Electric Vehicle Charging Stations Market by Charging Station (AC Charging Station, DC Charging Station), Installation Type (Residential, Commercial), and Region (North America, Europe, Asia Pacific, and Row) - Global Forecast to 2023

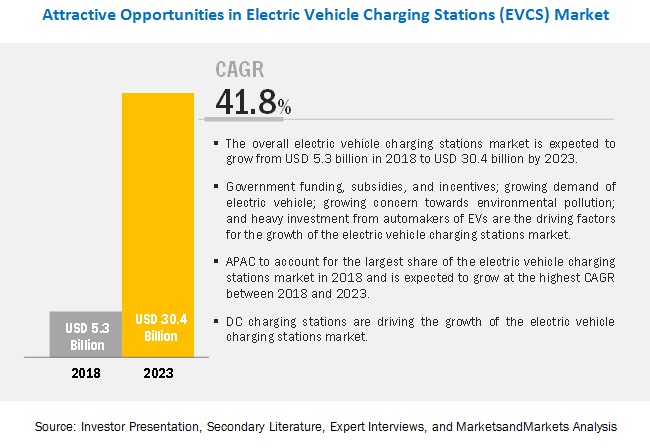

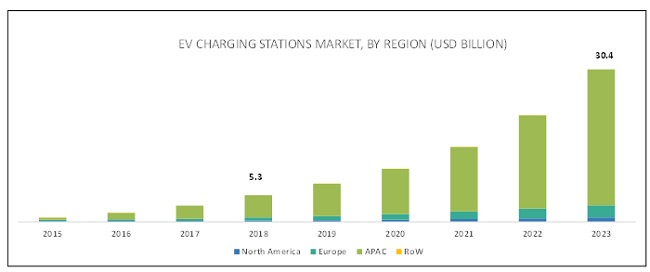

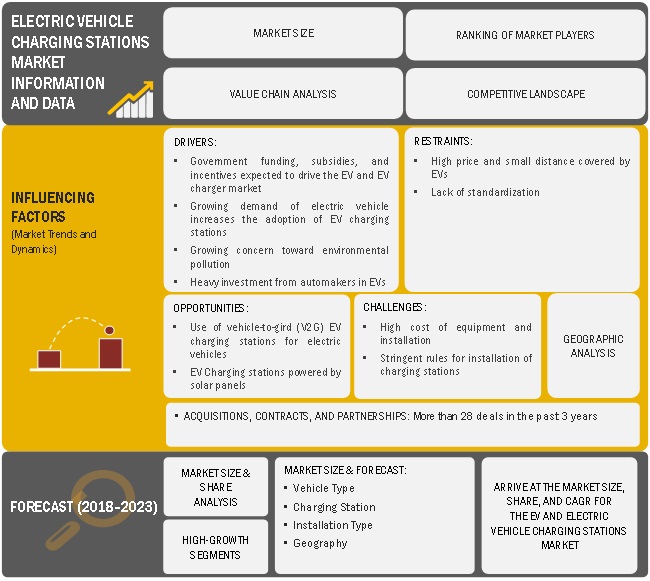

MarketsandMarkets forecasts the electric vehicle charging stations (EVCS) market is expected to grow from USD 3.22 billion in 2017 to reach USD 30.41 billion by 2023, at a CAGR of 41.8% between 2018 and 2023. The key factors driving the growth of the market include government funding, subsidies, and incentives, growing demand of electric vehicles, growing concern toward environmental pollution, and heavy investment from automakers in EVs. However, high price and small distance covered by EVs and lack of standardization with EV charging are the key restraining factors for market growth.

DC charging station to hold largest share of electric vehicle charging stations market between 2018 and 2023

The ability of DC charging stations to charge an EV in lesser time compared to AC charging stations is the primary driving factor for the high growth rate of former in the electric vehicle charging stations market. Also, the increasing popularity of public charging stations is boosting the demand for DC charging stations. Furthermore, automakers are planning to invest in DC fast charging network to support their launch of long-range BEVs.

Commercial installation to hold largest share of electric vehicle charging stations market between 2018 and 2023

The growth is attributed to an increased deployment of charging stations at public places such as shopping malls, commercial buildings, airports, and restaurants. The convenience of being able to use an EV charger while shopping or during office hours is expected to boost the adoption of electric vehicles. Furthermore, government offerings, such as tax credits, on the installation of publicly accessible stations are expected to boost the commercial installation of charging stations.

APAC to hold the largest share of electric vehicle charging stations market during forecast period

A majority of electric vehicle charging station installations in APAC is driven by huge demand in countries such as China and Japan. Currently, APAC is the largest market for electric vehicle charging stations globally. Furthermore, South Korea and India are taking initiatives to reduce greenhouse gas emissions by increasing the use of EVs. For instance, India, one of the largest contributors of greenhouse gases, has pledged to phase out petrol and diesel cars by 2030. This initiative by the Indian government is expected to create a huge demand for EVs and EV charging infrastructure in the country. Moreover, in September 2017, the Indian government decided to buy 10,000 electric cars from Tata Motors to replace old petrol and diesel cars used by government agencies. Furthermore, in September 2017, the Singapore government launched its first large-scale EV car sharing program. Under the car sharing program, BlueSG (Singapore), a subsidiary of Bollore Group, will install 500 charging stations equipped with 2,000 charging points in Singapore.

Market Dynamics

Driver: Government funding, subsidies, and incentives to drive the EV charging stations market

The growing need for EVs in various parts of the world is expected to increase the demand for charging stations. As a result, various governments are funding for the development of charging station infrastructure, as well as subsidizing the EV charging infrastructure. For instance, in July 2016, the US Government announced to form a partnership between the Department of Transportation (DOT) and the Department of Energy (DOE) for “a 2020 vision for a national fast charging network.” The project is a part of Fixing America’s Surface Transportation (FAST) Act. The partnership will determine the best locations for charging stations and the cost for charging and utility infrastructure. Furthermore, in September 2017, the German Federal Ministry of Transport and Digital Infrastructure granted a fund of USD 4.9 million to Fastned B.V., an EV fast-charging station provider. This fund was given to develop 25 fast-charging stations in Germany, which are capable to provide a distance up to 250 km within 20 minutes.

Restraint: High price and small distance covered by EVs

An electric vehicle costs more than a conventional vehicle. For instance, FIAT 500X (petrol version) and FIAT 500e (electric version) cost USD 19,995 and USD 32,780, respectively. Moreover, BMW, Audi, Mercedes-Benz, Cadillac, and Tesla cost between USD 43,000 and USD 100,000, which are more expensive than normal cars. The high pricing of EV is constraining the adoption of vehicles.

In addition, many vehicle owners are concerned about the range or distance covered in a single drive of EVs. The coverage of EVs is shorter than that of fuel-based cars. Many EVs cover a distance between 11 miles and 21 miles, because of the low-energy density of batteries. The maximum coverage of an EV is 315 miles (Tesla Model S). Users usually prefer covering a long distance without any interruption, especially for long trips, and a long-range EV comes at a high price. This factor could inhibit the growth of the electric vehicle charging stations market.

Opportunity: Use of vehicle-to-grid (V2G) EV charging stations for electric vehicles

Vehicle-to-grid (V2G) EV charging describes a system in which there is a bi-directional electrical energy flow between plug-in EVs and the power grid. V2G technology facilitates EVs to store unused power and discharge it to the grid. V2G technology can improve the electrical component’s performance and create value for EV owners.

In May 2017, Enel Energia S.p.a installed 2 vehicle-to-grid (V2G) electric car charging stations at the Genoa headquarters of the Italian Institute of Technology. The installation is part of MOV-E, a corporate electric car sharing pilot project in collaboration with Nissan. Nissan has provided 2 battery EVs (LEAF model) to the Italian Institute of Technology, as well as provided an app management platform known as Glide. The agreement between Enel and Nissan signifies a change in the world of technology in terms of sustainable mobility. Thus, V2G charging technology is a key opportunity for manufactures as it will transform the world of EVs and shape the future of EV charging.

Challenge: Stringent rules for installation of charging stations

A service provider must follow a certain set of instructions when installing a charging station. They need approval from plot owners when the installation is on a private property, local governments in terms of regulatory mandates, and utility providers for energy transfer. For instance, homeowners or contractors need to submit plot plan, electrical load calculations, electrical plans, installation instructions, and charger specifications to the local permitting office for obtaining a permit for a typical installation of residential EV charging station. The installation of EV charging stations is more complex in commercial locations than in residential locations. The commercial installation requires permits, community or design guidelines, electrical source or metering, parking and signage requirements, zoning requirements, and inspection fees. Thus, the installation of charging station is complex as many stages are involved in the value chain.

Scope of Report:

|

Report Metric |

Details |

|

Years considered for providing market size |

2015–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) in million/billion |

|

Segments covered |

Vehicle Type, Charging Station, Installation Type |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ABB (Switzerland), AeroVironment (US), ChargePoint (US), Engie (France), Tesla (US), Schneider Electric (France), Siemens (Germany), Efacec (Portugal), EVgo (US), Leviton (US), Alfen (Netherlands), Allego (Netherlands), Blink Charging (US), Clipper Creek (US), SemaConnect (US), and TGOOD (Hong Kong) |

This research report categorizes the global electric vehicle market on the basis of vehicle type and region; and the electric vehicle charging stations market on the basis of charging station, installation type, and region.

Electric Vehicle Market, by Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Electric Vehicle Charging Stations Market, by Charging Station

- AC Charging Station

- Level 1 AC

- Level 2 AC

- DC Charging Station

- Inductive Charging Station

Electric Vehicle Charging Stations Market, by Installation Type

- Residential

- Commercial

Electric Vehicle and Electric Vehicle Charging Stations Market, by Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Key Market Players

As of 2017, ABB (Switzerland), AeroVironment (US), ChargePoint (US), Engie (France), and Tesla (US) were the major players in the electric vehicle charging stations market.

ChargePoint is one of the leading players in the electric vehicle charging stations market. The company maintains and operates world’s largest open EV charging network. Moreover, ChargePoint is one of the few EV charging companies, which designs and develops its own EV charging hardware and software. To further strengthen its leadership position, the company adopts strategies such as strategic partnerships and acquisitions to expand its charging network globally. In the recent past, ChargePoint has established partnerships with local EV charging network providers to expand its network in Europe. For instance, in November 2017, ChargePoint partnered with Technical Services Group (TSG) to install EV charging stations in Europe.

Tesla is engaged in designing and developing electric cars and DC fast charging stations for its customers. Tesla is recognized to revolutionize the electro mobility ecosystem by manufacturing all electric production cars. The company’s cutting edge battery technology and electric powertrain coupled with a rapidly growing fast charging network has contributed in becoming one of the leading players in the electric vehicle charging stations market. Tesla’s ambitious plan of increasing the production rate of its EV and expanding its supercharger network globally is going to strengthen its leadership position in the electric vehicle charging stations market. The company mainly focuses on forming strategic partnerships with other companies to expand its EV charging infrastructure. For instance, in July 2016, Tesla entered into a partnership with Ruby Tuesday (US), a leading multinational foodservice retailer. Ruby Tuesday will be opening a series of supercharger stations in the premises of its restaurants spread across the world starting from one of its restaurant in Missouri, US.

Key Developments

- In January 2018, AeroVironment launched TurboDX, the company’s next-generation EV charging station at the CES Digital Experience held in Las Vegas, US. The highly durable TurboDX is compatible with the company’s TurboCord charging system, giving customers the option of choosing from a variety of Open Charge Point Protocol (OCPP)-compliant charging network. The new charging station also features smart charging, which is capable of meeting the different energy needs of residential, commercial, and utility charging.

- In January 2018, ABB signed a contract with Nanyang Technological University (Singapore). ABB will be providing its state-of-the-art heavy vehicle chargers—300P—to the upcoming autonomous electric bus project in Singapore. The 300kW DC fast charging station will be used to charge 2 Volvo 7900 electric buses, which are used in the project.

- In December 2017, EVgo partnered with Nissan North America (US) to expand its fast charging network across US. The company installed its 1,000th DC fast charging station in Washington, DC.

Key Questions Answered:

- Which type of charging station is expected to have the highest demand in the future?

- Which is the most dominated installation type of EV charging stations in the market?

- Which are the key geographies for EV charging stations in the market?

- What are the key trends in the EV charging stations market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Primary Sources

2.1.3 Secondary & Primary Research

2.1.3.1 Key Industry Insights

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Electric Vehicle Market, By Vehicle Type

4.2 Electric Vehicle Charging Stations Market, 2020–2025 (USD Million)

4.3 Electric Vehicle Charging Stations Market, By Charging Station

4.4 Electric Vehicle Charging Stations Market, By Installation Type

4.5 Electric Vehicle Charging Stations Market, By Geography

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Funding, Subsidies, and Incentives Expected to Drive the EV and EV Charging Stations Market

5.2.1.2 Growing Demand for Electric Vehicles Increases the Adoption of EV Charging Stations

5.2.1.3 Growing Concern Toward Environmental Pollution

5.2.1.4 Heavy Investment From Automakers in EVS

5.2.2 Restraints

5.2.2.1 High Price and Small Distance Covered By EVS

5.2.2.2 Lack of Standardization

5.2.3 Opportunities

5.2.3.1 Use of Vehicle-To-Grid (V2G) EV Charging Stations for Electric Vehicles

5.2.3.2 EV Charging Stations Powered By Solar Panels

5.2.4 Challenges

5.2.4.1 High Cost of Equipment and Installation

5.2.4.2 Stringent Rules for Installation of Charging Stations

6 Industry Tends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Batteries Used in Electric Vehicles

6.3.1 Lead–Acid Battery

6.3.1.1 Advantages of Lead–Acid Battery

6.3.1.2 Disadvantages of Lead–Acid Battery

6.3.2 Nickel–Metal Hydride Battery

6.3.2.1 Advantages of Ni-Mh Battery

6.3.2.2 Disadvantages of Ni-Mh Battery

6.3.3 Lithium–Ion Battery

6.3.3.1 Advantages of Lithium–Ion Battery

6.3.3.2 Disadvantages of Lithium–Ion Battery

6.3.4 Solid-State Battery

7 EV Market Analysis, By Vehicle Type

7.1 Introduction

7.2 Battery Electric Vehicle (BEV)

7.3 Plug–In Hybrid Vehicle (PHEV)

7.3.1 Series PHEV

7.3.2 Parallel PHEV

8 EVCS Market Analysis, By Charging Station

8.1 Introduction

8.2 AC Charging Station

8.2.1 Level 1 Charging Station

8.2.2 Level 2 Charging Station

8.3 DC Charging Station

8.4 Inductive Charging Station—An Upcoming Technology

9 Standards of Electric Vehicle Charging Stations

9.1 Introduction

9.2 SAE J1772

9.3 Chademo

9.4 Tesla Supercharger

9.5 GB/T

9.6 CCS

9.7 IEC 62196

10 EVCS Market Analysis, By Installation Type

10.1 Introduction

10.2 Residential

10.3 Commercial

11 EVCS Market Analysis, By Geography

11.1 Introduction

11.2 North America

11.2.1 Us

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Norway

11.3.2 Germany

11.3.3 Uk

11.3.4 France

11.3.5 Netherlands

11.3.6 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 Rest of APAC

11.5 RoW

11.5.1 Middle East

11.5.2 Africa

12 Competitive Landscape

12.1 Overview

12.2 Market Ranking Analysis of EV Charging Station Manufacturers

12.3 Competitive Situations & Trends

12.3.1 Contracts & Acquisitions

12.3.2 Collaborations & Partnerships

12.3.3 Product Launches

12.3.4 Expansions

13 Company Profiles

13.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

13.2 Key Players

13.2.1 Abb

13.2.2 Aerovironment

13.2.3 Chargepoint

13.2.4 Engie

13.2.5 Tesla

13.2.6 Schneider Electric

13.2.7 Siemens

13.2.8 Efacec

13.2.9 Evgo

13.2.10 Leviton

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13.3 Key Innovators

13.3.1 Alfen

13.3.2 Allego

13.3.3 Blink Charging

13.3.4 Clipper Creek

13.3.5 SemaConnect

13.3.6 TGOOD

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (102 Tables)

Table 1 Government Incentive Programs, 2019

Table 2 EV Market, in Terms of Value and Volume, 2017–2025(USD Billion and Thousand Units)

Table 3 EV Market, By Vehicle Type, 2017–2025(USD Billion)

Table 4 EV Market, By Vehicle Type, 2017–2025(Thousand Units)

Table 5 BEV Market, By Region, 2017–2025(USD Billion)

Table 6 PHEV Market, By Region, 2017–2025(USD Billion)

Table 7 EVCS Market, in Terms of Value and Volume, 2017–2025(USD Billion and Thousand Units)

Table 8 EVCS Market, By Charging Station, 2017–2025(USD Billion)

Table 9 EVCS Market, By Charging Station, 2017–2025(Thousand Units)

Table 10 EVCS Services Market, By Charging Station, 2017–2025(USD Billion)

Table 11 AC Charging Stations Market, By Type, 2017–2025(USD Billion)

Table 12 AC Charging Stations Market, By Type, 2017–2025(Thousand Units)

Table 13 AC Charging Stations Market, By Installation Type, 2017–2025(USD Million)

Table 14 AC Charging Stations Market, By Installation Type, 2017–2025(Thousand Units)

Table 15 AC Charging Stations Market, By Region, 2017–2025(USD Million)

Table 16 AC Charging Stations Market, By Region, 2017–2025(Thousand Units)

Table 17 Level 1 Charging Stations Market, By Installation Type, 2017–2025(USD Million)

Table 18 Level 1 Charging Stations Market, By Installation Type, 2017–2025(Thousand Units)

Table 19 Level 1 Charging Stations Market, By Region, 2017–2025(USD Million)

Table 20 Level 1 Charging Stations Market, By Region, 2017–2025(Thousand Units)

Table 21 Level 1 Charging Stations Market in Residential Application, By North American Countries, 2017–2025(USD Million)

Table 22 Level 1 Charging Stations Market in Residential Application, By North American Countries, 2017–2025(Thousand Units)

Table 23 Level 1 Charging Stations Market in Residential Application, By European Countries, 2017–2025(USD Million)

Table 24 Level 1 Charging Stations Market in Residential Application, By European Countries, 2017–2025(Thousand Units)

Table 25 Level 1 Charging Stations Market in Residential Application, By APAC Countries, 2017–2025(USD Million)

Table 26 Level 1 Charging Stations Market in Residential Application, By APAC Countries, 2017–2025(Thousand Units)

Table 27 Level 1 Charging Stations Market in Residential Application, By RoW, 2017–2025(USD Million)

Table 28 Level 1 Charging Stations Market in Residential Application, By RoW, 2017–2025(Thousand Units)

Table 29 Level 2 Charging Stations Market, By Installation Type, 2017–2025(USD Million)

Table 30 Level 2 Charging Stations Market, By Installation Type, 2017–2025(Thousand Units)

Table 31 Level 2 Charging Stations Market, By Region, 2017–2025(USD Million)

Table 32 Level 2 Charging Stations Market, By Region, 2017–2025(Thousand Units)

Table 33 Level 2 Charging Stations Market in Residential Application, By North American Countries, 2017–2025(USD Million)

Table 34 Level 2 Charging Stations Market in Residential Application, By North American Countries, 2017–2025(Thousand Units)

Table 35 Level 2 Charging Stations Market in Residential Application, By European Countries, 2017–2025(USD Million)

Table 36 Level 2 Charging Stations Market in Residential Application, By European Countries, 2017–2025(Thousand Units)

Table 37 Level 2 Charging Stations Market in Residential Application, By APAC Countries, 2017–2025(USD Million)

Table 38 Level 2 Charging Stations Market in Residential Application, By APAC Countries, 2017–2025(Thousand Units)

Table 39 Level 2 Charging Stations Market in Residential Application, By RoW, 2017–2025(USD Million)

Table 40 Level 2 Charging Stations Market in Residential Application, By RoW, 2017–2025(Thousand Units)

Table 41 Level 2 Charging Stations Market in Residential Application, By Region, 2017–2025(USD Million)

Table 42 Level 2 Charging Stations Market in Residential Application, By Region, 2017–2025(Thousand Units)

Table 43 Level 2 Charging Stations Market in Commercial Application, By North American Countries, 2017–2025(USD Million)

Table 44 Level 2 Charging Stations Market in Commercial Application, By North American Countries, 2017–2025(Thousand Units)

Table 45 Level 2 Charging Stations Market in Commercial Application, By European Countries, 2017–2025(USD Million)

Table 46 Level 2 Charging Stations Market in Commercial Application, By European Countries, 2017–2025(Thousand Units)

Table 47 Level 2 Charging Stations Market in Commercial Application, By APAC Countries, 2017–2025(USD Million)

Table 48 Level 2 Charging Stations Market in Commercial Application, By APAC Countries, 2017–2025(Thousand Units)

Table 49 Level 2 Charging Stations Market in Commercial Application, By RoW, 2017–2025(USD Million)

Table 50 Level 2 Charging Stations Market in Commercial Application, By RoW, 2017–2025(Thousand Units)

Table 51 Level 2 Charging Stations Market in Commercial Application, By Region, 2017–2025(USD Million)

Table 52 Level 2 Charging Stations Market in Commercial Application, By Region, 2017–2025(Thousand Units)

Table 53 DC Charging Stations Market, By Installation Type, 2017–2025(USD Million)

Table 54 DC Charging Stations Market, By Installation Type, 2017–2025(Thousand Units)

Table 55 DC Charging Stations Market, By Region, 2017–2025(USD Million)

Table 56 DC Charging Stations Market, By Region, 2017–2025(Thousand Units)

Table 57 DC Charging Stations Market in Commercial Application, By North American Countries, 2017–2025(USD Million)

Table 58 DC Charging Stations Market in Commercial Application, By North American Countries, 2017–2025(Thousand Units)

Table 59 DC Charging Stations Market in Commercial Application, By European Countries, 2017–2025(USD Million)

Table 60 DC Charging Stations Market in Commercial Application, By European Countries, 2017–2025(Thousand Units)

Table 61 DC Charging Stations Market in Commercial Application, By APAC Countries, 2017–2025(USD Million)

Table 62 DC Charging Stations Market in Commercial Application, By APAC Countries, 2017–2025(Thousand Units)

Table 63 DC Charging Stations Market in Commercial Application, By RoW, 2017–2025(USD Million)

Table 64 DC Charging Stations Market in Commercial Application, By RoW, 2017–2025(Thousand Units)

Table 65 Inductive Charging Stations Market, in Terms of Value and Volume, 2017–2025(USD Million and Units)

Table 66 EVCS Market, By Installation Type, 2017–2025(USD Billion)

Table 67 EVCS Market, By Installation Type, 2017–2025(Thousand Units)

Table 68 EVCS Market for Residential Installation, By Charging Station, 2017–2025(USD Billion)

Table 69 EVCS Market for Residential Installation, By Region, 2017–2025(USD Million)

Table 70 EVCS Market for Residential Installation, By Region, 2017–2025(Thousand Units)

Table 71 EVCS Market for Commercial Installation, By Charging Station, 2017–2025(USD Billion)

Table 72 EVCS Market for Commercial Installation, By Region, 2017–2025(USD Million)

Table 73 EVCS Market for Commercial Installation, By Region, 2017–2025(Thousand Units)

Table 74 EV Market, By Region, 2017–2025(USD Billion)

Table 75 EV Market, By Region, 2017–2025(Thousand Units)

Table 76 EVCS Market, By Region, 2017–2025(USD Million)

Table 77 EVCS Market, By Region, 2017–2025(Thousand Units)

Table 78 EV Market in North America, By Country, 2017–2025(USD Million)

Table 79 EV Market in North America, By Country, 2017–2025(Thousand Units)

Table 80 EVCS Market in North America, By Country, 2017–2025(USD Million)

Table 81 EVCS Market in North America, By Country, 2017–2025(Thousand Units)

Table 82 EV Market in North America, By Vehicle Type, 2017–2025(USD Billion)

Table 83 EV Market in Europe, By Country, 2017–2025(USD Billion)

Table 84 Market in Europe, By Country, 2017–2025(Thousand Units)

Table 85 EVCS Market in Europe, By Country, 2017–2025(USD Million)

Table 86 EVCS Market in Europe, By Country, 2017–2025(Thousand Units)

Table 87 EV Market in Europe, By Vehicle Type, 2017–2025(USD Billion)

Table 88 EV Market in APAC, By Country, 2017–2025(USD Billion)

Table 89 EV Market in APAC, By Country, 2017–2025(Thousand Units)

Table 90 EVCS Market in APAC, By Country, 2017–2025(USD Million)

Table 91 EVCS Market in APAC, By Country, 2017–2025(Thousand Units)

Table 92 EV Market in APAC, By Vehicle Type, 2017–2025(USD Billion)

Table 93 EV Market in RoW, By Region, 2017–2025(USD Million)

Table 94 EV Market in RoW, By Region, 2017–2025(Thousand Units)

Table 95 EVCS Market in RoW, By Region, 2017–2025(USD Million)

Table 96 EVCS Market in RoW, By Region, 2017–2025(Thousand Units)

Table 97 EV Market in RoW, By Vehicle Type, 2017–2025(USD Million)

Table 98 Ranking of Top 5 Players: Electric Vehicle Charging Stations Market, 2019

Table 99 Contracts & Acquisitions, 2017–2019

Table 100 Collaborations and Partnerships, 2017–2019

Table 101 Product Launches, 2017–2019

Table 102 Expansions, 2017–2019

List of Figures (60 Figures)

Figure 1 Electric Vehicle Market Segmentation

Figure 2 Electric Vehicle Charging Stations Market Segmentation

Figure 3 Electric Vehicle Charing Stations Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at Market Size

Figure 5 Top-Down Approach to Arrive at the Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions of Research Study

Figure 8 Electric Vehicle Market Segmentation

Figure 9 BEV Expected to Hold Larger Size of EV Market in 2020

Figure 10 APAC to Hold the Largest Share of Electric Vehicle Market in 2020

Figure 11 Electric Vehicle Charging Stations Market Segmentation

Figure 12 Market for DC Charging Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Market for Commercial Installation of Electric Vehicle Charging Station Expected to Grow at A Higher CAGR Between 2020 and 2025

Figure 14 APAC to Hold the Largest Share of Electric Vehicle Charging Stations Market in 2020

Figure 15 Battery Electric Vehicle (BEV) Market to Grow at A Higher CAGR Between 2020 and 2025

Figure 16 Government Incentives to Boost the Adoption of EV Charging Stations

Figure 17 Market for DC Charging Station Expected to Be the Largest During 2020–2025

Figure 18 DC Charging Stations Market for Commercial Installation to Hold the Largest Share of the Overall Market in 2020

Figure 19 China to Hold the Largest Share of the Electric Vehicle Charging Stations Market in 2020

Figure 20 DROCs: Electric Vehicle Charging Stations Market, 2018

Figure 21 BEVs and PHEVs Sold During 2010–2017

Figure 22 Working of V2G Charing Station

Figure 23 Major Value is Added During the Manufacturing and Assembly Stage

Figure 24 Types of Electric Vehicle Battery

Figure 25 EV Market Segmentation, By Vehicle Type

Figure 26 APAC to Lead the BEV Market During the Forecast Period

Figure 27 PHEV Market in APAC Expected to Grow at the Highest CAGR Between 2020 and 2025

Figure 28 Market Segmentation, By Charging Station

Figure 29 DC Charging Station Expected to Hold the Largest Share of the Overall Market During the Forecast Period

Figure 30 Commercial Installations Expected to Dominate the AC Charging Stations Market Between 2020 and 2025

Figure 31 Level 1 Charging Stations Market in APAC Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 32 Commercial Installations Estimated to Lead the Level 2 Charging Stations Market During the Forecast Period

Figure 33 APAC Estimated to Lead the DC Charging Stations Market During the Forecast Period

Figure 34 Standards of Electric Vehicle Charging Stations

Figure 35 Number of Chademo Installations, 2010–2018

Figure 36 Market Segmentation, By Installation Type

Figure 37 APAC Expected to Lead the EVCS Market for Residential Installation

Figure 38 Commercial Installation Market in APAC Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 39 Electric Vehicle Charging Stations Market in China Expected to Grow at the Highest CAGR During the Forecast Period

Figure 40 APAC is Expected to Hold the Largest Size of the Electric Vehicle Charging Stations Market During the Forecast Period

Figure 41 Snapshot: Electric Vehicle Charging Stations Market in North America

Figure 42 US Expected to Hold the Largest Share of EV Market in North America Between 2020 and 2025

Figure 43 Electric Vehicle Charging Stations Market in Canada Expected to Grow at the Highest CAGR Between 2020 and 2025

Figure 44 Snapshot: Electric Vehicle Charging Stations Market in Europe

Figure 45 EVCS Market in the UK Expected to Grow at the Highest CAGR Between 2020 and 2025

Figure 46 BEV Expected to Hold A Larger Share of the EV Market in Europe During the Forecast Period

Figure 47 Snapshot: Electric Vehicle Charging Stations Market in APAC

Figure 48 China Expected to Grow at the Highest CAGR Between 2020 and 2025

Figure 49 Electric Vehicle Charging Stations Market in RoW

Figure 50 Africa Expected to Grow at A Higher CAGR During the Forecast Period

Figure 51 Key Players Adopted Contracts and Acquisitions as Key Growth Strategies Between 2017 and 2019

Figure 52 Market Evolution Framework: Contracts and Acquisitions Fueled the Growth of the Electric Vehicle Charging Stations Market During 2017–2019

Figure 53 Contracts and Acquisitions have Been the Key Strategies Between 2017 and 2019

Figure 54 ABB: Company Snapshot

Figure 55 Aerovironment: Company Snapshot

Figure 56 Engie: Company Snapshot

Figure 57 Tesla: Company Snapshot

Figure 58 Schneider Electric: Company Snapshot

Figure 59 Siemens: Company Snapshot

Figure 60 Efacec: Company Snapshot

The study involved 4 major activities in estimating the current size of the electric vehicle charging stations market. Exhaustive secondary research was done to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, electric vehicle charging stations-related journals, IEST publications; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which has been further validated by primary research.

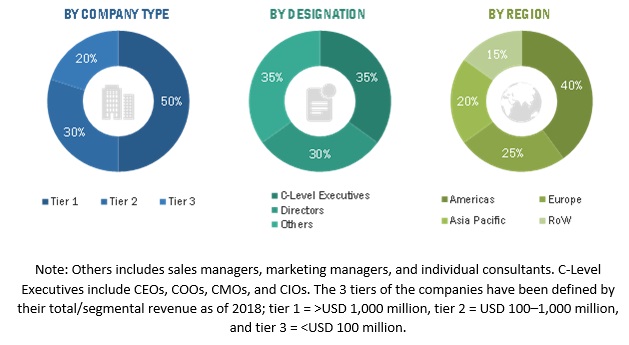

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research has been conducted after understanding and analyzing the electric vehicle charging stations market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). RoW comprises Middle East and Africa. Approximately 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the electric vehicle charging stations market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides across different end-use applications.

Study Objectives

- To describe and forecast the electric vehicle charging stations market, in terms of value, segmented on the basis of vehicle type, charging station, installation type and region

- To describe and forecast the market size with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

- To analyze competitive developments such as product launches/developments, partnerships, expansions, and Research & Development (R&D) activities carried out by players in the Electric vehicle charging stations market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company's specific needs. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown for different segments (By Vehicle Type, Charging Station and Installation Type) in North America, Europe, Asia Pacific, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Electric Vehicle Charging Stations Market

The growing need for EVs in various parts of the world is expected to increase the demand for charging stations. As a result, various governments are funding for the development of charging station infrastructure, as well as subsidizing the EV charging infrastructure. Does your report covers regulatory scenario of EV charging station market?

Heavy investments from makers of EVs are expected to play a major role in the evolution of the electric vehicle charging stations market. Tesla, Volkswagen, Mahindra & Mahindra, Ford, Nissan, BMW, and General Motors have huge R&D budgets for the development of EVs. Do you have detailed coverage about investments made by automakers in the ecosystem?

ICE vehicles emit a high volume of carbon gas that is released into atmosphere, creating pollution and greenhouse gases. To reduce pollution, governments of several countries are taking initiatives for the deployment of EVs for future. This would help in improving the air quality. Does your report cover the government acts for environmental pollution control across geographies?

The widespread use of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) has led to an increase in the number of installations of EV charging stations. So it is important for us to have detailed information about the growth and demand scenario of electric vehicles (EVs). Does your report covers details about EV market in US, Europe, and China?

Standardization of EV charging technology has emerged as the crucial point for the development of electric vehicles. Governments need to standardize charging infrastructure for the development of a favorable ecosystem and increasing the sales of EVs. I am looking for information on EV charging market, different industry standards, and business models with particular focus on the UK.