Metal Chelates Market by Type (Primary Nutrients, Secondary Nutrients, Micronutrients), Mode of Application (Soil, Foliar, Fertigation), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), and Region - Global Forecast to 2022

The global metal chelates market was valued at USD 357.0 Million in 2015, and is projected to grow at a CAGR of 8.54% from 2016, to reach USD 619.5 Million by 2022. The main objectives of the report are to define, segment, and project the size of the global metal chelates market with respect to type, crop type, mode of application, and region; provide detailed information regarding the key factors influencing the growth of the market; and strategically profile key players and comprehensively analyze their core competencies.

Years considered for this report

2015 Base year

2016 Estimated year

2022 Projected year

Research Methodology

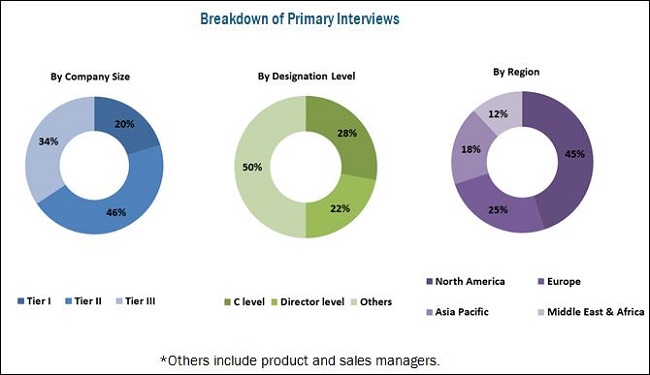

This research study involves the extensive usage of secondary sources Food and Agriculture Organization of the United Nations (FAO), United States Department of Agriculture (USDA), National Center for Biotechnological Information (NCBI), Micronutrients Manufacturers Association (MMA), Agro Inputs Manufacturers Association of India (AIM) to identify and collect information useful for this technical, market-oriented, and commercial study of the metal chelates market. The primary sources are mainly several industry experts from core & related industries and preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standard & certification organizations related to all the segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants among other experts to obtain and verify critical qualitative & quantitative information as well as to assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of metal chelates begins with R&D and product development, in which the selection of source and the quality of the product are determined by the requirement of the product. The value chain helps in bringing about coordination among stakeholders such as BASF SE (Germany), Akzo Nobel N.V. (The Netherlands), Syngenta AG (Switzerland), Nufarm Limited (Australia) and Haifa Chemicals Limited (Israel).

Target Audience

The key stakeholders for the report are as follows:

- Metal chelates manufacturers

- Metal chelates importers and exporters

- Government regulatory authorities and research organizations

- Metal chelates industry bodies

Scope of the Metal Chelates Market Report

On the basis of type, the market is segmented as follows:

- Primary nutrients

- Secondary nutrients

- Micronutrients

- Other nutrients (amino acid, humic acid, and fulvic acid)

On the basis of crop type, the market is segmented as follows:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other crops (turf & ornamentals and plantation crops)

On the basis of mode of application, the market is segmented as follows:

- Soil

- Foliar

- Fertigation

- Others (seed treatment and hydroponics)

On the basis of Region, the market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- MEA

Key Takeaways from This Report

- Global market size in 2015; industry growth forecast from 2016 to 2022

- The micronutrients segment dominated the metal chelates market in 2015

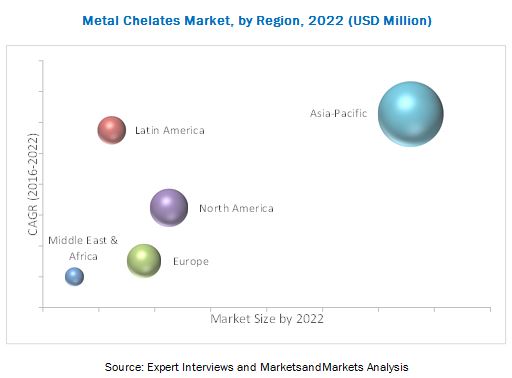

- The Asia-Pacific region market for metal chelates was dominant in 2015

- Detailed company profiles of key manufacturers of metal chelates market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The metal chelates market has grown exponentially in the last few years. Decrease in soil quality and pH level, increasing demand for high production and growing awareness about the nutrient deficiencies and its impact are the major drivers for the market.

On the basis of type, the market for metal chelates is segmented into primary nutrients, secondary nutrients, micronutrients, and other nutrients (amino acid, humic acid & fulvic acid). The micronutrients was the largest segment in 2015, followed by primary nutrients. The micronutrients is also the fastest growing segment during forecast period.

The fruits & vegetables, on the basis of crop type, is projected to grow at a significant rate during the forecast period. As fruits and vegetables are the sensitive crops, they can get completely damaged due to the nutrient deficiencies in the soil. The awareness among farmers about the importance of nutrients for these crops, and the increasing demand for fruits and vegetables will drive the metal chelates markets growth.

On the basis of mode of application, the global market is segmented into soil, foliar and fertigation. The foliar segment is projected to grow at the highest CAGR during the forecast period. Foliar is easy, economical and time-effective mode. Hence, the foliar mode has become popular among farmers.

The Asia-Pacific market is projected to grow at the highest CAGR during the forecast period, owing to the increasing awareness about the modern agricultural practices. The growing demand for food is also driving the metal chelates market. Growth is majorly witnessed in China, India, Australia, and New Zealand, due to increase in the demand for, awareness about, and adoption of modern agricultural practices.

The major restraints of the metal chelates market include the impact of non-biodegradable metal chelates. The market has a number of large and small-scale firms. Expansion and agreements were the key strategies adopted by market players to ensure their growth. Leading players in the global market for metal chelates are BASF SE (Germany), Akzo Nobel N.V. (The Netherlands), Syngenta AG (Switzerland), Nufarm Limited (Australia), and Haifa Chemicals Limited (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Macro Indicators

2.2.1 Growing Population and Decreasing Arable Land

2.2.2 Increasing Farm Expenditure

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in this Market

4.2 Metal Chelates Market, By Key Country, 2016

4.3 Life Cycle Analysis: Metal Chelates Market, By Region

4.4 Metal Chelates Market, By Type

4.5 Developed vs Emerging Metal Chelates Markets, 2016 vs 2022

4.6 Market, By Type & Region, 2015

4.7 Asia-Pacific: the Largest Market for Metal Chelates

4.8 Market, By Mode of Application

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Crop Type

5.2.3 By Mode of Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for High Yield From Crop Production

5.3.1.2 Increasing Awareness About Nutrient Deficiencies in Crops

5.3.1.3 Deteriorating Soil Quality

5.3.2 Restraints

5.3.2.1 Adverse Impact of Non-Biodegradable Metal Chelates

5.3.3 Opportunities

5.3.3.1 Upgraded Farming Practices in Emerging Markets

5.3.4 Challenges

5.3.4.1 Lack of Awareness and Low Acceptance Among Farmers

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End Users (Manufacturers/Consumers)

6.3.4 Key Influencers

6.4 Regulatory Framework

6.4.1 North America

6.4.2 Europe

6.4.3 Asia-Pacific

7 Metal Chelates Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Primary Nutrients

7.3 Secondary Nutrients

7.4 Micronutrients

7.5 Other Nutrients

8 Metal Chelates Market, By Crop Type (Page No. - 60)

8.1 Introduction

8.2 Cereals & Grains

8.3 Oilseeds & Pulses

8.4 Fruits & Vegetables

8.5 Other Crops

9 Metal Chelates Market, By Mode of Application (Page No. - 68)

9.1 Introduction

9.2 Soil

9.3 Foliar

9.4 Fertigation

9.5 Others

10 Metal Chelates Market, By Region (Page No. - 75)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 Italy

10.3.4 France

10.3.5 Spain

10.3.6 Poland

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Australia

10.4.4 New Zealand

10.4.5 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of Latin America

10.6 Middle East & Africa (MEA)

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Ranking Analysis, By Company

11.3 Competitive Situations & Trends

11.3.1 Expansions

11.3.2 Agreements

11.3.3 New Product Launches

11.3.4 Collaborations & Acquisitions

11.3.5 Investments & Divestments

12 Company Profiles (Page No. - 110)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

12.1 Introduction

12.2 BASF SE

12.3 Akzo Nobel N.V.

12.4 Syngenta AG

12.5 Nufarm Limited

12.6 Haifa Chemicals Ltd.

12.7 Aries Agro Limited

12.8 Van Iperen International

12.9 Valagro SPA

12.10 Protex International

12.11 Deretil Agronutritional

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 136)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Other Developments

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (82 Tables)

Table 1 List of Chelating Agents Recognized By European Union

Table 2 Metal Chelates Market Size, By Type, 20142022 (USD Million)

Table 3 Market Size, By Type, 20142022 (KT)

Table 4 Primary Nutrients Market Size, By Type, 20142022 (USD Million)

Table 5 Primary Nutrients Market Size, By Region, 20142022 (USD Million)

Table 6 Primary Nutrients Market Size, By Region, 20142022 (KT)

Table 7 Secondary Nutrients Market Size, By Type, 20142022 (USD Million)

Table 8 Secondary Nutrients Market Size, By Region, 20142022 (USD Million)

Table 9 Secondary Nutrients Market Size, By Region, 20142022 (KT)

Table 10 Micronutrients Market Size, By Type, 20142022 (USD Million)

Table 11 Micronutrients Market Size, By Region, 20142022 (USD Million)

Table 12 Micronutrients Market Size, By Region, 20142022 (KT)

Table 13 Other Nutrients Market Size, By Region, 20142022 (USD Million)

Table 14 Other Nutrients Market Size, By Region, 20142022 (USD Million)

Table 15 Metal Chelates Market Size, By Crop Type, 2014-2022 (USD Million)

Table 16 Market Size, By Crop Type, 2014-2022 (KT)

Table 17 Cereals & Grains Market Size, By Region, 2014-2022 (USD Million)

Table 18 Cereals & Grains Market Size, By Region, 2014-2022 (KT)

Table 19 Oilseeds & Pulses Market Size, By Region, 2014-2022 (USD Million)

Table 20 Oilseeds & Pulses Market Size, By Region, 2014-2022 (KT)

Table 21 Fruits & Vegetables Market Size, By Region, 2014-2022 (USD Million)

Table 22 Fruits & Vegetables Market Size, By Region, 2014-2022 (KT)

Table 23 Metal Chelates Market Size for Other Crops, By Region, 2014-2022 (USD Million)

Table 24 Market Size for Other Crops, By Region, 2014-2022 (KT)

Table 25 Market Size, By Mode of Application, 20142022 (USD Million)

Table 26 Market Size, By Mode of Application, 20142022 (KT)

Table 27 Soil Market Size, By Region, 20142022 (USD Million)

Table 28 Soil Market Size, By Region, 20142022 (KT)

Table 29 Foliar Market Size, By Region, 20142022 (USD Million)

Table 30 Foliar Market Size, By Region, 20142022 (KT)

Table 31 Fertigation Market Size, By Region, 20142022 (USD Million)

Table 32 Fertigation Market Size, By Region, 20142022 (KT)

Table 33 Others Market Size, By Region, 20142022 (USD Million)

Table 34 Others Market Size, By Region, 20142022 (KT)

Table 35 Metal Chelates Market Size, By Region, 2014-2022 (USD Million)

Table 36 Market Size, By Region, 2014-2022 (KT)

Table 37 North America: Metal Chelates Market Size, By Country, 2014-2022 (USD Million)

Table 38 North America: Market Size, By Type, 2014-2022 (USD Million)

Table 39 North America: Market Size, By Crop Type, 2014-2022 (USD Million)

Table 40 North America: Market Size, By Mode of Application, 2014-2022 (USD Million)

Table 41 U.S.: Market Size, By Type, 2014-2022 (USD Million)

Table 42 Canada: Market Size, By Type, 2014-2022 (USD Million)

Table 43 Mexico: Market Size, By Type, 2014-2022 (USD Million)

Table 44 Europe: Market Size, By Country, 20142022 (USD Million)

Table 45 Europe: Market Size, By Type, 20142022 (USD Million)

Table 46 Europe: Market Size, By Crop Type, 20142022 (USD Million)

Table 47 Europe: Market Size, By Mode of Application, 20142022 (USD Million)

Table 48 U.K.: Market Size, By Type, 20142022 (USD Million)

Table 49 Germany: Market Size, By Type, 20142022 (USD Million)

Table 50 Italy: Market Size, By Type, 20142022 (USD Million)

Table 51 France: Market Size, By Type, 20142022 (USD Million)

Table 52 Spain: Market Size, By Type, 20142022 (USD Million)

Table 53 Poland: Market Size, By Type, 20142022 (USD Million)

Table 54 Rest of Europe: Market Size, By Type, 20142022 (USD Million)

Table 55 Asia-Pacific: Market Size, By Country, 2014-2022 (USD Million)

Table 56 Asia-Pacific: Market Size, By Type, 2014-2022 (USD Million)

Table 57 Asia-Pacific: Market Size, By Crop Type, 2014-2022 (USD Million)

Table 58 Asia-Pacific: Market Size, By Mode of Application, 2014-2022 (USD Million)

Table 59 China: Market Size, By Type, 2014-2022 (USD Million)

Table 60 India: Market Size, By Type, 2014-2022 (USD Million)

Table 61 Australia: Market Size, By Type, 2014-2022 (USD Million)

Table 62 New Zealand: Market Size, By Type, 2014-2022 (USD Million)

Table 63 Rest of Asia-Pacific: Metal Chelates Market Size, By Type, 2014-2022 (USD Million)

Table 64 Latin America: Market Size, By Country, 2014-2022 (USD Million)

Table 65 Latin America: Market Size, By Type, 2014-2022 (USD Million)

Table 66 Latin America: Market Size, By Crop Type, 2014-2022 (USD Million)

Table 67 Latin America: Market Size, By Mode of Application, 2014-2022 (USD Million)

Table 68 Brazil: Market Size, By Type, 2014-2022 (USD Million)

Table 69 Argentina: Market Size, By Type, 2014-2022 (USD Million)

Table 70 Rest of Latin America: Market Size, By Type, 2014-2022 (USD Million)

Table 71 MEA: Market Size, By Country, 20142022 (USD Million)

Table 72 MEA: Market Size, By Type, 20142022 (USD Million)

Table 73 MEA: Market Size, By Crop Type, 20142022 (USD Million)

Table 74 MEA: Market Size, By Mode of Application, 20142022 (USD Million)

Table 75 Africa: Metal Chelates Market Size, By Type, 20142022 (USD Million)

Table 76 Middle East: Chelates Market Size, By Type, 20142022 (USD Million)

Table 77 Top Five Companies in the Metal Chelates Market, on the Basis of Products and Developments

Table 78 Expansions, 20102015

Table 79 Agreements, 20102015

Table 80 New Product Launches, 20102015

Table 81 Collaborations & Acquisitions, 20102015

Table 82 Investments & Divestments, 20102015

List of Figures (51 Figures)

Figure 1 Market Segmentation

Figure 2 Metal Chelates: Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation & Region

Figure 4 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 5 Decreasing Arable Land, 20082012

Figure 6 Increasing Farm Expenditure in Asian Countries, 1995 vs 2013 (USD)

Figure 7 Market Size Estimation: Bottom-Up Approach

Figure 8 Market Size Estimation: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Metal Chelates Market Size, By Type, 2016 vs 2022 (USD Million)

Figure 11 Fruits & Vegetables Segment is Projected to Be the Fastest-Growing Between 2016 & 2022

Figure 12 Foliar Segment to Dominate the Market for Metal Chelates in 2016

Figure 13 Asia-Pacific is Estimated to Be the Largest Market, 20142022

Figure 14 Asia-Pacific is Projected to Be the Fastest-Growing Region for Metal Chelates Market From 2016 to 2022

Figure 15 Metal Chelates: an Emerging Market With Promising Growth Potential, 20162022

Figure 16 China is the Fastest-Growing Market for Metal Chelates Between 2016 & 2022

Figure 17 Metal Chelates Market in Asia-Pacific is Experiencing High Growth

Figure 18 Micronutrients is Estimated to Dominate the Market Throughout the Forecast Period

Figure 19 China & India are Projected to Be the Most Attractive Markets for Metal Chelates, 2016 to 2022

Figure 20 Asia-Pacific Accounted for the Largest Share in the Micronutrients Segment in 2015

Figure 21 Increased Nutrient Deficiency in the Soil Strengthened the Demand for Metal Chelates in the Asia-Pacific Region

Figure 22 Foliar Segment is Projected to Be the Largest Throughout the Forecast Period

Figure 23 Metal Chelates Market, By Type

Figure 24 Market, By Crop Type

Figure 25 Market, By Mode of Application

Figure 26 Market, By Region

Figure 27 Metal Chelates: Market Dynamics

Figure 28 Increase in Yield of Crops, By Crop Type (Mt/Hectare)

Figure 29 Metal Chelates: Value Chain

Figure 30 Metal Chelates: Supply Chain

Figure 31 Metal Chelates Market, By Type : A Snapshot

Figure 32 Market, By Crop Type: A Snapshot

Figure 33 Market, By Mode of Application: A Snapshot

Figure 34 Regional Snapshot: Asia-Pacific to Be the Most Attractive Market for Metal Chelates, 2016-2022

Figure 35 North American Metal Chelates Market: A Snapshot

Figure 36 Asia-Pacific Metal Chelates Market Snapshot: China Accounted for the Largest Share in 2015

Figure 37 Expansion is the Key Startegy Adopted By the Key Players in the Market

Figure 38 Expansions Have Promoted Growth & Innovation in the Metal Chelates Market, 2010-2015

Figure 39 Expansions: the Key Strategy, 20102015

Figure 40 Annual Developments in the Metal Chelates Market, 20102015

Figure 41 Geographical Revenue Mix of Top 4 Market Players

Figure 42 BASF SE: Company Snapshot

Figure 43 BASF SE: SWOT Analysis

Figure 44 Akzo Nobel N.V.: Company Snapshot

Figure 45 Akzo Nobel N.V.: SWOT Analysis

Figure 46 Syngenta AG: Company Snapshot

Figure 47 Syngenta AG: SWOT Analysis

Figure 48 Nufarm Limited : Company Snapshot

Figure 49 Nufarm Limited: SWOT Analysis

Figure 50 Haifa Chemicals Ltd: SWOT Analysis

Figure 51 Aries Agro Limited: Company Snapshot

Growth opportunities and latent adjacency in Metal Chelates Market