Food Traceability Market Size, Share, Industry Growth, Trends Report (Technology & Software) by Technology Type (RFID, Barcodes, Infrared, Biometrics, GPS), Software Type (ERP, LIMS, Warehouse), Software End User, Technology Application and Region - Global Forecast to 2025

Food Traceability Market Size

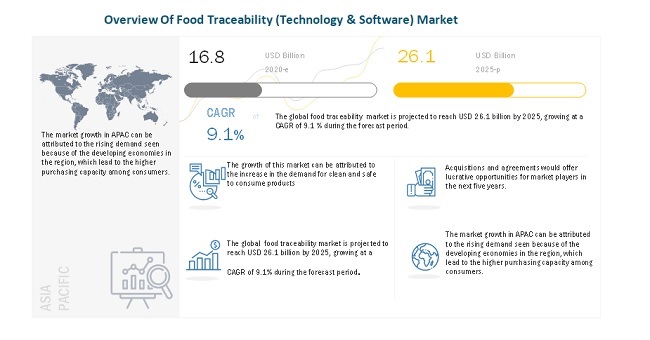

The food traceability market size was valued at USD 16.8 billion in 2020 and projected to reach USD 26.1 billion by 2025, recording a CAGR of 9.1%. The growing demand for safe to consume products among the consumers is expected to drive the market. The Asia pacific segment is poised to dominate the market due to its high population demanding safe and secure food, it is projected to be the fastest-growing as well, owing to the larger demand of safety concern due to recent COVID outbreak in China.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Traceability Market Dynamics

Drivers : Increase in foodborne diseases and food adulteration incidents cause serious health-related issues

Foodborne illnesses are generally caused due to the contamination of food with pathogens and mycotoxins. The presence of pathogens, such as Salmonella and Listeria, in food certainly compromises the microbiological safety and quality of food, thereby resulting in foodborne illnesses. According to the CDC, 76 million cases of foodborne illnesses are recorded in the US every year, resulting in 325,000 hospitalizations and 5000 deaths. Although, according to WHO, the WHO region of the Americas has the second-lowest burden due to foodborne diseases.

According to the Food Standards Agency (FSA), Campylobacter is the most common form of food poisoning in the UK. An estimated 280,000 people are affected by Campylobacter contamination in chicken annually. In 2014, in the UK, a study by the FSA inferred that most supermarket chickens were contaminated with Campylobacter bacteria.

According to WHO, the consumption of unsafe food caused nearly 600 million cases of foodborne diseases each year globally. Due to such instances, food safety has become a major concern attributed to serious health threats. This is projected to drive the demand for food traceability, thereby impacting the market growth positively.

Commercial food services have risen dramatically over the last three decades and require extensive food handling. This has led to an increase in the number of people handling food and various other changes such as new methods of producing and distributing food, which has led to a potential increase in the possibility of transmission of foodborne infections from handlers to consumers, thereby driving the demand for food traceability systems.

Restraints: Privacy issues in data sharing

Traceability is related to tracing and tracking food products throughout the supply chain, from raw material to end consumer. Advanced technology-based solutions are available for tracking products through supply chains such as barcodes and RFID. In addition to supporting product traceability, the equipment also supports data capture, recording, storage, and sharing of traceability attributes on processing, genetics, inputs, disease tracking, and measurement of environmental variables. However, the implementation of these technologies includes concerns, such as protecting the privacy and security of data stored on the RFID tag by unauthorized access and tampering. Other threats caused by RFID include consumers becoming apprehensive about the privacy invasion as they feel they could be tracked if they have purchased RFID-enabled products. Therefore, the privacy issues of consumers and manufacturers regarding data sharing are inhibiting the growth of the food traceability market.

Opportunities: Government contribution to offer opportunities for the adoption of food traceability systems

Stringent regulations set by the government in developed regions, such as Europe, are projected to further highlight the importance of food safety across all stages of the supply chain. For instance, EFSA (European Food Safety Agency) is raising the awareness of food safety in Europe and amendments are made in the General Food Law Regulation to improve risk assessment across the food supply chains. This will present opportunities for the adoption of traceability systems to assess and mitigate risks associated with food contamination.

According to the food safety director of the WHO, in the Eastern Europe and Central Asian regions, where food is dealt with by more than five ministries, a good level of communication should exist between the parties to ensure the safety of food from production to inspect food products. These trends would contribute to the growing demand for food traceability technologies and software to trace food product contamination.

Regulatory bodies, such as CDC, US FDA & USDA’s FSIS are closely collaborating at the federal level to promote food safety in the US. These bodies are enhancing capacities and improving surveillance and investigation of foodborne infections through PulseNet, the Integrated Food Safety Centers of Excellence, and other programs. This would present opportunities for technological developments in the food traceability market as they are effective in detecting the source of contamination, thereby identifying the source of foodborne infections.

Challenges: Additional cost requirements for traceability systems

End-to-end food traceability systems are expensive and challenging to implement. Traceability helps to minimize various kinds of costs, including the packaging cost, the cost of rejected products, and the cost involved in the recall of contaminated food products. In comparison to the cost of record, product differentiation, and cost of certifying a product against certain standards, the cost of the establishment of a traceability system creates a burden on food manufacturers. The establishment of traceability systems includes the installation of hardware, software, systems engineering, training, support, and system upgrades, which is comparatively expensive.

High-end technologies, such as RFID and blockchain, used for effective food traceability, are associated with high costs. Furthermore, an increased focus on system upgrades and the necessity for accuracy and reliability of data further results in an increase in the cost of these traceability systems. The cost of procuring these technologies is high for food manufacturers, particularly in low and middle-income economies.

The cost related to advanced food traceability systems is considered a barrier and a major challenge for their mass adoption. With the continuous increase in demand for food traceability to address food safety issues globally, a large number of traceability tags are produced every year. This is projected to increase the cost of silicon-based tags that contain a unique serial number of food products. However, it is likely that with the increase in the adoption of food traceability technologies, the costs are likely to decline. This is projected to drive the growth of the food traceability market.

To know about the assumptions considered for the study, download the pdf brochure

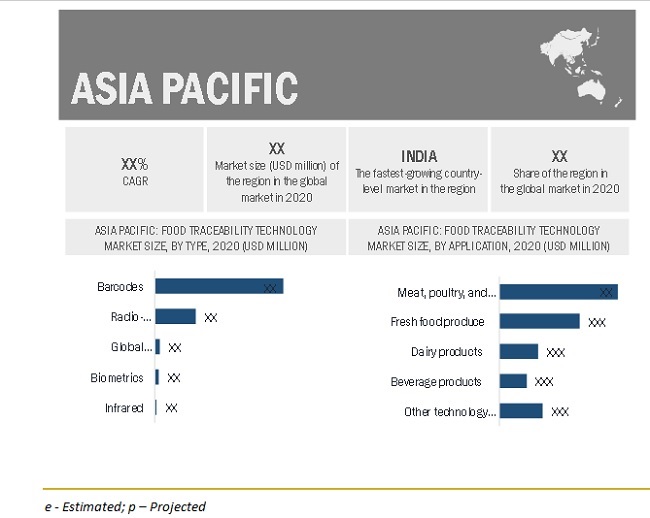

Asia Pacific is projected to account for the fastest-growing market during the forecast period

Due to the high population in the region and the high purchasing capacity, consumers are looking for high quality of safe food to consume. The shift in the consumption habits of the population due to an increase in the awareness regarding healthy food and beverages is also increasing the demand for food traceability services. The millennial population is increasing the demand for clean and safe food & beverages, which is again a driving factor for the food traceability market.

Key Market Players:

C.H. Robinson (US) ,Bio-Rad Laboratories, Inc (US), OPTEL GROUP (Canada), Cognex (US) , Honeywell International Inc. (US), SGS SA (Switzerland), Zebra Technologies (US), Bar Code Integrators (US), Carlisle (US), Merit-Trax (Canada), FoodLogiq (US), Safe Traces (US), Food Forensics (UK), Bext360 (US), rfxcel (US), Covectra (US), SMAG (France), TE-Food (Germany), Mass Group (US), Source Trace (US), Trace One (US), Crest Solutions (Ireland), Traceall Global (UK), and VeeMee (Croatia).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation in 2020 |

USD 16.8 billion |

|

Market size forcast in 2025 |

USD 26.1 billion |

|

Growth rate |

CAGR 9.1% |

|

Units considered |

Value (USD) |

|

Markets Covered |

|

|

Regions covered |

|

|

Companies studied |

|

Target Audience:

- Raw material suppliers

- Food traceability manufacturers and suppliers

- Food safety agencies

- Food & beverage manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of food traceability

- Food & beverage traders, distributors, and suppliers

- Government organizations, research organizations, consulting firms, trade associations, and industry bodies

- Associations, regulatory bodies, and other industry-related bodies

Food Traceability Market Report Scope:

This research report categorizes the market based on application and region.

Technology type

- Radio-frequency identification

- Barcodes

- Infrared

- Biometrics

- Global positioning system

Software type

- Enterprise Resource Planning (ERP)

- Friction welding (stir, linear, rotary)

- Laboratory Information Management Software (LIMS)

- Warehouse software

- Other types (quality management software, poultry farm software, and hybrid software)

Technology Application

- Fresh food produce

- Meat, poultry & seafood products

- Dairy products

- Beverage products

- Other applications(grains, oilseeds, nuts, and coffee)

Software end user

- Enterprise Resource Planning (ERP)

- Friction welding (stir, linear, rotary)

- Laboratory Information Management Software (LIMS)

- Warehouse software

- Others (non-profit organizations, animal welfare organization, and cooperative organization)

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- Middle East

- Africa

- South America

Recent Developments in Food Traceability Market

- Dec 2020, Honeywell (US) acquires Rebellion Photonics (US), a Houston-based provider of innovative, intelligent, visual gas monitoring solutions that maximize safety, operational performance, emissions mitigation and compliance in the oil and gas, petrochemical and power industries.

- Sep 2020, Bio-Rad Laboratories acquired Celsee, Inc. (US), a company that offers instruments and consumables for the isolation, detection, and analysis of single cells. Using the Genesis System, scientists can isolate, analyze, and interpret cellular behavior and collect cell-based information

- Oct 2019, Cognex (US) acquired SUALAB (Korea) to advance its leadership in deep learning-based machine vision. This was done to extend the company’s deep learning capabilities and accelerate opportunities to automate difficult visual inspection tasks in industrial markets

- Jul 2019, SGS SA (Switzerland) acquired a major stake in DMW ENVIRONMENTAL SAFETY LTD.(UK), a leading solution provider of health and safety services, including asbestos surveys, monitoring and analysis, building compliance services, water hygiene services (legionella risk assessment), fire safety audits, and occupational hygiene.

- June 2019, Bio-Rad Laboratories (US) signed a co-marketing agreement with Bruker (India) to bring foodborne pathogen detection and confirmation workflow solutions to the food safety industry; the solutions complemented Bio-Rad’s existing food safety testing product line.

Frequently Asked Questions (FAQ):

Does the report covers the market size and estimations for the software and technology market for food traceability?

The report has overall number at regional and country level. However, the further country wise analysis of can be provided. Please let us know your geography/application preferences.

Does the scope covers traceability for beverage and pharma based products?

No. Only food traceability are included in the study. Further analysis of beverages, pharmaceutical and personal care can also be provided. Please let us know your geography/application preferences.

Is it possible to provide the source segmentation and analysis of software and technology market?

Yes, further segmentation is possible for food traceability market as per technology and software.Please provide your preferred geography.

We are looking for quantification at each stage in the supply chain. Can this be provided?

The report covers value chain analysis and supply chain analysis at global levels. Further drill down at regional level can be provided for required products.

What level of coverage is covered forthe market size in each application by type?

The report covers market size for applications at regional level. The further criss cross for types can be provided.

Can you provide estimation for countries of Middle Eastern region?

We can provide additional country wise estimation for different regions, such as: Egypt, Sudan, Turkey, Jordan, Oman, and Saudi Arabia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 FOOD TRACEABILITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 2 FOOD TRACEABILITY MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 9 TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 13 TRACEABILITY (TECHNOLOGY & SOFTWARE) MARKET SHARE (VALUE), BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 BRIEF OVERVIEW OF THE MARKET (TECHNOLOGY & SOFTWARE)

FIGURE 14 INCREASING INSTANCES OF FOOD FRAUD AND DEMAND FOR SAFE FOOD TO DRIVE THE GROWTH OF THE MARKET

4.2 FOOD TRACEABILITY INDUSTRY: MAJOR REGIONAL SUBMARKETS (TECHNOLOGY & SOFTWARE)

FIGURE 15 THE US IS ESTIMATED TO BE THE LARGEST MARKET FOR FOOD TRACEABILITY IN 2020

4.3 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION AND COUNTRY

FIGURE 16 INDIA IS PROJECTED TO GROW AT THE HIGHEST RATE IN THE ASIA PACIFIC TECHNOLOGY MARKET BY 2025

4.4 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET, BY END USER AND COUNTRY

FIGURE 17 CHINA TO ACCOUNT FOR THE LARGEST SHARE IN THE ASIA PACIFIC SOFTWARE MARKET IN 2020

4.5 FOOD TRACEABILITY TECHNOLOGY MARKET, BY TYPE AND REGION

FIGURE 18 BARCODES TO DOMINATE THE MARKET IN 2020

4.6 FOOD TRACEABILITY SOFTWARE MARKET, BY TYPE

FIGURE 19 ENTERPRISE RESOURCE PLANNING (ERP) IS PROJECTED TO DOMINATE THE MARKET, 2020 VS. 2025

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 FOOD TRACEABILITY MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in foodborne diseases, and food adulteration incidents cause serious health-related issues

TABLE 3 RECENT FOODBORNE OUTBREAKS IN THE US

5.2.1.1.1 Increase in food adulteration incidents

5.2.1.1.2 Rise in global healthcare expenditure for foodborne diseases to drive the market growth

FIGURE 21 PATHOGENS CONTRIBUTING TO THE ECONOMIC BURDEN OF FOODBORNE ILLNESSES IN THE US

TABLE 4 RANKING OF REGIONS BASED ON THE BURDEN OF FOODBORNE DISEASES

5.2.1.2 Increase in concerns pertaining to food safety among consumers

FIGURE 22 FOOD SAFETY SURVEY, ON THE BASIS OF AWARENESS OF GERMS AMONG CONSUMERS, 2016

FIGURE 23 FOOD SAFETY SURVEY, ON THE BASIS OF FOOD THERMOMETER OWNERSHIP AND USE, 2016

5.2.1.3 Initiatives by regulatory bodies to improve food safety across countries

5.2.1.4 Traces contamination and assists product recalls

FIGURE 24 FOOD RECALLS COORDINATED BY FSANZ IN AUSTRALIA, 2010–2019

5.2.1.5 Legislative Framework

5.2.2 RESTRAINTS

5.2.2.1 Privacy issues in data sharing

5.2.2.2 Lack of basic supporting infrastructure in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Government contribution to offer opportunities for the adoption of food traceability systems

5.2.3.2 Technological advancements in food traceability

5.2.3.3 Globalization of food trade results in increased complexities in the supply chain

FIGURE 25 GLOBAL AGRI-FOOD EXPORT, 2016–2018 (USD BILLION)

5.2.3.3.1 Increased dependency of importers on food traceability systems

5.2.3.3.2 Growing border rejection cases in Europe

FIGURE 26 BORDER REJECTION CASES AGAINST CONTAMINATED FOODS IN EUROPE, 2018 – 2019

5.2.3.4 Emerging countries to offer high-growth opportunities

5.2.4 CHALLENGES

5.2.4.1 Additional cost requirements for traceability systems

5.2.4.2 Lack of standardization and harmonization related to food traceability systems

5.2.4.3 Difficulty in data collection and accuracy of information

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 COVID-19 TO DRIVE THE GROWTH OF TECHNOLOGICALLY ADVANCED TRACEABILITY SYSTEMS

5.3.2 COVID-19 TO DRIVE THE DEMAND FOR TRACEABILITY TOOLS AND SYSTEMS TO FURTHER DIGITIZE SUPPLY CHAINS

5.3.3 COVID-19 TO RESULT IN STRINGENCY OF REGULATIONS TO ENCOURAGE FOOD SAFETY

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 FOOD TRACEABILITY MARKET: VALUE CHAIN

5.5 YC-YCC SHIFT

FIGURE 28 FOOD TRACEABILITY INDUSTRY: YC-YCC SHIFT

5.6 ECOSYSTEM MAP

FIGURE 29 FOOD SAFETY, TIC, AND TRACEABILITY: ECOSYSTEM VIEW

FIGURE 30 FOOD SAFETY, TIC, AND TRACEABILITY: MARKET MAP

5.7 TECHNOLOGY ANALYSIS

5.7.1 BLOCKCHAIN TECHNOLOGY

5.7.2 NEAR FIELD COMMUNICATION TECHNOLOGY

5.8 CASE STUDIES

5.8.1 TECHNOLOGICAL GROWTH

5.8.2 INCREASE IN SUPPORT BY FEDERAL BODIES

TABLE 5 PROPOSED FOOD TRACEABILITY LIST (FTL)

6 FOOD TRACEABILITY TECHNOLOGY MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 31 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 6 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 7 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

6.2 RADIO-FREQUENCY IDENTIFICATION

6.2.1 INCREASE IN INVESTMENTS IN TECHNOLOGY IN THE APAC REGION HAS LED TO A RISE IN THE DEMAND FOR RFID

TABLE 8 RADIO-FREQUENCY IDENTIFICATION (RFID) MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 RADIO-FREQUENCY IDENTIFICATION (RFID) MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.3 BARCODES

6.3.1 EASY-TO-USE TECHNOLOGY IS MORE FAVORED AMONG MANUFACTURERS

TABLE 10 BARCODE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 BARCODE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.4 INFRARED

6.4.1 ABILITY TO USE IR TECHNOLOGY IN HARSH ENVIRONMENTS IN FACTORIES HAS MADE IT POPULAR AMONG MANUFACTURERS

TABLE 12 INFRARED MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 INFRARED MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.5 BIOMETRICS

6.5.1 PRECISE INSIGHTS FOUND BY BIOMETRIC INSPECTION HAS MADE IT A RELIABLE TECHNOLOGY AMONG TRANSPORTERS FOR FOOD PRODUCTS

TABLE 14 BIOMETRICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 BIOMETRICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.6 GLOBAL POSITIONING SYSTEM

6.6.1 LOW-COST TECHNOLOGY OF GPS WITNESSES A HIGH ADOPTION RATE AMONG MID AND SMALL-LEVEL MANUFACTURERS

TABLE 16 GLOBAL POSITIONING SYSTEM MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 GLOBAL POSITIONING SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 FOOD TRACEABILITY SOFTWARE MARKET, BY TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 32 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 18 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 19 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

7.2 ENTERPRISE RESOURCE PLANNING (ERP)

7.2.1 ERP OFFERS TIMELY AND RELIABLE INFORMATION

TABLE 20 GLOBAL COMPANIES AND THEIR ERP SOFTWARE

TABLE 21 ENTERPRISE RESOURCE PLANNING (ERP) MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 ENTERPRISE RESOURCE PLANNING (ERP) MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 FRICTION WELDING

7.3.1 BENEFITS OF FRICTION WELDING SOFTWARE OVER CONVENTIONAL WELDING TO OFFER GROWTH OPPORTUNITIES

TABLE 23 FRICTION WELDING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 FRICTION WELDING MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.4 LABORATORY INFORMATION MANAGEMENT SOFTWARE (LIMS)

7.4.1 RISING DEMAND FOR THE INTEGRATION OF LABORATORY SYSTEMS TO DRIVE MARKET GROWTH

TABLE 25 LABORATORY INFORMATION MANAGEMENT SOFTWARE (LIMS) MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 LABORATORY INFORMATION MANAGEMENT SOFTWARE (LIMS) MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.5 WAREHOUSE SOFTWARE

7.5.1 THE GROWING DEMAND FOR WAREHOUSE SOFTWARE IS ATTRIBUTED TO INCREASING INVENTORY AND WORKLOAD

TABLE 27 WAREHOUSE SOFTWARE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 WAREHOUSE SOFTWARE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.6 OTHER SOFTWARE TYPES

7.6.1 RAPID URBANIZATION AND CHANGING FOOD-RELATED LIFESTYLES TO DRIVE THE GROWTH OF SOFTWARE

TABLE 29 OTHER SOFTWARE TYPES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 OTHER SOFTWARE TYPES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 FOOD TRACEABILITY MARKET, BY END USER (Page No. - 87)

8.1 INTRODUCTION

FIGURE 33 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020 VS. 2025 (USD MILLION)

TABLE 31 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 32 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE FOOD TRACEABILITY SOFTWARE MARKET, BY END USER

8.1.1.1 Optimistic Scenario

TABLE 33 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON FOOD TRACEABILITY SOFTWARE MARKET, BY END USER, 2018–2021 (USD MILLION)

8.1.1.2 Realistic Scenario

TABLE 34 REALISTIC SCENARIO: COVID-19 IMPACT ON FOOD TRACEABILITY SOFTWARE MARKET, BY END USER, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic Scenario

TABLE 35 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON FOOD TRACEABILITY SOFTWARE MARKET, BY END USER, 2018-2021 (USD MILLION)

8.2 FOOD MANUFACTURING

TABLE 36 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR FOOD MANUFACTURING, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR FOOD MANUFACTURING, BY REGION, 2020–2025 (USD MILLION)

8.3 WAREHOUSE & TRANSPORT

TABLE 38 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR WAREHOUSES, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR WAREHOUSES, BY REGION, 2020–2025 (USD MILLION)

8.4 RETAILING

TABLE 40 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR RETAILING, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR RETAILING, BY REGION, 2020–2025 (USD MILLION)

8.5 GOVERNMENT DEPARTMENTS

TABLE 42 FOOD TRACEABILITY LIST (FTL)

TABLE 43 GOVERNMENT DEPARTMENTS MARKET SIZE FOR RETAILING, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 GOVERNMENT DEPARTMENTS MARKET SIZE FOR RETAILING, BY REGION, 2020–2025 (USD MILLION)

8.6 OTHER END USERS

FIGURE 34 GLOBAL STATISTICS OF THE INCREASING INTERNET USAGE, 2015–2019

TABLE 45 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR OTHER END USERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 FOOD TRACEABILITY SOFTWARE MARKET SIZE FOR OTHER END USERS, BY REGION, 2020–2025 (USD MILLION)

9 FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 35 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 47 FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.1.1 COVID-19 IMPACT ON THE FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION

9.1.1.1 Optimistic Scenario

TABLE 49 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

9.1.1.2 Realistic Scenario

TABLE 50 REALISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic Scenario

TABLE 51 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD TRACEABILITY TECHNOLOGY MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

9.2 FRESH FOOD PRODUCE

9.2.1 HIGH PERISHABILITY IS A KEY FACTOR THAT ENCOURAGES THE DEMAND FOR TRACEABILITY IN FRESH FOOD PRODUCE

TABLE 52 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN FRESH FOOD PRODUCE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN FRESH FOOD PRODUCE, BY REGION, 2020–2025 (USD MILLION)

9.3 MEAT, POULTRY & SEAFOOD PRODUCTS

9.3.1 INCREASE IN INCIDENCES OF MEAT FRAUDULENCE TO ENCOURAGE THE DEMAND FOR TRACEABILITY OF MEAT & SEAFOOD

TABLE 54 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN MEAT, POULTRY, AND SEAFOOD PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN MEAT, POULTRY, AND SEAFOOD PRODUCTS, BY REGION, 2020–2025 (USD MILLION)

9.4 DAIRY PRODUCTS

9.4.1 INCREASE IN CONTAMINATION OF DAIRY PRODUCTS AND CONSUMER CONCERNS FOR FOOD SAFETY TO DRIVE THE GROWTH OF THE TRACEABILITY SYSTEMS MARKET FOR DAIRY PRODUCTS

TABLE 56 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN DAIRY PRODUCTS, BY REGION, 2020–2025 (USD MILLION)

9.5 BEVERAGE PRODUCTS

9.5.1 ADULTERATION TO DRIVE THE GROWTH OF BEVERAGE TRACEABILITY

TABLE 58 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN BEVERAGE PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN BEVERAGE PRODUCTS, BY REGION, 2020–2025 (USD MILLION)

9.6 OTHER APPLICATIONS

TABLE 60 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

10 FOOD TRACEABILITY MARKET, BY REGION (Page No. - 108)

10.1 INTRODUCTION

FIGURE 36 INDIA TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 62 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 64 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 66 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE MARKET, BY REGION

10.1.1.1 Optimistic Scenario

TABLE 68 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.2 Pessimistic Scenario

TABLE 69 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.3 Realistic Scenario

TABLE 70 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: FOOD TRACEABILITY INDUSTRY SNAPSHOT, 2020

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: FOOD TRACEABILITY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION 2016–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 83 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Legislative framework in the US to fuel the market

TABLE 85 US: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 86 US: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 87 US: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 88 US: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Active involvement of regulatory bodies, such as CFIA, to drive the growth of the food traceability market in Canada

TABLE 89 CANADA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 90 CANADA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 91 CANADA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 92 CANADA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Growth in food trade resulting in the demand for better food traceability systems to ensure food safety in the country

TABLE 93 MEXICO: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 94 MEXICO: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 95 MEXICO: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 MEXICO: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT, 2020

TABLE 97 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 EUROPE: FOOD TRACEABILITY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 99 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 101 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 102 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 103 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 105 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 106 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 107 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 110 EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High adaptability rate among consumers and manufacturers

TABLE 111 GERMANY: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 GERMANY: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 113 GERMANY: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 GERMANY: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Occurrence of several health hazards in recent times has increased the demand for safe food

TABLE 115 UK: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 UK: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 117 UK: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 UK: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 With an increase in the demand for services of hospitality and related industries, the need for traceability is increasing

TABLE 119 FRANCE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 120 FRANCE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 121 FRANCE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 FRANCE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Introduction of new technology is boosting the confidence among manufacturers for food traceability services

TABLE 123 ITALY: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 124 ITALY: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 125 ITALY: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 126 ITALY: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Rising consumer awareness is the key to drive the market in the country

TABLE 127 SPAIN: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 128 SPAIN: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 129 SPAIN: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 130 SPAIN: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.3.6 REST OF EUROPE

10.3.6.1 Widespread use of IT to drive the use of RFID and barcode labels

TABLE 131 REST OF EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 132 REST OF EUROPE: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 133 REST OF EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 134 REST OF EUROPE: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: FOOD TRACEABILITY MARKET SNAPSHOT, 2020

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: FOOD TRACEABILITY INDUSTRY SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 137 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 138 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 139 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 140 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 141 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 142 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 143 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 145 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION 2016–2019 (USD MILLION)

TABLE 146 ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 147 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 148 ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Technological advancements in China to fuel the food traceability market

TABLE 149 CHINA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 150 CHINA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 151 CHINA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 152 CHINA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.4.2 INDIA

10.4.2.1 Demand for effective food supply chain management in India to drive the growth of food traceability solutions

TABLE 153 INDIA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 INDIA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 155 INDIA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 INDIA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 The need for compliance with food safety standards to drive the demand for food traceability in the country

TABLE 157 JAPAN: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 158 JAPAN: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 159 JAPAN: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 160 JAPAN: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.4.1 Increasing instances of foodborne illnesses to drive the growth of food traceability technologies

TABLE 161 AUSTRALIA AND NEW ZEALAND: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 AUSTRALIA AND NEW ZEALAND: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 163 AUSTRALIA AND NEW ZEALAND: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 164 AUSTRALIA AND NEW ZEALAND: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Stringent food safety standards to provide various opportunities for the growth of food traceability in Southeast Asian countries

TABLE 165 REST OF ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 169 ROW: FOOD TRACEABILITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 170 ROW: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 171 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 172 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 173 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 174 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 175 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 176 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 177 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 179 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 180 ROW: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 181 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 182 ROW: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Adoption of new and advanced traceability technologies in the region to present growth opportunities

TABLE 183 SOUTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 184 SOUTH AMERICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 185 SOUTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 186 SOUTH AMERICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Introduction of strict guidelines to ensure food safety to drive the demand for food traceability technologies

TABLE 187 MIDDLE EAST: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 188 MIDDLE EAST: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 189 MIDDLE EAST: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 190 MIDDLE EAST: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Lack of supporting infrastructure restrains the growth of the African food traceability market

TABLE 191 AFRICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 192 AFRICA: FOOD TRACEABILITY TECHNOLOGY MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

TABLE 193 AFRICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 194 AFRICA: FOOD TRACEABILITY SOFTWARE MARKET SIZE, BY TYPE 2020–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 173)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK, 2017–2020

11.3 MARKET SHARE ANALYSIS, 2019

TABLE 195 FOOD TRACEABILITY: DEGREE OF COMPETITION

11.4 COMPANY EVALUATION MATRIX (OVERALL MARKET)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

11.5 COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

FIGURE 41 FOOD TRACEABILITY MARKET: COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

11.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 42 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS, 2019

TABLE 196 MARKET: COMPANY APPLICATION FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 197 FOOD TRACEABILITY MARKET DEALS, 2018–2020

12 COMPANY PROFILES (Page No. - 181)

(Business overview, Services/Software offered, SWOT analysis, Recent developments, Right to win)*

12.1 KEY COMPANIES

12.1.1 BIO-RAD LABORATORIES, INC.

FIGURE 43 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

FIGURE 44 BIO-RAD LABORATORIES, INC.: SWOT ANALYSIS

12.1.2 C.H. ROBINSON

FIGURE 45 C.H. ROBINSON: COMPANY SNAPSHOT

FIGURE 46 C.H. ROBINSON: SWOT ANALYSIS

12.1.3 OPTEL GROUP

FIGURE 47 OPTEL GROUP: SWOT ANALYSIS

12.1.4 COGNEX

FIGURE 48 COGNEX: COMPANY SNAPSHOT

FIGURE 49 COGNEX: SWOT ANALYSIS

12.1.5 HONEYWELL INTERNATIONAL INC

FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 51 HONEYWELL INTERNATIONAL INC: SWOT ANALYSIS

12.1.6 SGS SA

FIGURE 52 SGS SA: COMPANY SNAPSHOT

12.1.7 ZEBRA TECHNOLOGIES CORPORATION

FIGURE 53 ZEBRA TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

12.1.8 BAR CODE INTEGRATORS, INC.

12.1.9 ABACO GROUP

12.1.10 CARLISLE COMPANIES INCORPORATED

FIGURE 54 CARLISLE COMPANIES INCORPORATED: COMPANY SNAPSHOT

12.2 START-UPS/SMES

12.2.1 MERIT-TRAX TECHNOLOGIES

12.2.2 FOODLOGIQ

12.2.3 SAFETRACES

12.2.4 FOOD FORENSICS

12.2.5 BEXT360

12.2.6 RFXCEL TRACEABILITY SYSTEM.

12.2.7 COVECTRA, INC.

12.2.8 SMAG

12.2.9 AGROMETRICS INC.

12.2.10 TE-FOOD

12.2.11 MASS GROUP

*Details on Business overview, Services/Software offered, SWOT analysis, Recent developments, Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 212)

13.1 DISCUSSION GUIDE

13.2 KEY PRIMARY INSIGHTS

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATION

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

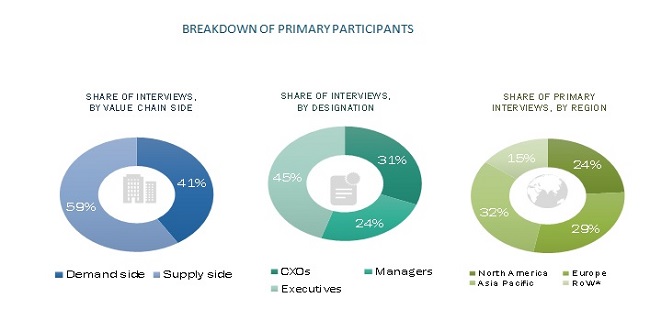

The study involved four major activities in estimating the food traceability market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of enzyme manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

Breakdown of Primary participants

To know about the assumptions considered for the study, download the pdf brochure

Food Traceability Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food traceability industry. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

Approach 1

- The key players in the industry and the markets were identified through extensive secondary research.

- The revenues of major food traceability players were determined through primary and secondary research such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players for each technology and software type from all regions, we arrived at the final market size of the food traceability market.

-

For distribution channel calculations, we analyzed revenue generated and market share by region for key distribution companies of the food traceability

- Based on this, we arrived at global and regional market share for products by distribution vs direct from manufacturers.

- Further this split was validated with primary interviews and insights on each product were gathered.

Approach 2

- The demand for each product type in each application was analyzed by region, and other factors such as service availability, pricing trends, the adoption rate, patents registered, and organic & inorganic growth attempts was derived from various secondary sources, such as publications by companies, industry publications, trade data providers, and paid databases.

- Demand analysis was conducted for each type by application and region.

- Pricing analysis was conducted on the basis of the cost of each type in the key regions.

- From this, we derived the market sizes for each region.

- Summing up the above, we arrived at the market size of the global food traceability market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

Market Intelligence

- Determining and projecting the size of the global food traceability market, with respect to type, software end user , technology application, distribution channel, and regional markets, over a five-year period ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

-

Competitive Intelligence

- Identifying and profiling the key market players in the market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Products offerings

- Business strategies

- Strengths and weaknesses

- Key financials

-

Competitive Intelligence

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights into key product innovations and investments in the food traceability market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Segmental Analysis

- A further breakdown of other types of application and end user at the regional or country level

- Further criss-cross of type by technology and software

Geographic analysis

- A further breakdown of the Rest of Asia Pacific food traceability market, by key country

- A further breakdown of the Rest of European market, by key country

Company information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Food Traceability Market