABORATIONS, ACQUISITIONS, AND AGREEMENTS

10.3 MARKET SHARE ANALYSIS

FIGURE 31 MARKET SHARE ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

10.4 GLOBAL CONTACT LENSES INDUSTRY: GEOGRAPHICAL ASSESSMENT, PRODUCT PORTFOLIO MATRIX, AND R&D EXPENDITURE OF KEY PLAYERS

FIGURE 32 GEOGRAPHICAL ASSESSMENT OF KEY PLAYERS IN THE GLOBAL MARKET

FIGURE 33 R&D EXPENDITURE OF KEY PLAYERS IN THE GLOBAL MARKET

TABLE 190 PRODUCT PORTFOLIO MATRIX: GLOBAL MARKET

10.5 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS: GLOBAL MARKET 2019

10.6 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE COMPANIES

10.6.4 EMERGING COMPANIES

FIGURE 35 COMPANY EVALUATION MATRIX: CONTACT LENSES MARKET

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 KEY PRODUCT LAUNCHES AND ENHANCEMENTS, 2017-2020

10.7.2 EXPANSIONS

TABLE 192 KEY EXPANSIONS, 2017-2020

10.7.3 ACQUISITIONS & DIVESTITURES

TABLE 193 KEY ACQUISITIONS & DIVESTITURES, 2017-2020

10.7.4 AGREEMENTS AND PARTNERSHIPS

TABLE 194 KEY AGREEMENTS AND PARTNERSHIPS, 2017-2020

11 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products, Strategic Overview, Key Insights, Recent Developments, SWOT Analysis, Right to Win)*

11.1 JOHNSON & JOHNSON

FIGURE 36 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2019)

11.2 ALCON

FIGURE 37 ALCON: COMPANY SNAPSHOT (2019)

11.3 THE COOPER COMPANIES

FIGURE 38 THE COOPER COMPANIES: COMPANY SNAPSHOT (2019)

11.4 BAUSCH + LOMB

FIGURE 39 BAUSCH + LOMB: COMPANY SNAPSHOT (2019)

11.5 CARL ZEISS MEDITEC AG

FIGURE 40 CARL ZEISS MEDITEC AG: COMPANY SNAPSHOT (2019)

11.6 HOYA CORPORATION

FIGURE 41 HOYA CORPORATION: COMPANY SNAPSHOT (2019)

11.7 SEED

FIGURE 42 SEED: COMPANY SNAPSHOT (2019)

11.8 MENICON

FIGURE 43 MENICON: COMPANY SNAPSHOT (2020)

11.9 ESSILORLUXOTTICA

FIGURE 44 ESSILORLUXOTTICA: COMPANY SNAPSHOT (2019)

11.10 BENQ MATERIALS CORPORATION

FIGURE 45 BENQ MATERIALS CORPORATION: COMPANY SNAPSHOT (2019)

11.11 SYNERGEYES

11.12 CONFORMA LABORATORIES

11.13 FRESHLADY CONTACT LENSES

11.14 ABB OPTICAL GROUP

11.15 X-CEL SPECIALTY CONTACTS

11.16 ST. SHINE OPTICAL

11.17 BESCON

11.18 NEO VISION

11.19 CLEARLAB

11.20 CAMAX OPTICAL CORPORATION

*Details on Products, Strategic Overview, Key Insights, Recent Developments, SWOT Analysis, and Right to Win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 194)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

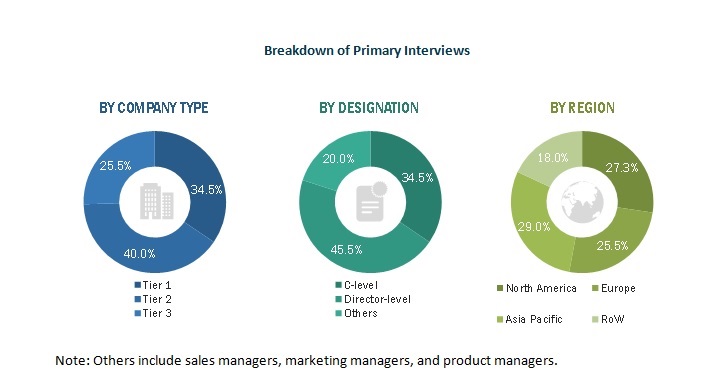

This study involved four major activities for estimating the current size of the contact lenses market. Exhaustive secondary research was conducted to collect information on the market and its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, Parent Market, and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the contact lenses market. Primary sources from the demand side include experts from hospitals and clinics and research and academic laboratories. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Note: Others include sales managers, marketing managers, and product managers.

Market Size Estimation

The total size of the contact lenses market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the contact lenses market

The size of the contact lenses market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global contact lenses market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the contact lenses market based on product and distribution channel

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, along with major countries in these regions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 in the contact lenses market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, new product developments, geographic expansions, and research and development activities in the contact lenses market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries.

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries.

Company Information

- Detailed analysis and profiling of additional market players, up to five.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Contact Lenses Market