Liquid Handling System Market by Product (Pipette, Consumables, Liquid Handling Workstations, Burettes, Software), Type (Automated, Electronic, Manual), Application (Drug Discovery, Clinical Diagnostics), End User (Research Institutes) & Region - Global Forecast to 2027

Updated on : May 04, 2023

Inquire Now to get the Global Forecasts Data upto 2028

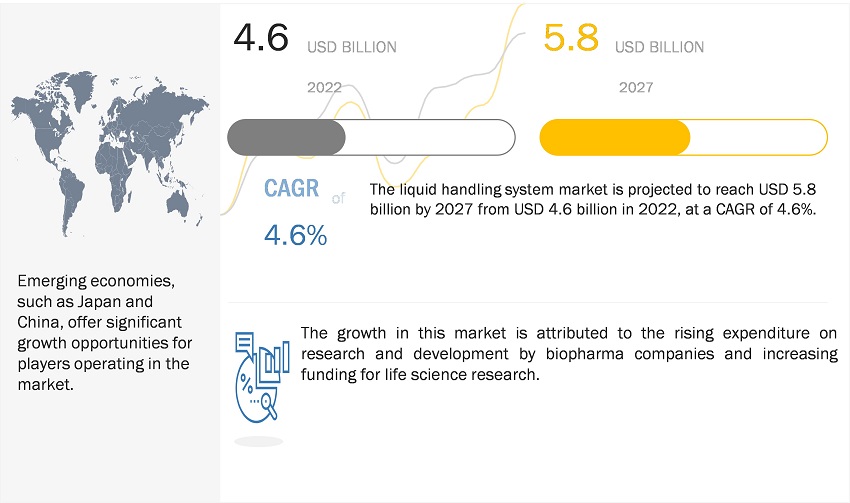

The global liquid handling system market in terms of revenue was estimated to be worth $4.6 billion in 2022 and is poised to reach $5.8 billion by 2027, growing at a CAGR of 4.6% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new edition of the report provides updated financial information until 2021 or 2022 for each listed company in a graphical representation in a single diagram (instead of multiple tables). This would help to analyze easily the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region or country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities. The growth in this market is attributed to the increased outsourcing of pharmaceutical research, increased funding for life sciences research and development, growth in the pharmaceutical sector, and increasing demand for high throughput screening, which will drive the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Liquid Handling System Market Dynamics

Driver: Global expansion of pharmaceutical & biotechnology industries

The pharmaceutical & biotechnology industries are growing at a substantial rate across the globe. The pharmaceutical industry is responsible for the research, development, production, and distribution of medications. The market has experienced significant growth during the past two decades, and pharma revenues worldwide totalled USD 1.42 trillion in 2021. The Pharma Times, in December 2021, reported that pharma sales in the 60 biggest markets worldwide were projected to grow 4.6% to reach USD 1.5 trillion.

Market growth has been bolstered by initiatives taken by global pharma & biopharma companies, such as partnerships with IT, clinical research in IT, digital supply chain & manufacturing, pharmacovigilance software, geographic expansions, mergers & acquisitions, and product innovations to tap the potential growth opportunities in these industries.

Opportunity: Growing genomics and proteomics research

The rising focus on Genomics and proteomics research in various areas from disease diagnosis to biomarker discovery. This can be attributed to major market developments and growing pharma & biotech R&D funding. Some important developments in this regard have been mentioned below:

- In January 2023, Novo Holdings (Denmark) announced a USD 40 million investment in Evosep (Denmark) to provide more customers with a solution for robust and high-throughput proteomics.

- In December 2022, the UK government announced a Euro 175 million investment in genomics research, including a study led by Genomics England, in partnership with the National Health Service (NHS), to explore the effectiveness of using whole-genome sequencing to find and treat rare genetic diseases in new-born babies.

- In December 2022, Health and Social Care Secretary announced A Euro 175 million fund for cutting-edge genomics research for patients with cancer and children born with treatable rare genetic diseases. Euro 105 million will be spent on a research study led by Genomics England in partnership with the NHS. The study will explore the effectiveness of using whole genome sequencing to find and treat rare genetic diseases in newborn babies.

- In December 2022, Parallel Bio secured USD 4.3 million seed round to accelerate drug discovery through the human immune system in a dish. The investment capital has enabled it to prove the viability of its immune-system-in-a-dish platform and accelerate the pace of drug discovery and development.

- November 2022, the Ontario government launched a USD 15 million Life Sciences Innovation Fund to help life sciences entrepreneurs and innovators bring their ideas and prototypes from the lab to the marketplace. Eligible companies will receive up to USD 500,000 to scale their made-in-Ontario health solutions both at home and in global markets.

Challenge: Dearth of skilled professionals

The proper usage of life science and analytical technologies requires expertise with relevant experience and knowledge, high throughput screening, compound weighting and dissolution, DNA/RNA purification, NGS, PCR, and sample preparation. Lack of knowledge may cause several direct and indirect expenses as well as increases the workload and time pressure on researchers.

This also leads to inefficient practical experience and an insufficient understanding of the phenotypic implications of sequencing-based data. A research paper related to NGS, published by the National Center for Biotechnology Information (US), states that the growing demand and the increasing adoption of NGS technologies in Australia are emphasizing the need for skilled biologists to handle and analyze NGS data. This highlights the need for highly skilled personnel for method development, validation, operation, and troubleshooting activities—the dearth of such a workforce can, therefore, be said to directly impact the growth of the market.

Currently, there is a shortage of skilled personnel for method development, validation, operation, and troubleshooting activities, which is expected to challenge the growth of the market to an extent in the coming years. This shortage of skilled labor in major markets is expected to affect the optimum growth potential of the market during the forecast period.

The pipettes segment accounted for the largest share of the liquid handling system market, by product type.

Based on the products, the market is broadly segmented into pipettes, consumables, software, liquid handling workstations, microplate reagent dispensers, burettes, microplate washers, and other products. Pipette dominated the market. The largest share can be attributed to the increasing number of biotechnology, pharmaceutical, medical science, and clinical research.

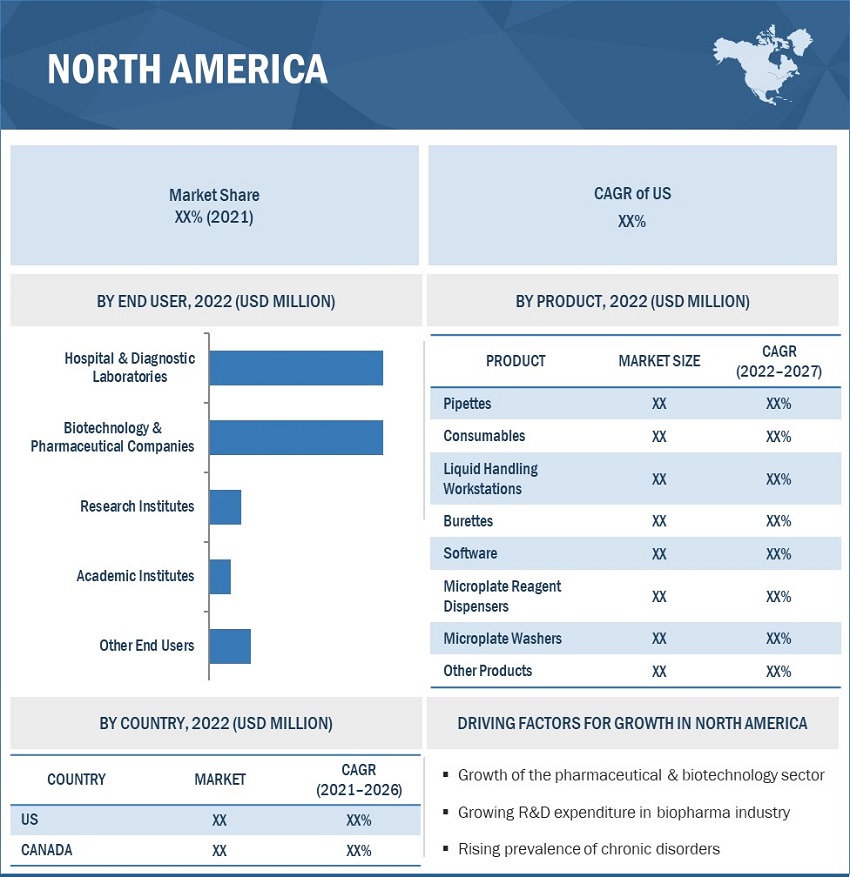

North America dominated the liquid handling system market.

The market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (ROW). North America dominated the market for liquid handling systems. The largest share can be attributed to the increasing number of chronic diseases and the growing focus on funding and investments in life sciences research.

To know about the assumptions considered for the study, download the pdf brochure

The liquid handling system market is dominated by players such as Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Eppendorf (Germany), PerkinElmer Inc. (US), and Agilent Technologies, Inc. (US).

Liquid Handling System Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$4.6 billion |

|

Projected Revenue by 2027 |

$5.8 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 4.6% |

|

Market Driver |

Global expansion of pharmaceutical & biotechnology industries |

|

Market Opportunity |

Growing genomics and proteomics research |

This research report categorizes the liquid handling system market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia

- Rest of the World

By Type

- Electronic Liquid Handling Systems

- Automated Liquid Handling Systems

- Manual Liquid Handling Systems

By Product

- Pipettes

- Consumables

- Microplate Reagent Dispensers

- Liquid Handling Workstations

- Burettes

- Microplate Washers

- Software

- Other Products

By Application

- Drug Discovery

- Genomics

- Clinical Diagnostics

- Proteomics

- Other Applications

By End User

- Biotechnology & Pharmaceutical Companies

- Research Institutes

- Hospital & Diagnostic Laboratories

- Academic Institutes

- Other End Users

Recent Developments:

- In 2022, Beckman Coulter Life Sciences (US) company of Danaher Corporation launched the Biomek NGeniuS liquid handling system. It automates the labor-intensive process of manual library construction and reagent transfers, helping free up technicians and researchers to focus on the science, not the workflow, while also reducing the possibility of errors.

- Gilson (US) launched MyPIPETMAN, a customizable and modular pipette. It is lightweight, ergonomic, reliable, and easy to use, with technical and personalization options to adapt to the researcher’s laboratory needs.

- In 2022, Endress+Hauser (Switzerland) launched Memosens 2.0 technology that converts the measured value to a digital signal and transfers it inductively to the transmitter, offering safe data transfer for increased availability of the measuring point and trouble-free operation. The new technology is available for pH/ORP, conductivity, and dissolved oxygen sensors—and it will be extended to the complete sensor portfolio for liquid analysis.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the liquid handling system market?

The liquid handling system market boasts a total revenue value of $5.8 billion by 2027.

What is the estimated growth rate (CAGR) of the liquid handling system market?

The global liquid handling system market has an estimated compound annual growth rate (CAGR) of 4.6% and a revenue size in the region of $4.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

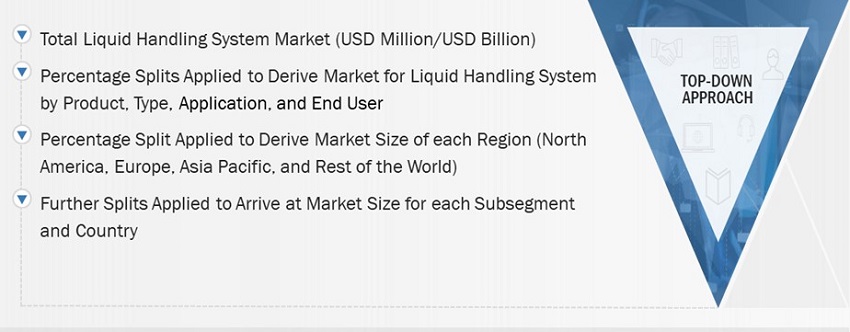

The study involved four major activities in estimating the current size of the liquid handling systems market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Liquid handling system market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

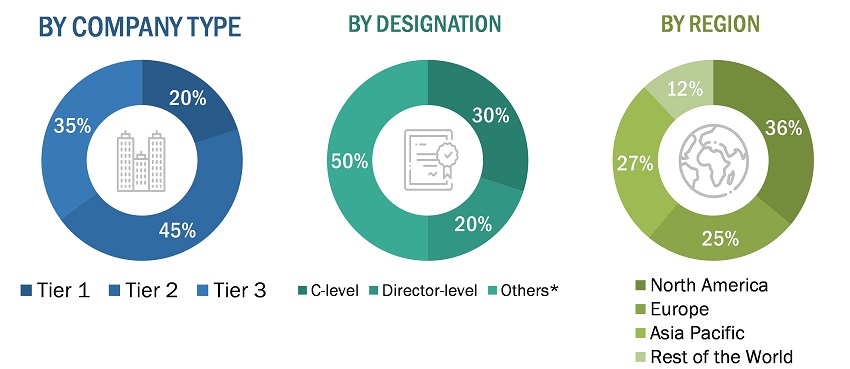

Extensive primary research was conducted after acquiring knowledge about the Liquid handling system market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such clinical laboratories, hospitals, and academic & research institutes) and supply-side (such as product manufacturers, wholesalers, channel partners, and distributors). Approximately 42% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 58%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various liquid handling system were identified at the global/regional level. Revenue mapping was done for the major players (who contribute at least 35-40% of the overall market share at the global level) and was extrapolated to arrive at the global market value of each type of segment. The market value of liquid handling system market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of market at the regional and country-level

- Relative adoption pattern of each market among key type segments at the regional and/or country-level

- Relative adoption pattern of each market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Liquid Handling System industry.

Report Objectives

- To define, describe, and forecast the liquid handling system market based on the product, type, application, end users and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to their growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of market segments with respect to five regions, namely, North America, Europe, Asia Pacific and ROW.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global Liquid handling system Market report:

- Company Information Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Liquid Handling System Market

Flow sensor of Liquid Handling System