Feed Binders Market by Type (Lignosulfonates, Plant Gums & Starches, Gelatin & Other Hydrocolloids, Clay, Molasses, and Others), Livestock (Poultry, Cattle, Swine, Aquatic Animals, Dogs & Cats, and Others), Region - Global Forecast to 2025

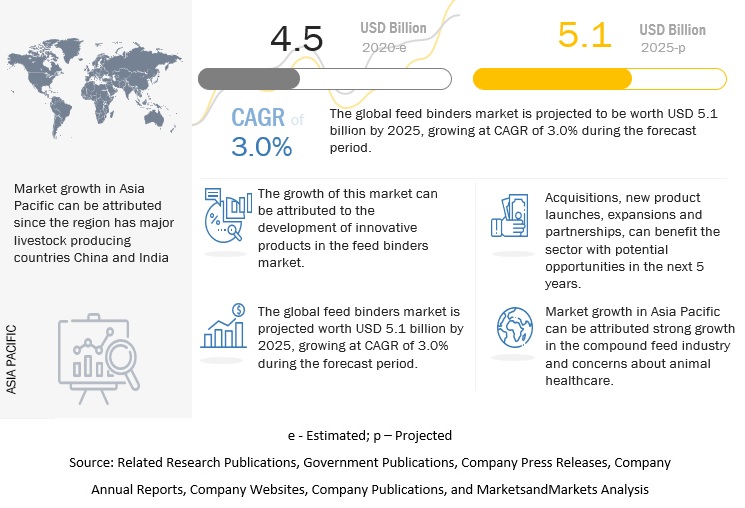

[293 Pages Report] The global feed binders market size is estimated to account for a value of USD 4.5 billion in 2020 and is projected to grow at a CAGR 3.0% from 2020, to reach a value of USD 5.1 billion by 2025. The rise in demand for feed due to the increased consumption of livestock-based products is projected to drive the growth of the market. The increasing awareness among manufacturers about the benefits offered by feed binders is projected to drive the market growth during the forecast period. Feed binders serve as an additive that can reduce the dusty and powdery nature of fine ground feed materials. In order to reduce the total operating cost, from manufacturing to its consumption stage, feed binders are observed to increase the health benefits of feed materials, and thus, are widely being opted by feed manufacturers.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Feed Binders Market

The FAO has acknowledged that the spread of COVID- 19 pandemic is subsiding in a few countries and regions of the world. Still, it is also resurging or spreading quickly in some other countries such as Korea, Brazil, and India. This outbreak has affected significant elements of both food supply and demand. Border closures, quarantines, market supply chains, and trade disruptions have restricted people’s access to sufficient and nutritious sources of food, especially in countries hit hard by the virus. However, as the governments on a global level shut down borders and economies for restricting the spread of the coronavirus, the businesses observed major impacts on their international trades. Many markets are focusing on fulfilling their requirements for feed additives and feed binders by domestic companies. This is, however, causing an imbalance between the demand and supply quantities. However, some regions are completely dependent on imports and are facing tough situations. All these factors hampered the potential growth of the market at the beginning of 2020.

- In January 2020, Darling Ingredients Inc. acquired the 50% joint venture of EnviroFlight, LLC (US), owned by Intrexon Corporation (US), thereby increasing its ownership interest in EnviroFlight to 100%.

Market Dynamics

Driver: Strong growth in the compound feed industry

The feed sector plays a crucial part in addressing global food and agriculture issues. Feed manufacturers are becoming more aware of the need to increase the nutritional value of feed products to improve the digestibility of animals to optimum levels. According to the FAO, global compound feed production has been estimated to be about 1 billion tonnes every year. Compound feed can be defined as the final feed product made up of various raw materials and additives. Additives are added to the feed to enhance their nutritional value, shelf-life, and quality. The compound feed industry is growing at a very fast pace, which fuels the need for the development of new additives in the feed market.

According to the International Feed Industry Federation (IFIF), there is a continuous increase in the demand for animal protein from the livestock, dairy, and fish sectors at a global level. The FAO estimated that the demand for food is projected to grow by 60% in 2050, with the expected growth of animal proteins at 1.7% per year. This, in turn, will increase the demand for feed and, in turn, would increase the demand for feed additives such as feed binders

Restraint: Price volatility and availability of raw materials

Binding agents, such as guar gum, corn starch, agar, carrageenan, and gelatin, are highly effective binders but are very expensive to include in the feed. To optimize the cost of feed ingredients, compound feed mixers, or livestock, farmers opt for binders with high-cohesive properties to reduce the amount of inclusion as well as to limit the cost. Cost-effective binders, such as lignosulphonates and clay, are moderately expensive, with very low inclusion levels from 0.2% to 0.8%. Feed products are mostly formulated and designed by limiting the overall cost to sustain their market presence. The prices of raw materials can increase based on the source, extraction process, or the chances of availability in the region.

Opportunity: Increased popularity of natural solutions for pet food nutrition

Owners of pets remain very sensitive and concerned about the quality, safety, and source of the ingredients involved in the manufacturing of pet food. The trend of keeping pets is also gaining pace these days. According to Agriculture and Agri-Food Canada, 2013, the US has the largest population of pets and has one of the largest pet food markets worldwide. In 2018, Agriculture and Agri-Food Canada quoted the value of the pet food market in Europe, which was worth USD 24.1 billion. It is projected to reach USD 28.1 billion by 2022, with an estimated CAGR of 3.5% from 2018 to 2022. This implies that pet owners are looking for premium products for their pets.

Challenges: Low-quality products can be a challenge in developing economies

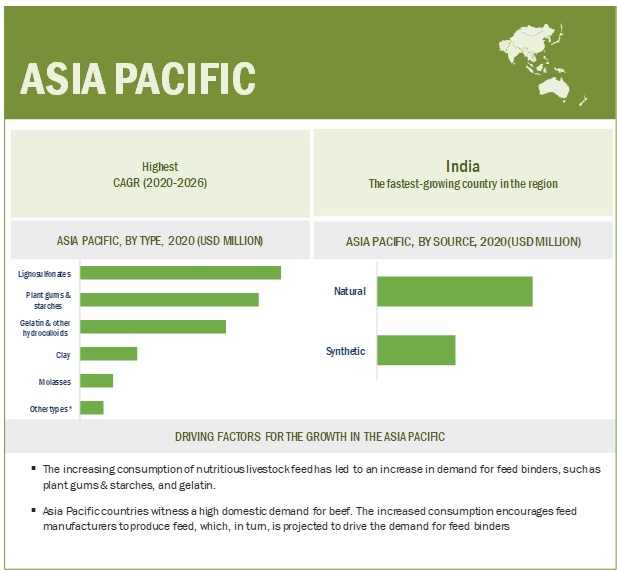

Low-quality products are used by some regional or local manufacturers to reap the benefits of the growing demand for compound feed. Duplicate and low-quality products can create health issues in the livestock and are a big concern for producers. There are many small players in the developing markets of Asia Pacific that offer compound feed without any brand name, and somehow increase their profits by selling unauthorized duplicate products. These local manufacturers attract feed consumers by offering lower prices for their low-quality compound feed.

By type, the lignosulphonates segment is projected to be the fastest-growing segment in the feed binders market during the forecast period.

The lignosulphonates segment is projected to be the fastest-growing segment in the market. They are used due to their binding, dispersing, and emulsifying properties in the manufacture of feed products, to provide structural integrity. It helps in adding more steam during the production of compressed pellets than hemicellulose, and hence, enhances the overall productivity. Moreover, these products are easily digestible by ruminants, particularly cattle, sheep, and goats. Hemicellulose extracts, along with molasses, can increase the pellet durability and improve intra-particle cohesion, due to which it witnesses significant demand.

By livestock, the poultry segment is projected to dominate the market during the forecast period.

The poultry segment is projected to hold the largest share in the feed binders market during the forecast period. Feed binders, such as clay and Lignosulfonates, are some of the significant binders used in poultry feed for high-quality and quantity production. On a global level, the total poultry production continues to increase, and with such growth in poultry production and consumption, it has become essential for meat producers to focus on the quality of meat. This is projected to drive the growth of the market, as it provides a complete nutritional feed for poultry.

By source, the natural segment is projected to dominate the feed binders market during the forecast period.

The natural segment is projected to hold the largest share in the market during the forecast period. With the increasing demand for organic animal feed and pet food, the demand for natural feed ingredients is increasing from the manufacturers of organic animal feed, aquafeed, and pet food. Consumers are now more conscious of the ingredients in animal feed. Additionally, since the demand for organic and natural food is increasing among consumers, pet owners want the same for their pets. Consumers expect the food for their pets to be made without any synthetic ingredients, such as artificial colors, flavors or preservatives, antibiotics, synthetic hormones, or toxic pesticides. Thus, the demand for natural animal feed and pet food ingredients is increasing.

To know about the assumptions considered for the study, download the pdf brochure

The increasing demand for feed binders in the Asia Pacific region is projected to drive the growth of the market.

Asia Pacific is witnessing a high demand for feed binders for use mainly in the poultry feed industry. The population in developing countries of the Asia Pacific region—such as India, China, Indonesia, Vietnam, and Thailand—are projected to increase the consumption of meat products at an annual rate of 2.4% till 2030, according to the FAO report on “World Agriculture: Towards 2015/2030.” These factors have increased the demand for high-quality feed, and thereby, for feed binders to enhance the structural integrity and reduce the loss of feed ingredients.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2016–2019, and 2020-2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) & Volume (‘000 Tons) |

|

Segments covered |

Type, Livestock, Source, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

The major market players include Archer Daniels Midland Company (US), Darling Ingredients, Inc. (US), Ingredion, Inc. (US), DuPont (US). (Total 25 companies). |

This research report categorizes the feed binders market based on type, livestock, source, and region.

Based on type:

- Lignosulfonates

- Plant gums & starches

- Gelatin & other hydrocolloids

- Molasses

- Clay

- Other types (carboxymethylcellulose (CMC), wheat gluten & middlings, urea-formaldehyde, and polymethylcellulose (PMC)

Based on source:

- Natural

- Synthetic

- Based on type:

- Poultry

- Cattle

- Swine

- Aquatic animals

- Dogs & Cats

- Other livestock (equine and pet animals such as reptiles & birds)

Based on the region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

*Rest of the World (RoW) includes South Africa, Egypt, and Other countries in RoW

Key Market Players

Key players in the market include Archer Daniels Midland Company (US), DuPont (US), Darling Ingredients Inc. (US), Roquette Freres (France), Borregaard ASA (Norway), Gelita AG (Germany), CP Kelco Inc. (US), and Avebe U.A. (Netherlands).

Recent Developments:

- In January 2020, Darling Ingredients Inc. acquired the 50% joint venture of EnviroFlight, LLC (US), owned by Intrexon Corporation (US), thereby increasing its ownership interest in EnviroFlight to 100%.

- In November 2019, Cargill Animal Nutrition and Health launched a mycotoxin binder known as Notox Ultimate Pro. This product helps swine farmers tackle the challenges of mycotoxin contamination in feed materials.

- In April 2019, ADM opened a new high-tech livestock feed facility in Quincy, Illinois, US, to increase its animal nutrition capabilities and cater to its customers in aquaculture and other animal industries.

- In December 2019, CP Kelco, a global leader of nature-based ingredient solutions, is announcing a new distribution agreement with IMCD Brasil to serve the Brazilian market in Latin America. Effective January 1, 2020, IMCD Brasil will be the company’s strategic distributor in Brazil for CP Kelco’s pectin, gellan gum, carrageenan, xanthan gum, and diutan gum for use in a wide range of foods, beverages, and consumer and industrial products.

- In March 2019, Ingredion Incorporated (US) acquired privately held potato starch producer, Western Polymer, in Washington State (US), thereby expanding the company's potato starch manufacturing capacity and processing capabilities.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the feed binders market?

Asia Pacific accounted for the major market share for feed binders due to the presence of major players in these regions and the high adoption rate of sustainable livestock practices.

What is the current size of the global feed binders market?

The global feed binders market is estimated to be USD 4.5 billion in 2020 and projected to reach USD 5.1 billion by 2025, at a CAGR of 3.0%.

How would COVID-19 impact the feed binders market?

COVID-19 has affected the supply chains across the globe and thus, the meat product prices experienced a spike in the initial months of 2020. Feed productions have been notably hampered in Europe, which is affecting the feed and livestock businesses. Due to the closing down of all cafeterias, restaurants, and public diners, the domestic demand for meat and poultry has been affected. Consequently, the feed binders market has been affected, as there is lowered demand from the manufacturers.

Which are the key players in the market, and how intense is the competition?

The key players include Archer Daniels Midland Company (US), DuPont (US), Darling Ingredients Inc. (US), Roquette Freres (France), Borregaard ASA (Norway), Gelita AG (Germany), CP Kelco Inc. (US), and Avebe U.A. (Netherlands). These companies cater to the requirements of the feed industry by providing customized feed binders products. Moreover, these companies have effective global manufacturing operations and supply chain strategies. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on feed binders manufacturers?

Feed binders suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. Though COVID-19 has impacted their businesses as well, there is no significant impact on the global operations and supply chain of their products. Multiple manufacturing facilities of players are still in operation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 FEED BINDERS MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2014–2018

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN: FEED BINDERS MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 7 FEED BINDERS MARKET, 2018–2025 (USD MILLION)

FIGURE 8 INCREASING DEMAND FOR POULTRY FEED TO DRIVE THE FEED BINDERS MARKET

FIGURE 9 LIGNOSULFONATES ARE THE MOST COMMONLY ADOPTED FEED BINDER IN FEED

FIGURE 10 NATURAL BINDERS ARE PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

FIGURE 11 FEED BINDERS MARKET SNAPSHOT: ASIA PACIFIC TO ACCOUNT FOR THE LARGEST SHARE (VALUE) IN 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 OPPORTUNITIES IN THE FEED BINDERS MARKET

FIGURE 12 INCREASING DEMAND FOR COMPOUND FEED IS DRIVING THE GROWTH OF THE MARKET

4.2 FEED BINDERS MARKET, BY KEY LIVESTOCK

FIGURE 13 POULTRY TO BE THE LARGEST SEGMENT IN THE FEED BINDERS MARKET IN 2020

4.3 ASIA PACIFIC: FEED BINDERS MARKET, BY KEY TYPE AND COUNTRY

FIGURE 14 ASIA PACIFIC: CHINA TO BE AMONG THE MAJOR CONSUMERS IN 2020

4.4 FEED BINDERS MARKET, BY LIVESTOCK & REGION

FIGURE 15 ASIA PACIFIC TO HOLD THE LARGEST MARKET SHARE FOR POULTRY IN 2020

4.5 FEED BINDER MARKET, BY KEY COUNTRY

FIGURE 16 INDIA IS PROJECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 GROWTH IN FEED PRODUCTION

FIGURE 17 GLOBAL FEED PRODUCTION, 2013–2017 (MILLION METRIC TONS)

5.2.2 INCREASE IN THE DEMAND FOR ANIMAL PRODUCTS IN DEVELOPING COUNTRIES

FIGURE 18 GLOBAL PER CAPITA MEAT CONSUMPTION, 2016–2020 (POUNDS/CAPITA)

5.3 MARKET DYNAMICS

FIGURE 19 INCREASING MEAT CONSUMPTION HAS LED TO AN INCREASED DEMAND FOR FEED, THEREBY INCREASING THE DEMAND FOR FEED BINDERS

5.3.1 DRIVERS

5.3.1.1 Strong growth in the compound feed industry

FIGURE 20 EU: COMPOUND FEED PRODUCTION TREND, 2011–2018 (MILLION TONNES)

5.3.1.1.1 COVID-19 impact on the global meat consumption

5.3.1.2 Growing concerns regarding animal health

5.3.1.2.1 COVID-19 impact on the global trade of feed equipment and production

5.3.2 RESTRAINTS

5.3.2.1 Price volatility and availability of raw materials

FIGURE 21 PRICE ANALYSIS OF FEED RAW MATERIALS, 2006–2017 (USD/TONNE)

5.3.2.2 Regulatory bans and restrictions

5.3.3 OPPORTUNITIES

5.3.3.1 Increased popularity of natural solutions for pet food nutrition

5.3.3.2 Strategic growth initiatives for manufacturers to enter untapped markets

5.3.4 CHALLENGES

5.3.4.1 Low-quality products can be a challenge in developing economies

5.3.4.2 To identify cost-efficient nutritive binders

5.4 PRE- & POST-COVID-19 IMPACT ON THE FEED BINDERS MARKET

FIGURE 22 PRE- & POST-COVID-19 IMPACT ON THE FEED BINDERS MARKET, 2020–2030 (USD MILLION)

5.5 INDUSTRY TRENDS

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 R&D AND RAW MATERIALS & MANUFACTURING: MAJOR PHASES OF VALUE ADDITION

5.7 REGULATORY FRAMEWORK

5.7.1 EUROPEAN UNION

5.7.2 US

5.7.3 CHINA

5.7.4 CANADA

5.7.5 BRAZIL

5.7.6 JAPAN

5.7.7 SOUTH AFRICA

6 FEED BINDERS MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 24 LIGNOSULFONATES SEGMENT TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD (USD MILLION)

TABLE 2 FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 3 FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 4 FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 5 FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

6.2 LIGNOSULFONATES

6.2.1 THE DEMAND FOR LIGNOSULFONATES INCREASES WITH THE EASY AVAILABILITY OF RAW MATERIALS, ESPECIALLY CELLULOSE MATERIALS

TABLE 6 LIGNOSULFONATES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 LIGNOSULFONATES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 8 LIGNOSULFONATES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 9 LIGNOSULFONATES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

6.3 PLANT GUMS & STARCHES

6.3.1 STRONG GROWTH WITNESSED IN ASIA PACIFIC DUE TO THE HIGH AVAILABILITY OF GUAR GUM AND TAPIOCA STARCH AT CHEAPER COSTS

TABLE 10 PLANT GUM & STARCHES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 PLANT GUM & STARCHES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 PLANT GUM & STARCHES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 13 PLANT GUM & STARCHES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

6.4 GELATIN & OTHER HYDROCOLLOIDS

6.4.1 REGULATORY CHALLENGES IN EUROPEAN COUNTRIES LED TO THE REDUCED ADOPTION OF GELATIN AS FEED BINDERS

TABLE 14 GELATIN & OTHER HYDROCOLLOIDS: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 GELATIN & OTHER HYDROCOLLOIDS: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 16 GELATIN & OTHER HYDROCOLLOIDS: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 17 GELATIN & OTHER HYDROCOLLOIDS: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

6.5 MOLASSES

6.5.1 MOLASSES BINDERS, A SAFE AND ECONOMICAL SOURCE OF BINDERS, WITNESSING STRONG GROWTH

TABLE 18 MOLASSES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 MOLASSES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 20 MOLASSES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 21 MOLASSES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

6.6 CLAY

6.6.1 THE UTILIZATION OF CLAY IN POULTRY FEED HAS BEEN INCREASING DUE TO ITS WATER ABSORPTION PROPERTIES TO REDUCE WET DROPPINGS

TABLE 22 CLAY: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 CLAY: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 24 CLAY: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 25 CLAY: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

6.7 OTHER TYPES

TABLE 26 OTHER TYPES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 OTHER TYPES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 28 OTHER TYPES: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 29 OTHER TYPES: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

7 FEED BINDERS MARKET, BY SOURCE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 25 NATURAL BINDERS ARE PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 30 FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 31 FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

7.2 NATURAL

7.2.1 INCREASING DEMAND FOR ORGANIC OR NATURAL FEED AND PET FOOD PROPELLING THE GROWTH OF THE MARKET

TABLE 32 NATURAL: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 NATURAL: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 SYNTHETIC

7.3.1 COST-EFFECTIVENESS OF SYNTHETIC BINDERS CONTINUES TO CREATE DEMAND

TABLE 34 SYNTHETIC: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 SYNTHETIC: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 FEED BINDERS MARKET, BY LIVESTOCK (Page No. - 93)

8.1 MACROECONOMIC INDICATORS

8.1.1 INCREASE IN LIVESTOCK POPULATION

FIGURE 26 GLOBAL LIVESTOCK PRODUCTION, 2011–2017 (BILLION HEADS)

8.2 INTRODUCTION

FIGURE 27 POULTRY IS PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 36 FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 37 FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

8.3 POULTRY

8.3.1 THE POULTRY SEGMENT IS PROJECTED TO BE THE LARGEST DURING THE FORECAST PERIOD

8.3.2 COVID-19 IMPACT ON THE POULTRY FEED SECTOR

TABLE 38 POULTRY: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 POULTRY: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.4 SWINE

8.4.1 INCREASING PORK CONSUMPTION TO PRESENT HIGH-GROWTH POTENTIAL FOR FEED BINDERS

8.4.2 COVID-19 IMPACT ON THE SWINE FEED SECTOR

TABLE 40 SWINE: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 SWINE: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.5 CATTLE

8.5.1 INCREASING DEMAND FOR DAIRY AND DAIRY-BASED PRODUCTS TO DRIVE THE DEMAND FOR THE CATTLE SEGMENT

8.5.2 COVID-19 IMPACT ON THE CATTLE FEED SECTOR

TABLE 42 CATTLE: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 CATTLE: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.6 AQUATIC ANIMALS

8.6.1 HIGH GROWTH IN THE AQUAFEED INDUSTRY IN THE ASIA PACIFIC REGION TO OFFER GROWTH OPPORTUNITIES FOR MANUFACTURERS

8.6.2 COVID-19 IMPACT ON THE AQUAFEED SECTOR

TABLE 44 AQUATIC ANIMALS: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 AQUATIC ANIMALS: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.7 DOGS & CATS

8.7.1 INCREASE IN THE NUMBER OF PET OWNERS AND RISING EXPENDITURE ON PET FOOD TO OFFER GROWTH OPPORTUNITIES

8.7.2 COVID-19 IMPACT ON DOG & CAT FOOD

TABLE 46 DOGS & CATS: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 DOGS & CATS: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.8 OTHER LIVESTOCK

TABLE 48 OTHER LIVESTOCK: FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 OTHER LIVESTOCK: FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 FEED BINDERS MARKET, BY REGION (Page No. - 107)

9.1 INTRODUCTION

FIGURE 28 CHINA TO ACCOUNT FOR THE LARGEST SHARE IN THE FEED BINDERS MARKET, BY VALUE, IN 2020

TABLE 50 FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (‘000 TONS)

TABLE 51 FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (‘000 TONS)

TABLE 52 FEED BINDERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 FEED BINDERS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: REGIONAL SNAPSHOT, 2020

TABLE 54 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (‘000 TONS)

TABLE 57 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (‘000 TONS)

TABLE 58 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 61 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 62 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Demand for quality feed products driving the demand for feed binders

TABLE 66 US: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 67 US: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 68 US: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 69 US: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 70 US: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 71 US: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Relatively low-cost feed raw materials allow manufacturers to adopt high-quality feed binders for compound feed production

TABLE 72 CANADA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 73 CANADA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 74 CANADA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 CANADA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 76 CANADA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 77 CANADA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Rising export demand for high-quality meat to boost the market for feed binders

TABLE 78 MEXICO: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 79 MEXICO: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 80 MEXICO: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 81 MEXICO: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 82 MEXICO: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 83 MEXICO: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.3 COVID-19 IMPACT ON NORTH AMERICA

9.4 EUROPE

FIGURE 30 EUROPE: REGIONAL SNAPSHOT, 2020

TABLE 84 EUROPE: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 86 EUROPE: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (‘000 TONS)

TABLE 87 EUROPE: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (‘000 TONS)

TABLE 88 EUROPE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 90 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 91 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 92 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 93 EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 94 EUROPE: FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 95 EUROPE: FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

9.4.1 SPAIN

9.4.1.1 Increasing demand to produce better quality, nutritious livestock feed propelling the demand for feed binders

TABLE 96 SPAIN: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 97 SPAIN: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 98 SPAIN: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 SPAIN: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 100 SPAIN: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 101 SPAIN: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.2 RUSSIA

9.4.2.1 Growth of the Russian meat industry increased consumption of compound feed and feed binders

TABLE 102 RUSSIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 103 RUSSIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 104 RUSSIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 105 RUSSIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 106 RUSSIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 107 RUSSIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.3 GERMANY

9.4.3.1 Increased production of quality feed has led to the usage of feed additives, such as feed binders

TABLE 108 GERMANY: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 109 GERMANY: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 110 GERMANY: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 111 GERMANY: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 112 GERMANY: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 113 GERMANY: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.4 FRANCE

9.4.4.1 Quality concerns pertaining to disease outbreaks have led to the increased adoption of high-quality feed additives

TABLE 114 FRANCE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 115 FRANCE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 116 FRANCE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 117 FRANCE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 118 FRANCE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 119 FRANCE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.5 ITALY

9.4.5.1 Increased focus on the imports of young calves to grow them for meat has led to the increased demand for feed and feed additives

TABLE 120 ITALY: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 121 ITALY: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 122 ITALY: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 ITALY: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 124 ITALY: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 125 ITALY: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.6 UK

9.4.6.1 Intensive farming adoption has led to higher usage of feed additives, such as feed binders

TABLE 126 UK: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 127 UK: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 128 UK: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 129 UK: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 130 UK: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 131 UK: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 132 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 133 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 134 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 135 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 136 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 137 REST OF EUROPE: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.5 COVID-19 IMPACT ON EUROPE

9.6 ASIA PACIFIC

TABLE 138 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 139 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 140 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (‘000 TONS)

TABLE 141 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (‘000 TONS)

TABLE 142 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 143 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 145 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 146 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

9.6.1 CHINA

9.6.1.1 Significant meat consumption in the country to drive the market growth

TABLE 150 CHINA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 151 CHINA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 152 CHINA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 153 CHINA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 154 CHINA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 155 CHINA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.6.2 INDIA

9.6.2.1 Increased inclination toward natural ingredients to drive the demand for feed binders in the country

TABLE 156 INDIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 157 INDIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 158 INDIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 159 INDIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 160 INDIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 161 INDIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.6.3 JAPAN

9.6.3.1 Improvements in feed quality and palatability have led to the adoption of feed binders

TABLE 162 JAPAN: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 163 JAPAN: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 164 JAPAN: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 165 JAPAN: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 166 JAPAN: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 167 JAPAN: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.6.4 INDONESIA

9.6.4.1 Organized development of the livestock sector has led to an increased usage of feed additives

TABLE 168 INDONESIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 169 INDONESIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 170 INDONESIA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 INDONESIA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 172 INDONESIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 173 INDONESIA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.6.5 SOUTH KOREA

9.6.5.1 Increasing consumption of poultry and beef cattle products to drive market growth

TABLE 174 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 175 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 176 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 177 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 178 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 179 SOUTH KOREA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.6.6 REST OF ASIA PACIFIC

TABLE 180 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 181 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 182 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.7 COVID-19 IMPACT ON ASIA PACIFIC

9.8 SOUTH AMERICA

TABLE 186 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 187 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 188 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (‘000 TONS)

TABLE 189 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (‘000 TONS)

TABLE 190 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 191 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 192 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 193 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 194 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 195 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 196 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 197 SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

9.8.1 BRAZIL

9.8.1.1 Growing demand for meat and meat products in domestic and international markets

TABLE 198 BRAZIL: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 199 BRAZIL: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 200 BRAZIL: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 201 BRAZIL: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 202 BRAZIL: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 203 BRAZIL: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.8.2 ARGENTINA

9.8.2.1 Increase in meat exports driving the usage of feed additives, such as feed binders

TABLE 204 ARGENTINA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 205 ARGENTINA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 206 ARGENTINA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 207 ARGENTINA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 208 ARGENTINA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 209 ARGENTINA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.8.3 REST OF SOUTH AMERICA

TABLE 210 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 211 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 212 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 213 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 214 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 215 REST OF SOUTH AMERICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.9 COVID-19 IMPACT ON SOUTH AMERICA

9.10 REST OF THE WORLD

TABLE 216 ROW: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 217 ROW: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 218 ROW: FEED BINDERS MARKET SIZE, BY COUNTRY, 2016–2019 (‘000 TONS)

TABLE 219 ROW: FEED BINDERS MARKET SIZE, BY COUNTRY, 2020–2025 (‘000 TONS)

TABLE 220 ROW: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 221 ROW: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

TABLE 222 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 223 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 224 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 225 ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 226 ROW: FEED BINDERS MARKET SIZE, BY SOURCE, 2016–2019 (USD MILLION)

TABLE 227 ROW: FEED BINDERS MARKET SIZE, BY SOURCE, 2020–2025 (USD MILLION)

9.10.1 SOUTH AFRICA

9.10.1.1 The advancements in the meat and dairy processing industries fuel the market growth

TABLE 228 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 229 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 230 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 231 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 232 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 233 SOUTH AFRICA: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.10.2 EGYPT

9.10.2.1 Increased investments in feed manufacturing facilities have led to a surge in demand for commercial feed in the country

TABLE 234 EGYPT: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 235 EGYPT: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 236 EGYPT: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 237 EGYPT: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 238 EGYPT: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 239 EGYPT: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.10.3 OTHERS IN ROW

TABLE 240 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (‘000 TONS)

TABLE 241 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (‘000 TONS)

TABLE 242 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 243 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 244 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2016–2019 (USD MILLION)

TABLE 245 OTHERS IN ROW: FEED BINDERS MARKET SIZE, BY LIVESTOCK, 2020–2025 (USD MILLION)

9.11 COVID-19 IMPACT ON ROW

10 COMPETITIVE LANDSCAPE (Page No. - 214)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS

FIGURE 31 MARKET SHARE ANALYSIS FOR FEED BINDERS, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 EMERGING PLAYERS

FIGURE 32 FEED BINDERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 33 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE FEED BINDERS MARKET, 2015–2020

10.4 COMPETITIVE SCENARIO

10.4.1 EXPANSIONS & INVESTMENTS

TABLE 246 EXPANSIONS & INVESTMENTS, 2015–2020

10.4.2 ACQUISITIONS

TABLE 247 ACQUISITIONS, 2015–2020

10.4.3 AGREEMENTS & JOINT VENTURES

TABLE 248 AGREEMENTS & JOINT VENTURES, 2015–2020

11 COMPANY PROFILES (Page No. - 222)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 ARCHER DANIELS MIDLAND COMPANY

FIGURE 34 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

11.2 ROQUETTE FRÈRES

11.3 DARLING INGREDIENTS

FIGURE 35 DARLING INGREDIENTS: COMPANY SNAPSHOT

11.4 INGREDION INCORPORATED

FIGURE 36 INGREDION INCORPORATED: COMPANY SNAPSHOT

11.5 KEMIN INDUSTRIES, INC.

11.6 GELITA AG

FIGURE 37 GELITA AG: COMPANY SNAPSHOT

11.7 DUPONT

FIGURE 38 DUPONT: COMPANY SNAPSHOT

11.8 BORREGAARD

FIGURE 39 BORREGAARD: COMPANY SNAPSHOT

11.9 J. M. HUBER CORPORATION

11.10 BENEO

11.11 UNISCOPE, INC.

11.12 AVEBE

FIGURE 40 AVEBE: COMPANY SNAPSHOT

11.13 IRO ALGINATE

11.14 A.F. SUTER & CO LTD

11.15 BENTOLI

11.16 BONAVENTURE ANIMAL NUTRITION

11.17 CRA-VAC INDUSTRIES INC.

11.18 FUZHOU WONDERFUL BIOLOGICAL TECHNOLOGY CO., LTD

11.19 BALTIVET

11.20 CHEMROSE

11.21 ALLWYN CHEM INDUSTRIES

11.22 VETLINE

11.23 VISCO STARCH

11.24 VETSFARMA LTD.

11.25 NATURAL REMEDIES

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 261)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 FEED ADDITIVES MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

FIGURE 41 FEED ADDITIVES MARKET IS ESTIMATED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

12.4 FEED ADDITIVES MARKET, BY LIVESTOCK

12.4.1 INTRODUCTION

TABLE 249 FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 250 FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

TABLE 251 FEED ADDITIVES FOR RUMINANTS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 252 FEED ADDITIVES FOR RUMINANTS MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 253 FEED ADDITIVES FOR RUMINANTS MARKET SIZE, BY REGION, 2015–2022 (KT)

12.5 FEED ADDITIVES MARKET, BY REGION

12.5.1 NORTH AMERICA

TABLE 254 NORTH AMERICA: FEED ADDITIVES MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 255 NORTH AMERICA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 256 NORTH AMERICA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

12.5.2 EUROPE

TABLE 257 EUROPE: FEED ADDITIVES MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 258 EUROPE: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 259 EUROPE: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

12.5.3 ASIA PACIFIC

TABLE 260 ASIA PACIFIC: FEED ADDITIVES MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 261 ASIA PACIFIC: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 262 ASIA PACIFIC: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

12.5.4 SOUTH AMERICA

TABLE 263 SOUTH AMERICA: FEED ADDITIVES MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 264 SOUTH AMERICA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 265 SOUTH AMERICA: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

12.5.5 REST OF THE WORLD

TABLE 266 ROW: FEED ADDITIVES MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 267 ROW: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (USD MILLION)

TABLE 268 ROW: FEED ADDITIVES MARKET SIZE, BY LIVESTOCK, 2015–2022 (KT)

12.6 FEED PROCESSING MARKET

12.7 LIMITATIONS

12.8 MARKET DEFINITION

12.9 MARKET OVERVIEW

FIGURE 42 FEED PROCESSING MARKET IS ESTIMATED TO HAVE A HIGH GROWTH DURING THE FORECAST PERIOD

12.10 FEED PROCESSING MARKET, BY LIVESTOCK

TABLE 269 FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

12.11 FEED PROCESSING MARKET, BY REGION

12.11.1 NORTH AMERICA

TABLE 270 NORTH AMERICA: FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

TABLE 271 NORTH AMERICA: FEED PROCESSING EQUIPMENT MARKET SIZE, BY FORM OF FEED, 2016–2023 (USD MILLION)

12.11.2 ASIA PACIFIC

TABLE 272 ASIA PACIFIC: FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

TABLE 273 ASIA PACIFIC: FEED PROCESSING EQUIPMENT MARKET SIZE, BY FORM OF FEED, 2016–2023 (USD MILLION)

12.11.3 EUROPE

TABLE 274 EUROPE: FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

TABLE 275 EUROPE: FEED PROCESSING EQUIPMENT MARKET SIZE, BY FORM OF FEED, 2016–2023 (USD MILLION)

12.11.4 SOUTH AMERICA

TABLE 276 SOUTH AMERICA: FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

TABLE 277 SOUTH AMERICA: FEED PROCESSING EQUIPMENT MARKET SIZE, BY FORM OF FEED, 2016–2023 (USD MILLION)

12.11.5 REST OF THE WORLD (ROW)

TABLE 278 ROW: FEED PROCESSING EQUIPMENT MARKET SIZE, BY LIVESTOCK, 2016–2023 (USD MILLION)

TABLE 279 ROW: FEED PROCESSING EQUIPMENT MARKET SIZE, BY FORM OF FEED, 2016–2023 (USD MILLION)

13 APPENDIX (Page No. - 284)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

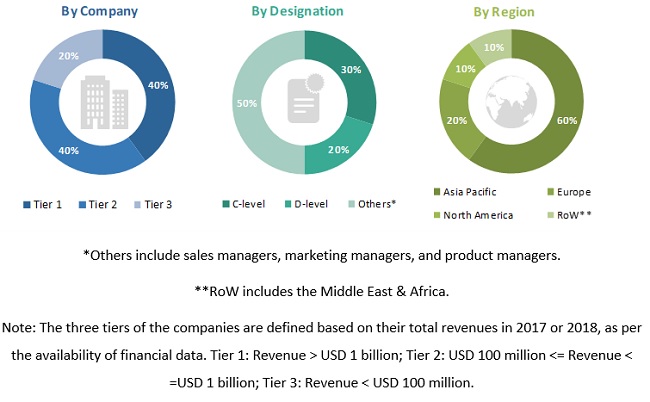

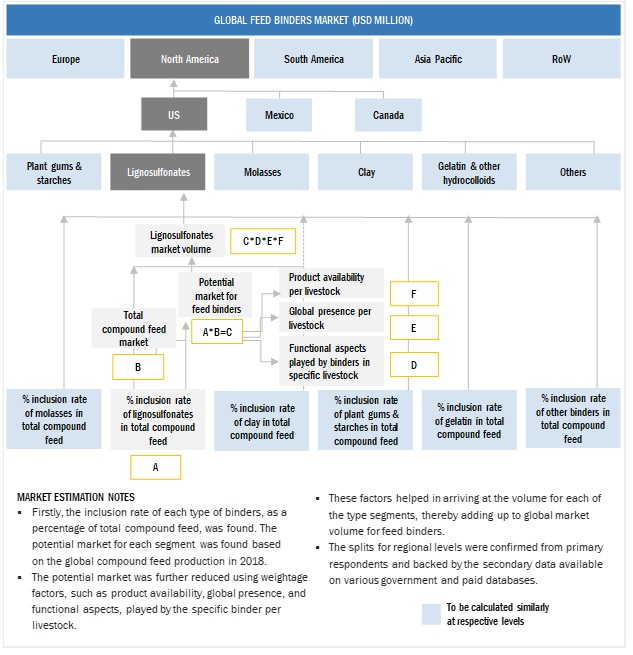

The study involves four major activities to estimate the current market size for feed binders. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The feed binders market comprises several stakeholders, such as manufacturers of feed binders, suppliers of raw materials, manufacturers of feed products, government & research organizations, and industry bodies. The demand-side of this market is characterized by the rising demand from the feed industry. The supply-side is characterized by the advancements in technology and production of diverse livestock products in the industry

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed binders market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Global Feed Binders Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes, as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for the feed binders market

- To understand the structure of the feed binders market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, concerning individual growth trends, prospects, and their contribution to the total feed binders market

- To project the size of the market and its submarkets, in terms of value and volume, for various regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific feed binders market, by country

- Further breakdown of the Rest of Europe feed binders market, by country

- Further breakdown of the Rest of South America feed binders market, by country

- Further breakdown of the Middle Eastern feed binders market, by country

- Further breakdown of the African feed binders market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Feed Binders Market