Mercury Analyzer Market by Type (Cold Vapor Atomic Absorption and Cold Vapor Atomic Fluorescence), Monitoring Type (Continuous and Lab), End-Use Industry (Environmental Monitoring, Food Industry) and Region - Global Forecast to 2029

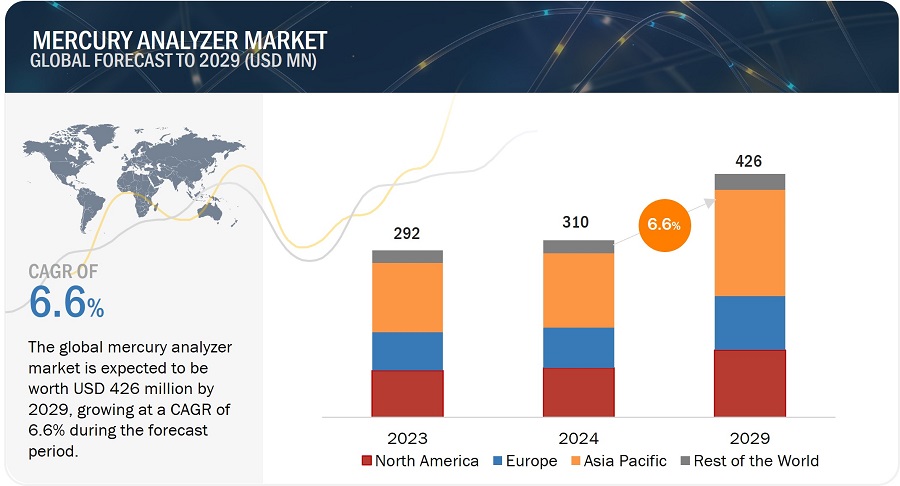

[200 Pages Report] The mercury analyzer market is expected to grow from USD 310 million in 2024 to USD 426 million by 2029, at a CAGR of 6.6% during the forecast period. Growing regulations for environmental protection and active government engagement and regulatory entities to monitor environmental conditions significantly influence the mercury analyzer market dynamics. In addition, increasing industrialization and urbanization in emerging economies, coupled with the emerging application of mercury analyzers in the research field, generate opportunities within the mercury analyzer market.

Mercury Analyzer Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Mercury Analyzer Market Dynamics

DRIVERS: Growing regulations for environmental protection

In many nations globally, numerous industrial sectors, including cement, oil & gas, chemicals, and power generation, emit significant volumes of harmful gases. Recognizing the detrimental impact of these emissions on human health and the environment, many countries have implemented stringent measures to monitor emission levels continually. Specific pollutants must adhere to prescribed limit values to safeguard the environment and public health, leading to the enactment of laws and regulations such as Germany's Federal Emission Control Act and the US Environmental Protection Agency's Clean Air Act. Consequently, heightened concerns about reducing hazardous gas emissions and concerted efforts to protect the environment have driven increased demand for emission monitoring systems, including mercury gas analyzers and other gas analyzers. Additionally, regulatory bodies have introduced guidelines governing the inspection, sampling, and testing of environmental samples, such as air, water, or soil, to detect the presence of mercury and other toxic pollutants. These agencies have also initiated various awareness programs and established testing standards to ensure environmental safety and mitigate associated health risks. Below, we outline some regulations stipulating permissible limits for mercury and other toxic pollutants.

RESTRAINTS: High cost of equipment for mercury analysis

Spectrometry instruments are renowned for their advanced capabilities and consequently command premium prices. Inductively coupled plasma mass spectrometry (ICP-MS) stands out among analytical techniques for trace element analysis due to its high sensitivity, wide linear dynamic range, and ability to simultaneously detect multiple elements, surpassing competing methods. As a result, ICP-MS has seen increased adoption in environmental and biomonitoring laboratories for concurrent measurement of mercury and other toxins. Despite the growing demand driven by technological advancements and operational efficiencies, the prices of mass spectrometers have risen. The price of spectrometers significantly influences the purchasing decisions of end users. Companies in environmental monitoring, petrochemicals, food, and healthcare require numerous such systems, leading to substantial capital costs. Additionally, academic research laboratories often struggle to afford these systems due to constrained budgets. These factors are major barriers to the wider adoption of mass spectrometry systems for mercury analysis among end users.

OPPORTUNITIES: Increasing industrialization and urbanization in emerging markets

The increasing industrialization and urbanization in emerging economies offer significant opportunities for the mercury analyzer market. As these countries address environmental challenges and adhere to international regulations, the demand for mercury monitoring solutions is rising across industries like power generation, mining, and manufacturing. Moreover, the industrialization surge in emerging regions like Asia Pacific has heightened environmental pollution and degradation awareness. Countries such as China, India, and Indonesia are experiencing rapid growth in industries such as petrochemicals, food processing, pharmaceuticals, textiles, and heavy metals. This escalating pollution and environmental degradation are expected to lead to the establishment of new environmental safety standards and amendments, particularly in Asia Pacific and South American regions, within the next five years. The surge in industrialization has prompted the implementation of various environmental protection acts, presenting a key opportunity for the environmental testing market, which, in turn, translates to significant potential for the mercury analyzer market.

CHALLENGES: Complexity of sampling and analytical procedures

In the mercury analyzer market, a significant challenge is the complexity of sampling and analysis. Mercury analysis often requires intricate procedures and specialized sampling techniques to ensure accurate results. This complexity arises from various factors. Ensuring representative samples can be challenging, particularly in environments with low mercury concentrations or complex matrices. Different sample types, such as air, water, soil, and biological tissues, may require distinct sampling methodologies to capture mercury effectively while minimizing contamination or loss. The presence of interfering compounds or matrix effects in samples can complicate mercury analysis, leading to inaccurate measurements. These interferences may originate from naturally occurring substances, environmental contaminants, or sample treatment processes. Overcoming these challenges often necessitates sophisticated analytical methods and sample preparation techniques tailored to the specific characteristics of the sample matrix. Additionally, the diversity of applications for mercury analysis adds to the complexity. Mercury monitoring is essential across various industries, including environmental monitoring, industrial processes, healthcare, and research. Ensuring the reliability and reproducibility of results is paramount, particularly in regulatory compliance and quality control applications. This requires not only accurate instrumentation but also rigorous quality assurance and control measures throughout the sampling and analysis process.

Mercury Analyzer Market Ecosystem

Cold vapor atomic fluorescence segment is expected to grow at the higher CAGR in the mercury analyzer market during the forecast period.

The Cold vapor atomic fluorescence segment is expected to grow at the higher CAGR in the mercury analyzer market during the forecast period, due to significant advancements in technology that have greatly improved cold vapor atomic fluorescence analyzers, making them more sensitive and precise. This improvement is particularly crucial for industries and regulatory bodies aiming to meet increasingly stringent environmental standards. Additionally, there is a growing concern about mercury contamination in various ecosystems and its harmful effects on human health. This concern is driving the demand for more sophisticated detection methods, leading to increased adoption of cold vapor atomic fluorescence analyzers.

The environmental monitoring segment is expected to grow at a higher CAGR in the mercury analyzer market during the forecast period.

The environmental monitoring segment is expected to grow at the higher CAGR in the mercury analyzer market during the forecast period. This surge is primarily due to the stringent environmental regulations globally are compelling industries to monitor and control mercury emissions more effectively. Additionally, increasing awareness about the harmful effects of mercury pollution on ecosystems and human health is prompting governments and organizations to invest in advanced monitoring technologies. Moreover, the expansion of industries such as power generation, mining, and chemical manufacturing, which are significant sources of mercury emissions, is fueling the adoption of mercury analyzers for continuous monitoring and compliance purposes.

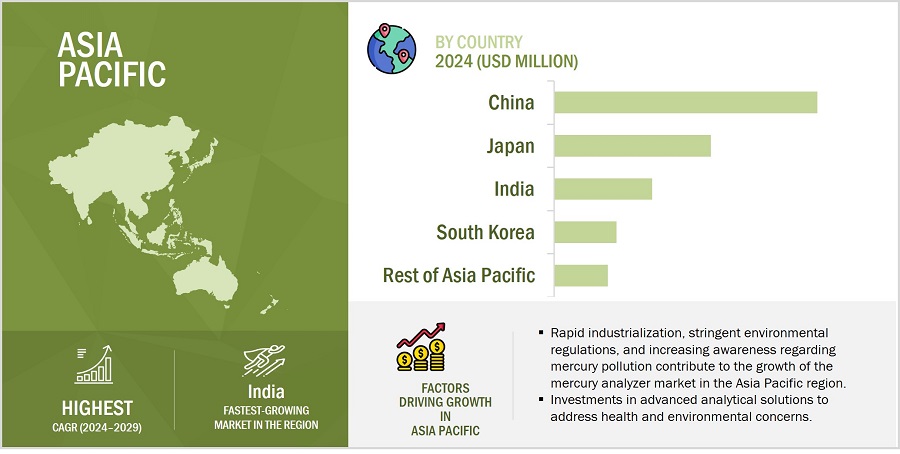

Asia Pacific is expected to grow at the higher CAGR in the mercury analyzer market during the forecast period.

Asia Pacific is expected to grow at the higher CAGR in the mercury analyzer market throughout the forecast period. Rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations are leading to increased mercury emissions from various industrial processes, necessitating stringent monitoring measures. Moreover, growing concerns about environmental pollution and its impact on public health are prompting governments in the region to enforce stricter regulations regarding mercury emissions, thereby driving the adoption of mercury analyzers for compliance monitoring. Additionally, rising investments in infrastructure development, particularly in sectors such as power generation, mining, and manufacturing, are fueling the demand for mercury analyzers for environmental monitoring purposes.

Mercury Analyzer Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The mercury analyzer companies have /implemented various types of organic and inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations, to strengthen their offerings in the market. The major players are Teledyne Leeman Labs (US), Tekran Instruments Corporation (Canada), Thermo Fisher Scientific Inc. (US), PerkinElmer Inc. (US), Milestone Srl (US), Analytik Jena GmbH+Co. KG (Germany), Nippon Instruments Corporation (Japan), Hitachi High-Tech Corporation (Japan), Lumex Instruments (Canada), ENVEA (France), among others. The study includes an in-depth competitive analysis of these key players in the mercury analyzer market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, End-Use Industry |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Teledyne Leeman Labs (US), Tekran Instruments Corporation (Canada), Thermo Fisher Scientific Inc. (US), PerkinElmer Inc. (US), Milestone Srl (US), Analytik Jena GmbH+Co. KG (Germany), Nippon Instruments Corporation (Japan), Hitachi High-Tech Corporation (Japan), Lumex Instruments (Canada), ENVEA (France), among others – Total 25 players have been covered. |

Mercury Analyzer Market Highlights

This research report categorizes the global Mercury Analyzer Market based on Type, End-Use Industry, and Region.

|

Segment |

Subsegment |

|

By Type: |

|

|

By End-Use Industry |

|

|

By Region: |

|

Recent Developments

- In February 2024, Lumex Instruments (Canada) introduced the Light 915M2 mercury analyzer, the successor to their popular mercury analyzer, Light-915 mercury analyzer. The new Light-915M2 operates into Lumex’s proprietary Zeeman atomic absorption spectrometry (AAS) technology with significant improvements and developments to enhance industrial mercury monitoring. It detects much lower mercury levels (down to 50 ng/m³) and boasts a wider measurement range (up to 200 µg/m³). This versatility allows the Light 915M2 to function seamlessly in labs, workshops, or even outdoors for field measurements or mounted on a vehicle.

- In October 2023, SICK AG (Germany) and Endress+Hauser (Switzerland) entered a strategic partnership. They signed a joint Memorandum of Understanding to enhance process automation by jointly refining and promoting SICK’s Flow and Analyzer technologies. Additionally, their focus is on improving customer support across the value chain, addressing key issues like climate and environmental protection, the energy transition, and the hydrogen economy within the process industry.

- In February 2023, ENVEA (France) launched the new SM-5 Continuous mercury monitor. The latest SM-5 CEMS Hg analyzer is engineered to deliver highly precise and dependable ongoing assessments of ultra-low levels of Hg in flue gas emissions. With its rapid response times, broad dynamic ranges, and consistent measurements in any conditions, the SM-5 ensures reliable performance.

Frequently Asked Questions (FAQs) :

What is a mercury analyzer?

A mercury analyzer is an instrument designed to detect and measure mercury (Hg) concentration in various sample types, including solids, liquids, and gases. The mercury analyzer utilizes techniques such as cold vapor atomic absorption and cold vapor atomic fluorescence spectrometry to separate atomic mercury from the sample's matrix. These analyzers are utilized across various sectors, including environmental monitoring of air, water, and soil; the food industry; oil, gas, and petrochemical industries; healthcare and cosmetics sectors; and research institutes and laboratories.

What is the total CAGR expected to be recorded for the mercury analyzer market during 2024-2029?

The global mercury analyzer market is expected to record a CAGR of 6.6% from 2024–2029.

What are the driving factors for the mercury analyzer market?

Growing regulations for environmental protection, active government engagement, and regulatory entities to monitor environmental conditions are some of the factors driving the mercury analyzer market.

Which are the significant players operating in the mercury analyzer market?

Teledyne Leeman Labs (US), Tekran Instruments Corporation (Canada), Thermo Fisher Scientific Inc. (US), PerkinElmer Inc. (US), Milestone Srl (US), Analytik Jena GmbH+Co. KG (Germany), Nippon Instruments Corporation (Japan), Hitachi High-Tech Corporation (Japan), Lumex Instruments (Canada), and ENVEA (France) are some of the major companies operating in the mercury analyzer market.

Which region will lead the mercury analyzer market in the future?

Asia Pacific is expected to lead the mercury analyzer market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

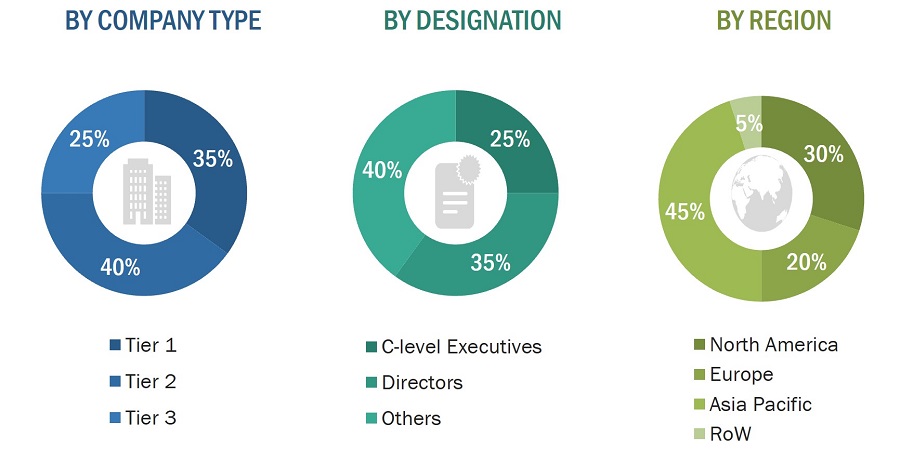

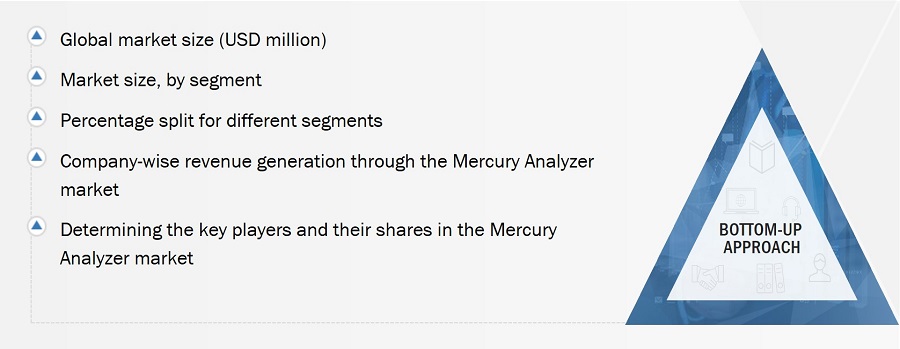

The study involved four major activities in estimating the current size of the mercury analyzer market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Finally, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was conducted mainly to obtain key information about the industry’s supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the mercury analyzer ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the overall mercury analyzer market and the market based on segments. The research methodology used to estimate the market size was given below:

- Major players operating in the mercury analyzer market were identified and considered for the report through extensive secondary research.

- The supply chain and market size of the mercury analyzer market, both in terms of value and units, were estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns, were determined through the use of secondary sources, which were further verified through primary sources.

Global Mercury Analyzer Market Size: Bottom-Up Approach

Global Mercury Analyzer Market Size: Top-Down Approach

Market Definition

A mercury analyzer is an instrument designed to detect and measure mercury (Hg) concentration in various sample types, including solids, liquids, and gases. The mercury analyzer utilizes techniques such as cold vapor atomic absorption and cold vapor atomic fluorescence spectrometry to separate atomic mercury from the sample's matrix. These analyzers are utilized across various sectors, including environmental monitoring of air, water, and soil; the food industry; oil, gas, and petrochemical industries; healthcare and cosmetics sectors; and research institutes and laboratories.

Key Stakeholders

- Mercury analyzer product manufacturers

- Mercury analyzer product traders/suppliers

- Raw material suppliers and distributors

- Associations, organizations, forums, and alliances related to mercury analysis

- Government bodies such as regulatory authorities and policy-makers

- Research laboratories and academic institutes

- National and regional pollution control boards and organizations

- Oil producing and distribution companies

- Municipalities and municipal corporations

- Sewage and wastewater treatment plants

- Food industry

- Healthcare establishments

- Cosmetic manufacturers

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe, and forecast the overall mercury analyzer market in terms of value and volume

- To describe, and forecast the mercury analyzer market segmented on the basis of type, end-use industry, and region

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the RoW

- To provide detailed information on the drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the supply chain and ecosystem, along with the average selling price of the mercury analyzer

- To strategically analyze the regulatory landscape, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape of the market

- To analyze strategic developments such as product launches, partnerships, expansions, and contracts in the mercury analyzer market

- To identify the key players operating in the mercury analyzer market and comprehensively analyze their market ranking and core competencies2

- To analyze strategic developments such as product launches, partnerships, expansions, and contracts in the mercury analyzer market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of 25 key players

Growth opportunities and latent adjacency in Mercury Analyzer Market

Continuous measurement of Mercury from coal-fired power plant flue gas emissions is getting mandatory. Over 90% of power plants in India are using our CEMs system for the measurement of CO,SO2,NOx, particulate matter parameters. Please suggest a reliable technique, make, model no. for the continuous measurement of Mercury. To measure - Elemental, Ionic & Total mercury, Measuring principle - Atomic absorption spectrometry Cold Vapor Atomic Fluorescence Automatic calibration facility.