Digital Mining Market

Digital Mining Market by Services (Advisory, Technical, Business, Managed IT), Mining Type (Surface Mining, Underground Mining), and Application (Exploration, Assessment, Development, Production Operation, Reclamation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The digital mining market is projected to reach USD 0.74 billion by 2030 from USD 0.45 billion in 2025, at a CAGR of 10.8% from 2025 to 2030. The digital mining market is driven by surging demand for critical minerals, rising operational costs, and strict ESG regulations. This compels the adoption of AI, automation, and IoT to boost operational efficiency, enhance worker safety, and ensure environmental compliance.

KEY TAKEAWAYS

-

BY SERVICETechnical services dominate the digital mining market because digital mining deployments require sustained expertise beyond standalone software or equipment. Mines need system integration, customization, deployment, commissioning, and ongoing support for telemetry, predictive maintenance, cybersecurity, and data governance. Legacy systems and harsh operating conditions drive reliance on external specialists for remote monitoring, digital twins, and real-time analytics, while regulatory and ESG obligations increase demand for consulting, verification, and audit-ready data pipelines. Vendors can capitalize by shifting to outcome-based models, expanding managed services and tiered support, bundling analytics and ESG offerings, and forming OEM and local partnerships to standardize deployments, reduce risk, and secure recurring revenue.

-

BY MINING TYPEUnderground mining is forecast to register the highest CAGR due to growing demand for deeper, higher-value deposits as near-surface ores deplete, which intensifies the need for advanced digital solutions. Safety, ventilation, and confined-space logistics drive adoption of automation, IoT sensors, and remote monitoring to reduce risk and improve productivity. Real-time analytics, digital twins, and predictive maintenance enhance equipment uptime and ventilation optimization. Labour shortages and stricter regulatory and ESG requirements further accelerate investment in robotics, communications networks, and integrated platforms that enable scalable, cost-effective underground operations.

-

BY APPLICATIONThe development segment in the digital mining market is expected to register the highest CAGR, as mining companies increasingly integrate digital technologies during the early stages of design, planning, and project execution. Advanced tools, such as 3D modeling, geospatial analytics, and digital twins, enhance accuracy in resource estimation, risk assessment, and scenario planning prior to on-site mining. AI-powered simulations and cloud-based collaboration enhance feasibility studies and engineering workflows, reducing rework, cost overruns, and delays. Digital platforms also support sustainability and safety by evaluating environmental impact, designing energy-efficient infrastructure for electrified fleets, and ensuring regulatory compliance from the beginning of projects. This integration helps accelerate development timelines and enhances returns on investment.

-

BY REGIONThe Asia Pacific region is projected to register the highest CAGR in digital mining due to rapid industrialization, technological advancement, and its central role in critical mineral production. Surging demand for minerals to support manufacturing, electronics, and infrastructure is driving miners to adopt AI, IoT, and automation to boost efficiency, safety, and regulatory compliance. Government initiatives for smart manufacturing further accelerate adoption across diverse, large-scale operations. Notable regional examples include Australia’s Greenbushes lithium operations, Indonesia’s Grasberg copper complex, China’s Bayan Obo rare earth deposits, Mongolia’s Erdenet copper-molybdenum mine, and iron ore activity in India’s Odisha region, all of which are increasingly deploying digital solutions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Metso (Finland), ABB (Switzerland), and Rockwell Automation (US) have entered into several agreements and partnerships to meet the growing demand for digital mining solutions and services.

The digital mining market is witnessing steady growth. Environmental sustainability and ESG reporting are now core priorities for the global mining sector. Governments are imposing stricter regulations on carbon and resource efficiency, while mining companies are setting ambitious targets for decarbonization and sustainability. Digital mining solutions support these objectives by optimizing energy consumption, automating haulage to reduce idle time, integrating electrified and alternative-fuel equipment, and providing advanced analytics for environmental performance monitoring and reporting. These capabilities enable miners to lower their carbon footprint, enhance transparency in ESG disclosures, and maintain compliance with regulatory standards, while also reducing operational costs and improving long-term sustainability across the mining value chain.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends and disruptions are rapidly transforming the digital mining services market, with a pronounced shift from traditional integration and consulting toward value-added, technology-driven offerings. The future revenue mix is expected to shift in favor of integrated digital twins, simulation services, and advanced AI-powered decision-making, with a corresponding increase from 20 percent to 80 percent of technology-centric services. Clients are demanding predictive and prescriptive analytics, energy and carbon management solutions, and platforms for regulatory, ESG, and traceability. These innovations address evolving client imperatives, including operational efficiency, safety and risk management, sustainability compliance, and performance monitoring. As contractors, processors, and mining companies adapt, their customers increasingly seek transparency, reliability, cost competitiveness, and supply chain accountability. This transformation drives the rise of performance-based partnerships and responsible sourcing, making digital mining providers essential partners in achieving productivity gains and sustainable outcomes for global players such as Vale, Glencore, and Hindalco.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising focus on sustainability and ESG compliance

-

Growing demand for critical minerals and energy transition

Level

-

Commodity price volatility and economic uncertainty

-

High capital investment requirements

Level

-

Renewable energy integration and decarbonization

-

Growth of cloud-based mining management platforms

Level

-

Operational risk in transitioning from manual to automated systems

-

Data interoperability and standardization issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on sustainability and ESG compliance

Rising sustainability and ESG compliance drive digital mining growth by forcing miners to measure, manage, and report environmental performance. Real-time telemetry, emissions monitoring, water and waste tracking, and digital twins enable audit-ready data and transparent disclosures. Investors and regulators demand verifiable ESG outcomes, prompting adoption of analytics, carbon accounting, and automated reporting tools. These technologies reduce energy and fuel consumption, lower compliance risk, and improve access to capital while demonstrating measurable progress on decarbonization and social responsibility.

Restraint: Commodity Price Volatility and Economic Uncertainty

Commodity price volatility and economic uncertainty restrain digital mining investment by compressing operators' capital budgets and deferring discretionary technology projects. When prices fall, miners prioritize near-term cash preservation and maintenance over transformative digital deployments, slowing procurement cycles. Uncertain macro conditions increase financing costs and risk aversion, making long-payback investments less attractive. Vendors face elongated sales cycles, demand for lower-risk pricing models, and increased pressure to demonstrate rapid, measurable ROI.

Opportunity: Renewable Energy Integration and Decarbonization

Integration of renewable energy and decarbonization offers digital mining vendors opportunities to optimize hybrid energy systems, manage distributed generation, and reduce scope 1 emissions. Energy management platforms, microgrid controls, and predictive analytics enable seamless coordination of solar, wind, storage, and electrified fleets to lower costs and improve reliability. Vendors can provide carbon accounting, real-time load balancing, and optimization-as-a-service, unlocking new revenue streams while helping operators meet regulatory targets and investor ESG expectations.

Challenge: Operational risk in transitioning from manual to automated systems

Transitioning from manual to automated systems introduces significant operational risks that challenge digital mining adoption. Integration complexity, legacy equipment interoperability issues, and data inconsistency can cause unplanned downtime and degraded production. Cybersecurity vulnerabilities rise with connected assets, while workforce resistance and skill gaps hinder safe operations and change management. Poorly executed rollouts risk safety incidents, regulatory non-compliance, and cost overruns. These factors lengthen deployment timelines, increase total project costs, and force vendors and operators to adopt phased implementations, rigorous testing, and comprehensive training to manage transition risks.

digital-mining-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Accenture acts as a strategic IT/technology services partner to Anglo American, supporting cloud, analytics, and digital transformation to improve operational predictability and drive production performance. | Accelerated digital roadmaps | Improved production predictability | Scaled IT delivery and innovation capacity |

|

Rio Tinto utilizes Microsoft Azure digital twin and cloud services to centralize sensor data, run digital twins, and support analytics for automation and decision-making at advanced mine sites. | Centralized data & analytics | Support for digital twins and AI use-cases | Improved scalability of cloud-based solutions |

|

Metso deployed a digital-twin and process-optimization solution across mine-to-mill to stabilize material flows, manage ore variability, and improve recovery and throughput. | Higher recovery and throughput | Reduced process variability | Faster operational decision making |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital mining market ecosystem operates through four interconnected tiers, each fulfilling distinct strategic roles in industry transformation. Technology & Solution Providers develop cloud infrastructure, software platforms, IoT systems, and analytics capabilities that convert raw operational data into actionable intelligence for mine optimization and predictive maintenance. Equipment & Hardware Manufacturers engineer autonomous equipment, sensors, and intelligent hardware solutions that enable physical automation and real-time data collection across mining sites. Mining Operators & Industry End Users deploy integrated digital systems across their operations, implementing autonomous equipment, remote operations centers, and data-driven decision-making frameworks. Regulatory Bodies & Compliance Organizations establish safety standards, environmental regulations, ESG metrics, and industry guidelines that shape technology adoption requirements. This four-tier framework creates a cohesive ecosystem where innovation, automation, implementation, and governance converge to drive sustainable mining transformation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Mining Market, By Service

Technical services are forecast to hold the largest market share because digital mining projects demand sustained, specialized expertise that goes far beyond one-off software or equipment sales. Mines increasingly rely on systems integration, bespoke customization, site commissioning, and continuous operational support to integrate IoT telemetry, edge analytics, digital twins, and legacy control systems across dispersed and harsh environments. Real-world deployments such as remote operations centers supporting Pilbara autonomous fleets and managed-service arrangements for fleet autonomy and predictive maintenance at large surface copper and nickel operations illustrate how operators depend on external specialists. Regulatory, safety, and ESG reporting obligations further drive demand for consulting, verified data pipelines, and audit-ready analytics, while cybersecurity and data governance create ongoing service needs. For vendors, this translates into lucrative recurring revenue models through outcome-based contracts, tiered managed services, and lifecycle support packages. By expanding local service hubs, training academies, and OEM partnerships, providers reduce deployment risk, accelerate multi-site rollouts, and capture long-term value. Consequently, technical services scale with market adoption and become the primary revenue engine in digital mining.

Digital Mining Market, By Mining Type

Underground mining is forecast to record a higher CAGR because deeper, higher-grade ore extraction requires intensified digital intervention to manage safety, ventilation, and complex logistics. Confined environments and declining ore grades drive the adoption of real-time monitoring, ventilation-on-demand, battery-electric vehicles, and remote operation systems to reduce risk and operating costs. Predictive maintenance and digital twins improve equipment uptime in inaccessible zones, while robust communications and automation mitigate labour shortages and regulatory safety demands. Industry examples include Freeport-McMoRan’s Grasberg underground developments, where the scale and complexity of deep mining make digital platforms, fleet telematics, and integrated analytics especially valuable. These drivers collectively accelerate investment in underground-focused software, services, and electrification solutions.

Digital Mining Market, By Application

The development segment is expected to record the highest CAGR as mining companies embed digital technologies into early-stage design, planning, and project execution. Advanced 3D modeling, geospatial analytics, and digital twins improve accuracy in resource estimation, risk assessment, and scenario planning before groundworks commence, reducing uncertainty and supporting faster permitting and financing. AI-driven simulations and cloud-enabled collaboration accelerate feasibility studies and engineering workflows, cutting rework, schedule slippage, and capital overruns. Digital platforms also enable sustainability-by-design, helping engineers evaluate environmental impacts, plan energy-efficient layouts for electrified fleets, and demonstrate regulatory compliance from project inception. Early integration of sensor-ready infrastructure and interoperable data standards simplifies later rollouts of autonomy, predictive maintenance, and remote operations. Real-world initiatives by major miners and technology suppliers show how development-stage digitization shortens time to first production and improves project economics. For vendors, this trend creates demand for modular digital-twin templates, pay-per-project simulation services, and consultancy-led implementation packages that lock in long-term engagements spanning construction through operations, thereby expanding lifetime customer value.

REGION

Asia Pacific to be fastest-growing region in global digital mining market during forecast period

The Asia Pacific region is projected to register the highest CAGR in the digital mining market due to rapid industrialization, technology investment, and its central role in critical mineral supply chains. China, India, Indonesia, and Australia are facing a rising demand for minerals to support manufacturing, electronics, and infrastructure, prompting miners to adopt AI, IoT, automation, and advanced analytics to boost efficiency, safety, and compliance. Government programs promoting smart manufacturing and digitalization further accelerate the deployment of these technologies. Large, diverse operations exemplify this trend: Australia’s Greenbushes lithium mine is advancing battery mineral digitization, Indonesia’s Grasberg complex is investing in digital ore control and fleet analytics, China’s Bayan Obo rare earth district is integrating process automation, Mongolia’s Tavan Tolgoi coalfields are deploying remote monitoring, and India’s Talcher coal region is implementing predictive maintenance systems. These developments position Asia Pacific as the leading hub for digital mining transformation.

digital-mining-market: COMPANY EVALUATION MATRIX

In the digital mining market matrix, Siemens (Star) leads with a strong market share and extensive product footprint, driven by its integrated automation, digital-twin, and IoT platforms, strong electrification expertise, and extensive industrial software, enabling end-to-end mine optimization, predictive analytics, and scalable, reliable deployments across global mining operations. Microsoft (Emerging Leader) is gaining visibility by offering Azure cloud, AI, and IoT platforms, enabling data-driven operations, digital twins, and collaborations with major miners for analytics, permitting, and optimization use cases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens (Germany)

- ABB (Switzerland)

- Caterpillar (US)

- Rockwell Automation (US)

- Metso (Finland)

- Wipro (India)

- Cyient (India)

- FLSmidth (Denmark)

- Sandvik (Sweden)

- Schneider Electric (France)

- Accenture (Ireland)

- Microsoft (US)

- IBM (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.41 Billion |

| Market Forecast in 2030 (Value) | USD 0.74 Billion |

| Growth Rate | CAGR of 10.8% from 2025 to 2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: digital-mining-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Mine Operator |

|

|

RECENT DEVELOPMENTS

- October 2025 : ABB signed a strategic technology partnership with LKAB to co-develop automation, electrification, and digitalization blueprints for low-emission mining, combining ABB system capabilities with LKAB’s operational scale to pilot next-generation mine solutions.

- October 2025 : Caterpillar entered an agreement to acquire RPMGlobal, expanding Cat’s software portfolio for mine planning, fleet management and autonomy and strengthening integrated digital offerings across equipment and enterprise systems.

- December 2024 : Sandvik completed the acquisition of Universal Field Robots (UFR), integrating autonomous interoperable solutions into its digital mining technologies division and accelerating robotized tasks in surface and underground operations and software integration capabilities.

- January 2025 : Accenture acquired a digital-twin technology platform, Percipient, strengthening simulation, planning and digital-twin driven mine optimisation capabilities while accelerating project delivery and scenario testing for greenfield and brownfield developments.

- April 2025 : Siemens acquired DownStream Technologies to strengthen manufacturing-data-preparation and digital workflows, enhancing Siemens’ software capabilities relevant to asset-lifecycle digital twins and data integration for heavy industries including mining.

Table of Contents

Methodology

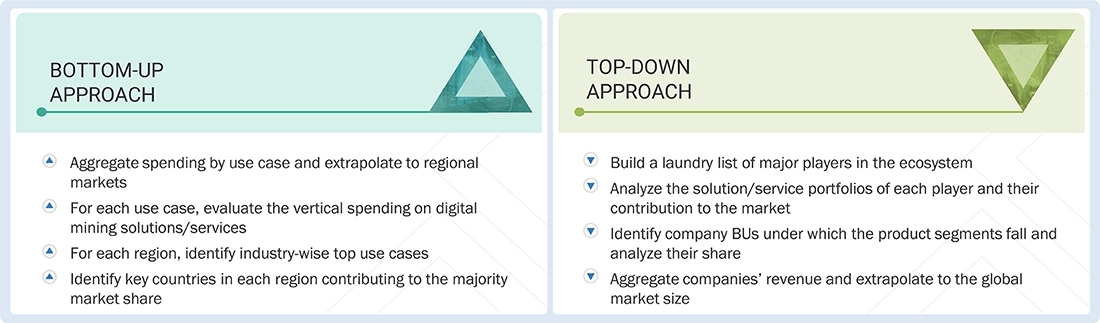

The research study involved four major activities in estimating the digital mining market size. Exhaustive secondary research was conducted to gather key information about the market and its peer markets. The next step was to validate these findings and assumptions, and size them up with the help of primary research involving industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. The market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of companies offering digital mining solutions to various end-users was determined based on secondary data obtained from both paid and unpaid sources, as well as an analysis of the product portfolios of major companies within the ecosystem. Companies were rated based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was primarily used to gather critical information on industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends, down to the most granular level, including regional markets and key developments from both market and technology-oriented perspectives.

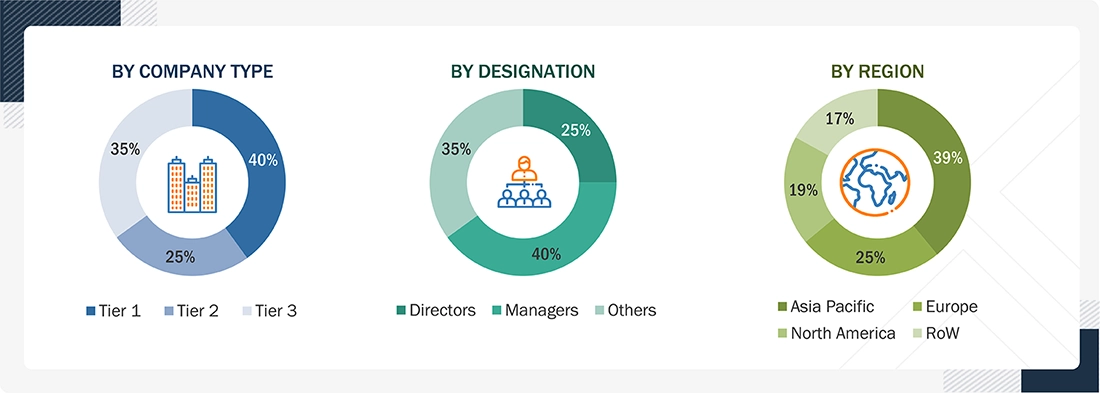

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the digital mining market.

Primary interviews were conducted to gather insights, including market statistics, revenue data from software and services, market segmentations, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use transportation management system, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of digital mining hardware, solutions and services, which is expected to affect the overall market growth.

Note 1: Tier 1 companies have revenues of more than USD 10 billion; tier 2 companies’ revenue ranges from USD

1 billion to USD 10 billion; and tier 3 companies’ revenue ranges from USD 500 million to USD 1 billion

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the market size of the digital mining market, as well as other dependent submarkets.

- MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Significant developments in the critical market area were considered.

- The recent and upcoming market developments, including investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships, were monitored, and the market size was estimated based on these developments and other key factors.

- Multiple discussions were conducted with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakdown of the scope of work carried out by major companies.

- The market was segmented based on technology types concerning applications, the types of which are to be used, and deriving the size of the global application market.

- The overall market was segmented into various market segments.

- The estimates were validated at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and with the domain experts at MarketsandMarkets.

Digital Mining Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the above estimation process, the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, where applicable, to complete the overall market engineering process and derive the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Digital mining refers to the integration of digital technologies, including artificial intelligence (AI), the Internet of Things (IoT), automation, data analytics, cloud computing, and digital twins, into the mining industry to optimize operations, enhance safety, and improve productivity throughout the mining value chain. Digital mining services refer to consulting, technical, business, and IT support offerings that help mining enterprises adopt and integrate digital technologies for optimizing asset performance, improving workforce safety, reducing operational costs, and achieving sustainability goals.

Stakeholders

- Mining companies/operators

- Mining equipment manufacturers (OEMs)

- Technology providers

- System integrators and service providers

- Software and platform vendors

- Cloud and connectivity providers

- Sensor and IoT device manufacturers

- Cybersecurity and data management firms

- Engineering, procurement, and construction (EPC) firms

- Government and regulatory bodies

- Research and academic institutions

- Industry associations and standardization bodies

- Investors and financial institutions

- Environmental and sustainability organizations

- Local communities and labor unions

Report Objectives

- To determine, segment, and forecast the digital mining market based on service, mining type, application, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To study the complete value chain and related industry segments, and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and research & development (R&D) activities

- To provide macroeconomic outlook for all regions considered under the study

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Mining Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital Mining Market