Palletizer Market Size, Share, Statistics and Industry Growth Analysis Report by Technology (Conventional, Robotic), Product Type (Bags, Boxes and Cases, Pails and Drums), Industry (Food & Beverages, Chemicals, Pharmaceuticals, Cosmetics & Personal Care, E-commerce and Retail) & Region - Global Growth Driver and Industry Forecast to 2029

Updated on : October 22, 2024

Palletizer Market Size & Growth

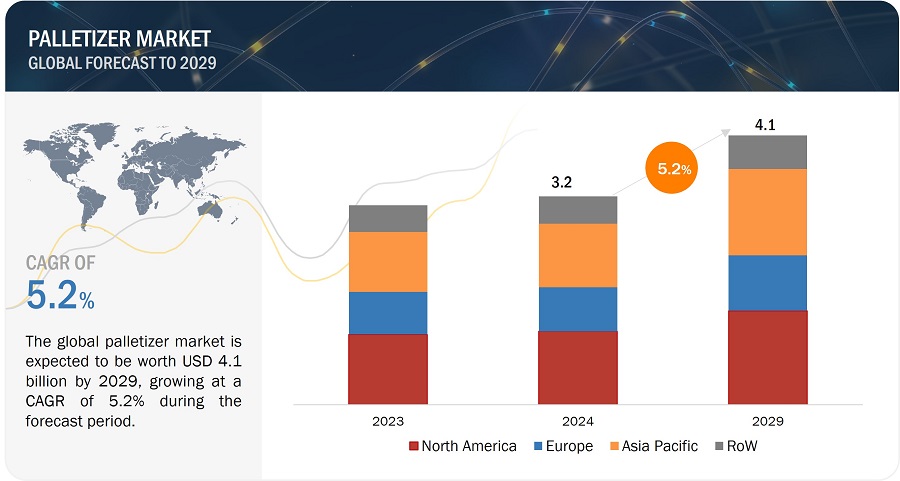

The global Palletizer Market was valued at USD 3.17 billion in 2024 and is projected to grow from USD 3.32 billion in 2025 to USD 4.09 billion by 2029, at a CAGR of 5.2% during the forecast period.

The growth of the palletizer market is propelled by technological advancements, increased labor costs, and the rising demand for automation across industries, particularly in the e-commerce and food & beverage sectors. The integration of advanced technologies such as augmented reality (AR) and virtual reality (VR) is set to further enhance the market dynamics.

Key Takeaways:

• The global Palletizer Market was valued at USD 3.17 billion in 2024 and is projected to grow from USD 3.32 billion in 2025 to USD 4.09 billion by 2029, at a CAGR of 5.2% during the forecast period.

• By Technology: The adoption of robotic palletizers is on the rise due to their high flexibility and ability to handle various products, packaging types, and palletizing patterns, driving demand across industries.

• By Product Type: The need for efficient and productive packaging operations is fueling the adoption of palletizers for boxes and cases, while the growth of e-commerce and retail packaging trends boosts demand for palletizing bags.

• By Application: There is a significant increase in demand for palletizers within the e-commerce industry, driven by the surge in online shopping and the need for efficient warehouse operations to handle diverse inventories.

• By End User: The food & beverage industry sees increased deployment of palletizers, enhancing operational efficiency and meeting the high demands of packaging and distribution.

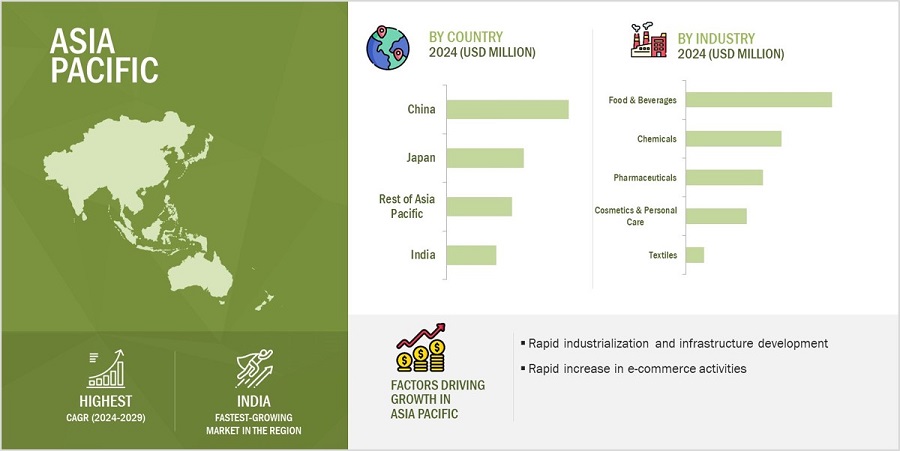

• By Region: ASIA PACIFIC is expected to grow fastest at a 6.4% CAGR, driven by rapid industrialization, increasing automation, and burgeoning e-commerce activities in the region.

• Market Dynamics: The integration of palletizers into warehouse automation systems and the use of machine vision and IoT are key technological drivers enhancing market growth.

The palletizer market is poised for substantial growth, driven by the evolving needs of industries seeking efficiency and automation to meet increasing demands. Opportunities lie in the integration of emerging technologies such as AR and VR, which promise to streamline operations further. Long-term, the market will see a shift towards more flexible, efficient, and user-friendly palletizing solutions, tailored to meet the specific needs of diverse industries and regions.

Palletizer Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Palletizer Market Trends and Dynamics

Driver: Rising demand for palletizers in e-commerce industry

The rising demand for palletizers in the e-commerce industry is a significant driver for the palletizer market growth. Automated palletizing systems are in high demand in the growing e-commerce industry to meet the evolving needs and challenges. The e-commerce industry is experiencing a surge in order volume due to the increasing popularity of online shopping. This increase in order volume has raised the need for efficient and streamlined warehouse operations, where palletizers play a crucial role by providing the adaptability required to handle various product types efficiently. As e-commerce platforms grapple with the complexities of diverse inventory, palletizing systems ensure streamlined warehouse operations, optimize spatial efficiency, and contribute to the overall effectiveness of order fulfillment processes.

Moreover, the growth in demand for e-commerce services has prompted businesses to prioritize precision, quality control, and labor efficiency. Automated palletizers not only elevate the accuracy of product handling but also minimize the risk of errors and damages during the palletizing process, which is pivotal in meeting customer expectations for precise and intact deliveries. In the evolving landscape of e-commerce, the adoption of automated palletizing solutions remains integral for achieving operational effectiveness, optimizing warehouse utilization, and meeting the demands of a dynamic market.

Restraint: High initial investment in deploying palletizers

The high initial investment is a significant restraint in the palletizer market, presenting a challenge for businesses considering the deployment of palletizing systems. Palletizers, especially advanced robotic and automated solutions, often require a substantial upfront investment in equipment and integration into existing manufacturing or warehouse systems. This financial barrier can deter some companies, especially smaller businesses or those with budget constraints, from embracing the efficiency and automation benefits of palletizers.

The financial barrier includes expenses related to the acquisition of palletizing equipment, necessary infrastructure modifications, and system integration into existing manufacturing or warehouse processes. Advanced technologies and precision capabilities of modern palletizing systems contribute to their elevated costs. Although these systems can offer long-term benefits such as improved efficiency, reduced labor expenses, and minimized errors, the high initial investment is a challenge for businesses seeking to reap these advantages. The return on investment (ROI) is achieved gradually, making it necessary for companies to overcome the initial financial hurdle to fully embrace palletizing solutions in their operations.

Opportunity: Integration of palletizers into warehouse automation

The integration of palletizers with warehouse automation presents a strategic opportunity for the palletizer market players by aligning palletizing systems with broader logistics technologies to optimize warehouse operations. This synergy streamlines processes like order fulfillment and inventory management by facilitating real-time data exchange and seamless coordination among automated systems, enhancing overall efficiency. The integrated approach reduces turnaround times, improves space utilization, and ensures adaptability to diverse product types. Moreover, it brings cost savings through minimized manual handling and high accuracy in operations. The scalability of these integrated solutions enables businesses to dynamically respond to changes in production volume and market demands, fostering a more agile and responsive supply chain.

Challenge: Complexities associated with integration of palletizers into existing production lines

The challenge for the palletizer market players lies in the intricate process of incorporating palletizers into established product lines in manufacturing or warehouse setups. Issues related to compatibility may necessitate adjustments to facilitate a seamless connection between the palletizing equipment and existing machinery. Managing space limitations, potential disruptions in workflow, and integration of advanced technologies present additional complexities. Additionally, adapting personnel to operate the new equipment and addressing customization needs for diverse products add to the intricacies. The integration process incurs costs, and customizing palletizers to suit the specific requirements of the existing product line may be necessary. This customization process can be intricate and requires collaboration with the palletizer industry manufacturer. Achieving successful integration requires meticulous planning, collaboration with experienced integrators, and a deep understanding of the existing production line to ensure a smooth and effective transition.

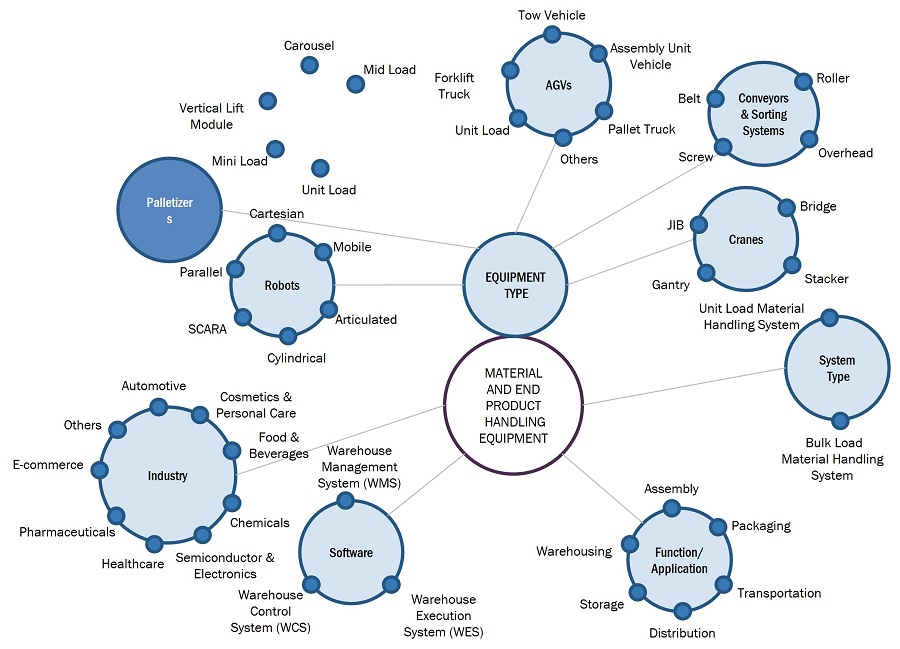

Palletizer Market Ecosystem

Palletizer Market Segmentation

The conventional technology segment accounted for the largest share of the palletizer market in 2023.

Technology segment is segmented into conventional palletizer and robotic palletizer. A conventional palletizer is a palletizing machine that uses mechanical arms, grippers, or other mechanisms to systematically stack products onto pallets. Conventional palletizers offer several advantages in industrial settings, characterized by their reliability, cost-effectiveness, and ease of maintenance. These systems have a proven track record and user-friendly operation, and they are well-suited for applications with consistent product sizes and palletizing patterns. Conventional palletizers are known for their high throughput in standardized applications and can be space efficient while providing flexibility in design.

The palletizer market for boxes and cases segment is to hold the largest market share during the forecast period.

The boxes and cases palletizers are specialized machines designed to automate the stacking and palletizing of individual boxes, cartons, or cases onto pallets. These packaging formats are extensively employed across diverse industries, featuring standardized shapes and sizes ideal for automated palletizing processes. Automated palletizers efficiently manage the high volume of goods packaged in boxes and cases, optimizing stacking patterns and maximizing pallet load stability. These palletizers are commonly used in the food and beverage, consumer goods, pharmaceuticals, logistics, and e-commerce and retail industries, where products are packaged in smaller units for distribution and storage.

Palletizer market for pharmaceuticals industry will grow at the highest CAGR during the forecast period.

The palletizer market for pharmaceuticals industry involves companies researching, developing, manufacturing, and distributing drugs and medications for medical use. Palletizers are extensively used in the pharmaceuticals industry to automate the palletizing of packaged pharmaceutical products for storage, transportation, and distribution. Pharmaceuticals are typically packaged in various forms, including bottles, vials, blister packs, and cartons. Stringent regulations and quality standards mandate precise handling and adherence to safety protocols, which automated palletizing solutions effectively ensure, minimizing the risk of contamination and human error. With increasing demand for pharmaceutical products, automated palletizers facilitate scalable production volumes while maintaining product

Palletizer Industry Regional Analysis

Palletizer market in Asia Pacific region to grow at the highest CAGR during the forecast period.

The palletizer market in Asia Pacific region is segmented into China, Japan, India, and the Rest of Asia Pacific, representing the fastest-growing market for palletizers. Both China and India stand out as the world's fastest-growing economies. The rapid industrialization and urbanization in countries across the region, such as China, India, and Southeast Asian nations, are driving increased demand for automation solutions in various industries, including manufacturing, logistics, and warehousing. The increase in industrial activity calls for effective material handling procedures, and palletizers are crucial for optimizing workflows and raising output. Rising disposable incomes and shifting customer preferences are also driving the retail and e-commerce industries' expansion, which is increasing the need for palletizing systems to control the flow of goods in warehouses and distribution centers.

Palletizer Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Palletizer Companies - Key Market Players

The major palletizer companies are

- KION GROUP AG (Germany),

- FANUC CORPORATION (Japan),

- KUKA AG (Germany),

- Honeywell International Inc. (US),

- Krones AG (Germany),

- ABB (Switzerland) and others

These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the palletizer market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

3.2 Billion in 2024 |

|

Projected Market Size |

4.1 Billion by 2029 |

|

Growth Rate |

CAGR of 5.2% |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Technology, Product Type, Industry and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

KION GROUP AG (Germany), FANUC CORPORATION (Japan), KUKA AG (Germany), Honeywell International Inc. (US), Krones AG (Germany), A total of 25 players are covered. |

Palletizer Market Highlights

In this report, the overall palletizer market has been segmented based on Technology, Product Type, Industry and Region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Product Type |

|

|

By Industry |

|

|

By Region |

|

Recent Developments in Palletizer Industry

- In January 2024 FANUC introduced the new M-950iA/500 robot, with a payload capacity of 500 kg. The M-950iA/500 is a serial-link robot offering a wider range of motion compared to standard parallel-link robots and can extend its arm upright and then rotate backward with minimal interference.

- In October 2023, Schneider Packaging Equipment Company, Inc., a Pacteon Group company, announced that it is entering the robotic high-speed palletizing market through a strategic licensing agreement with ITW Hartness Division. Schneider signed a licensing agreement for the Hartness Division’s high-speed robotic palletizing offerings to ensure future project support. Also included in the agreement is Schneider’s ability to support systems already commissioned by Hartness.

- In March 2023, Sidel launched RoboAccess_Pal S, a robotic palletizer with a great performance/footprint ratio and equipped with guards that can be folded if it needs to be moved to another line.

Frequently Asked Questions (FAQs):

What will be the global palletizer market size in 2024?

The palletizer market is expected to be valued at USD 3.2 billion in 2024.

Who are the global palletizer market share winners?

Companies such as KION GROUP AG, FANUC CORPORATION, KUKA AG, Honeywell International Inc., Krones AG, ABB fall under the winners’ category.

Which region is expected to hold the highest global palletizer market share?

North America will dominate the global palletizer market in 2024.

What are the major drivers of the palletizer market share?

Technological advancements in palletizers, Increased labor costs and demand for automation in various industries, Rising demand for palletizers in e-commerce industry, Increased deployment of robotic palletizers in food & beverages industry.

What are the major strategies adopted by palletizer companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements in palletizers- Increased labor costs and demand for automation in various industries- Rising demand for palletizers in e-commerce industry- Increased deployment of robotic palletizers in food & beverages industryRESTRAINTS- High initial investment in deploying palletizersOPPORTUNITIES- Integration of augmented reality (AR) and virtual reality (VR) technologies into palletizers- Integration of palletizers into warehouse automationCHALLENGES- Complexities associated with integration of palletizers into existing production lines- Handling of fragile or irregularly shaped products

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND OF ROBOTIC PALLETIZERSAVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGYINDICATIVE PRICING TREND OF ROBOTIC PALLETIZERS, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Machine vision- Augmented reality (AR)- Big data- Internet of Things (IoT)COMPLEMENTARY TECHNOLOGY- Automated storage and retrieval system (ASRS)ADJACENT TECHNOLOGY- Conveyor and sortation systems

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISKAUFMAN DESIGNED KPAL V CENTRALIZED PALLETIZATION SYSTEM FOR CUSTOMER TO TACKLE MULTIPLE CHALLENGESLEONARD’S DEPLOYED MODULAR ROBOTIC PALLETIZER OFFERED BY SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC. AT FACILITY IN DETROIT TO INCREASE SPEED OF BOX PRODUCTIONREMIA DEPLOYED TWO NEW HIGHRUNNER PALLETIZERS OFFERED BY QIMAROX TO INCREASE PRODUCTION CAPACITY

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS- ISO standard

-

5.14 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 COLLABORATIVE PALLETIZING

- 6.3 INTERNET OF THINGS (IOT) AND CONNECTIVITY

- 6.4 MACHINE LEARNING (ML) AND AI INTEGRATION (AI)

- 6.5 ENERGY-EFFICIENT SOLUTIONS

- 6.6 CUSTOMIZATION AND FLEXIBILITY

- 6.7 ERGONOMIC DESIGN AND USER-FRIENDLY INTERFACES

- 6.8 MOBILE PALLETIZING SOLUTIONS

- 6.9 SOFTWARE INTEGRATION FOR OPTIMIZATION

- 6.10 SAFETY INNOVATIONS

- 7.1 INTRODUCTION

-

7.2 KEY COMPONENTS OF PALLETIZING SYSTEMSINFEED CONVEYORPALLET DISPENSERPRODUCT ALIGNMENT AND SINGULATION SYSTEMPRODUCT GRIPPER OR END-EFFECTORMECHANICAL PALLETIZERSAFETY SYSTEMCONTROL SYSTEMSOFTWARE

-

7.3 KEY END USERS OF PALLETIZING SYSTEMSFACTORIESDISTRIBUTION CENTERSFULFILMENT CENTERS

- 8.1 INTRODUCTION

-

8.2 CONVENTIONAL PALLETIZERSHIGH-LEVEL PALLETIZERS- Rising preference for high-level palletizers in facilities with space constraints to drive marketLOW-LEVEL PALLETIZERS- Easy accessibility of low-level palletizers for operators and maintenance personnel, simplifying routine inspections and adjustments to drive demand

-

8.3 ROBOTIC PALLETIZERSTRADITIONAL ROBOT PALLETIZERS- High flexibility and ability to handle various products, packaging types, and palletizing patterns to drive demandCOBOT PALLETIZERS- Capability to work alongside human operators and increase overall productivity and throughput to drive demand

- 9.1 INTRODUCTION

-

9.2 BAGSGROWTH OF E-COMMERCE INDUSTRY AND RETAIL PACKAGING TREND TO FUEL DEMAND

-

9.3 BOXES AND CASESNEED FOR INCREASING EFFICIENCY AND PRODUCTIVITY OF PACKAGING OPERATIONS TO FUEL ADOPTION

-

9.4 PAILS AND DRUMSHIGH USE OF PAIL AND DRUM PALLETIZERS IN CHEMICALS, PAINTS, COATINGS, AND FOOD PROCESSING INDUSTRIES TO DRIVE MARKET

- 9.5 OTHER PRODUCT TYPES

- 10.1 INTRODUCTION

-

10.2 FOOD & BEVERAGESINCREASING DEMAND FOR FOOD & BEVERAGES AND NEED TO EFFICIENTLY HANDLE LARGE VOLUMES OF PRODUCTS AND ENSURE TIMELY DELIVERY TO DRIVE DEMAND

-

10.3 CHEMICALSABILITY OF PALLETIZERS TO ENSURE COMPLIANCE WITH SAFETY REGULATIONS TO DRIVE DEMAND

-

10.4 PHARMACEUTICALSGROWING POPULARITY OF ROBOTIC PALLETIZERS IN ASIA PACIFIC PHARMACEUTICALS INDUSTRY TO DRIVE MARKET

-

10.5 COSMETICS & PERSONAL CAREINCREASING DEMAND FOR PALLETIZERS TO REDUCE PRODUCT DAMAGE TO DRIVE MARKET

-

10.6 E-COMMERCE AND RETAILBOOMING E-COMMERCE INDUSTRY TO DRIVE DEMAND

-

10.7 TEXTILESRISE IN POPULARITY OF ROBOTIC PALLETIZERS OWING TO PRECISION AND VERSATILITY TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAIMPACT OF RECESSION ON PALLETIZER MARKET IN NORTH AMERICAUS- Rapid technological advancements in retail sector to drive marketCANADA- Aging workforce to boost demandMEXICO- Increased demand for convenience foods and prepared meals to drive demand

-

11.3 EUROPEIMPACT OF RECESSION ON MARKET IN EUROPEUK- Expanding e-commerce industry and retail sector to drive marketGERMANY- Increased adoption of automation across various industries to drive marketFRANCE- Integration of advanced technologies into palletizers to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFICCHINA- Rise of e-commerce industry and preference for automation to boost demandJAPAN- Development of robotic systems and AI-driven solutions to drive marketINDIA- Booming e-commerce industry to drive demandREST OF ASIA PACIFIC

-

11.5 ROWSOUTH AMERICA- Increasing foreign investments in manufacturing sector to fuel market growthGCC COUNTRIES- Rapid industrialization to drive demandAFRICA & REST OF MIDDLE EAST

- 12.1 INTRODUCTION

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021−2024

- 12.3 REVENUE ANALYSIS, 2018–2022

- 12.4 PALLETIZER MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2023

- 12.6 BRAND/PRODUCT COMPARISON

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Overall footprint- Product type footprint- Technology footprint- Industry footprint- Regional footprint

-

12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: START-UPS/SMES, 2023- List of key start-ups/SMEs- Competitive benchmarking of key start-ups/SMEs

-

12.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSKION GROUP AG- Business overview- Products/Solutions/Services offered- MnM viewFANUC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- MnM viewKRONES AG- Business overview- Products/Solutions/Services offered- MnM viewABB- Business overview- Products/Solutions/Services offeredCONCETTI SPA- Business overview- Products/Solutions/Services offeredREGAL REXNORD AUTOMATION SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developmentsSCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSIDEL- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSA-B-C PACKAGING MACHINE CORPORATIONAETNA GROUP SPABEUMER GROUPBRILLOPAKBW INTEGRATED SYSTEMSCOLUMBIA MACHINE, INC.EUROIMPIANTI SPAFUJI YUSOKI KOGYO CO., LTD.HAVER & BOECKERKHS GROUPMMCIOKURA YUSOKI CO., LTD.PROMACHROTHE PACKTECH PVT. LTD.S&R ROBOT SYSTEMS, LLC

- 14.1 INTRODUCTION

- 14.2 AUTONOMOUS MOBILE ROBOTS MARKET

-

14.3 E-COMMERCEEXPANSION OF E-COMMERCE INDUSTRY TO DRIVE MARKET

-

14.4 RETAILNEED TO IMPROVE INVENTORY MANAGEMENT EFFICIENCY TO BOOST DEMAND

-

14.5 MANUFACTURINGHIGH FOCUS ON OPTIMIZING MANUFACTURING WORKFLOW TO DRIVE DEMAND

-

14.6 FOOD & BEVERAGEADOPTION OF AUTONOMOUS MOBILE ROBOTS TO MEET REGULATORY REQUIREMENTS TO FUEL MARKET GROWTH

-

14.7 HEALTHCAREEMPHASIS ON IMPROVING OPERATIONAL EFFICIENCY AND PATIENT CARE TO BOOST ADOPTION

-

14.8 LOGISTICSRISING IMPORTANCE OF INVENTORY MANAGEMENT IN LOGISTICS TO DRIVE DEMAND

- 14.9 OTHERS

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON PALLETIZER MARKET

- TABLE 2 GLOBAL LABOR COST, BY REGION, 2019–2023 (USD)

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGY (USD)

- TABLE 4 ROLES OF COMPANIES IN PALLETIZER ECOSYSTEM

- TABLE 5 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 6 LIST OF PATENTS RELATED TO PALLETIZERS, 2019–2023

- TABLE 7 MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 STANDARDS RELATED TO PALLETIZERS

- TABLE 13 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 16 MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 17 MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 18 MARKET, 2020–2023 (UNITS)

- TABLE 19 PALLETIZER MARKET, 2024–2029 (UNITS)

- TABLE 20 CONVENTIONAL PALLETIZERS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 21 CONVENTIONAL PALLETIZERS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 22 CONVENTIONAL PALLETIZERS: MARKET, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

- TABLE 23 CONVENTIONAL PALLETIZERS: MARKET, BY PRODUCT TYPE, 2024–2029 (USD MILLION)

- TABLE 24 CONVENTIONAL PALLETIZERS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 25 CONVENTIONAL PALLETIZERS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 26 CONVENTIONAL PALLETIZERS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 27 CONVENTIONAL PALLETIZERS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 28 ROBOTIC PALLETIZERS: MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 29 ROBOTIC PALLETIZERS: MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 30 ROBOTIC PALLETIZERS: MARKET, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

- TABLE 31 ROBOTIC PALLETIZERS: MARKET, BY PRODUCT TYPE, 2024–2029 (USD MILLION)

- TABLE 32 ROBOTIC PALLETIZERS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 33 ROBOTIC PALLETIZERS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 34 ROBOTIC PALLETIZERS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 35 ROBOTIC PALLETIZERS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 36 PALLETIZER MARKET, BY PRODUCT TYPE, 2020–2023 (USD MILLION)

- TABLE 37 MARKET, BY PRODUCT TYPE, 2024–2029 (USD MILLION)

- TABLE 38 BAGS: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 39 BAGS: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 40 BOXES AND CASES: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 41 BOXES AND CASES: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 42 PAILS AND DRUMS: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 43 PAILS AND DRUMS: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 44 OTHER PRODUCT TYPES: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 45 OTHER PRODUCT TYPES: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 46 MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 47 PALLETIZER MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 48 FOOD & BEVERAGES: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 49 FOOD & BEVERAGES: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 50 FOOD & BEVERAGES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 51 FOOD & BEVERAGES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 52 CHEMICALS: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 53 CHEMICALS: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 54 CHEMICALS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 CHEMICALS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 PHARMACEUTICALS: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 57 PHARMACEUTICALS: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 58 PHARMACEUTICALS: PALLETIZER MARKT, BY REGION, 2020–2023 (USD MILLION)

- TABLE 59 PHARMACEUTICALS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 60 COSMETICS & PERSONAL CARE: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 61 COSMETICS & PERSONAL CARE: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 62 COSMETICS & PERSONAL CARE: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 63 COSMETICS & PERSONAL CARE: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 64 E-COMMERCE AND RETAIL: PALLETIZER MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 65 E-COMMERCE AND RETAIL: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 66 E-COMMERCE AND RETAIL: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 E-COMMERCE AND RETAIL: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 TEXTILES: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 69 TEXTILES: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 70 TEXTILES: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 71 TEXTILES: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 72 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 80 EUROPE: PALLETIZER MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 92 ROW: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 93 ROW: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 94 ROW: MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 95 ROW: MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 96 ROW: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 97 ROW: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 98 MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2024

- TABLE 99 MARKET: DEGREE OF COMPETITION, 2023

- TABLE 100 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 101 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 102 COMPANY INDUSTRY FOOTPRINT

- TABLE 103 COMPANY REGION FOOTPRINT

- TABLE 104 PALLETIZER MARKET: LIST OF KEY START-UPS/SMES

- TABLE 105 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 106 MARKET: PRODUCT LAUNCHES, MAY 2020–JANUARY 2024

- TABLE 107 MARKET: DEALS, NOVEMBER 2021–OCTOBER 2023

- TABLE 108 KION GROUP AG: COMPANY OVERVIEW

- TABLE 109 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 111 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 113 KUKA AG: COMPANY OVERVIEW

- TABLE 114 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 KUKA AG: PRODUCT LAUNCHES

- TABLE 116 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 KRONES AG: COMPANY OVERVIEW

- TABLE 119 KRONES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 ABB: COMPANY OVERVIEW

- TABLE 121 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 CONCETTI SPA: COMPANY OVERVIEW

- TABLE 123 CONCETTI SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 REGAL REXNORD AUTOMATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 125 REGAL REXNORD AUTOMATION SOLUTIONS: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 126 REGAL REXNORD AUTOMATION SOLUTIONS: DEALS

- TABLE 127 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: COMPANY OVERVIEW

- TABLE 128 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 130 SCHNEIDER PACKAGING EQUIPMENT COMPANY, INC.: DEALS

- TABLE 131 SIDEL: COMPANY OVERVIEW

- TABLE 132 SIDEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 SIDEL: PRODUCT LAUNCHES

- TABLE 134 A-B-C PACKAGING MACHINE CORPORATION: COMPANY OVERVIEW

- TABLE 135 AETNA GROUP SPA: COMPANY OVERVIEW

- TABLE 136 BEUMER GROUP: COMPANY OVERVIEW

- TABLE 137 BRILLOPAK: COMPANY OVERVIEW

- TABLE 138 BW INTEGRATED SYSTEMS: COMPANY OVERVIEW

- TABLE 139 COLUMBIA MACHINE, INC.: COMPANY OVERVIEW

- TABLE 140 EUROIMPIANTI SPA: COMPANY OVERVIEW

- TABLE 141 FUJI YUSOKI KOGYO CO., LTD.: COMPANY OVERVIEW

- TABLE 142 HAVER & BOECKER: COMPANY OVERVIEW

- TABLE 143 KHS GROUP: COMPANY OVERVIEW

- TABLE 144 MMCI: COMPANY OVERVIEW

- TABLE 145 OKURA YUSOKI CO., LTD.: COMPANY OVERVIEW

- TABLE 146 PROMACH: COMPANY OVERVIEW

- TABLE 147 ROTHE PACKTECH PVT. LTD.: COMPANY OVERVIEW

- TABLE 148 S&R ROBOT SYSTEMS, LLC: COMPANY OVERVIEW

- TABLE 149 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 150 MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 E-COMMERCE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 152 E-COMMERCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 153 E-COMMERCE: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 154 E-COMMERCE: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 155 E-COMMERCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 156 E-COMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 157 RETAIL: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 158 RETAIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 159 RETAIL: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 160 RETAIL: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 161 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 162 RETAIL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 MANUFACTURING: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 164 MANUFACTURING: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 165 MANUFACTURING: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 166 MANUFACTURING: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 167 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 168 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 169 FOOD & BEVERAGE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 170 FOOD & BEVERAGE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 171 FOOD & BEVERAGE: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 172 FOOD & BEVERAGE: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 173 FOOD & BEVERAGE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 174 FOOD & BEVERAGE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 176 HEALTHCARE: PALLETIZER MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 177 HEALTHCARE: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 178 HEALTHCARE: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 179 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 180 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 181 LOGISTICS: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 182 LOGISTICS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 183 LOGISTICS: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 184 LOGISTICS: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 185 LOGISTICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 186 LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 187 OTHERS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 188 OTHERS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 OTHERS: MARKET, BY PAYLOAD CAPACITY, 2019–2022 (USD MILLION)

- TABLE 190 OTHERS: MARKET, BY PAYLOAD CAPACITY, 2023–2028 (USD MILLION)

- TABLE 191 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 192 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 PALLETIZER MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: BOTTOM-UP APPROACH

- FIGURE 3 MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 RESEARCH ASSUMPTIONS

- FIGURE 7 RISK ASSESSMENT

- FIGURE 8 MARKET: GROWTH PROJECTION, 2020−2029 (USD MILLION)

- FIGURE 9 BOXES AND CASES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 10 ROBOTIC PALLETIZERS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 PHARMACEUTICALS INDUSTRY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR IN MARKET FROM 2024 TO 2029

- FIGURE 13 RISING DEMAND FOR PALLETIZERS IN E-COMMERCE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 CONVENTIONAL PALLETIZERS SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2023

- FIGURE 15 FOOD & BEVERAGES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 17 PALLETIZER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 23 AVERAGE SELLING PRICE (ASP) TREND OF ROBOTIC PALLETIZERS, 2020−2029 (USD)

- FIGURE 24 AVERAGE SELLING PRICE (ASP) OF PALLETIZERS OFFERED BY THREE KEY PLAYERS, BY TECHNOLOGY (USD)

- FIGURE 25 INDICATIVE PRICING TREND OF ROBOTIC PALLETIZERS, BY REGION, 2021–2023 (USD)

- FIGURE 26 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 PALLETIZER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2017–2022

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR, 2014–2023

- FIGURE 31 IMPORT DATA FOR HS CODE 441520-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 441520-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 33 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2023

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 36 PALLETIZER MARKET, BY TECHNOLOGY

- FIGURE 37 ROBOTIC PALLETIZERS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 MARKET, BY IMPLEMENTATION

- FIGURE 39 BOXES AND CASES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 MARKET, BY INDUSTRY

- FIGURE 41 PHARMACEUTICALS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 CHINA TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 45 EUROPE: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 47 MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 48 MARKET SHARE ANALYSIS, 2023

- FIGURE 49 MARKET: COMPANY VALUATION, 2023

- FIGURE 50 MARKET: FINANCIAL METRICS, 2023

- FIGURE 51 MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 52 PALLETIZER MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 53 COMPANY OVERALL FOOTPRINT

- FIGURE 54 MARKET: COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- FIGURE 55 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 KUKA AG: COMPANY SNAPSHOT

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 59 KRONES AG: COMPANY SNAPSHOT

- FIGURE 60 ABB: COMPANY SNAPSHOT

- FIGURE 61 REGAL REXNORD AUTOMATION SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 62 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- FIGURE 63 E-COMMERCE SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 64 NORTH AMERICA TO CAPTURE LARGEST SHARE OF AUTONOMOUS MOBILE MARKET FOR MANUFACTURING IN 2028

- FIGURE 65 100−500 KG SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR LOGISTICS IN 2028

The study involves four major activities that estimate the size of the palletizer market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the palletizer market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

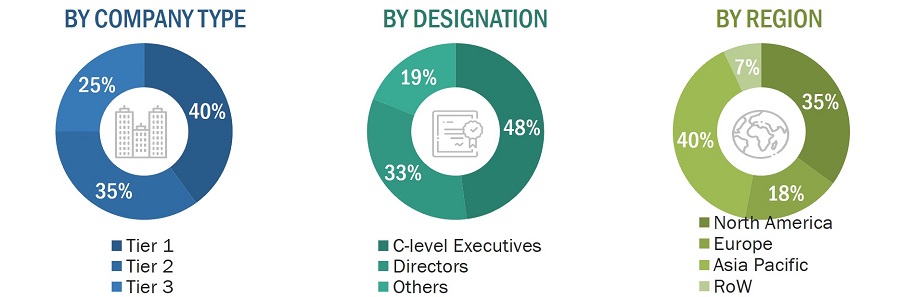

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from palletizer providers, (such as KION GROUP AG, KHS Group, BEUMER Group, Krones AG) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the palletizer market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-Up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

A palletizer is an automated material handling machine designed to automatically sort, transfer, and stack cases of products onto a pallet in a consistent and organized manner. The palletizer can stack several products, such as cartons, trays, cases, and bags, onto pallets. They are mainly used by companies engaged in large-volume manufacturing. Companies in the palletizer market offer different types of technologies, such as conventional and robotic palletizers. They are commonly used in manufacturing, warehousing, and distribution facilities to streamline palletization, replacing manual labor with a more efficient and precise automated system.

Stakeholders

- Associations, forums, and alliances related to the palletizer ecosystem

- Assembly and packaging vendors

- Electronic design automation (EDA) and design tool vendors

- Palletizers manufacturers and distributors

- Industries such as automotive, chemical, e-commerce, retail, food & beverages, healthcare, pharmaceuticals, cosmetics & personal care, and textiles

- Component manufacturers

- Raw material and manufacturing equipment suppliers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- Robotic arm provider

- System integrators

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

The main objectives of this study are as follows:

- To describe and forecast the palletizer market based on technology, product type, industry, and region, in terms of value

- To describe and forecast the palletizer market, in terms of volume

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries, in terms of value

- To analyze the impact of the recession on the growth of the market and its segments

- To forecast the overall palletizer market till 2029

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall palletizer market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the palletizer market

- To analyze the opportunities in the palletizer market and provide details of the competitive landscape for market leaders

- To analyze competitive developments such as acquisitions, collaborations, partnerships, expansions, and product launches, along with research and development (R&D), in the palletizer market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Palletizer Market