Sleep Apnea Oral Appliances Market by Product (Mandibular Advancement Devices (MAD), Tongue-Retaining Devices (TRD)), Purchase Type (Physician-prescribed), Gender (Male, Female), Age Group, Distribution Channel (Online, Retail) & Region - Global Forecast to 2028

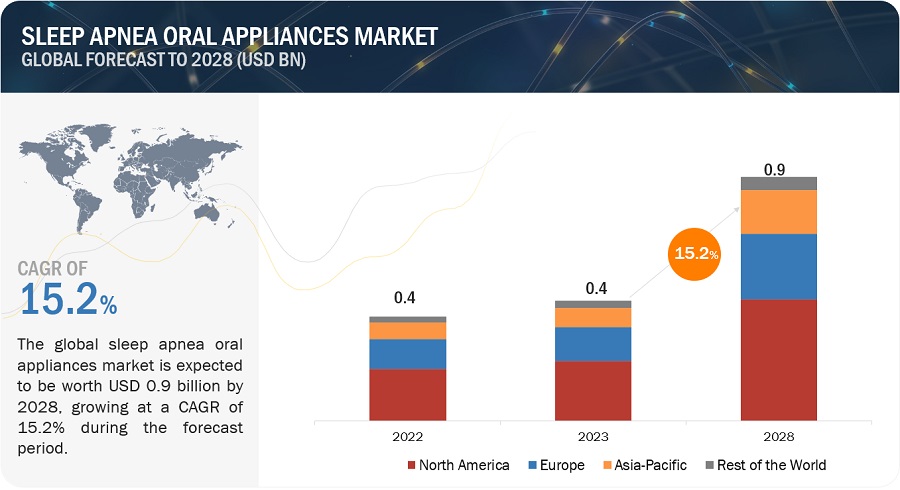

The global sleep apnea oral appliances market in terms of revenue was estimated to be worth $0.4 billion in 2023 and is poised to reach $0.9 billion by 2028, growing at a CAGR of 15.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth in this market is attributed to the rising awarness and diagnosis of sleep apnea. On the other hand, limited effectiveness on patients with severe sleep apnea may challenge the growth of sleep apnea oral appliances market. Whereas, use of increasing availabiliy and accessibility of oral appliances provides growth opportunities for sleep apnea oral appliances market.

Attractive Opportunities in the Sleep Apnea Oral Appliances Market

To know about the assumptions considered for the study, Request for Free Sample Report

Sleep Apnea Oral Appliances Market Dynamics

Driver: Large pool of undiagnosed sleep apnea patients

Sleep apnea is one of the most common sleep disorder globally and effects people of all age groups. In 2022, the American Sleep Apnea Association (ASAA) stated that in the US alone, obstructive sleep apnea is estimated to affect between 10% and 30% of adults in the United States. Sleep apnea is associated with several other medical comorbidities. ResMed highlighted the strong association of sleep apnea with many cardiovascular and metabolic diseases. Changing lifestyles also contribute to the rise in obesity prevalence across the globe, which is likely to result in a significant increase in the sleep apnea patient pool. This expanding pool of patients offers high growth opportunities for the sleep apnea oral appliances market.

Restraint: Associated risks of oral appliances for obstructive sleep apnea treatment

While generally considered safe and effective, there are some potential risks and side effects associated with oral appliance therapy. OAT devices may lead to dental discomfort or changes in bite alignment, especially if the device is not properly fitted or adjusted. This might include jaw pain, tooth discomfort, or changes in the position of teeth over time. Therefore it becomes important for patients undergoing oral appliance therapy for sleep apnea to have proper fitting, regular follow-ups, and adjustments to the device which can help minimize potential side effects and ensure its effectiveness.

Opportunity: Poor compliance associated with CPAP

Although CPAP is an effective treatment for OSA, poor compliance remains an area of concern. Nonadherence is defined as a mean of ≤4 hours of use per night. Therefore, despite the high efficacy associated with CPAP, the long-term health effects offered by this therapy are likely to be compromised by low compliance and suboptimal hours of treatment use. Therefore, the nonadherence to PAP therapy is a crucial factor stimulating the demand for oral appliances and posing a major opportunity for players in the sleep apnea oral appliances market.

Challenge: Expenses associated with customization of oral appliances

Customized oral appliances are designed and manufactured to fit patient’s oral anatomy are higher in cost. The expenses associated with making of customized oral appliances makes it less accessible than standard CPAP treatment. Customization of oral appliances involves accurate measurements and design of proper fitting which is a time intensive process between diagnosis and treatment initiation. Due to the above factors mass production of customized devices is challenging which impacts the sleep apnea oral appliances market growth.

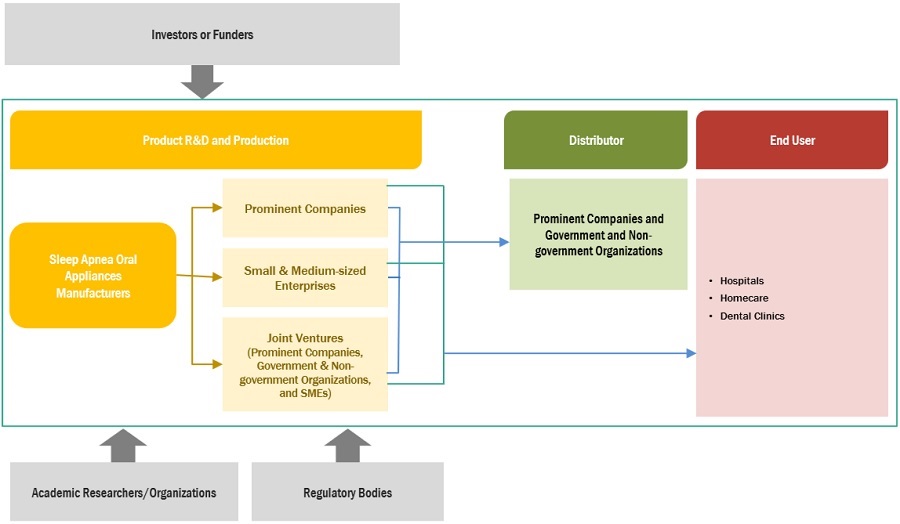

Sleep Apnea Oral Appliances Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of diagnostic and therapeutic sleep apnea oral appliances. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Revvity (US), and The Cooper Companies, Inc. (US).

In 2022, mandibular advancement devices to dominate with highest market share of the sleep apnea oral appliances industry, by product.

Based on the products, the global sleep apnea oral appliances market is broadly segmented into mandibular advancement devices, tongue retaining devices, and daytime nighttime appliance. In 2022, mandibular advancement device to dominate the sleep apnea oral appliances market due to enhanced effectiveness for patient comfort and compliance.

In 2022, physician-prescibed/cutomized oral appliances segment to dominate the sleep apnea oral appliances industry, by purchase type.

Based on purchase type, the sleep apnea oral appliances market is segmented into Physician-prescribed/Customized Oral Appliances and online OTC oral appliances. Physicians prescribed oral appliances are more patient-centric approach with consideration of patient preferences and individualized treatment plans.

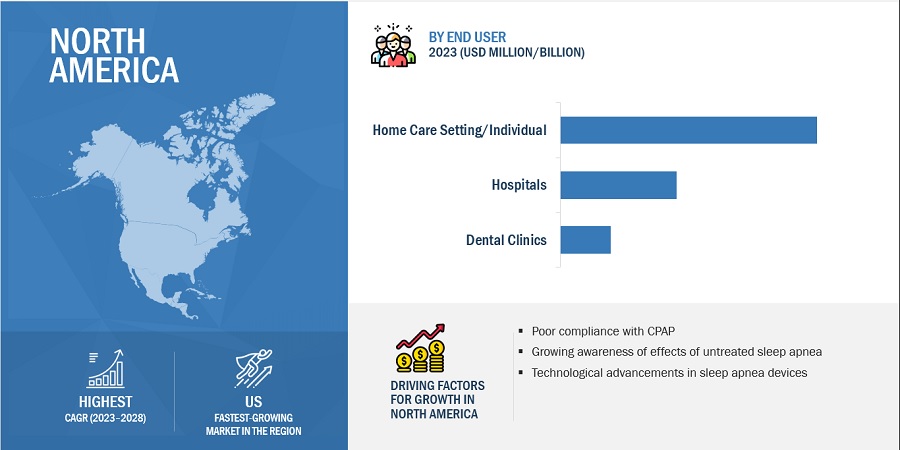

In 2022, North America to dominate in sleep apnea oral appliances industry.

The global sleep apnea oral appliances market is segmented into North America, Europe, Asia Pacific and the Rest of the World. North America is expected to dominate during the forecast period, primarily due to the rising obesity raes, ongoing technological advancements in sleep apnea devices along with favorable regulatory and reimbursement scenario.

To know about the assumptions considered for the study, download the pdf brochure

The sleep apnea oral appliances market is dominated by players such SomnoMed (Australia), ResMed (US), Whole You, Inc. (US), ProSomnus Sleep Technologies (US), and Vivos Therapeutic, Inc. (US).

Scope of the Sleep Apnea Oral Appliances Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.4 billion |

|

Projected Revenue by 2028 |

$0.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 15.2% |

|

Market Driver |

Large pool of undiagnosed sleep apnea patients |

|

Market Opportunity |

Poor compliance associated with CPAP |

This research report categorizes the sleep apnea oral appliance market to forecast revenue and analyze trends in each of the following submarkets:

|

By Region |

|

|

By Product |

|

|

By Purchase Type |

|

|

By Gender |

|

|

By Age Group |

|

|

By Distribution Channel |

|

|

By End User |

|

Recent Developments of Sleep Apnea Oral Appliances Industry

- In 2023, Vivos Therapeutics, Inc. (US) DNA appliance was granted 510(k) clearance from the U.S. Food & Drug Administration (or FDA) as a Class II medical device in December 2022 for the treatment of snoring and mild to moderate OSA in adults.

- In 2022, ResMed (US) acquired the German-based clinical, financial, and operational solutions provider MEDIFOX DAN (Germany) to drive leadership in out-of-hospital software solutions.

- In 2021, SomoMed (Australia) conducted SomSUMMIT ’21, which aimed to enhance research, education, and awareness of oral appliance therapy as a primary solution to successful OSA treatment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global sleep apnea oral appliances market?

The global sleep apnea oral appliances market boasts a total revenue value of $0.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global sleep apnea oral appliances market?

The global sleep apnea oral appliances market has an estimated compound annual growth rate (CAGR) of 15.2% and a revenue size in the region of $0.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

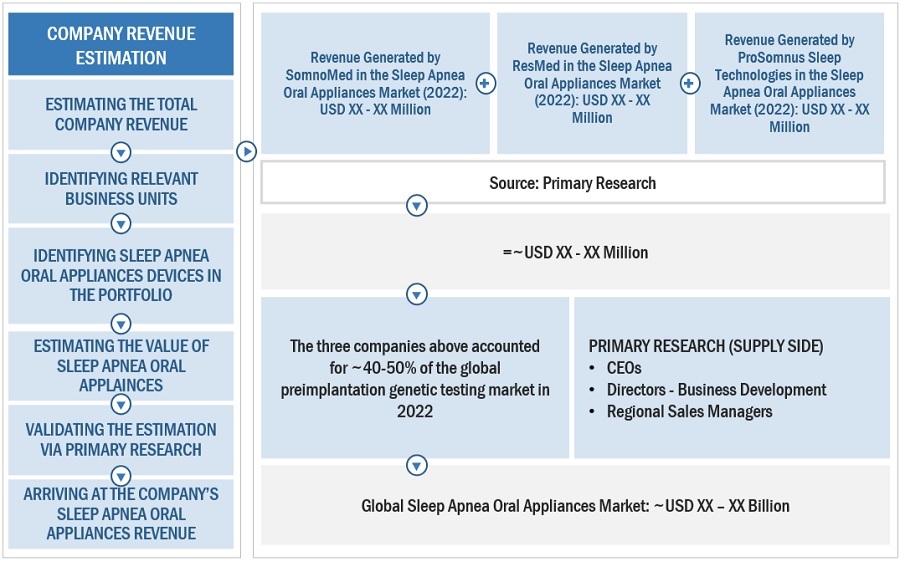

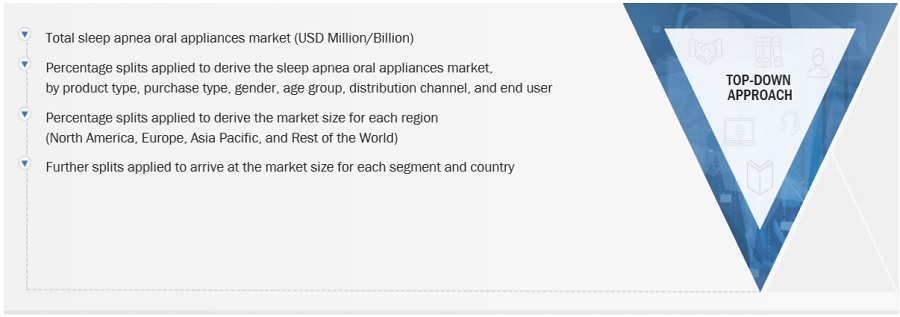

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements and partnerships of the leading players, the competitive landscape of the sleep apnea oral appliance market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the sleep apnea oral appliance market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

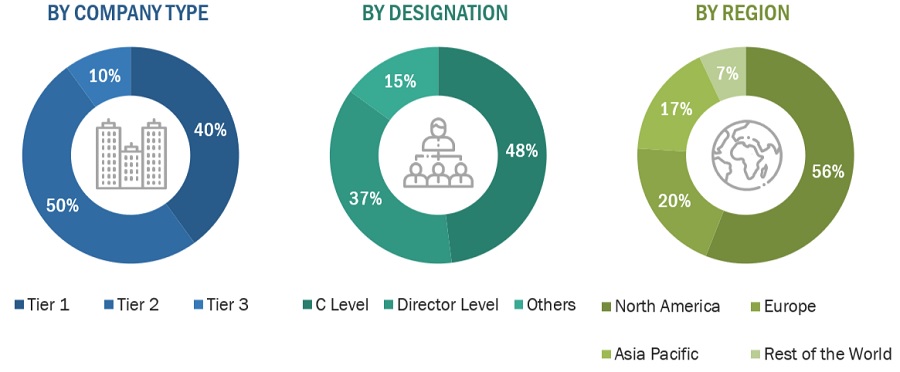

The primary research data was collected after acquiring knowledge about the sleep apnea oral appliance market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as sleep clinics, dental clinics, and hospitals) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2021, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

SomnoMed |

General Manager |

|

ResMed |

Senior Product Manager |

|

ProSomnus Sleep Technologies |

Regional Manager |

Market Size Estimation

All major product manufacturers offering various sleep apnea oral appliance products were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value sleep apnea oral appliance market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of sleep apnea oral appliance market at the regional and country-level

- Relative adoption pattern of each sleep apnea oral appliance market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Sleep apnea oral appliance Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Sleep apnea oral appliance Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Sleep apnea oral appliance industry.

Market Definition

Sleep apnea is a common sleep disorder that usually goes undiagnosed but has serious and life-threatening effects. The most common type of sleep apnea is obstructive sleep apnea. Due to patient non-compliance with positive airway pressure (PAP) devices, oral appliances are gaining popularity in treating sleep apnea. Oral appliance therapy (OAT) treats patients with snoring and obstructive sleep apnea (OSA). OAT can be an effective treatment for patients who prefer oral appliances over continuous positive airway pressure (CPAP) or those unable to tolerate CPAP.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global sleep apnea oral appliance market by product, purchase type, gender, age, distribution channel, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall sleep apnea oral appliance market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Sleep apnea oral appliance market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Sleep apnea oral appliance Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sleep Apnea Oral Appliances Market